PUBLISHER: Juniper Research Ltd | PRODUCT CODE: 1883930

PUBLISHER: Juniper Research Ltd | PRODUCT CODE: 1883930

AI Agents for Customer Experience Platforms Market: 2025-2030

'AI Agents to Power 1,000% More Customer Interactions for Enterprises Globally by 2027'

| KEY STATISTICS | |

|---|---|

| Global AI agents in communications revenue in 2025: | $1.3bn |

| Global AI agents in communications revenue in 2030: | $18.3bn |

| Global AI agents in communications revenue growth 2025-2030: | 1300% |

| Forecast period: | 2025-2030 |

Overview

Our comprehensive "AI Agents for Customer Experience Platforms" research suite comprises detailed assessment of a market that is set to disrupt mobile communications. It provides stakeholders with insight into the key opportunities within the AI agents for customer experience platforms market over the next two years. The leading market study provides an evaluation of the key drivers of the AI agents market in 2025, including:

- How the adoption of the Model Context Protocol (MCP) has accelerated development of context-aware AI agents that can perform different tasks.

- The emergence of the Agent2Agent (A2A) protocol, which makes it easier to build multi-agent systems.

- Technological and hardware advancements that are allowing AI agents to be deployed at lower latency and cost.

The report includes several different options that can be purchased separately. This includes access to market forecasts of business adoption of AI agents for communications, number of customer interactions automated, and revenue, split by key market verticals:

|

|

It also includes a comprehensive study of the market trends and opportunities, as well as a Competitor Leaderboard document containing an extensive analysis of the major vendors in the market. The coverage can also be purchased as a full research suite; containing all these elements and including a substantial discount.

The study provides strategic recommendations for AI agent vendors on how to scale enterprise adoption of AI for customer experience platforms in 2026, including how to monetise, which industries to target, and the countries where they should be looking to expand.

All report content is delivered in the English language.

Key Features

- Market Dynamics: Provides detailed insight into the outlook of the AI agents for customer experience platforms market; assessing key drivers to future market growth, including the impact of the adoption of MCP and A2A protocols, technological and infrastructure improvements, and protocols supporting agentic commerce. It addresses the challenges facing future adoption of AI agents in communications, and how these can be overcome. The research also includes a Country Readiness Index, which categorises countries as a Focus, Growth, Saturated, or Developing Market; based on their market readiness and future growth prospects.

- Key Takeaways & Strategic Recommendations: In-depth analysis of key development opportunities, industry trends, and findings within the AI agents for customer experience platforms market, accompanied by key strategic recommendations for stakeholders.

- Benchmark Industry Forecasts: This provides market sizing and forecasts for the AI agents for customer experience platforms market, including five-year forecasts for business adoption of AI agents for communications, number of customer interactions automated, and revenue.

- Juniper Research Competitor Leaderboard: Key industry player capability and capacity assessment for 16 AI agents for customer experience platforms vendors, via the Juniper Research Competitor Leaderboard.

SAMPLE VIEW

Market Trends & Strategies Report

The numbers tell you what's happening, but our written report details why, alongside the methodologies.

SAMPLE VIEW

Market Trends & Forecasts PDF Report

A comprehensive analysis of the current market landscape, alongside strategic recommendations.

Market Trends & Strategies Report

This market study assesses the "AI Agents for Customer Experience Platforms" landscape in detail; assessing the key factors driving market growth, such as technological and infrastructure advancements, MCP and A2A adoption, and the declining cost of AI agent deployment which will allow enterprises to scale.

It provides strategic recommendations into how AI agent vendors can increase enterprise adoption, including which industries to prioritise. Moreover, it covers key challenges facing the AI agents' market, including demonstrating clear return on investment, data fragmentation, market regulations, an increasing the self-serviceability of AI agents. It also provides recommendations for AI agent vendors on how to capitalise on enterprise adoption of AI agents over the next year.

The report also includes a Country Readiness Index, which identifies the key countries to focus on for expansion in the AI agents for customer experience platforms space. It categorises countries as a Focus, Growth, Saturated, or Developing market; based on the country's readiness to adopt AI agents. Considerations include whether a market has the infrastructure in place to support the scaling of AI agents, and consumer readiness to interact with AI agents.

Competitor Leaderboard Report

Our "AI Agents for Customer Experience Platforms" market study includes a Competitor Leaderboard report, which provides detailed evaluation and market positioning of 16 vendors in the space. The vendors are positioned as an Established Leader, Leading Challenger, or Disruptor and Challenger based on product and capability assessments.

Juniper Research's Vendor Competitor Leaderboard for AI agents for customer experience platforms includes the following key players:

|

|

This report is centred around the Juniper Research Competitor Leaderboard; a vendor positioning tool that provides an at-a-glance view of the competitive landscape in a market, backed by robust methodology.

Table of Contents

Market Trends & Strategies

1. Key Takeaways & Strategic Recommendations

- 1.1. Key Takeaways

- 1.2. Strategic Recommendations

2. Future Market Outlook

- 2.1. Introduction to AI Agents in Communications

- Figure 2.1: Timeline of Automation Within Communications

- 2.1.1. Market Overview

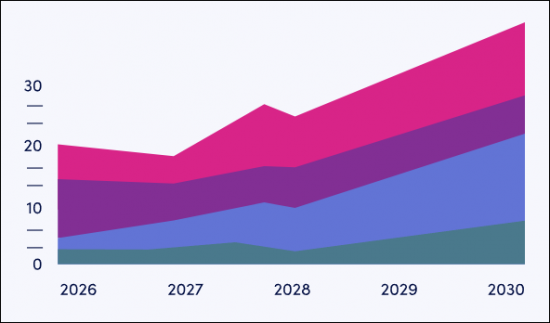

- Figure 2.2: Total Revenue from AI Agents in Communications ($m), Split by 8 Key Regions, 2025-2030

- i. MCP Protocol Accelerates Building of AI Agent Use Cases

- Figure 2.3: Integration of AI Agents With External Tools, Before and With MCP

- ii. Protocols for AI Agent Commerce

- iii. Emergence of AI Agent Marketplaces and the A2A Protocol

- iv. RL Environments Enable Increased Agent Performance Over Time

- v. AI Agent Scaling Coinciding With RCS Business Messaging Growth

- Figure 2.4: Mobile Network Operator (MNO) Revenue from Account-to-Person (A2P) RCS Traffic ($m), Split by 8 Key Regions, 2025-2030

- vi. AI Agent Advancements

- Figure 2.5: Statistics on Voice for Customer Service

- Figure 2.6: Orchestration Agent Overview

- vii. Expansion of Cloud Infrastructure

- Figure 2.7: Businesses in the OECD Purchasing Cloud Computing Services: Hosting of Databases (%), 2014-2024

- viii. Convergence of Network APIs With AI Agent Systems

- 2.1.2. AI Agent Use Cases in Customer Experience

- i. Customer Support

- Figure 2.8: Example of an AI Agent Anticipating Why the Customer is Reaching Out

- ii. Marketing & Commerce

- Figure 2.9: Agentic Commerce Transaction Flow

- i. Customer Support

- 2.1.3. Market Challenges

- i. Ensuring Clear ROI for Enterprises

- ii. Legacy Systems

- iii. Quality of Data

- iv. Market Regulations

- v. Fraud & Security Risks

- vi. Self-serviceability of AI Agents

- Figure 2.10: Roadmap to AI Agent Adoption for Enterprise Communications

- 2.1.4. Monetisation

3. Country Readiness Index

- 3.1. Introduction to Country Readiness Index

- Figure 3.1: Juniper Research Country Readiness Index Regional Definitions

- Table 3.2: Juniper Research Country Readiness Index Scoring Criteria: AI Agents for Customer Experience Platforms

- Figure 3.3: Juniper Research Country Readiness Index: AI Agents for Customer Experience

- Table 3.4: Juniper Research AI Agents for Customer Experience Country Readiness Index: Market Segments

- 3.2. Focus Markets

- i. AI Regulations and Enforcement in Focus Markets Support Innovation and Growth

- Table 3.5: Examples of AI Laws and Regulations That Have Been Implemented

- ii. Investment in Infrastructure Will Support AI Agent Development and Adoption

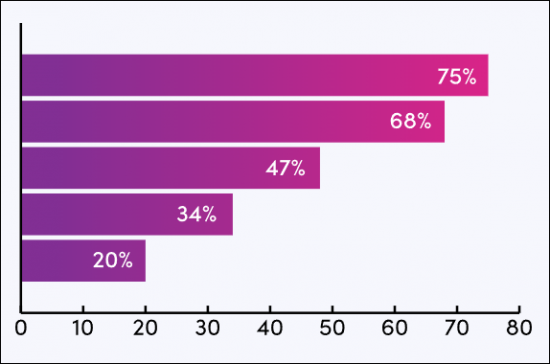

- Figure 3.6: Proportion of Businesses That Have Adopted AI Agents for Communications in 2025 (%), Split by Country Categories Based on 5G Penetration

- i. AI Regulations and Enforcement in Focus Markets Support Innovation and Growth

- 3.3. Growth Markets

- i. Limited 5G Infrastructure Impacts Market Readiness

- ii. Low Internet and Smartphone Penetration Influences Customer Readiness

- Figure 3.7: Internet Penetration in 2025 (%), Split by Growth and Focus Markets, 2025-2027

- iii. Data Infrastructure Will Enable Scaling of AI Agents in Communications

- 3.4. Saturated Markets

- i. Saturated Markets Are Smaller With Fewer B2C Enterprises

- ii. Average Enterprise Spend on AI Agents Will be Lower, Owing to Automation of Fewer Customer Interactions

- 3.5. Developing Markets

- i. Lower Concentration of Connected Data Centres Will Limit AI Agent Scaling

- ii. Limited AI Guidelines and Weaker Enforcement Impacts Enterprise Trust in AI

- Figure 3.8: Proportion of Businesses That Have Adopted AI Agents in 2025 (%), Split by Countries Which Scored a 5 for Market Regulations ('High') and Those Which Scored a 1 ('Low')

- iii. Slower Development of Supportive Infrastructure

- Table 3.9: Juniper Research Country Readiness Index Heatmap: North America

- Table 3.10: Juniper Research Country Readiness Index Heatmap: Latin America

- Table 3.11: Juniper Research Country Readiness Index Heatmap: West Europe

- Table 3.12: Juniper Research Country Readiness Index Heatmap: Central & East Europe

- Table 3.13: Juniper Research Country Readiness Index Heatmap: Far East & China

- Table 3.14: Juniper Research Country Readiness Index Heatmap: Indian Subcontinent

- Table 3.15: Juniper Research Country Readiness Index Heatmap: Rest of Asia Pacific

- Table 3.16: Juniper Research Country Readiness Index Heatmap: Africa & Middle East

Competitor Leaderboard

1. Juniper Research Competitor Leaderboard - AI Agents for Customer Experience Platforms

- Figure 1.1: Juniper Research Competitor Leaderboard: AI Agents for Customer Experience Platforms Product Portfolio

- Figure 1.2: Juniper Research Competitor Leaderboard: AI Agents for Customer Experience Platforms - Vendors

- Figure 1.3: Juniper Research Competitor Leaderboard: Vendors & Positioning

- Figure 1.4: Juniper Research Competitor Leaderboard Heatmap: AI Agents for Customer Experience Platforms - Vendors

2. Vendor Profiles

- 2.1. AI Agents for Customer Experience Platforms: Vendor Profiles

- 2.1.1. AWS

- i. Corporate Information

- Table 2.1: AWS' Revenue ($bn), 2022-2024

- ii. Geographical Spread

- Figure 2.2: Amazon Web Service Infrastructure Deployments Map, 2025

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.2. BTS (Business Telecommunications Services)

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.3. Cisco

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.4. CM.com

- i. Corporate Information

- Table 2.3: Relevant Acquisitions Made by CM.com, 2020-present

- Table 2.4: CM.com's Select Financial Information (Euro-m), 2022-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.5. Genesys

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.6. Google

- i. Corporate Information

- Table 2.5: Google's Relevant Acquisitions, 2014-present

- Figure 2.6: Google's Select Financial Information ($billion), 2022-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.7. Graia

- i. Corporate Information

- Table 2.7: BOSQAR INVEST's Select Financial Information (Euro-million), 2023-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.8. Gupshup

- i. Corporate Information

- Table 2.8: Gupshup's Acquisitions, 2021-present

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.9. IBM

- i. Corporate Information

- Figure 2.9: IBM Select Financial Information ($m), 2023-2024

- Figure 2.10: IBM Recent Acquisitions Relevant to its AI and Software Solutions, 2023-present

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.10. Infobip

- i. Corporate Information

- Figure 2.11: Infobip's Acquisitions - April 2021 to Present

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.11. Microsoft

- i. Corporate Information

- Figure 2.12: Relevant Microsoft Acquisitions, 2018-present

- Figure 2.13: Microsoft's Select Financial Information ($billion), FY 2022-FY 2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.12. NiCE

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.14: NiCE's CXone Mpower

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.13. Salesforce

- i. Corporate Information

- Table 2.15: Salesforce's Select Financial Information ($bn), 2023-2025

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.16: Agentforce Interoperability

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.14. Sprinklr

- i. Corporate Information

- Table 2.17: Sprinklr's Select Financial Information ($m), FY 2022-FY 2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.15. Tata Communications

- i. Corporate Information

- Table 2.18: Tata Communications' Select Financial Information (Indian Rupee in crore), FY 23-24 & FY 24-25

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.16. Vonage

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.1. AWS

- 2.2. Juniper Research Leaderboard Assessment Methodology

- 2.3. Limitations & Interpretations

- Table 2.19: Juniper Research Competitor Leaderboard Scoring Criteria

- 2.4. Related Research

Data & Forecasting

1. AI Agents for Customer Experience Platforms Market Summary

- 1.1. AI Agents for Customer Experience Platforms

- 1.1.1. AI Agents for Customer Experience Platforms Market Forecast Methodology

- 1.1.2. Business Adoption of AI Agents for Customer Experience

- Figure & Table 1.1: Number of Businesses That Have Adopted AI Agents for Customer Experience (m), Split by 8 Key Regions, 2025-2030

- i. Juniper Research's View

- Table 1.2: Cost Savings and Value Produced by Implementing AI Agents to Automate Order Cancellations, 2025-2030, Based on US Figures

- Figure 1.3: Value Produced by AI Agent Applications Automating Order Cancellations, 2025-2030, Based on US Figures

- 1.1.3. Customer Interactions Handled by AI Agents

- Figure & Table 1.4: Number of Customer Interactions Handled by AI Agents (m), 2025-2030, Split by 8 Key Regions

- i. Juniper Research's View

- Figure 1.5: Average Number of Interactions Handled by AI Agents per Business per Month, 2022-2030, Split by 8 Key Regions

- 1.1.4. AI Agents for Customer Experience Platforms Revenue

- Figure & Table 1.6: Total Spend on AI Agents for Customer Experience ($), 2025-2030, Split by 8 Key Regions

- i. Juniper Research's View

- Figure 1.7: Average Spend per Customer Interaction Handled by AI Agents ($), Split by 8 Key Regions, 2025-2030

- Figure 1.8: AI Agents for Customer Experience Platforms Market Forecast Methodology

2. Market Verticals

- 2.1. AI Agents for Customer Experience Platforms: Key Market Verticals

- 2.1.1. AI Agents in Customer Experience Platforms: Methodology for Market Vertical Split

- 2.1.2. Industry Use of AI Agents Across Market Verticals

- Figure & Table 2.1: Number of Businesses That Have Adopted AI Agents for Customer Experience (m), Split by Key Market Verticals, 2025-2030

- 2.1.3. Customer Interactions Automated by AI Agents Across Market Verticals

- Figure & Table 2.2: Number of Customer Interactions Handled by AI Agents (m), Split by Key Market Verticals, 2025-2030

- 2.1.4. Revenue From AI Agents Across Market Verticals

- Figure & Table 2.3: Total Spend on AI Agents for Customer Experience ($), Split by Key Market Verticals, 2025-2030

- Table 2.4: Average Cost per Customer Interaction Handled by AI Agents ($)

- Figure 2.5: AI Agents for Customer Experience Platforms Market Verticals Forecast Methodology