PUBLISHER: Juniper Research Ltd | PRODUCT CODE: 1881280

PUBLISHER: Juniper Research Ltd | PRODUCT CODE: 1881280

eCommerce Fraud Prevention Market: 2025-2030

'Digital Goods Fraud to Cost eCommerce Merchants $27 Billion Globally by 2030 as AI Tools Accelerate Attacks'

| KEY STATISTICS | |

|---|---|

| Total value of eCommerce fraud in 2025: | $56.1 billion |

| Total value of eCommerce fraud in 2030: | $131 billion |

| 2025-2030 Market growth: | 133% |

| Forecast period: | 2025-2030 |

Overview

Our "eCommerce Fraud Prevention" research suite provides a detailed and insightful analysis of this evolving market; enabling stakeholders from financial institutions, law enforcement agencies, regulatory bodies and technology vendors to understand future growth, key trends, and the competitive environment.

The suite includes several different options that can be purchased separately, including access to data mapping adoption and future growth of the eCommerce fraud prevention market. The research is an insightful study uncovering the latest trends and opportunities within the market and providing extensive analysis of the 21 market leaders in the fight against eCommerce fraud. The coverage can also be purchased as a full research suite, containing all of these elements, and including a substantial discount.

Collectively, these documents provide a critical tool for understanding this rapidly emerging market; enabling merchants, payment service providers, banks and technology vendors to shape their future strategy. Its unparalleled coverage makes this research an incredibly useful resource for charting the future of such an uncertain and rapidly growing market.

All report content is delivered in the English language.

Key Features

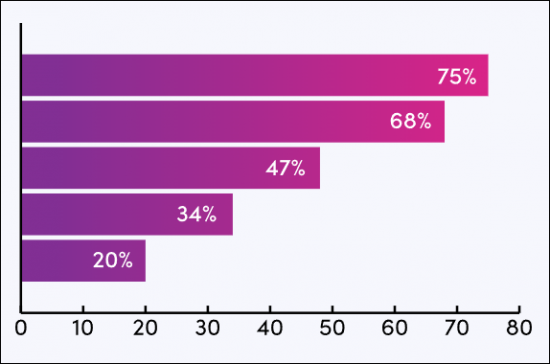

- Market Dynamics: Insights into key trends and market expansion challenges within the eCommerce fraud prevention market. The research includes a Country Readiness Index; providing analysis on where the best opportunities lie for eCommerce fraud prevention adoption across over 60 countries. It also includes analysis of current developments across 6 different segments of the eCommerce fraud market, and an assessment of eCommerce fraud prevention regulations across key regions. The report addresses challenges posed by increasingly complex financial crimes, the potential benefits of increasing regulatory involvement, and an assessment of the many next-generation technological approaches to detect fraudulent activity.

- Key Takeaways & Strategic Recommendations: In-depth analysis of key development opportunities and findings within the eCommerce fraud prevention market, accompanied by key strategic recommendations for stakeholders.

- Benchmark Industry Forecasts: Global eCommerce fraudulent transaction spend assessed across 7 key eCommerce segments, including Airline Tickets, Digital Goods & Physical Goods and the total Fraud Detection and Prevention (FDP) spend by eCommerce merchants.

- Juniper Research Competitor Leaderboard: Key player capability and capacity assessment for 21 eCommerce Fraud Prevention vendors, via the Juniper Research Competitor Leaderboard.

SAMPLE VIEW

Market Data & Forecasts Report

The numbers tell you what's happening, but our written report details why, alongside the methodologies.

SAMPLE VIEW

Market Trends & Strategies Report

A comprehensive analysis of the current market landscape, alongside strategic recommendations.

Market Data & Forecasts Report

The market-leading research suite for the "eCommerce Fraud Prevention" market includes access to the full set of forecast data of 44 tables and over 30,465 datapoints.

Metrics in the research suite include:

- Total number of eCommerce merchant transactions.

- Total annual transaction value of CNP (Card-not-present) eCommerce merchant fraud.

- Total number of eCommerce merchants employing FDP (Fraud Detection & Prevention) solutions.

- Total spend on FDP solutions by eCommerce merchants.

- Proportion of eCommerce merchant transactions that are fraudulent, by value.

These metrics are provided for the following key market verticals:

- Airline eTicketing

- Airline mTicketing

- Remote Digital Goods (mobile)

- Remote Digital Goods (online)

- Remote Physical Goods (mobile)

- Remote Physical Goods (online)

- Fraud Detection and Prevention (FDP) eCommerce merchant spend

Juniper Research's Interactive Forecast Excel contains the following functionality:

- Statistics Analysis: Users benefit from the ability to search for specific metrics displayed for all regions and countries across the data period. Graphs are easily modified and can be exported to the clipboard.

