PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892706

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892706

US Pick Up Trucks Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

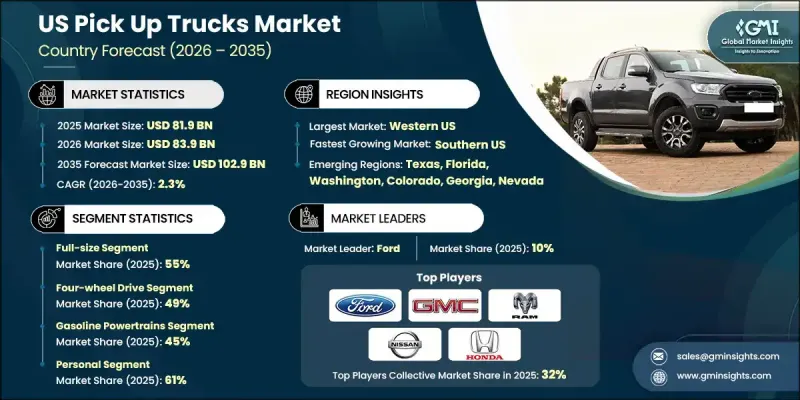

US Pick Up Trucks Market was valued at USD 81.9 billion in 2025 and is estimated to grow at a CAGR of 2.3% to reach USD 102.9 billion by 2035.

The market is experiencing noticeable shifts driven by advances in electrification, vehicle connectivity, and safety technology, all while retaining the utility-focused design that defines this segment. Automakers are expanding hybrid offerings across full-size and mid-size lineups to meet regulatory expectations without compromising power and towing capability. Safety systems are evolving quickly as well, supported by regulations that increasingly require features aimed at reducing collisions and improving driver awareness. Hybrid powertrains are becoming more common across mid-size trucks, delivering higher torque, improved fuel economy, and enhanced performance. Demand for premium pickup trims continues to rise as buyers gravitate toward off-road packages and high-end equipment that support outdoor lifestyles. This combination of evolving powertrains, upgraded safety technology, and rising interest in recreation-oriented models continues to reshape the competitive landscape across the US pickup truck market.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $81.9 Billion |

| Forecast Value | $102.9 Billion |

| CAGR | 2.3% |

The full-size segment held a 55% share in 2025 and is projected to grow at a CAGR of 1.6% through 2035. Full-size trucks such as the Ford F-150, GMC Sierra 1500, Chevrolet Silverado 1500, Ram 1500, Nissan Titan, and Toyota Tundra remain dominant due to strong commercial demand and long-standing brand loyalty. Although expansion is slowing because of increased competition from mid-size alternatives, premium variants with advanced interiors and upgraded technology continue to contribute significantly to revenue through higher pricing.

The four-wheel drive segment held a 49% share in 2025 and is expected to grow at a CAGR of 2.5% from 2026 to 2035. These systems provide enhanced traction through controlled distribution of power to the front and rear axles, making them highly valued by buyers operating in severe weather, rugged environments, or heavy-duty towing conditions. Modern 4WD configurations now include electronic assist features, terrain-specific modes, advanced locking systems, and downhill control technologies that strengthen capability across diverse landscapes.

Wyoming Pick Up Trucks Market accounted for a 24% share in 2025, generating USD 8 billion. With vast open terrain, demanding winter conditions, and an economy shaped by agriculture and natural resources, the state has one of the nation's highest pickup ownership rates. Trucks serve as essential transport for residents and support recreational activities in parks, forests, and public lands, where towing, trail access, and outdoor travel require dependable performance.

Major companies participating in the US Pick Up Trucks Market include Alpha Motor Corporation, Bollinger Motors, Canoo Inc., Ford, GMC, Honda, Hyundai, Nissan, RAM, and Toyota. Companies in the US Pick Up Trucks Market use several strategies to reinforce their competitive positions. Many are accelerating the launch of hybrid and alternative-powertrain models to meet emissions requirements while maintaining capability. Automakers are also integrating advanced driver-assistance systems, enhanced connectivity, and over-the-air software features to boost safety and user experience. Premium and off-road-focused trims continue to play a key role in revenue growth, prompting manufacturers to expand specialized packages and luxury-oriented upgrades. Strategic investments in modular platforms allow companies to streamline production and adapt quickly to changing market needs. Additionally, partnerships with battery suppliers, improvements in towing technology, and expanded service networks help brands strengthen loyalty and increase long-term market presence.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Size

- 2.2.3 Powertrain

- 2.2.4 Application

- 2.2.5 Drive Type

- 2.2.6 Bed Length

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing popularity of off-roading and outdoor activities

- 3.2.1.2 Consumer demand for versatility and utility

- 3.2.1.3 Advancements in pickup truck technology

- 3.2.1.4 Electrification and sustainability trends

- 3.2.1.5 Expanding commercial & fleet demand

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High purchase price and affordability

- 3.2.2.2 Consumer preferences shifting toward SUVs and crossovers

- 3.2.3 Market opportunities

- 3.2.3.1 Electrified pickup growth (EV and hybrid segments)

- 3.2.3.2 Mid-size pickup segment expansion

- 3.2.3.3 Fleet solutions and total cost of ownership (TCO) optimization services

- 3.2.3.4 Luxury and lifestyle-oriented variants

- 3.2.3.5 Retrofit and aftermarket electrification

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 NHTSA Safety Standards (49 CFR)

- 3.4.2 EPA Emissions Requirements

- 3.4.3 DOE CAFE Standards (MY 2027-2031)

