PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913404

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913404

Third-Party Logistics (3PL) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

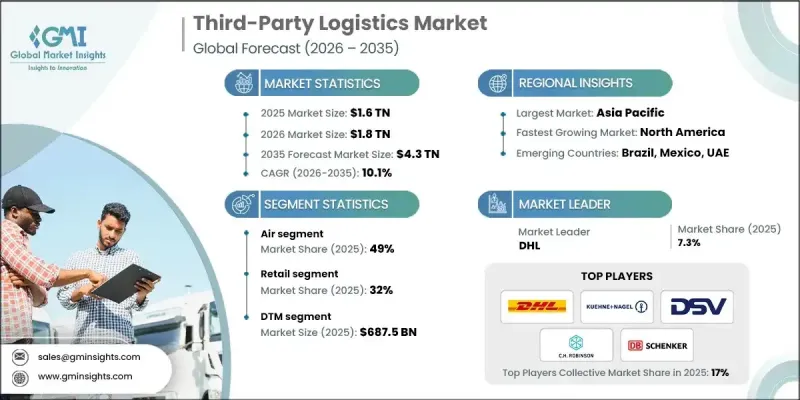

The Global Third-Party Logistics (3PL) Market was valued at USD 1.6 trillion in 2025 and is estimated to grow at a CAGR of 10.1% to reach USD 4.3 trillion by 2035.

The market is propelled by the rapid expansion of e-commerce, increasing globalization of supply chains, rising customer demand for faster deliveries, and the growing complexity of logistics and distribution networks. Businesses are increasingly outsourcing logistics functions to specialized 3PL providers to achieve cost efficiency, operational flexibility, real-time visibility, and scalable supply chain operations. Technological innovations such as cloud-based transportation management systems (TMS), warehouse management systems (WMS), AI- and ML-powered route optimization, IoT-enabled shipment tracking, robotics, warehouse automation, and advanced data analytics are transforming traditional logistics. These solutions enhance inventory accuracy, optimize transportation, reduce transit times, and improve demand forecasting. Rising adoption of omnichannel retail, cross-border trade, and last-mile delivery solutions further accelerates the demand for integrated, flexible, and technology-driven 3PL services globally.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.6 Trillion |

| Forecast Value | $4.3 Trillion |

| CAGR | 10.1% |

The air freight segment held 49% share in 2025 and is anticipated to grow at a CAGR of 11.2% from 2026 to 2035. Air logistics dominates due to its essential role in enabling time-sensitive, high-value, and express shipments. Strong demand from industries requiring rapid delivery has increased the adoption of air freight for cross-border deliveries, just-in-time inventory, and premium logistics needs. Advanced cargo handling, real-time tracking, priority shipping, and integrated express networks ensure speed, reliability, and service quality, positioning air transport as the preferred solution for urgent and high-value goods.

The domestic transportation management (DTM) segment reached USD 687.5 billion in 2025. DTM solutions are crucial for handling high-frequency, time-sensitive, and cost-efficient domestic shipments. They provide optimized route planning, carrier selection, shipment tracking, and last-mile delivery management. This functionality is critical for e-commerce, retail, FMCG, and manufacturing supply chains, enabling rapid fulfillment, just-in-time delivery, and scalable operations. DTM remains a key focus area for both shippers and logistics service providers seeking efficiency and reliability.

China Third-Party Logistics (3PL) Market held a 57% share, generating USD 374.9 billion in 2025. The region's growth is driven by the expansion of e-commerce, high manufacturing output, and increasing adoption of technology-driven logistics solutions. Investments in AI-based route optimization, cloud-based TMS/WMS, real-time tracking, and automated fulfillment systems are accelerating the region's logistics capabilities. Advanced infrastructure, large freight volumes, and evolving regulatory standards further strengthen Asia-Pacific's position in the Global Third-Party Logistics (3PL) Market.

Key players operating in the Global Third-Party Logistics (3PL) Market include DB Schenker Logistics, DHL, DSV A/S (UTi Worldwide, Inc.), C.H. Robinson Worldwide, Expeditors International of Washington, Ceva Logistics, Nippon Express, Kuehne + Nagel International AG, XPO Logistics, and SinoTrans (HK) Logistics Limited. Companies in the Global Third-Party Logistics (3PL) Market strengthen their presence through technology adoption, investing heavily in AI- and ML-powered logistics platforms, cloud-based TMS/WMS, IoT-enabled real-time tracking, and warehouse automation to enhance efficiency. Strategic partnerships with e-commerce firms, retailers, and manufacturers expand service reach. Firms focus on offering integrated end-to-end logistics solutions, optimizing last-mile delivery, and providing scalable operations to meet diverse client needs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Solution

- 2.2.3 Mode

- 2.2.4 Application

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid Growth of E-commerce & Omnichannel Retail

- 3.2.1.2 Rising Supply Chain Complexity & Global Trade

- 3.2.1.3 Technology Adoption & Digital Transformation

- 3.2.1.4 Cost Optimization & Asset-Light Business Models

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Rising Operational & Labor Costs

- 3.2.2.2 Regulatory & Compliance Complexity

- 3.2.3 Market opportunities

- 3.2.3.1 Last-Mile Delivery & Value-Added Logistics Services

- 3.2.3.2 Digital & Sustainable Logistics Solutions

- 3.2.3.3 Adoption of AI, ML, and IoT Technologies

- 3.2.3.4 Sustainability and Green Logistics Services

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S. DOT & FMCSA Regulations

- 3.4.1.2 EPA Emission Standards

- 3.4.1.3 Transport Canada Standards

- 3.4.2 Europe

- 3.4.2.1 Germany TUV & BaFin Compliance

- 3.4.2.2 France DGCCRF & CNIT Guidelines

- 3.4.2.3 United Kingdom DVSA & FCA Regulations

- 3.4.2.4 Italy Ministry of Infrastructure & Transport Compliance

- 3.4.3 Asia Pacific

- 3.4.3.1 China MIIT Guidelines

- 3.4.3.2 Japan FSA Automotive Compliance

- 3.4.3.3 South Korea MOT & FSC Regulations

- 3.4.3.4 India BIS & Automotive Research Association Guidelines

- 3.4.4 Latin America

- 3.4.4.1 Brazil ANTT & DENATRAN Regulations

- 3.4.4.2 Mexico SEMARNAT & SCT Guidelines

- 3.4.5 Middle East and Africa

- 3.4.5.1 UAE Roads & Transport Authority Guidelines

- 3.4.5.2 Saudi Arabia General Authority for Transport (GAT) Regulations

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 Current technological trends

- 3.7.1.1 Automation & robotics

- 3.7.1.2 Ai & machine learning

- 3.7.1.3 Internet of things (IOT)

- 3.7.1.4 Cloud-based supply chain platforms

- 3.7.2 Emerging technologies

- 3.7.2.1 Hyper-connected supply chains

- 3.7.2.2 Robotics-as-a-service (RAAS)

- 3.7.2.3 AI-driven dynamic pricing & capacity management

- 3.7.2.4 Augmented reality (AR) & wearables

- 3.7.1 Current technological trends

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and Environmental Aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.11.5 Carbon footprint considerations

- 3.12 Use case scenarios

- 3.13 Regional Infrastructure & Deployment Trends

- 3.13.1 Transportation & logistics infrastructure scoring

- 3.13.2 Digital & connectivity readiness

- 3.13.3 Port, rail & intermodal capacity trends

- 3.13.4 Smart logistics hubs & free zones

- 3.14 Demand and Supply-Side Assessment

- 3.14.1 Supply-Side Analysis

- 3.14.1.1 Provider capacity, infrastructure, and capabilities

- 3.14.1.2 Technology adoption & operational efficiency

- 3.14.1.3 Cost structures and profitability

- 3.14.2 Demand-Side Analysis

- 3.14.2.1 End-user industry requirements

- 3.14.2.2 Volume, frequency, and service-level expectations

- 3.14.2.3 Pricing sensitivity and adoption trends

- 3.14.1 Supply-Side Analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Solution, 2022 - 2035 ($ Bn)

- 5.1 Key trends

- 5.2 Dedicated contract carriage (DCC)

- 5.3 Dedicated transportation management (DTM)

- 5.4 International transportation management (ITM)

- 5.5 Warehousing & distribution

- 5.6 Logistics software

Chapter 6 Market Estimates & Forecast, By Mode, 2022 - 2035 ($ Bn)

- 6.1 Key trends

- 6.2 Air

- 6.3 Sea

- 6.4 Rail & Road

Chapter 7 Market Estimates & Forecast, By Application, 2022 - 2035 ($ Bn)

- 7.1 Key trends

- 7.2 Food & beverages

- 7.3 Healthcare

- 7.4 Retail

- 7.5 Automotive

- 7.6 Manufacturing

- 7.7 E-commerce & Logistics

- 7.8 Chemicals & Petrochemicals

- 7.9 Pharmaceuticals

- 7.10 Others

Chapter 8 Market Estimates & Forecast, By Region, 2022 - 2035 ($ Bn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 US

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Belgium

- 8.3.7 Netherlands

- 8.3.8 Sweden

- 8.3.9 Switzerland

- 8.3.10 Austria

- 8.3.11 Norway

- 8.3.12 Denmark

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 Singapore

- 8.4.6 South Korea

- 8.4.7 Vietnam

- 8.4.8 Indonesia

- 8.4.9 Malaysia

- 8.4.10 Thailand

- 8.4.11 Philippines

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Chile

- 8.5.5 Colombia

- 8.5.6 Peru

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

- 8.6.4 Egypt

- 8.6.5 Israel

- 8.6.6 Qatar

Chapter 9 Company Profiles

- 9.1 Global Player

- 9.1.1 C.H. Robinson Worldwide

- 9.1.2 Ceva Logistics

- 9.1.3 DB Schenker Logistics

- 9.1.4 DHL Supply Chain & Global Forwarding

- 9.1.5 DSV A/S

- 9.1.6 Expeditors International of Washington

- 9.1.7 FedEx Supply Chain

- 9.1.8 Kuehne + Nagel International AG

- 9.1.9 Nippon Express

- 9.1.10 XPO Logistics

- 9.2 Regional Player

- 9.2.1 Agility Logistics

- 9.2.2 APL Logistics

- 9.2.3 Bollore Logistics

- 9.2.4 Geodis

- 9.2.5 Hellmann Worldwide Logistics

- 9.2.6 Hitachi Transport System

- 9.2.7 Kerry Logistics

- 9.2.8 Panalpina

- 9.2.9 Toll Group

- 9.2.10 Yusen Logistics

- 9.3 Emerging Players

- 9.3.1 eBike Diagnostic Solutions

- 9.3.2 MotoTech Diagnostics

- 9.3.3 NeoMotor Diagnostics

- 9.3.4 RideScan Electronics

- 9.3.5 SmartMoto Diagnostics