PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913482

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913482

Nanocellulose Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

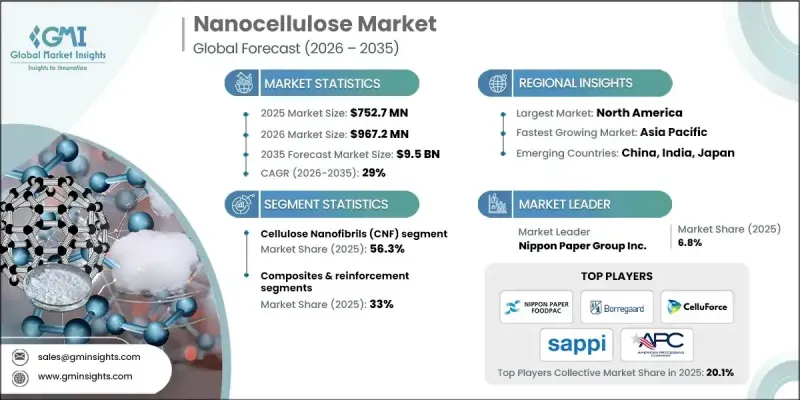

The Global Nanocellulose Market was valued at USD 752.7 million in 2025 and is estimated to grow at a CAGR of 29% to reach USD 9.5 billion by 2035.

Nanocellulose, a bio-based nanomaterial derived from cellulose, the planet's most abundant biopolymer, offers a remarkable stiffness-to-weight ratio, high specific surface area, and customizable surface chemistry. Its tensile strength can reach approximately 10 GPa, with a Young's modulus of 140-150 GPa for cellulose nanocrystals, enabling it to replace petroleum-based additives in demanding applications. The market revolves around three main types: cellulose nanocrystals (CNC), cellulose nanofibrils (CNF), and bacterial nanocellulose (BNC), each with unique morphologies and production methods suited to specific industrial applications. Growing adoption of sustainable packaging, development of biomedical solutions such as wound care scaffolds and hydrogels, and integration into energy storage devices for wearables and next-generation batteries are further accelerating market expansion.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $752.7 Million |

| Forecast Value | $9.5 Billion |

| CAGR | 29% |

The cellulose nanofibrils (CNF) segment captured 56.3% share in 2025 owing to their versatility in rheology modification, coatings, and reinforcement. CNF production is supported by large-scale industrial operations in regions such as Norway and Japan, and is applied across construction admixtures, waterborne coatings, and other commercial uses. Cellulose nanocrystals (CNC), produced through acid hydrolysis, deliver rod-like crystals with high crystallinity and excellent oxygen barrier properties, making them suitable for advanced films and composites.

The composites and reinforcement segment accounted for 33% share in 2025, driven by automakers and Tier 1 suppliers exploring CNF-reinforced engineering plastics for lightweight yet durable automotive components. Paper and paperboard applications leverage CNF to enhance tensile strength and surface properties while reducing fiber use, and packaging and barrier films continue to gain traction for applications requiring oxygen resistance and compostability.

North America Nanocellulose Market held 39.3% share in 2025, backed by robust research infrastructure, pilot plants, and active collaboration between industry and academia. Initiatives by research institutions and government agencies supporting commercialization have further strengthened the region's market leadership.

Key companies operating in the Global Nanocellulose Market include Borregaard ASA, Kruger Inc., FPInnovations, Sappi Limited, Stora Enso, CelluForce Inc., Oji Holdings Corporation, Holmen AB, Melodea Ltd., J. Rettenmaier & Sohne GmbH + Co. KG, CelluComp Ltd., Asahi Kasei Corporation, Daicel Corporation, and American Process Inc. (API). Market players in the Global Nanocellulose Market are adopting multiple strategies to solidify their presence and expand market share. These include investing in R&D for novel applications, forming strategic partnerships with end-use industries, and expanding production capacities through commercial-scale facilities. Companies are also prioritizing sustainable sourcing, enhancing process efficiencies, and exploring high-value applications in biomedical, packaging, and energy storage sectors. Additionally, marketing initiatives, intellectual property protection, and global distribution network expansion are key tactics employed to strengthen brand visibility and maintain leadership in a rapidly evolving market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By form

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product, 2022-2035 (USD Billion & Tons)

- 5.1 Key trends

- 5.2 Cellulose Nanocrystals (CNC)

- 5.2.1 Sulfated CNC

- 5.2.2 Carboxylated CNC

- 5.2.3 Other chemically modified CNC

- 5.3 Cellulose Nanofibrils (CNF)

- 5.3.1 Enzymatically treated CNF

- 5.3.2 TEMPO-Mediated Oxidation

- 5.3.3 Carboxymethylation

- 5.4 Bacterial Nanocellulose (BNC)

- 5.5 Cellulose Microcrystals (CMC/MCC)

- 5.6 Surface-Modified & Functionalized Nanocellulose

Chapter 6 Market Estimates and Forecast, By Application, 2022-2035 (USD Billion & Tons)

- 6.1 Key trends

- 6.2 Composites & Reinforcement

- 6.2.1 Polymer Matrix Types

- 6.2.1.1 Thermoplastic Composites

- 6.2.1.2 Thermoset Composites

- 6.2.1.3 Bio-Based Polymer Composites

- 6.2.1 Polymer Matrix Types

- 6.3 Packaging & Barrier Films

- 6.3.1 Food Contact Applications

- 6.3.1.1 Oxygen Barrier Films

- 6.3.1.2 Moisture Barrier Coatings

- 6.3.1.3 Grease-Resistant Packaging

- 6.3.2 Active & Intelligent Packaging

- 6.3.3 Biodegradable Packaging Solutions

- 6.3.1 Food Contact Applications

- 6.4 Coatings & Paints

- 6.4.1 Rheology Modification

- 6.4.2 Barrier & Protective Coatings

- 6.4.3 Anti-Corrosion Applications

- 6.5 Paper & Paperboard Enhancement

- 6.6 Biomedical & Healthcare

- 6.7 Filtration & Membranes

- 6.7.1 Water Treatment Applications

- 6.7.2 Air Filtration

- 6.7.3 Oil-Water Separation

- 6.7.4 Heavy Metal Removal

- 6.8 Energy Storage & Electronics

- 6.8.1 Battery Separators

- 6.8.2 Supercapacitor Electrodes

- 6.8.3 Flexible Electronics Substrates

- 6.8.4 Sensors & Actuators

- 6.9 Rheology Modifiers & Additives

- 6.10 Agricultural Applications

- 6.11 Construction Materials

- 6.11.1 Cement & Concrete Additives

- 6.11.2 Adhesives & Sealants

- 6.11.3 Wood Composites & Engineered Wood

Chapter 7 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion & Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.5.4 Rest of Latin America

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

- 7.6.4 Rest of Middle East and Africa

Chapter 8 Company Profiles

- 8.1 Sappi Limited

- 8.2 Borregaard ASA

- 8.3 CelluForce Inc.

- 8.4 FPInnovations

- 8.5 American Process Inc. (API)

- 8.6 Kruger Inc.

- 8.7 Daicel Corporation

- 8.8 Nippon Paper Group Inc.

- 8.9 Melodea Ltd.

- 8.10 J. Rettenmaier & Sohne GmbH + Co. KG

- 8.11 CelluComp Ltd.

- 8.12 Asahi Kasei Corporation

- 8.13 Oji Holdings Corporation

- 8.14 Stora Enso

- 8.15 Holmen AB

- 8.16 Anomera