PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937258

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937258

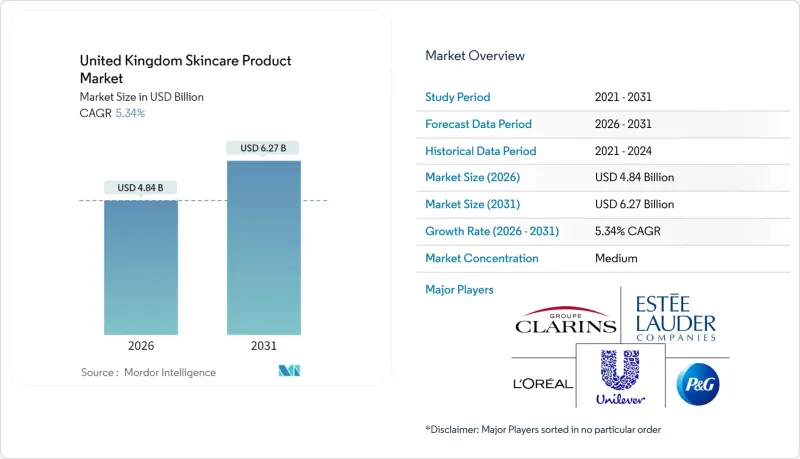

United Kingdom Skincare Product - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The United Kingdom skincare product market is expected to grow from USD 4.59 billion in 2025 to USD 4.84 billion in 2026 and is forecast to reach USD 6.27 billion by 2031 at 5.34% CAGR over 2026-2031.

Resilient consumer demand, expanding clean-beauty portfolios, and widespread integration of AI-powered personalization engines continue to reinforce market fundamentals. Facial care leads category expansion as anti-aging actives with clinical validation win consumer trust, while regulatory tightening post-Brexit is steering the industry toward higher ingredient safety standards. Premium players are outgrowing mass brands because efficacy-driven shoppers are willing to pay more for science-backed formulations, even in an inflationary environment. Online channels remain the fastest route to market, owing to data-rich purchase journeys that amplify shopper education and retention.

United Kingdom Skincare Product Market Trends and Insights

Increased focus on skin health

The focus in the United Kingdom skincare market is shifting from cosmetic enhancement to prioritizing skin health, driving changes in consumer expectations and product innovation. Avon's Future of Beauty Report 2024 highlights that 97% of women now prioritize skincare for hydration and overall skin health over traditional anti-aging benefits, signaling a significant move towards a health-centric approach . This shift is fueling demand for dermatologist-formulated products and clinical-grade ingredients. Leading brands are responding by forming strategic collaborations, such as Boots and No7 Beauty Company, renewing their 20-year research partnership with the University of Manchester in April 2024 to support evidence-based formulations. Besides, younger consumers in the United Kingdom are adopting preventative skincare routines earlier, ensuring consistent demand for products that promote long-term skin health. Brands like CeraVe and Eucerin are leveraging this trend by focusing on dermatologist-approved ingredients that strengthen the skin barrier. Additionally, AI-driven tools are gaining traction, with Boots' SmartSkin Checker achieving 95% diagnostic accuracy for skin conditions, enabling consumers to address specific skin health needs with precision. This evolution is anchoring product development in scientific validation, establishing efficacy, safety, and partnerships with medical research institutions as critical standards for market leadership in the skincare industry.

Growing demand for anti-ageing and dermatologist-backed claims

The skincare product market in the United Kingdom is increasingly focusing on anti-ageing innovations, driven by scientific advancements and a growing consumer demand for dermatologist-backed efficacy. L'Oreal's March 2024 launch of Melasyl, a groundbreaking ingredient developed over 18 years and backed by 121 scientific studies, underscores the industry's commitment to substantiated anti-ageing results, setting a new standard for evidence-based product development. This consumer demand for tangible clinical results is mirrored in the surging popularity of med spas throughout the United Kingdom. More individuals are opting for aesthetic procedures in regulated medical environments, highlighting a distinct preference for clinical expertise and safety over conventional beauty treatments. Regulatory changes, like the newly imposed 0.3% limit on over-the-counter retinol concentrations for facial products, bolster this trend towards dermatologist-supervised methods. Yet, they ensure continued access to potent prescription-strength treatments through medical avenues. Collaborative efforts are speeding up ingredient discovery and innovation. A prime example is the University of Birmingham's research into PEPITEM-derived peptides, which have shown effectiveness on par with steroid creams for psoriasis, highlighting academia's pivotal role in the future of skincare. In tandem with L'Oreal, brands such as SkinCeuticals are adapting to this shifting landscape, curating portfolios that emphasize clinical validation and dermatologist endorsement. This move reaffirms the market's dedication to scientific integrity and the pursuit of safe, effective anti-ageing solutions.

