PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844335

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844335

Pickup Truck Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

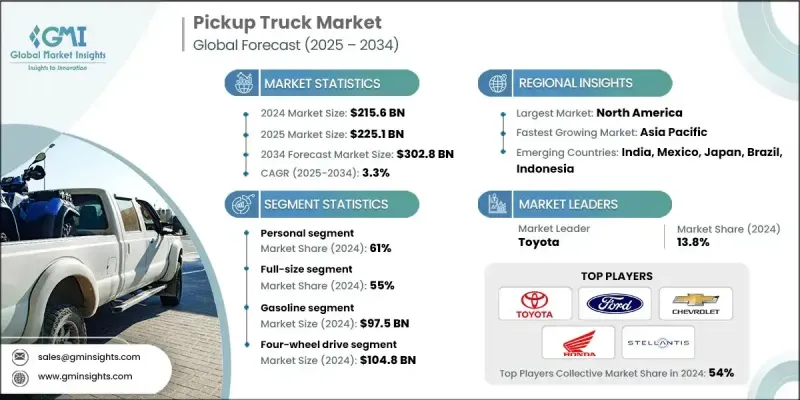

The Global Pickup Truck Market was valued at USD 215.6 billion in 2024 and is estimated to grow at a CAGR of 3.3% to reach USD 302.8 billion by 2034.

As a critical segment within the global automotive industry, pickup trucks continue to gain traction across personal, commercial, industrial, and recreational applications. Consumers are increasingly drawn to trucks that blend utility and everyday usability, offering space, ruggedness, and comfort in one package. The segment is evolving with rising interest in electric and hybrid-powered options, which are gaining momentum not just because of environmental regulations but also due to innovation and growing buyer interest. Automakers are integrating high-end comfort, infotainment, and advanced safety systems while maintaining strong towing and payload capabilities, making pickups appealing to both families and fleet owners.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $215.6 Billion |

| Forecast Value | $302.8 Billion |

| CAGR | 3.3% |

The industry has seen a major shift toward electric mobility, with manufacturers channeling investments into EV technology to address environmental goals and future regulatory requirements. In response to industry-wide disruptions, many companies also established collaborative alliances to reduce development expenses and streamline supply chains. These partnerships resulted in the integration of connected tech, electrification, and versatile design features, driving customer engagement and adapting to the fast-changing auto landscape.

In 2024, the personal-use category held 61% share and will grow at a CAGR of 3% through 2034. This leadership is driven by rising demand for multipurpose vehicles that can handle commuting, family travel, and outdoor lifestyles with ease. Buyers are looking for performance-driven trucks that don't sacrifice convenience, leading manufacturers to introduce luxury-grade interiors, touchscreen controls, smart safety features, and top-tier infotainment in their higher-end variants. These evolving preferences are reshaping the image of pickup trucks from utilitarian machines to well-rounded, daily-use lifestyle vehicles.

The full-size pickup segment held a 55% share in 2024 and is forecasted to grow at a CAGR of 2.6% between 2025 and 2034. Full-size pickups are widely preferred for their strength, space, and towing capabilities. Manufacturers are upgrading these models with EV drivetrains and exclusive trims offering customized features, expanded range, and sophisticated performance packages. The appeal of luxury trims in full-size pickups has elevated customer expectations, pushing OEMs to develop comprehensive ownership experiences with added convenience, loyalty perks, and digital-first service solutions.

U.S. Pickup Truck Market held 90% share and generated USD 99.8 billion in 2024. The segment remains the country's best-selling vehicle category, due to a widespread cultural and functional preference for full-size trucks. Personal and recreational usage has grown significantly, and consumer appetite for high-spec, electrified models continues to surge. Automakers are launching advanced variants and tech-rich trims to retain loyalty while attracting new audiences.

