PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928981

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928981

Automotive Communication Technology Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

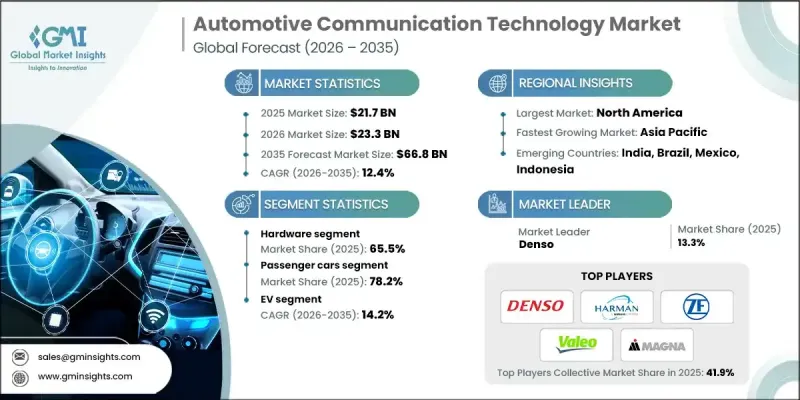

The Global Automotive Communication Technology Market was valued at USD 21.7 billion in 2025 and is estimated to grow at a CAGR of 12.4% to reach USD 66.8 billion by 2035.

The market's expansion is driven by the shift toward connected and data-intensive vehicles. Automakers and suppliers are increasingly adopting technologies that enable vehicles to communicate with each other, infrastructure, and cloud-based services. This includes both physical components, such as telematics control units and network modules, and software platforms that support connected services. Next-generation connectivity solutions are being developed to handle growing data requirements and enhance in-vehicle experiences. Industry stakeholders are aligning standards and communication protocols globally to ensure vehicles meet safety, performance, and compliance requirements across different markets. The move from legacy networks to high-speed Ethernet-based systems, along with zonal architectures, helps manage the increasing number of sensors, cameras, and controllers in modern vehicles. Fleet operators and automakers are leveraging telematics and real-time data to optimize maintenance, improve efficiency, and reduce operating costs, reinforcing the value of connected technologies.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $21.7 Billion |

| Forecast Value | $66.8 Billion |

| CAGR | 12.4% |

The hardware segment held a 65.5% share in 2025. Hardware remains critical to automotive communication, encompassing ECUs, transceivers, wiring harnesses, gateways, sensors, and connectors. As vehicles incorporate advanced electronic systems for ADAS, infotainment, and powertrain management, the need for robust communication hardware has intensified. These components cannot be replaced by software and are essential for reliable in-vehicle networking and data flow.

The passenger cars segment accounted for 78.2% share in 2025 and is expected to reach USD 49.5 billion by 2035. The segment leads because passenger vehicles are produced in large volumes and rapidly adopt new communication technologies. Features like V2X, telematics, and advanced in-vehicle networking are becoming standard or mid-range options, enhancing safety, infotainment, and driver assistance across mass-market vehicles.

U.S. Automotive Communication Technology Market reached USD 5.5 billion in 2025. A key trend in the U.S. is the increasing deployment of vehicle-to-everything (V2X) communication, allowing vehicles to exchange information with infrastructure, other vehicles, and networks. This technology is being promoted to enhance safety and traffic management, supported by smart city initiatives and pilot programs. Automakers and tech companies are advancing V2X while still maintaining traditional in-vehicle protocols such as CAN, LIN, and newer Ethernet-based systems.

Major companies in the Global Automotive Communication Technology Market include Mitsubishi Electric, Yazaki, Aptiv, Harman International, Lear, ZF Friedrichshafen, Magna, Valeo, Denso, and Autoliv. To strengthen presence, companies in the Automotive Communication Technology Market are focusing on innovation in high-speed connectivity, telematics, and in-vehicle networking solutions. They are investing heavily in R&D to improve system reliability, data handling, and integration with ADAS and infotainment systems. Strategic partnerships with automakers and semiconductor providers help accelerate adoption and expand global reach. Firms are standardizing protocols, offering modular platforms, and aligning with regulatory requirements to enhance cross-market compatibility. Additionally, companies are leveraging software updates, predictive maintenance, and real-time data analytics to increase client retention, optimize vehicle performance, and ensure long-term competitiveness in a rapidly evolving connected vehicle landscape.

