PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910703

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910703

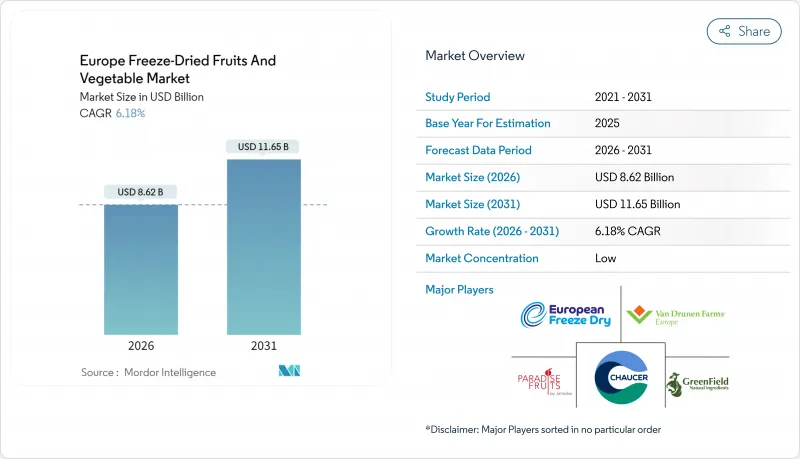

Europe Freeze-Dried Fruits And Vegetable - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Europe freeze dried fruits and vegetables market is expected to grow from USD 8.12 billion in 2025 to USD 8.62 billion in 2026 and is forecast to reach USD 11.65 billion by 2031 at 6.18% CAGR over 2026-2031.

Rising demand for clean-label convenience foods, energy-efficient technological upgrades, and the stabilization of input costs after the 2024 food-price spike frame the growth path. Declining production costs in vacuum and spray-freeze systems encourage manufacturers to scale output while tightening quality controls. Food processors view freeze-dried inputs as a route to extended shelf life without synthetic additives, and retailers court consumers who favor nutrient-retentive snacks over sugar-laden alternatives. Simultaneously, European Union sustainability policies reinforce a shift toward low-waste preservation, offering additional tailwinds to the Europe freeze dried fruits and vegetables market.

Europe Freeze-Dried Fruits And Vegetable Market Trends and Insights

Rising Demand for Ready-to-Eat Foods

European consumers are increasingly prioritizing convenience and nutritional quality, driving higher demand for ready-to-eat products that incorporate freeze-dried ingredients. The EU food market, consisting of approximately 310,000 companies and employing 4.8 million people, is experiencing growing interest in specialty, prepared, and pre-packaged convenience goods. Small and medium-sized enterprises dominate this market, accounting for 99% of the total. This trend is particularly evident in urban areas, where time-constrained consumers seek healthier alternatives to traditional processed foods. According to Tate and Lyle's 2024 research, over half of European consumers now purchase soups with added health benefits, demonstrating their willingness to pay more for improved nutritional value. As the convenience food sector transitions toward "Enhanced Eating," significant opportunities emerge for integrating freeze-dried fruits and vegetables into various product categories. Manufacturers are responding to this shift, recognizing that consumer preferences now emphasize health benefits and natural ingredients over traditional price-focused considerations.

Technological Advancements in Freeze-Drying, Enhancing Quality and Efficiency

Advancements in freeze-drying technology have significantly boosted processing efficiency and product quality, effectively addressing traditional cost challenges that previously restricted market growth. Innovations in spray freeze-drying combine the strengths of conventional freeze-drying and spray-drying methods, resulting in high-quality, stable powders with improved bioavailability. Pre-treatment approaches, such as enzymatic processing and ultrasound applications, reduce drying time by up to 50% while enhancing product texture and retaining bioactive compounds. Additionally, improvements in energy efficiency within freeze-drying processes address both sustainability concerns and operational costs, with new technologies potentially cutting energy consumption by up to 70% compared to traditional methods. These advancements enable manufacturers to scale production while maintaining high-quality standards. In the European market, the adoption of hybrid drying techniques and process optimization provides a competitive advantage for early adopters.

Supply Chain Disruptions Affecting Raw Material Availability

European agriculture is facing increasing challenges, including extreme weather, geopolitical tensions, and climate disruptions, all of which threaten the supply of raw materials for freeze-dried products. In 2025, freezing temperatures severely impacted Europe's cherry crop, resulting in significant supply shortages in the freeze-dried fruit market. Agricultural monitoring systems across Europe, using the Combined Drought Indicator, continue to highlight risks to crop production by analyzing various hydro-meteorological parameters. Additionally, Brexit has exacerbated trade complexities, leading to fruit and vegetable rationing in United Kingdom supermarkets. This rationing is driven by extreme weather in Spain and Morocco, rising energy costs, and new trade barriers. These disruptions have caused price volatility and pushed manufacturers to implement more resilient sourcing strategies. The European Statistics Handbook 2025 reports notable declines in apple and pear production due to adverse weather, while some vegetables, such as onions and peppers, experienced increased production, illustrating the uneven effects on different raw materials.

