PUBLISHER: 360iResearch | PRODUCT CODE: 1434495

PUBLISHER: 360iResearch | PRODUCT CODE: 1434495

Automotive Finance Market by Provider Type (Banks, OEMs), Type (Direct, Indirect), Purpose Type, Vehicle Type - Global Forecast 2023-2030

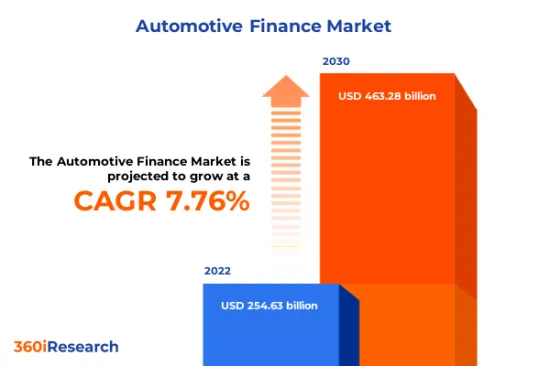

[199 Pages Report] The Automotive Finance Market size was estimated at USD 254.63 billion in 2022 and expected to reach USD 271.98 billion in 2023, at a CAGR 7.76% to reach USD 463.28 billion by 2030.

Global Automotive Finance Market

| KEY MARKET STATISTICS | |

|---|---|

| Base Year [2022] | USD 254.63 billion |

| Estimated Year [2023] | USD 271.98 billion |

| Forecast Year [2030] | USD 463.28 billion |

| CAGR (%) | 7.76% |

Automotive finance encompasses the financial products and services that facilitate the acquisition of vehicles, including loans, leases, and fleet financing offered by banks, credit unions, and dedicated financing arms of automobile manufacturers. Its proliferation is predominantly driven by the increasing demand for personal mobility, technological advancements in the auto industry, and the availability of diverse financing options that cater to varying customer profiles. Favorable interest rates and longer loan tenure options also contribute to the expansion of automotive financing. However, stringent regulatory requirements and evolving financial laws can pose significant challenges for both providers and consumers. Service providers are offering innovative financing solutions with flexible repayment structures and adapting to regulatory changes by maintaining robust compliance programs. The industry is also expected to capitalize on emerging technologies such as blockchain for secure transactions and artificial intelligence to underwrite loans more effectively and personalize financing options. In addition, there is an opportunity for growth in emerging markets where auto financing penetration is currently lower relative to developed regions.

Regional Insights

In the Americas, particularly the United States, automotive finance is deeply entrenched, with a significant majority of new vehicle purchases being financed through loans or leases. Companies in the region are highly competitive, offering a plethora of options such as longer-term loans and online financing. The APAC region is experiencing rapid growth in automotive finance, fueled by the expanding middle class, especially in emerging economies such as China and India. The use of automotive finance in APAC is increasingly facilitated by digital platforms and fintech startups, which are challenging traditional banks and expanding access to finance options. In the EMEA region, particularly in developed European countries, there is a mature automotive finance market with a strong presence of captive finance companies. These companies typically offer a variety of financing products, including personal contract purchases (PCPs) and leases, with a recent uptick in green financing products catering to the increasing demand for electric and hybrid vehicles. Regulations such as the European Union's Consumer Credit Directive and Basel III have fostered a more stringent lending environment, impacting the production of finance products and requiring companies to maintain higher capital reserves compared to their counterparts in other regions.

FPNV Positioning Matrix

The FPNV Positioning Matrix is pivotal in evaluating the Automotive Finance Market. It offers a comprehensive assessment of vendors, examining key metrics related to Business Strategy and Product Satisfaction. This in-depth analysis empowers users to make well-informed decisions aligned with their requirements. Based on the evaluation, the vendors are then categorized into four distinct quadrants representing varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital (V).

Market Share Analysis

The Market Share Analysis is a comprehensive tool that provides an insightful and in-depth examination of the current state of vendors in the Automotive Finance Market. By meticulously comparing and analyzing vendor contributions in terms of overall revenue, customer base, and other key metrics, we can offer companies a greater understanding of their performance and the challenges they face when competing for market share. Additionally, this analysis provides valuable insights into the competitive nature of the sector, including factors such as accumulation, fragmentation dominance, and amalgamation traits observed over the base year period studied. With this expanded level of detail, vendors can make more informed decisions and devise effective strategies to gain a competitive edge in the market.

