PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913313

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913313

Freeze Dried Fruits and Vegetables Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

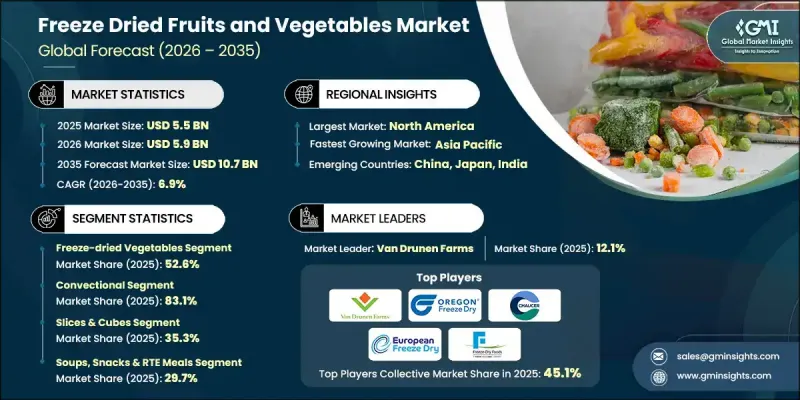

The Global Freeze Dried Fruits and Vegetables Market was valued at USD 5.5 billion in 2025 and is estimated to grow at a CAGR of 6.9% to reach USD 10.7 billion by 2035.

Market momentum is being driven by a strong shift toward healthier lifestyles, increased preference for convenient food options, and growing demand for products with clean labels and transparent ingredient profiles. Consumers are increasingly favoring food products that preserve nutritional value while offering extended shelf stability and ease of use. Freeze drying technology supports these preferences by maintaining the natural characteristics of fruits and vegetables without the need for artificial additives. Rising awareness around wellness-oriented diets and ingredient sourcing is encouraging food manufacturers and retailers to expand premium offerings, particularly within organic and non-GMO categories. Busy lifestyles are also influencing purchasing behavior, leading to higher consumption of shelf-stable and easy-to-prepare foods. As a result, freeze dried ingredients are gaining wider adoption across packaged food and beverage categories, supporting innovation and product diversification across both mass-market and specialized food segments.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $5.5 Billion |

| Forecast Value | $10.7 Billion |

| CAGR | 6.9% |

The freeze dried vegetables segment is expected to grow at a CAGR of 5.6% through 2034, supported by sustained demand from processed food manufacturing and foodservice operations. Their functional benefits, including long storage life, low weight, and rehydration efficiency, continue to support adoption as ingredients in shelf-stable food formulations. The ongoing expansion of convenience-focused food categories and the need for extended product durability remain key growth contributors.

The minced and chopped freeze dried fruits and vegetables segment reached USD 1.2 billion in 2025. This growth is supported by strong demand from commercial kitchens and industrial food production due to reduced preparation time and improved handling efficiency compared to other formats.

North America Freeze Dried Fruits and Vegetables Market generated USD 1.5 billion in 2025. Regional growth is supported by high consumption of ready-to-eat foods, advanced processing capabilities, and a well-developed food manufacturing ecosystem. Growing interest in health-focused and clean-label products continues to reinforce regional demand.

Key companies operating in the Global Freeze Dried Fruits and Vegetables Market include Van Drunen Farms, OFD Foods (Oregon Freeze Dry), Chaucer Foods Ltd., Natierra (Sunridge Farms), European Freeze Dry Ltd., Harmony House Foods, Crispy Green, Inc., Thrive Freeze Dry / Thrive Life, Freeze-Dry Foods GmbH, and Expedition Foods Limited. Companies in the Global Freeze Dried Fruits and Vegetables Market are strengthening their market position through product innovation and portfolio expansion focused on organic and clean-label offerings. Many players are investing in advanced freeze-drying technologies to improve nutrient retention, texture, and flavor consistency. Strategic sourcing of raw materials and long-term supplier partnerships are being used to ensure quality and supply stability. Firms are also expanding private-label and foodservice-focused product lines to reach diverse customer segments.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Nature

- 2.2.4 Form

- 2.2.5 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for convenience foods

- 3.2.1.2 Growing health and nutrition awareness

- 3.2.1.3 Expansion of food processing industry

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production and equipment costs

- 3.2.2.2 Limited consumer awareness in developing regions

- 3.2.2.3 Texture changes after rehydration

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand for organic and natural foods

- 3.2.3.2 Increasing outdoor and space food applications

- 3.2.3.3 Innovation in packaging and processing technology

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)( Note: The trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Freeze-dried fruits

- 5.3 Freeze-dried vegetables

Chapter 6 Market Estimates and Forecast, By Nature, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Conventional

- 6.3 Organic

Chapter 7 Market Estimates and Forecast, By Form, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Whole

- 7.3 Slices & cubes

- 7.4 Minced & chopped

- 7.5 Powder & granules

Chapter 8 Market Estimates and Forecast, By Application, 2022-2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Soups, snacks & RTE meals

- 8.3 Breakfast cereals

- 8.4 Beverages & smoothies

- 8.5 Bakery & confectionery

- 8.6 Ice cream & desserts

- 8.7 Sauces, dips & dressings

- 8.8 Others

Chapter 9 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Chaucer Foods Ltd.

- 10.2 Crispy Green, Inc.

- 10.3 European Freeze Dry Ltd.

- 10.4 Expedition Foods Limited

- 10.5 Freeze-Dry Foods GmbH

- 10.6 Harmony House Foods

- 10.7 Natierra (Sunridge Farms)

- 10.8 OFD Foods (Oregon Freeze Dry)

- 10.9 Thrive Freeze Dry / Thrive Life

- 10.10 Van Drunen Farms