PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936633

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936633

Skin Care Oil Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

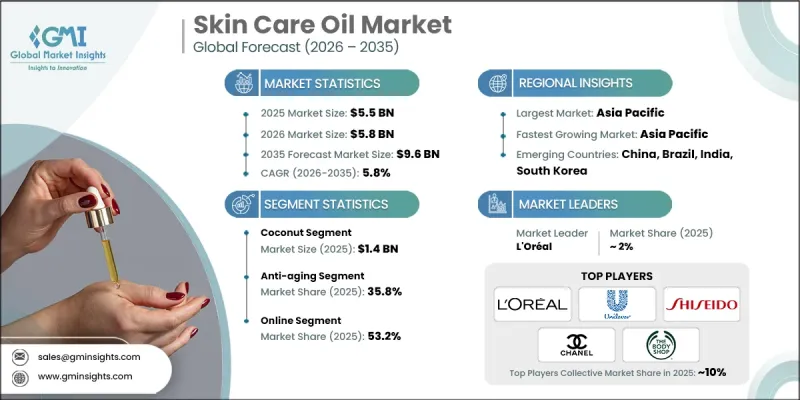

The Global Skin Care Oil Market was valued at USD 5.5 billion in 2025 and is estimated to grow at a CAGR of 5.8% to reach USD 9.6 billion by 2035.

Market growth is influenced by the rising preference for clean beauty and transparency-focused personal care products. Consumers are increasingly shifting toward formulations perceived as natural and free from synthetic additives, driven by heightened awareness of ingredient safety and long-term skin health. Skin care oils are gaining traction as essential daily-use products because they deliver nourishment, hydration, and barrier support while aligning with minimalist beauty routines. These oils are widely valued for their nutrient density, antioxidant content, and skin-conditioning properties that contribute to improved texture and appearance. Digital commerce has played a critical role in accelerating adoption by offering broader product access, detailed ingredient information, and personalized purchasing experiences. Brands are also strengthening customer engagement through digital campaigns and social platforms, allowing them to communicate brand values and build trust more effectively. These combined dynamics continue to position skin care oils as a fast-growing category within the global beauty industry.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $5.5 Billion |

| Forecast Value | $9.6 Billion |

| CAGR | 5.8% |

The coconut oil segment generated USD 1.4 billion in 2025 and is expected to grow at a CAGR of 6.3% from 2026 to 2035. This segment maintains a leading position due to its multifunctional nature and broad acceptance across skin care routines. Coconut-based formulations are widely used for hydration-focused applications and remain appealing due to their compatibility with various skin profiles and product formats.

The anti-aging application segment accounted for 35.8% share in 2025 and is forecast to grow at a CAGR of 6% through 2035. Demand in this segment is supported by increasing focus on preventive skin care and long-term skin maintenance. Consumers are investing in oils formulated to support skin renewal, improve elasticity, and address visible aging concerns, particularly within premium product lines.

United States Skin Care Oil Market reached USD 0.9 billion in 2025 and is projected to grow at a CAGR of 5.4% from 2026 to 2035. Strong consumer inclination toward premium, clean-label products, combined with high digital adoption, continues to drive demand. Online platforms and sustainability-focused branding play a central role in purchasing decisions across age groups.

Major companies operating in the Global Skin Care Oil Market include L'Oreal, Unilever, Shiseido, Chanel, Clarins, Clinique, Weleda, The Body Shop, Kiehl's, Nuxe, Lancome, Amway, Avon, Origins, and Neutrogena. Companies in the skin care oil market strengthen their competitive position through clean-label innovation, premium positioning, and digital-first strategies. Many brands focus on developing traceable, responsibly sourced formulations that align with sustainability expectations. Investment in research supports improved texture, absorption, and multifunctional benefits. Firms expand their presence through e-commerce optimization and targeted social engagement to reach niche consumer segments. Limited-edition launches and personalization options help enhance brand differentiation. Strategic pricing, strong packaging design, and transparent communication around ingredient integrity further reinforce consumer trust and long-term market presence.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Market estimates & forecasts parameters

- 1.4 Forecast Model

- 1.4.1 Key trends for market estimates

- 1.4.2 Quantified market impact analysis

- 1.4.2.1 Mathematical impact of growth parameters on forecast

- 1.4.3 Scenario analysis framework

- 1.5 Primary research and validation

- 1.5.1 Some of the primary sources (but not limited to)

- 1.6 Data mining sources

- 1.6.1 Paid Sources

- 1.7 Primary research and validation

- 1.7.1 Primary sources

- 1.8 Research Trail & confidence scoring

- 1.8.1 Research trail components

- 1.8.2 Scoring components

- 1.9 Research transparency addendum

- 1.9.1 Source attribution framework

- 1.9.2 Quality assurance metrics

- 1.9.3 Our commitment to trust

- 1.10 Market Definitions

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Function

- 2.2.4 Price range

- 2.2.5 End user

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for natural & organic products

- 3.2.1.2 Expansion of e-commerce & direct-to-consumer channels

- 3.2.1.3 Growing awareness of multi-functional benefits

- 3.2.2 Pitfalls & Challenges

- 3.2.2.1 Price volatility of raw materials

- 3.2.2.2 Intense market competition & counterfeit products

- 3.2.3 Opportunities

- 3.2.3.1 Innovation in oil blends & functional formulations

- 3.2.3.2 Emerging markets & male grooming segment

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory landscape

- 3.7.1 North America

- 3.7.1.1 US: Consumer Product Safety Commission (CPSC) 16 Code of Federal Regulations (CFR) part 1512

- 3.7.1.2 Canada: International Organization for Standardization (ISO) 4210

- 3.7.2 Europe

- 3.7.2.1 Germany: Deutsches Institut fur Normung (DIN) European Norm (EN) ISO 4210

- 3.7.2.2 UK: European Norm (EN) ISO 4210 / United Kingdom Conformity Assessed (UKCA)

- 3.7.2.3 France: European Norm (EN) ISO 4210

- 3.7.3 Asia Pacific

- 3.7.3.1 China: Guobiao (GB) 3565

- 3.7.3.2 India: Indian Standard (IS) 10613

- 3.7.3.3 Japan: Japanese Industrial Standard (JIS) D 9110

- 3.7.4 Latin America

- 3.7.4.1 Brazil: Associacao Brasileira de Normas Tecnicas (ABNT) Norma Brasileira (NBR) ISO 4210

- 3.7.4.2 Mexico: International Organization for Standardization (ISO) 4210

- 3.7.5 Middle East & Africa

- 3.7.5.1 South Africa: South African National Standard (SANS) 311

- 3.7.5.2 Saudi Arabia: Saudi Standards, Metrology and Quality Organization (SASO) Gulf Standardization Organization (GSO) ISO 4210

- 3.7.1 North America

- 3.8 Trade statistics (HS code- 3304)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2022 - 2035, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Coconut

- 5.3 Almond

- 5.4 Olive

- 5.5 Lemon

- 5.6 Lavender

- 5.7 Tea Tree

- 5.8 Argan

- 5.9 Others (mint, peppermint, shea butter, orange, rosehip)

Chapter 6 Market Estimates & Forecast, By Function, 2022 - 2035, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Anti-aging

- 6.3 Moisturizing/Nourishing

- 6.4 Acne/Marks Treatment

- 6.5 Others (cleansing, pre-shave)

Chapter 7 Market Estimates & Forecast, By Price Range, 2022 - 2035, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By End User, 2022 - 2035, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Women

- 8.3 Men

- 8.4 Unisex

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 E-commerce

- 9.2.2 Company websites

- 9.3 Offline

- 9.3.1 Specialty beauty stores

- 9.3.2 Pharmacies/drugstores

- 9.3.3 Department stores

- 9.3.4 Others (salons & spas, etc.)

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Amway

- 11.2 Avon

- 11.3 Chanel

- 11.4 Clarins

- 11.5 Clinique

- 11.6 Kiehl’s

- 11.7 Lancome

- 11.8 L'Oreal

- 11.9 Neutrogena

- 11.10 Nuxe

- 11.11 Origins

- 11.12 Shiseido

- 11.13 The Body Shop.

- 11.14 Unilever

- 11.15 Weleda