Adverse reactions to synthetic actives

Rising consumer concerns over ingredient safety, particularly regarding synthetic actives linked to adverse reactions, are impacting the United Kingdom skincare market. In response to this growing awareness, regulatory measures have been introduced, such as the United Kingdom's recent cap on over-the-counter retinol concentrations at 0.3% for facial products. This move reflects formal recognition of increasing reports that undermine confidence in conventional synthetic ingredients. To adapt, brands are reformulating their offerings, shifting toward gentler, biotech-derived alternatives like naringenin from L'Oreal-backed Deinde, which delivers anti-inflammatory benefits without the risks associated with synthetic components. This transition aligns with the accelerating growth of the natural and organic skincare segments, which are outperforming conventional product lines in the United Kingdom. However, the shift is not without challenges, as natural ingredients can also cause sensitivities. This highlights the critical need for brands to prioritize safe ingredient sourcing, rigorous safety testing, and transparent communication. These efforts are essential to educate consumers and maintain trust in a market where ingredient-related concerns can quickly influence purchasing decisions. These dynamics reflect a broader trend prioritizing skin health and safety alongside efficacy, driving innovation while challenging brands to balance effectiveness, gentleness, and consumer reassurance.

Other drivers and restraints analyzed in the detailed report include:

- Trend toward clean and sustainable skincare

- Influence of social media and beauty influencers

- Strict regulatory compliance creating cost hurdles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Facial care holds a dominant 77.68% market share in 2025 and is projected to lead growth with a 5.74% CAGR through 2031. This performance reflects consumers' increasing focus on facial routines and a shift towards premium products. The segment's prominence is driven by rising anti-aging demands, the pervasive influence of social media, and advancements in product formulations. A notable example of this innovation is No7's Future Renew Night Serum, co-developed with the University of Manchester, which demonstrates 100% efficacy in reversing visible skin damage, as confirmed by clinical studies. Body care products, including washes, scrubs, lotions, and creams, maintain steady demand, supported by hygiene essentials and seasonal trends. Artificial tan products, in particular, are experiencing a sales boost in 2024. Although lip care represents the smallest segment, it remains resilient due to multi-functional products that combine treatment and cosmetic benefits.

Facial care's competitive edge is further strengthened by continuous innovation in delivery systems. Research into dissolvable microneedle patches has shown an 83.3% reduction in acne-related inflammatory signs within four weeks. Within the facial care category, serums and essences are achieving the highest growth rates, driven by their concentrated active ingredient delivery and compatibility with layered skincare routines promoted on social media. Cleansers and toners continue to see stable demand as routine essentials, while face masks and packs benefit from the self-care trend and social media-driven usage occasions. Regulatory compliance, supported by MHRA oversight and Trading Standards enforcement, ensures product safety and bolsters consumer confidence in facial applications.

In 2025, the mass market category holds a dominant 64.72% share of the skincare product market in the United Kingdom, driven by its extensive accessibility and distribution network catering to price-sensitive consumers. However, the premium/luxury segment is surpassing overall market growth, achieving a strong 6.29% CAGR. This growth is attributed to consumers' increasing willingness to spend on higher-priced products that promise superior efficacy and brand prestige, even in the face of economic challenges. The premium segment supports its elevated price points through access to exclusive ingredients, rigorous clinical testing, and strategic marketing initiatives. Brands such as Medik8 exemplify this trend by leveraging evidence-based philosophies and professional endorsements to justify premium pricing, a growth area that has attracted strategic acquisitions, including one by L'Oreal.

Meanwhile, mass market brands are enhancing their competitiveness by incorporating premium ingredients and advanced technologies, increasingly narrowing the gap between the two segments. This evolution is further driven by the rise of premium private label offerings from retailers, which deliver professional-grade formulations at more affordable prices, intensifying competition across price tiers. The premium segment's growth is further bolstered by specialty retailers and advanced online platforms, which provide consumers with detailed product information and user reviews. These tools enable brands to effectively communicate their superior benefits, reinforcing the value of premium pricing. Together, these factors are shaping a dynamic market landscape in the United Kingdom, where both mass and premium categories are evolving to align with shifting consumer expectations.

The United Kingdom Skincare Product Market Report is Segmented by Product Type (Facial Care, Body Care, Lip Care), Category (Mass, Premium/Luxury), Nature (Conventional, Natural/Organic), and Distribution Channel (Supermarkets/Hypermarkets, Health and Beauty Stores, Online Retail Stores, Other Distribution Channels). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- The Procter & Gamble Company

- Beiersdorf AG

- L'Oreal SA

- The Estee Lauder Companies Inc.

- Group L'Occitane

- Kenvue Inc.

- Groupe Clarins

- Natura & Co. Holding S.A

- Unilever PLC

- AbbVie Inc. (Allergan Aesthetics)

- NAOS

- Edgewell Personal Care Brands LLC

- Walgreens Boots Alliance, Inc.

- THG plc

- Shiseido Company, Limited

- Caudalie

- Galderma SA

- Amorepacific Corporation

- Supergoop

- Byoma

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased focus on skin health

- 4.2.2 Growing demand for anti-ageing and dermatologist-backed claims

- 4.2.3 Trend toward clean and sustainable skincare

- 4.2.4 Influence of social media and beauty influencers

- 4.2.5 Personalized skincare solutions owing to usage of advanced technologies

- 4.2.6 Dominance of specialty clinics offering targeted products

- 4.3 Market Restraints

- 4.3.1 Adverse reactions to synthetic actives

- 4.3.2 Strict regulatory compliance creating cost hurdles

- 4.3.3 Impact of brand fatigue on consumer behavior

- 4.3.4 Challenges in building consumer loyalty

- 4.4 Consumer Behavior Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Facial Care

- 5.1.1.1 Cleansers/Toners

- 5.1.1.2 Moisturizers

- 5.1.1.3 Serums and Essence

- 5.1.1.4 Face Masks and Packs

- 5.1.1.5 Other Facial Care Products

- 5.1.2 Body Care

- 5.1.2.1 Body Wash and Scrubs

- 5.1.2.2 Body Lotions and Creams

- 5.1.3 Lip Care

- 5.1.1 Facial Care

- 5.2 By Category

- 5.2.1 Mass

- 5.2.2 Premium/Luxury

- 5.3 By Nature

- 5.3.1 Conventional

- 5.3.2 Natural/Organic

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets/Hypermarkets

- 5.4.2 Health and Beauty Stores

- 5.4.3 Online Retail Stores

- 5.4.4 Other Distribution Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 The Procter & Gamble Company

- 6.4.2 Beiersdorf AG

- 6.4.3 L'Oreal SA

- 6.4.4 The Estee Lauder Companies Inc.

- 6.4.5 Group L'Occitane

- 6.4.6 Kenvue Inc.

- 6.4.7 Groupe Clarins

- 6.4.8 Natura & Co. Holding S.A

- 6.4.9 Unilever PLC

- 6.4.10 AbbVie Inc. (Allergan Aesthetics)

- 6.4.11 NAOS

- 6.4.12 Edgewell Personal Care Brands LLC

- 6.4.13 Walgreens Boots Alliance, Inc.

- 6.4.14 THG plc

- 6.4.15 Shiseido Company, Limited

- 6.4.16 Caudalie

- 6.4.17 Galderma SA

- 6.4.18 Amorepacific Corporation

- 6.4.19 Supergoop

- 6.4.20 Byoma

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK