PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910834

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910834

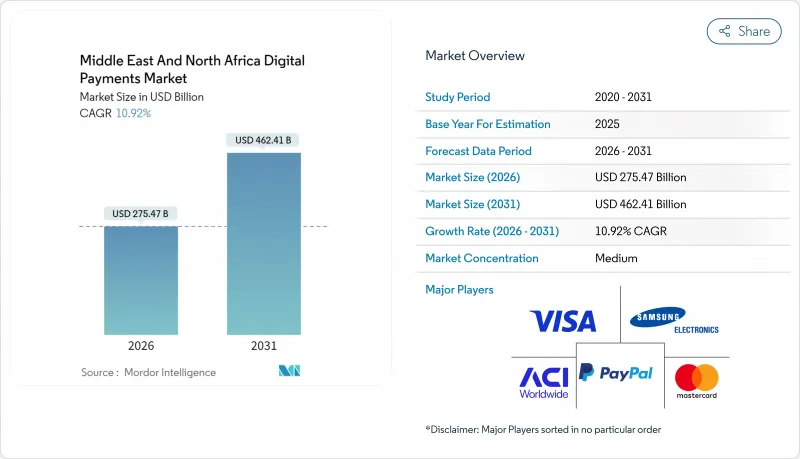

Middle East And North Africa Digital Payments - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Middle East and North Africa digital payments market was valued at USD 248.35 billion in 2025 and estimated to grow from USD 275.47 billion in 2026 to reach USD 462.41 billion by 2031, at a CAGR of 10.92% during the forecast period (2026-2031).

Rapid real-time rails, policy-led cashless mandates, and cross-border e-commerce flows are cementing digital channels as the default settlement method across consumer and B2B contexts. Fintech sandboxes in Bahrain, Abu Dhabi, and Saudi Arabia are accelerating wallet and API innovation, while super-app ecosystems in the Gulf are embedding payments inside everyday consumer journeys. Regional processors are pursuing scale through mergers, and global networks are deepening local partnerships to capture rising card-not-present volumes. Heightened fraud risks in Egypt and Morocco are prompting substantial investments in AI-driven risk engines, tightening the link between security posture and customer adoption.

Middle East And North Africa Digital Payments Market Trends and Insights

Rapid Real-time Payment Rails: Transforming Transaction Velocity

Saudi Arabia's SARIE processed 463 million transfers worth SAR 3.2 trillion in 2024, up 42% year-on-year. The UAE Instant Payment Platform captured 28% of domestic transfers within six months. Instant settlement has shortened working-capital cycles for SMEs, catalysed overlay services such as request-to-pay, and fostered wallet uptake among cash-centric segments. Processors are integrating ISO 20022 messaging to enable richer remittance data, a prerequisite for B2B embedded finance. Banks are recalibrating fee models as intraday liquidity risks decline, while merchants report lower cart abandonment thanks to irrevocable push-payments. The network effects are expected to peak between 2026-2028 as remaining GCC banks finalise full API connectivity.

Government-backed Cashless Mandates: Policy-driven Transformation

Saudi Arabia reached 79% non-cash retail transactions by Q1 2025, surpassing Vision 2030's interim 70% goal. Dubai recorded 88% cashless usage under its Cashless Strategy. Fiscal authorities are linking VAT rebates and procurement contracts to digital acceptance, turning compliance into a commercial incentive. Central banks are synchronising open-finance and token-service rules to streamline wallet provisioning and ensure data portability. Public-sector payroll disbursements now default to wallets, driving inclusion among migrant workers. With statutory e-invoice mandates due in most GCC markets by 2026, card-present and account-to-account rails will converge around national ID tokenisation, tightening KYC assurance.

Fragmented Interchange and MDR Caps: Economics Under Pressure

Disparate merchant-discount-rate ceilings complicate cross-border acquiring economics. PSPs operating in both UAE (flexible MDR) and Egypt (tighter caps) struggle to harmonise blended pricing models, leading to margin compression. SMEs delay terminal deployment when economics appear unfavourable, prolonging cash reliance. Regional associations are lobbying for convergence around cost-based interchange, but legislative cycles point to a multi-year resolution. In the interim, acquirers bundle value-added services such as analytics and instant settlement to defend fee revenue. Tokenised account-to-account propositions also emerge as MDR-free alternatives, reshaping gateway strategy.

Other drivers and restraints analyzed in the detailed report include:

- Cross-border E-commerce: Reshaping Regional Trade Flows

- Fintech Sandboxes: Cultivating Innovation Ecosystems

- Cyber-fraud Escalation: Barriers in Emerging Markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Middle East and North Africa digital payments market recorded 54.60% of its 2025 transaction value at the point of sale; however, online and remote channels grew at a 14.45% CAGR, chipping away at historical dominance. Mobile wallets already account for 18% of in-store spending in the Gulf and are expected to exceed one-third by 2027 as Near-Field Communication (NFC) acceptance becomes ubiquitous. QR-code rails launched by central banks are further collapsing the distinction between "card-present" and "card-not-present," delivering checkout consistency in both physical stores and social-commerce feeds.

Heightened e-commerce adoption after the 2024 pandemic phase-out created durable behavioral change: 85% of regional consumers tested at least one emerging method, such as tokenized click-to-pay or BNPL checkout. Processors now optimise for gateway orchestration that can auto-failover between local schemes, international networks, and account-to-account options in under 200 milliseconds. As instant rails converge with open-banking APIs, PSPs expect authorisation cost reductions of up to 40 basis points, sustaining the margin economics of remote commerce as volume scales.