- Country Data Tool: This tool lets users look at metrics for all regions and countries in the forecast period. Users can refine the metrics displayed via a search bar.

- Country Comparison Tool: Users can select and compare each of the countries. The ability to export graphs is included in this tool.

- What-if Analysis: Here, users can compare forecast metrics against their own assumptions, via five interactive scenarios.

Market Trends & Strategies Report

This report examines the "eCommerce Fraud Prevention" market landscape in detail; assessing market trends and factors shaping the evolution of this rapidly growing market. The report delivers comprehensive analysis of the strategic opportunities for eCommerce fraud prevention solution providers; addressing key verticals' developing challenges in online financial crimes and illicit activities, and revision of fraud prevention laws across key regions. It offers an assessment of the next generation of technological approaches for detecting suspicious transactions and how stakeholders should navigate these. It also includes evaluation of key country-level opportunities for eCommerce fraud prevention solution growth, via the Country Readiness Index.

Competitor Leaderboard Report

The Competitor Leaderboard report provides a detailed evaluation and market positioning for 21 leading vendors in the "eCommerce Fraud Prevention" space. The vendors are positioned as established leaders, leading challengers, or disruptors and challengers, based on capacity and capability assessments.

Juniper Research's Competitor Leaderboard for "eCommerce Fraud Prevention" includes the following key players:

|

|

|

This document is centered around the Juniper Research Competitor Leaderboard; a vendor positioning tool that provides an at-a-glance view of the competitive landscape in a market, backed by a robust methodology.

Table of Contents

Market Trends & Strategies

1. Key Takeaways & Strategic Recommendations

- 1.1. Key Takeaways

- 1.2. Strategic Recommendations

2. Market Landscape

- 2.1. Introduction

- 2.2. Definitions & Scope

- 2.3. Types of Merchant Fraud

- Figure 2.1: Visualisation of Merchant Fraud

- 2.3.1. First-party Fraud

- i. Chargeback Fraud

- ii. Friendly Fraud

- iii. Policy Abuse

- 2.3.2. ATO Fraud

- 2.3.3. Other Types of Fraud

- i. Clean Fraud

- ii. Affiliate Fraud

- iii. Botnets

- iv. Triangulation Fraud

- Figure 2.2: Visualisation of Triangulation Fraud

- v. Synthetic Identity Fraud

- 2.4. Solutions Used in Merchant Fraud Detection & Prevention

- 2.4.1. Merchant Fraud Detection & Prevention Tools

- Figure 2.3: Methods of Merchant Fraud Prevention

- i. Biometrics

- ii. Behavioural Analytics

- iii. Tokenisation

- iv. APIs

- v. 3D Secure Authentication 2.0

- 2.4.1. Merchant Fraud Detection & Prevention Tools

- 2.5. Physical & Digital Goods

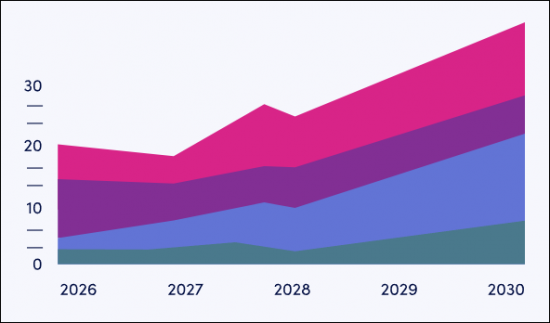

- Figure 2.4: Total Value of Fraudulent CNP Transactions Globally ($m), Split by 8 Key Regions, 2025-2030

- 2.5.1. Remote Physical Goods

- Figure 2.5: Total Value of Fraudulent Remote Physical Goods Purchases Globally ($m), Split by 8 Key Regions, 2025-2030

- 2.5.2. Remote Digital Goods

- Figure 2.6: Total Value of Fraudulent Remote Digital Goods Purchases Globally ($m), Split by 8 Key Regions, 2025-2030

