PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892817

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892817

Bifacial Solar Module Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

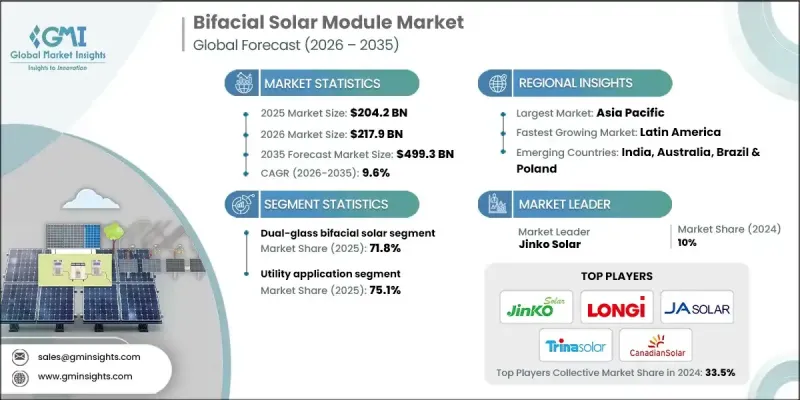

The Global Bifacial Solar Module Market was valued at USD 204.2 billion in 2025 and is estimated to grow at a CAGR of 9.6% to reach USD 499.3 billion by 2035.

Market momentum is supported by rising demand for high-capacity solar solutions that deliver greater electricity output from the same land area, particularly in large-scale renewable energy developments. Advanced cell architectures, including n-type PERC, TOPCon, and heterojunction technologies, are accelerating adoption by improving conversion efficiency, reducing degradation, and enhancing long-term performance. Bifacial solar modules are designed to capture solar radiation from both sides of the panel, allowing energy generation from direct sunlight on the front surface and reflected or diffused light on the rear side. This configuration increases overall power output compared to conventional single-sided modules. Growing deployment in demanding environments has encouraged manufacturers to engineer more resilient module designs that deliver reliable performance over extended operating lifetimes. Continuous improvements in cell efficiency and module durability are strengthening the role of bifacial technology as a preferred solution for maximizing energy yield in modern solar installations.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $204.2 Billion |

| Forecast Value | $499.3 Billion |

| CAGR | 9.6% |

The dual-glass bifacial solar modules segment accounted for 71.8% share in 2025 and is forecast to grow at a CAGR of 8.4% through 2035. Market growth is driven by increasing preference for modules with extended lifespan and higher structural strength. Dual-glass construction improves resistance to environmental stressors and enhances long-term reliability, which supports lower operating expenses and stronger financial returns for both utility-scale and commercial deployments.

The commercial and industrial segment is expected to register a CAGR of 10.8% through 2035. Adoption in this segment is driven by the need to maximize electricity generation where installation space is constrained. Bifacial modules enable higher output without expanding system size, which supports improved energy economics and drives wider use across business facilities.

U.S. Bifacial Solar Module Market held 95.8% share in 2025 and is expected to reach USD 39 billion by 2035. Strong demand for advanced solar technologies, combined with expanding large-scale solar installations and supportive federal incentive structures, continues to boost market penetration. Developers increasingly rely on bifacial systems to enhance project returns and optimize energy production from available land resources.

Key companies active in the Global Bifacial Solar Module Market include Jinko Solar, Canadian Solar, LONGi Green Energy Technology, Trina Solar, JA Solar Technology, Hanwha Q CELLS, First Solar, Sharp Corporation, Vikram Solar, Silfab Solar, Astronergy, AE Solar, Axitec, Boviet Solar, Bluesun Solar, Seraphim Solar, Yingli Solar, Primroot, Sunergy, and 3Sun. Companies operating in the Global Bifacial Solar Module Market focus on multiple strategic initiatives to strengthen their competitive position. Manufacturers prioritize investments in research and development to enhance cell efficiency, reduce power loss, and extend product lifespan. Capacity expansion and vertical integration strategies are adopted to control production costs and ensure stable supply chains. Strategic partnerships with project developers and energy providers help accelerate market penetration and secure long-term contracts. Firms also emphasize geographic expansion to capture demand in high-growth regions while aligning product portfolios with local regulatory frameworks.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Market estimates & forecast parameters

- 1.3 Forecast

- 1.3.1 Key trends for market estimates

- 1.3.1.1 Quantified market impact analysis

- 1.3.2 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario analysis framework

- 1.3.1 Key trends for market estimates

- 1.4 Primary research and validation

- 1.4.1 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Paid Sources

- 1.5.2 Sources, by region

- 1.6 Research trail & scoring components

- 1.6.1 Research trail components

- 1.6.2 Scoring components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

- 1.8 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022 - 2035

- 2.2 Business trends

- 2.3 Thickness trends

- 2.4 Type trends

- 2.5 Application trends

- 2.6 Technology trends

- 2.7 Frame type trends

- 2.8 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Cost structure analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

- 3.7.1 Political factors

- 3.7.2 Economic factors

- 3.7.3 Social factors

- 3.7.4 Technological factors

- 3.7.5 Legal factors

- 3.7.6 Environmental factors

- 3.8 Emerging opportunities & trends

- 3.8.1 Digitalization & IoT integration

- 3.8.2 Emerging market penetration

- 3.9 Investment analysis and future outlook

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2025

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Thickness, 2022 - 2035 (USD Billion)

- 5.1 Key trends

- 5.2 < 2 mm

- 5.3 2 mm to 3 mm

- 5.4 > 3 mm

Chapter 6 Market Size and Forecast, By Type, 2022 - 2035 (USD Billion)

- 6.1 Key trends

- 6.2 Dual-Glass Bifacial Solar

- 6.3 Glass-Backsheet Bifacial Solar

Chapter 7 Market Size and Forecast, By Application, 2022 - 2035 (USD Billion)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial & Industrial

- 7.4 Utility

Chapter 8 Market Size and Forecast, By Technology, 2022 - 2035 (USD Billion)

- 8.1 Key trends

- 8.2 Passivated Emitter Rear Contact (PERC)

- 8.3 TOPCon

- 8.4 Heterojunction (HJT)

Chapter 9 Market Size and Forecast, By Frame Type, 2022 - 2035 (USD Billion)

- 9.1 Key trends

- 9.2 Framed

- 9.3 Frameless

Chapter 10 Market Size and Forecast, By Region, 2022 - 2035 (USD Billion)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 Spain

- 10.3.3 Netherlands

- 10.3.4 Poland

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Australia

- 10.4.3 India

- 10.4.4 Japan

- 10.5 Middle East & Africa

- 10.5.1 UAE

- 10.5.2 Turkey

- 10.5.3 Egypt

- 10.6 Latin America

- 10.6.1 Brazil

- 10.6.2 Chile

Chapter 11 Company Profiles

- 11.1 3Sun

- 11.2 AE Solar

- 11.3 Astronergy

- 11.4 Axitec

- 11.5 Bluesun Solar

- 11.6 Boviet Solar

- 11.7 Canadian Solar

- 11.8 First Solar

- 11.9 Hanwha Q CELLS

- 11.10 JA Solar Technology

- 11.11 Jinko Solar

- 11.12 LONGi Green Energy Technology

- 11.13 Primroot

- 11.14 Seraphim Solar

- 11.15 Sharp Corporation

- 11.16 Silfab Solar

- 11.17 Sunergy

- 11.18 Trina Solar

- 11.19 Vikram Solar

- 11.20 Yingli Solar