Solutions gateways, processors, wallets, and fraud engines held 60.85% of the Middle East and North Africa digital payments market size in 2025, reflecting the foundational nature of core infrastructure. Yet Services are projected to climb 18.05% CAGR to 2031, overtaking software revenue in fast-growing sub-markets such as Saudi Arabia. Consultancies are booked nine months in advance for open-API readiness audits, and cloud migration mandates from regulators intensify demand for integration specialists.

Managed fraud monitoring is shifting from licence fees to usage-based models that flex with transaction peaks during Ramadan and Singles' Day. Banks outsource white-label wallets to platform providers, preferring SLA-backed uptime guarantees over in-house builds. Regulatory support functions, including reporting, dispute management, and consumer-protection dashboards, round out service bundles, pushing the average contract value 1.7 times higher than its 2023 equivalents. Consequently, hybrid vendors that pair modular SaaS with advisory retainment enjoy double-digit expansion in bookings through 2028.

The Middle East and North Africa Digital Payments Market Report is Segmented by Mode of Payment (Point of Sale (POS), Online / Remote Payment), Component (Solutions (Gateway, Processing, Wallet, Fraud, Other), Services (Consulting, Integration, Support)), Enterprise Size (Large Enterprises, and More), End-User Industry (Retail and E-Commerce and More), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- PayPal Holdings, Inc.

- Apple Inc.

- Google LLC (Google Pay)

- Samsung Electronics Co., Ltd. (Samsung Pay)

- Mastercard Incorporated

- Visa Inc.

- ACI Worldwide Inc.

- Fawry for Banking and Payment Technology Services S.A.E.

- Network International Holdings plc

- STC Pay - Saudi Digital Payments Co.

- Mada Pay - Saudi Payments

- First Data Corporation (Fiserv, Inc.)

- Denarii Cash Ltd.

- BayanPay - Bayantech Payment Services

- HalalaH Payments Co.

- Beam Wallet LLC

- Commercial International Bank (CIB) Egypt

- Qatar National Bank Al-Ahli (QNB Al-Ahli)

- Emirates Digital Wallet LLC

- BKM Express - BankalararasI Kart Merkezi A.S.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Real-time Payment Rails Roll-out across GCC and Egypt

- 4.2.2 Government-backed Cashless Society Mandates in Saudi Arabia and UAE

- 4.2.3 Surge in Cross-border E-commerce Imports via Turkey and UAE Free-Zones

- 4.2.4 FinTech Sandboxes liberalising Digital Wallet Licensing in Bahrain, Abu Dhabi, and Saudi

- 4.2.5 High Expat Remittance Volumes converging on Mobile P2P Platforms

- 4.2.6 Retailer-led Super-App Race accelerating Embedded Payments

- 4.3 Market Restraints

- 4.3.1 Fragmented Interchange / MDR Caps across MENA Jurisdictions

- 4.3.2 Cyber-fraud escalation in Egypt and Morocco dampening consumer trust

- 4.3.3 Legacy POS infrastructure outside Tier-1 cities

- 4.3.4 Foreign-currency liquidity pressure on cross-border settlements

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook (Open-API, Tokenisation, AI-fraud)

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Competitive Rivalry

- 4.7.5 Threat of Substitutes

- 4.8 Evolution of the Payments Landscape in MENA

- 4.9 Assessment of Macro Economic Trends on the Market

- 4.10 Key Base Indicators

- 4.10.1 Digital Literacy Index

- 4.10.2 Population and Demographics

- 4.10.3 Expatriate Workforce Share

- 4.11 Major Case Studies and Implementation Use-cases

- 4.11.1 Kuwait Finance House and Mashreq - Instant Payments

- 4.11.2 Bank Dhofar Wallet Launch

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Mode of Payment

- 5.1.1 Point of Sale (POS)

- 5.1.2 Online / Remote Payment

- 5.2 By Component

- 5.2.1 Solutions (Gateway, Processing, Wallet, Fraud, Other)

- 5.2.2 Services (Consulting, Integration, Support)

- 5.3 By Enterprise Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises (SMEs)

- 5.4 By End-user Industry

- 5.4.1 Retail and E-commerce

- 5.4.2 Media and Entertainment

- 5.4.3 Healthcare

- 5.4.4 Hospitality and Travel

- 5.4.5 Other End-user Industries (Education, Utilities, Govt.)

- 5.5 By Country

- 5.5.1 Saudi Arabia

- 5.5.2 United Arab Emirates

- 5.5.3 Egypt

- 5.5.4 Turkey

- 5.5.5 Morocco

- 5.5.6 Rest of Middle East and North Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 PayPal Holdings, Inc.

- 6.4.2 Apple Inc.

- 6.4.3 Google LLC (Google Pay)

- 6.4.4 Samsung Electronics Co., Ltd. (Samsung Pay)

- 6.4.5 Mastercard Incorporated

- 6.4.6 Visa Inc.

- 6.4.7 ACI Worldwide Inc.

- 6.4.8 Fawry for Banking and Payment Technology Services S.A.E.

- 6.4.9 Network International Holdings plc

- 6.4.10 STC Pay - Saudi Digital Payments Co.

- 6.4.11 Mada Pay - Saudi Payments

- 6.4.12 First Data Corporation (Fiserv, Inc.)

- 6.4.13 Denarii Cash Ltd.

- 6.4.14 BayanPay - Bayantech Payment Services

- 6.4.15 HalalaH Payments Co.

- 6.4.16 Beam Wallet LLC

- 6.4.17 Commercial International Bank (CIB) Egypt

- 6.4.18 Qatar National Bank Al-Ahli (QNB Al-Ahli)

- 6.4.19 Emirates Digital Wallet LLC

- 6.4.20 BKM Express - BankalararasI Kart Merkezi A.S.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment