PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913390

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913390

Europe Biofuel Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

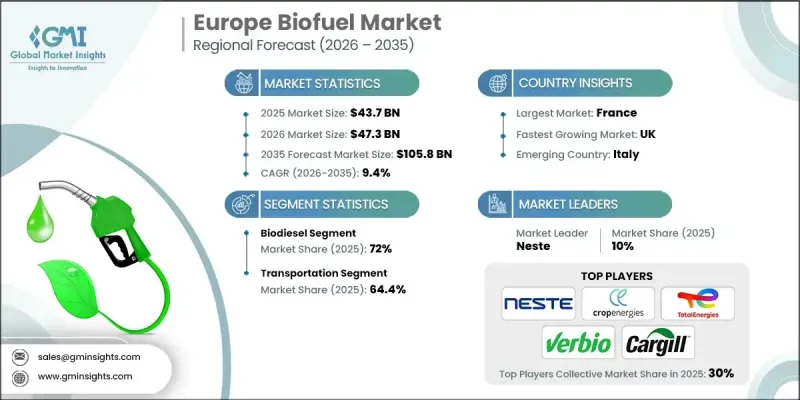

Europe Biofuel Market was valued at USD 43.7 billion in 2025 and is estimated to grow at a CAGR of 9.4% to reach USD 105.8 billion by 2035.

The growth trajectory is supported by Europe's aggressive decarbonization agenda and evolving renewable energy policies. Regulatory frameworks are reshaping fuel demand by increasing renewable energy targets in transport while reinforcing sustainability and emissions reduction requirements. The revised Renewable Energy Directive has introduced stricter lifecycle emissions thresholds, promoted advanced biofuels and renewable fuels of non-biological origin, and reduced reliance on traditional crop-based fuels. These measures are accelerating investment in next-generation biofuel production capacity and supply chain readiness. Aviation-focused renewable fuel mandates are also creating consistent long-term demand, encouraging infrastructure upgrades and long-term procurement strategies across the region. As renewable fuels transition from pilot-scale deployment to regular commercial use, biofuels are becoming an integral component of Europe's energy transition strategy, supported by regulatory certainty, predictable demand, and rising industry collaboration.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $43.7 Billion |

| Forecast Value | $105.8 Billion |

| CAGR | 9.4% |

The biodiesel segment held 72% share in 2025 and is projected to grow at a CAGR of 8.3% through 2035. Its dominance is supported by compatibility with existing vehicle fleets and fuel distribution networks. The market is increasingly shifting toward advanced biodiesel formulations that deliver improved emissions performance and seamless integration. Policy frameworks favor sustainable feedstocks, reinforcing the transition toward waste- and residue-based inputs while limiting dependence on conventional agricultural sources.

The transport segment held a 64.4% share in 2025 and is expected to grow at a CAGR of 9.3% by 2035. Biofuels remain critical for reducing emissions in road transport, particularly in segments where electrification faces technical or economic constraints. Higher blending rates and broader fuel availability are being supported by regulatory mandates and increasing vehicle compatibility with advanced renewable fuels.

France Biofuel Market held 15% share, generating USD 6 .6 billion in 2025. The country's biofuel strategy aligns renewable fuels with broader industrial energy initiatives and evolving compliance mechanisms under updated EU directives. Ongoing policy adjustments and incentive structures continue to support market expansion and investment activity.

Key companies active in the Europe Biofuel Market include Neste, TotalEnergies, BP, ADM, Cargill, Wilmar International Ltd, UPM, VERBIO AG, Chevron Corporation, Borregaard AS, CLARIANT, COFCO, CropEnergies AG, POET, LLC, The Andersons, Inc., Munzer Bioindustrie GmbH, BTG International Ltd, Green Joules, My Eco Energy, and FutureFuel Corporation. These participants are shaping the competitive landscape through feedstock innovation, capacity expansion, and long-term supply agreements. Companies operating in the Europe Biofuel Market are reinforcing their market position through strategic investments in advanced production technologies and sustainable feedstock sourcing. Many players are expanding refining capacity to support higher volumes of next-generation biofuels while improving lifecycle emissions performance. Long-term supply contracts with transport operators and fuel distributors are being prioritized to secure stable demand.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.3 Forecast model

- 1.3.1 Key trends for market estimates

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario analysis framework

- 1.4 Primary research and validation

- 1.4.1 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Paid Sources

- 1.5.2 Sources, by geography

- 1.6 Research Trail & confidence scoring

- 1.6.1 Research trail components

- 1.6.2 Scoring components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

- 1.8 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022 - 2035

- 2.1.1 Business trends

- 2.1.2 Fuel type trends

- 2.1.3 Feedstock trends

- 2.1.4 Application trends

- 2.1.5 Country trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technology factors

- 3.6.5 environmental factors

- 3.6.6 Legal factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digitalization and IoT integration

- 3.7.2 Emerging market penetration

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic initiatives

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Fuel Type, 2022 - 2035 (USD Million, Mtoe)

- 5.1 Key trends

- 5.2 Biodiesel

- 5.3 Ethanol

- 5.4 Others

Chapter 6 Market Size and Forecast, By Feedstock, 2022 - 2035 (USD Million, Mtoe)

- 6.1 Key trends

- 6.2 Coarse grain

- 6.3 Sugar crop

- 6.4 Vegetable oil

- 6.5 Others

Chapter 7 Market Size and Forecast, By Application, 2022 - 2035 (USD Million, Mtoe)

- 7.1 Key trends

- 7.2 Transportation

- 7.3 Aviation

- 7.4 Others

Chapter 8 Market Size and Forecast, By Country, 2022 - 2035 (USD Million, Mtoe)

- 8.1 Key trends

- 8.2 Germany

- 8.3 France

- 8.4 UK

- 8.5 Spain

- 8.6 Italy

Chapter 9 Company Profiles

- 9.1 ADM

- 9.2 BP

- 9.3 Borregaard AS

- 9.4 BTG International Ltd

- 9.5 Cargill

- 9.6 Chevron Corporation

- 9.7 CLARIANT

- 9.8 COFCO

- 9.9 CropEnergies AG

- 9.10 FutureFuel Corporation

- 9.11 Green Joules

- 9.12 Munzer Bioindustrie GmbH

- 9.13 My Eco Energy

- 9.14 Neste

- 9.15 POET, LLC

- 9.16 The Andersons, Inc.

- 9.17 TotalEnergies

- 9.18 UPM

- 9.19 VERBIO AG

- 9.20 Wilmar International Ltd