Key Company Profiles

The report delves into recent significant developments in the Automotive Finance Market, highlighting leading vendors and their innovative profiles. These include Ally Financial Inc., Auto Financial Group, Banco Bradesco S.A., Bank of America Corporation, Bayerische Motoren Werke AG, BNP Paribas SA, Capital One Financial Corporation, Credit Acceptance, Exeter Finance LLC., Ford Motor Company, General Motors Financial Company, Inc., HSBC Holdings PLC, Huntington Bancshares Incorporated, Hyundai Motor Company, JPMorgan Chase & Co., KPMG International Limited, Mercedes-Benz Group AG, Mitsubishi HC Capital Inc., Nissan Motor Co. Ltd., Nucleus Software Exports Ltd., SAIC Motor Corporation Limited, Santander Consumer Bank AS, Standard Bank Group Limited, Stellantis N.V., Tata Motors Finance Ltd., The PNC Financial Services Group, Inc., Toyota Motor Credit Corporation, Volkswagen Financial Services AG, and Wells Fargo & Company.

Market Segmentation & Coverage

This research report categorizes the Automotive Finance Market to forecast the revenues and analyze trends in each of the following sub-markets:

- Provider Type

- Banks

- OEMs

- Type

- Direct

- Indirect

- Purpose Type

- Leasing

- Loan

- Exchange

- New Vehicle

- Resale

- Vehicle Type

- Commercial Vehicles

- Passenger Vehicles

- Region

- Americas

- Argentina

- Brazil

- Canada

- Mexico

- United States

- California

- Florida

- Illinois

- New York

- Ohio

- Pennsylvania

- Texas

- Asia-Pacific

- Australia

- China

- India

- Indonesia

- Japan

- Malaysia

- Philippines

- Singapore

- South Korea

- Taiwan

- Thailand

- Vietnam

- Europe, Middle East & Africa

- Denmark

- Egypt

- Finland

- France

- Germany

- Israel

- Italy

- Netherlands

- Nigeria

- Norway

- Poland

- Qatar

- Russia

- Saudi Arabia

- South Africa

- Spain

- Sweden

- Switzerland

- Turkey

- United Arab Emirates

- United Kingdom

- Americas

The report offers valuable insights on the following aspects:

1. Market Penetration: It presents comprehensive information on the market provided by key players.

2. Market Development: It delves deep into lucrative emerging markets and analyzes the penetration across mature market segments.

3. Market Diversification: It provides detailed information on new product launches, untapped geographic regions, recent developments, and investments.

4. Competitive Assessment & Intelligence: It conducts an exhaustive assessment of market shares, strategies, products, certifications, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players.

5. Product Development & Innovation: It offers intelligent insights on future technologies, R&D activities, and breakthrough product developments.

The report addresses key questions such as:

1. What is the market size and forecast of the Automotive Finance Market?

2. Which products, segments, applications, and areas should one consider investing in over the forecast period in the Automotive Finance Market?

3. What are the technology trends and regulatory frameworks in the Automotive Finance Market?

4. What is the market share of the leading vendors in the Automotive Finance Market?

5. Which modes and strategic moves are suitable for entering the Automotive Finance Market?

Table of Contents

1. Preface

- 1.1. Objectives of the Study

- 1.2. Market Segmentation & Coverage

- 1.3. Years Considered for the Study

- 1.4. Currency & Pricing

- 1.5. Language

- 1.6. Limitations

- 1.7. Assumptions

- 1.8. Stakeholders

2. Research Methodology

- 2.1. Define: Research Objective

- 2.2. Determine: Research Design

- 2.3. Prepare: Research Instrument

- 2.4. Collect: Data Source

- 2.5. Analyze: Data Interpretation

- 2.6. Formulate: Data Verification

- 2.7. Publish: Research Report

- 2.8. Repeat: Report Update

3. Executive Summary

4. Market Overview

- 4.1. Introduction

- 4.2. Automotive Finance Market, by Region

5. Market Insights

- 5.1. Market Dynamics

- 5.1.1. Drivers

- 5.1.1.1. Growing Demand for Automotives Globally

- 5.1.1.2. Increasing Number of Govt Banks and Authorized Financial Institution Offering Auto Loan/Lease

