PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936504

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936504

Passenger Car Digital Twin Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

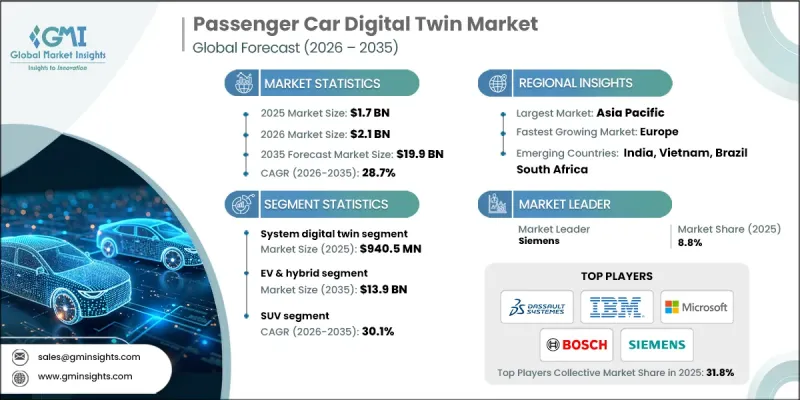

The Global Passenger Car Digital Twin Market was valued at USD 1.7 billion in 2025 and is estimated to grow at a CAGR of 28.7% to reach USD 19.9 billion by 2035.

Automotive production demands advanced technologies that reduce development cycles, minimize rework, lower prototype costs, and prevent equipment or component failures. Digital twin platforms address these needs by enabling virtual validation across the vehicle lifecycle before physical production begins. Manufacturers rely on these systems to simulate design, manufacturing, and operational behavior in real time, significantly improving decision-making and cost control. Artificial intelligence and machine learning further enhance digital twin value by enabling early fault detection, performance validation, and predictive failure analysis. These capabilities allow manufacturers and suppliers to identify issues before vehicles reach the market. The shift toward data-driven manufacturing, connected factories, and software-defined vehicles continues to increase reliance on digital twins as a core enabler of modern automotive production strategies.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.7 Billion |

| Forecast Value | $19.9 Billion |

| CAGR | 28.7% |

The system-level digital twins segment held a 55.2% share in 2025, generating approximately USD 940.5 million. This segment dominates due to the rising demand for holistic simulation of interconnected vehicle systems. System digital twins allow manufacturers to analyze complex interactions between subsystems such as power delivery, safety architecture, and digital interfaces. These models support real-time system monitoring and predictive maintenance, improving reliability and reducing downtime across production and operational stages.

The electric and hybrid vehicles segment held 64.6% share in 2025 and is projected to reach USD 13.9 billion by 2035. These vehicles integrate advanced electronic components and sensors that connect seamlessly with digital twin platforms. Digital twins help manufacturers simulate battery aging, thermal performance, power efficiency, and software behavior, which are critical factors for electric and hybrid platforms. This capability positions digital twins as essential tools for optimizing next-generation vehicle architectures.

United States Passenger Car Digital Twin Market reached USD 348.2 million in 2025. Adoption grows as manufacturers deploy digital twins within smart manufacturing initiatives to optimize production lines, reduce operational disruptions, and address supply chain complexity. Real-time digital replicas of manufacturing environments enable faster issue resolution and continuous performance improvement. Cloud-based platforms and connected systems further support digital twin adoption across production and post-production analytics.

Key companies active in the Global Passenger Car Digital Twin Market include Siemens, NVIDIA, SAP, Dassault, PTC, Microsoft, ANSYS, IBM, GE Vernova, and Robert Bosch. Companies in the passenger car digital twin market strengthen their competitive position by investing in AI-driven simulation, cloud-native platforms, and scalable digital engineering solutions. Many focus on integrating digital twins across design, manufacturing, and after-sales operations to deliver end-to-end lifecycle value. Strategic partnerships with automakers and suppliers accelerate platform adoption and customization. Continuous innovation in predictive analytics, real-time monitoring, and system interoperability enhances differentiation. Vendors emphasize compatibility with connected factory infrastructure and vehicle software ecosystems.

Table of Contents

Chapter 1 Methodology

- 1.1 Research approach

- 1.2 Quality commitments

- 1.2.1 GMI AI policy & data integrity commitment

- 1.3 Research trail & confidence scoring

- 1.3.1 Research trail components

- 1.3.2 Scoring components

- 1.4 Data collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.6 Base estimates and calculations

- 1.6.1 Base year calculation

- 1.7 Forecast model

- 1.8 Research transparency addendum

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Digital Twin

- 2.2.4 Deployment Mode

- 2.2.5 Vehicle

- 2.2.6 Propulsion

- 2.2.7 Application

- 2.2.8 End-Use

- 2.3 TAM analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising adoption of software-defined vehicles (SDVs)

- 3.2.1.2 Increasing complexity of passenger car architectures

- 3.2.1.3 Growing demand for virtual prototyping and simulation

- 3.2.1.4 OEM focus on reducing time-to-market

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial implementation and integration costs

- 3.2.2.2 Cybersecurity and data privacy concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Digital twin deployment across vehicle lifecycle phases

- 3.2.3.2 Real-time digital twins for in-use vehicle monitoring

- 3.2.3.3 Usage-based insurance (UBI) models enhanced by digital twins

- 3.2.3.4 Co-development of digital twin solutions for component validations

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 National Highway Traffic Safety Administration (NHTSA)

- 3.4.1.2 FMVSS (Federal Motor Vehicle Safety Standards)

- 3.4.1.3 EPA (Environmental Protection Agency)

