PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906172

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906172

Blinds - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

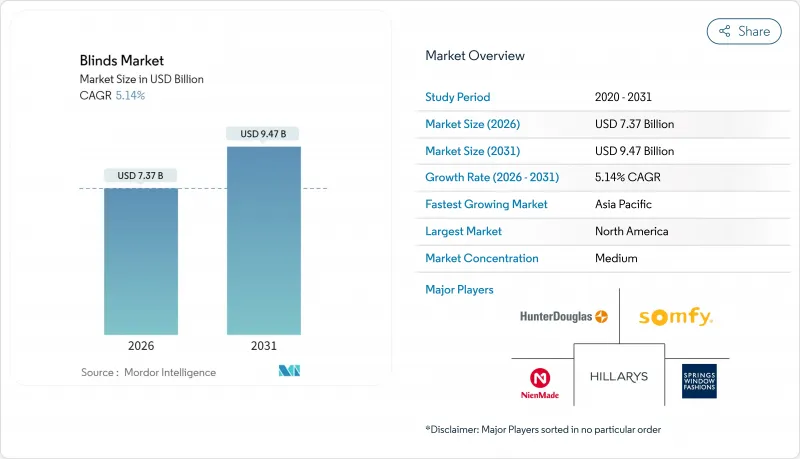

The global blinds market was valued at USD 7.01 billion in 2025 and estimated to grow from USD 7.37 billion in 2026 to reach USD 9.47 billion by 2031, at a CAGR of 5.14% during the forecast period (2026-2031).

Energy-efficiency mandates contained in ASHRAE 90.1-2022 and state codes such as California Title 24 are steering specifications toward motorized and sensor-driven solutions. Post-pandemic remodeling has revived residential demand and commercial real-estate developers are embracing circadian-lighting-ready shading to comply with WELL and LEED requirements. Input price swings for aluminum, wood, and PVC raise cost-management challenges, yet they also accelerate innovation in recycled and bio-based materials. Smart-home platforms, IoT connectivity, and wellness certification together expand the addressable blinds market far beyond its traditional replacement cycles.

Global Blinds Market Trends and Insights

Rising Smart-Home & IoT Adoption

Smart-ready blinds now link natively with voice assistants and multi-protocol hubs, turning shading into a standard node on household or building networks. Vendors embed HDR-based luminance sensors and predictive algorithms that track sun position and occupancy, thereby cutting lighting energy by up to half while boosting visual comfort. National procurement guidelines for federal facilities in the United States stipulate automatic shade controls that maintain daylight autonomy, accelerating specification in public buildings. Subscription models for remote diagnostics and firmware updates create recurring revenue streams that tilt the industry toward service-oriented economics. The shift reinforces consumer expectations that every window covering will eventually be app-controlled.

Energy-Efficiency Building Codes & Green Certifications

California Title 24 and the International Energy Conservation Code raise the bar on solar-heat-gain coefficients and U-factors, effectively nudging architects toward dynamic shading paired with Low-E glazing. ASHRAE 90.1-2022 widens its scope to include on-site renewables, which magnifies the payoff from demand-side daylight harvesting. Buildings pursuing LEED v4 or WELL v2 achieve multiple points when automated blinds are integrated with daylighting controls, giving premium products a clear compliance advantage. As codes tighten, a two-tier pricing structure is emerging: baseline manual blinds for simple retrofits and high-margin motorized systems that exceed minimum performance thresholds. Manufacturers that document measurable energy savings gain preferred-supplier status on large public projects.

Low-Cost Substitute Curtains & Drapes

Ready-made curtains dominate rental housing and emerging markets, where budget considerations often overshadow automation. From 2017 to 2021, European imports of curtains rose from USD 1.66 billion to USD 1.97 billion, underscoring the enduring appeal of textile alternatives that seamlessly blend decor and privacy. These curtains offer a cost-effective solution for households and businesses seeking functional yet aesthetically pleasing window treatments. Natural fiber drapes resonate with eco-friendly trends and come at a lower price point than motorized blinds and their control hardware. Additionally, their straightforward installation process appeals to both short-stay accommodations and DIY renovators, making them a preferred choice in these segments. In response to this challenge, blind manufacturers have begun offering bundled installation services and warranty coverage, a competitive edge that curtains currently lack. This strategic move aims to attract consumers who prioritize convenience and long-term value over initial cost savings.

Other drivers and restraints analyzed in the detailed report include:

- Commercial Real-Estate Expansion & Glare-Control Standards

- Insurance Discounts Tied to Fire-Rated Automated Blinds

- Volatile Aluminum, Wood & PVC Input Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Roller blinds held 33.74% of 2025 revenue, benefiting from minimal stack depth and compatibility with wide glass facades. Enhanced by silent motors and adaptive sensor packages, they now match aesthetics with advanced performance, broadening appeal in both offices and mid-price housing. Smart blinds, though a smaller base today, record a 7.39% CAGR and showcase the fastest uptake among tech-savvy end-users who value app control and automated routines. Field studies reveal that dynamic roller models cut lighting electricity by 50% while sustaining comfortable luminance for 90% of occupied hours, thereby satisfying utility rebates tied to peak-load shaving. The convergence of AI controllers with classical fabrics blurs product boundaries and lifts the overall blinds market beyond commodity status.

Venetian and vertical formats continue to dominate open-plan offices that require angle-specific glare control and outward view preservation. Roman blinds thrive in premium residential interiors where layered textiles create decor depth without compromising functional shading. Pleated cellular variants deliver measurable insulation gains, complementing government incentives for thermal retrofits. Panel tracks occupy a niche in hospitality lobbies and conference partitions, yet they demonstrate above-average margins because of custom printing and wide-panel engineering. Across all categories, the incremental cost of embedded motors and wireless chips is falling, enabling suppliers to pre-wire intelligence even in SKUs that once shipped purely manually; this shift steadily enlarges the addressable blinds market among mid-income consumers.

Manual units still dominate at 70.42% due to low initial cost and simple installation, especially in DIY retail channels. That share is eroding as building codes and corporate ESG policies weigh life-cycle performance over purchase price. Motorized systems, projected to grow 8.65% annually, align with open-plan offices where frequent manual adjustment is impractical, and labor costs outweigh motor premiums within two years of operation. Retrofit innovations such as solar-powered battery tubes and stick-on RF remotes bypass wiring constraints, removing a long-standing barrier to adoption. Compliance with FCC and CE wireless protocols remains a hurdle, but leading brands use modular transceivers that can switch frequency bands to meet regional rules, safeguarding global rollouts.

Smart controllers exploit cloud analytics to predict sun paths and occupancy patterns, driving autonomous schedules that enhance occupant comfort and energy savings. Voice assistants and smart-home dashboards elevate blinds from background furnishings to interactive features, fostering higher replacement interest among tech-oriented households. Facility managers favor open APIs that slot directly into BACnet or KNX networks, ensuring future flexibility. As SaaS dashboards offer energy reports and fault diagnostics, vendors shift revenue toward subscription bundles that bundle maintenance with firmware updates. The evolution from pull cords to predictive algorithms epitomizes how automation amplifies the blinds market value proposition.

The Global Blinds Market is Segmented by Product Type (Roller Blinds, Venetian Blinds, Vertical Blinds, Roman Blinds, and More), Operation Mode (Manual Blinds and Motorized Blinds), Material (Fabric, Wood, Faux Wood, and More), Application (Residential and Commercial), Distribution Channel (B2C/Retail Channels and B2B/Projects), and Geography. The Market Forecasts are Provided in Value (USD).

Geography Analysis

North America commands leadership with a market share of 31.72%, powered by stringent energy codes and a mature aftermarket of homeowners willing to invest in smart-home upgrades. Single-family housing starts reached a 12-month high of 1.50 million units in February 2025, sustaining pipeline demand for new installations. Title 24 and the U.S. federal facility standards formalize automated shading as a compliance pathway, pushing specifiers toward motorized units with documented performance. Remodelers leverage tax incentives and favorable financing to bundle window treatments into broader energy retrofits, ensuring repeat sales in aging housing stock. Canadian provinces follow similar trajectories, with cold-climate emphasis on cellular insulation and edge-seal technologies.

Europe is the proving ground for eco-material innovation and circular design principles, with continued growth from USD 1.66 billion in 2017 to USD 1.97 billion in 2021 despite pandemic headwinds. Germany, France, and the United Kingdom anchor demand through a mix of renovation programs and corporate wellness initiatives. Regulation (EU) 923/2023 reshapes product portfolios by outlawing high-lead PVC compositions, steering the blinds market toward natural fibers and recycled metals. Northern and Western Europe showcase advanced daylight-harvesting projects using facade-integrated blinds, while Southern Europe emphasizes solar-heat-gain mitigation. Production clusters in Poland and the Czech Republic provide cost-effective manufacturing that complements regional distribution hubs.

Asia-Pacific is the fastest-growing territory with a CAGR of 6.02%, driven by rapid urbanization and skyscraper proliferation requiring sophisticated facade solutions. Developers in markets such as China, India, and Southeast Asia import North American and European automation standards to attract multinational tenants. Climate diversity from tropical humidity to temperate monsoons creates demand for wide material palettes ranging from moisture-resistant PVC to reflective aluminum. Domestic smart-home ecosystems integrate locally designed blinds with voice assistants in regional languages, enhancing adoption among middle-income households. Strong e-commerce growth adds momentum, particularly in Japan and South Korea, where compact living spaces favor made-to-measure postal delivery services that expand the overall blinds market.

- Hunter Douglas

- Springs Window Fashions

- Somfy Systems

- Nien Made Enterprise

- Hillarys

- Graber

- Budget Blinds

- 3 Day Blinds

- Warema Renkhoff SE

- Griesser AG

- Luxaflex

- Lutron Electronics

- Vertilux

- ABC Blinds & Awnings

- Alta Window Fashions

- TOSO Co., Ltd.

- Nichibei Co., Ltd.

