PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910813

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910813

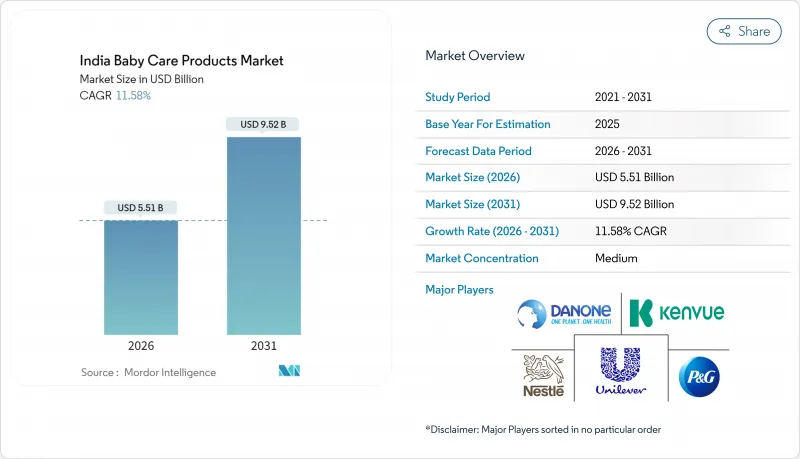

India Baby Care Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

India baby care products market size in 2026 is estimated at USD 5.51 billion, growing from 2025 value of USD 4.94 billion with 2031 projections showing USD 9.52 billion, growing at 11.58% CAGR over 2026-2031.

This growth is driven by factors such as rapid urbanization, a consistently high annual birth rate of approximately 26 million, and rising disposable incomes. These factors are boosting demand for baby care products not only in metropolitan areas but also in smaller tier-2 and tier-3 cities. Increasing digital penetration, the expansion of organized retail networks, and a growing preference for premium products are further propelling the market. The market can be segmented by product type, where nutritional products and skincare items are witnessing significant growth. By nature, organic products are gaining traction and challenging the dominance of conventional offerings. In terms of age group, products for infants are seeing a surge in demand, although toddler-focused products continue to dominate. Distribution channels are also evolving, with e-commerce platforms playing a key role in reshaping how consumers access baby care products. The competitive landscape is moderately intense, with multinational corporations and domestic companies competing by balancing pricing strategies and investing in innovation. Key opportunities in the market include subscription-based e-commerce models, products tailored to specific climate conditions, and organic offerings that incorporate traditional Indian ingredients, which appeal to consumers seeking natural and heritage-based solutions.

India Baby Care Products Market Trends and Insights

Growing awareness of infant health and hygiene

Awareness about infant health and hygiene is growing rapidly in India, driven by increased health consciousness after the pandemic and recommendations from pediatricians. Parents are more focused on purchasing baby care products that ensure safety and comfort for their children. This trend is evident among urban families with dual incomes, where premium product offerings play a significant role in purchasing decisions. With approximately 25% of India's population in the 0-14 age group as of 2024, as per the World Bank, it ensures a consistent demand for baby care products. Brands are introducing innovative products to stand out in the market. For example, in January 2024, Pampers India launched its new and improved Pampers Premium Care diaper. Marketed as India's #1 softest diaper, appealing to parents seeking superior comfort for their infants.

Shift toward organic and chemical-free products

The preference for organic and chemical-free products is becoming a significant trend in India's baby care market, driven by increasing incomes and changing consumer priorities. With India's GDP at purchasing power parity projected to reach USD 17.65 trillion in 2025, as per the International Monetary Fund, parents are now more willing to invest in premium baby care products that emphasize safety and natural ingredients. Millennial parents, in particular, are drawn to chemical-free and Ayurveda-inspired products, considering them safer and healthier for their children. This trend is evident in product launches like the Himalaya Baby Care Pure Cow Ghee range, introduced in 2024, which is free from harsh chemicals and designed to improve the skin barrier, protect the skin's natural microbiome, especially for those with sensitive skin or newborns.

Cultural preferences for traditional remedies

Cultural preferences for traditional remedies remain a significant challenge in India's baby care products market, especially in rural areas, where approximately 63% of the population resided in 2024, according to World Bank data. Many parents in these regions continue to rely on long-standing, home-based practices such as using natural oils, herbal pastes, or cow ghee for infant massage and skincare. These traditional methods are deeply ingrained in their daily routines and are often viewed as safer, more effective, and cost-efficient compared to commercially available baby care products. This reliance on traditional remedies makes it difficult for companies to promote modern products like lotions, wipes, or diapers, particularly premium or innovative options. Brands need to adopt culturally sensitive strategies, such as highlighting how their products can complement traditional practices or incorporating natural, familiar ingredients into their formulations.

Other drivers and restraints analyzed in the detailed report include:

- Increasing awareness about product safety and certifications

- Technological advancements in baby care products

- High price sensitivity in rural India

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Baby Food and Beverages accounted for a notable 25.62% share of India's baby care products market in 2025, reflecting the growing focus on infant nutrition during the critical early years. This segment includes products like infant formula, cereals, juices, and fortified drinks, which are increasingly enriched with essential nutrients to support healthy growth and immunity. Urban parents are particularly drawn to ready-to-use and clinically tested options that ensure convenience and safety. Both domestic and international brands are innovating with age-specific formulations and user-friendly packaging to cater to evolving consumer needs.

The Baby Skin Care segment is the fastest-growing category, projected to grow at a 12.54% CAGR through 2031, driven by increasing awareness of infant skin sensitivity and safety. Parents are seeking products like lotions, creams, oils, and gentle cleansers that are specifically designed for delicate baby skin. Companies are developing formulations suited to India's diverse climates, from humid coastal areas to dry regions, ensuring better skin protection. Hypoallergenic and dermatologically tested claims are becoming essential factors influencing purchase decisions. The use of natural and organic ingredients is gaining traction, appealing to health-conscious parents who prioritize both safety and comfort for their babies.

Synthetic/Conventional Products continued to dominate the India baby care products market in 2025, contributing 75.12% of the total revenue. These products remain popular due to their affordability, widespread availability, and strong brand presence, especially in rural and tier-3 cities. Their extensive distribution networks and competitive pricing make them accessible to a larger audience, particularly price-sensitive households. Aggressive marketing campaigns and retailer incentives have further strengthened their foothold in the market. Despite growing competition from organic alternatives, conventional products maintain their appeal by offering reliable quality at a lower cost.

Natural/Organic Formulations, on the other hand, are rapidly gaining traction and are expected to grow at a 13.62% CAGR through 2031, outpacing the overall market growth. Parents are increasingly prioritizing safety and health, opting for products with natural or organic ingredients, even at a higher price point. This segment includes baby lotions, oils, wipes, and creams made with plant-based or Ayurveda-inspired formulations, appealing to urban and affluent consumers. Certifications like BIS organic labels play a crucial role in building trust and ensuring product authenticity. As awareness of chemical-free and eco-friendly options grows, this segment is becoming a key driver of innovation and premiumization in the baby care market.

The India Baby Care Products Market Report is Segmented by Product Type (Baby Skin Care, Baby Hair Care, and More), Nature (Natural/Organic and Synthetic/Conventional), Age Group (Infants (0-1 Years) and Toddlers (1-3 Years)), and Distribution Channel (Supermarkets/Hypermarkets, Pharmacies/Drug Stores, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Kenvue Inc.

- The Procter & Gamble Company

- Nestle SA

- Unilever PLC

- Kimberly-Clark Corp.

- Danone SA

- Unicharm Corporation

- Himalaya Global Holdings Ltd

- Honasa Consumer Limited (Mama Earth)

- Dabur India Ltd

- Patanjali Ayurved Ltd

- Reckitt Benckiser Group plc

- ITC Limited (Mother Sparsh Baby Care Pvt Ltd)

- Emami Ltd

- Navashya Consumer Products Private Limited (Super Bottoms)

- MeeMee (Me N Moms)

- Artsana SpA (Chicco)

- Sebapharma GmbH & Co. KG

- FirstCry (Brainbees Solutions)

- R for Rabbit Baby Products Pvt Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing awareness of infant health and hygiene

- 4.2.2 Shift toward organic and chemical-free products

- 4.2.3 Innovations in product offerings

- 4.2.4 Technological advancements in baby care products

- 4.2.5 Increasing awareness about product safety and certifications

- 4.2.6 Rising availability of international and premium brands

- 4.3 Market Restraints

- 4.3.1 High price-sensitivity in rural India

- 4.3.2 Availability of counterfeit and substandard products

- 4.3.3 Cultural preferences for traditional remedies

- 4.3.4 Import duties on international products

- 4.4 Regulatory Outlook

- 4.5 Consumer Behaviour Analysis

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Baby Skin Care

- 5.1.2 Baby Hair Care

- 5.1.3 Baby Toiletries

- 5.1.3.1 Bath and Fragrances

- 5.1.3.2 Diapers and Wipes

- 5.1.4 Baby Food and Beverages

- 5.2 By Nature

- 5.2.1 Natural/Organic

- 5.2.2 Synthetic/Conventional

- 5.3 By Age Group

- 5.3.1 Infants (0-1 Year)

- 5.3.2 Toddlers (1-3 Years)

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets/Hypermarkets

- 5.4.2 Pharmacies/Drug Stores

- 5.4.3 Online Retail Channels

- 5.4.4 Other Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Kenvue Inc.

- 6.4.2 The Procter & Gamble Company

- 6.4.3 Nestle SA

- 6.4.4 Unilever PLC

- 6.4.5 Kimberly-Clark Corp.

- 6.4.6 Danone SA

- 6.4.7 Unicharm Corporation

- 6.4.8 Himalaya Global Holdings Ltd

- 6.4.9 Honasa Consumer Limited (Mama Earth)

- 6.4.10 Dabur India Ltd

- 6.4.11 Patanjali Ayurved Ltd

- 6.4.12 Reckitt Benckiser Group plc

- 6.4.13 ITC Limited (Mother Sparsh Baby Care Pvt Ltd)

- 6.4.14 Emami Ltd

- 6.4.15 Navashya Consumer Products Private Limited (Super Bottoms)

- 6.4.16 MeeMee (Me N Moms)

- 6.4.17 Artsana SpA (Chicco)

- 6.4.18 Sebapharma GmbH & Co. KG

- 6.4.19 FirstCry (Brainbees Solutions)

- 6.4.20 R for Rabbit Baby Products Pvt Ltd

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK