PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906123

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906123

North America Freeze Dried Fruits And Vegetables - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

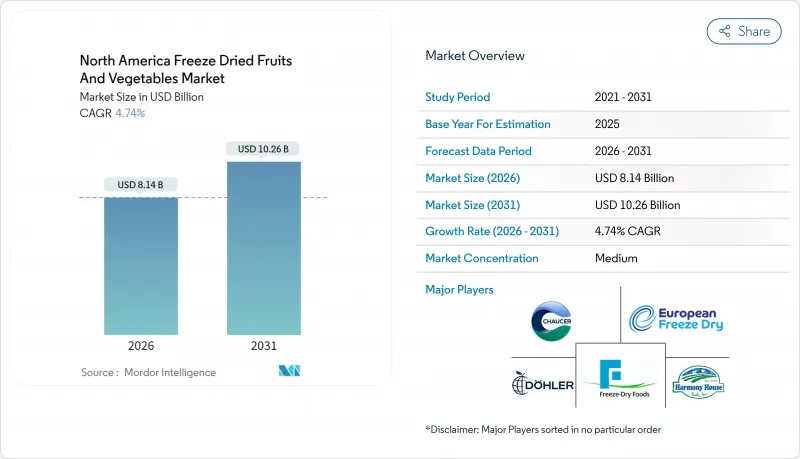

The North America freeze-dried fruits and vegetables market was valued at USD 7.77 billion in 2025 and estimated to grow from USD 8.14 billion in 2026 to reach USD 10.26 billion by 2031, at a CAGR of 4.74% during the forecast period (2026-2031).

The market growth is primarily driven by increasing consumer demand for products that offer both nutritional value and extended shelf life, particularly as more individuals embrace plant-based diets and seek convenient food solutions for their fast-paced lifestyles. Recent technological advancements in the sublimation process have significantly reduced manufacturing costs while improving product texture and quality, enabling manufacturers to introduce innovative products across multiple categories including cereals, snacks, and ready-to-eat meals. The rise of e-commerce platforms has created new opportunities for specialized health food brands to reach their target consumers, while restaurants and food service providers increasingly rely on freeze-dried ingredients to ensure consistent food quality throughout the year. The industry structure continues to evolve through strategic consolidation, with major processing companies acquiring regional facilities to better manage climate-related supply risks and optimize their distribution networks.

North America Freeze Dried Fruits And Vegetables Market Trends and Insights

Rising Awareness of Nutritional Benefits of Freeze-Dried Foods

Retail channels are increasingly positioning freeze-dried products as premium offerings, driven by consumer education on their superior nutrient retention. The sublimation process in freeze-drying preserves a significant portion of original vitamins and minerals, maintaining cellular structure for optimal rehydration. This creates unique differentiation opportunities for manufacturers aiming at health-conscious consumers. Research from Johns Hopkins Center for a Livable Future reveals that many American adults adhere to specific diets . Notably, younger generations are actively seeking nutrient-dense options. Social media plays a pivotal role in product discovery for these audiences. Many Americans are making a conscious effort to increase their protein intake, and a growing number are exploring AI-assisted nutritional choices. This demographic's shift towards evidence-based nutrition fuels a consistent demand for freeze-dried products, especially those that transparently highlight their health benefits. Specialty crop processors stand to gain the most, as they can command premium prices for their nutrient-verified products, especially when targeting the expanding flexitarian market segment.

Extended Shelf Life Without Preservatives

Freeze-drying, which can achieve an extended shelf life without chemical preservatives, not only aligns with clean-label mandates but also addresses concerns about supply chain resilience. The U.S. Fish & Wildlife Service highlighted that Backyard Farms, operating in New Mexico, processes significant quantities from numerous regional farms. This effort not only reduces food waste but also turns climate-damaged crops into marketable products . As climate-driven production volatility rises, this preservation capability gains strategic importance. USDA projections indicate uneven agricultural productivity impacts across states in the coming years. Given the uptick in natural disasters and recent extreme weather-induced supply chain disruptions, emergency preparedness markets emerge as a largely untapped opportunity. Furthermore, the advantage of shelf stability allows manufacturers to streamline inventory management and cut down on cold storage expenses. These operational efficiencies pave the way for reinvestment in capacity expansion or product development initiatives.

Volatility in Agricultural Yields Affecting Supply Consistency

As extreme weather events become more frequent, key growing regions that supply freeze-dried processors are facing threats to both the availability of raw materials and the stability of their prices. An analysis by the USDA Economic Research Service highlights that agricultural total factor productivity is becoming more volatile. States like Louisiana, Mississippi, Missouri, Florida, and North Dakota are projected to bear significant negative impacts . In California, specialty crops are particularly at risk. Climate projections indicate that reduced chill hours, heightened summer heat, and changing precipitation patterns are jeopardizing crops like almonds, stone fruits, strawberries, and various vegetables that are staples in freeze-dried products. Leaders in the Midwest's specialty crop sector voice concerns over rising pest and disease pressures, increased water demands, and overall production instability. They emphasize economic unpredictability as their primary concern. This volatility in supply compels processors to hold larger inventory levels and diversify their sourcing regions. While this strategy addresses immediate challenges, it also amplifies working capital needs, complicates operations, and may limit opportunities for margin expansion.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Trend Toward Plant-Based Diets and Veganism

- Growth of Clean-Label and Minimally Processed Food Trends

- Limited Supply Chain Infrastructure for Temperature Control and Storage

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fruits maintained a dominant position with a 62.88% market share in 2025, reflecting strong consumer acceptance and widespread adoption across retail and foodservice sectors. The extensive use of fruits in various applications stems from their familiar taste profiles and established processing methods. Strawberries, raspberries, and pineapples continue to be the preferred fruit ingredients in the market, particularly due to their excellent freeze-drying characteristics and successful integration into breakfast cereals and snack products.

