PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936570

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936570

Fruit and Vegetable Processing Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

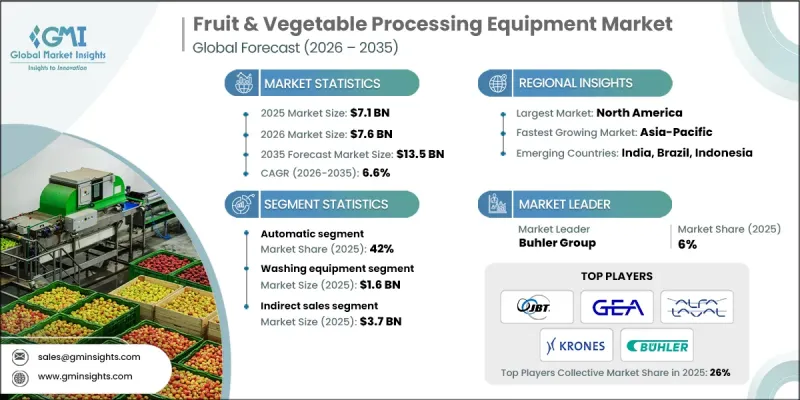

The Global Fruit & Vegetable Processing Equipment Market was valued at USD 7.1 billion in 2025 and is estimated to grow at a CAGR of 6.6% to reach USD 13.5 billion by 2035.

The market holds immense potential, but it faces challenges, primarily due to the high initial investment required for sophisticated machinery and stringent international food safety standards. These factors, particularly the cost of advanced automation, may limit smaller manufacturers from entering emerging markets and hinder the sector from reaching its full potential. Consumer trends, such as the growing demand for convenient, ready-to-eat food in North America, are shaping market growth, while evolving regulations in Europe and rapid industrialization in Asia Pacific are laying the commercial foundation. As demand increases for nutrient-rich, long shelf-life alternatives to fresh produce, processing equipment is gaining traction, offering techniques that preserve flavor and nutritional content, including high-pressure processing (HPP) and aseptic packaging. Heightened awareness of food safety is further motivating food manufacturers worldwide to adopt advanced processing systems, driving sustained market expansion.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $7.1 Billion |

| Forecast Value | $13.5 Billion |

| CAGR | 6.6% |

In 2025, the automatic segment accounted for 42% share, driven by the need for high-volume production, labor cost savings, and precision in processing. Fully automated systems move produce through washing, peeling, and cutting stages with minimal human involvement, using sensors and programmable logic controllers (PLCs). These systems are highly efficient for industrial-scale operations and handle delicate fruits and vegetables with care, reducing physical damage and minimizing waste. In contrast, traditional manual methods often lead to inconsistent product quality and higher wastage, making automation increasingly attractive for large-scale processors.

Indirect sales segment generated USD 3.7 billion in 2025, capturing a major market share. This dominance is largely due to local distributors who extend the reach of equipment manufacturers by providing installation, maintenance, and after-sales support in various regions, ensuring equipment reliability and faster adoption across diverse geographies.

North America Fruit & Vegetable Processing Equipment Market reached USD 1.6 billion in 2025. The region's high labor costs encourage the adoption of automated processing solutions, while strong consumer awareness of food safety drives demand for advanced equipment. North America is a leader in food processing innovation, with rapid adoption of HPP systems and AI-enabled sorting technologies. Strict FDA regulations and sustainability initiatives further reinforce the market, creating favorable conditions for equipment that optimizes water and energy consumption while meeting safety and quality standards.

Key players in the Global Fruit & Vegetable Processing Equipment Market include Alfa Laval AB, Bertuzzi Food Processing S.r.l., Bucher Industries AG, Buhler Group, FENCO Food Machinery S.r.l., GEA Group, Heat and Control, Inc., JBT Corporation, Key Technology, Inc., Krones AG, Lyco Manufacturing, Inc., Marel, Mepaco, Navatta Group Food Processing S.r.l., and Sormac B.V. Companies in this market are employing several strategies to strengthen their foothold and expand their presence. They are investing heavily in research and development to deliver high-efficiency, next-generation equipment with advanced automation and food safety features. Long-term partnerships with distributors and OEMs are secured to ensure market reach and reliable after-sales service. Strategic acquisitions and collaborations allow companies to broaden their product portfolios and enter new geographical markets. Manufacturers are also focusing on customizing equipment to meet local regulations and production requirements, while expanding regional production capacities to reduce costs and improve lead times. Additionally, companies are leveraging sustainability-focused innovations, such as energy- and water-efficient systems, to enhance competitiveness and align with global environmental standards, driving long-term growth and market leadership.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Operation

- 2.2.4 End Users

- 2.2.5 Category

- 2.2.6 Application

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Surge in Demand for Convenience Foods

- 3.2.1.2 Shift Toward Health-Conscious Consumption

- 3.2.1.3 Automation and AI Integration

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High Initial Capital Investment

- 3.2.2.2 Complex Regulatory Compliance

- 3.2.3 Opportunities

- 3.2.3.1 Expansion of Cold-Chain Infrastructure

- 3.2.3.2 Emerging Markets Adoption

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2022-2035 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Washing

- 5.3 Peeling

- 5.4 Cutting

- 5.5 Juicing

- 5.6 Blanching

- 5.7 Packaging

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Operation 2022-2035 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Automatic

- 6.3 Semi-automatic

- 6.4 Manual

Chapter 7 Market Estimates & Forecast, By End Users, 2022-2035 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Food Processing Industries

- 7.3 Foodservice Providers

Chapter 8 Market Estimates & Forecast, By Category, 2022-2035 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Fruits

- 8.3 Vegetables

Chapter 9 Market Estimates & Forecast, By Application, 2022-2035 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Fresh & Fresh-Cut

- 9.3 Canned

- 9.4 Drying & Dehydration

- 9.5 Frozen

- 9.6 Others (Pickling & seasoning, etc.)

Chapter 10 Market Estimates & Forecast, By End Use Industries, 2022-2035 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Small-Scale Processing plants

- 10.3 Medium-Scale Processing plants

- 10.4 Industrial/Large-Scale Processing plants

Chapter 11 Market Estimates & Forecast, By Distribution channel, 2022-2035 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Direct sales

- 11.3 Indirect sales

Chapter 12 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 Japan

- 12.4.3 India

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 Middle East and Africa

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 Alfa Laval AB

- 13.2 Bertuzzi Food Processing S.r.l.

- 13.3 Bucher Industries AG

- 13.4 Buhler Group

- 13.5 FENCO Food Machinery S.r.l.

- 13.6 GEA Group

- 13.7 Heat and Control, Inc.

- 13.8 JBT Corporation

- 13.9 Key Technology, Inc.

- 13.10 Krones AG

- 13.11 Lyco Manufacturing, Inc.

- 13.12 Marel

- 13.13 Mepaco

- 13.14 Navatta Group Food Processing S.r.l.

- 13.15 Sormac B.V.