Other drivers and restraints analyzed in the detailed report include:

- Long Shelf Life and Retention of Nutrients

- Consumer Demand for Clean-Label Products

- High Production Costs and Technological Investment

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Freeze dried fruits command 57.62% market share in 2025, reflecting consumer preferences for natural snacking alternatives and versatile ingredient applications across food processing sectors. The segment benefits from diverse product offerings including strawberries, blueberries, raspberries, blackberries, cranberries, and mangoes, each serving distinct market niches from premium snacking to industrial ingredient applications. Freeze dried vegetables demonstrate the highest growth trajectory at 7.08% CAGR through 2031, driven by expanding applications in soups, ready meals, and plant-based product formulations. This growth acceleration reflects the increasing adoption of vegetables in convenience food applications where nutritional enhancement and extended shelf life provide competitive advantages.

Technological innovations in pre-treatment methods significantly enhance both fruit and vegetable processing efficiency, with enzymatic treatments and ultrasound applications reducing processing time while improving texture and bioactive compound retention. Beans, corn, peas, tomatoes, and mushrooms represent the primary vegetable segments, each addressing specific market demands from foodservice applications to retail consumer products. The regulatory framework under EU food safety regulations ensures consistent quality standards across both fruit and vegetable segments, with compliance requirements driving investment in quality control systems and traceability protocols.

The Europe Freeze-Dried Fruits and Vegetables Report is Segmented by Type (Fruits and Vegetables), End User (Foodservice/HoReCa, Food Processing, and Retail), and Geography (United Kingdom, Germany, France, Spain, Italy, Netherlands, Belgium, Russia, and Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Tons).

List of Companies Covered in this Report:

- Paradise Fruits Solutions GmbH & Co. KG

- Chaucer Foods Ltd

- European Freeze Dry

- Van Drunen Farms

- GreenField Sp. z o.o. Sp. k.

- Lyovit

- Dohler GmbH

- European Food Ingredients Ltd

- Freeze-Dry Foods GmbH

- Berrifine A/S

- Olam Food Ingredients

- Katadyn Group (Trek'n Eat)

- Drytech AS

- LYOFOOD Sp. z o.o.

- Mercer Foods (EMEA)

- Nutrisio SpA

- Freeze-Dry Ingredients Ltd

- AgroSphere SAS

- Dried Food Ingredients Ltd

- Frutex Austria GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for ready-to-eat foods

- 4.2.2 Technological advancements in freeze-drying, enhancing quality and efficiency.

- 4.2.3 Long shelf life and retention of nutrients

- 4.2.4 Consumer demand for clean-label products

- 4.2.5 Increasing health consciousness and preference for vegan, gluten-free, and all-natural products

- 4.2.6 Wider application across food sectors

- 4.3 Market Restraints

- 4.3.1 Supply chain disruptions affecting raw material availability

- 4.3.2 Stringent regulatory requirements around food labeling and additives.

- 4.3.3 Competition from other drying and preservation methods

- 4.3.4 High production costs and technological investment

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECAST (IN VALUE AND VOLUME)

- 5.1 By Type

- 5.1.1 Fruits

- 5.1.1.1 Strawberry

- 5.1.1.2 Blueberry

- 5.1.1.3 Raspberry

- 5.1.1.4 Blackberry

- 5.1.1.5 Cranberry

- 5.1.1.6 Mango

- 5.1.1.7 Other Fruit Types

- 5.1.2 Vegetables

- 5.1.2.1 Beans

- 5.1.2.2 Corn

- 5.1.2.3 Peas

- 5.1.2.4 Tomato

- 5.1.2.5 Mushroom

- 5.1.2.6 Other Vegetable Types

- 5.1.1 Fruits

- 5.2 By End User

- 5.2.1 Foodservice/HoReCa

- 5.2.2 Food Processing

- 5.2.2.1 Breakfast Cereal

- 5.2.2.2 Soups and Snacks

- 5.2.2.3 Ice Cream and Desserts

- 5.2.2.4 Bakery and Confectionery

- 5.2.2.5 Others

- 5.2.3 Retail

- 5.2.3.1 Supermarkets/Hypermarkets

- 5.2.3.2 Specialty Stores

- 5.2.3.3 Online Retail

- 5.2.3.4 Other Distribution Channels

- 5.3 By Geography

- 5.3.1 United Kingdom

- 5.3.2 Germany

- 5.3.3 France

- 5.3.4 Spain

- 5.3.5 Italy

- 5.3.6 Netherlands

- 5.3.7 Belgium

- 5.3.8 Russia

- 5.3.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Paradise Fruits Solutions GmbH & Co. KG

- 6.4.2 Chaucer Foods Ltd

- 6.4.3 European Freeze Dry

- 6.4.4 Van Drunen Farms

- 6.4.5 GreenField Sp. z o.o. Sp. k.

- 6.4.6 Lyovit

- 6.4.7 Dohler GmbH

- 6.4.8 European Food Ingredients Ltd

- 6.4.9 Freeze-Dry Foods GmbH

- 6.4.10 Berrifine A/S

- 6.4.11 Olam Food Ingredients

- 6.4.12 Katadyn Group (Trek'n Eat)

- 6.4.13 Drytech AS

- 6.4.14 LYOFOOD Sp. z o.o.

- 6.4.15 Mercer Foods (EMEA)

- 6.4.16 Nutrisio SpA

- 6.4.17 Freeze-Dry Ingredients Ltd

- 6.4.18 AgroSphere SAS

- 6.4.19 Dried Food Ingredients Ltd

- 6.4.20 Frutex Austria GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK