PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913449

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913449

Explosives and Pyrotechnics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

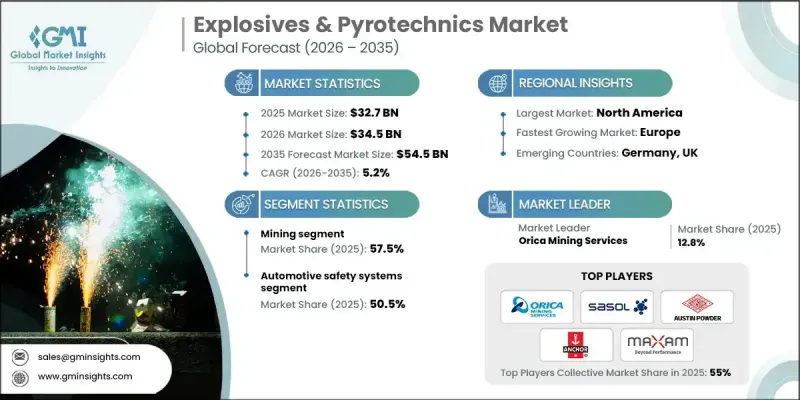

The Global Explosives & Pyrotechnics Market was valued at USD 32.7 billion in 2025 and is estimated to grow at a CAGR of 5.2% to reach USD 54.5 billion by 2035.

This market encompasses commercial blasting materials used in mining and infrastructure development, energetic compounds applied in defense and aerospace programs, and pyrotechnic components integrated into automotive safety systems and controlled visual displays. Bulk ammonium nitrate-based formulations continue to account for the largest consumption volumes, with annual demand reaching nearly 20 million tons due to sustained mining and quarrying activity. Pyrotechnic components used in vehicle safety mechanisms are regulated as UN 3268 Class 9 materials and are manufactured to meet defined thermal and electrical activation requirements ensure predictable performance. Defense and aerospace applications remain stable growth contributors, supported by ongoing public-sector investment in munitions and propulsion systems that rely on energetic materials. Automotive-related pyrotechnics also generate consistent demand due to high production volumes and mandatory safety standards. At the same time, environmental considerations are influencing material innovation, as traditional nitrate-based explosives carry emissions and residue challenges that are encouraging suppliers to optimize formulations and manufacturing efficiency.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $32.7 Billion |

| Forecast Value | $54.5 Billion |

| CAGR | 5.2% |

The mining segment held 57.5% share in 2025, driven by the rising production of copper, nickel, lithium, and other critical minerals. Expanding clean energy supply chains and long-term resource requirements translate directly into higher blasting material consumption, with surface operations favoring bulk emulsions and underground projects relying more on packaged products and electronic blasting systems.

The automotive safety applications segment accounted for 50.5% share in 2025, reflecting strong demand for airbag and restraint activation systems manufactured under established transport and qualification standards.

U.S. Explosives & Pyrotechnics Market reached USD 7.9 billion in 2025 and is projected to reach USD 12.7 billion by 2035. Growth is supported by sustained defense spending, mature domestic production capacity, and advanced adoption of digital blasting technologies, while Canada contributes steady demand through metals and potash extraction.

Key companies active in the Global Explosives & Pyrotechnics Market include Orica Mining Services, MAXAM Corp, ENAEX, AECI Group, Incitec Pivot Limited, Austin Powder Company, Sasol Limited, EPC Group, Chemring Group, Titanobel SAS, Hanwha Corporation, LSB Industries Inc., Solar Industries India, Zambelli Fireworks, Celebration Fireworks, Supreme Fireworks UK, Entertainment Fireworks, Melrose Pyrotechnics, Impact Pyro, Skyburst The Firework, Angelfire Pyrotechnics, Pyro Company Fireworks, Howard & Sons, and Impact Pyro. Companies operating in the Global Explosives & Pyrotechnics Market are strengthening their market position by focusing on operational efficiency, digital blasting solutions, and product innovation that improves safety and performance consistency. Strategic investments in capacity expansion and localized manufacturing help ensure supply reliability near major mining and defense customers. Many players are also prioritizing environmentally optimized formulations to address regulatory pressure and sustainability goals.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Explosives Market, By End-user

- 2.2.2 Pyrotechnics Market, By End-user

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Explosives Market, By End Use, 2022-2035 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Mining

- 5.2.1 Coal mining

- 5.2.2 Metal mining

- 5.2.3 Others

- 5.3 Construction & infrastructure

- 5.3.1 Tunneling & underground construction

- 5.3.2 Road & highway construction

- 5.3.3 Dam, reservoir & hydroelectric projects

- 5.3.4 Others

- 5.4 Military & defense

- 5.4.1 Military training & simulation

- 5.4.2 Military engineering & construction

- 5.4.3 Naval & maritime operations

- 5.4.4 Others

- 5.5 Others

- 5.5.1 Oil & gas industry

- 5.5.2 Avalanche control & snow safety

- 5.5.3 Agriculture & land clearing

- 5.5.4 Geotechnical & scientific applications

- 5.5.5 Emergency services & disaster response

- 5.5.6 Forestry & logging

Chapter 6 Pyrotechnics Market, By End Use, 2022-2035 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Consumer & retail

- 6.2.1 Household consumers

- 6.2.2 Retail distribution channels

- 6.2.3 Others

- 6.3 Automotive industry - safety systems

- 6.4 Aerospace & space industry

- 6.5 Military & defense

- 6.6 Marine & maritime applications

- 6.7 Others

Chapter 7 Market Size and Forecast, By Region, 2022-2035 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.5.4 Rest of Latin America

- 7.6 Middle East & Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

- 7.6.4 Rest of Middle East & Africa

Chapter 8 Company Profiles

- 8.1 Orica Mining Services

- 8.2 Incitec Pivot Limited

- 8.3 Sasol Limited

- 8.4 Austin Powder Company

- 8.5 ENAEX

- 8.6 MAXAM Corp

- 8.7 AECI Group

- 8.8 EPC Group

- 8.9 Chemring Group

- 8.10 Titanobel SAS

- 8.11 Hanwha Corporation

- 8.12 LSB Industries Inc

- 8.13 Solar Industries India

- 8.14 Zambelli Fireworks

- 8.15 Howard & Sons

- 8.16 Angelfire Pyrotechnics

- 8.17 Pyro Company Fireworks

- 8.18 Melrose Pyrotechnics

- 8.19 Skyburst The Firework

- 8.20 Entertainment Fireworks

- 8.21 Supreme Fireworks UK

- 8.22 Celebration Fireworks

- 8.23 Impact Pyro