PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1787262

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1787262

Liquid Biopsy Market by Product & Service (Kits, Instruments), Circulating Biomarker (ctDNA, cfDNA, CTC), Technology (NGS, PCR), Application (Lung, Breast, Prostate Cancer), Sample Type (Blood, Urine, CSF), End User (Hospitals) - Global Forecast to 2030

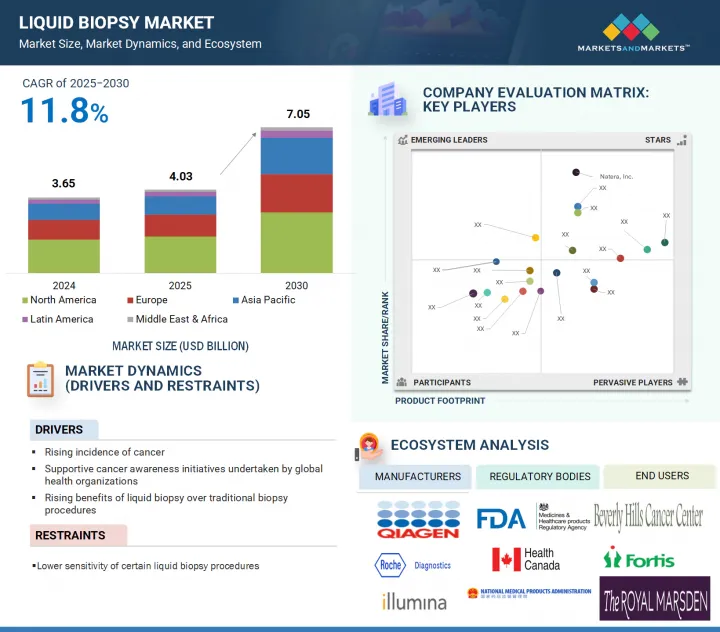

The liquid biopsy market is projected to reach USD 7.05 billion by 2030 from USD 4.03 billion in 2025, at a CAGR of 11.8% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product & Service, Circulating Biomarker Type, Technology, Application, Clinical Application, Sample Type, and End User |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Liquid biopsy offers several key advantages over traditional biopsy methods, including its non-invasive nature, lower procedural costs, the ability to monitor disease progression more easily, and the potential for detecting cancer at early stages. These benefits have contributed to growing acceptance among end users. As a result, the increasing adoption and recognition of liquid biopsy's clinical value are expected to fuel market growth during the forecast period.

By clinical application, the early cancer screening segment is expected to grow at the highest CAGR during the forecast period.

The liquid biopsy market is segmented by clinical application into early cancer screening, therapy selection, treatment monitoring, and recurrence monitoring. The early cancer screening segment is projected to register the highest CAGR during the forecast period. The high growth rate of this segment is driven by the rising incidence of cancer, the increasing importance of early disease diagnosis, and the development of effective oncology therapeutics for treatment. Rising research efforts & funding dedicated to early detection are accelerating the development of liquid biopsy technologies.

By sample type, the blood sample segment accounted for the largest market share in 2024.

Based on sample type, the liquid biopsy market is segmented into blood and other sample types. In 2024, the blood sample segment accounted for the largest share of the market. The large share of this segment is attributed to the ease of collection, minimal invasiveness, and its ability to provide comprehensive molecular insights from circulating biomarkers such as ctDNA, cfDNA, and CTCs. Blood-based sampling is safer, quicker, and more acceptable to patients than tissue biopsies, which has led to its widespread adoption in both research and diagnostics.

By region, the Asia Pacific is projected to grow at the highest CAGR during the forecast period.

The market is segmented by region into North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. The Asia Pacific region is expected to grow at the highest CAGR during the forecast period. The high growth rate of this market is driven by the increasing prevalence of cancer, the rising healthcare expenditure, expanding access to advanced diagnostics, and the growing presence of international & local diagnostic companies. Additionally, supportive government initiatives for cancer screening programs and rising awareness of non-invasive diagnostic options are expected to contribute to market growth.

The break-up of the profile of primary participants in the liquid biopsy market:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C-level - 27%, D-level - 18%, and Others - 55%

- By Region: North America - 51%, Europe - 21%, Asia Pacific - 18%, Latin America - 6%, and the Middle East & Africa- 4%

The key players in this market are Natera, Inc. (US), Guardant Health (US), Myriad Genetics, Inc. (US), Illumina, Inc. (US), F. Hoffmann-La Roche Ltd. (Switzerland), QIAGEN (Netherlands), Thermo Fisher Scientific Inc. (US), Bio-Rad Laboratories, Inc. (US), Exact Sciences Corporation (US), Sysmex Corporation (Japan), maxhealth (US), Personalis, Inc. (US), GRAIL, Inc. (US), Menarini-Silicon Biosystems (Italy), NeoGenomics. Laboratories (US), ANGLE plc (UK), Vortex Biotech Holdings (US), Bio-Techne (US), MedGenome (US), Mesa Labs, Inc. (US), Labcorp, Holdings Inc (US), Freenome, Holdings, Inc. (US), Strand (India), LungLife Al, Inc. (US), Lucence Health Inc. (US), and New Day Diagnostics, LLC (US).

Research Coverage:

This research report categorizes the liquid biopsy market by product & service (assay kits, instruments, and services), circulating biomarker type (circulating tumor cells, circulating tumor DNA, cell-free DNA, extracellular vesicles, and other circulating biomarkers), technology (multi-gene parallel analysis using NGS and single-gene analysis using PCR & microarrays), application [cancer applications (lung cancer, breast cancer, colorectal cancer, prostate cancer, melanoma, and other cancers) and non-cancer applications (non-invasive prenatal testing, organ transplantation, and infectious disease testing]), clinical application (early cancer screening, therapy selection, treatment monitoring, and recurrence monitoring), sample type (blood and other sample types), end user (reference laboratories, hospitals & physician laboratories, academic & research centers, and other end users), and region (North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa). The report's scope covers detailed information regarding the leading factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the liquid biopsy market. A thorough analysis of the key industry players has provided insights into their business overview, solutions, key strategies, acquisitions, and agreements. New product launches and recent developments associated with the liquid biopsy market. This report covers a competitive analysis of upcoming startups in the liquid biopsy market ecosystem.

Reasons to buy this report:

The report will help market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall liquid biopsy market and the subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, opportunities, and challenges.

The report provides insights into the following pointers:

- Analysis of key drivers (Rising incidence and prevalence of cancer, cancer awareness initiatives undertaken by global health organizations, and increased benefits of liquid biopsy over traditional biopsy procedures), opportunities (Growing significance of companion diagnostics and growth opportunities in emerging countries), restraints (Lower sensitivity of specific liquid biopsy procedures), and challenges (Unclear reimbursement scenario) influencing the growth of the liquid biopsy market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the liquid biopsy market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the liquid biopsy market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the liquid biopsy market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings of leading players like Natera, Inc. (US), Guardant Health (US), Myriad Genetics, Inc. (US), Illumina, Inc. (US), and F. Hoffmann-La Roche Ltd. (Switzerland).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 KEY STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.2 RESEARCH APPROACH

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key secondary sources

- 2.2.1.2 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Primary sources

- 2.2.2.2 Key data from primary sources

- 2.2.2.3 Key industry insights

- 2.2.2.4 Breakdown of primary interviews

- 2.2.1 SECONDARY DATA

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Approach 1: Company revenue estimation approach

- 2.3.1.2 Approach 2: Presentations of companies and primary interviews

- 2.3.1.3 Growth forecast

- 2.3.1.4 CAGR projections

- 2.3.2 TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.5 MARKET SHARE ASSESSMENT

- 2.6 RESEARCH ASSUMPTIONS

- 2.6.1 PARAMETRIC ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

- 2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 LIQUID BIOPSY MARKET OVERVIEW

- 4.2 LIQUID BIOPSY MARKET, BY PRODUCT & SERVICE, 2025 VS. 2030 (USD MILLION)

- 4.3 LIQUID BIOPSY MARKET, BY CIRCULATING BIOMARKER TYPE, 2025 VS. 2030 (USD MILLION)

- 4.4 LIQUID BIOPSY MARKET, BY TECHNOLOGY, 2025 VS. 2030 (USD MILLION)

- 4.5 LIQUID BIOPSY MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- 4.6 LIQUID BIOPSY MARKET, BY CLINICAL APPLICATION, 2025 VS. 2030 (USD MILLION)

- 4.7 LIQUID BIOPSY MARKET, BY SAMPLE TYPE, 2025 VS. 2030 (USD MILLION)

- 4.8 LIQUID BIOPSY MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- 4.9 LIQUID BIOPSY MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing burden of cancer

- 5.2.1.2 Cancer awareness initiatives undertaken by global health organizations

- 5.2.1.3 Expanding benefits of liquid biopsy over traditional biopsy procedures

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lower sensitivity of specific liquid biopsy procedures

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing significance of companion diagnostics

- 5.2.3.2 Growth potential of emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Unfavorable reimbursement scenario

- 5.2.1 DRIVERS

- 5.3 PRICING ANALYSIS

- 5.3.1 INDICATIVE SELLING PRICE TREND OF LIQUID BIOPSY PRODUCTS, 2023-2025

- 5.3.2 INDICATIVE SELLING PRICE TREND OF ASSAY KITS, BY KEY PLAYER, 2023-2025

- 5.3.3 INDICATIVE SELLING PRICE TREND OF LIQUID BIOPSY PRODUCTS, BY REGION, 2023-2025

- 5.4 PATENT ANALYSIS

- 5.4.1 LIST OF MAJOR PATENTS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 TRADE ANALYSIS

- 5.7.1 TRADE ANALYSIS FOR DIAGNOSTIC & LABORATORY REAGENTS

- 5.7.2 IMPORT DATA (HS CODE 3822)

- 5.7.3 EXPORT DATA (HS CODE 3822)

- 5.8 ECOSYSTEM ANALYSIS

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF BUYERS

- 5.9.4 BARGAINING POWER OF SUPPLIERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.2 NORTH AMERICA

- 5.10.2.1 US

- 5.10.2.2 Canada

- 5.10.3 EUROPE

- 5.10.4 ASIA PACIFIC

- 5.10.4.1 China

- 5.10.4.2 Japan

- 5.10.4.3 India

- 5.10.5 LATIN AMERICA

- 5.10.5.1 Brazil

- 5.10.5.2 Mexico

- 5.10.6 MIDDLE EAST

- 5.10.6.1 Africa

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 KEY TECHNOLOGIES

- 5.11.1.1 Digital Droplet PCR (ddPCR)

- 5.11.1.2 Tagged-amplicon Deep Sequencing (TAm-Seq)

- 5.11.2 COMPLEMENTARY TECHNOLOGIES

- 5.11.2.1 Electrochemical biosensing technology

- 5.11.3 ADJACENT TECHNOLOGIES

- 5.11.3.1 Microfluidic-based devices

- 5.11.1 KEY TECHNOLOGIES

- 5.12 KEY CONFERENCES & EVENTS, 2025-2026

- 5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.14 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 INVESTMENT & FUNDING SCENARIO

- 5.16 CASE STUDY ANALYSIS

- 5.16.1 CASE STUDY 1: DETECTION OF LOW-FREQUENCY MUTATIONS USING TARGET SELECTOR CTDNA TECHNOLOGY

- 5.16.2 CASE STUDY 2: ANALYTICAL ASSESSMENT OF PLASMA & SERUM FOR CTDNA MUTATION DETECTION

- 5.17 IMPACT OF AI/GENERATIVE AI ON LIQUID BIOPSY MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 MARKET POTENTIAL OF AI

- 5.17.3 AI USE CASES

- 5.17.4 FUTURE OF AI IN LIQUID BIOPSY MARKET

- 5.18 TRUMP TARIFF IMPACT ON LIQUID BIOPSY MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 KEY IMPACT ON COUNTRY/REGION

- 5.18.4.1 North America

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON END-USE INDUSTRIES

- 5.18.5.1 Reference laboratories

- 5.18.5.2 Hospitals & physicians' laboratories

- 5.18.5.3 Academic & research centers

6 LIQUID BIOPSY MARKET, BY PRODUCT & SERVICE

- 6.1 INTRODUCTION

- 6.2 ASSAY KITS

- 6.2.1 RECURRING PURCHASE TO PROPEL MARKET

- 6.3 INSTRUMENTS

- 6.3.1 RISING TECHNOLOGICAL ADVANCES IN DDPCR TO FUEL MARKET

- 6.4 SERVICES

- 6.4.1 ADOPTION OF CFDNA & CTC TESTING SERVICES TO SUPPORT MARKET GROWTH

7 LIQUID BIOPSY MARKET, BY CIRCULATING BIOMARKER TYPE

- 7.1 INTRODUCTION

- 7.2 CIRCULATING TUMOR DNA

- 7.2.1 HIGH SENSITIVITY & SPECIFICITY TO PROPEL MARKET

- 7.3 CELL-FREE DNA

- 7.3.1 BROADENING APPLICATIONS IN PRENATAL SCREENING TO DRIVE MARKET

- 7.4 CIRCULATING TUMOR CELLS

- 7.4.1 EASY COLLECTION AND PERSISTENT ASSESSMENT & ANALYSIS OF TUMORS TO FUEL MARKET

- 7.5 EXTRACELLULAR VESICLES

- 7.5.1 HIGH STABILITY IN BLOOD CIRCULATION TO ENSURE CONSISTENT GROWTH

- 7.6 OTHER CIRCULATING BIOMARKERS

8 LIQUID BIOPSY MARKET, BY TECHNOLOGY

- 8.1 INTRODUCTION

- 8.2 MULTI-GENE PARALLEL ANALYSIS USING NGS

- 8.2.1 HIGHER THROUGHPUT EFFICIENCY TO PROPEL MARKET

- 8.3 SINGLE-GENE ANALYSIS USING PCR MICROARRAYS

- 8.3.1 COST-EFFICIENCY AND EASE OF USE TO FUEL UPTAKE

9 LIQUID BIOPSY MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 CANCER APPLICATIONS

- 9.2.1 LUNG CANCER

- 9.2.1.1 Growing prevalence of lung cancer to propel market

- 9.2.2 BREAST CANCER

- 9.2.2.1 Increasing funding investments for breast cancer research to drive market