3. Emerging Merchant Fraud Prevention Market

- 3.1. Key Themes & Areas Involved

- 3.2. Key Trends & Current Market Drivers

- 3.2.1. Rapid Rise of eCommerce

- 3.2.2. Emerging Fraudulent Methods & Tactics

- i. Generative AI

- ii. FaaS

- 3.2.3. Customers Are Poorly Educated on New Technologies

- 3.2.4. Deepfakes

- 3.2.5. Cutting Business Costs

- 3.3. BNPL

- i. BNPL Fraud Methods

- ii. BNPL Fraud Prevention Methods

- 3.4. Technologies

- 3.4.1. AI

- i. Benefits of AI in Merchant Fraud Prevention

- Figure 3.1: AI Benefits in Merchant Fraud Prevention

- ii. Drawbacks of AI in Merchant Fraud Prevention

- i. Benefits of AI in Merchant Fraud Prevention

- 3.4.2. ML

- i. Benefits of ML in Merchant Fraud Prevention

- ii. Drawbacks of ML in eCommerce Fraud Prevention

- 3.4.3. eCommerce Fraud Prevention APIs

- 3.4.1. AI

- 3.5. PSD2

- 3.5.1. How PSD2 Affects Merchants

- 3.6 3DS2 & Biometric Authorisation of Transactions

- 3.6.1. Methods of Authentication

- i. OTPs

- ii. Biometrics

- Figure 3.2: Types of Biometric Authentication

- 3.6.2. 3DS2 Implications

- 3.6.1. Methods of Authentication

4. Segment Analysis

- 4.1. Introduction

- 4.1.1. Different Merchants That Are Affected by Fraud

- i. Generalist Retailers

- ii. Specialist Retailers

- iii. Streaming Services

- iv. Hospitality

- 4.1.1. Different Merchants That Are Affected by Fraud

- 4.2. Remote Digital & Physical Goods

- 4.2.1. Digital Goods

- Figure 4.1: Total Number of Transactions for Remote Digital Goods (m), Split by 8 Key Regions, 2025-2030

- i. Video Games

- ii. Music

- iii. Video

- iv. Ticketing

- 4.2.2. Physical Goods

- Figure 4.2: Total Value of Remote Physical Goods Transactions Globally ($m), Split by 8 Key Regions, 2025-2030

- 4.2.1. Digital Goods

- 4.3. Key Challenges

- 4.3.1. Organised Fraud

- i. Scattered Spider

- ii. AI Music Streaming Scam

- 4.3.2. Lack of Physical Biometrics

- 4.3.1. Organised Fraud

5. Country Readiness Index

- 5.1. Introduction

- Figure 5.1: Juniper Research Country Readiness Index Regional Definitions

- Table 5.2: Juniper Research Country Readiness Index Scoring Criteria: eCommerce Fraud Prevention

- Figure 5.3: Juniper Research Country Readiness Index: eCommerce Fraud Prevention Market 2025

- Figure 5.4: eCommerce Fraud Prevention Market Country Readiness Index: Market Segments

- 5.2. Focus Markets

- 5.2.1. Convergence of Fraud, Identity, and Payment Risk

- 5.2.2. Fraud Prevention as Part of Broader Digital Commerce Strategy

- 5.2.3. Country-level Assessment: US

- 5.3. Growth Markets

- 5.3.1. Country-level Assessment: The UK

- 5.4. Saturated Markets

- 5.5. Developing Markets

- Table 5.5: Juniper Research Country Readiness Index Heatmap: North America

- Table 5.6: Juniper Research Country Readiness Index Heatmap: Latin America

- Table 5.7: Juniper Research Country Readiness Index Heatmap: West Europe

- Table 5.8: Juniper Research Country Readiness Index Heatmap: Central & East Europe

- Table 5.9: Juniper Research Country Readiness Index Heatmap: Far East & China

- Table 5.10: Juniper Research Country Readiness Index Heatmap: Indian Subcontinent

- Table 5.11: Juniper Research Country Readiness Index Heatmap: Rest of Asia Pacific

- Figure 5.12: Juniper Research Country Readiness Index Heatmap: Africa & Middle East

Competitor Leaderboard

1. Juniper Research Competitor Leaderboard

- 1.1. Why Read This Report?

- Figure 1.1: Juniper Research Competitor Leaderboard Vendors: eCommerce Fraud Detection & Prevention

- Figure 1.2: Juniper Research Competitor Leaderboard: eCommerce Fraud Detection & Prevention Vendors

- Table 1.3: Juniper Research Competitor Leaderboard: eCommerce Fraud Detection & Prevention Vendors

- Table 1.4: Juniper Research Heatmap: eCommerce Fraud Detection & Prevention Vendors

2. Vendor Profiles

- 2.1. eCommerce Fraud Detection & Prevention Vendor Profiles

- 2.1.1. Accertify

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.1: Accertify's Four Key Areas for Chargeback Management

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.2. ACI Worldwide

- i. Corporate

- Table 2.2: ACI Worldwide Revenue ($m), 2022-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 2.1.3. ClearSale