- 5.1.1.3. Digital Lending Platforms Reshaping the Car Financing Processes

- 5.1.2. Restraints

- 5.1.2.1. Limited Understanding of Auto Finance Among User

- 5.1.2.2. Non-Transparent Credit History of First-Time Buyers

- 5.1.3. Opportunities

- 5.1.3.1. Innovative Approaches to Offer NBFC & Micro Finance Solutions

- 5.1.3.2. Fintech Enhancing Automotive Finance and Potential Demand for Autonomous Vehicles

- 5.1.4. Challenges

- 5.1.4.1. Cyber Attacks on Auto Financing Services

- 5.1.4.2. Higher Rate of Loan Defaults in Automotive Markets and Auto Finance Bubble

- 5.1.1. Drivers

- 5.2. Market Segmentation Analysis

- 5.2.1. Provider Type: Availability of competitive rates and perceived safety of automotive finance from banks

- 5.2.2. Type: Clearer loan terms and the ability for pre-approval in direct loan segments

- 5.2.3. Purpose Type: Increasing adoption of automotive loans for outright ownership of vehicles

- 5.2.4. Vehicle Type: Emerging collaborations of commercial vehicle manufacturers with finance companies to provide affordable leasing options

- 5.3. Market Trend Analysis

- 5.4. Cumulative Impact of COVID-19

- 5.5. Cumulative Impact of Russia-Ukraine Conflict

- 5.6. Cumulative Impact of High Inflation

- 5.7. Porter's Five Forces Analysis

- 5.7.1. Threat of New Entrants

- 5.7.2. Threat of Substitutes

- 5.7.3. Bargaining Power of Customers

- 5.7.4. Bargaining Power of Suppliers

- 5.7.5. Industry Rivalry

- 5.8. Value Chain & Critical Path Analysis

- 5.9. Regulatory Framework

- 5.10. Client Customization

6. Automotive Finance Market, by Provider Type

- 6.1. Introduction

- 6.2. Banks

- 6.3. OEMs

7. Automotive Finance Market, by Type

- 7.1. Introduction

- 7.2. Direct

- 7.3. Indirect

8. Automotive Finance Market, by Purpose Type

- 8.1. Introduction

- 8.2. Leasing

- 8.3. Loan

- 8.4.1. Exchange

- 8.4.2. New Vehicle

- 8.4.3. Resale

9. Automotive Finance Market, by Vehicle Type

- 9.1. Introduction

- 9.2. Commercial Vehicles

- 9.3. Passenger Vehicles

10. Americas Automotive Finance Market

- 10.1. Introduction

- 10.2. Argentina

- 10.3. Brazil

- 10.4. Canada

- 10.5. Mexico

- 10.6. United States

11. Asia-Pacific Automotive Finance Market

- 11.1. Introduction

- 11.2. Australia

- 11.3. China

- 11.4. India

- 11.5. Indonesia

- 11.6. Japan

- 11.7. Malaysia

- 11.8. Philippines

- 11.9. Singapore

- 11.10. South Korea

- 11.11. Taiwan

- 11.12. Thailand

- 11.13. Vietnam

12. Europe, Middle East & Africa Automotive Finance Market

- 12.1. Introduction

- 12.2. Denmark

- 12.3. Egypt

- 12.4. Finland

- 12.5. France

- 12.6. Germany

- 12.7. Israel

- 12.8. Italy

- 12.9. Netherlands

- 12.10. Nigeria

- 12.11. Norway

- 12.12. Poland

- 12.13. Qatar

- 12.14. Russia

- 12.15. Saudi Arabia

- 12.16. South Africa

- 12.17. Spain

- 12.18. Sweden

- 12.19. Switzerland

- 12.20. Turkey

- 12.21. United Arab Emirates

- 12.22. United Kingdom

13. Competitive Landscape

- 13.1. FPNV Positioning Matrix

- 13.2. Market Share Analysis, By Key Player

- 13.3. Competitive Scenario Analysis, By Key Player

- 13.3.1. Agreement, Collaboration, & Partnership

- 13.3.1.1. Renault India and Bajaj Finance partners to offer attractive financing solutions to its customers

- 13.3.1.2. Maruti Suzuki and Bajaj Finance partner to offer tailor-made auto financing

- 13.3.2. New Product Launch & Enhancement

- 13.3.2.1. Carputty Deploys AI to Add Transparency to Auto Lending Process

- 13.3.1. Agreement, Collaboration, & Partnership

14. Competitive Portfolio

- 14.1. Key Company Profiles

- 14.1.1. Ally Financial Inc.