- 9.2.3 COLORECTAL CANCER

- 9.2.3.1 Rising geriatric population to fuel uptake

- 9.2.4 PROSTATE CANCER

- 9.2.4.1 Adoption of tumor cell kits to boost demand

- 9.2.5 MELANOMA

- 9.2.5.1 Growing need for early diagnosis of genetically mutated tumors to drive market

- 9.2.6 OTHER CANCERS

- 9.2.1 LUNG CANCER

- 9.3 NON-CANCER APPLICATIONS

- 9.3.1 NON-INVASIVE PRENATAL TESTING

- 9.3.1.1 Growing demand for NIPT in high-risk pregnancies to drive market

- 9.3.2 ORGAN TRANSPLANTATION

- 9.3.2.1 Early disease diagnosis & detection to support market growth

- 9.3.3 INFECTIOUS DISEASE TESTING

- 9.3.3.1 Potential accuracy & efficacy for testing to fuel uptake

- 9.3.1 NON-INVASIVE PRENATAL TESTING

10 LIQUID BIOPSY MARKET, BY CLINICAL APPLICATION

- 10.1 INTRODUCTION

- 10.2 THERAPY SELECTION

- 10.2.1 GROWING PREFERENCE FOR PERSONALIZED TREATMENT TO DRIVE MARKET

- 10.3 TREATMENT MONITORING

- 10.3.1 EARLY DETECTION OF DISEASE PROGRESSION TO BOOST DEMAND

- 10.4 EARLY CANCER SCREENING

- 10.4.1 GROWING INCIDENCE OF CANCER AND RISING FUNDING INVESTMENTS TO PROPEL MARKET

- 10.5 RECURRENCE MONITORING

- 10.5.1 RISING NEED FOR POST-TREATMENT SURVEILLANCE TO FUEL UPTAKE

11 LIQUID BIOPSY MARKET, BY SAMPLE TYPE

- 11.1 INTRODUCTION

- 11.2 BLOOD SAMPLES

- 11.2.1 STANDARD SIMPLICITY AND HIGH PATIENT ACCEPTANCE TO PROPEL MARKET

- 11.3 OTHER SAMPLE TYPES

12 LIQUID BIOPSY MARKET, BY END USER

- 12.1 INTRODUCTION

- 12.2 REFERENCE LABORATORIES

- 12.2.1 RISING OUTSOURCING OF TESTS AND ABILITY TO UNDERTAKE LARGE SAMPLE VOLUMES TO PROPEL MARKET

- 12.3 HOSPITALS & PHYSICIANS LABORATORIES

- 12.3.1 INCREASING ESTABLISHMENT OF HOSPITALS TO BOOST DEMAND

- 12.4 ACADEMIC & RESEARCH CENTERS

- 12.4.1 INCREASING R&D ACTIVITIES FOR INNOVATIVE TESTS TO SUPPORT MARKET GROWTH

- 12.5 OTHER END USERS

13 LIQUID BIOPSY MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 13.2.2 US

- 13.2.2.1 High healthcare expenditure to propel market

- 13.2.3 CANADA

- 13.2.3.1 Availability of various cancer screening programs to drive market

- 13.3 EUROPE

- 13.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 13.3.2 GERMANY

- 13.3.2.1 Favorable research funding investments for cancer research to fuel market

- 13.3.3 UK

- 13.3.3.1 NHS-funded lab-based disease screening facilities to boost demand

- 13.3.4 FRANCE

- 13.3.4.1 Growing focus on expanding access to advanced genomic technologies to drive market

- 13.3.5 ITALY

- 13.3.5.1 Development of novel circulating cancer biomarkers to support market growth

- 13.3.6 SPAIN

- 13.3.6.1 Focus on personalized medicine to support market uptake

- 13.3.7 REST OF EUROPE

- 13.4 ASIA PACIFIC

- 13.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 13.4.2 CHINA

- 13.4.2.1 Increasing incidence of infectious diseases to propel market

- 13.4.3 JAPAN

- 13.4.3.1 Universal healthcare reimbursement policy to fuel market

- 13.4.4 INDIA

- 13.4.4.1 Increasing incidence of chronic diseases and growing focus on early disease diagnosis to drive market

- 13.4.5 REST OF ASIA PACIFIC

- 13.5 LATIN AMERICA

- 13.5.1 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 13.5.2 BRAZIL

- 13.5.2.1 Improvements in laboratory infrastructure to drive market

- 13.5.3 MEXICO

- 13.5.3.1 Improving accessibility to advanced healthcare services to support market growth

- 13.5.4 REST OF LATIN AMERICA

- 13.6 MIDDLE EAST & AFRICA

- 13.6.1 INCREASING COLLABORATIONS & DEVELOPMENTS FOR ENHANCED DIAGNOSTIC ACCESS TO SUPPORT MARKET GROWTH

- 13.6.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 14.2.1 OVERVIEW OF STRATEGIES DEPLOYED BY PLAYERS IN LIQUID BIOPSY MARKET

- 14.3 REVENUE ANALYSIS, 2022-2024

- 14.4 MARKET SHARE ANALYSIS

- 14.4.1 LIQUID BIOPSY MARKET

- 14.5 COMPANY EVALUATION MATRIX: KEY PLAYERS

- 14.5.1 STARS

- 14.5.2 EMERGING LEADERS

- 14.5.3 PERVASIVE PLAYERS

- 14.5.4 PARTICIPANTS

- 14.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.5.5.1 Company footprint

- 14.5.5.2 Region footprint

- 14.5.5.3 Product & Service footprint

- 14.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES

- 14.6.1 PROGRESSIVE COMPANIES

- 14.6.2 RESPONSIVE COMPANIES

- 14.6.3 DYNAMIC COMPANIES

- 14.6.4 STARTING BLOCKS

- 14.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 14.6.5.1 Detailed list of key startups/SMEs

- 14.6.5.2 Competitive benchmarking of key startups/SMEs, by product & service

- 14.6.5.3 Competitive benchmarking of key startups/SMEs, by region

- 14.7 COMPANY VALUATION & FINANCIAL METRICS

- 14.7.1 FINANCIAL METRICS

- 14.7.2 COMPANY VALUATION

- 14.8 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 14.8.1 BRAND COMPARISON OF PCR-BASED LIQUID BIOPSY ASSAYS

- 14.8.1.1 QIAGEN N.V.

- 14.8.1.2 Thermo Fisher Scientific Inc.

- 14.8.1.3 Bio-Rad Laboratories, Inc.

- 14.8.1 BRAND COMPARISON OF PCR-BASED LIQUID BIOPSY ASSAYS

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 PRODUCT/SERVICE LAUNCHES & APPROVALS

- 14.9.2 DEALS

- 14.9.3 EXPANSIONS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 NATERA, INC.

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Services offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Product/Service launches

- 15.1.1.3.2 Deals

- 15.1.1.3.3 Other developments

- 15.1.1.4 MnM view

- 15.1.1.4.1 Key strengths

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses & competitive threats

- 15.1.2 GUARDANT HEALTH

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Services offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Product/Service launches & approvals

- 15.1.2.3.2 Deals

- 15.1.2.4 MnM view

- 15.1.2.4.1 Key strengths

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses & competitive threats

- 15.1.3 MYRIAD GENETICS, INC.

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Services offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Product/Service launches

- 15.1.3.3.2 Deals

- 15.1.3.4 MnM view

- 15.1.3.4.1 Key strengths

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses & competitive threats

- 15.1.4 ILLUMINA, INC.

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Services offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Product/Service launches & approvals

- 15.1.4.3.2 Deals

- 15.1.4.3.3 Expansions

- 15.1.4.3.4 Other developments

- 15.1.4.4 MnM view

- 15.1.4.4.1 Key strengths

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses & competitive threats

- 15.1.5 F. HOFFMANN-LA ROCHE LTD.

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Services offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Product/Service launches

- 15.1.5.3.2 Expansions

- 15.1.5.4 MnM view

- 15.1.5.4.1 Key strengths

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses & competitive threats

- 15.1.6 QIAGEN N.V.

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Services offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Product/Service launches

- 15.1.6.3.2 Deals

- 15.1.6.3.3 Expansions

- 15.1.7 EXACT SCIENCES CORPORATION

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Services offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Product/Service launches

- 15.1.7.3.2 Deals

- 15.1.8 THERMO FISHER SCIENTIFIC INC.

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Services offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Product/Service launches

- 15.1.8.3.2 Deals

- 15.1.8.3.3 Expansions

- 15.1.9 GRAIL, INC.

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Services offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Product/Service approvals

- 15.1.9.3.2 Deals

- 15.1.10 BIO-RAD LABORATORIES, INC.

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Services offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Product/Service launches

- 15.1.10.3.2 Deals

- 15.1.11 SYSMEX CORPORATION

- 15.1.11.1 Business overview

- 15.1.11.2 Products/Services offered

- 15.1.11.3 Recent developments

- 15.1.11.3.1 Deals

- 15.1.11.3.2 Expansions

- 15.1.12 MDXHEALTH

- 15.1.12.1 Business overview

- 15.1.12.2 Products/Services offered

- 15.1.12.3 Recent developments

- 15.1.12.3.1 Deals

- 15.1.13 PERSONALIS, INC.

- 15.1.13.1 Business overview

- 15.1.13.2 Products/Services offered

- 15.1.13.3 Recent developments

- 15.1.13.3.1 Product/Service launches

- 15.1.13.3.2 Deals

- 15.1.14 THE MENARINI GROUP

- 15.1.14.1 Business overview

- 15.1.14.2 Products/Services offered

- 15.1.14.3 Recent developments

- 15.1.14.3.1 Product/Service launches

- 15.1.14.3.2 Deals

- 15.1.1 NATERA, INC.

- 15.2 OTHER PLAYERS

- 15.2.1 NEOGENOMICS LABORATORIES

- 15.2.2 ANGLE PLC

- 15.2.3 LABCORP HOLDINGS INC.

- 15.2.4 BIO-TECHNE

- 15.2.5 MESA LABS, INC.

- 15.2.6 MEDGENOME

- 15.2.7 LUNGLIFE AI, INC.

- 15.2.8 STRAND

- 15.2.9 VORTEX BIOTECH HOLDINGS

- 15.2.10 FREENOME HOLDINGS, INC.

- 15.2.11 LUCENCE HEALTH INC.

- 15.2.12 NEW DAY DIAGNOSTICS, LLC

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

List of Tables

- TABLE 1 LIQUID BIOPSY MARKET: KEY DATA FROM PRIMARY SOURCES

- TABLE 2 LIQUID BIOPSY MARKET: RISK ASSESSMENT ANALYSIS

- TABLE 3 INCIDENCE OF CANCER CASES WORLDWIDE, BY TYPE (2022)

- TABLE 4 PROJECTED INCREASE IN CANCER PATIENTS, 2022 VS. 2035 VS. 2050, BY REGION

- TABLE 5 INDICATIVE SELLING PRICING TREND OF LIQUID BIOPSY PRODUCTS, 2023-2025

- TABLE 6 INDICATIVE SELLING PRICE TREND OF ASSAY KITS, BY KEY PLAYER, 2023-2025

- TABLE 7 INDICATIVE SELLING PRICE TREND OF LIQUID BIOPSY PRODUCTS, BY REGION, 2023-2025

- TABLE 8 LIQUID BIOPSY MARKET: LIST OF KEY PATENTS

- TABLE 9 IMPORT DATA (HS CODE 3822), BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 10 EXPORT DATA (HS CODE 3822), BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 11 LIQUID BIOPSY MARKET: ROLE IN THE ECOSYSTEM

- TABLE 12 LIQUID BIOPSY MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: CLASSIFICATION OF DEVICES

- TABLE 19 JAPAN: TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- TABLE 20 LIQUID BIOPSY MARKET: DETAILED LIST OF KEY CONFERENCES & EVENTS, JANUARY 2025-DECEMBER 2026

- TABLE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF LIQUID BIOPSY PRODUCTS (%)

- TABLE 22 KEY BUYING CRITERIA FOR LIQUID BIOPSY PRODUCTS, BY RANK

- TABLE 23 IMPLEMENTATION OF AI, BY KEY COMPANY & USE CASE

- TABLE 24 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 25 LIQUID BIOPSY MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 26 KEY ASSAY KITS CURRENTLY OFFERED

- TABLE 27 LIQUID BIOPSY ASSAY KITS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 28 NORTH AMERICA: LIQUID BIOPSY ASSAY KITS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 29 EUROPE: LIQUID BIOPSY ASSAY KITS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 30 ASIA PACIFIC: LIQUID BIOPSY ASSAY KITS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 31 LATIN AMERICA: LIQUID BIOPSY ASSAY KITS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 32 KEY INSTRUMENTS CURRENTLY OFFERED

- TABLE 33 LIQUID BIOPSY INSTRUMENTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 34 NORTH AMERICA: LIQUID BIOPSY INSTRUMENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 35 EUROPE: LIQUID BIOPSY INSTRUMENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 36 ASIA PACIFIC: LIQUID BIOPSY INSTRUMENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 37 LATIN AMERICA: LIQUID BIOPSY INSTRUMENTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 38 LIQUID BIOPSY SERVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 39 NORTH AMERICA: LIQUID BIOPSY SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 40 EUROPE: LIQUID BIOPSY SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 41 ASIA PACIFIC: LIQUID BIOPSY SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 42 LATIN AMERICA: LIQUID BIOPSY SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 43 LIQUID BIOPSY MARKET, BY CIRCULATING BIOMARKER TYPE, 2023-2030 (USD MILLION)

- TABLE 44 KEY CTDNA PRODUCTS CURRENTLY AVAILABLE

- TABLE 45 LIQUID BIOPSY MARKET FOR CIRCULATING TUMOR DNA, BY REGION, 2023-2030 (USD MILLION)

- TABLE 46 NORTH AMERICA: LIQUID BIOPSY MARKET FOR CIRCULATING TUMOR DNA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 47 EUROPE: LIQUID BIOPSY MARKET FOR CIRCULATING TUMOR DNA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 48 ASIA PACIFIC: LIQUID BIOPSY MARKET FOR CIRCULATING TUMOR DNA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 49 LATIN AMERICA: LIQUID BIOPSY MARKET FOR CIRCULATING TUMOR DNA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 50 KEY CELL-FREE DNA PRODUCTS CURRENTLY AVAILABLE

- TABLE 51 LIQUID BIOPSY MARKET FOR CELL-FREE DNA, BY REGION, 2023-2030 (USD MILLION)

- TABLE 52 NORTH AMERICA: LIQUID BIOPSY MARKET FOR CELL-FREE DNA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 53 EUROPE: LIQUID BIOPSY MARKET FOR CELL-FREE DNA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 54 ASIA PACIFIC: LIQUID BIOPSY MARKET FOR CELL-FREE DNA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 55 LATIN AMERICA: LIQUID BIOPSY MARKET FOR CELL-FREE DNA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 56 KEY CTC PRODUCTS CURRENTLY AVAILABLE

- TABLE 57 LIQUID BIOPSY MARKET FOR CIRCULATING TUMOR CELLS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 58 NORTH AMERICA: LIQUID BIOPSY MARKET FOR CIRCULATING TUMOR CELLS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 59 EUROPE: LIQUID BIOPSY MARKET FOR CIRCULATING TUMOR CELLS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 60 ASIA PACIFIC: LIQUID BIOPSY MARKET FOR CIRCULATING TUMOR CELLS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 61 LATIN AMERICA: LIQUID BIOPSY MARKET FOR CIRCULATING TUMOR CELLS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 62 KEY EXTRACELLULAR VESICLE PRODUCTS CURRENTLY AVAILABLE

- TABLE 63 LIQUID BIOPSY MARKET FOR EXTRACELLULAR VESICLES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 64 NORTH AMERICA: LIQUID BIOPSY MARKET FOR EXTRACELLULAR VESICLES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 65 EUROPE: LIQUID BIOPSY MARKET FOR EXTRACELLULAR VESICLES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 66 ASIA PACIFIC: LIQUID BIOPSY MARKET FOR EXTRACELLULAR VESICLES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 67 LATIN AMERICA: LIQUID BIOPSY MARKET FOR EXTRACELLULAR VESICLES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 68 OTHER CIRCULATING BIOMARKER PRODUCTS CURRENTLY AVAILABLE

- TABLE 69 LIQUID BIOPSY MARKET FOR OTHER CIRCULATING BIOMARKERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 70 NORTH AMERICA: LIQUID BIOPSY MARKET FOR OTHER CIRCULATING BIOMARKERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 71 EUROPE: LIQUID BIOPSY MARKET FOR OTHER CIRCULATING BIOMARKERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 72 ASIA PACIFIC: LIQUID BIOPSY MARKET FOR OTHER CIRCULATING BIOMARKERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 73 LATIN AMERICA: LIQUID BIOPSY MARKET FOR OTHER CIRCULATING BIOMARKERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 74 LIQUID BIOPSY MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 75 KEY NGS-BASED PRODUCTS CURRENTLY AVAILABLE

- TABLE 76 LIQUID BIOPSY MARKET FOR MULTI-GENE PARALLEL ANALYSIS USING NGS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 77 NORTH AMERICA: LIQUID BIOPSY MARKET FOR MULTI-GENE PARALLEL ANALYSIS USING NGS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 78 EUROPE: LIQUID BIOPSY MARKET FOR MULTI-GENE PARALLEL ANALYSIS USING NGS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 79 ASIA PACIFIC: LIQUID BIOPSY MARKET FOR MULTI-GENE PARALLEL ANALYSIS USING NGS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 80 LATIN AMERICA: LIQUID BIOPSY MARKET FOR MULTI-GENE PARALLEL ANALYSIS USING NGS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 81 KEY PCR & MICROARRAY-BASED PRODUCTS CURRENTLY AVAILABLE

- TABLE 82 LIQUID BIOPSY MARKET FOR SINGLE-GENE ANALYSIS USING PCR MICROARRAYS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 83 NORTH AMERICA: LIQUID BIOPSY MARKET FOR SINGLE-GENE ANALYSIS USING PCR MICROARRAYS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 84 EUROPE: LIQUID BIOPSY MARKET FOR SINGLE-GENE ANALYSIS USING PCR MICROARRAYS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 85 ASIA PACIFIC: LIQUID BIOPSY MARKET FOR SINGLE-GENE ANALYSIS USING PCR MICROARRAYS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 86 LATIN AMERICA: LIQUID BIOPSY MARKET FOR SINGLE-GENE ANALYSIS USING PCR MICROARRAYS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 87 LIQUID BIOPSY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 88 GLOBAL CANCER INCIDENCE, 2022 VS. 2035 VS. 2045, BY REGION

- TABLE 89 LIQUID BIOPSY MARKET FOR CANCER APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 90 NORTH AMERICA: LIQUID BIOPSY MARKET FOR CANCER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 91 EUROPE: LIQUID BIOPSY MARKET FOR CANCER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 92 ASIA PACIFIC: LIQUID BIOPSY MARKET FOR CANCER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 93 LATIN AMERICA: LIQUID BIOPSY MARKET FOR CANCER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 94 LIQUID BIOPSY MARKET FOR CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 95 GLOBAL LUNG CANCER INCIDENCE, 2022 VS. 2035 VS. 2050

- TABLE 96 KEY LIQUID BIOPSY PRODUCTS FOR LUNG CANCER

- TABLE 97 LIQUID BIOPSY MARKET FOR LUNG CANCER, BY REGION, 2023-2030 (USD MILLION)

- TABLE 98 NORTH AMERICA: LIQUID BIOPSY MARKET FOR LUNG CANCER, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 99 EUROPE: LIQUID BIOPSY MARKET FOR LUNG CANCER, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 100 ASIA PACIFIC: LIQUID BIOPSY MARKET FOR LUNG CANCER, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 101 LATIN AMERICA: LIQUID BIOPSY MARKET FOR LUNG CANCER, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 102 GLOBAL BREAST CANCER INCIDENCE, 2022 VS. 2035 VS. 2050

- TABLE 103 KEY LIQUID BIOPSY PRODUCTS FOR BREAST CANCER

- TABLE 104 LIQUID BIOPSY MARKET FOR BREAST CANCER, BY REGION, 2023-2030 (USD MILLION)

- TABLE 105 NORTH AMERICA: LIQUID BIOPSY MARKET FOR BREAST CANCER, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 106 EUROPE: LIQUID BIOPSY MARKET FOR BREAST CANCER, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 107 ASIA PACIFIC: LIQUID BIOPSY MARKET FOR BREAST CANCER, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 108 LATIN AMERICA: LIQUID BIOPSY MARKET FOR BREAST CANCER, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 109 GLOBAL COLORECTAL CANCER INCIDENCE, 2022 VS. 2035 VS. 2050

- TABLE 110 KEY LIQUID BIOPSY PRODUCTS FOR COLORECTAL CANCER

- TABLE 111 LIQUID BIOPSY MARKET FOR COLORECTAL CANCER, BY REGION, 2023-2030 (USD MILLION)

- TABLE 112 NORTH AMERICA: LIQUID BIOPSY MARKET FOR COLORECTAL CANCER, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 113 EUROPE: LIQUID BIOPSY MARKET FOR COLORECTAL CANCER, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 114 ASIA PACIFIC: LIQUID BIOPSY MARKET FOR COLORECTAL CANCER, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 115 LATIN AMERICA: LIQUID BIOPSY MARKET FOR COLORECTAL CANCER, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 116 GLOBAL PROSTATE CANCER INCIDENCE, 2022 VS. 2035 VS. 2050

- TABLE 117 KEY LIQUID BIOPSY PRODUCTS FOR PROSTATE CANCER

- TABLE 118 LIQUID BIOPSY MARKET FOR PROSTATE CANCER, BY REGION, 2023-2030 (USD MILLION)

- TABLE 119 NORTH AMERICA: LIQUID BIOPSY MARKET FOR PROSTATE CANCER, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 120 EUROPE: LIQUID BIOPSY MARKET FOR PROSTATE CANCER, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 121 ASIA PACIFIC: LIQUID BIOPSY MARKET FOR PROSTATE CANCER, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 122 LATIN AMERICA: LIQUID BIOPSY MARKET FOR PROSTATE CANCER, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 123 GLOBAL MELANOMA INCIDENCE, 2022 VS. 2035 VS. 2050

- TABLE 124 LIQUID BIOPSY MARKET FOR MELANOMA, BY REGION, 2023-2030 (USD MILLION)

- TABLE 125 NORTH AMERICA: LIQUID BIOPSY MARKET FOR MELANOMA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 126 EUROPE: LIQUID BIOPSY MARKET FOR MELANOMA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 127 ASIA PACIFIC: LIQUID BIOPSY MARKET FOR MELANOMA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 128 LATIN AMERICA: LIQUID BIOPSY MARKET FOR MELANOMA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 129 GLOBAL INCIDENCE OF OTHER CANCERS, 2022 VS. 2050

- TABLE 130 LIQUID BIOPSY MARKET FOR OTHER CANCERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 131 NORTH AMERICA: LIQUID BIOPSY MARKET FOR OTHER CANCERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 132 EUROPE: LIQUID BIOPSY MARKET FOR OTHER CANCERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 133 ASIA PACIFIC: LIQUID BIOPSY MARKET FOR OTHER CANCERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 134 LATIN AMERICA: LIQUID BIOPSY MARKET FOR OTHER CANCERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 135 LIQUID BIOPSY MARKET FOR NON-CANCER APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 136 LIQUID BIOPSY MARKET FOR NON-CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 137 NORTH AMERICA: LIQUID BIOPSY MARKET FOR NON-CANCER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 138 EUROPE: LIQUID BIOPSY MARKET FOR NON-CANCER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 139 ASIA PACIFIC: LIQUID BIOPSY MARKET FOR NON-CANCER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 140 LATIN AMERICA: LIQUID BIOPSY MARKET FOR NON-CANCER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 141 KEY NIPT LIQUID BIOPSY PRODUCTS

- TABLE 142 LIQUID BIOPSY MARKET FOR NIPT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 143 NORTH AMERICA: LIQUID BIOPSY MARKET FOR NIPT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 144 EUROPE: LIQUID BIOPSY MARKET FOR NIPT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 145 ASIA PACIFIC: LIQUID BIOPSY MARKET FOR NIPT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 146 LATIN AMERICA: LIQUID BIOPSY MARKET FOR NIPT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 147 LIQUID BIOPSY MARKET FOR ORGAN TRANSPLANTATION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 148 NORTH AMERICA: LIQUID BIOPSY MARKET FOR ORGAN TRANSPLANTATION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 149 EUROPE: LIQUID BIOPSY MARKET FOR ORGAN TRANSPLANTATION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 150 ASIA PACIFIC: LIQUID BIOPSY MARKET FOR ORGAN TRANSPLANTATION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 151 LATIN AMERICA: LIQUID BIOPSY MARKET FOR ORGAN TRANSPLANTATION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 152 LIQUID BIOPSY MARKET FOR INFECTIOUS DISEASE TESTING, BY REGION, 2023-2030 (USD MILLION)

- TABLE 153 NORTH AMERICA: LIQUID BIOPSY MARKET FOR INFECTIOUS DISEASE TESTING, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 154 EUROPE: LIQUID BIOPSY MARKET FOR INFECTIOUS DISEASE TESTING, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 155 ASIA PACIFIC: LIQUID BIOPSY MARKET FOR INFECTIOUS DISEASE TESTING, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 156 LATIN AMERICA: LIQUID BIOPSY MARKET FOR INFECTIOUS DISEASE TESTING, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 157 LIQUID BIOPSY MARKET, BY CLINICAL APPLICATION, 2023-2030 (USD MILLION)

- TABLE 158 LIQUID BIOPSY MARKET FOR THERAPY SELECTION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 159 NORTH AMERICA: LIQUID BIOPSY MARKET FOR THERAPY SELECTION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 160 EUROPE: LIQUID BIOPSY MARKET FOR THERAPY SELECTION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 161 ASIA PACIFIC: LIQUID BIOPSY MARKET FOR THERAPY SELECTION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 162 LATIN AMERICA: LIQUID BIOPSY MARKET FOR THERAPY SELECTION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 163 LIQUID BIOPSY MARKET FOR TREATMENT MONITORING, BY REGION, 2023-2030 (USD MILLION)

- TABLE 164 NORTH AMERICA: LIQUID BIOPSY MARKET FOR TREATMENT MONITORING, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 165 EUROPE: LIQUID BIOPSY MARKET FOR TREATMENT MONITORING, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 166 ASIA PACIFIC: LIQUID BIOPSY MARKET FOR TREATMENT MONITORING, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 167 LATIN AMERICA: LIQUID BIOPSY MARKET FOR TREATMENT MONITORING, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 168 LIQUID BIOPSY MARKET FOR EARLY CANCER SCREENING, BY REGION, 2023-2030 (USD MILLION)

- TABLE 169 NORTH AMERICA: LIQUID BIOPSY MARKET FOR EARLY CANCER SCREENING, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 170 EUROPE: LIQUID BIOPSY MARKET FOR EARLY CANCER SCREENING, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 171 ASIA PACIFIC: LIQUID BIOPSY MARKET FOR EARLY CANCER SCREENING, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 172 LATIN AMERICA: LIQUID BIOPSY MARKET FOR EARLY CANCER SCREENING, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 173 LIQUID BIOPSY MARKET FOR RECURRENCE MONITORING, BY REGION, 2023-2030 (USD MILLION)

- TABLE 174 NORTH AMERICA: LIQUID BIOPSY MARKET FOR RECURRENCE MONITORING, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 175 EUROPE: LIQUID BIOPSY MARKET FOR RECURRENCE MONITORING, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 176 ASIA PACIFIC: LIQUID BIOPSY MARKET FOR RECURRENCE MONITORING, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 177 LATIN AMERICA: LIQUID BIOPSY MARKET FOR RECURRENCE MONITORING, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 178 LIQUID BIOPSY MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 179 LIQUID BIOPSY SAMPLES & APPLICATIONS

- TABLE 180 KEY BLOOD SAMPLE-BASED PRODUCTS CURRENTLY AVAILABLE

- TABLE 181 LIQUID BIOPSY MARKET FOR BLOOD SAMPLES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 182 NORTH AMERICA: LIQUID BIOPSY MARKET FOR BLOOD SAMPLES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 183 EUROPE: LIQUID BIOPSY MARKET FOR BLOOD SAMPLES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 184 ASIA PACIFIC: LIQUID BIOPSY MARKET FOR BLOOD SAMPLES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 185 LATIN AMERICA: LIQUID BIOPSY MARKET FOR BLOOD SAMPLES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 186 LIQUID BIOPSY MARKET FOR OTHER SAMPLE TYPES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 187 NORTH AMERICA: LIQUID BIOPSY MARKET FOR OTHER SAMPLE TYPES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 188 EUROPE: LIQUID BIOPSY MARKET FOR OTHER SAMPLE TYPES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 189 ASIA PACIFIC: LIQUID BIOPSY MARKET FOR OTHER SAMPLE TYPES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 190 LATIN AMERICA: LIQUID BIOPSY MARKET FOR OTHER SAMPLE TYPES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 191 LIQUID BIOPSY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 192 LIQUID BIOPSY MARKET FOR REFERENCE LABORATORIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 193 NORTH AMERICA: LIQUID BIOPSY MARKET FOR REFERENCE LABORATORIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 194 EUROPE: LIQUID BIOPSY MARKET FOR REFERENCE LABORATORIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 195 ASIA PACIFIC: LIQUID BIOPSY MARKET FOR REFERENCE LABORATORIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 196 LATIN AMERICA: LIQUID BIOPSY MARKET FOR REFERENCE LABORATORIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 197 LIQUID BIOPSY MARKET FOR HOSPITALS & PHYSICIANS LABORATORIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 198 NORTH AMERICA: LIQUID BIOPSY MARKET FOR HOSPITALS & PHYSICIANS LABORATORIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 199 EUROPE: LIQUID BIOPSY MARKET FOR HOSPITALS & PHYSICIANS LABORATORIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 200 ASIA PACIFIC: LIQUID BIOPSY MARKET FOR HOSPITALS & PHYSICIANS LABORATORIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 201 LATIN AMERICA: LIQUID BIOPSY MARKET FOR HOSPITALS & PHYSICIANS LABORATORIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 202 LIQUID BIOPSY MARKET FOR ACADEMIC & RESEARCH CENTERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 203 NORTH AMERICA: LIQUID BIOPSY MARKET FOR ACADEMIC & RESEARCH CENTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 204 EUROPE: LIQUID BIOPSY MARKET FOR ACADEMIC & RESEARCH CENTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 205 ASIA PACIFIC: LIQUID BIOPSY MARKET FOR ACADEMIC & RESEARCH CENTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 206 LATIN AMERICA: LIQUID BIOPSY MARKET FOR ACADEMIC & RESEARCH CENTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 207 LIQUID BIOPSY MARKET FOR OTHER END USERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 208 NORTH AMERICA: LIQUID BIOPSY MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 209 EUROPE: LIQUID BIOPSY MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 210 ASIA PACIFIC: LIQUID BIOPSY MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 211 LATIN AMERICA: LIQUID BIOPSY MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 212 LIQUID BIOPSY MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 213 NORTH AMERICA: NUMBER OF NEW CANCER CASES, BY CANCER TYPE, 2022 VS. 2050

- TABLE 214 NORTH AMERICA: MACROECONOMIC INDICATORS

- TABLE 215 NORTH AMERICA: LIQUID BIOPSY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 216 NORTH AMERICA: LIQUID BIOPSY MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 217 NORTH AMERICA: LIQUID BIOPSY MARKET, BY CIRCULATING BIOMARKER TYPE, 2023-2030 (USD MILLION)

- TABLE 218 NORTH AMERICA: LIQUID BIOPSY MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 219 NORTH AMERICA: LIQUID BIOPSY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 220 NORTH AMERICA: LIQUID BIOPSY MARKET FOR CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 221 NORTH AMERICA: LIQUID BIOPSY MARKET FOR NON-CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 222 NORTH AMERICA: LIQUID BIOPSY MARKET, BY CLINICAL APPLICATION, 2023-2030 (USD MILLION)

- TABLE 223 NORTH AMERICA: LIQUID BIOPSY MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 224 NORTH AMERICA: LIQUID BIOPSY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 225 US: LIQUID BIOPSY MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 226 US: LIQUID BIOPSY MARKET, BY CIRCULATING BIOMARKER TYPE, 2023-2030 (USD MILLION)

- TABLE 227 US: LIQUID BIOPSY MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 228 US: LIQUID BIOPSY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 229 US: LIQUID BIOPSY MARKET FOR CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 230 US: LIQUID BIOPSY MARKET FOR NON-CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 231 US: LIQUID BIOPSY MARKET, BY CLINICAL APPLICATION, 2023-2030 (USD MILLION)

- TABLE 232 US: LIQUID BIOPSY MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 233 US: LIQUID BIOPSY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 234 US: TOTAL NUMBER OF WOMEN WHO UNDERGO NIPT TESTING, 2023-2030 (MILLION UNITS)

- TABLE 235 CANADA: LIQUID BIOPSY MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 236 CANADA: LIQUID BIOPSY MARKET, BY CIRCULATING BIOMARKER TYPE, 2023-2030 (USD MILLION)

- TABLE 237 CANADA: LIQUID BIOPSY MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 238 CANADA: LIQUID BIOPSY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 239 CANADA: LIQUID BIOPSY MARKET FOR CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 240 CANADA: LIQUID BIOPSY MARKET FOR NON-CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 241 CANADA: LIQUID BIOPSY MARKET, BY CLINICAL APPLICATION, 2023-2030 (USD MILLION)

- TABLE 242 CANADA: LIQUID BIOPSY MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 243 CANADA: LIQUID BIOPSY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 244 EUROPE: MACROECONOMIC INDICATORS

- TABLE 245 EUROPE: LIQUID BIOPSY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 246 EUROPE: LIQUID BIOPSY MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 247 EUROPE: LIQUID BIOPSY MARKET, BY CIRCULATING BIOMARKER TYPE, 2023-2030 (USD MILLION)

- TABLE 248 EUROPE: LIQUID BIOPSY MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 249 EUROPE: LIQUID BIOPSY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 250 EUROPE: LIQUID BIOPSY MARKET FOR CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 251 EUROPE: LIQUID BIOPSY MARKET FOR NON-CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 252 EUROPE: LIQUID BIOPSY MARKET, BY CLINICAL APPLICATION, 2023-2030 (USD MILLION)

- TABLE 253 EUROPE: LIQUID BIOPSY MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 254 EUROPE: LIQUID BIOPSY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 255 GERMANY: LIQUID BIOPSY MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 256 GERMANY: LIQUID BIOPSY MARKET, BY CIRCULATING BIOMARKER TYPE, 2023-2030 (USD MILLION)

- TABLE 257 GERMANY: LIQUID BIOPSY MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 258 GERMANY: LIQUID BIOPSY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 259 GERMANY: LIQUID BIOPSY MARKET FOR CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 260 GERMANY: LIQUID BIOPSY MARKET FOR NON-CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 261 GERMANY: LIQUID BIOPSY MARKET, BY CLINICAL APPLICATION, 2023-2030 (USD MILLION)

- TABLE 262 GERMANY: LIQUID BIOPSY MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 263 GERMANY: LIQUID BIOPSY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 264 UK: LIQUID BIOPSY MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 265 UK: LIQUID BIOPSY MARKET, BY CIRCULATING BIOMARKER TYPE, 2023-2030 (USD MILLION)