Major companies actively competing in the Global Pickup Truck Market include Nissan, Stellantis (Ram Trucks), Ford, Alpha Motor, Toyota, Honda, Chevrolet, GMC, Bollinger, and Canoo. To maintain and strengthen their positions in the competitive pickup truck market, leading manufacturers are pursuing multiple strategic initiatives. They are heavily investing in electrified vehicle platforms and battery technology to align with environmental regulations and customer expectations for sustainable mobility. Simultaneously, companies are expanding product lines with luxury-oriented and performance-driven trims tailored for specific customer lifestyles. Strategic alliances and joint ventures are playing a role in accelerating product development, optimizing production, and enhancing supply chain resilience. Additionally, many players are building direct-to-consumer digital retail platforms and enhancing aftersales service offerings to improve customer loyalty and long-term engagement.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.6.1.1 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Size

- 2.2.3 Power Train

- 2.2.4 Towing Capability

- 2.2.5 Drive

- 2.2.6 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material providers

- 3.1.1.2 Manufacturer

- 3.1.1.3 Distributor

- 3.1.1.4 End use

- 3.1.2 Cost structure

- 3.1.3 Profit margin

- 3.1.4 Value addition at each stage

- 3.1.5 Factors impacting the supply chain

- 3.1.6 Disruptors

- 3.1.1 Supplier landscape

- 3.2 Impact on forces

- 3.2.1 Growth drivers

- 3.2.1.1 Infrastructure expansion fuels demand for pickup trucks

- 3.2.1.2 Technological advancements enhance pickup truck efficiency and safety

- 3.2.1.3 Government investments in transportation infrastructure spur demand

- 3.2.1.4 Mining sector growth boosts pickup truck sales

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Economic downturns reduce construction and mining activities

- 3.2.2.2 Stringent emissions regulations increase manufacturing costs

- 3.2.3 Market opportunities

- 3.2.3.1 Rising adoption of electric and hybrid pickup trucks

- 3.2.3.2 Smart fleet management and telematics integration

- 3.2.1 Growth drivers

- 3.3 Technology trends & innovation ecosystem

- 3.3.1 Current technologies

- 3.3.1.1 Powertrain technology evolution

- 3.3.1.2 Battery technology for electric pickups

- 3.3.1.3 Autonomous driving integration

- 3.3.1.4 Connectivity & infotainment systems

- 3.3.1.5 Advanced Driver Assistance Systems (ADAS)

- 3.3.2 Emerging technologies

- 3.3.2.1 Lightweight materials & construction

- 3.3.2.2 Manufacturing technology advances

- 3.3.2.3 Charging infrastructure development

- 3.3.2.4 Vehicle-to-Grid (V2G) technology

- 3.3.2.5 Over-the-Air (OTA) update capabilities

- 3.3.1 Current technologies

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 CAFE fuel economy standards

- 3.5.2 EPA emissions regulations

- 3.5.3 NHTSA safety standards

- 3.5.4 State-Level ZEV mandates

- 3.5.5 Commercial vehicle regulations

- 3.5.6 Future regulatory trends

- 3.6 Price trends analysis

- 3.6.1 Historical price evolution by segment

- 3.6.2 Regional price variations

- 3.6.3 Trim level pricing strategies

- 3.6.4 Electric vs ICE price parity timeline

- 3.6.5 Fleet vs retail pricing dynamics

- 3.6.6 Options & accessories pricing

- 3.7 Production & sales statistics

- 3.7.1 Global production capacity analysis

- 3.7.2 Manufacturing plant utilization

- 3.7.3 Sales volume trends by model

- 3.7.4 Seasonal sales patterns

- 3.7.5 Inventory management analysis

- 3.7.6 Production flexibility assessment

- 3.7.7 Supply chain lead times

- 3.8 Cost breakdown analysis

- 3.8.1 Vehicle development costs

- 3.8.2 Manufacturing cost structure

- 3.8.3 Material cost analysis

- 3.8.4 Labor cost assessment

- 3.8.5 Technology integration costs

- 3.8.6 Regulatory compliance costs

- 3.9 Patent & innovation analysis

- 3.9.1 Powertrain technology patents

- 3.9.2 Electric vehicle patents

- 3.9.3 Autonomous driving patents

- 3.9.4 Lightweight construction patents

- 3.9.5 Manufacturing process patents

- 3.9.6 Patent portfolio analysis by OEM

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Environmental impact assessment & lifecycle analysis

