PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937306

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937306

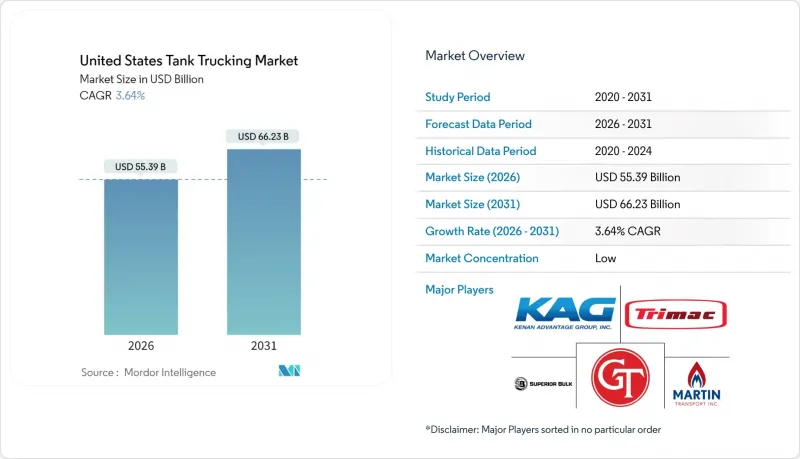

United States Tank Trucking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

United States Tank Trucking Market size in 2026 is estimated at USD 55.39 billion, growing from 2025 value of USD 53.45 billion with 2031 projections showing USD 66.23 billion, growing at 3.64% CAGR over 2026-2031.

The sustained expansion reflects the market's capacity to adapt to shifting energy mixes, stricter safety rules, and volatile input costs. Rising movements of renewable diesel, specialty chemicals, and temperature-controlled food ingredients are expanding the freight base, while digital dispatch tools and lighter tank specifications are pushing asset productivity higher. In parallel, driver shortages, hazmat compliance penalties, and disruptive pilot programs for autonomous trucks are pressuring operating economics and forcing carriers to re-evaluate route design, fleet mix, and capital plans. Despite these challenges, the United States tank trucking market continues to attract private equity capital, with acquisitions aimed at scaling compliance infrastructure and expanding access to niche, higher-margin cargoes.

United States Tank Trucking Market Trends and Insights

Rising Demand for Oil & Refined Products

Biofuel manufacturing momentum is redrawing petroleum logistics corridors as plants require dependable first-mile feedstock deliveries and last-mile finished fuel distribution. United States biofuel output is projected to reach 1.3 million barrels of oil equivalent per day by 2035, a trend that directly increases specialized tank requirements. Gulf Coast refiners and West Coast renewable diesel producers rely on tanks certified for elevated flash-point fuels, driving fleet upgrades that cut tare weight and speed turnarounds. California's updated Low-Carbon Fuel Standard compels carriers to handle a widening slate of low-carbon fuels through 2046, reinforcing demand for insulated, dedicated equipment. Higher-value specialty products pay premiums that offset longer haul distances, securing revenues even as total diesel consumption gradually declines nationwide.

Expansion of U.S. Chemical Production

After the brief 2024 contraction, chemical output is set to advance 1.9% by the end of 2025 as improved industrial demand and a favorable ethane feedstock gap lift utilization rates. Ethylene, propylene, and specialty battery materials moving from Gulf Coast and Midwest plants spur origin-destination realignment that favors tank trucks over rail for just-in-time export container stuffing. Petrochemical producers lean on dedicated carriers to minimize contamination risks and capture higher export premiums at coastal terminals. Investments in semiconductor-grade chemical plants further diversify the freight mix, creating steady contract carriage volumes that smooth seasonal refinery swings.

Tightening HOS & Hazmat Compliance Costs

FMCSA civil penalties have surged, with hazmat violations now costing up to USD 102,348 per count. PHMSA registration fees for small carriers rose 50%, while cargo-tank inspection failures can trigger USD 8,000 fines. Digital audits from electronic logging devices expose once-routine schedule adjustments, cutting utilization and requiring additional headcount to keep fleets legal. Smaller operators lacking compliance personnel are either exiting or selling, accelerating consolidation but trimming available capacity.

Other drivers and restraints analyzed in the detailed report include:

- Growth in Food-Grade Bulk/Liquid Shipping

- LNG Refueling Corridor Build-Out

- Acute Driver & Technician Shortages

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Petroleum products supplied 46.30% of 2025 revenue, underpinning the United States tank trucking market size with resilient refinery throughput and a growing renewable diesel blend pool. Renewable-fuel producers favor dedicated stainless or aluminum barrels to safeguard product integrity, reinforcing long-term contract demand. Food and beverages register the fastest 4.24% CAGR (2026-2031), supported by dairy modernization and beverage SKU proliferation that lengthen haul distances. Chemicals remain the second-largest revenue pillar, lifted by Gulf Coast expansion and Midwest fertilizer output. Fertilizer shipments peak around planting seasons yet drive pronounced spot-rate spikes that carriers exploit to balance regional flows.

