PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936500

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936500

Europe Trucks Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

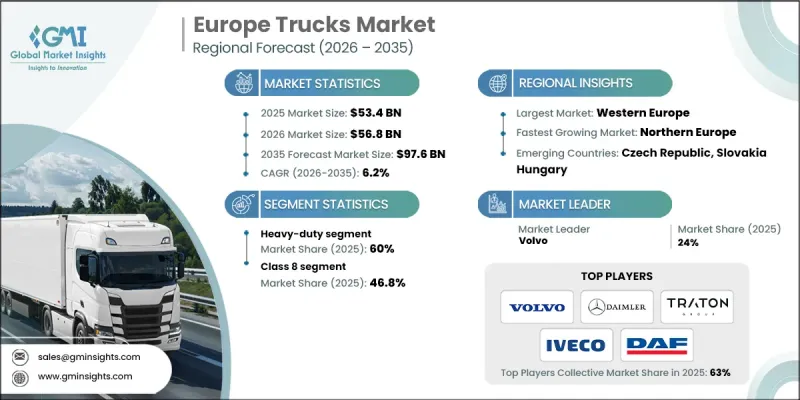

Europe Trucks Market was valued at USD 53.4 billion in 2025 and is estimated to grow at a CAGR of 6.2% to reach USD 97.6 billion by 2035.

Strict emission standards and long-term decarbonization goals are pushing the adoption of electric, hydrogen, and low-emission trucks across medium- and heavy-duty segments. Incentives such as scrappage schemes, low-emission zones, and financial support for green fleets are further driving the shift toward next-generation vehicles. Growth in e-commerce and last-mile delivery is boosting demand for trucks capable of urban and intercity logistics. Investments in intelligent transport corridors, highways, logistics parks, and cross-border routes are enhancing freight efficiency, reducing transit times, and lowering operational costs, while also improving vehicle utilization. The market expansion is being fueled by fleet modernization cycles, increasing parcel volumes, and the adoption of purpose-built trucks for urban and regional distribution.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $53.4 Billion |

| Forecast Value | $97.6 Billion |

| CAGR | 6.2% |

The heavy-duty truck segment held 60% share and is expected to grow at a CAGR 5% through 2035. Stringent noise and emission regulations are accelerating the renewal of diesel-heavy networks, prompting operators to upgrade to Euro VI-compliant or hydrogen-ready trucks. These regulatory measures are creating sustained demand for efficient heavy-duty platforms capable of meeting future zero-emission standards. Growth is further supported by investments in electric and hydrogen-powered truck corridors, including high-power charging stations and hydrogen refueling infrastructure, which help extend operational ranges and reduce range anxiety, making zero-emission heavy trucks increasingly viable for long-haul applications.

The class 8 trucks segment held a 46.8% share in 2025 and is projected to grow at a CAGR of 5% between 2026 and 2035. Stricter CO2 emission regulations for long-haul vehicles are driving the replacement of outdated Class 8 fleets with Euro VI diesel, battery-electric, and hydrogen-ready tractors. The high demand for long-distance freight transport, including intra-European trade, port-to-inland logistics, and industrial supply chains, supports the continued adoption of high-capacity Class 8 trucks designed for efficiency, low emissions, and regulatory compliance.

Germany Trucks Market held 27% share, generating USD 8.5 billion in 2025. Germany's leadership is driven by its role as a key manufacturing and export hub, where heavy volumes of automotive, chemical, machinery, and industrial products require reliable road transportation. The country's strategic geographic location positions it as a major freight transit corridor for goods moving between Western, Eastern, and Northern Europe. Strong domestic and international logistics demand sustains medium- and heavy-duty truck adoption, while continued industrial production and high export activity maintain robust market growth.

Major players operating in the Europe Trucks Market include BelAZ, DAF Trucks, Iveco, MAN Truck, Daimler, Renault Trucks, Scania, Sisu Auto, Tatra, and Volvo Trucks. Leading Europe Trucks Market leaders employ multiple strategies to strengthen market presence and secure long-term growth. Companies are investing heavily in electrification, hydrogen fuel technologies, and hybrid drivetrains to meet emission regulations and offer future-ready fleets. Strategic partnerships with infrastructure providers, energy companies, and logistics operators enhance the adoption of alternative-fuel trucks. Fleet customization, tailored solutions for urban delivery, and long-haul operations are used to address specific customer needs. R&D efforts focus on efficiency improvements, digital telematics integration, and predictive maintenance to reduce the total cost of ownership.

Table of Contents

Chapter 1 Methodology

- 1.1 Research approach

- 1.2 Quality commitments

- 1.2.1 GMI AI policy & data integrity commitment

- 1.3 Research trail & confidence scoring

- 1.3.1 Research trail components

- 1.3.2 Scoring components

- 1.4 Data collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.6 Base estimates and calculations

- 1.6.1 Base year calculation

- 1.7 Forecast model

- 1.8 Research transparency addendum

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Class

- 2.2.3 Vehicle

- 2.2.4 Propulsion

- 2.2.5 Body

- 2.2.6 End Use

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for freight transportation driven by e-commerce

- 3.2.1.2 Long-deferred replacement demand from aging truck fleets

- 3.2.1.3 Increasing manufacturing activities and improving road infrastructure in Eastern Europe

- 3.2.1.4 Expansion of last-mile delivery demand

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Shortage of skilled drivers

- 3.2.2.2 High cost of ownership for electric and hybrid trucks

- 3.2.3 Market opportunities

- 3.2.3.1 Smart highways and intelligent transport systems enabling efficiency and sustainability

- 3.2.3.2 Electric and hybrid truck adoption

- 3.2.3.3 Rapid deployment of green hydrogen refueling infrastructure

- 3.2.3.4 Autonomous truck technology reducing labor costs and addressing driver shortages

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Western Europe

- 3.4.1.1 EU Alternative Fuels Infrastructure Regulation (AFIR)

- 3.4.1.2 Eurovignette Toll Exemption Extension

- 3.4.1.3 Zero Emission / Low Emission Zones

- 3.4.2 Eastern Europe

- 3.4.2.1 EU AFIR Charger Deployment Targets

- 3.4.2.2 National EV Charging Network Tenders

- 3.4.2.3 EU CO2 Emissions Standards for HDVs

- 3.4.3 Northern Europe

- 3.4.3.1 AFIR Infrastructure Mandates

- 3.4.3.2 National Subsidies & Tax Exemptions for EV Trucks

- 3.4.3.3 Low Emission / Zero-Emission Zones

- 3.4.4 Southern Europe

- 3.4.4.1 AFIR Charging Corridor Requirements

- 3.4.4.2 Diesel Truck Entry Bans

- 3.4.4.3 Regional Incentives & Funding for EV Trucks

- 3.4.1 Western Europe

- 3.5 PESTEL analysis

- 3.6 Technology and Innovation landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Patent analysis

- 3.8 Production statistics

- 3.8.1 Production hubs

- 3.8.2 Consumption hubs

- 3.8.3 Export and import

- 3.9 Pricing Analysis

- 3.9.1 By region

- 3.9.2 By Product

- 3.10 Cost analysis & total cost of ownership (TCO)

- 3.11 Sustainability and environmental impact analysis

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.11.5 Carbon footprint considerations

- 3.12 Future outlook & opportunities

- 3.13 Fleet adoption & usage patterns

- 3.13.1 Fleet size & deployment

- 3.13.2 Urban vs long-haul usage

- 3.13.3 Fleet electrification roadmap

- 3.13.4 Total fleet cost savings

- 3.14 OEM sourcing & procurement dynamics

- 3.15 ADAS & sensor integration economics

- 3.16 Aftermarket replacement economics

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Western Europe

- 4.2.2 Eastern Europe

- 4.2.3 Northern Europe

- 4.2.4 Southern Europe

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Class, 2022 - 2035 ($Bn, Unit)

- 5.1 Key trends

- 5.2 Class 2

- 5.3 Class 3

- 5.4 Class 4

- 5.5 Class 5

- 5.6 Class 6

- 5.7 Class 7

- 5.8 Class 8

Chapter 6 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Bn, Unit)

- 6.1 Key trends

- 6.2 Light duty

- 6.3 Medium duty

- 6.4 Heavy duty

Chapter 7 Market Estimates & Forecast, By Propulsion, 2022 - 2035 ($Bn, Unit)

- 7.1 Key trends

- 7.2 BEV

- 7.3 PHEV

- 7.4 HEV

- 7.5 FCEV

Chapter 8 Market Estimates & Forecast, By Body, 2022 - 2035 ($Bn, Unit)

- 8.1 Key trends

- 8.2 Pickup

- 8.3 Box / cargo

- 8.4 Flatbed

- 8.5 Dump

- 8.6 Refrigerated

- 8.7 Tanker

- 8.8 Concrete mixer

- 8.9 Refuse

- 8.10 Tow truck

- 8.11 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2022 - 2035 ($Bn, Unit)

- 9.1 Key trends

- 9.2 Construction

- 9.3 Logistics & transportation

- 9.4 Mining

- 9.5 Oil & gas

- 9.6 Municipal services

- 9.7 Agriculture

- 9.8 Defense

- 9.9 Retail & e-commerce

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn, Units)

- 10.1 Key trends

- 10.2 Western Europe

- 10.2.1 Germany

- 10.2.2 Austria

- 10.2.3 France

- 10.2.4 Switzerland

- 10.2.5 Belgium

- 10.2.6 Luxembourg

- 10.2.7 Netherlands

- 10.2.8 Portugal

- 10.3 Eastern Europe

- 10.3.1 Poland

- 10.3.2 Romania

- 10.3.3 Czechia

- 10.3.4 Slovenia

- 10.3.5 Hungary

- 10.3.6 Bulgaria

- 10.3.7 Slovakia

- 10.3.8 Croatia

- 10.4 Northern Europe

- 10.4.1 UK

- 10.4.2 Denmark

- 10.4.3 Sweden

- 10.4.4 Finland

- 10.4.5 Norway

- 10.5 Southern Europe

- 10.5.1 Italy

- 10.5.2 Spain

- 10.5.3 Greece

- 10.5.4 Bosnia and Herzegovina

- 10.5.5 Albania

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 BelAZ

- 11.1.2 BYD

- 11.1.3 Daimler Truck

- 11.1.4 Ford

- 11.1.5 Fuso

- 11.1.6 Hyundai Motor

- 11.1.7 Isuzu

- 11.1.8 Nikola

- 11.1.9 Tesla

- 11.1.10 Volvo Trucks

- 11.2 Regional Players

- 11.2.1 DAF Trucks

- 11.2.2 Einride

- 11.2.3 Iveco

- 11.2.4 MAN Truck

- 11.2.5 Quantron

- 11.2.6 Renault Trucks

- 11.2.7 Scania

- 11.2.8 Sisu Auto

- 11.2.9 Tatra

- 11.2.10 TATA

- 11.3 Emerging Players

- 11.3.1 Tevva Motors

- 11.3.2 E-Trucks Europe BE

- 11.3.3 Quantron

- 11.3.4 SuperPanther

- 11.3.5 Windrose Technology