- 3.12.2 Social impact & community relations

- 3.12.3 Governance & corporate responsibility

- 3.12.4 Sustainable technological development

- 3.13 Investment Landscape Analysis

- 3.13.1 OEM capital investment patterns

- 3.13.2 Electric vehicle investment

- 3.13.3 Manufacturing facility investments

- 3.13.4 R&D investment allocation

- 3.13.5 Joint venture & partnership investments

- 3.14 Customer behavior analysis

- 3.14.1 Purchase decision factors

- 3.14.2 Brand loyalty patterns

- 3.14.3 Usage pattern analysis

- 3.14.4 Replacement cycle trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Key developments

- 4.5.1 Mergers & acquisitions

- 4.5.2 Partnerships & collaborations

- 4.5.3 New product launches

- 4.5.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Size, 2021 - 2034 ($ Bn & Units)

- 5.1 Key trends

- 5.2 Compact

- 5.3 Mid-size

- 5.4 Full-size

Chapter 6 Market Estimates & Forecast, By Power Train, 2021 - 2034 ($ Bn & Units)

- 6.1 Key trends

- 6.2 Gasoline

- 6.3 Diesel

- 6.4 Electric

- 6.5 Hybrid

Chapter 7 Market Estimates & Forecast, By Towing Capability, 2021 - 2034 ($ Bn & Units)

- 7.1 Key trends

- 7.2 Light towing pickup trucks (Up to 7,500 lbs)

- 7.3 Medium towing pickup trucks (7,501-12,000 lbs)

- 7.4 Heavy towing pickup trucks (12,001+ lbs)

Chapter 8 Market Estimates & Forecast, By Drive, 2021 - 2034 ($ Bn & Units)

- 8.1 Key trends

- 8.2 Rear-wheel drive

- 8.3 All wheel drive

- 8.4 Four-wheel drive

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($ Bn & Units)

- 9.1 Key trends

- 9.2 Personal

- 9.3 Commercial

- 9.3.1 Construction and heavy equipment

- 9.3.2 Agriculture and farming

- 9.3.3 Landscaping and outdoor services

- 9.3.4 Utility and municipal use

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($ Bn & Units)

- 10.1 North America

- 10.1.1 US

- 10.1.2 Canada

- 10.2 Europe

- 10.2.1 UK

- 10.2.2 Germany

- 10.2.3 France

- 10.2.4 Italy

- 10.2.5 Spain

- 10.2.6 Belgium

- 10.2.7 Netherlands

- 10.2.8 Sweden

- 10.3 Asia Pacific

- 10.3.1 China

- 10.3.2 India

- 10.3.3 Japan

- 10.3.4 Australia

- 10.3.5 Singapore

- 10.3.6 South Korea

- 10.3.7 Vietnam

- 10.3.8 Indonesia

- 10.4 Latin America

- 10.4.1 Brazil

- 10.4.2 Mexico

- 10.4.3 Argentina

- 10.5 MEA

- 10.5.1 South Africa

- 10.5.2 Saudi Arabia

- 10.5.3 UAE

Chapter 11 Company Profiles

- 11.1 Global players

- 11.1.1 Ford

- 11.1.2 GMC

- 11.1.3 Stellantis (Ram Trucks)

- 11.1.4 Toyota

- 11.1.5 Nissan

- 11.1.6 Honda

- 11.1.7 Rivian Automotive

- 11.1.8 Tesla

- 11.1.9 Isuzu Motors

- 11.1.10 Mahindra & Mahindra

- 11.1.11 Chevrolet

- 11.2 Regional players

- 11.2.1 Great Wall Motors

- 11.2.2 Canoo

- 11.2.3 Alpha Motor

- 11.2.4 Bollinger

- 11.2.5 SAIC Motor

- 11.2.6 Tata Motors

- 11.2.7 Volkswagen Commercial Vehicles

- 11.2.8 Mitsubishi Motors

- 11.2.9 Hyundai Motor Company

- 11.2.10 JAC Motors

- 11.2.11 Foton Motor

- 11.2.12 SsangYong Motor

- 11.2.13 Changan Automobile

- 11.3 Emerging players

- 11.3.1 Lordstown Motors

- 11.3.2 Atlis Motor Vehicles

- 11.3.3 Fisker

- 11.3.4 Hercules Electric Vehicles

- 11.3.5 Nikola

- 11.3.6 Workhorse

- 11.3.7 XOS