Intensifying LCFS requirements steer investment toward renewable feedstock logistics, weighting future growth toward bio-derived liquids. The petroleum segment's share may ease post-2027 as renewable volumes scale, yet absolute barrels shipped continue to rise, underscoring the enduring role of fuels logistics in the United States tank trucking market. Meanwhile, FDA food-safety mandates grant specialized carriers pricing power, securing margins amid climbing wash-bay costs. Together, these trends cement a diverse cargo base that tempers cyclical swings in any single commodity line.

Heavy trucks generated 51.85% of 2025 revenue, benefitting from larger load factors that spread fixed costs over more gallons per trip. DOT-412 retrofits further expand payload windows, reinforcing the heavy-duty fleet's central role in long-haul petrochemical corridors. The light-duty bracket, though smaller, produces the strongest 3.72% CAGR (2026-2031) as urban zoning curbs large trailer access and e-commerce fuel stations demand shorter, more frequent replenishment cycles. Medium-duty assets fill hazmat niches where routing around weight-restricted bridges trumps load size.

Electrification pilots focus on the light-duty class because battery range suffices for daily metro loops, and weight savings offset cargo penalties. Conversely, hydrogen and LNG options appeal to heavy tractors seeking extended range without payload sacrifice. These technology splits assure all capacity classes retain defined growth paths, supporting equipment manufacturers as well as carriers.

The United States Tank Trucking Market Report is Segmented by Product Category (Crude Petroleum, Petroleum Products, Chemicals, Food and Beverages, Fertilizers, and Others), Capacity (Light Duty, Medium Duty, and Heavy Duty), Destination (Domestic and International), Distance (Long Haul and Short Haul), Application (Residential, Commercial, and Industrial). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Kenan Advantage Group

- Trimac Transportation

- Groendyke Transport

- Superior Bulk Logistics

- Martin Transport

- Miller Transporters

- Dupre Logistics

- Eagle Transport

- Tankstar USA

- Florida Rock & Tank Lines

- Mission Petroleum Carriers

- Genox Transportation

- J&M Tank Lines

- CLI Transport

- Tidewater Transit

- Service Transport Company

- Andrews Logistics

- CTL Transportation

- Coastal Transport

- Viessman Trucking

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Oil & Refined Products

- 4.2.2 Expansion of U.S. Chemical Production

- 4.2.3 Growth in Food-Grade Bulk/Liquid Shipping

- 4.2.4 LNG Refueling Corridor Build-Out

- 4.2.5 Adoption of Heavier-Payload DOT-412 Spec Tanks

- 4.2.6 Expansion of Renewable Diesel & Biofuel Production Accelerates Specialized Tank Moves

- 4.3 Market Restraints

- 4.3.1 Tightening HOS & Hazmat Compliance Costs

- 4.3.2 Fuel-Price Volatility

- 4.3.3 Acute Driver & Technician Shortages

- 4.3.4 Rail Tank-Car Capacity Rebound

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Impact of COVID-19 & Geo-Political Events

5 Market Size & Growth Forecasts

- 5.1 By Product Category

- 5.1.1 Crude Petroleum

- 5.1.2 Petroleum Products

- 5.1.3 Chemicals

- 5.1.4 Food and Beverages

- 5.1.5 Fertilizers

- 5.1.6 Other Product Categories

- 5.2 By Capacity

- 5.2.1 Light Duty

- 5.2.2 Medium Duty

- 5.2.3 Heavy Duty

- 5.3 Destination

- 5.3.1 Domestic

- 5.3.2 International

- 5.4 By Distance

- 5.4.1 Long Haul

- 5.4.2 Short Haul

- 5.5 By Application

- 5.5.1 Residential

- 5.5.2 Commercial

- 5.5.3 Industrial

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Kenan Advantage Group

- 6.4.2 Trimac Transportation

- 6.4.3 Groendyke Transport

- 6.4.4 Superior Bulk Logistics

- 6.4.5 Martin Transport

- 6.4.6 Miller Transporters

- 6.4.7 Dupre Logistics

- 6.4.8 Eagle Transport

- 6.4.9 Tankstar USA

- 6.4.10 Florida Rock & Tank Lines

- 6.4.11 Mission Petroleum Carriers

- 6.4.12 Genox Transportation

- 6.4.13 J&M Tank Lines

- 6.4.14 CLI Transport

- 6.4.15 Tidewater Transit

- 6.4.16 Service Transport Company

- 6.4.17 Andrews Logistics

- 6.4.18 CTL Transportation

- 6.4.19 Coastal Transport

- 6.4.20 Viessman Trucking

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment