PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892757

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892757

Canned Tuna Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

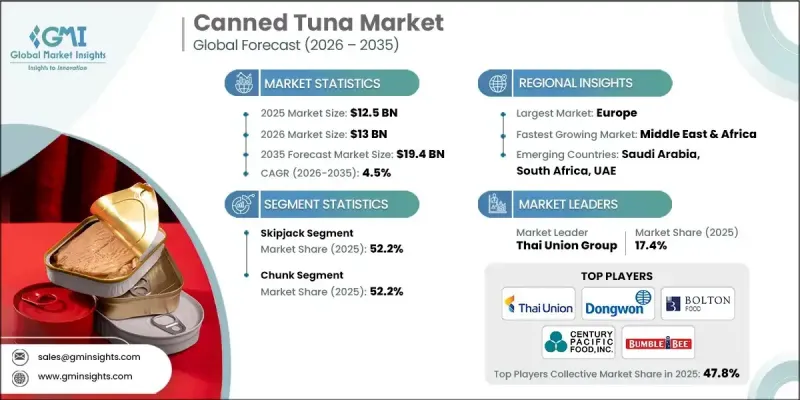

The Global Canned Tuna Market was valued at USD 12.5 billion in 2025 and is estimated to grow at a CAGR of 4.5% to reach USD 19.4 billion by 2035.

Canned tuna is a preserved seafood product where tuna is stored in cans with oil, water, or brine, offering a convenient and long-lasting source of protein. Its affordability, nutritional benefits, and ease of preparation make it a staple in households worldwide. Rising consumer interest in high-protein diets and healthier food options has fueled demand, as canned tuna provides a lean protein source ideal for fitness-conscious individuals. Governments and health organizations globally encourage protein consumption, particularly among the elderly and health-oriented younger populations, highlighting the role of canned tuna in maintaining overall wellness and supporting dietary goals.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $12.5 Billion |

| Forecast Value | $19.4 Billion |

| CAGR | 4.5% |

The skipjack tuna segment held a 52.2% share in 2024 and is expected to grow at a CAGR of 4.6% through 2035. Its widespread availability, low cost, and mild flavor contribute to its dominance. Tropical waters supply skipjack abundantly, reducing sourcing costs for manufacturers and enabling competitive pricing. Its steady supply chain and consumer preference for milder taste profiles further bolster its market position.

The chunk tuna segment accounted for a 52.2% share in 2025 and continues to lead due to its appealing texture and versatility. Chunk tuna is favored by consumers and food manufacturers alike for salads, sandwiches, and ready-to-eat meals, making it a highly sought-after product across retail and food service channels.

North America Canned Tuna Market is expected to grow at a CAGR of 4.6% between 2026 and 2035, with the U.S. alone accounting for USD 3 billion in 2025. Growing consumer awareness around health and sustainability is driving demand for responsibly sourced and organic canned tuna. Manufacturers are adopting eco-friendly fishing practices, using selective gear and vessel tracking technologies to ensure sustainable harvesting. Packaging innovations, including lightweight and recyclable materials, further appeal to environmentally conscious consumers while meeting regulatory and industry sustainability standards.

Key players in the Canned Tuna Market include American Tuna, Bumble Bee Foods, Century Pacific Food, Crown Prince, Dongwon Group, Nauterra, Princes Food, Safe Catch, StarKist Co., Thai Union Group, and Wild Planet Foods. Companies in the canned tuna market are enhancing their market foothold through strategies like sustainable sourcing and responsible fishing practices, which appeal to eco-conscious consumers and regulatory bodies. Investment in innovative, eco-friendly packaging reduces environmental impact while attracting premium buyers. Firms are also expanding their global distribution networks, forging strategic partnerships with retailers and food service providers to increase product availability. Marketing campaigns emphasizing health benefits, quality, and traceability help build brand loyalty. Additionally, companies focus on research and development to diversify product lines, including organic, low-sodium, and specialty flavored options, to cater to evolving consumer preferences and strengthen their competitive position.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Product form

- 2.2.4 Container type

- 2.2.5 End Use

- 2.2.6 Distribution channel

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing protein diet

- 3.2.1.2 Expansion of the food industry

- 3.2.1.3 Convenience trend driving flavored & pouch formats

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Price volatility of tuna

- 3.2.2.2 Competition from alternative proteins

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand for ready-to-eat protein options

- 3.2.3.2 Rising interest in eco-friendly packaging

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Type, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Albacore

- 5.3 Skipjack

- 5.4 Yellowfin

- 5.5 Bigeye

- 5.6 Bluefin

- 5.7 Tongol/longtail

- 5.8 Others

Chapter 6 Market Estimates and Forecast, By Product Form, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Solid

- 6.3 Chunk

- 6.4 Flake

- 6.5 Smoked

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Container Type, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Metal cans

- 7.3 Flexible pouches (retort pouches)

- 7.4 Glass jars

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By End Use, 2022-2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Retail/household consumption

- 8.3 Foodservice (restaurants, hotels, catering)

- 8.4 Institutional (schools, hospitals, military, corporate)

- 8.5 Food processing & manufacturing

- 8.6 Pet food

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2022-2035 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Mass retailers (supermarkets, hypermarkets, warehouse clubs)

- 9.3 Convenience stores

- 9.4 Online retail & e-commerce

- 9.5 Specialty & health food stores

- 9.6 Foodservice distributors

- 9.7 Export/international distributors

- 9.8 Others

Chapter 10 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 American Tuna

- 11.2 Bumble Bee Foods

- 11.3 Century Pacific Food

- 11.4 Crown Prince

- 11.5 Dongwon Group

- 11.6 Nauterra

- 11.7 Princes Food

- 11.8 Safe Catch

- 11.9 StarKist Co.

- 11.10 Thai Union Group

- 11.11 Wild Planet Foods