- 14.1.2. Auto Financial Group

- 14.1.3. Banco Bradesco S.A.

- 14.1.4. Bank of America Corporation

- 14.1.5. Bayerische Motoren Werke AG

- 14.1.6. BNP Paribas SA

- 14.1.7. Capital One Financial Corporation

- 14.1.8. Credit Acceptance

- 14.1.9. Exeter Finance LLC.

- 14.1.10. Ford Motor Company

- 14.1.11. General Motors Financial Company, Inc.

- 14.1.12. HSBC Holdings PLC

- 14.1.13. Huntington Bancshares Incorporated

- 14.1.14. Hyundai Motor Company

- 14.1.15. JPMorgan Chase & Co.

- 14.1.16. KPMG International Limited

- 14.1.17. Mercedes-Benz Group AG

- 14.1.18. Mitsubishi HC Capital Inc.

- 14.1.19. Nissan Motor Co. Ltd.

- 14.1.20. Nucleus Software Exports Ltd.

- 14.1.21. SAIC Motor Corporation Limited

- 14.1.22. Santander Consumer Bank AS

- 14.1.23. Standard Bank Group Limited

- 14.1.24. Stellantis N.V.

- 14.1.25. Tata Motors Finance Ltd.

- 14.1.26. The PNC Financial Services Group, Inc.

- 14.1.27. Toyota Motor Credit Corporation

- 14.1.28. Volkswagen Financial Services AG

- 14.1.29. Wells Fargo & Company

- 14.2. Key Product Portfolio

15. Appendix

- 15.1. Discussion Guide

- 15.2. License & Pricing

LIST OF FIGURES

- FIGURE 1. AUTOMOTIVE FINANCE MARKET RESEARCH PROCESS

- FIGURE 2. AUTOMOTIVE FINANCE MARKET SIZE, 2022 VS 2030

- FIGURE 3. AUTOMOTIVE FINANCE MARKET SIZE, 2018-2030 (USD MILLION)

- FIGURE 4. AUTOMOTIVE FINANCE MARKET SIZE, BY REGION, 2022 VS 2030 (%)

- FIGURE 5. AUTOMOTIVE FINANCE MARKET SIZE, BY REGION, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 6. AUTOMOTIVE FINANCE MARKET DYNAMICS

- FIGURE 7. AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2022 VS 2030 (%)

- FIGURE 8. AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 9. AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2022 VS 2030 (%)

- FIGURE 10. AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 11. AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2022 VS 2030 (%)

- FIGURE 12. AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 13. AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2022 VS 2030 (%)

- FIGURE 14. AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 15. AMERICAS AUTOMOTIVE FINANCE MARKET SIZE, BY COUNTRY, 2022 VS 2030 (%)

- FIGURE 16. AMERICAS AUTOMOTIVE FINANCE MARKET SIZE, BY COUNTRY, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 17. UNITED STATES AUTOMOTIVE FINANCE MARKET SIZE, BY STATE, 2022 VS 2030 (%)

- FIGURE 18. UNITED STATES AUTOMOTIVE FINANCE MARKET SIZE, BY STATE, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 19. ASIA-PACIFIC AUTOMOTIVE FINANCE MARKET SIZE, BY COUNTRY, 2022 VS 2030 (%)

- FIGURE 20. ASIA-PACIFIC AUTOMOTIVE FINANCE MARKET SIZE, BY COUNTRY, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 21. EUROPE, MIDDLE EAST & AFRICA AUTOMOTIVE FINANCE MARKET SIZE, BY COUNTRY, 2022 VS 2030 (%)

- FIGURE 22. EUROPE, MIDDLE EAST & AFRICA AUTOMOTIVE FINANCE MARKET SIZE, BY COUNTRY, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 23. AUTOMOTIVE FINANCE MARKET, FPNV POSITIONING MATRIX, 2022

- FIGURE 24. AUTOMOTIVE FINANCE MARKET SHARE, BY KEY PLAYER, 2022

LIST OF TABLES

- TABLE 1. AUTOMOTIVE FINANCE MARKET SEGMENTATION & COVERAGE

- TABLE 2. UNITED STATES DOLLAR EXCHANGE RATE, 2018-2022

- TABLE 3. AUTOMOTIVE FINANCE MARKET SIZE, 2018-2030 (USD MILLION)

