PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936531

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936531

Airport Cabin Baggage Scanner Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

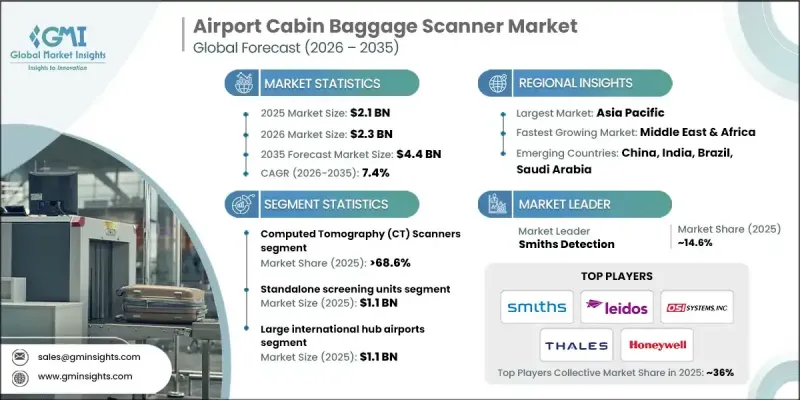

The Global Airport Cabin Baggage Scanner Market was valued at USD 2.1 billion in 2025 and is estimated to grow at a CAGR of 7.4% to reach USD 4.4 billion by 2035.

Market growth is driven by rising global air travel volumes, tighter aviation security standards, rapid adoption of advanced imaging technologies, and increasing investments in airport infrastructure upgrades. Growth trends indicate that market expansion is primarily supported by the replacement of legacy systems rather than first-time installations, as airports redesign security checkpoints to accommodate higher passenger throughput while enhancing detection accuracy. A coordinated push from regulatory bodies, combined with advancements in artificial intelligence and computed tomography technology, is reshaping security screening operations. AI-enabled CT scanners are improving threat detection consistency, reducing false alarms, and accelerating image analysis, which improves checkpoint efficiency and reduces staffing strain. As passenger volumes continue to rise, airports are increasingly investing in next-generation screening systems to balance operational efficiency with stringent security requirements, accelerating the replacement cycle across global aviation hubs.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $2.1 Billion |

| Forecast Value | $4.4 Billion |

| CAGR | 7.4% |

The computed tomography scanners segment held 68.6% share in 2025. Market differentiation is increasingly driven by software capabilities, including advanced image reconstruction, material discrimination, and AI-based threat recognition trained on large image datasets. Vendors are offering scalable solutions ranging from compact systems for lower-traffic facilities to fully automated screening lanes with integrated remote inspection and workflow optimization. Procurement patterns are shifting from individual scanners to complete screening lane ecosystems, favoring suppliers that deliver integrated hardware, software, and long-term service support to improve operational performance and lifecycle value.

The standalone screening units generated USD 1.1 billion in 2025, holding the largest share within deployment types. Airports are increasingly adopting automated screening configurations that integrate CT scanners with tray handling automation to improve passenger processing rates and reduce congestion. These systems support higher throughput, lower inspection delays, and more consistent screening performance. Manufacturers are focusing on developing reliable, high-capacity standalone units with minimal downtime, seamless system integration, and robust automation to meet the evolving needs of high-traffic aviation environments.

North America Airport Cabin Baggage Scanner Market accounted for 38.8% share in 2025, making it the leading regional market. Growth in the region is supported by strong regulatory alignment, sustained funding, and coordinated modernization initiatives across airports of varying sizes. The market is characterized by accelerated replacement of conventional X-ray systems with advanced CT-based solutions, alongside broader investments in digital infrastructure, workforce optimization, and remote screening capabilities. These factors are contributing to consistent demand for advanced baggage screening technologies and long-term market stability.

Key companies operating in the Global Airport Cabin Baggage Scanner Market include Thales Group, Smiths Detection (Smiths Group), OSI Systems (Rapiscan Systems), Leidos Holdings, Inc., Nuctech Company Limited, L3Harris Technologies, Astrophysics Inc., Analogic Corporation, Vanderlande Industries, CEIA S.p.A., Autoclear LLC, Garrett Metal Detectors, Safeway Inspection Systems, VOTI Detection, Gilardoni S.p.A., Aventura Technologies, Surescan Corporation, Adani Systems, Inc., Unisys Corporation, NEC Corporation, Honeywell International, Bosch Security Systems, Thruvision, and QinetiQ Group. Companies in the airport cabin baggage scanner market are strengthening their market position by investing in advanced AI-driven detection software and next-generation CT imaging technologies. Manufacturers are expanding integrated product portfolios that combine hardware, automation, and analytics to deliver complete screening solutions. Long-term service contracts, system upgrades, and lifecycle support are being prioritized to secure recurring revenue.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry snapshot

- 2.2 Key market trends

- 2.2.1 Technology trends

- 2.2.2 Integration level trends

- 2.2.3 Application trends

- 2.2.4 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Million)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factors affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising regulatory mandates on CT-based cabin baggage scanner adoption

- 3.2.1.2 Passenger traffic growth is driving checkpoint capacity expansion

- 3.2.1.3 AI and automation are driving operational efficiency

- 3.2.1.4 Government and multilateral funding are accelerating market growth

- 3.2.1.5 Passenger-centric initiatives fuel security equipment demand.

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High capital requirements restrain market growth

- 3.2.2.2 Checkpoint infrastructure constraints restrain scanner expansion

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in emerging markets

- 3.2.3.2 Integration with smart airport ecosystems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 Historical price analysis (2022-2024)

- 3.8.2 Price trend drivers

- 3.8.3 Regional price variations

- 3.8.4 Price forecast (2026-2035)

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Sustainability measures

- 3.13 Consumer Sentiment Analysis

- 3.14 Patent and IP analysis

- 3.15 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2022-2025

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates & Forecast, By Technology, 2022 - 2035 (USD Million)

- 5.1 Key trends,

- 5.2 X-ray Based Scanners

- 5.2.1 Single-view X-ray

- 5.2.2 Dual-view X-ray

- 5.2.3 Multi-view X-ray

- 5.3 Computed Tomography (CT) Scanners

- 5.3.1 Standard-resolution CT

- 5.3.2 High-resolution CT (EDS-CB compliant)

- 5.4 Specialized Cabin Baggage Detection Systems

- 5.4.1 Liquid Explosive Detection Systems (LEDS)

- 5.4.2 Explosive Trace Detection (ETD)

- 5.4.3 Others

Chapter 6 Market Estimates and Forecast, By Integration Level, 2022 - 2035 (USD Million)

- 6.1 Key trends

- 6.2 Standalone Screening Units

- 6.3 Integrated Automated Screening Lane Systems

- 6.4 Networked/ Remote screening capable systems

Chapter 7 Market Estimates & Forecast, By Application, 2022 - 2035 (USD Million)

- 7.1 Key trends

- 7.2 Large international hub airports

- 7.3 Regional/domestic airports

- 7.4 Government & military facilities

- 7.5 Private/corporate aviation terminals

Chapter 8 Market Estimates & Forecast, By Region, 2022 - 2035 (USD Million)

- 8.1 Key trends, by region

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Rest of Europe

- 8.4 Asia-Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 ANZ

- 8.4.6 Rest of Asia-Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Rest of Latin America

- 8.6 MEA

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of MEA

Chapter 9 Company Profiles

- 9.1 Adani Systems, Inc.

- 9.2 Analogic Corporation

- 9.3 Astrophysics Inc.

- 9.4 Autoclear LLC

- 9.5 Aventura Technologies

- 9.6 Bosch Security Systems

- 9.7 CEIA & Associates

- 9.8 CEIA S.p.A.

- 9.9 Garrett Metal Detectors

- 9.10 Gilardoni S.p.A.

- 9.11 Honeywell International

- 9.12 L3Harris Technologies

- 9.13 Leidos Holdings, Inc.

- 9.14 NEC Corporation

- 9.15 Nuctech Company Limited

- 9.16 OSI Systems (Rapiscan Systems)

- 9.17 QinetiQ Group

- 9.18 Safeway Inspection Systems

- 9.19 Smiths Detection (Smiths Group)

- 9.20 Surescan Corporation

- 9.21 Thales Group

- 9.22 Thruvision

- 9.23 Unisys Corporation

- 9.24 Vanderlande Industries

- 9.25 VOTI Detection