PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1859657

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1859657

Generator Market by Fuel Type (Diesel, Gas, LPG, Biofuel), Power Rating (Up to 50 kW, 51-280 kW, 281-500 kW, 501-2,000 kW, 2,001-3,500 kW, Above 3,500 kW), Application, End User, Design, Sales Channel, and Region - Global Forecast to 2030

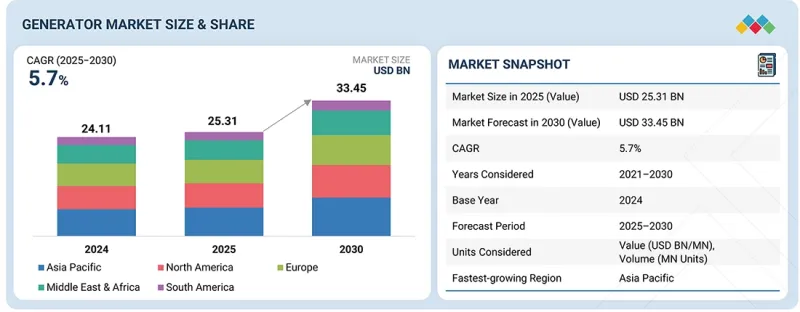

The generator market was valued at USD 25.31 billion in 2025 and is estimated to reach USD 33.45 billion by 2030, registering a CAGR of 5.7% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Thousand Units) |

| Segments | Fuel type, application, sales channel, design, end user, power rating, and region |

| Regions covered | North America, Europe, Asia Pacific, South America, and the Middle East & Africa |

The increasing demand for uninterrupted and reliable power supply, rapid industrialization, and the rapidly expanding manufacturing sector are expected to augment the demand for generators. Furthermore, supportive government policies and incentives for renewable energy integration and energy efficiency encourage industrial and commercial adoption, boosting overall market growth.

"Fuel cells segment is projected to grow at the highest CAGR between 2025 and 2030."

By fuel type, the fuel cells segment is projected to record the highest CAGR in the generator market. Fuel cell generators are gaining traction globally due to their ability to deliver efficient and clean power generation. These systems use electrochemical conversion to produce electricity with minimal emissions, making them an ideal solution for sustainable and decentralized energy production. Advancements in fuel cell technology and the expanding availability of renewable hydrogen accelerate their adoption across industrial, commercial, and residential applications. As global economies prioritize decarbonization and energy transition goals, the demand for hydrogen-based fuel cell generators is expected to rise significantly. These systems are crucial in shaping a cleaner, more resilient, and sustainable global power landscape.

"Commercial is expected to be the second-largest end user segment in 2025."

The commercial segment is anticipated to emerge as the second-largest end user segment in 2025, driven by the critical need for uninterrupted operations. Diverse commercial sectors-IT & telecommunications, healthcare, data centers, hospitality, retail, and public infrastructure-fuel the demand for reliable backup power solutions to ensure business continuity and operational resilience. In these industries, even brief power interruptions can result in significant financial losses, data disruption, and safety concerns. Consequently, generators have become indispensable for maintaining seamless operations, particularly during peak demand periods or in regions where grid reliability remains inconsistent. By providing a stable and continuous power supply, generators are vital in safeguarding business assets, minimizing downtime, and enhancing overall operational efficiency across the commercial landscape.

"China is likely to exhibit the highest CAGR in the Asia Pacific generator market during the forecast period."

China is witnessing the highest growth rate in the global generator market, driven by a combination of structural, economic, and demographic factors. The large customer base and the strong presence of established domestic and international manufacturers continue to propel the market. Rapid urbanization and the ongoing migration from rural to urban areas have intensified the demand for robust infrastructure development, which in turn necessitates a stable and reliable power supply. As cities expand and industrial zones proliferate, the need for continuous and backup power has become increasingly critical. Generators are in high demand across construction sites, manufacturing facilities, commercial complexes, and energy-intensive urban centers, supporting the ongoing development and industrial modernization efforts across the country.

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1 - 45%, Tier 2 - 30%, and Tier 3 - 25%

By Designation: C-Level Executives - 25%, Directors - 35%, and Others - 40%

By Region: North America - 10%, Europe - 15%, Asia Pacific - 60%, the Middle East & Africa - 10%, and South America - 5%

Note: Others include product engineers, product specialists, and engineering leads.

Note: The tiers of the companies are defined based on their total revenues as of 2023. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

Caterpillar (US), Cummins Inc. (US), Rolls-Royce Plc (UK), Mitsubishi Heavy Industries Ltd. (Japan), Generac (US), Wacker Neuson SE (Germany), Briggs & Stratton (US), Atlas Copco (Sweden), and Kirloskar (India) are some key players in the generator market.

The study includes an in-depth competitive analysis of these key players in the generator market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report defines, describes, and forecasts the generator market by fuel type (Diesel, Gas, LPG, Biofuels, Coal Gas, Gasoline, Producer Gas, Fuel Cells), Application (Standby, Peak Shaving, Prime & Continuous), Sales Channel (Direct, Indirect), Design (Stationary, Portable), Power Rating (Up to 50 KW, 51-280 KW, 281-500 KW, 501-2,000 KW, 2,001-3,500 KW, Above 3,500 KW), End User (Industrial, Commercial, and Residential), and region (North America, South America, Europe, Asia Pacific, and Middle East & Africa). The report's scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the generator market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, services, and key strategies, such as contracts, partnerships, agreements, product/solution/service launches, mergers & acquisitions, and recent developments within the generator market. Competitive analysis of upcoming startups in the generator ecosystem is covered in this report.

Key Benefits of Buying the Report

- Analysis of key drivers (Increasing demand for uninterrupted and reliable power supply, Rapid industrialization, Growing concern about power outages, Integration of renewable energy and distributed energy resource management systems), restraints (High operational costs associated with diesel generators, Capital expenditure associated with hydrogen energy storage, Rise in investments in upgrading T&D infrastructure), opportunities (Rising adoption of fuel cell generators across several industries for backup power, Increasing deployment of hybrid, bi-fuel, and inverter generators, Government initiatives supporting development of hydrogen economy, Growing popularity of fuel cell generators), and challenges (Longer startup times of solid oxide fuel cells, Stringent government regulations pertaining to conventional fuel generators) that influences the growth of the generator market.

- Product Development/ Innovation: Developments such as hybrid generator systems are an emerging technology in the generator market due to their ability to combine traditional generators with renewable energy sources, including solar or wind power. This integration helps reduce fuel consumption and emissions by using renewable energy as a primary power source, with the generator providing backup power as needed, leading to cost savings and more efficient operation.

- Market Development: Fuel cells are gaining traction as a clean, versatile energy carrier, offering promising solutions for decarbonizing multiple sectors. Recognizing its potential, governments worldwide are introducing policies encouraging fuel cell production, distribution, and use. These initiatives foster a supportive environment for developing and adopting clean energy technologies, including fuel cell generators. Clean hydrogen production is crucial in advancing fuel cell generators as sustainable energy alternatives. With the increasing emphasis on hydrogen technologies, the demand for fuel cell generators is expected to grow, driving a shift from traditional fossil fuel-based power generation to cleaner, more sustainable solutions.

- Market Diversification: Cummins focuses on driving revenue growth and improving gross margins by strategically repositioning its product portfolio to maximize long-term shareholder value. In 2025, the company launched the S17 Centum generator set, a 17-liter engine platform delivering up to 1 MW of power in a compact design. Developed for space-constrained urban environments, it combines high performance with reliability across critical sectors.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as Caterpillar (US), Cummins Inc. (US), Rolls-Royce Plc (UK), Mitsubishi Heavy Industries Ltd. (Japan), Generac (US), and Wacker Neuson SE (Germany), Briggs & Stratton (US), Atlas Copco (Sweden), Kirloskar (India), in the generator market are covered.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

3 PREMIUM INSIGHTS

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Increasing demand for uninterrupted and reliable power supply

- 4.2.1.2 Global focus on reducing carbon emissions and environmental impact

- 4.2.1.3 Rising need for consistent power supply in industrial sector

- 4.2.1.4 Mounting adoption of distributed energy resource management systems

- 4.2.1.5 Increasing power outages due to aging infrastructure

- 4.2.1.6 Rising integration of renewable energy sources

- 4.2.2 RESTRAINTS

- 4.2.2.1 High diesel generator operational costs

- 4.2.2.2 Rising capital expenditure associated with hydrogen energy storage technologies

- 4.2.2.3 Increasing investment in transmission and distribution infrastructure

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Rising adoption of fuel cell generators

- 4.2.3.2 Growing popularity of hybrid and bi-fuel generators and inverters

- 4.2.3.3 Government-led initiatives to promote and distribute hydrogen

- 4.2.3.4 Growing awareness about clean power generation solutions

- 4.2.3.5 Supportive government policies, incentives, and rebates on installation of fuel cell generators

- 4.2.4 CHALLENGES

- 4.2.4.1 Imposition of strict emission standards

- 4.2.4.2 Long start-up times of solid oxide fuel cells

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.5 EMERGING BUSINESS MODELS AND ECOSYSTEM SHIFTS

- 4.6 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 BARGAINING POWER OF SUPPLIERS

- 5.1.2 BARGAINING POWER OF BUYERS

- 5.1.3 THREAT OF NEW ENTRANTS

- 5.1.4 THREAT OF SUBSTITUTES

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMIC OUTLOOK

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 INFLATION

- 5.2.4 MANUFACTURING VALUE ADDED (% OF GDP)

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE OF GENERATORS OFFERED BY KEY PLAYERS, BY POWER RATING, 2024

- 5.5.2 AVERAGE SELLING PRICE TREND OF GENERATORS, BY REGION, 2021-2024

- 5.6 TRADE ANALYSIS

- 5.6.1 HS CODE 850161

- 5.6.1.1 Export scenario

- 5.6.1.2 Import scenario

- 5.6.2 HS CODE 850162

- 5.6.2.1 Export scenario

- 5.6.2.2 Import scenario

- 5.6.3 HS CODE 850163

- 5.6.3.1 Export scenario

- 5.6.3.2 Import scenario

- 5.6.1 HS CODE 850161

- 5.7 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 CASE STUDY ANALYSIS

- 5.11 IMPACT OF 2025 US TARIFF ON GENERATOR MARKET

- 5.11.1 INTRODUCTION

- 5.11.2 KEY TARIFF RATES

- 5.11.3 PRICE IMPACT ANALYSIS

- 5.11.4 IMPACT ON COUNTRIES/REGIONS

- 5.11.4.1 US

- 5.11.4.2 Europe

- 5.11.4.3 Asia Pacific

- 5.11.5 IMPACT ON END USERS

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACTS, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.3 TECHNOLOGY/PRODUCT ROADMAP

- 6.4 PATENT ANALYSIS

- 6.5 FUTURE APPLICATIONS

- 6.6 IMPACT OF AI/GEN AI ON GENERATOR MARKET

- 6.6.1 TOP USE CASES AND MARKET POTENTIAL

- 6.6.2 BEST PRACTICES IN GENERATOR MARKET

- 6.6.3 CASE STUDIES OF AI IMPLEMENTATION IN GENERATOR MARKET

- 6.6.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.6.5 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN GENERATOR MARKET

- 6.6.6 IMPACT OF GEN AI/AI, BY END USER AND REGION

7 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.2 SUSTAINABILITY INITIATIVES

- 7.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF GENERATORS

- 7.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 7.4 CERTIFICATIONS, LABELING, ECO-STANDARDS

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

- 8.5 MARKET PROFITABILITY

9 GENERATOR MARKET, BY FUEL TYPE

- 9.1 INTRODUCTION

- 9.2 DIESEL

- 9.2.1 LONG LIFE AND HIGH AVAILABILITY TO FOSTER SEGMENTAL GROWTH

- 9.3 GAS

- 9.3.1 COST-EFFECTIVENESS AND EFFICIENCY TO ACCELERATE SEGMENTAL GROWTH

- 9.4 LPG

- 9.4.1 USE IN RURAL LOCATIONS WITH ERRATIC ELECTRICAL SUPPLIES TO FACILITATE SEGMENTAL GROWTH

- 9.5 BIOFUELS

- 9.5.1 PUSH FOR CLEAN AND SUSTAINABLE ENERGY SOLUTIONS TO FUEL SEGMENTAL GROWTH

- 9.6 COAL GAS

- 9.6.1 WIDESPREAD AVAILABILITY AND COST-EFFECTIVENESS TO BOLSTER SEGMENTAL GROWTH

- 9.7 GASOLINE

- 9.7.1 USE IN APPLICATIONS WHERE MOBILITY, CONVENIENCE, AND USER-FRIENDLINESS ARE CRUCIAL TO DRIVE MARKET

- 9.8 PRODUCER GAS

- 9.8.1 EMERGENCE AS ECONOMIC AND ENVIRONMENT-FRIENDLY ENERGY SOURCE TO SPUR DEMAND

- 9.9 FUEL CELLS

- 9.9.1 ABILITY TO REDUCE CLIMATE CHANGE AND IMPROVE AIR QUALITY TO PROMOTE SEGMENTAL GROWTH

10 GENERATOR MARKET, BY DESIGN

- 10.1 INTRODUCTION

- 10.2 STATIONARY

- 10.2.1 FOCUS ON ENSURING RELIABILITY AND REDUCING POWER INTERRUPTIONS TO BOOST SEGMENTAL GROWTH

- 10.3 PORTABLE 129 10.3.1 FLEXIBILITY, EASE OF INSTALLATION, AND QUICK DEPLOYMENT TO SPUR DEMAND

11 GENERATOR MARKET, BY POWER RATING

- 11.1 INTRODUCTION

- 11.2 UP TO 50 KW

- 11.2.1 UP TO 10 KW

- 11.2.1.1 Portability, ease of use, and low upfront cost to augment segmental growth

- 11.2.2 11-20 KW

- 11.2.2.1 Suitability for temporary installations to contribute to segmental growth

- 11.2.3 21-30 KW

- 11.2.3.1 Adoption to support sustained and higher-capacity backup power to foster segmental growth

- 11.2.4 31-40 KW

- 11.2.4.1 Adaptability and dependability to accelerate segmental growth

- 11.2.5 41-50 KW

- 11.2.5.1 Use to offer backup power to satisfy demands of residential and business environments to support market growth

- 11.2.1 UP TO 10 KW

- 11.3 51-280 KW

- 11.3.1 ADOPTION IN DISTRIBUTED GENERATION FACILITIES, UTILITY PEAKING PLANTS, AND POWER MANAGEMENT TO BOOST DEMAND

- 11.4 281-500 KW

- 11.4.1 USE TO SUPPORT OPERATIONS IN REMOTE AREAS TO BOLSTER SEGMENTAL GROWTH

- 11.5 501-2,000 KW

- 11.5.1 REQUIREMENT FOR RELIABLE AND CONTINUOUS POWER TO FUEL SEGMENTAL GROWTH

- 11.6 2,001-3,500 KW

- 11.6.1 USE IN CRITICAL INFRASTRUCTURE AND LARGE-SCALE MANUFACTURING FACILITIES TO DRIVE MARKET

- 11.7 ABOVE 3,500 KW

- 11.7.1 RESILIENCE TO HARSH AND VARIABLE WEATHER CONDITIONS TO FOSTER MARKET GROWTH

12 GENERATOR MARKET, BY SALES CHANNEL

- 12.1 INTRODUCTION

- 12.2 DIRECT

- 12.2.1 DEMAND FOR CUSTOMIZED, HIGH-CAPACITY GENERATOR SYSTEMS AND INTEGRATED POWER SOLUTIONS TO DRIVE MARKET

- 12.3 INDIRECT

- 12.3.1 WIDE ACCESSIBILITY AND LOCALIZED SUPPORT TO ACCELERATE SEGMENTAL GROWTH

13 GENERATOR MARKET, BY APPLICATION

- 13.1 INTRODUCTION

- 13.2 STANDBY

- 13.2.1 ABILITY TO PROVIDE IMMEDIATE BACKUP POWER DURING GRID OUTAGES TO BOOST DEMAND

- 13.3 PRIME & CONTINUOUS

- 13.3.1 IMPLEMENTATION IN REMOTE BUILDING SITES AND OFF-GRID LOCATIONS TO ACCELERATE SEGMENTAL GROWTH

- 13.4 PEAK SHAVING

- 13.4.1 USE TO AVOID HIGH TARIFFS CHARGED BY UTILITIES TO DRIVE MARKET

14 GENERATOR MARKET, BY END USER

- 14.1 INTRODUCTION

- 14.2 INDUSTRIAL

- 14.2.1 UTILITIES/POWER GENERATION

- 14.2.1.1 Strong focus on addressing limited access to transmission networks to fuel segmental growth

- 14.2.2 OIL & GAS

- 14.2.2.1 power-intensive and operational complexity nature to accelerate segmental growth

- 14.2.3 CHEMICALS & PETROCHEMICALS

- 14.2.3.1 Requirement for stable power supply to avoid severe production losses and safety hazards to fuel segmental growth

- 14.2.4 METALS & MINING

- 14.2.4.1 Dependency on uninterrupted and high-capacity power supply to bolster segmental growth

- 14.2.5 MANUFACTURING

- 14.2.5.1 Emphasis on maintaining production volume and product quality to augment segmental growth

- 14.2.6 MARINE

- 14.2.6.1 Operation in isolated environments with no access to external grid infrastructure to boost segmental growth

- 14.2.7 CONSTRUCTION

- 14.2.7.1 Focus on providing power at remote locations to drive market

- 14.2.8 OTHER INDUSTRIAL END USERS

- 14.2.1 UTILITIES/POWER GENERATION

- 14.3 RESIDENTIAL

- 14.3.1 MOUNTING DEMAND FOR WHOLE-HOME BACKUP POWER SOLUTIONS TO CONTRIBUTE TO SEGMENTAL GROWTH

- 14.4 COMMERCIAL

- 14.4.1 HEALTHCARE

- 14.4.1.1 Requirement for continuous operation of life support machines and critical equipment to expedite segmental growth

- 14.4.2 IT & TELECOMMUNICATIONS

- 14.4.2.1 Need to keep customers connected without interruptions to augment segmental growth

- 14.4.3 DATA CENTERS

- 14.4.3.1 High demand for digital services to contribute to segmental growth

- 14.4.4 OTHER COMMERCIAL END USERS

- 14.4.1 HEALTHCARE

15 GENERATOR MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 NORTH AMERICA

- 15.2.1 US

- 15.2.1.1 Increasing occurrence of weather-related incidents to boost market growth

- 15.2.2 CANADA

- 15.2.2.1 Mounting demand for reliable power solutions across various sectors to foster market growth

- 15.2.3 MEXICO

- 15.2.3.1 Rising infrastructure-related power disruptions to drive market

- 15.2.1 US

- 15.3 EUROPE

- 15.3.1 GERMANY

- 15.3.1.1 Increasing need for reliable backup power solutions to fuel market growth

- 15.3.2 RUSSIA

- 15.3.2.1 Increase in crude oil exports to accelerate market growth

- 15.3.3 FRANCE

- 15.3.3.1 Energy transition and demand for reliable power to support market growth

- 15.3.4 UK

- 15.3.4.1 Advent of Industry 4.0 technology to offer lucrative market growth opportunities

- 15.3.5 REST OF EUROPE

- 15.3.1 GERMANY

- 15.4 ASIA PACIFIC

- 15.4.1 CHINA

- 15.4.1.1 Vast population and manufacturing sector to boost market growth

- 15.4.2 INDIA

- 15.4.2.1 Increasing investment in clean energy to fuel market growth

- 15.4.3 JAPAN

- 15.4.3.1 Rising gas-based power generation to foster market growth

- 15.4.4 AUSTRALIA

- 15.4.4.1 Rapid expansion of renewable energy infrastructure to accelerate market growth

- 15.4.5 SOUTH KOREA

- 15.4.5.1 Mounting demand for energy-efficient and LNG-powered vessels to drive market

- 15.4.6 NEW ZEALAND

- 15.4.6.1 Growing emphasis on achieving net-zero goals to bolster market growth

- 15.4.7 INDONESIA

- 15.4.7.1 Strong focus on generating clean and emission-free electricity to offer market growth opportunities

- 15.4.8 REST OF ASIA PACIFIC

- 15.4.1 CHINA

- 15.5 MIDDLE EAST & AFRICA

- 15.5.1 GCC

- 15.5.1.1 Saudi Arabia

- 15.5.1.1.1 Growing number of infrastructure megaprojects to fuel market growth

- 15.5.1.2 UAE

- 15.5.1.2.1 Increasing foreign direct investment in renewable energy to boost market growth

- 15.5.1.3 Rest of GCC

- 15.5.1.1 Saudi Arabia

- 15.5.2 SOUTH AFRICA

- 15.5.2.1 Rising need to address power outages to augment market growth

- 15.5.3 NIGERIA

- 15.5.3.1 Increasing demand for uninterrupted power supply to foster market growth

- 15.5.4 ALGERIA

- 15.5.4.1 Significant infrastructure investments and rising energy demand to drive market

- 15.5.5 REST OF MIDDLE EAST & AFRICA

- 15.5.1 GCC

- 15.6 SOUTH AMERICA

- 15.6.1 BRAZIL

- 15.6.1.1 High emphasis on net-zero emissions to boost market growth

- 15.6.2 ARGENTINA

- 15.6.2.1 Growing instances of power outages to drive market

- 15.6.3 REST OF SOUTH AMERICA

- 15.6.1 BRAZIL

16 COMPETITIVE LANDSCAPE

- 16.1 OVERVIEW

- 16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 16.3 MARKET SHARE ANALYSIS, 2024

- 16.4 REVENUE ANALYSIS, 2020-2024

- 16.5 COMPANY VALUATION AND FINANCIAL METRICS

- 16.6 PRODUCT COMPARISON

- 16.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 16.7.1 STARS

- 16.7.2 EMERGING LEADERS

- 16.7.3 PERVASIVE PLAYERS

- 16.7.4 PARTICIPANTS

- 16.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 16.7.5.1 Company footprint

- 16.7.5.2 Region footprint

- 16.7.5.3 Fuel type footprint

- 16.7.5.4 Application footprint

- 16.7.5.5 End user footprint

- 16.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 16.8.1 PROGRESSIVE COMPANIES

- 16.8.2 RESPONSIVE COMPANIES

- 16.8.3 DYNAMIC COMPANIES

- 16.8.4 STARTING BLOCKS

- 16.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 16.8.5.1 Detailed list of key startups/SMEs

- 16.8.5.2 Competitive benchmarking of key startups/SMEs

- 16.9 COMPETITIVE SCENARIO

- 16.9.1 PRODUCT LAUNCHES

- 16.9.2 DEALS

- 16.9.3 OTHER DEVELOPMENTS

17 COMPANY PROFILES

- 17.1 KEY PLAYERS

- 17.1.1 CATERPILLAR

- 17.1.1.1 Business overview

- 17.1.1.2 Products/Solutions/Services offered

- 17.1.1.3 Recent developments

- 17.1.1.3.1 Product launches

- 17.1.1.3.2 Deals

- 17.1.1.3.3 Other developments

- 17.1.1.4 MnM view

- 17.1.1.4.1 Key strengths/Right to win

- 17.1.1.4.2 Strategic choices

- 17.1.1.4.3 Weaknesses/Competitive threats

- 17.1.2 CUMMINS INC.

- 17.1.2.1 Business overview

- 17.1.2.2 Products/Solutions/Services offered

- 17.1.2.3 Recent developments

- 17.1.2.3.1 Product launches

- 17.1.2.3.2 Deals

- 17.1.2.3.3 Other developments

- 17.1.2.4 MnM view

- 17.1.2.4.1 Key strengths/Right to win

- 17.1.2.4.2 Strategic choices

- 17.1.2.4.3 Weaknesses/Competitive threats

- 17.1.3 MITSUBISHI HEAVY INDUSTRIES, LTD.

- 17.1.3.1 Business overview

- 17.1.3.2 Products/Solutions/Services offered

- 17.1.3.3 Recent developments

- 17.1.3.3.1 Product launches

- 17.1.3.3.2 Other developments

- 17.1.3.4 MnM view

- 17.1.3.4.1 Key strengths/Right to win

- 17.1.3.4.2 Strategic choices

- 17.1.3.4.3 Weaknesses/Competitive threats

- 17.1.4 ROLLS-ROYCE PLC

- 17.1.4.1 Business overview

- 17.1.4.2 Products/Solutions/Services offered

- 17.1.4.3 Recent developments

- 17.1.4.3.1 Product launches

- 17.1.4.3.2 Deals

- 17.1.4.3.3 Other developments

- 17.1.4.4 MnM view

- 17.1.4.4.1 Key strengths/Right to win

- 17.1.4.4.2 Strategic choices

- 17.1.4.4.3 Weaknesses/Competitive threats

- 17.1.5 GENERAC POWER SYSTEMS, INC.

- 17.1.5.1 Business overview

- 17.1.5.2 Products/Solutions/Services offered

- 17.1.5.3 Recent developments

- 17.1.5.3.1 Product launches

- 17.1.5.3.2 Deals

- 17.1.5.4 MnM view

- 17.1.5.4.1 Key strengths/Right to win

- 17.1.5.4.2 Strategic choices

- 17.1.5.4.3 Weaknesses/Competitive threats

- 17.1.6 WARTSILA

- 17.1.6.1 Business overview

- 17.1.6.2 Products/Solutions/Services offered

- 17.1.6.3 Recent developments

- 17.1.6.3.1 Developments

- 17.1.7 WACKER NEUSON SE

- 17.1.7.1 Business overview

- 17.1.7.2 Products/Solutions/Services offered

- 17.1.7.3 Recent developments

- 17.1.7.3.1 Product launches

- 17.1.8 SIEMENS ENERGY

- 17.1.8.1 Business overview

- 17.1.8.2 Products/Solutions/Services offered

- 17.1.8.3 Recent developments

- 17.1.8.3.1 Developments

- 17.1.9 ATLAS COPCO AB

- 17.1.9.1 Business overview

- 17.1.9.2 Products/Solutions/Services offered

- 17.1.9.3 Recent developments

- 17.1.9.3.1 Deals

- 17.1.10 KIRLOSKAR

- 17.1.10.1 Business overview

- 17.1.10.2 Products/Solutions/Services offered

- 17.1.10.3 Recent developments

- 17.1.10.3.1 Product launches

- 17.1.11 GREAVES COTTON LIMITED

- 17.1.11.1 Business overview

- 17.1.11.2 Products/Solutions/Services offered

- 17.1.12 EVERLLENCE

- 17.1.12.1 Business overview

- 17.1.12.2 Products/Solutions/Services offered

- 17.1.13 BRIGGS & STRATTON

- 17.1.13.1 Business overview

- 17.1.13.2 Products/Solutions/Services offered

- 17.1.13.3 Recent developments

- 17.1.13.3.1 Product launches

- 17.1.13.3.2 Deals

- 17.1.14 REHLKO

- 17.1.14.1 Business overview

- 17.1.14.2 Products/Solutions/Services offered

- 17.1.14.3 Recent development

- 17.1.14.3.1 Product launches

- 17.1.15 AKSA POWER GENERATION

- 17.1.15.1 Business overview

- 17.1.15.2 Products/Solutions/Services offered

- 17.1.1 CATERPILLAR

- 17.2 OTHER PLAYERS

- 17.2.1 HONDA INDIA POWER PRODUCTS LTD.

- 17.2.2 DOOSAN PORTABLE POWER

- 17.2.3 MULTIQUIP INC.

- 17.2.4 TAYLOR GROUP INC.

- 17.2.5 AB VOLVO PENTA

- 17.2.6 SHANGHAI NEW POWER AUTOMOTIVE TECHNOLOGY COMPANY LIMITED

- 17.2.7 DEERE & COMPANY

- 17.2.8 AGGREKO

- 17.2.9 DENYO CO., LTD

- 17.2.10 YANMAR HOLDINGS CO., LTD.

18 RESEARCH METHODOLOGY

- 18.1 RESEARCH DATA

- 18.1.1 SECONDARY AND PRIMARY RESEARCH

- 18.1.2 SECONDARY DATA

- 18.1.2.1 Key data from secondary sources

- 18.1.2.2 List of key secondary sources

- 18.1.3 PRIMARY DATA

- 18.1.3.1 Key data from primary sources

- 18.1.3.2 Key industry insights

- 18.1.3.3 List of primary interview participants

- 18.1.3.4 Breakdown of primaries

- 18.2 MARKET SIZE ESTIMATION

- 18.2.1 BOTTOM-UP APPROACH

- 18.2.2 TOP-DOWN APPROACH

- 18.3 MARKET FORECAST APPROACH

- 18.3.1 DEMAND SIDE

- 18.3.1.1 Demand-side assumptions

- 18.3.1.2 Demand-side calculations

- 18.3.2 SUPPLY SIDE

- 18.3.2.1 Supply-side assumptions

- 18.3.2.2 Supply-side calculations

- 18.3.1 DEMAND SIDE

- 18.4 DATA TRIANGULATION

- 18.5 FACTOR ANALYSIS

- 18.6 RESEARCH ASSUMPTIONS

- 18.7 RESEARCH LIMITATIONS

- 18.8 RISK ANALYSIS

19 APPENDIX

- 19.1 INSIGHTS FROM INDUSTRY EXPERTS

- 19.2 DISCUSSION GUIDE

- 19.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 19.4 CUSTOMIZATION OPTIONS

- 19.5 RELATED REPORTS

- 19.6 AUTHOR DETAILS

List of Tables

- TABLE 1 GENERATOR MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 GENERATOR MARKET SNAPSHOT

- TABLE 3 REGION-WISE DATA ON T&D INFRASTRUCTURE EXPANSION, 2014-2035

- TABLE 4 TYPES OF FUEL CELL TECHNOLOGIES

- TABLE 5 INTERCONNECTED MARKETS

- TABLE 6 KEY MOVES AND STRATEGIC FOCUS OF TIER 1/2/3 PLAYERS

- TABLE 7 IMPACT OF PORTER'S FIVE FORCES

- TABLE 8 WORLDWIDE GDP GROWTH PROJECTION, 2021-2028 (USD TRILLION)

- TABLE 9 INFLATION RATE, AVERAGE CONSUMER PRICES, AND ANNUAL PERCENTAGE CHANGE, 2024

- TABLE 10 MANUFACTURING VALUE ADDED (% OF GDP), 2023

- TABLE 11 ROLE OF COMPANIES IN GENERATOR ECOSYSTEM

- TABLE 12 AVERAGE SELLING PRICE OF GENERATORS OFFERED BY MAJOR PLAYERS, 2024 (USD/UNIT)

- TABLE 13 AVERAGE SELLING PRICE TREND OF GENERATORS, BY REGION, 2021-2024 (USD/UNIT)

- TABLE 14 EXPORT DATA FOR HS CODE 850161-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 15 IMPORT DATA FOR HS CODE 850161-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 16 EXPORT DATA FOR HS CODE 850162-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 17 IMPORT DATA FOR HS CODE 850162-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 18 EXPORT DATA FOR HS CODE 850163-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 19 IMPORT DATA FOR HS CODE 850163-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 20 LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 21 TGC DELIVERS STANDBY GENERATOR TO FUNCTION AS POWER BACKUP SYSTEM IN CANCER TREATMENT FACILITY IN LONDON

- TABLE 22 DTGEN HELPS INSTALL GENERATORS AT QUEEN ELIZABETH UNIVERSITY HOSPITAL TO IMPROVE POWER INFRASTRUCTURE

- TABLE 23 PERENNIAL BRITE GLOBAL PROVIDES HIGH-CAPACITY DIESEL GENERATOR RENTAL SERVICE TO OIL AND GAS COMPANY TO ADDRESS INCREASED POWER DEMAND

- TABLE 24 US-ADJUSTED RECIPROCAL TARIFF RATES, 2024 (USD BILLION)

- TABLE 25 LIST OF PATENTS, 2022-2023

- TABLE 26 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 27 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 28 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 29 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 30 GLOBAL: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 31 CODES AND REGULATIONS/STANDARDS

- TABLE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY DESIGN (%)

- TABLE 33 KEY BUYING CRITERIA, BY DESIGN

- TABLE 34 GENERATOR MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 35 GENERATOR MARKET, BY FUEL TYPE, 2025-2030 (USD MILLION)

- TABLE 36 DIESEL: GENERATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 37 DIESEL: GENERATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 GAS: GENERATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 39 GAS: GENERATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 LPG: GENERATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 41 LPG: GENERATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 BIOFUELS: GENERATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 43 BIOFUELS: GENERATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 COAL GAS: GENERATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 45 COAL GAS: GENERATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 GASOLINE: GENERATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 47 GASOLINE: GENERATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 PRODUCER GAS: GENERATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 49 PRODUCER GAS: GENERATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 FUEL CELLS: GENERATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 51 FUEL CELLS: GENERATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 GENERATOR MARKET, BY DESIGN, 2021-2024 (USD MILLION)

- TABLE 53 GENERATOR MARKET, BY DESIGN, 2025-2030 (USD MILLION)

- TABLE 54 STATIONARY: GENERATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 55 STATIONARY: GENERATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 PORTABLE: GENERATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 57 PORTABLE: GENERATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 GENERATOR MARKET, BY POWER RATING, 2021-2024 (USD MILLION)

- TABLE 59 GENERATOR MARKET, BY POWER RATING, 2025-2030 (USD MILLION)

- TABLE 60 UP TO 50 KW: GENERATOR MARKET, BY POWER RATING TYPE, 2021-2024 (USD MILLION)

- TABLE 61 UP TO 50 KW: GENERATOR MARKET, BY POWER RATING TYPE, 2025-2030 (USD MILLION)

- TABLE 62 UP TO 50 KW: GENERATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 63 UP TO 50 KW: GENERATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 64 51-280 KW: GENERATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 65 51-280 KW: GENERATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 66 281-500 KW: GENERATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 67 281-500 KW: GENERATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 501-2,000 KW: GENERATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 69 501-2,000 KW: GENERATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 2,001-3,500 KW: GENERATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 71 2,001-3,500 KW: GENERATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 ABOVE 3,500 KW: GENERATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 73 ABOVE 3,500 KW: GENERATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 74 GENERATOR MARKET, BY SALES CHANNEL, 2021-2024 (USD MILLION)

- TABLE 75 GENERATOR MARKET, BY SALES CHANNEL, 2025-2030 (USD MILLION)

- TABLE 76 DIRECT: GENERATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 77 DIRECT: GENERATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 INDIRECT: GENERATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 79 INDIRECT: GENERATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 80 GENERATOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 81 GENERATOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 82 STANDBY: GENERATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 83 STANDBY: GENERATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 84 PRIME & CONTINUOUS: GENERATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 85 PRIME & CONTINUOUS: GENERATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 86 PEAK SHAVING: GENERATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 87 PEAK SHAVING: GENERATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 88 GENERATOR MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 89 GENERATOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 90 INDUSTRIAL: GENERATOR MARKET, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 91 INDUSTRIAL: GENERATOR MARKET, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 92 INDUSTRIAL: GENERATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 93 INDUSTRIAL: GENERATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 94 UTILITIES/POWER GENERATION: GENERATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 95 UTILITIES/POWER GENERATION: GENERATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 96 OIL & GAS: GENERATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 97 OIL & GAS: GENERATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 98 CHEMICALS & PETROCHEMICALS: GENERATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 99 CHEMICALS & PETROCHEMICALS: GENERATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 100 METALS & MINING: GENERATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 101 METALS & MINING: GENERATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 102 MANUFACTURING: GENERATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 103 MANUFACTURING: GENERATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 104 MARINE: GENERATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 105 MARINE: GENERATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 106 CONSTRUCTION: GENERATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 107 CONSTRUCTION: GENERATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 108 OTHER INDUSTRIAL END USERS: GENERATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 109 OTHER INDUSTRIAL END USERS: GENERATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 110 RESIDENTIAL: GENERATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 111 RESIDENTIAL: GENERATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 112 COMMERCIAL: GENERATOR MARKET, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 113 COMMERCIAL: GENERATOR MARKET, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 114 HEALTHCARE: GENERATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 115 HEALTHCARE: GENERATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 116 IT & TELECOMMUNICATIONS: GENERATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 117 IT & TELECOMMUNICATIONS: GENERATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 118 DATA CENTERS: GENERATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 119 DATA CENTERS: GENERATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 120 OTHER COMMERCIAL END USERS: GENERATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 121 OTHER COMMERCIAL END USERS: GENERATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 122 GENERATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 123 GENERATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 124 GENERATOR MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 125 GENERATOR MARKET, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 126 NORTH AMERICA: GENERATOR MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 127 NORTH AMERICA: GENERATOR MARKET, BY FUEL TYPE, 2025-2030 (USD MILLION)

- TABLE 128 NORTH AMERICA: GENERATOR MARKET, BY POWER RATING, 2021-2024 (USD MILLION)

- TABLE 129 NORTH AMERICA: GENERATOR MARKET, BY POWER RATING, 2025-2030 (USD MILLION)

- TABLE 130 NORTH AMERICA: GENERATOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 131 NORTH AMERICA: GENERATOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 132 NORTH AMERICA: GENERATOR MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 133 NORTH AMERICA: GENERATOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 134 NORTH AMERICA: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 135 NORTH AMERICA: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 136 NORTH AMERICA: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 137 NORTH AMERICA: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 138 NORTH AMERICA: GENERATOR MARKET, BY SALES CHANNEL, 2021-2024 (USD MILLION)

- TABLE 139 NORTH AMERICA: GENERATOR MARKET, BY SALES CHANNEL, 2025-2030 (USD MILLION)

- TABLE 140 NORTH AMERICA: GENERATOR MARKET, BY DESIGN, 2021-2024 (USD MILLION)

- TABLE 141 NORTH AMERICA: GENERATOR MARKET, BY DESIGN, 2025-2030 (USD MILLION)

- TABLE 142 NORTH AMERICA: GENERATOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 143 NORTH AMERICA: GENERATOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 144 US: GENERATOR MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 145 US: GENERATOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 146 US: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 147 US: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 148 US: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 149 US: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 150 CANADA: GENERATOR MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 151 CANADA: GENERATOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 152 CANADA: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 153 CANADA: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 154 CANADA: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 155 CANADA: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 156 MEXICO: GENERATOR MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 157 MEXICO: GENERATOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 158 MEXICO: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 159 MEXICO: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 160 MEXICO: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 161 MEXICO: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 162 EUROPE: GENERATOR MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 163 EUROPE: GENERATOR MARKET, BY FUEL TYPE, 2025-2030 (USD MILLION)

- TABLE 164 EUROPE: GENERATOR MARKET, BY POWER RATING, 2021-2024 (USD MILLION)

- TABLE 165 EUROPE: GENERATOR MARKET, BY POWER RATING, 2025-2030 (USD MILLION)

- TABLE 166 EUROPE: GENERATOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 167 EUROPE: GENERATOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 168 EUROPE: GENERATOR MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 169 EUROPE: GENERATOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 170 EUROPE: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 171 EUROPE: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 172 EUROPE: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 173 EUROPE: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 174 EUROPE: GENERATOR MARKET, BY SALES CHANNEL, 2021-2024 (USD MILLION)

- TABLE 175 EUROPE: GENERATOR MARKET, BY SALES CHANNEL, 2025-2030 (USD MILLION)

- TABLE 176 EUROPE: GENERATOR MARKET, BY DESIGN, 2021-2024 (USD MILLION)

- TABLE 177 EUROPE: GENERATOR MARKET, BY DESIGN, 2025-2030 (USD MILLION)

- TABLE 178 EUROPE: GENERATOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 179 EUROPE: GENERATOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 180 GERMANY: GENERATOR MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 181 GERMANY: GENERATOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 182 GERMANY: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 183 GERMANY: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 184 GERMANY: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 185 GERMANY: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 186 RUSSIA: GENERATOR MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 187 RUSSIA: GENERATOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 188 RUSSIA: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 189 RUSSIA: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 190 RUSSIA: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 191 RUSSIA: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 192 FRANCE: GENERATOR MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 193 FRANCE: GENERATOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 194 FRANCE: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 195 FRANCE: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 196 FRANCE: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 197 FRANCE: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 198 UK: GENERATOR MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 199 UK: GENERATOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 200 UK: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 201 UK: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 202 UK: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 203 UK: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 204 REST OF EUROPE: GENERATOR MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 205 REST OF EUROPE: GENERATOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 206 REST OF EUROPE: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 207 REST OF EUROPE: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 208 REST OF EUROPE: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 209 REST OF EUROPE: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 210 ASIA PACIFIC: GENERATOR MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 211 ASIA PACIFIC: GENERATOR MARKET, BY FUEL TYPE, 2025-2030 (USD MILLION)

- TABLE 212 ASIA PACIFIC: GENERATOR MARKET, BY POWER RATING, 2021-2024 (USD MILLION)

- TABLE 213 ASIA PACIFIC: GENERATOR MARKET, BY POWER RATING, 2025-2030 (USD MILLION)

- TABLE 214 ASIA PACIFIC: GENERATOR MARKET FOR UP TO 50 KW, BY POWER RATING TYPE, 2021-2024 (USD MILLION)

- TABLE 215 ASIA PACIFIC: GENERATOR MARKET FOR UP TO 50 KW, BY POWER RATING TYPE, 2025-2030 (USD MILLION)

- TABLE 216 ASIA PACIFIC: GENERATOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 217 ASIA PACIFIC: GENERATOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 218 ASIA PACIFIC: GENERATOR MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 219 ASIA PACIFIC: GENERATOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 220 ASIA PACIFIC: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 221 ASIA PACIFIC: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 222 ASIA PACIFIC: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 223 ASIA PACIFIC: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 224 ASIA PACIFIC: GENERATOR MARKET, BY SALES CHANNEL, 2021-2024 (USD MILLION)

- TABLE 225 ASIA PACIFIC: GENERATOR MARKET, BY SALES CHANNEL, 2025-2030 (USD MILLION)

- TABLE 226 ASIA PACIFIC: GENERATOR MARKET, BY DESIGN, 2021-2024 (USD MILLION)

- TABLE 227 ASIA PACIFIC: GENERATOR MARKET, BY DESIGN, 2025-2030 (USD MILLION)

- TABLE 228 ASIA PACIFIC: GENERATOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 229 ASIA PACIFIC: GENERATOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 230 CHINA: GENERATOR MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 231 CHINA: GENERATOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 232 CHINA: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 233 CHINA: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 234 CHINA: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 235 CHINA: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 236 INDIA: GENERATOR MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 237 INDIA: GENERATOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 238 INDIA: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 239 INDIA: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 240 INDIA: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 241 INDIA: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 242 JAPAN: GENERATOR MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 243 JAPAN: GENERATOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 244 JAPAN: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 245 JAPAN: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 246 JAPAN: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 247 JAPAN: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 248 AUSTRALIA: GENERATOR MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 249 AUSTRALIA: GENERATOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 250 AUSTRALIA: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 251 AUSTRALIA: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 252 AUSTRALIA: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 253 AUSTRALIA: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 254 SOUTH KOREA: GENERATOR MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 255 SOUTH KOREA: GENERATOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 256 SOUTH KOREA: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 257 SOUTH KOREA: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 258 SOUTH KOREA: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 259 SOUTH KOREA: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 260 NEW ZEALAND: GENERATOR MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 261 NEW ZEALAND: GENERATOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 262 NEW ZEALAND: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 263 NEW ZEALAND: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 264 NEW ZEALAND: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 265 NEW ZEALAND: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 266 INDONESIA: GENERATOR MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 267 INDONESIA: GENERATOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 268 INDONESIA: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 269 INDONESIA: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 270 INDONESIA: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 271 INDONESIA: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 272 REST OF ASIA PACIFIC: GENERATOR MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 273 REST OF ASIA PACIFIC: GENERATOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 274 REST OF ASIA PACIFIC: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 275 REST OF ASIA PACIFIC: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 276 REST OF ASIA PACIFIC: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 277 REST OF ASIA PACIFIC: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 278 MIDDLE EAST & AFRICA: GENERATOR MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 279 MIDDLE EAST & AFRICA: GENERATOR MARKET, BY FUEL TYPE, 2025-2030 (USD MILLION)

- TABLE 280 MIDDLE EAST & AFRICA: GENERATOR MARKET, BY POWER RATING, 2021-2024 (USD MILLION)

- TABLE 281 MIDDLE EAST & AFRICA: GENERATOR MARKET, BY POWER RATING, 2025-2030 (USD MILLION)

- TABLE 282 MIDDLE EAST & AFRICA: GENERATOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 283 MIDDLE EAST & AFRICA: GENERATOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 284 MIDDLE EAST & AFRICA: GENERATOR MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 285 MIDDLE EAST & AFRICA: GENERATOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 286 MIDDLE EAST & AFRICA: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 287 MIDDLE EAST & AFRICA: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 288 MIDDLE EAST & AFRICA: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 289 MIDDLE EAST & AFRICA: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 290 MIDDLE EAST & AFRICA: GENERATOR MARKET, BY SALES CHANNEL, 2021-2024 (USD MILLION)

- TABLE 291 MIDDLE EAST & AFRICA: GENERATOR MARKET, BY SALES CHANNEL, 2025-2030 (USD MILLION)

- TABLE 292 MIDDLE EAST & AFRICA: GENERATOR MARKET, BY DESIGN, 2021-2024 (USD MILLION)

- TABLE 293 MIDDLE EAST & AFRICA: GENERATOR MARKET, BY DESIGN, 2025-2030 (USD MILLION)

- TABLE 294 MIDDLE EAST & AFRICA: GENERATOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 295 MIDDLE EAST & AFRICA: GENERATOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 296 GCC: GENERATOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 297 GCC: GENERATOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 298 SAUDI ARABIA: GENERATOR MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 299 SAUDI ARABIA: GENERATOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 300 SAUDI ARABIA: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 301 SAUDI ARABIA: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 302 SAUDI ARABIA: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 303 SAUDI ARABIA: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 304 UAE: GENERATOR MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 305 UAE: GENERATOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 306 UAE: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 307 UAE: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 308 UAE: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 309 UAE: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 310 REST OF GCC: GENERATOR MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 311 REST OF GCC: GENERATOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 312 REST OF GCC: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 313 REST OF GCC: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 314 REST OF GCC: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 315 REST OF GCC: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 316 SOUTH AFRICA: GENERATOR MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 317 SOUTH AFRICA: GENERATOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 318 SOUTH AFRICA: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 319 SOUTH AFRICA: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 320 SOUTH AFRICA: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 321 SOUTH AFRICA: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 322 NIGERIA: GENERATOR MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 323 NIGERIA: GENERATOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 324 NIGERIA: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 325 NIGERIA: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 326 NIGERIA: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 327 NIGERIA: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 328 ALGERIA: GENERATOR MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 329 ALGERIA: GENERATOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 330 ALGERIA: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 331 ALGERIA: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 332 ALGERIA: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 333 ALGERIA: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 334 REST OF MIDDLE EAST & AFRICA: GENERATOR MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 335 REST OF MIDDLE EAST & AFRICA: GENERATOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 336 REST OF MIDDLE EAST & AFRICA: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 337 REST OF MIDDLE EAST & AFRICA: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 338 REST OF MIDDLE EAST & AFRICA: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 339 REST OF MIDDLE EAST & AFRICA: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 340 SOUTH AMERICA: GENERATOR MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 341 SOUTH AMERICA: GENERATOR MARKET, BY FUEL TYPE, 2025-2030 (USD MILLION)

- TABLE 342 SOUTH AMERICA: GENERATOR MARKET, BY POWER RATING, 2021-2024 (USD MILLION)

- TABLE 343 SOUTH AMERICA: GENERATOR MARKET, BY POWER RATING, 2025-2030 (USD MILLION)

- TABLE 344 SOUTH AMERICA: GENERATOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 345 SOUTH AMERICA: GENERATOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 346 SOUTH AMERICA: GENERATOR MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 347 SOUTH AMERICA: GENERATOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 348 SOUTH AMERICA: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 349 SOUTH AMERICA: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 350 SOUTH AMERICA: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 351 SOUTH AMERICA: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 352 SOUTH AMERICA: GENERATOR MARKET, BY SALES CHANNEL, 2021-2024 (USD MILLION)

- TABLE 353 SOUTH AMERICA: GENERATOR MARKET, BY SALES CHANNEL, 2025-2030 (USD MILLION)

- TABLE 354 SOUTH AMERICA: GENERATOR MARKET, BY DESIGN, 2021-2024 (USD MILLION)

- TABLE 355 SOUTH AMERICA: GENERATOR MARKET, BY DESIGN, 2025-2030 (USD MILLION)

- TABLE 356 SOUTH AMERICA: GENERATOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 357 SOUTH AMERICA: GENERATOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 358 BRAZIL: GENERATOR MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 359 BRAZIL: GENERATOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 360 BRAZIL: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 361 BRAZIL: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 362 BRAZIL: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 363 BRAZIL: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 364 ARGENTINA: GENERATOR MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 365 ARGENTINA: GENERATOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 366 ARGENTINA: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 367 ARGENTINA: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 368 ARGENTINA: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 369 ARGENTINA: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 370 REST OF SOUTH AMERICA: GENERATOR MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 371 REST OF SOUTH AMERICA: GENERATOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 372 REST OF SOUTH AMERICA: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 373 REST OF SOUTH AMERICA: GENERATOR MARKET FOR INDUSTRIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 374 REST OF SOUTH AMERICA: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2021-2024 (USD MILLION)

- TABLE 375 REST OF SOUTH AMERICA: GENERATOR MARKET FOR COMMERCIAL, BY END USER TYPE, 2025-2030 (USD MILLION)

- TABLE 376 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS, JANUARY 2021-SEPTEMBER 2025

- TABLE 377 GENERATOR MARKET: DEGREE OF COMPETITION, 2024

- TABLE 378 GENERATOR MARKET: REGION FOOTPRINT

- TABLE 379 GENERATOR MARKET: FUEL TYPE FOOTPRINT

- TABLE 380 GENERATOR MARKET: APPLICATION FOOTPRINT

- TABLE 381 GENERATOR MARKET: END USER FOOTPRINT

- TABLE 382 GENERATOR MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 383 GENERATOR MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 384 GENERATOR MARKET: PRODUCT LAUNCHES, JANUARY 2021-SEPTEMBER 2025

- TABLE 385 GENERATOR MARKET: DEALS, JANUARY 2021-SEPTEMBER 2025

- TABLE 386 GENERATOR MARKET: OTHER DEVELOPMENTS, JANUARY 2021-SEPTEMBER 2025

- TABLE 387 CATERPILLAR: COMPANY OVERVIEW

- TABLE 388 CATERPILLAR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 389 CATERPILLAR: PRODUCT LAUNCHES

- TABLE 390 CATERPILLAR: DEALS

- TABLE 391 CATERPILLAR: OTHER DEVELOPMENTS

- TABLE 392 CUMMINS INC.: COMPANY OVERVIEW

- TABLE 393 CUMMINS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 394 CUMMINS INC.: PRODUCT LAUNCHES

- TABLE 395 CUMMINS INC.: DEALS

- TABLE 396 CUMMINS INC.: OTHER DEVELOPMENTS

- TABLE 397 MITSUBISHI HEAVY INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 398 MITSUBISHI HEAVY INDUSTRIES, LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 399 MITSUBISHI HEAVY INDUSTRIES, LTD.: PRODUCT LAUNCHES

- TABLE 400 MITSUBISHI HEAVY INDUSTRIES, LTD.: OTHER DEVELOPMENTS

- TABLE 401 ROLLS-ROYCE PLC: COMPANY OVERVIEW

- TABLE 402 ROLLS-ROYCE PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 403 ROLLS-ROYCE PLC: PRODUCT LAUNCHES

- TABLE 404 ROLLS-ROYCE PLC: DEALS

- TABLE 405 ROLLS-ROYCE PLC: OTHER DEVELOPMENTS

- TABLE 406 GENERAC POWER SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 407 GENERAC POWER SYSTEMS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 408 GENERAC POWER SYSTEMS, INC.: PRODUCT LAUNCHES

- TABLE 409 GENERAC POWER SYSTEMS, INC.: DEALS

- TABLE 410 WARTSILA: COMPANY OVERVIEW

- TABLE 411 WARTSILA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 412 WARTSILA: DEVELOPMENTS

- TABLE 413 WACKER NEUSON SE: COMPANY OVERVIEW

- TABLE 414 WACKER NEUSON SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 415 WACKER NEUSON SE: PRODUCT LAUNCHES

- TABLE 416 SIEMENS ENERGY: COMPANY OVERVIEW

- TABLE 417 SIEMENS ENERGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 418 SIEMENS ENERGY: DEVELOPMENTS

- TABLE 419 ATLAS COPCO AB: COMPANY OVERVIEW

- TABLE 420 ATLAS COPCO AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 421 ATLAS COPCO AB: DEALS

- TABLE 422 KIRLOSKAR: COMPANY OVERVIEW

- TABLE 423 KIRLOSKAR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 424 KIRLOSKAR: PRODUCT LAUNCHES

- TABLE 425 GREAVES COTTON LIMITED: COMPANY OVERVIEW

- TABLE 426 GREAVES COTTON LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 427 EVERLLENCE: COMPANY OVERVIEW

- TABLE 428 EVERLLENCE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 429 BRIGGS & STRATTON: COMPANY OVERVIEW

- TABLE 430 BRIGGS & STRATTON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 431 BRIGGS & STRATTON: PRODUCT LAUNCHES

- TABLE 432 BRIGGS & STRATTON: DEALS

- TABLE 433 REHLKO: COMPANY OVERVIEW

- TABLE 434 REHLKO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 435 REHLKO: PRODUCT LAUNCHES

- TABLE 436 AKSA POWER GENERATION: COMPANY OVERVIEW

- TABLE 437 AKSA POWER GENERATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 438 HONDA INDIA POWER PRODUCTS LTD.: COMPANY OVERVIEW

