PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892711

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892711

Sodium Ion Battery Material Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

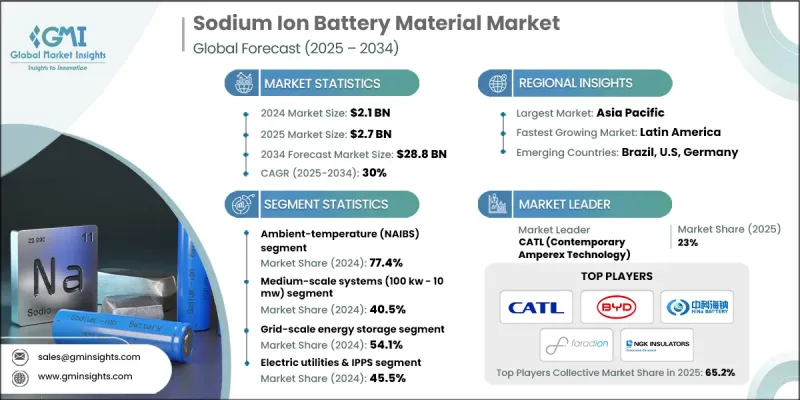

The Global Sodium Ion Battery Material Market was valued at USD 2.1 billion in 2024 and is estimated to grow at a CAGR of 30% to reach USD 28.8 billion by 2034.

This technology is moving beyond early-stage development and progressing toward broader commercialization as innovations in prussian blue analog (PBA) cathodes and improved high-rate capabilities continue to gain traction. Energy density enhancements reaching 160-175 Wh/kg, combined with expanding multi-GWh manufacturing capacity, are accelerating worldwide adoption. Supportive government initiatives are also encouraging investment in sodium-ion production as global stakeholders aim to reduce dependence on lithium-based materials. The push toward domestic supply chains through various incentive programs is further strengthening industry infrastructure. As performance improves and capital requirements decline, sodium-ion systems are increasingly being incorporated into grid-scale storage, backup power networks, microgrids, and short-distance mobility applications. Several regions are promoting production to ease the pressure on critical mineral supply chains, while ongoing advancements in hard-carbon anodes, cell assembly processes, and recycling facilities position the technology for large-scale deployment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.1 Billion |

| Forecast Value | $28.8 Billion |

| CAGR | 30% |

The ambient-temperature (NAIBS) systems segment held 77.4% in 2024 and is projected to grow at a CAGR of 29.4% through 2034. Their rapid integration into commercial uses, combined with favorable cost profiles and strong compatibility with stationary storage and short-range mobility, is reinforcing their role as a key technology. Growth is expected to continue as production of next-generation PBA and layered-oxide materials is expanded across multiple facilities.

The medium-scale systems segment generated USD 883.7 million in 2024, supported by rising installations across commercial and industrial applications, including backup power networks, distribution-level energy resources, and microgrid environments. Their adaptability and straightforward deployment make them an appealing choice for data-intensive environments, telecommunications, and solutions that assist high-demand charging operations.

North America Sodium Ion Battery Material Market accounted for 21.3% share in 2024 and continues to gain momentum as demand for large-scale energy storage and renewable capacity expansion increases. The region benefits from supportive financial policies, procurement requirements, and access to essential raw materials, enabling consistent supply availability. Utilities across the U.S. and Canada are evaluating sodium-ion systems for long-duration storage, resilience enhancement, and effective cold-weather performance. Growing interest in microgrids and electrification of remote areas also positions North America as an emerging hotspot for commercial deployment. Data networks and communication infrastructure are expanding their use of sodium-ion technology to support reliability and power stability.

Key participants in the Sodium Ion Battery Material Market include Altris AB, AMTE Power plc, BYD, CATL (Contemporary Amperex Technology Co., Ltd.), Hina Battery, NGK Insulators, Natron Energy, Inc., Reliance, Tiamat Energy (Neogy), and Xiamen Tob New Technology Co. Ltd. Companies active in the Sodium Ion Battery Material Market are adopting several strategies to enhance their competitive edge and broaden their market reach. Many are rapidly scaling manufacturing capacity to support multi-GWh output, enabling cost reductions and improved supply stability. Firms are investing heavily in advanced anode and cathode material development to boost energy density, cycle life, and performance in extreme temperatures. Strategic collaborations with energy storage developers and mobility solution providers are strengthening integration across end-use sectors. Organizations are also focusing on regional production localization to benefit from policy incentives and reduce supply chain risks.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Battery Technology Type

