PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913275

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913275

Blinds and Shutters Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

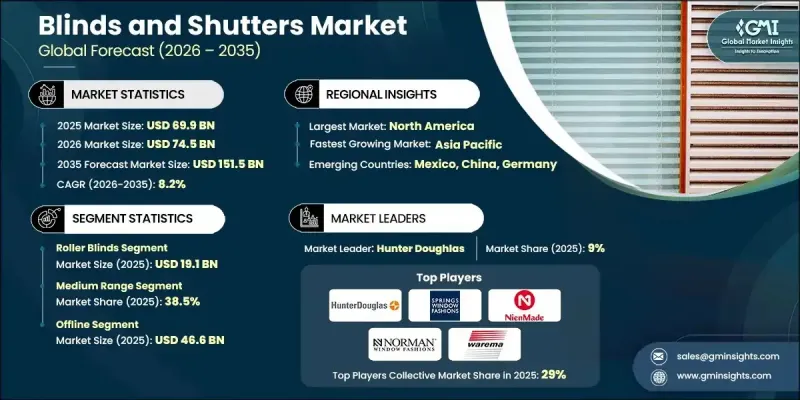

The Global Blinds and Shutters Market was valued at USD 69.9 billion in 2025 and is estimated to grow at a CAGR of 8.2% to reach USD 151.5 billion by 2035.

This growth reflects a fundamental shift in how window coverings are perceived, as consumers increasingly treat blinds and shutters as design elements rather than purely functional products. Homeowners now prioritize visual harmony, material appeal, and design alignment with interior spaces, which has significantly influenced purchasing behavior. Manufacturers are responding by expanding product portfolios that balance appearance, performance, and customization. Design-conscious consumers are seeking window solutions that reflect modern lifestyles, whether minimalistic or upscale, and this demand continues to shape product development strategies. The growing influence of digital platforms has also contributed to faster trend adoption, allowing consumers to discover new design ideas and product variations with greater ease. As a result, the blinds and shutters industry is experiencing a transformation driven by evolving design preferences, increasing discretionary spending on home upgrades, and the availability of diverse product choices that meet both aesthetic and practical expectations.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $69.9 Billion |

| Forecast Value | $151.5 Billion |

| CAGR | 8.2% |

Blinds and shutters are now widely recognized as integral components of interior styling rather than simple window coverings. Buyers increasingly expect these products to enhance overall decor while maintaining functionality. This change in perception has encouraged suppliers to introduce broader selections of colors, textures, and materials, along with refined finishes and customization capabilities. Products are being developed to align with contemporary, elegant, and high-end interior themes, allowing consumers to achieve a cohesive visual identity throughout their spaces. This evolution has prompted manufacturers to curate multiple collections that cater to varied design preferences and lifestyle needs without compromising quality or affordability.

The roller blinds segment generated USD 19.1 billion in 2025, securing a leading share within the overall market. Their strong position is supported by their adaptable design, ease of use, and visual simplicity. These characteristics have made roller blinds a preferred choice among consumers seeking streamlined window solutions that align with modern interior trends. Their ability to combine practicality with clean aesthetics has reinforced their widespread appeal and sustained demand across global markets.

The medium-priced category accounted for 38.5% share in 2025, making it the most dominant pricing segment. This range attracts buyers who seek noticeable improvements in durability, appearance, and material quality compared to entry-level offerings, while remaining cost-effective. Consumers in this segment value balanced solutions that deliver reliable performance and enhanced visual appeal without the premium pricing associated with luxury products. This positioning has made the medium range a critical revenue driver for manufacturers worldwide.

United States Blinds and Shutters Market held 79.7% share, generating USD 22.1 billion in 2025. The region benefits from strong demand driven by housing activity, renovation spending, and high purchasing power. Well-established distribution systems and a mature consumer base continue to support consistent sales growth, reinforcing North America's influential role within the global blinds and shutters industry.

Key companies actively shaping the Global Blinds and Shutters Market include Hunter Douglas N.V., Springs Window Fashions, 3 Day Blinds LLC, Norman Window Fashions, Hillarys Blinds Ltd., Griesser AG, Warema Renkhoff SE, Coulisse B.V., Lafayette Interior Fashions, Rollease Acmeda, Nichibei Co., Ltd., Tachikawa Corporation, Nien Made Enterprise, TOSO Company, and Thomas Sanderson Ltd. These players continue to invest in product innovation, brand positioning, and global expansion to strengthen their market presence. Companies operating in the Global Blinds and Shutters Market are strengthening their competitive position through a combination of product innovation, customization capabilities, and strategic expansion. Many brands are investing in advanced materials, improved operating mechanisms, and refined finishes to meet rising consumer expectations for quality and design. Custom-made solutions are being emphasized to address diverse style preferences and sizing requirements.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Material

- 2.2.4 Type

- 2.2.5 Price range

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising home renovation and interior design consciousness

- 3.2.1.2 Energy efficiency and sustainability mandates

- 3.2.1.3 Expansion of smart home integration

- 3.2.2 Pitfalls & Challenges

- 3.2.2.1 Intense price competition and market fragmentation

- 3.2.2.2 Supply chain vulnerabilities and raw material volatility

- 3.2.3 Opportunities

- 3.2.3.1 Expansion into eco-friendly and recycled materials

- 3.2.3.2 Customization and direct-to-consumer digital channels

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code-3925.30.00)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Gap Analysis

- 3.10 Risk assessment and mitigation

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

- 3.13 Consumer behaviour analysis

- 3.13.1 Purchasing patterns

- 3.13.2 Preference analysis

- 3.13.3 Regional variations in consumer behaviour

- 3.13.4 Impact of e-commerce on buying decision

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022 - 2035 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Roller blinds

- 5.3 Venetian blinds

- 5.4 Vertical blinds

- 5.5 Roman & pleated blinds

- 5.6 Plantation shutters

- 5.7 Panel track / sliding panels

- 5.8 Others (cellular, smart, outdoor)

Chapter 6 Market Estimates and Forecast, By Material, 2022 - 2035 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Blinds

- 6.2.1 Fabric

- 6.2.2 Wood

- 6.2.3 Aluminum

- 6.2.4 Plastic

- 6.2.5 Composite

- 6.3 Shutters

- 6.3.1 Wood (basswood, cedar)

- 6.3.2 Vinyl/PVC

- 6.3.3 Composite

- 6.3.4 Aluminum

Chapter 7 Market Estimates and Forecast, By Type, 2022 - 2035 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Manual

- 7.3 Motorized

- 7.4 Smart / IoT-enabled

Chapter 8 Market Estimates and Forecast, By Price Range, 2022 - 2035 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 E-commerce

- 9.2.2 Company websites

- 9.3 Offline

- 9.3.1 Specialty stores

- 9.3.2 Retail stores

- 9.3.3 Others (interior design studios & boutiques, etc.)

Chapter 10 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 3 Day Blinds LLC

- 11.2 Coulisse B.V.

- 11.3 Griesser AG

- 11.4 Hillarys Blinds Ltd.

- 11.5 Hunter Douglas N.V.

- 11.6 Lafayette Interior Fashions

- 11.7 Nichibei Co., Ltd.

- 11.8 Nien Made Enterprise

- 11.9 Norman Window Fashions

- 11.10 Rollease Acmeda

- 11.11 Springs Window Fashions

- 11.12 Tachikawa Corporation

- 11.13 Thomas Sanderson Ltd.

- 11.14 TOSO Company

- 11.15 Warema Renkhoff SE