PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892830

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892830

Commercial Seaweed Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

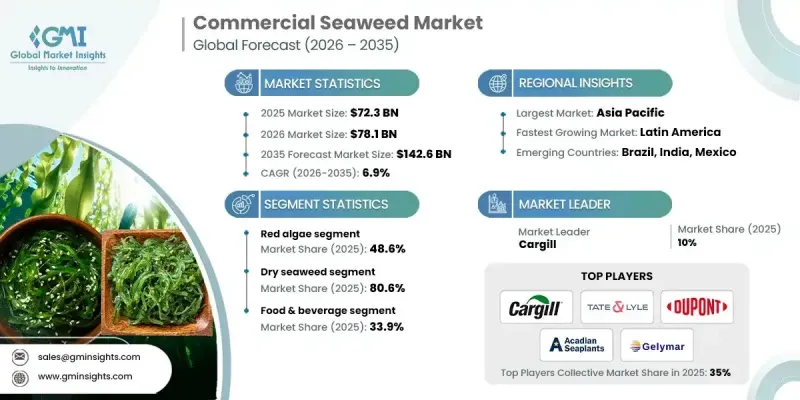

The Global Commercial Seaweed Market was valued at USD 72.3 billion in 2025 and is estimated to grow at a CAGR of 6.9% to reach USD 142.6 billion by 2035.

The market continues to gain momentum as seaweed becomes increasingly integrated into multiple value chains, supported by its functional versatility and sustainability profile. Demand growth is strongly linked to the rising use of seaweed-derived hydrocolloids that perform essential binding, stabilizing, and thickening functions across food, cosmetics, and industrial formulations. These applications collectively account for more than 40% of global commercial seaweed revenue. At the same time, the transition toward environmentally responsible agricultural practices is accelerating the adoption of seaweed-based inputs, positioning seaweed as a natural solution aligned with regenerative and low-impact farming models. Global policy alignment with sustainable agriculture has further strengthened demand. In parallel, innovation across seaweed biotechnology is expanding the market's value potential, as producers invest in advanced processing to extract high-value compounds for nutrition, health, and specialty applications. These developments are reshaping the commercial seaweed industry from a volume-driven sector into a technology-enabled, high-value ecosystem with diversified end uses and strong long-term growth visibility.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $72.3 Billion |

| Forecast Value | $142.6 Billion |

| CAGR | 6.9% |

The red algae segment held a 48.6% share in 2025 and is expected to grow at a CAGR of 6.8% through 2035. This dominance is supported by its widespread use in hydrocolloid production, which remains a foundational input across food, pharmaceutical, and personal care manufacturing, reinforcing steady global demand.

The food & beverage applications segment held 33.9% share in 2025 and is forecast to grow at a CAGR of 6.8% from 2026 to 2035. Seaweed continues to be widely incorporated as a natural functional ingredient, supporting formulation stability, nutritional enhancement, and clean-label positioning across packaged and processed food categories.

North America Commercial Seaweed Market accounted for 11% share in 2025 and is showing rapid growth. The region benefits from increasing investment in sustainable aquaculture, climate-aligned materials, and alternative feed solutions, driving broader commercial adoption and downstream innovation.

Key companies operating in the Global Commercial Seaweed Market include Cargill, Tate & Lyle, DuPont, FMC Corporation, Algaia, Gelymar, Acadian Seaplants, Irish Seaweeds, KIMICA Corporation, Qingdao Seawin Biotech Group, Ocean Harvest Technology, Seasol, Seaweed Energy Solutions, Indo Alginate, TBK Manufacturing Corporation, W Hydrocolloids, Inc., MCPI, Mara Seaweed, Qingdao Gather Great Ocean Algae Industry Group, and Shaanxi Hongda Phytochemistry. Companies in the Global Commercial Seaweed Market are strengthening their market position by expanding vertically across cultivation, processing, and formulation to secure supply consistency and improve margins. Significant investment is directed toward research and development to unlock high-value extracts and improve processing efficiency. Strategic partnerships with food, agriculture, and wellness manufacturers are helping accelerate commercialization and application development. Firms are also scaling production capacity in high-growth regions to reduce logistics costs and meet rising demand.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Form

- 2.2.4 End use

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code)(Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Type, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Red algae

- 5.3 Brown algae

- 5.4 Green algae

Chapter 6 Market Estimates and Forecast, By Form, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Dry seaweed

- 6.3 Wet/Fresh seaweed

Chapter 7 Market Estimates and Forecast, By End use, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food & beverage

- 7.2.1 Dairy products

- 7.2.2 Bakery & confectionery

- 7.2.3 Processed meats & seafood

- 7.2.4 Vegan/plant-based foods

- 7.2.5 Functional beverages

- 7.2.6 Edible seaweed snacks

- 7.2.7 Sauces, soups & seasonings

- 7.3 Animal feed

- 7.3.1 Livestock feed additives

- 7.3.2 Poultry feed

- 7.3.3 Aquaculture feed

- 7.3.4 Pet food supplements

- 7.3.5 Methane-reducing feed for ruminants

- 7.4 Pharmaceutical & personal care

- 7.4.1 Wound healing ointments

- 7.4.2 Drug delivery systems

- 7.4.3 Skin care lotions & creams

- 7.4.4 Shampoos & conditioners

- 7.4.5 Anti-aging & anti-inflammatory products

- 7.4.6 Oral care products

- 7.5 Biofuels

- 7.5.1 Bioethanol production

- 7.5.2 Biogas generation

- 7.5.3 Algal biomass pre-treatment inputs

- 7.5.4 Hybrid renewable energy blends

- 7.6 Others

- 7.6.1 Agricultural biostimulants

- 7.6.2 Soil conditioners

- 7.6.3 Water treatment agents

- 7.6.4 Textile industry applications

- 7.6.5 Bioplastics & packaging materials

Chapter 8 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Acadian Seaplants

- 9.2 Algaia

- 9.3 Cargill

- 9.4 DuPont

- 9.5 FMC Corporation

- 9.6 Gelymar

- 9.7 Indo Alginate

- 9.8 Irish Seaweeds

- 9.9 KIMICA Corporation

- 9.10 Mara Seaweed

- 9.11 MCPI (Marine Chemicals & Polymers Industries)

- 9.12 Ocean Harvest Technology

- 9.13 Qingdao Gather Great Ocean Algae Industry Group

- 9.14 Qingdao Seawin Biotech Group

- 9.15 Seasol

- 9.16 Seaweed Energy Solutions

- 9.17 Shaanxi Hongda Phytochemistry Co., Ltd.

- 9.18 Tate & Lyle

- 9.19 TBK Manufacturing Corporation (Philippines)

- 9.20 W Hydrocolloids, Inc.

- 9.21 Others