PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892729

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892729

Mobility Payment Integration Platforms Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

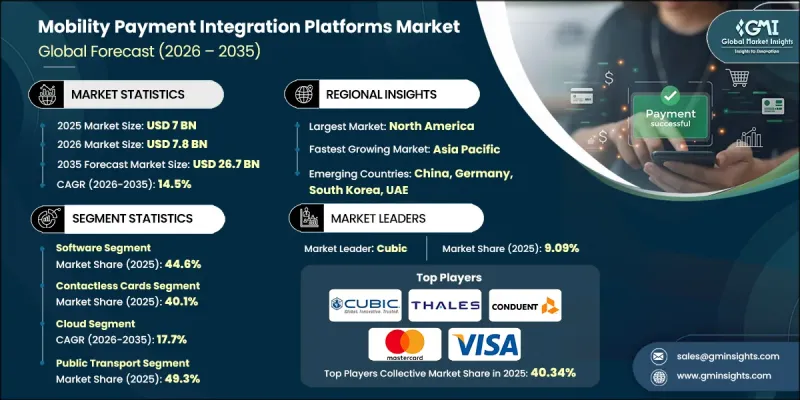

The Global Mobility Payment Integration Platforms Market is estimated at USD 7 billion in 2025 and is estimated to grow at a CAGR of 14.5% to reach USD 26.7 billion by 2035.

This market growth is shaped by the rapid digital transformation of urban mobility systems worldwide. Transit authorities are accelerating the shift toward cashless fare collection models to improve operational efficiency, reduce physical handling costs, and meet rising passenger expectations for seamless, fast, and hygienic travel experiences. The post-pandemic emphasis on touch-free transactions has further intensified the adoption of advanced payment integration technologies. Cities are increasingly focused on delivering frictionless mobility journeys that minimize boarding delays while enabling real-time fare processing. The growing reliance on centralized platforms that unify payment, ticketing, and validation across transport networks is also reshaping the competitive landscape. These platforms are becoming critical digital infrastructure for modern urban mobility, enabling data-driven fare management, customer personalization, and long-term cost optimization for operators. As governments prioritize smart city initiatives and sustainable transportation, mobility payment integration platforms are evolving into strategic tools that support broader digital mobility ecosystems while meeting the demands of increasingly tech-savvy commuters. Urban centers are actively merging public transit, shared mobility, private transport services, and parking systems into cohesive Mobility-as-a-Service environments. This integration requires robust payment engines capable of managing multimodal fare structures, account-based billing, and automated fare caps across operators. As unified mobility applications gain traction, platforms that can function seamlessly across multiple transport services are witnessing growing demand. The inclusion of shared mobility options into citywide payment ecosystems is expanding the functional scope of these platforms. This integration supports improved last-mile connectivity, encourages environmentally responsible travel behavior, and allows operators to introduce flexible pricing models driven by real-time data.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $7 Billion |

| Forecast Value | $26.7 Billion |

| CAGR | 14.5% |

The cloud-based segment is expected to grow at a CAGR of 17.7% between 2026 and 2035. Cloud infrastructure is favored due to its scalability, reduced maintenance burden, and strong alignment with account-based ticketing and MaaS architectures. Cloud platforms support real-time fare computation, advanced analytics, remote system updates, and rapid onboarding of third-party mobility providers. Increasing trust in cloud security frameworks, combined with the availability of compliance-ready cloud services and hybrid deployment models, is accelerating adoption among transit authorities and mobility operators.

The public transportation segment accounted for a 49.3% share in 2025 and is forecast to grow at a CAGR of 13.6% from 2026 to 2035. This segment remains the largest contributor due to widespread implementation of account-based ticketing, EMV-compatible payments, and multimodal fare integration. Public transport payment systems must handle extremely high transaction volumes with near-instant processing speeds to maintain passenger flow. Additional complexities include layered fare policies, transfer rules, discount structures, offline functionality for underground systems, and interoperability across multiple agencies and service providers.

Europe Mobility Payment Integration Platforms Market generated USD 1.8 billion in 2025 and is expected to grow at a CAGR of 13.7% throughout 2035. Europe continues to lead global adoption of integrated mobility and account-based fare systems. Strong regulatory frameworks promoting interoperability are encouraging cities to unify various transport services under a single payment ecosystem, including cross-border travel capabilities. High penetration of contactless payment technologies, supported by a mature digital payments infrastructure, is enabling rapid adoption and consistent user experiences across the region.

Key companies operating in the Global Mobility Payment Integration Platforms Market include Mastercard, Cubic, Thales, Visa, Masabi, Siemens Mobility, Conduent, Scheidt & Bachmann, INIT Innovations, and NXP Semiconductors. Companies operating in the Mobility Payment Integration Platforms Market are strengthening their market position through continuous platform innovation, strategic partnerships, and geographic expansion. Leading players are investing heavily in cloud-native architectures, cybersecurity enhancements, and real-time analytics capabilities to support large-scale deployments. Collaboration with transit authorities, technology providers, and mobility operators is being used to accelerate multimodal integration and expand service offerings. Firms are also focusing on interoperability standards to ensure seamless deployment across diverse transport ecosystems.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Payment Mode

- 2.2.4 Deployment

- 2.2.5 Application

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Accelerating Urbanization & Public Transit Demand

- 3.2.1.2 Consumer Preference for Contactless & Mobile Payments

- 3.2.1.3 Government Mandates for Open Payment Systems & Interoperability

- 3.2.1.4 Mobility-as-a-Service (MaaS) Platform Proliferation

- 3.2.1.5 Cost Reduction Through Automated Fare Collection

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High Initial Capital Investment for System Upgrades

- 3.2.2.2 Legacy System Integration Complexity & Technical Debt

- 3.2.2.3 Interoperability Challenges Across Heterogeneous Systems

- 3.2.2.4 Data Privacy & Security Concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Blockchain-Based Settlement & Smart Contract Automation

- 3.2.3.2 Biometric Authentication for Touchless Fare Payment

- 3.2.3.3 AI-Powered Dynamic Pricing & Demand Management

- 3.2.3.4 Integration with Autonomous Vehicle Payment Systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 Electronic Fund Transfer Act (Reg E)

- 3.4.1.2 FINTRAC MSB Regulations

- 3.4.2 Europe

- 3.4.2.1 Payment Services Regulations 2017 (PSRs 2017)

- 3.4.2.2 General Data Protection Regulation (Regulation (EU) 2016/679)

- 3.4.3 Asia Pacific

- 3.4.3.1 Cybersecurity Law of the PRC

- 3.4.3.2 Payment Services Act (PSA) Japan

- 3.4.3.3 Indian Payment and Settlement Systems Act, 2007

- 3.4.4 LATAM

- 3.4.4.1 BCB Circular No. 3,682 - Payment Institutions Rules

- 3.4.4.2 FinTech Law (Ley para Regular las Instituciones de Tecnologia Financiera) 2018

- 3.4.5 MEA

- 3.4.6 ADGM - Financial Services & Markets Regulations (FSMR)

- 3.4.7 Financial Intelligence Centre Act (FICA)

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Cost breakdown analysis

- 3.10 Cost breakdown analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly Initiatives

- 3.12 Future Outlook & Opportunities

- 3.12.1 Emerging Technology Trends

- 3.12.2 Regulatory & Policy Evolution

- 3.12.3 Market Expansion Opportunities

- 3.12.4 Business Model Innovation

- 3.12.5 Strategic Imperatives for Market Participants

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2022 - 2035 (USD Mn)

- 5.1 Key trends

- 5.2 Software

- 5.3 Hardware

- 5.3.1 Validators

- 5.3.2 NFC terminals

- 5.4 Services

- 5.4.1 Integration

- 5.4.2 Consulting

Chapter 6 Market Estimates & Forecast, By Payment Mode, 2022 - 2035 (USD Mn)

- 6.1 Key trends

- 6.2 Contactless cards

- 6.3 Mobile wallets

- 6.4 NFC

- 6.5 QR

- 6.6 Other digital payment

Chapter 7 Market Estimates & Forecast, By Deployment, 2022 - 2035 (USD Mn)

- 7.1 Key trends

- 7.2 Cloud

- 7.3 On-premises

Chapter 8 Market Estimates & Forecast, By Application, 2022 - 2035 (USD Mn)

- 8.1 Key trends

- 8.2 Public transport

- 8.3 Ride-hailing

- 8.4 Bike-sharing

- 8.5 Car-sharing

- 8.6 Parking

- 8.7 Micromobility

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035 (USD Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.3.8 Portugal

- 9.3.9 Croatia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Singapore

- 9.4.7 Thailand

- 9.4.8 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Turkey

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Cubic Transportation Systems

- 10.1.2 Visa

- 10.1.3 Mastercard

- 10.1.4 Thales

- 10.1.5 IDEMIA

- 10.1.6 Conduent

- 10.1.7 HID Global

- 10.1.8 NXP Semiconductors

- 10.1.9 Worldline

- 10.1.10 Indra Sistemas

- 10.2 Regional Players

- 10.2.1 Masabi

- 10.2.2 GMV Innovating

- 10.2.3 Paragon ID

- 10.2.4 INIT Innovation in Traffic Systems

- 10.2.5 Scheidt & Bachmann

- 10.2.6 Vix Technology

- 10.2.7 Flowbird

- 10.2.8 Trapeze

- 10.2.9 AEP Ticketing

- 10.2.10 Snapper Services

- 10.3 Emerging Players

- 10.3.1 Littlepay

- 10.3.2 Token Transit

- 10.3.3 Bytemark

- 10.3.4 Moovit