PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928864

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928864

Biodiesel and Biofuels Processing Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

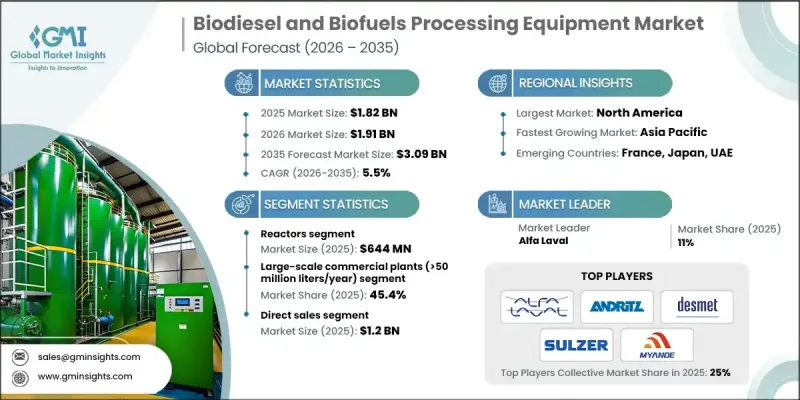

The Global Biodiesel and Biofuels Processing Equipment Market was valued at USD 1.82 billion in 2025 and is estimated to grow at a CAGR of 5.5% to reach USD 3.09 billion by 2035.

Communities worldwide are actively reassessing how energy systems are developed and deployed as pressure increases to achieve net-zero targets. Governments, corporations, and investors are shifting their focus away from fossil fuel dependency and toward renewable and low-carbon energy sources. This transition is driven by increasing climate-related risks, stronger ESG accountability across industries, and continuous technological improvements that allow renewable fuels to compete on cost and performance. Biofuels are positioned as essential components in national and sector-specific decarbonization strategies, especially where immediate alternatives remain limited. Demand is accelerating in industries that require high-energy, compatible fuels, which is leading to greater investment in new production facilities and advanced processing equipment. Manufacturers are prioritizing scalable, efficient, and reliable systems that can support long-term fuel supply stability while meeting regulatory blending mandates and sustainability objectives.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.82 Billion |

| Forecast Value | $3.09 Billion |

| CAGR | 5.5% |

The market continues to benefit from rising investment in advanced production equipment designed to support higher throughput and consistent operational performance. Producers increasingly demand systems that improve efficiency, enhance output, and support continuous operation. This shift reflects a broader move toward modernized equipment configurations that deliver operational flexibility and improved cost control, allowing manufacturers to respond more effectively to growing global fuel demand.

The reactors segment generated USD 644 million in 2025. These systems remain central to biodiesel and biofuel manufacturing, as they serve as the core processing units within production facilities. Market demand favors solutions that deliver stable conditions, higher conversion efficiency, and increased output volumes. Equipment suppliers continue to develop advanced designs that outperform traditional systems by enabling continuous operation, better process control, and greater scalability to meet industrial-level production requirements.

The large-scale commercial facilities with annual output exceeding 50 million liters accounted for 45.4% share in 2025. These plants play a vital role in meeting government blending mandates while supplying renewable fuels to industrial consumers. Their ability to operate continuously throughout the year requires sophisticated engineering, dependable equipment, and strong logistics support for feedstock sourcing. High-volume production allows these facilities to achieve lower per-unit costs, making biofuels increasingly competitive with conventional fuels.

North America Biodiesel and Biofuels Processing Equipment Market held 77.2% share and generated USD 475.1 million in 2025. Federal and state-level incentives continue to support the adoption of cleaner fuels, encouraging producers to expand capacity. Equipment demand is rising as commercial operators develop large production facilities to comply with renewable fuel standards and respond to increasing interest in alternative fuel applications.

Key companies operating in the Global Biodiesel and Biofuels Processing Equipment Market include Alfa Laval, ANDRITZ, Desmet, Sulzer, Myande, CPM Crown, JBT, SRS International, N&T Engitech, Advance Biofuel, Florida Biodiesel, Springboard Biodiesel, American Crane & Equipment, S. Howes, and Ecolab. Companies in the Global Biodiesel and Biofuels Processing Equipment Market focus on capacity expansion, technology upgrades, and strategic partnerships to strengthen their market position. Many manufacturers invest heavily in research and development to improve the efficiency, durability, and scalability of equipment. Firms also emphasize customization to meet regional regulatory requirements and diverse feedstock conditions. Strategic collaborations with fuel producers help suppliers secure long-term contracts and improve product validation. Expansion into emerging markets allows companies to capture new demand driven by sustainability mandates.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment Type

- 2.2.3 Material Type

- 2.2.4 Application

- 2.2.5 End use scale

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Global decarbonization & energy transition

- 3.2.1.2 Government blend mandates & policy incentives

- 3.2.1.3 Rising adoption of advanced biofuels (HVO, SAF)

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High capital costs

- 3.2.2.2 Infrastructure & supply chain weaknesses

- 3.2.3 Opportunities

- 3.2.3.1 Expansion of advanced biofuel plants

- 3.2.3.2 Growth in aviation & marine renewable fuels

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By equipment type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter';s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Equipment Type, 2022 - 2035 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Heat exchangers

- 5.2.1 Process cooling/heating heat exchangers

- 5.2.2 Methanol recovery heat exchangers

- 5.2.3 Glycerin processing heat exchangers

- 5.2.4 Tube content per heat exchanger unit

- 5.3 Distillation columns

- 5.3.1 Methanol rectification columns

- 5.3.2 Glycerin purification columns

- 5.3.3 Feedstock pre-treatment columns

- 5.3.4 Tube content per column

- 5.4 Evaporation & concentration systems

- 5.4.1 Methanol flash evaporators

- 5.4.2 Falling film evaporators

- 5.5 Reactors

Chapter 6 Market Estimates and Forecast, By Material Type, 2022 - 2035 (USD Million)

- 6.1 Key trends

- 6.2 Stainless steel 304/304l tubes

- 6.3 Stainless steel 316/316L tubes

- 6.4 Duplex and super duplex stainless-steel tubes

- 6.5 Titanium tubes

- 6.6 Nickel alloys and other materials

Chapter 7 Market Estimates and Forecast, By Application, 2022 - 2035 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Methanol recovery and purification systems

- 7.3 Glycerin recovery and purification systems

- 7.4 Feedstock pre-treatment and preparation

- 7.5 Transesterification reaction thermal management

- 7.6 Biodiesel/FAMA cooling and finishing

- 7.7 Renewable diesel (HVO/HEFA) high-pressure systems

Chapter 8 Market Estimates and Forecast, By End Use Scale, 2022 - 2035 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Large-scale commercial plants (>50 million liters/year)

- 8.3 Mid-scale regional plants (10-50 million liters/year)

- 8.4 Small-scale and distributed production (<10 million liters/year)

- 8.5 On-farm and cooperative biodiesel systems

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Advance Biofuel

- 11.2 Alfa Laval

- 11.3 American Crane & Equipment

- 11.4 ANDRITZ

- 11.5 CPM Crown

- 11.6 Desmet

- 11.7 Ecolab

- 11.8 Florida Biodiesel

- 11.9 JBT

- 11.10 Myande

- 11.11 N&T Engitech

- 11.12 S. Howes

- 11.13 Springboard Biodiesel

- 11.14 SRS International

- 11.15 Sulzer