- 2.2.3 Capacity Size

- 2.2.4 Application

- 2.2.5 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Critical Mineral Independence: Eliminating Lithium, Cobalt & Nickel Dependencies

- 3.2.1.2 Cost Competitiveness: 20-30% Lower Production Costs vs. LFP at Scale

- 3.2.1.3 Cold-Climate Performance: >90% Capacity Retention at -40°C Enabling Northern Markets

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lower Energy Density: 140-175 Wh/kg Limiting Passenger EV Adoption

- 3.2.2.2 Standards & Certification Gaps: Lack of Sodium-Ion-Specific Testing Protocols

- 3.2.2.3 Hard Carbon Anode Supply Constraints: Limited Domestic Production Capacity

- 3.2.3 Market opportunities

- 3.2.3.1 22,255 MW U.S. Utility-Scale Battery Additions (2023-2026) Targeting Stationary Storage

- 3.2.3.2 Defense & Military Applications: BABA-Compliant Domestic Supply Chains

- 3.2.3.3 High-Cycle-Life Frequency Regulation: >50,000 Cycles Enabling $110/kW-yr Revenue

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By Battery Technology Type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Battery Technology Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Ambient-Temperature NaIBs

- 5.2.1 Prussian Blue Analog (PBA) Cathodes

- 5.2.2 Layered Transition Metal Oxide Cathodes

- 5.2.3 Polyanion Cathodes

- 5.3 High-Temperature Molten

- 5.3.1 Sodium-Sulfur (NaS) Batteries

- 5.3.2 Sodium-Metal Halide (Na-NiCl2/ZEBRA) Batteries

- 5.3.3 Intermediate-Temperature Sodium Batteries (<200°C)

- 5.4 Solid State Battery

- 5.4.1 Ceramic Solid Electrolytes

- 5.4.2 Polymer Solid Electrolytes

Chapter 6 Market Estimates and Forecast, By Capacity Size, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Small-Scale (<100 kW)

- 6.3 Medium-Scale (100 kW - 10 MW)

- 6.4 Large-Scale (10 MW - 100 MW)

- 6.5 Extra-Large-Scale (>100 MW)

Chapter 7 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Grid-Scale Energy Storage

- 7.2.1 Frequency Regulation & Ancillary Services

- 7.2.2 Energy Arbitrage & Peak Shaving

- 7.2.3 Renewable Energy Integration & Firming

- 7.2.4 Transmission & Distribution Upgrade Deferral

- 7.2.5 Black Start & Grid Resilience

- 7.3 Commercial & Industrial Storage

- 7.3.1 Data Center & Telecom Backup Power

- 7.3.2 Industrial Peak Shaving & Demand Response

- 7.3.3 Microgrid & Distributed Generation Support

- 7.3.4 EV Fast Charging Infrastructure

- 7.4 Residential Energy Storage

- 7.4.1 Solar Self-Consumption & Backup

- 7.4.2 Virtual Power Plant (VPP) Aggregation

- 7.5 Electric Vehicle Applications

- 7.5.1 Passenger Electric Vehicles (BEVs & PHEVs)

- 7.5.2 Two-Wheelers & Three-Wheelers

- 7.5.3 Commercial Buses & Heavy-Duty Trucks

- 7.5.4 Battery Swapping Systems

- 7.6 Defense & Military

- 7.6.1 Military Vehicles & Portable Power

- 7.6.2 Remote Installations & Critical Infrastructure

Chapter 8 Market Estimates and Forecast, By End Use, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Electric Utilities & IPPs

- 8.3 Telecommunications & Data Centers

- 8.4 Automotive OEMs & EV Manufacturers

- 8.5 Industrial & Manufacturing

- 8.6 Renewable Energy Developers

- 8.7 Government & Defense

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Altris AB

- 10.2 AMTE Power plc

- 10.3 BYD

- 10.4 CATL (Contemporary Amperex Technology Co., Ltd.)

- 10.5 Hina Battery

- 10.6 NGK Insulators

- 10.7 Natron Energy, Inc.

- 10.8 Reliance

- 10.9 Tiamat Energy (Neogy)

- 10.10 Xiamen Tob New Technology Co Ltd