- TABLE 4. GLOBAL AUTOMOTIVE FINANCE MARKET SIZE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 5. AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 6. AUTOMOTIVE FINANCE MARKET SIZE, BY BANKS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 7. AUTOMOTIVE FINANCE MARKET SIZE, BY OEMS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 8. AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 9. AUTOMOTIVE FINANCE MARKET SIZE, BY DIRECT, BY REGION, 2018-2030 (USD MILLION)

- TABLE 10. AUTOMOTIVE FINANCE MARKET SIZE, BY INDIRECT, BY REGION, 2018-2030 (USD MILLION)

- TABLE 11. AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 12. AUTOMOTIVE FINANCE MARKET SIZE, BY LEASING, BY REGION, 2018-2030 (USD MILLION)

- TABLE 13. AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, BY REGION, 2018-2030 (USD MILLION)

- TABLE 14. AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 15. AUTOMOTIVE FINANCE MARKET SIZE, BY EXCHANGE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 16. AUTOMOTIVE FINANCE MARKET SIZE, BY NEW VEHICLE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 17. AUTOMOTIVE FINANCE MARKET SIZE, BY RESALE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 18. AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 19. AUTOMOTIVE FINANCE MARKET SIZE, BY COMMERCIAL VEHICLES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 20. AUTOMOTIVE FINANCE MARKET SIZE, BY PASSENGER VEHICLES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 21. AMERICAS AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 22. AMERICAS AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 23. AMERICAS AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 24. AMERICAS AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 25. AMERICAS AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 26. AMERICAS AUTOMOTIVE FINANCE MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 27. ARGENTINA AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 28. ARGENTINA AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 29. ARGENTINA AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 30. ARGENTINA AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 31. ARGENTINA AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 32. BRAZIL AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 33. BRAZIL AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 34. BRAZIL AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 35. BRAZIL AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 36. BRAZIL AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 37. CANADA AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 38. CANADA AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 39. CANADA AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 40. CANADA AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 41. CANADA AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 42. MEXICO AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 43. MEXICO AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 44. MEXICO AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 45. MEXICO AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 46. MEXICO AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 47. UNITED STATES AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 48. UNITED STATES AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 49. UNITED STATES AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 50. UNITED STATES AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 51. UNITED STATES AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 52. UNITED STATES AUTOMOTIVE FINANCE MARKET SIZE, BY STATE, 2018-2030 (USD MILLION)

- TABLE 53. ASIA-PACIFIC AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 54. ASIA-PACIFIC AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 55. ASIA-PACIFIC AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 56. ASIA-PACIFIC AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 57. ASIA-PACIFIC AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 58. ASIA-PACIFIC AUTOMOTIVE FINANCE MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 59. AUSTRALIA AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 60. AUSTRALIA AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 61. AUSTRALIA AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 62. AUSTRALIA AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 63. AUSTRALIA AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 64. CHINA AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 65. CHINA AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 66. CHINA AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 67. CHINA AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 68. CHINA AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 69. INDIA AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 70. INDIA AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 71. INDIA AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 72. INDIA AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 73. INDIA AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 74. INDONESIA AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 75. INDONESIA AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 76. INDONESIA AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 77. INDONESIA AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 78. INDONESIA AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 79. JAPAN AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 80. JAPAN AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 81. JAPAN AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 82. JAPAN AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 83. JAPAN AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 84. MALAYSIA AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 85. MALAYSIA AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 86. MALAYSIA AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 87. MALAYSIA AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 88. MALAYSIA AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 89. PHILIPPINES AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 90. PHILIPPINES AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 91. PHILIPPINES AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 92. PHILIPPINES AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 93. PHILIPPINES AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 94. SINGAPORE AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 95. SINGAPORE AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 96. SINGAPORE AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 97. SINGAPORE AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 98. SINGAPORE AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 99. SOUTH KOREA AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 100. SOUTH KOREA AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 101. SOUTH KOREA AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 102. SOUTH KOREA AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 103. SOUTH KOREA AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 104. TAIWAN AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 105. TAIWAN AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 106. TAIWAN AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 107. TAIWAN AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 108. TAIWAN AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 109. THAILAND AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 110. THAILAND AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 111. THAILAND AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 112. THAILAND AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 113. THAILAND AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 114. VIETNAM AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 115. VIETNAM AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 116. VIETNAM AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 117. VIETNAM AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 118. VIETNAM AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 119. EUROPE, MIDDLE EAST & AFRICA AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 120. EUROPE, MIDDLE EAST & AFRICA AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 121. EUROPE, MIDDLE EAST & AFRICA AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 122. EUROPE, MIDDLE EAST & AFRICA AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 123. EUROPE, MIDDLE EAST & AFRICA AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 124. EUROPE, MIDDLE EAST & AFRICA AUTOMOTIVE FINANCE MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 125. DENMARK AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 126. DENMARK AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 127. DENMARK AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 128. DENMARK AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 129. DENMARK AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 130. EGYPT AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 131. EGYPT AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 132. EGYPT AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 133. EGYPT AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 134. EGYPT AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 135. FINLAND AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 136. FINLAND AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 137. FINLAND AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 138. FINLAND AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 139. FINLAND AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 140. FRANCE AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 141. FRANCE AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 142. FRANCE AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 143. FRANCE AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 144. FRANCE AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 145. GERMANY AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 146. GERMANY AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 147. GERMANY AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 148. GERMANY AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 149. GERMANY AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 150. ISRAEL AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 151. ISRAEL AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 152. ISRAEL AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 153. ISRAEL AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 154. ISRAEL AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 155. ITALY AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 156. ITALY AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 157. ITALY AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 158. ITALY AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 159. ITALY AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 160. NETHERLANDS AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 161. NETHERLANDS AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 162. NETHERLANDS AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 163. NETHERLANDS AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 164. NETHERLANDS AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 165. NIGERIA AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 166. NIGERIA AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 167. NIGERIA AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 168. NIGERIA AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 169. NIGERIA AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 170. NORWAY AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 171. NORWAY AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 172. NORWAY AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 173. NORWAY AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 174. NORWAY AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 175. POLAND AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 176. POLAND AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 177. POLAND AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 178. POLAND AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 179. POLAND AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 180. QATAR AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 181. QATAR AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 182. QATAR AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 183. QATAR AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 184. QATAR AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 185. RUSSIA AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 186. RUSSIA AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 187. RUSSIA AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 188. RUSSIA AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 189. RUSSIA AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 190. SAUDI ARABIA AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 191. SAUDI ARABIA AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 192. SAUDI ARABIA AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 193. SAUDI ARABIA AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 194. SAUDI ARABIA AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 195. SOUTH AFRICA AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 196. SOUTH AFRICA AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 197. SOUTH AFRICA AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 198. SOUTH AFRICA AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 199. SOUTH AFRICA AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 200. SPAIN AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 201. SPAIN AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 202. SPAIN AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 203. SPAIN AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 204. SPAIN AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 205. SWEDEN AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 206. SWEDEN AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 207. SWEDEN AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 208. SWEDEN AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 209. SWEDEN AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 210. SWITZERLAND AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 211. SWITZERLAND AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 212. SWITZERLAND AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 213. SWITZERLAND AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 214. SWITZERLAND AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 215. TURKEY AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 216. TURKEY AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 217. TURKEY AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 218. TURKEY AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 219. TURKEY AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 220. UNITED ARAB EMIRATES AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 221. UNITED ARAB EMIRATES AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 222. UNITED ARAB EMIRATES AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 223. UNITED ARAB EMIRATES AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 224. UNITED ARAB EMIRATES AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 225. UNITED KINGDOM AUTOMOTIVE FINANCE MARKET SIZE, BY PROVIDER TYPE, 2018-2030 (USD MILLION)

- TABLE 226. UNITED KINGDOM AUTOMOTIVE FINANCE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 227. UNITED KINGDOM AUTOMOTIVE FINANCE MARKET SIZE, BY PURPOSE TYPE, 2018-2030 (USD MILLION)

- TABLE 228. UNITED KINGDOM AUTOMOTIVE FINANCE MARKET SIZE, BY LOAN, 2018-2030 (USD MILLION)

- TABLE 229. UNITED KINGDOM AUTOMOTIVE FINANCE MARKET SIZE, BY VEHICLE TYPE, 2018-2030 (USD MILLION)

- TABLE 230. AUTOMOTIVE FINANCE MARKET, FPNV POSITIONING MATRIX, 2022

- TABLE 231. AUTOMOTIVE FINANCE MARKET SHARE, BY KEY PLAYER, 2022

- TABLE 232. AUTOMOTIVE FINANCE MARKET LICENSE & PRICING