- 3.4.1.4 Canadian Motor Vehicle Safety Standards (Transport Canada)

- 3.4.2 Europe

- 3.4.2.1 European Commission (EC)

- 3.4.2.2 UNECE (United Nations Economic Commission for Europe)

- 3.4.2.3 EU General Data Protection Regulation (GDPR)

- 3.4.3 Asia Pacific

- 3.4.3.1 JASIC (Japan Automobile Standards Internationalization Center)

- 3.4.3.2 SAE China (Society of Automotive Engineers of China)

- 3.4.3.3 KATS (Korea Automotive Technology Institute)

- 3.4.3.4 AIS (Automotive Industry Standard)

- 3.4.4 Latin America

- 3.4.4.1 Associacao Nacional dos Fabricantes de Veiculos Automotores

- 3.4.4.2 National Institute of Metrology, Standardization and Industrial Standards (INMETRO)

- 3.4.4.3 LATAM Vehicle Safety Regulations

- 3.4.5 Middle East & Africa

- 3.4.5.1 GCC Standardization Organization (GSO)

- 3.4.5.2 South African Bureau of Standards (SABS)

- 3.4.5.3 Saudi Standards, Metrology and Quality Organization (SASO)

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.9 Sustainability and environmental impact

- 3.9.1 Environmental impact assessment

- 3.9.2 Social impact & community benefits

- 3.9.3 Governance & corporate responsibility

- 3.9.4 Sustainable finance & investment trends

- 3.10 Data architecture for digital twins

- 3.10.1 Real-time data streaming architecture

- 3.10.2 Sensor data management & processing

- 3.10.3 Data quality & governance frameworks

- 3.10.4 Interoperability & data exchange protocols

- 3.11 Cybersecurity & privacy frameworks

- 3.11.1 Cybersecurity threat landscape for digital twins

- 3.11.2 Data encryption & access control mechanisms

- 3.11.3 Zero trust architecture implementation

- 3.11.4 Privacy-preserving technologies

- 3.11.5 Compliance frameworks

- 3.12 Case studies

- 3.13 Future outlook & opportunities

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2022 - 2035 ($Bn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 IoT sensors & devices

- 5.2.2 Edge computing hardware

- 5.2.3 Data acquisition systems

- 5.2.4 Connectivity infrastructure

- 5.3 Software

- 5.4 Services

- 5.4.1 Professional services

- 5.4.1.1 System integration

- 5.4.1.2 Training & consulting

- 5.4.1.3 Support & maintenance

- 5.4.2 Managed services

- 5.4.1 Professional services

Chapter 6 Market Estimates & Forecast, By Digital Twin, 2022 - 2035 ($Bn)

- 6.1 Key trends

- 6.2 System digital twin

- 6.3 Product digital twin

- 6.4 Process digital twin

Chapter 7 Market Estimates & Forecast, By Deployment Mode, 2022 - 2035 ($Bn)

- 7.1 Key trends

- 7.2 Cloud-based

- 7.3 On-premises

- 7.4 Hybrid

Chapter 8 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Bn)

- 8.1 Key trends

- 8.2 Hatchback

- 8.3 Sedan

- 8.4 SUV

Chapter 9 Market Estimates & Forecast, By Propulsion, 2022 - 2035 ($Bn)

- 9.1 Key trends

- 9.2 Internal Combustion Engine (ICE)

- 9.3 EV & Hybrid

- 9.3.1 Battery electric vehicle (BEV)

- 9.3.2 Plug-in hybrid electric vehicle (PHEV)

- 9.3.3 Hybrid electric vehicle (HEV)

- 9.3.4 Fuel cell electric vehicle (FCEV)

Chapter 10 Market Estimates & Forecast, By Application, 2022 - 2035 ($Bn)

- 10.1 Key trends

- 10.2 Product design & development

- 10.3 Predictive maintenance & performance monitoring

- 10.4 Manufacturing & process optimization

- 10.5 In-service operations & fleet management

Chapter 11 Market Estimates & Forecast, By End Use, 2022 - 2035 ($Bn)

- 11.1 Key trends

- 11.2 Original equipment manufacturers

- 11.3 Tier 1 & Tier 2 Suppliers

- 11.4 Automotive software & technology companies

- 11.5 Mobility service providers

- 11.6 Insurance companies

- 11.7 Aftermarket & service centers

Chapter 12 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 US

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.3.7 Czech Republic

- 12.3.8 Belgium

- 12.3.9 Netherlands

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.4.6 Singapore

- 12.4.7 Malaysia

- 12.4.8 Indonesia

- 12.4.9 Vietnam

- 12.4.10 Thailand

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.5.4 Colombia

- 12.6 MEA

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 Global companies

- 13.1.1 ANSYS

- 13.1.2 Autodesk

- 13.1.3 Dassault

- 13.1.4 GE Vernova

- 13.1.5 Hexagon

- 13.1.6 IBM

- 13.1.7 Microsoft

- 13.1.8 NVIDIA

- 13.1.9 PTC

- 13.1.10 Robert Bosch

- 13.1.11 SAP

- 13.1.12 Siemens

- 13.2 Regional companies

- 13.2.1 ABB

- 13.2.2 AVEVA

- 13.2.3 Emerson

- 13.2.4 Honeywell

- 13.2.5 Oracle

- 13.2.6 Rockwell

- 13.2.7 Schneider

- 13.2.8 TCS

- 13.3 Emerging companies

- 13.3.1 Amazon Web Services

- 13.3.2 Lauterbach

- 13.3.3 Toobler

- 13.3.4 Unity

- 13.3.5 Valeo