- Norman Window Fashions

- The Shade Store

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Table of Contents - Blinds Market

2 Introduction

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

3 Research Methodology

4 Executive Summary

5 Market Landscape

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.2.1 Rising smart-home & IoT adoption

- 5.2.2 Energy-efficiency building codes & green certifications

- 5.2.3 Post-pandemic residential remodeling surge

- 5.2.4 Commercial real-estate expansion & glare-control standards

- 5.2.5 Insurance discounts tied to fire-rated automated blinds

- 5.2.6 Circadian-lighting integration in wellness-certified offices

- 5.3 Market Restraints

- 5.3.1 Low-cost substitute curtains & drapes

- 5.3.2 Volatile aluminum, wood & PVC input prices

- 5.3.3 RF-interference compliance hurdles for retro-fit motors

- 5.3.4 Regulatory scrutiny on PVC plasticizers in vinyl blinds

- 5.4 Industry Value Chain Analysis

- 5.5 Porter's Five Forces Analysis

- 5.5.1 Threat of New Entrants

- 5.5.2 Bargaining Power of Suppliers

- 5.5.3 Bargaining Power of Buyers

- 5.5.4 Threat of Substitutes

- 5.5.5 Competitive Rivalry

- 5.6 Insights into the Latest Trends and Innovations in the Market

- 5.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

6 Market Size & Growth Forecasts (value)

- 6.1 By Product Type

- 6.1.1 Roller Blinds

- 6.1.2 Venetian Blinds

- 6.1.3 Vertical Blinds

- 6.1.4 Roman Blinds

- 6.1.5 Pleated / Cellular Blinds

- 6.1.6 Panel Blinds

- 6.1.7 Smart Blinds

- 6.2 By Operation Mode

- 6.2.1 Manual Blinds

- 6.2.2 Motorized / Electric Blinds

- 6.3 By Material

- 6.3.1 Fabric / Textile

- 6.3.2 Wood

- 6.3.3 Faux Wood / Composite

- 6.3.4 Aluminum

- 6.3.5 Plastic / Vinyl

- 6.3.6 Bamboo & Natural Fiber

- 6.4 By Application

- 6.4.1 Residential

- 6.4.2 Commercial

- 6.4.2.1 Offices

- 6.4.2.2 Hospitality (Hotels & Restaurants)

- 6.4.2.3 Healthcare & Institutional

- 6.4.2.4 Industrial & Warehouses

- 6.5 By Distribution Channel

- 6.5.1 B2C/Retail Channels

- 6.5.1.1 Specialty Stores

- 6.5.1.2 Home Improvement Stores

- 6.5.1.3 Department Stores

- 6.5.1.4 Online

- 6.5.1.5 Other Distribution Channels

- 6.5.2 B2B/Projects

- 6.5.1 B2C/Retail Channels

- 6.6 By Geography

- 6.6.1 North America

- 6.6.1.1 Canada

- 6.6.1.2 United States

- 6.6.1.3 Mexico

- 6.6.2 South America

- 6.6.2.1 Brazil

- 6.6.2.2 Peru

- 6.6.2.3 Chile

- 6.6.2.4 Argentina

- 6.6.2.5 Rest of South America

- 6.6.3 Europe

- 6.6.3.1 United Kingdom

- 6.6.3.2 Germany

- 6.6.3.3 France

- 6.6.3.4 Spain

- 6.6.3.5 Italy

- 6.6.3.6 BENELUX (Belgium, Netherlands, Luxembourg)

- 6.6.3.7 NORDICS (Denmark, Finland, Iceland, Norway, Sweden)

- 6.6.3.8 Rest of Europe

- 6.6.4 Asia-Pacific

- 6.6.4.1 India

- 6.6.4.2 China

- 6.6.4.3 Japan

- 6.6.4.4 Australia

- 6.6.4.5 South Korea

- 6.6.4.6 South-East Asia

- 6.6.4.7 Rest of Asia-Pacific

- 6.6.5 Middle East and Africa

- 6.6.5.1 United Arab Emirates

- 6.6.5.2 Saudi Arabia

- 6.6.5.3 South Africa

- 6.6.5.4 Nigeria

- 6.6.5.5 Rest of Middle East and Africa

- 6.6.1 North America

7 Competitive Landscape

- 7.1 Market Concentration

- 7.2 Strategic Moves

- 7.3 Market Share Analysis

- 7.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 7.4.1 Hunter Douglas

- 7.4.2 Springs Window Fashions

- 7.4.3 Somfy Systems

- 7.4.4 Nien Made Enterprise

- 7.4.5 Hillarys

- 7.4.6 Graber

- 7.4.7 Budget Blinds

- 7.4.8 3 Day Blinds

- 7.4.9 Warema Renkhoff SE

- 7.4.10 Griesser AG

- 7.4.11 Luxaflex

- 7.4.12 Lutron Electronics

- 7.4.13 Vertilux

- 7.4.14 ABC Blinds & Awnings

- 7.4.15 Alta Window Fashions

- 7.4.16 TOSO Co., Ltd.

- 7.4.17 Nichibei Co., Ltd.

- 7.4.18 Norman Window Fashions

- 7.4.19 The Shade Store

8 Market Opportunities & Future Outlook

- 8.1 Rising Demand for Smart and Motorized Blinds

- 8.2 Growth in Residential and Commercial Real Estate Projects