- 3.4.4 State-Level Regulations (CARB)

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.1.1 Battery technology (NMC, LFP, Solid-State)

- 3.7.1.2 Electric motors & inverters

- 3.7.1.3 Thermal management

- 3.7.1.4 Charging technology (Level 2, DC Fast, V2G)

- 3.7.2 Emerging technologies

- 3.7.2.1 5G embedded connectivity

- 3.7.2.2 OTA updates

- 3.7.2.3 Fleet telematics

- 3.7.2.4 V2I communication

- 3.7.1 Current technological trends

- 3.8 Pricing dynamics & trends

- 3.8.1 MSRP evolution by class

- 3.8.2 Incentive & financing trends

- 3.8.3 Total cost of ownership (TCO) analysis

- 3.8.4 Used pickup market dynamics

- 3.8.5 Transaction price trends & dealer profitability

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.11.1 Battery technology patents

- 3.11.2 Electric powertrain patents

- 3.11.3 Autonomous/ADAS patents

- 3.11.4 Lightweight materials patents

- 3.11.5 Patent filing trends by company

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Investment & funding analysis

- 3.13.1 OEM capex on electrification

- 3.13.2 EV startup funding & valuations

- 3.13.3 Government grants & loans

- 3.13.4 PE/VC activity

- 3.13.5 Failed investments & bankruptcy analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Northeast US

- 4.2.2 Midwest US

- 4.2.3 Southern US

- 4.2.4 Western US

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Size, 2022 - 2035 ($Bn, Units)

- 5.1 Key trends

- 5.2 Compact

- 5.2.1 Gasoline

- 5.2.2 Diesel

- 5.2.3 Electric

- 5.2.4 Hybrid

- 5.3 Mid-size

- 5.3.1 Gasoline

- 5.3.2 Diesel

- 5.3.3 Electric

- 5.3.4 Hybrid

- 5.4 Full-size

- 5.4.1 Gasoline

- 5.4.2 Diesel

- 5.4.3 Electric

- 5.4.4 Hybrid

Chapter 6 Market Estimates & Forecast, By Powertrain, 2022 - 2035 ($Bn, Units)

- 6.1 Key trends

- 6.2 Gasoline

- 6.3 Diesel

- 6.4 Electric

- 6.5 Hybrid

Chapter 7 Market Estimates & Forecast, By Application, 2022 - 2035 ($Bn, Units)

- 7.1 Key trends

- 7.2 Personal

- 7.3 Commercial

- 7.3.1 Construction and heavy equipment

- 7.3.2 Agriculture and farming

- 7.3.3 Landscaping and outdoor services

- 7.3.4 Utility and municipal use

Chapter 8 Market Estimates & Forecast, By Drive Type, 2022 - 2035 ($Bn, Units)

- 8.1 Key trends

- 8.2 Rear-wheel drive

- 8.3 All wheel drive

- 8.4 Four-wheel drive

Chapter 9 Market Estimates & Forecast, By Bed Length, 2022 - 2035 ($Bn, Units)

- 9.1 Key trends

- 9.2 Short bed (5.5-6 ft)

- 9.3 Standard bed (6.5-7 ft)

- 9.4 Long bed (8-8.1 ft)

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn, Units)

- 10.1 Key trends

- 10.2 Northeast

- 10.2.1 Maine

- 10.2.2 Massachusetts

- 10.2.3 New Jersey

- 10.2.4 New York

- 10.2.5 Pennsylvania

- 10.3 Midwest

- 10.3.1 Illinois

- 10.3.2 Indiana

- 10.3.3 Michigan

- 10.3.4 Ohio

- 10.3.5 Wisconsin

- 10.3.6 Iowa

- 10.3.7 Kansas

- 10.3.8 Minnesota

- 10.3.9 Missouri

- 10.3.10 Nebraska

- 10.3.11 North Dakota

- 10.3.12 South Dakota

- 10.4 Southern

- 10.4.1 Florida

- 10.4.2 Georgia

- 10.4.3 North Carolina

- 10.4.4 South Carolina

- 10.4.5 Virginia

- 10.4.6 West Virginia

- 10.4.7 Alabama

- 10.4.8 Kentucky

- 10.4.9 Mississippi

- 10.4.10 Tennessee

- 10.4.11 Arkansas

- 10.4.12 Louisiana

- 10.4.13 Oklahoma

- 10.4.14 Texas

- 10.5 Western

- 10.5.1 Arizona

- 10.5.2 Colorado

- 10.5.3 Idaho

- 10.5.4 Montana

- 10.5.5 Nevada

- 10.5.6 New Mexico

- 10.5.7 Utah

- 10.5.8 Wyoming

- 10.5.9 Alaska

- 10.5.10 California

- 10.5.11 Oregon

- 10.5.12 Washington

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Ford Motor Company

- 11.1.2 General Motors / Chevrolet (GMC)

- 11.1.3 Nissan Motor

- 11.1.4 Stellantis / Ram Trucks

- 11.1.5 Toyota Motor

- 11.1.6 Paccar Trucks

- 11.2 Regional Players

- 11.2.1 Honda Motor

- 11.2.2 Hyundai Motor

- 11.2.3 Isuzu Motors

- 11.2.4 Mazda Motor

- 11.2.5 Mitsubishi Motors

- 11.3 Emerging & Niche Players

- 11.3.1 Alpha Motor

- 11.3.2 Bollinger Motors

- 11.3.3 Canoo

- 11.3.4 Lordstown Motors

- 11.3.5 Nikola

- 11.3.6 Rivian Automotive