PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913414

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913414

Electric Baby Car Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

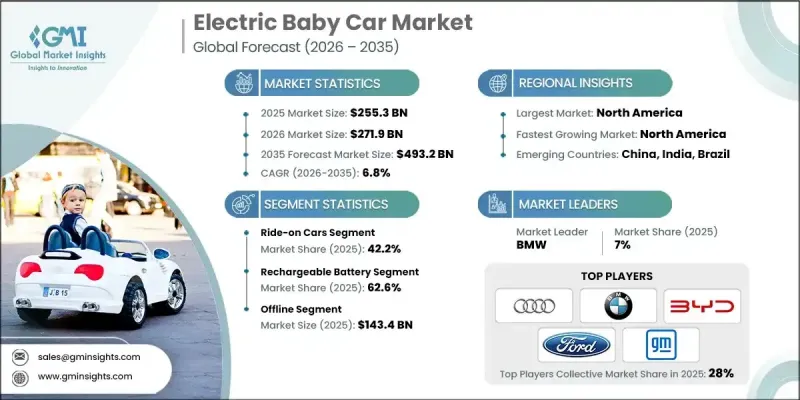

The Global Electric Baby Car Market was valued at USD 255.3 billion in 2025 and is estimated to grow at a CAGR of 6.8% to reach USD 493.2 billion by 2035.

Rapid advancements in smart technology are transforming electric ride-on cars into highly sophisticated, connected products. Manufacturers are incorporating innovative features that enhance engagement, safety, and overall user experience for children and parents. Mobile app connectivity is a key driver, providing parents with remote control, real-time speed management, emergency braking, and geo-fencing that disables the vehicle outside designated safe zones. Additional features such as GPS tracking, RFID start keys, and smart dashboards further improve safety and monitoring, while music apps and voice-guided instructions introduce early educational opportunities. As IoT integration becomes commonplace, smart electric cars are increasingly positioned as premium products, appealing to tech-savvy parents seeking high-quality, feature-rich models. Market expansion is fueled by the rising demand for connected, safe, and interactive mobility solutions for children.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $255.3 Billion |

| Forecast Value | $493.2 Billion |

| CAGR | 6.8% |

The ride-on cars segment held a 42.2% share in 2025, owing to their adaptability, rear-to-forward seating transitions, and long-term value. Popularity stems from safety compliance, side-impact protection, and easy installation systems. These vehicles offer realistic driving experiences, complete with working headlights and safety belts, and their growth is expected to continue with the introduction of Bluetooth connectivity and advanced parental controls.

The offline sales segment generated USD 143.4 billion in 2025, capturing a major portion of the market. Consumers prefer offline channels for the hands-on experience, personalized guidance on product selection, configuration, and after-sales support, which is critical for electric baby cars.

U.S. Electric Baby Car Market held 84.5% share, generating USD 78.8 billion in 2025. Market growth is driven by strong logistics networks, widespread technology adoption, and government safety regulations, positioning North America as a major contributor to global demand.

Prominent players in the Global Electric Baby Car Market include Tesla, Ford, Lucid Motors, BMW, Audi, Mercedes-Benz, Rivian, Volkswagen, Honda, Hyundai, Kia, Nissan, Polestar, Peg Perego, and General Motors (Chevrolet). To strengthen their presence, companies are focusing on continuous product innovation by integrating advanced smart features, safety enhancements, and connectivity options into their vehicles. Collaborations with technology providers and app developers improve real-time monitoring and parental control functionalities. Firms are expanding offline and online distribution networks to enhance accessibility and consumer reach. They invest in targeted marketing campaigns to highlight premium, safe, and interactive product offerings.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Power source

- 2.2.4 Age group

- 2.2.5 Pricing

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Enforcement of stringent child safety regulation

- 3.2.1.2 Increased parental awareness and focus on child safety

- 3.2.1.3 Technological integration of smart seats

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial cost and certified seat systems

- 3.2.2.2 Consumer confusion and installation gaps

- 3.2.3 Opportunities

- 3.2.3.1 Growth in emerging economies.

- 3.2.3.2 Development of lightweight and e-commerce optimized seats

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2022 - 2035 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Ride-on cars

- 5.3 Remote-controlled cars

- 5.4 Battery-powered vehicles

Chapter 6 Market Estimates and Forecast, By Age Group, 2022 - 2035 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 0-1 years

- 6.3 1-3 years

- 6.4 3-5 years

Chapter 7 Market Estimates and Forecast, By Price, 2022 - 2035 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates and Forecast, By Power Source, 2022 - 2035 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Rechargeable battery

- 8.3 Plug-in electric

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 E-commerce site

- 9.2.2 Company owned site

- 9.3 Offline

- 9.3.1 Retail stores

- 9.3.2 Others

Chapter 10 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Audi

- 11.2 BMW

- 11.3 Peg Perego

- 11.4 Ford

- 11.5 General Motors (Chevrolet)

- 11.6 Volkswagen

- 11.7 Honda

- 11.8 Hyundai

- 11.9 Kia

- 11.10 Lucid Motors

- 11.11 Mercedes-Benz

- 11.12 Nissan

- 11.13 Polestar

- 11.14 Rivian

- 11.15 Tesla