The vegetables segment demonstrates robust growth potential, with a projected CAGR of 5.14% from 2026 to 2031. This growth is primarily driven by increased incorporation in ready-to-eat meals, soups, and plant-based protein products. Within this category, peas and corn dominate volume sales, while mushrooms maintain their premium position in specialty products. Carrots and potatoes fulfill the requirements of industrial ingredient markets. The expansion of the vegetable segment aligns with evolving consumer preferences for plant-based nutrition and minimally processed ingredients. Oregon Freeze Dry's strategic reorganization in April 2024, establishing distinct Food and Life Sciences divisions, positions the company to effectively serve both traditional fruit markets and capitalize on emerging opportunities in vegetable-based nutraceuticals.

Powder and granules formats held a 48.73% market share in 2025 and are expected to grow at a CAGR of 5.35% during 2026-2031, due to their efficient incorporation properties in food and beverage manufacturing. The format's dominant position stems from its versatility across applications, from smoothie bases to bakery ingredients, where uniform particle size and quick rehydration provide significant processing benefits. The consistent performance of powder formats in manufacturing environments has made them the preferred choice for food processors seeking reliable ingredient integration.

Chunks and pieces primarily serve outdoor recreation and emergency preparedness markets, where their distinct form factor meets specific consumer needs. Flakes cater to premium retail segments focused on visual appeal and texture differentiation in finished products. The powder segment's growth trajectory is supported by the increasing adoption in plant-based protein formulations and functional foods, where freeze-dried ingredients deliver concentrated nutrition without artificial additives. This expansion into new application areas continues to strengthen the powder format's market position.

The North America Freeze Dried Fruits and Vegetables Market Report is Segmented by Product Type (Fruits and Vegetables), Form (Powder Granules, Chunks / Pieces, and Flakes), Nature (Organic, and Conventional), End- Use (Foodservice/HoReCa, Food Processing, and Retail), and Geography (United States, Canada, Mexico, and Rest of North America). The Market Forecasts are Provided in Terms of Value and Volume (USD/Tonnes).

List of Companies Covered in this Report:

- European Freeze Dry Ltd.

- Dohler Group SE

- Freeze-Dry Foods Ltd.

- Harmony House Foods Inc.

- Chaucer Foods Ltd.

- Mercer Foods LLC

- LYO Foods

- Natierra

- Nissin Foods

- Thrive Foods LLC

- Pacific Farms

- Van Drunen Farms

- Saraf Foods Ltd.

- SouthAm Freeze Dry

- BCFoods Inc.

- OFD Foods LLC

- Nutristore

- Augason Farms

- Stoneridge Orchards

- Wise Foods Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising awareness of nutritional benefits of freeze-dried foods

- 4.2.2 Extended shelf life without preservatives

- 4.2.3 Expanding trend toward plant-based diets and veganism

- 4.2.4 Growth of clean-label and minimally processed food trends

- 4.2.5 Increasing adoption in ready-to-eat and convenience meals

- 4.2.6 Demand for natural flavors and colors, replacing synthetics

- 4.3 Market Restraints

- 4.3.1 Restrictions on the types of fruits/vegetables that can be freeze-dried

- 4.3.2 Volatility in agricultural yields affecting supply consistency

- 4.3.3 Limited supply chain infrastructure for temperature control and storage

- 4.3.4 Challenges in maintaining sensory quality

- 4.4 Technology Outlook

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Product Type

- 5.1.1 Fruits

- 5.1.1.1 Strawberry

- 5.1.1.2 Raspberry

- 5.1.1.3 Pineapple

- 5.1.1.4 Apple

- 5.1.1.5 Mango

- 5.1.1.6 Other Fruits

- 5.1.2 Vegetables

- 5.1.2.1 Pea

- 5.1.2.2 Corn

- 5.1.2.3 Carrot

- 5.1.2.4 Potato

- 5.1.2.5 Mushroom

- 5.1.2.6 Other Vegetables

- 5.1.1 Fruits

- 5.2 By Form

- 5.2.1 Powder / Granules

- 5.2.2 Chunks / Pieces

- 5.2.3 Flakes

- 5.3 By Nature

- 5.3.1 Organic

- 5.3.2 Conventional

- 5.4 By End-Use

- 5.4.1 Foodservice/HoReCa

- 5.4.2 Food Processing

- 5.4.2.1 Breakfast Cereal

- 5.4.2.2 Soups and Snacks

- 5.4.2.3 Ice Cream and Desserts

- 5.4.2.4 Bakery and Confectionery

- 5.4.2.5 Others

- 5.4.3 Retail

- 5.4.3.1 Supermarkets/Hypermarkets

- 5.4.3.2 Specialty Stores

- 5.4.3.3 Online Retail

- 5.4.3.4 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Mexico

- 5.5.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 European Freeze Dry Ltd.

- 6.4.2 Dohler Group SE

- 6.4.3 Freeze-Dry Foods Ltd.

- 6.4.4 Harmony House Foods Inc.

- 6.4.5 Chaucer Foods Ltd.

- 6.4.6 Mercer Foods LLC

- 6.4.7 LYO Foods

- 6.4.8 Natierra

- 6.4.9 Nissin Foods

- 6.4.10 Thrive Foods LLC

- 6.4.11 Pacific Farms

- 6.4.12 Van Drunen Farms

- 6.4.13 Saraf Foods Ltd.

- 6.4.14 SouthAm Freeze Dry

- 6.4.15 BCFoods Inc.

- 6.4.16 OFD Foods LLC

- 6.4.17 Nutristore

- 6.4.18 Augason Farms

- 6.4.19 Stoneridge Orchards

- 6.4.20 Wise Foods Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK