PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913418

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913418

Fragrance Product Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

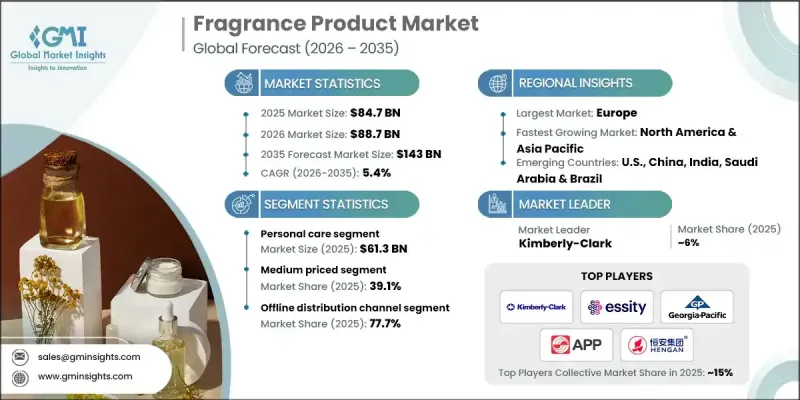

The Global Fragrance Product Market was valued at USD 84.7 billion in 2025 and is estimated to grow at a CAGR of 5.4% to reach USD 143 billion by 2035.

Rising purchasing power across both mature and developing economies supports sustained demand for fragrance products. Consumers increasingly associate fragrances with personal identity, emotional well-being, and everyday self-care rather than viewing them as optional beauty items. Heightened awareness of health, transparency, and environmental responsibility is reshaping buying behavior, leading to stronger demand for products developed with clean-label positioning and responsibly sourced inputs. Sustainability considerations now play a critical role in purchase decisions, encouraging brands to reformulate offerings with greater accountability and ethical alignment. This shift supports long-term growth opportunities for companies that prioritize natural composition, traceable sourcing, and environmentally conscious practices. The market continues to benefit from evolving consumer lifestyles, premiumization trends, and the growing role of fragrance in daily routines, reinforcing its position as a resilient and emotionally driven consumer category.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $84.7 Billion |

| Forecast Value | $143 Billion |

| CAGR | 5.4% |

The personal care segment generated USD 61.3 billion in 2025 and is expected to grow at a CAGR of 5.6% between 2026 and 2035. Rising income levels, particularly in developing regions, continue to drive spending on higher-value personal care solutions. Fragrance products are increasingly integrated into everyday grooming habits across a broad consumer base. Digital influence and brand visibility further support demand, while ongoing innovation in formulation and delivery enhances consumer engagement and segment growth.

The medium-priced products segment held a 39.1% share and is forecast to grow at a CAGR of 5.1% through 2035. Consumers gravitate toward offerings that balance perceived quality with affordability, supporting steady demand within this tier. The expansion of middle-income populations and improved retail accessibility contribute to the segment's strong performance, while digital sales channels enhance reach and brand awareness.

United States Fragrance Product Market was valued at USD 16 billion in 2025 and is projected to grow at a CAGR of 5.4% from 2026 to 2035. Strong cultural emphasis on personal expression and grooming supports consistent consumption. The presence of established brands, rapid innovation cycles, and advanced digital retail infrastructure further strengthens market leadership.

Prominent companies operating in the Global Fragrance Product Market include L'Oreal, Estee Lauder, Chanel, Coty, Givaudan, Firmenich, Symrise, International Flavors & Fragrances, LVMH, Puig, Shiseido, Inter Parfums, Unilever, Procter & Gamble, and Elizabeth Arden. Companies in the Global Fragrance Product Market strengthen their market position through continuous innovation, sustainability-driven reformulation, and strategic brand positioning. Investments in responsible sourcing, transparency, and clean-label development align offerings with evolving consumer values. Digital marketing, direct-to-consumer platforms, and data-driven personalization enhance customer engagement and loyalty. Strategic collaborations and portfolio diversification support expansion across regions and price tiers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Fragrance type

- 2.2.4 Price

- 2.2.5 End use

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing disposable income

- 3.2.1.2 Growing personal grooming & self-care trends

- 3.2.1.3 Increasing demand for natural & organic ingredients

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High competition & market saturation

- 3.2.2.2 Volatility in raw material prices

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By Region

- 3.6.2 By Product

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product, 2022 - 2035, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Personal care

- 5.2.1 Perfumes

- 5.2.1.1 Parfum or De Parfum

- 5.2.1.2 Eau De Parfum (EDP)

- 5.2.1.3 Eau De Toilette (EDT)

- 5.2.1.4 Eau De Cologne (EDC)

- 5.2.1.5 Others (Eau Fraiche, Perfume Oil)

- 5.2.2 Deodorants and antiperspirants

- 5.2.3 Body mists

- 5.2.4 Others (colognes, powder, etc.)

- 5.2.5 Home fragrances

- 5.2.5.1 Candles

- 5.2.5.2 Diffusers

- 5.2.5.3 Air fresheners & gel pockets

- 5.2.5.4 Room sprays and mists

- 5.2.5.5 Essential oils

- 5.2.5.6 Others (wax melts & warmer, beads, etc.)

- 5.2.1 Perfumes

Chapter 6 Market Estimates & Forecast, By Fragrance Type, 2022 - 2035, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Natural

- 6.3 Synthetic

- 6.4 Hybrid

Chapter 7 Market Estimates & Forecast, By Price, 2022 - 2035, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By End Use, 2022 - 2035, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Personal/Residential

- 8.3 Commercial

- 8.4 Hotel and hospitality

- 8.5 Spa and wellness centers

- 8.6 Retail

- 8.7 Corporates

- 8.8 Others (Educational institutes, healthcare, etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.1.1 E-commerce sites

- 9.1.2 Company websites

- 9.2 Offline

- 9.2.1 Specialty stores

- 9.2.2 Mega retail stores

- 9.2.3 Others (departmental stores, individual stores, etc.)

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Indonesia

- 10.4.7 Malaysia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Chanel

- 11.2 Coty

- 11.3 Elizabeth Arden

- 11.4 Estee Lauder

- 11.5 Firmenich

- 11.6 Givaudan

- 11.7 Inter Parfums

- 11.8 International Flavors & Fragrances

- 11.9 L'Oreal

- 11.10 LVMH

- 11.11 Procter & Gamble

- 11.12 Puig

- 11.13 Shiseido

- 11.14 Symrise

- 11.15 Unilever