PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913272

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913272

North America Blinds and Shutters Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

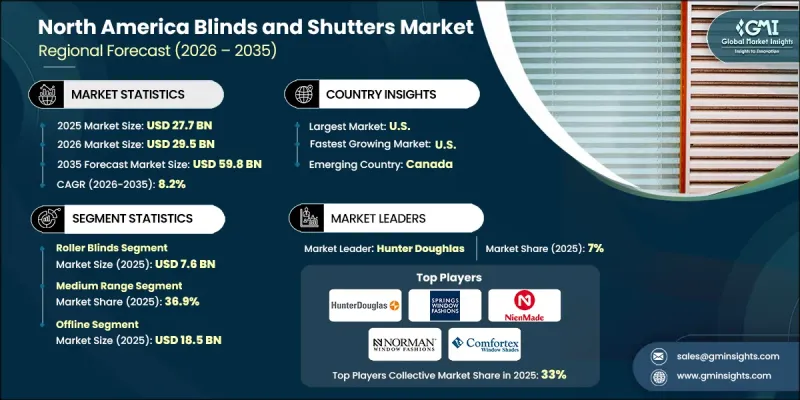

North America Blinds and Shutters Market was valued at USD 27.7 billion in 2025 and is estimated to grow at a CAGR of 8.2% to reach USD 59.8 billion by 2035.

Consumer perception across the region shifts significantly as window coverings move beyond their functional utility and become design-focused elements within interior spaces. Buyers now treat blinds and shutters as visual enhancers that support a unified home theme rather than standalone products. This change reshapes purchasing behavior and elevates expectations related to design flexibility, finish quality, and personalization. Manufacturers respond by offering diverse product portfolios that allow seamless alignment with evolving interior preferences. Customization, coordinated aesthetics, and value-driven innovation increasingly influence brand selection. The rising interest in renovation activities, coupled with greater awareness of interior styling, positions blinds and shutters as essential components of home improvement investments. Brands benefit from this evolution by positioning themselves as design collaborators rather than product suppliers, delivering tailored solutions and consultation-based services. This transformation strengthens market depth, supports long-term demand, and reinforces North America's position as a mature yet fast-evolving regional market driven by style-conscious consumers and consistent spending capacity.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $27.7 Billion |

| Forecast Value | $59.8 Billion |

| CAGR | 8.2% |

The roller blinds segment generated USD 7.6 billion in 2025. Strong demand stems from their adaptability, refined appearance, and broad design appeal, which aligns well with contemporary consumer preferences focused on simplicity and functionality.

The medium price range segment held 36.9% share in 2025. This segment attracts the widest customer base by striking a balance between visual appeal, reliable performance, and reasonable pricing. Buyers favor this category because it delivers noticeable quality improvements without the cost burden associated with high-end offerings.

U.S. Blinds and Shutters Market held a 79.7% share in 2025 and reached USD 22.1 billion. Strong housing activity, an established renovation culture, and sustained consumer purchasing power support this dominant position and drive consistent demand across product categories.

Key companies active in the North America Blinds and Shutters Market include Hunter Douglas N.V., Springs Window Fashions, 3 Day Blinds LLC, Lutron Electronics, Norman Window Fashions, Draper, Inc., Lafayette Interior Fashions, Nien Made Enterprise, Coulisse B.V., Rollease Acmeda, Vista Products, Comfortex Window Fashions, Skandia Window Fashions, Timber Blinds, and Maxxmar Window Fashions. Companies in the North America Blinds and Shutters Market strengthen their foothold through product differentiation, design-driven innovation, and expanded customization capabilities. Many brands invest in advanced materials, improved operating systems, and refined finishes to meet rising consumer expectations. Strategic partnerships with designers, builders, and renovation specialists help firms integrate their products earlier in the decision-making process. Businesses also emphasize omnichannel distribution models, combining digital visualization tools with in-person consultation services.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional

- 1.3.2 Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Country

- 2.2.2 Product

- 2.2.3 Material

- 2.2.4 Type

- 2.2.5 Price range

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising home renovation and interior design consciousness

- 3.2.1.2 Energy efficiency and sustainability mandates

- 3.2.1.3 Expansion of smart home integration

- 3.2.2 Pitfalls & Challenges

- 3.2.2.1 Intense price competition and market fragmentation

- 3.2.2.2 Supply chain vulnerabilities and raw material volatility

- 3.2.3 Opportunities

- 3.2.3.1 Expansion into eco-friendly and recycled materials

- 3.2.3.2 Customization and direct-to-consumer digital channels

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By country

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Gap Analysis

- 3.10 Risk assessment and mitigation

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

- 3.13 Consumer behaviour analysis

- 3.13.1 Purchasing patterns

- 3.13.2 Preference analysis

- 3.13.3 Regional variations in consumer behaviour

- 3.13.4 Impact of e-commerce on buying decision

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By country

- 4.2.1.1 U.S.

- 4.2.1.2 Canada

- 4.2.1 By country

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022 - 2035 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Roller blinds

- 5.3 Venetian blinds

- 5.4 Vertical blinds

- 5.5 Roman & pleated blinds

- 5.6 Plantation shutters

- 5.7 Panel track/sliding panels

- 5.8 Others (cellular, smart, outdoor)

Chapter 6 Market Estimates and Forecast, By Material, 2022 - 2035 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Blinds

- 6.2.1 Fabric

- 6.2.2 Wood

- 6.2.3 Aluminum

- 6.2.4 Plastic

- 6.2.5 Composite

- 6.3 Shutters

- 6.3.1 Wood (basswood, cedar)

- 6.3.2 Vinyl/PVC

- 6.3.3 Composite

- 6.3.4 Aluminum

Chapter 7 Market Estimates and Forecast, By Type, 2022 - 2035 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Manual

- 7.3 Motorized

- 7.4 Smart/IoT-enabled

Chapter 8 Market Estimates and Forecast, By Price Range, 2022 - 2035 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 E-commerce

- 9.2.2 Company websites

- 9.3 Offline

- 9.3.1 Specialty stores

- 9.3.2 Retail stores

- 9.3.3 Others (interior design studios & boutiques, etc.)

Chapter 10 Market Estimates and Forecast, By Country, 2022 - 2035 (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 U.S.

- 10.3 Canada

Chapter 11 Company Profiles

- 11.1 3 Day Blinds LLC

- 11.2 Comfortex Window Fashions

- 11.3 Coulisse B.V.

- 11.4 Draper, Inc.

- 11.5 Hunter Douglas N.V.

- 11.6 Lafayette Interior Fashions

- 11.7 Lutron Electronics

- 11.8 Maxxmar Window Fashions

- 11.9 Nien Made Enterprise

- 11.10 Norman Window Fashions

- 11.11 Rollease Acmeda

- 11.12 Skandia Window Fashions

- 11.13 Springs Window Fashions

- 11.14 Timber Blinds

- 11.15 Vista Products