PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913380

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913380

Bakery Processing Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

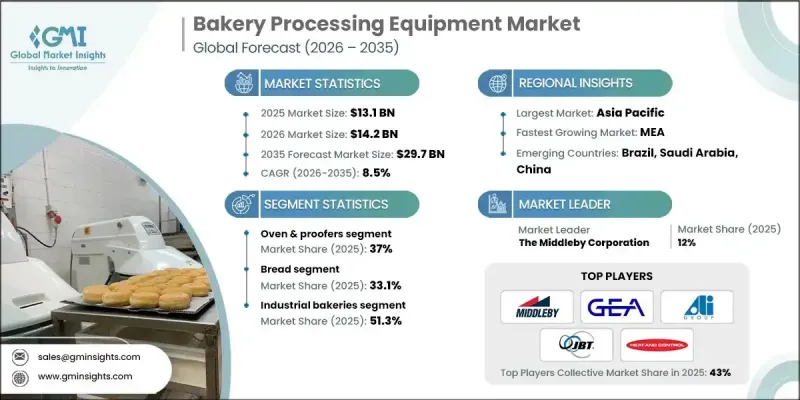

The Global Bakery Processing Equipment Market was valued at USD 13.1 billion in 2025 and is estimated to grow at a CAGR of 8.5% to reach USD 29.7 billion by 2035.

Market momentum is driven by the accelerating shift toward automation across bakery operations, as businesses focus on improving efficiency, lowering workforce dependency, and maintaining uniform product standards. Automated systems are increasingly being adopted to optimize end-to-end production workflows, helping bakeries meet rising output requirements while controlling operational expenses. Growing consumer demand for differentiated and made-to-order bakery offerings is also influencing equipment purchasing decisions, encouraging investment in adaptable machinery capable of handling frequent product changes without affecting throughput. In parallel, heightened attention to food safety and hygiene standards is shaping equipment design priorities. Bakeries place greater emphasis on machinery that supports sanitation, reduces contamination risk, and aligns with evolving regulatory expectations. Equipment suppliers are responding by introducing designs that support cleanliness, durability, and compliance, reinforcing the importance of quality assurance in modern bakery environments. These combined trends continue to position bakery processing equipment as a critical enabler of scalable, compliant, and consumer-responsive production.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $13.1 Billion |

| Forecast Value | $29.7 Billion |

| CAGR | 8.5% |

The industrial bakeries segment accounted for 51.3% share in 2025. This segment relies heavily on large-scale, high-performance equipment to support continuous production while ensuring consistent quality across large volumes. Demand from this segment remains focused on solutions that improve precision, reduce manual intervention, and support cost-efficient mass production.

The ovens and proofers category represented 37% share in 2023. This segment plays a central role in controlling baking and fermentation conditions, which directly influences product consistency, structure, and overall quality. Equipment in this category is valued for its ability to maintain stable processing environments that support reliable production outcomes.

Europe Bakery Processing Equipment Market reached USD 3.9 billion in 2025, supported by strong innovation capabilities, rigorous quality benchmarks, and a growing focus on sustainability. Regional manufacturers continue to prioritize advanced engineering, energy efficiency, and environmentally responsible production practices, aligning with regulatory frameworks and evolving consumer expectations.

Key companies active in the Global Bakery Processing Equipment Market include GEA Group, Baker Perkins Ltd., The Middleby Corporation, Rheon Automatic Machinery Co., Ltd., Gemini Bakery Equipment Company, ALI Group S.R.L. A Socio Unico, Heat and Control, Inc., John Bean Technologies Corporation, Fritsch Group, and Markel Ventures Inc. Companies operating in the Global Bakery Processing Equipment Market are strengthening their competitive position through technology-driven innovation and customer-focused solutions. Many manufacturers are investing in automation and digital integration to enhance equipment performance and operational reliability. Customization capabilities are being expanded to help bakeries respond to changing consumer preferences without sacrificing efficiency. Strategic partnerships with bakery operators are supporting long-term equipment adoption and service-based revenue models.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product Type

- 2.2.3 Application

- 2.2.4 End Use

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising automation to offset bakery labor shortages

- 3.2.1.2 Growth in frozen and packaged bakery products

- 3.2.1.3 Focus on food safety and product consistency

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High upfront capital cost for small bakeries

- 3.2.2.2 Space and utility constraints in existing facilities

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of retail chains and in-store bakeries

- 3.2.3.2 Clean-label, gluten-free and specialty product trends

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)

( Note: The trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Oven & proofers

- 5.3 Mixers

- 5.3.1 Below 250 kg

- 5.3.2 250-500 kg

- 5.3.3 500-1,000 kg

- 5.3.4 1,000-1,500 kg

- 5.3.5 Above 1,500 kg

- 5.4 Slicer

- 5.4.1 Below 100 kg

- 5.4.2 100-150 kg

- 5.4.3 150-250 kg

- 5.4.4 250-350 kg

- 5.4.5 Above 350 kg

- 5.5 Sheeters & molders

- 5.5.1 500-1,000 kg

- 5.5.2 1,000-1,500 kg

- 5.5.3 Above 1,500 kg

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Application, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Bread

- 6.3 Pastry

- 6.4 Pizza

- 6.5 Croissant

- 6.6 Flatbread

- 6.7 Pie/Quiche

- 6.8 Biscuits

- 6.9 Tortilla

Chapter 7 Market Estimates and Forecast, By End Use 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Industrial bakeries

- 7.3 Artisanal bakeries

- 7.4 Retail bakeries

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 The Middleby Corporation

- 9.2 GEA Group

- 9.3 ALI Group S.R.L. A Socio Unico

- 9.4 John Bean Technologies Corporation

- 9.5 Markel Ventures Inc.

- 9.6 Heat and Control, Inc.

- 9.7 Rheon Automatic Machinery Co., Ltd.

- 9.8 Fritsch Group

- 9.9 Baker Perkins Ltd.

- 9.10 Gemini Bakery Equipment Company