PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928945

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928945

Synthetic Biology Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

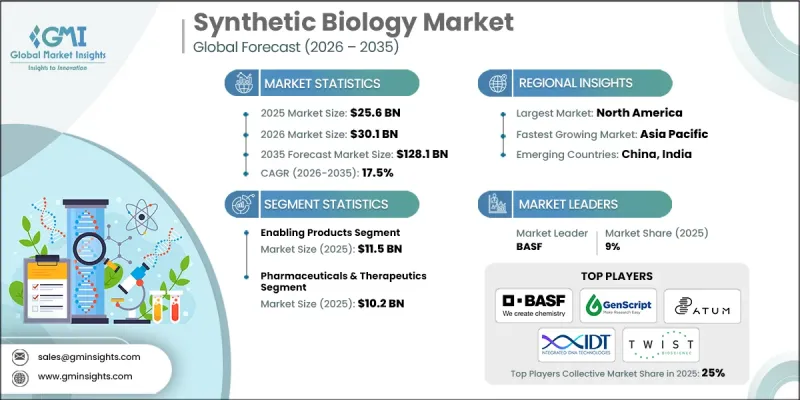

The Global Synthetic Biology Market was valued at USD 25.6 billion in 2025 and is estimated to grow at a CAGR of 17.5% to reach USD 128.1 billion by 2035.

Synthetic biology is revolutionizing the way we engineer biological systems by integrating engineering principles with biology to design novel biological components, devices, and systems. The field has evolved from simple genetic engineering to advanced platforms that enable precise programming of cellular functions. This transformation is driven by breakthroughs in DNA synthesis and sequencing, computational biology, and deeper insights into biological design. The market spans enabling products such as oligonucleotides, enzymes, and chassis organisms; core products including synthetic genes, cells, and DNA libraries; and enabled products covering pharmaceuticals, industrial chemicals, biofuels, and biomaterials. Cutting-edge genome editing technologies like CRISPR-Cas9 have accelerated the adoption of synthetic biology across therapeutics, agriculture, and industrial sectors, while also offering sustainable alternatives to traditional resource-intensive processes.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $25.6 Billion |

| Forecast Value | $128.1 Billion |

| CAGR | 17.5% |

The enabling products segment reached USD 11.5 billion in 2025 and is expected to grow at a CAGR of 16.5% through 2035. This category includes essential tools and reagents required for synthetic biology R&D, such as oligonucleotides, enzymes like polymerases and ligases, cloning kits, chassis organisms like bacterial, yeast, and mammalian cell lines, and software platforms for design and simulation. Its dominance reflects the foundational role these products play in supporting all synthetic biology initiatives.

The pharmaceuticals and therapeutics segment reached USD 10.2 billion in 2025 and is projected to grow at a CAGR of 14.5% through 2035. This segment encompasses cell and gene therapies, mRNA vaccines, engineered biologics, and biosynthetic small molecules. Commercial and clinical validation has been achieved for multiple products, positioning pharmaceuticals and therapeutics as the most commercially advanced area of synthetic biology.

U.S. Synthetic Biology Market was valued at USD 8.6 billion in 2025 and is expected to reach USD 43.1 billion by 2035. Strong government backing supports research and development, including USD 161 million allocated by various agencies in 2020 for biomanufacturing and bioenergy, alongside USD 178 million from the Department of Energy in 2022 aimed at developing sustainable alternatives to petroleum-based products.

Leading companies in the Global Synthetic Biology Market include Novozymes, GenScript, Thermo Fisher Scientific, Ginkgo Bioworks, Twist Bioscience, Integrated DNA Technologies, ATUM, Blue Heron, Amyris, BASF, Biomax Informatics, Pareto Biotechnologies, Gevo Inc., Royal DSM, Bristol-Myers Squibb, Genomatica, Synthetic Genomics, Codexis, Butamax Scarab Genomics, MorphoSys, Evolva, and Igenbio. Key strategies adopted by synthetic biology companies to strengthen their market presence include investing heavily in research and development to create advanced, high-precision solutions, expanding product portfolios through acquisitions and strategic partnerships, and forming collaborations with academic and industrial research institutions. Companies are also focusing on scaling manufacturing capabilities, integrating AI and computational tools for better biological design, and entering emerging geographic markets to expand their global footprint.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product type

- 2.2.2 Technology

- 2.2.3 Application

- 2.2.4 Chassis type

- 2.3 TAM analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Size and Forecast, By Product Type, 2022-2035 (USD Billion)

- 5.1 Key trends

- 5.2 Core products

- 5.2.1 Synthetic nucleic acids

- 5.2.2 Genome editing tools & reagents

- 5.2.3 Enzymes & proteins

- 5.2.4 Chassis organisms & cell lines

- 5.2.5 Genetic parts & vectors

- 5.2.6 Others

- 5.3 Enabling products

- 5.3.1 Bioinformatics & computational tools

- 5.3.2 Automation & robotics

- 5.3.3 Microfluidics & lab-on-chip

- 5.3.4 Others

- 5.4 Enabled products

- 5.4.1 Therapeutic products

- 5.4.2 Biofuels & renewable energy

- 5.4.3 Bio-based chemicals & materials

- 5.4.4 Food & nutrition products

- 5.4.5 Agricultural products

- 5.4.6 Diagnostics & biosensors

- 5.4.7 Others

Chapter 6 Market Size and Forecast, By Technology, 2022-2035 (USD Billion)

- 6.1 Key trends

- 6.2 Nucleotide Synthesis & Sequencing Technologies

- 6.3 Genetic Engineering Technologies

- 6.4 Bioinformatics & Computational Biology

- 6.5 Microfluidics & Miniaturization

- 6.6 Others

Chapter 7 Market Size and Forecast, By Application, 2022-2035 (USD Billion)

- 7.1 Key trends

- 7.2 Pharmaceuticals & therapeutics

- 7.2.1 Cell & gene therapies

- 7.2.2 Biologics production

- 7.2.3 Vaccine development

- 7.2.4 Drug discovery & development

- 7.3 Diagnostics & biosensing

- 7.3.1 Medical diagnostics

- 7.3.2 Environmental monitoring

- 7.3.3 Food safety & quality

- 7.3.4 Biodefense & security

- 7.4 Industrial chemicals & materials

- 7.4.1 Specialty chemicals

- 7.4.2 Polymers & plastics

- 7.4.3 Industrial enzymes

- 7.4.4 Biomaterials & textiles

- 7.5 Agriculture & food production

- 7.5.1 Crop improvement

- 7.5.2 Agricultural biologicals

- 7.5.3 Livestock & aquaculture

- 7.5.4 Food ingredients & additives

- 7.6 Energy & biofuels

- 7.6.1 First & second generation biofuels

- 7.6.2 Advanced biofuels

- 7.6.3 Hydrogen & emerging fuels

- 7.6.4 Feedstock conversion

- 7.7 Environmental applications

- 7.7.1 Bioremediation

- 7.7.2 Carbon capture & utilization

- 7.7.3 Wastewater treatment

- 7.7.4 Environmental monitoring networks

- 7.8 Others

Chapter 8 Market Size and Forecast, By Chassis Type, 2022-2035 (USD Billion)

- 8.1 Key trends

- 8.2 Bacterial chassis

- 8.3 Yeast chassis

- 8.4 Mammalian cell chassis

- 8.5 Plant chassis

- 8.6 Algal & photosynthetic chassis

- 8.7 Others

Chapter 9 Market Size and Forecast, By Region, 2022-2035 (USD Billion)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East & Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 Novozymes

- 10.2 BASF

- 10.3 GenScript

- 10.4 ATUM

- 10.5 Integrated DNA Technologies

- 10.6 Twist Bioscience

- 10.7 Biomax Informatics

- 10.8 Pareto Biotechnologies

- 10.9 Blue Heron

- 10.10 TeselaGenSyntrox

- 10.11 Thermo Fisher Scientific

- 10.12 Gevo Inc

- 10.13 Royal DSM

- 10.14 Bristol-Myers Squibb

- 10.15 Amyris

- 10.16 Genomatica

- 10.17 Synthetic Genomics

- 10.18 Codexis

- 10.19 Butamax Scarab Genomics

- 10.20 Scarab Genomics

- 10.21 MorphoSys

- 10.22 Ginkgo Bioworks

- 10.23 Evolva

- 10.24 Igenbio