Table of Contents

Chapter 1 Methodology

- 1.1 Research approach

- 1.2 Quality commitments

- 1.2.1 GMI AI policy & data integrity commitment

- 1.3 Research trail & confidence scoring

- 1.3.1 Research trail components

- 1.3.2 Scoring components

- 1.4 Data collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.6 Base estimates and calculations

- 1.6.1 Base year calculation

- 1.7 Forecast model

- 1.8 Research transparency addendum

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Bus Module

- 2.2.4 Connectivity

- 2.2.5 Vehicle

- 2.2.6 Vehicle Class

- 2.2.7 Propulsion

- 2.2.8 Application

- 2.2.9 Sales Channel

- 2.3 TAM analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising vehicle electrification and software-defined vehicles

- 3.2.1.2 Growing integration of advanced driver assistance systems (ADAS)

- 3.2.1.3 Increasing demand for in-vehicle infotainment and connectivity

- 3.2.1.4 Shift toward autonomous and semi-autonomous vehicles

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Complexity of network integration and interoperability

- 3.2.2.2 Cybersecurity and data privacy concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Growth of vehicle-to-everything (V2X) communication

- 3.2.3.2 Increasing adoption of 5G-enabled automotive networks

- 3.2.3.3 Expansion of electric and autonomous commercial vehicles

- 3.2.3.4 Integration of AI-driven in-vehicle data processing

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 Society of Automotive Engineers (SAE) J2735

- 3.4.1.2 Institute of Electrical and Electronics Engineers (IEEE)

- 3.4.1.3 Dedicated Short Range Communications (DSRC) Protocol

- 3.4.2 Europe

- 3.4.2.1 European Telecommunications Standards Institute (ETSI)

- 3.4.2.2 Cellular Vehicle-to-Everything (C-V2X) Communication Standard

- 3.4.3 Asia Pacific

- 3.4.3.1 Vehicle Network Communication Protocol (China)

- 3.4.3.2 Automotive Industry Standard 140 (AIS 140, India)

- 3.4.4 Latin America

- 3.4.4.1 International Telecommunication Union Recommendation

- 3.4.4.2 ISO 21217

- 3.4.5 Middle East & Africa

- 3.4.5.1 SHC 801 - Autonomous Vehicles Requirements

- 3.4.5.2 The National Electric Vehicles Policy

- 3.4.1 North America

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.9 Sustainability and environmental impact

- 3.9.1 Environmental impact assessment

- 3.9.2 Social impact & community benefits

- 3.9.3 Governance & corporate responsibility

- 3.9.4 Sustainable finance & investment trends

- 3.10 Case studies

- 3.11 Future outlook & opportunities

- 3.12 Evolution of Automotive E/E Architectures

- 3.12.1 Distributed, Domain and Zonal architectures

- 3.12.2 Impact on in-vehicle networking protocols

- 3.12.3 Reduction in ECUs & wiring harness complexity

- 3.12.4 OEM roadmap timelines (2025-2035)

- 3.13 Communication Protocol Performance Benchmarking

- 3.14 Software-Defined Vehicle (SDV) Enablement Analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2022 - 2035 ($Bn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Transceivers

- 5.2.2 Connectors & Cables

- 5.2.3 Gateways & Domain Controllers

- 5.3 Software

- 5.4 Services

Chapter 6 Market Estimates & Forecast, By Bus Module, 2022 - 2035 ($Bn)

- 6.1 Key trends

- 6.2 Local Interconnect Network (LIN)

- 6.3 Controller Area Network (CAN)

- 6.4 FlexRay

- 6.5 Media Oriented Systems Transport (MOST)

- 6.6 Ethernet

Chapter 7 Market Estimates & Forecast, By Connectivity, 2022 - 2035 ($Bn)

- 7.1 Key trends

- 7.2 In-vehicle/Internal communication technology

- 7.3 External communication technology

Chapter 8 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Bn)

- 8.1 Key trends

- 8.2 Passenger cars

- 8.2.1 Hatchback

- 8.2.2 SUV

- 8.2.3 Sedan

- 8.3 Commercial vehicles

- 8.3.1 LCV

- 8.3.2 MCV

- 8.3.3 HCV

Chapter 9 Market Estimates & Forecast, By Vehicle Class, 2022 - 2035 ($Bn)

- 9.1 Key trends

- 9.2 Economy

- 9.3 Mid-range

- 9.4 Luxury

Chapter 10 Market Estimates & Forecast, By Propulsion, 2022 - 2035 ($Bn)

- 10.1 Key trends

- 10.2 ICE

- 10.3 EV

- 10.4 Hybrid

Chapter 11 Market Estimates & Forecast, By Application, 2022 - 2035 ($Bn)

- 11.1 Key trends

- 11.2 Powertrain & Chassis

- 11.3 Body Control & Comfort

- 11.4 Infotainment & Telematics

- 11.5 Safety & ADAS

- 11.6 Others

Chapter 12 Market Estimates & Forecast, By Sales Channel, 2022 - 2035 ($Bn)

- 12.1 Key trends

- 12.2 OEM

- 12.3 Aftermarket

Chapter 13 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn)

- 13.1 Key trends

- 13.2 North America

- 13.2.1 US

- 13.2.2 Canada

- 13.3 Europe

- 13.3.1 Germany

- 13.3.2 UK

- 13.3.3 France

- 13.3.4 Italy

- 13.3.5 Spain

- 13.3.6 Russia

- 13.3.7 Nordics

- 13.3.8 Benelux

- 13.4 Asia Pacific

- 13.4.1 China

- 13.4.2 India

- 13.4.3 Japan

- 13.4.4 South Korea

- 13.4.5 ANZ

- 13.4.6 Singapore

- 13.4.7 Malaysia

- 13.4.8 Indonesia

- 13.4.9 Vietnam

- 13.4.10 Thailand

- 13.5 Latin America

- 13.5.1 Brazil

- 13.5.2 Mexico

- 13.5.3 Argentina

- 13.5.4 Colombia

- 13.6 MEA

- 13.6.1 South Africa

- 13.6.2 Saudi Arabia

- 13.6.3 UAE

Chapter 14 Company Profiles

- 14.1 Global companies

- 14.1.1 Robert Bosch

- 14.1.2 Continental

- 14.1.3 NXP Semiconductors

- 14.1.4 Infineon

- 14.1.5 Denso

- 14.1.6 Qualcomm

- 14.1.7 STMicroelectronics

- 14.1.8 Texas Instruments

- 14.1.9 Renesas Electronics

- 14.1.10 Intel

- 14.1.11 Harman International

- 14.1.12 Broadcom

- 14.1.13 ON Semiconductor

- 14.1.14 ZF Friedrichshafen

- 14.1.15 Valeo

- 14.1.16 Magna

- 14.1.17 Mitsubishi Electric

- 14.1.18 Aptiv

- 14.1.19 Yazaki

- 14.1.20 Autoliv

- 14.2 Regional companies

- 14.2.1 Vector Informatik

- 14.2.2 Melexis

- 14.2.3 TTTech Auto

- 14.2.4 Autotalks

- 14.2.5 Cohda Wireless

- 14.2.6 LG Electronics

- 14.2.7 Lear Corporation

- 14.2.8 Delphi Technologies

- 14.3 Emerging companies

- 14.3.1 iWave Systems

- 14.3.2 Marben Products

- 14.3.3 Danlaw

- 14.3.4 Ficosa Internacional