- i. Corporate

- Table 2.3: ClearSale Revenue ($m), 2022-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 2.1.4. DataDome

- i. Corporate

- Table 2.4: Discover Financial Services Revenue ($m), 2018-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 2.1.5. Discover Financial Services

- i. Corporate

- Figure 2.5: Discover Financial Services Revenue ($m), 2022-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 2.1.6. Experian

- i. Corporate

- Table 2.6: Experian Financial Snapshot ($m), 2022-2025

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 2.1.7. Forter

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.8. Fraudio

- i. Corporate

- Figure 2.7: Fraudio Funding Rounds ($m), 2020-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.8: Fraudio's Centralised ML AI Brain

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 2.1.9. FraudNet

- i. Corporate

- Figure 2.9: FraudNet Funding Rounds ($m), 2018-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 2.1.10. Kount

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.11. MangoPay

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients and Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.12. Mastercard

- i. Corporate

- Figure 2.10: Mastercard Revenue ($m), 2022-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 2.1.13. Riskified

- i. Corporate

- Table 2.11: Riskified Revenue ($m), 2022-2024

- ii. Geographical Spread

- iii. Key Clients and Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 2.1.14. RSA Security

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients and Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.15. SEON

- i. Corporate

- Figure 2.12: SEON Investment Rounds, 2018-2025

- ii. Geographical Spread

- iii. Key Clients and Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 2.1.16. Sift

- i. Corporate

- Table 2.13: Sift Funding Rounds: 2013-2022

- ii. Geographical Spread

- iii. Key Clients and Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 2.1.17. Signifyd

- i. Corporate

- Figure 2.14: Signifyd's Investment Rounds ($m), 2012-2021

- ii. Geographical Spread

- iii. Key Clients and Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 2.1.18. TransUnion

- i. Corporate

- Table 2.15: TransUnion Revenue ($m), 2022-2024

- ii. Geographical Spread

- iii. Key Clients and Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 2.1.19. Vesta

- i. Corporate

- Figure 2.16: Vesta Investment Rounds ($m), 2003-2025

- ii. Geographical Spread

- iii. Key Clients and Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.17: Visualisation Displaying Vesta's Payment Guarantee

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 2.1.20. Visa Acceptance Solutions

- i. Corporate

- Table 2.18: Visa Revenue ($m), 2022-2024

- ii. Geographical Spread

- iii. Key Clients and Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.19: How Visa Acceptance Solutions' Payer Authentication Works

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 2.1.21. Worldpay

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients and Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.1. Accertify

- 2.2. Juniper Research Leaderboard Assessment Methodology

- 2.2.1. Limitations & Interpretations

- Table 2.21: Juniper Research eCommerce Fraud Prevention Assessment Criteria

- 2.2.1. Limitations & Interpretations

- 2.3. Related Research

Data & Forecasting

1. eCommerce Fraud Prevention Forecast Methodology

- 1.1. Methodology & Assumptions

- Figure 1.1: Airline Tickets Forecast Methodology

- Figure 1.2: Remote Digital Goods Forecast Methodology

- Figure 1.3: Remote Physical Goods Forecast Methodology

- Figure 1.4: FDP Software Forecast Methodology

2. Airline Tickets Forecast

- 2.1. Online Airline eTickets

- 2.1.1. Total Number of Online Airline eTickets Issued per annum

- Figure & Table 2.1: Total Number of Online Airline eTickets Issued Globally per annum (m), Split by 8 Key Regions, 2025-2030

- 2.1.2. Total Number of Fraudulent Online Airline eTickets Issued

- Figure & Table 2.2: Total Number of Fraudulent Online Airline eTickets Issued Globally (m), Split by 8 Key Regions, 2025-2030

- 2.1.3. Total Value of Fraudulent Online Airline eTicket Transactions

- Figure & Table 2.3: Total Value of Fraudulent Online Airline eTicket Transactions Globally ($m), Split by 8 Key Regions, 2025-2030

- 2.1.1. Total Number of Online Airline eTickets Issued per annum

- 2.2. Mobile Airline mTickets

- 2.2.1. Total Number of Mobile Airline mTickets Issued per annum

- Figure & Table 2.4: Total Number of Mobile Airline mTickets Issued per annum Globally (m), Split by 8 Key Regions, 2025-2030

- 2.2.2. Total Number of Fraudulent Mobile Airline mTickets Issued

- Figure & Table 2.5: Total Number of Fraudulent Mobile Airline mTickets Issued Globally (m), Split by 8 Key Regions, 2025-2030

- 2.2.3. Total Value of Fraudulent Mobile Airline mTicket Transactions

- Figure & Table 2.6: Total Value of Fraudulent Mobile Airline mTicket Transactions Globally ($m), Split by 8 Key Regions, 2025-2030

- 2.2.1. Total Number of Mobile Airline mTickets Issued per annum

3. Remote Digital Goods Forecast

- 3.1. Online Remote Digital Goods

- 3.1.1. Total Transactions for Remote Online Digital Goods Purchases, Less Airline Tickets

- Figure & Table 3.1: Total Number of Transactions for Remote Online Digital Goods Purchases, Less Airline Tickets, Globally (m), Split by 8 Key Regions, 2025-2030

- 3.1.2. Total Number of Fraudulent Remote Online Digital Goods Purchases

- Figure & Table 3.2: Total Number of Fraudulent Remote Digital Goods Purchases Globally (m), Split by 8 Key Regions, 2025-2030

- 3.1.3. Total Value of Fraudulent Remote Online Digital Goods Transactions

- Figure & Table 3.3: Total Value of Fraudulent Remote Online Digital Goods Transactions Globally ($m), Split by 8 Key Regions, 2025-2030

- 3.1.1. Total Transactions for Remote Online Digital Goods Purchases, Less Airline Tickets

- 3.2. Mobile Remote Digital Goods

- 3.2.1. Total Transactions for Remote Mobile Digital Goods Purchases, Less Airline Tickets

- Figure & Table 3.4: Total Number of Transactions for Remote Mobile Digital Goods Purchases, Less Airline Tickets, Globally (m), Split by 8 Key Regions, 2025-2030

- 3.2.2. Total Number of Fraudulent Remote Mobile Digital Goods Purchases

- Figure & Table 3.5: Total Number of Fraudulent Remote Mobile Digital Goods Purchased Globally (m), Split by 8 Key Regions, 2025-2030

- 3.2.3. Total Value of Fraudulent Remote Mobile Digital Goods Transactions

- Figure & Table 3.6: Total Value of Fraudulent Remote Mobile Digital Goods Transactions Globally ($m), Split by 8 Key Regions, 2025-2030

- 3.2.1. Total Transactions for Remote Mobile Digital Goods Purchases, Less Airline Tickets

4. Remote Physical Goods Forecast

- 4.1. Remote Online Physical Goods

- 4.1.1. Total Transactions for Remote Online Physical Goods Purchases

- Figure & Table 4.1: Total Transactions for Remote Online Physical Goods Purchases Globally (m), Split by 8 Key Regions, 2025-2030

- 4.1.2. Total Number of Fraudulent Remote Online Physical Goods Purchases

- Figure & Table 4.2: Total Number of Fraudulent Remote Physical Goods Purchases Globally (m), Split by 8 Key Regions, 2025-2030

- 4.1.1. Total Transactions for Remote Online Physical Goods Purchases

- 4.2. Remote Mobile Physical Goods

- 4.2.1. Total Transactions for Remote Mobile Physical Goods Purchases

- Figure & Table 4.3: Total Transactions for Remote Mobile Physical Goods Purchases Globally (m), Split by 8 Key Regions, 2025-2030

- 4.2.2. Total Number of Fraudulent Remote Mobile Physical Goods Purchases

- Figure & Table 4.4: Total Number of Fraudulent Remote Mobile Physical Goods Purchases (m), Split by 8 Key Regions, 2025-2030

- 4.2.3. Total Value of Fraudulent Remote Mobile Physical Goods Transactions

- Figure & Table 4.5: Total Value of Fraudulent Remote Mobile Physical Goods Transactions Globally ($m), Split by 8 Key Regions, 2025-2030

- 4.2.1. Total Transactions for Remote Mobile Physical Goods Purchases

5. FDP Software Forecast

- 5.1. FDP Spend

- 5.1.1. Number of eCommerce Merchants That Spend on FDP

- Figure & Table 5.1: Number of eCommerce Merchants That Spend on FDP Globally (m), Split by 8 Key Regions, 2025-2030

- 5.1.2. Total Value of eCommerce CNP Transactions, Including Airlines

- Figure & Table 5.2: Total Value of eCommerce CNP Transactions, Including Airlines, Globally ($m), Split by 8 Key Regions, 2025-2030

- 5.1.3. Total FDP Spend by eCommerce Merchants

- Figure & Table 5.3: Total FDP Spend by eCommerce Merchants Globally ($m), Split by 8 Key Regions, 2025-2030

- 5.1.1. Number of eCommerce Merchants That Spend on FDP