- TABLE 439 DOOSAN PORTABLE POWER: COMPANY OVERVIEW

- TABLE 440 MULTIQUIP INC.: COMPANY OVERVIEW

- TABLE 441 TAYLOR GROUP INC.: COMPANY OVERVIEW

- TABLE 442 AB VOLVO PENTA: COMPANY OVERVIEW

- TABLE 443 SHANGHAI NEW POWER AUTOMOTIVE TECHNOLOGY COMPANY LIMITED: COMPANY OVERVIEW

- TABLE 444 DEERE & COMPANY: COMPANY OVERVIEW

- TABLE 445 AGGREKO: COMPANY OVERVIEW

- TABLE 446 DENYO CO., LTD: COMPANY OVERVIEW

- TABLE 447 YANMAR HOLDINGS CO., LTD.: COMPANY OVERVIEW

- TABLE 448 MAJOR SECONDARY SOURCES

- TABLE 449 DATA CAPTURED FROM PRIMARY SOURCES

- TABLE 450 PRIMARY INTERVIEW PARTICIPANTS

- TABLE 451 GENERATOR MARKET: RISK ANALYSIS

List of Figures

- FIGURE 1 GENERATOR MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 GENERATOR MARKET: DURATION COVERED

- FIGURE 3 ASIA PACIFIC HELD LARGEST SHARE OF GENERATOR MARKET IN 2024

- FIGURE 4 DIESEL SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025 AND 2030

- FIGURE 5 STANDBY SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 6 INDUSTRIAL SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2025

- FIGURE 7 INDIRECT SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2030

- FIGURE 8 STATIONARY SEGMENT TO HOLD LARGER SHARE OF GENERATOR MARKET IN 2030

- FIGURE 9 51-280 KW SEGMENT TO DOMINATE MARKET BETWEEN 2025 AND 2030

- FIGURE 10 EXPANDING MANUFACTURING SECTOR AND RAPID INDUSTRIALIZATION TO OFFER LUCRATIVE MARKET GROWTH OPPORTUNITIES

- FIGURE 11 INDUSTRIAL SEGMENT AND CHINA CAPTURED LARGEST SHARE OF ASIA PACIFIC GENERATOR MARKET IN 2024

- FIGURE 12 DIESEL SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 13 STANDBY SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 14 RESIDENTIAL SEGMENT TO CAPTURE LARGEST SHARE OF GENERATOR MARKET IN 2030

- FIGURE 15 INDIRECT SEGMENT TO ACCOUNT FOR LARGER SHARE OF GENERATOR MARKET IN 2030

- FIGURE 16 STATIONARY SEGMENT TO HOLD LARGER MARKET SHARE IN 2030

- FIGURE 17 51-280 KW SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2030

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 NET ELECTRICITY GENERATION IN US, 2024

- FIGURE 20 CARBON DIOXIDE EMISSION FROM ENERGY COMBUSTION AND INDUSTRIAL PROCESSES, 2000-2024

- FIGURE 21 WEATHER-RELATED POWER OUTAGES IN US, 2000-2023

- FIGURE 22 DIESEL PRICES IN US AND EUROPE, 2019-2024

- FIGURE 23 GLOBAL INVESTMENT IN CLEAN ENERGY, 2018-2025

- FIGURE 24 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 25 VALUE CHAIN ANALYSIS

- FIGURE 26 GENERATOR ECOSYSTEM ANALYSIS

- FIGURE 27 AVERAGE SELLING PRICE OF GENERATORS PROVIDED BY KEY PLAYERS, BY POWER RATING, 2024

- FIGURE 28 AVERAGE SELLING PRICE TREND OF GENERATORS IN DIFFERENT REGIONS, 2021-2024

- FIGURE 29 EXPORT DATA FOR HS CODE 850161-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2021-2024

- FIGURE 30 IMPORT DATA FOR HS CODE 850161-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2021-2024

- FIGURE 31 EXPORT DATA FOR HS CODE 850162-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2021-2024

- FIGURE 32 IMPORT DATA FOR HS CODE 850162-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2021-2024

- FIGURE 33 EXPORT DATA FOR HS CODE 850163-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2021-2024

- FIGURE 34 IMPORT DATA FOR HS CODE 850163-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2021-2024

- FIGURE 35 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 36 INVESTMENT AND FUNDING SCENARIO

- FIGURE 37 PATENTS APPLIED AND GRANTED, 2013-2024

- FIGURE 38 IMPACT OF GEN AI/AI, BY END USER AND REGION

- FIGURE 39 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY DESIGN

- FIGURE 40 KEY BUYING CRITERIA, BY DESIGN

- FIGURE 41 GENERATOR MARKET SHARE, BY FUEL TYPE, 2024

- FIGURE 42 GENERATOR MARKET SHARE, BY DESIGN, 2024

- FIGURE 43 GENERATOR MARKET SHARE, BY POWER RATING, 2024

- FIGURE 44 GENERATOR MARKET SHARE, BY SALES CHANNEL, 2024

- FIGURE 45 GENERATOR MARKET SHARE, BY APPLICATION, 2024

- FIGURE 46 GENERATOR MARKET SHARE, BY END USER, 2024

- FIGURE 47 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN GENERATOR MARKET FROM 2025 TO 2030

- FIGURE 48 GENERATOR MARKET SHARE, BY REGION, 2024

- FIGURE 49 NORTH AMERICA: GENERATOR MARKET SNAPSHOT

- FIGURE 50 ASIA PACIFIC: GENERATOR MARKET SNAPSHOT

- FIGURE 51 MARKET SHARE ANALYSIS OF COMPANIES OFFERING GENERATORS, 2024

- FIGURE 52 GENERATOR MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2024

- FIGURE 53 COMPANY VALUATION

- FIGURE 54 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 55 PRODUCT COMPARISON

- FIGURE 56 GENERATOR MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 57 GENERATOR MARKET: COMPANY FOOTPRINT

- FIGURE 58 GENERATOR MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 59 CATERPILLAR: COMPANY SNAPSHOT

- FIGURE 60 CUMMINS INC.: COMPANY SNAPSHOT

- FIGURE 61 MITSUBISHI HEAVY INDUSTRIES, LTD.: COMPANY SNAPSHOT

- FIGURE 62 ROLLS-ROYCE PLC: COMPANY SNAPSHOT

- FIGURE 63 GENERAC POWER SYSTEMS, INC.: COMPANY SNAPSHOT

- FIGURE 64 WARTSILA: COMPANY SNAPSHOT

- FIGURE 65 WACKER NEUSON SE: COMPANY SNAPSHOT

- FIGURE 66 SIEMENS ENERGY: COMPANY SNAPSHOT

- FIGURE 67 ATLAS COPCO AB: COMPANY SNAPSHOT

- FIGURE 68 KIRLOSKAR: COMPANY SNAPSHOT

- FIGURE 69 GREAVES COTTON LIMITED: COMPANY SNAPSHOT

- FIGURE 70 GENERATOR MARKET: RESEARCH DESIGN

- FIGURE 71 DATA CAPTURED FROM SECONDARY SOURCES

- FIGURE 72 CORE FINDINGS FROM INDUSTRY EXPERTS

- FIGURE 73 BREAKDOWN OF PRIMARY INTERVIEWS, BY MANUFACTURING COMPANY, ASSOCIATION, AND AGENCY

- FIGURE 74 GENERATOR MARKET: BOTTOM-UP APPROACH

- FIGURE 75 GENERATOR MARKET: TOP-DOWN APPROACH

- FIGURE 76 REGIONAL ANALYSIS

- FIGURE 77 COUNTRY-LEVEL ANALYSIS

- FIGURE 78 KEY STEPS CONSIDERED TO ASSESS SUPPLY OF GENERATORS

- FIGURE 79 GENERATOR MARKET SIZE ESTIMATION (SUPPLY SIDE)

- FIGURE 80 GENERATOR MARKET: DATA TRIANGULATION

- FIGURE 81 KEY METRICS CONSIDERED TO ANALYZE DEMAND FOR GENERATORS

- FIGURE 82 GENERATOR MARKET: RESEARCH ASSUMPTIONS

- FIGURE 83 GENERATOR MARKET: RESEARCH LIMITATIONS