PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936569

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936569

Washing Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

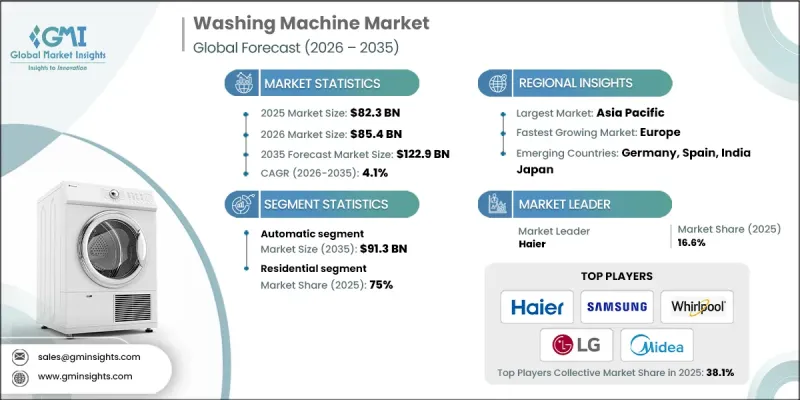

The Global Washing Machine Market was valued at USD 82.3 billion in 2025 and is estimated to grow at a CAGR of 4.1% to reach USD 122.9 billion by 2035.

Market growth is driven by rising urbanization, increasing disposable incomes, and growing demand for household appliances that save time, water, and energy. Rapid adoption of smart home technologies, coupled with consumer preference for automated and energy-efficient appliances, is further accelerating market expansion. Manufacturers are increasingly integrating advanced features such as AI-enabled wash cycles, inverter motors, and water optimization technologies to enhance user convenience and reduce operating costs. Additionally, replacement demand in mature markets and rising first-time adoption in developing regions continue to support the sustained growth of the washing machine market.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $82.3 Billion |

| Forecast Value | $122.9 Billion |

| CAGR | 4.1% |

By product type, the automatic segment reached USD 91.3 billion in 2025. These machines are widely preferred due to their convenience, reduced manual intervention, and superior washing performance. The availability of front-load and top-load fully automatic variants allows consumers to choose models based on space availability, water consumption, and fabric care requirements. Continuous technological advancements, including smart connectivity, noise reduction, and enhanced energy efficiency, are further boosting adoption. Fully automatic machines are particularly popular among urban households and working professionals seeking time-saving and reliable laundry solutions.

In terms of end use, the residential segment held 75% share in 2025. Growing nuclear families, increasing apartment living, and rising awareness of hygiene and cleanliness are key factors driving residential demand. Consumers are increasingly investing in advanced washing machines that offer fabric-specific programs, quick wash options, and reduced water and detergent usage. Additionally, the growing trend of premium home appliances and smart homes is encouraging households to upgrade to technologically advanced washing machines, strengthening the segment's revenue contribution.

Asia Pacific Washing Machine Market is expected to grow at a CAGR of 4.5% during 2026 to 2035. The region's dominance is supported by a large population base, rapid urbanization, and rising middle-class income levels in countries such as China, India, and Southeast Asian nations. Increasing penetration of household appliances, expanding retail and e-commerce channels, and strong local manufacturing capabilities further reinforce Asia Pacific's leading position. Government initiatives promoting energy-efficient appliances are also contributing to higher adoption rates across the region.

Key players operating in the Global Washing Machine Market include LG Electronics, Samsung Electronics, Whirlpool Corporation, Haier Group, Bosch (BSH Home Appliances), Panasonic Corporation, Electrolux AB, IFB Industries, Midea Group, and Toshiba Corporation. These companies compete through product innovation, energy-efficient technologies, strong distribution networks, and competitive pricing strategies. Companies in the washing machine market are focusing on technological innovation, energy efficiency, and product premiumization to strengthen their market position. Leading manufacturers invest heavily in R&D to introduce smart washing machines with AI-driven wash cycles, IoT connectivity, and inverter motor technology that reduces energy consumption and noise. Expanding product portfolios across multiple price points helps companies cater to both budget-conscious and premium consumers. Strategic partnerships with retailers and e-commerce platforms enhance market reach and customer engagement.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Mode of Operation

- 2.2.4 Capacity

- 2.2.5 Price

- 2.2.6 End-user

- 2.2.7 Distribution Channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Technological advancements

- 3.2.1.2 Rising disposable income

- 3.2.1.3 Urbanization and the growing middle class

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High competition and price wars

- 3.2.2.2 Environmental regulations

- 3.2.3 Opportunities

- 3.2.3.1 Energy-efficient & eco-friendly models

- 3.2.3.2 Expansion of smart and functional washing machine

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By product type

- 3.6.2 By region

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS Code- 8450)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Gap analysis

- 3.10 Risk assessment and mitigation

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

- 3.13 Consumer behaviour analysis

- 3.13.1 Purchasing patterns

- 3.13.2 Preference analysis

- 3.13.3 Regional variations in consumer behaviour

- 3.13.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2022-2035 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Top-Load

- 5.3 Front-Load

Chapter 6 Market Estimates & Forecast, By Mode of Operation, 2022-2035 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Semi-automatic

- 6.3 Automatic

Chapter 7 Market Estimates & Forecast, By Capacity, 2022-2035 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Below 6 kg

- 7.3 6 kg - 9 kg

- 7.4 Above 9 kg

Chapter 8 Market Estimates & Forecast, By Price, 2022-2035 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

Chapter 9 Market Estimates & Forecast, By End-user, 2022-2035 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Residential

- 9.3 Commercial

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2022-2035 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 E-Commerce

- 10.2.2 Company website

- 10.3 Offline

- 10.3.1 Supermarkets/Hypermarkets

- 10.3.2 Specialty Stores

- 10.3.3 Others (Individual stores, Departmental stores, etc.)

Chapter 11 Market Estimates & Forecast, By Region, 2022-2035 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 France

- 11.3.3 UK

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Bosch

- 12.2 Electrolux

- 12.3 GE Appliances

- 12.4 Godrej & Boyce

- 12.5 Haier

- 12.6 Hisense

- 12.7 Hitachi

- 12.8 LG

- 12.9 Midea

- 12.10 Panasonic

- 12.11 Samsung

- 12.12 Sharp

- 12.13 TCL

- 12.14 Toshiba

- 12.15 Whirlpool