PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928992

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928992

Robotics Laser Welding Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

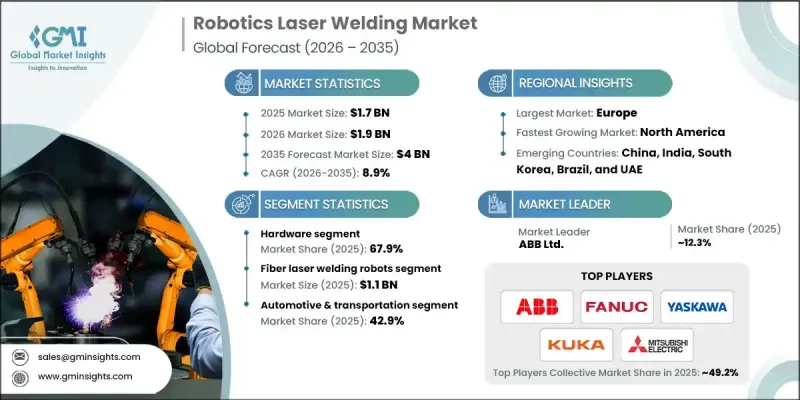

The Global Robotics Laser Welding Market was valued at USD 1.7 billion in 2025 and is estimated to grow at a CAGR of 8.9% to reach USD 4 billion by 2035.

Market growth is driven by the steady expansion of manufacturing industries worldwide, alongside rising requirements for precision, speed, and consistency in welding operations. The increasing use of advanced materials, particularly lightweight components, has further strengthened demand for high-accuracy welding solutions. Continuous progress in robotics integration and laser technologies is enabling manufacturers to achieve superior weld quality while improving productivity and reducing error rates. As global manufacturing volumes rise, especially across fast-developing economies, automation is becoming a critical tool for maintaining cost efficiency and production reliability. Robotics-based laser welding systems are increasingly viewed as essential for meeting strict quality standards while supporting scalable manufacturing environments. The accelerating shift toward electric mobility has also contributed to higher adoption levels, as advanced welding solutions support complex assemblies and demanding performance requirements. Overall, the market continues to evolve as industries prioritize automated, precise, and flexible welding technologies to remain competitive.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.7 Billion |

| Forecast Value | $4 Billion |

| CAGR | 8.9% |

The hardware segment accounted for 67.9% share in 2025. This dominance reflects ongoing improvements in laser sources, robotic arms, controllers, and supporting components that enhance accuracy, reliability, and scalability across diverse industrial applications. Hardware innovation remains central to delivering compact, efficient, and cost-effective systems.

The fiber laser welding robots segment generated USD 1.1 billion in 2025, leading the market by technology type. Their growth is supported by improvements in laser efficiency, automation compatibility, and precision control, enabling high-speed operations with reduced energy consumption across multiple manufacturing environments.

North America Robotics Laser Welding Market represented 27.2% share in 2025. Regional growth is supported by strong demand for advanced manufacturing solutions, increasing automation adoption, and supportive initiatives aimed at improving industrial productivity and innovation.

Key companies operating in the Global Robotics Laser Welding Market include ABB Ltd., KUKA AG, Fanuc Corporation, TRUMPF Group, Yaskawa Electric Corporation, Panasonic Corporation, Mitsubishi Electric, IPG Photonics, Comau S.p.A., Kawasaki Heavy Industries, Coherent Inc., Han's Laser Tech Group, DAIHEN Corporation, Laserline GmbH, Precitec Group, Staubli International, Universal Robots A/S, Amada Holdings Co. Ltd., Jenoptik AG, OMRON Corp., Siasun Robot & Automation, Esab, CLOOS GmbH, Nachi-Fujikoshi Corp., Miller Electric Mfg. LLC, and Toshiba Machine / Denso. Companies in the Robotics Laser Welding Market are strengthening their competitive position through continuous technology innovation and system integration capabilities. Many players focus on enhancing laser efficiency, welding precision, and automation flexibility to address evolving manufacturing requirements. Strategic investments in research and development help deliver compact, energy-efficient, and high-performance solutions. Partnerships with industrial manufacturers and system integrators support broader market reach and customized offerings.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Component trends

- 2.2.2 Robot type trends

- 2.2.3 Technology trends

- 2.2.4 End use trends

- 2.2.5 Regional trends

- 2.3 TAM Analysis, 2026-2035 (USD Million)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry ecosystem analysis

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Growing automotive and aerospace industries

- 3.3.1.2 Increasing demand for high-quality welding

- 3.3.1.3 Global expansion of manufacturing activities

- 3.3.1.4 Ongoing advancements in laser technology and robotics

- 3.3.1.5 Rising demand for lightweight materials

- 3.3.2 Pitfalls and challenges

- 3.3.2.1 Initial implementation costs

- 3.3.2.2 Integration with existing systems

- 3.3.3 Market opportunities

- 3.3.3.1 Development of advanced laser technologies

- 3.3.3.2 Adoption of industry 4.0 and smart manufacturing

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.5.4 Latin America

- 3.5.5 Middle East & Africa

- 3.6 Porter';s analysis

- 3.7 PESTEL analysis

- 3.8 Technology and Innovation landscape

- 3.8.1 Current technological trends

- 3.8.2 Emerging technologies

- 3.9 Emerging Business Models

- 3.10 Compliance Requirements

- 3.11 Sustainability Measures

- 3.12 Consumer Sentiment Analysis

- 3.13 Patent and IP analysis

- 3.14 Geopolitical and trade dynamics

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Component, 2022 - 2035 (USD Million)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Robots

- 5.2.2 Welding equipment

- 5.2.3 Sensors and vision systems

- 5.3 Software

- 5.3.1 Controller software

- 5.3.2 Simulation software

- 5.4 Services

Chapter 6 Market Estimates and Forecast, By Robot Type, 2022 - 2035 (USD Million)

- 6.1 Key trends

- 6.2 Industrial robots

- 6.2.1 <50 kg payload

- 6.2.2 50-150 kg payload

- 6.2.3 Above 150 kg payload

- 6.3 Collaborative robots

- 6.3.1 <50 kg payload

- 6.3.2 50-150 kg payload

- 6.3.3 Above 150 kg payload

- 6.4 Mobile robots

- 6.4.1 <50 kg payload

- 6.4.2 50-150 kg payload

- 6.4.3 Above 150 kg payload

Chapter 7 Market Estimates and Forecast, By Technology, 2022 - 2035 (USD Million)

- 7.1 Key trends

- 7.2 Fiber laser welding robots

- 7.3 CO2 laser welding robots

- 7.4 Solid-state laser welding robots

Chapter 8 Market Estimates and Forecast, By End Use, 2022 - 2035 (USD Million)

- 8.1 Key trends

- 8.2 Automotive & transportation

- 8.3 Metals & machinery

- 8.4 Electrical & electronics

- 8.5 Aerospace & defense

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Key Players

- 10.1.1 ABB Ltd.

- 10.1.2 Fanuc Corporation

- 10.1.3 KUKA AG

- 10.1.4 Mitsubishi Electric

- 10.1.5 Yaskawa Electric Corporation

- 10.2 Regional key players

- 10.2.1 North America

- 10.2.1.1 Miller Electric Mfg. LLC

- 10.2.1.2 OMRON Corp.

- 10.2.2 Asia Pacific

- 10.2.2.1 Comau S.p.A.

- 10.2.2.2 Han’s Laser Tech Group

- 10.2.2.3 IPG Photonics

- 10.2.2.4 Kawasaki Heavy Industries

- 10.2.2.5 Siasun Robot & Automation

- 10.2.2.6 Panasonic Corporation

- 10.2.3 Europe

- 10.2.3.1 Amada Holdings Co. Ltd.

- 10.2.3.2 CLOOS GmbH

- 10.2.3.3 Coherent Inc.

- 10.2.3.4 TRUMPF Group

- 10.2.3.5 Staubli International

- 10.2.1 North America

- 10.3 Niche Players/Disruptors

- 10.3.1 Precitec Group

- 10.3.2 Nachi-Fujikoshi Corp.

- 10.3.3 Esab

- 10.3.4 Laserline GmbH

- 10.3.5 Jenoptik AG

- 10.3.6 Toshiba Machine / Denso

- 10.3.7 Universal Robots A/S

- 10.3.8 DAIHEN Corporation