- TABLE 266 UK: LIQUID BIOPSY MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 267 UK: LIQUID BIOPSY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 268 UK: LIQUID BIOPSY MARKET FOR CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 269 UK: LIQUID BIOPSY MARKET FOR NON-CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 270 UK: LIQUID BIOPSY MARKET, BY CLINICAL APPLICATION, 2023-2030 (USD MILLION)

- TABLE 271 UK: LIQUID BIOPSY MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 272 UK: LIQUID BIOPSY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 273 FRANCE: LIQUID BIOPSY MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 274 FRANCE: LIQUID BIOPSY MARKET, BY CIRCULATING BIOMARKER TYPE, 2023-2030 (USD MILLION)

- TABLE 275 FRANCE: LIQUID BIOPSY MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 276 FRANCE: LIQUID BIOPSY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 277 FRANCE: LIQUID BIOPSY MARKET FOR CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 278 FRANCE: LIQUID BIOPSY MARKET FOR NON-CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 279 FRANCE: LIQUID BIOPSY MARKET, BY CLINICAL APPLICATION, 2023-2030 (USD MILLION)

- TABLE 280 FRANCE: LIQUID BIOPSY MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 281 FRANCE: LIQUID BIOPSY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 282 ITALY: LIQUID BIOPSY MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 283 ITALY: LIQUID BIOPSY MARKET, BY CIRCULATING BIOMARKER TYPE, 2023-2030 (USD MILLION)

- TABLE 284 ITALY: LIQUID BIOPSY MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 285 ITALY: LIQUID BIOPSY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 286 ITALY: LIQUID BIOPSY MARKET FOR CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 287 ITALY: LIQUID BIOPSY MARKET FOR NON-CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 288 ITALY: LIQUID BIOPSY MARKET, BY CLINICAL APPLICATION, 2023-2030 (USD MILLION)

- TABLE 289 ITALY: LIQUID BIOPSY MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 290 ITALY: LIQUID BIOPSY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 291 SPAIN: LIQUID BIOPSY MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 292 SPAIN: LIQUID BIOPSY MARKET, BY CIRCULATING BIOMARKER TYPE, 2023-2030 (USD MILLION)

- TABLE 293 SPAIN: LIQUID BIOPSY MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 294 SPAIN: LIQUID BIOPSY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 295 SPAIN: LIQUID BIOPSY MARKET FOR CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 296 SPAIN: LIQUID BIOPSY MARKET FOR NON-CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 297 SPAIN: LIQUID BIOPSY MARKET, BY CLINICAL APPLICATION, 2023-2030 (USD MILLION)

- TABLE 298 SPAIN: LIQUID BIOPSY MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 299 SPAIN: LIQUID BIOPSY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 300 REST OF EUROPE: LIQUID BIOPSY MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 301 REST OF EUROPE: LIQUID BIOPSY MARKET, BY CIRCULATING BIOMARKER TYPE, 2023-2030 (USD MILLION)

- TABLE 302 REST OF EUROPE: LIQUID BIOPSY MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 303 REST OF EUROPE: LIQUID BIOPSY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 304 REST OF EUROPE: LIQUID BIOPSY MARKET FOR CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 305 REST OF EUROPE: LIQUID BIOPSY MARKET FOR NON-CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 306 REST OF EUROPE: LIQUID BIOPSY MARKET, BY CLINICAL APPLICATION, 2023-2030 (USD MILLION)

- TABLE 307 REST OF EUROPE: LIQUID BIOPSY MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 308 REST OF EUROPE: LIQUID BIOPSY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 309 ASIA PACIFIC: MACROECONOMIC INDICATORS

- TABLE 310 ASIA PACIFIC: LIQUID BIOPSY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 311 ASIA PACIFIC: LIQUID BIOPSY MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 312 ASIA PACIFIC: LIQUID BIOPSY MARKET, BY CIRCULATING BIOMARKER TYPE, 2023-2030 (USD MILLION)

- TABLE 313 ASIA PACIFIC: LIQUID BIOPSY MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 314 ASIA PACIFIC: LIQUID BIOPSY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 315 ASIA PACIFIC: LIQUID BIOPSY MARKET FOR CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 316 ASIA PACIFIC: LIQUID BIOPSY MARKET FOR NON-CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 317 ASIA PACIFIC: LIQUID BIOPSY MARKET, BY CLINICAL APPLICATION, 2023-2030 (USD MILLION)

- TABLE 318 ASIA PACIFIC: LIQUID BIOPSY MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 319 ASIA PACIFIC: LIQUID BIOPSY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 320 CHINA: LIQUID BIOPSY MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 321 CHINA: LIQUID BIOPSY MARKET, BY CIRCULATING BIOMARKER TYPE, 2023-2030 (USD MILLION)

- TABLE 322 CHINA: LIQUID BIOPSY MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 323 CHINA: LIQUID BIOPSY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 324 CHINA: LIQUID BIOPSY MARKET FOR CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 325 CHINA: LIQUID BIOPSY MARKET FOR NON-CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 326 CHINA: LIQUID BIOPSY MARKET, BY CLINICAL APPLICATION, 2023-2030 (USD MILLION)

- TABLE 327 CHINA: LIQUID BIOPSY MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 328 CHINA: LIQUID BIOPSY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 329 JAPAN: LIQUID BIOPSY MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 330 JAPAN: LIQUID BIOPSY MARKET, BY CIRCULATING BIOMARKER TYPE, 2023-2030 (USD MILLION)

- TABLE 331 JAPAN: LIQUID BIOPSY MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 332 JAPAN: LIQUID BIOPSY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 333 JAPAN: LIQUID BIOPSY MARKET FOR CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 334 JAPAN: LIQUID BIOPSY MARKET FOR NON-CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 335 JAPAN: LIQUID BIOPSY MARKET, BY CLINICAL APPLICATION, 2023-2030 (USD MILLION)

- TABLE 336 JAPAN: LIQUID BIOPSY MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 337 JAPAN: LIQUID BIOPSY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 338 INDIA: LIQUID BIOPSY MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 339 INDIA: LIQUID BIOPSY MARKET, BY CIRCULATING BIOMARKER TYPE, 2023-2030 (USD MILLION)

- TABLE 340 INDIA: LIQUID BIOPSY MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 341 INDIA: LIQUID BIOPSY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 342 INDIA: LIQUID BIOPSY MARKET FOR CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 343 INDIA: LIQUID BIOPSY MARKET FOR NON-CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 344 INDIA: LIQUID BIOPSY MARKET, BY CLINICAL APPLICATION, 2023-2030 (USD MILLION)

- TABLE 345 INDIA: LIQUID BIOPSY MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 346 INDIA: LIQUID BIOPSY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 347 REST OF ASIA PACIFIC: LIQUID BIOPSY MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 348 REST OF ASIA PACIFIC: LIQUID BIOPSY MARKET, BY CIRCULATING BIOMARKER TYPE, 2023-2030 (USD MILLION)

- TABLE 349 REST OF ASIA PACIFIC: LIQUID BIOPSY MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 350 REST OF ASIA PACIFIC: LIQUID BIOPSY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 351 REST OF ASIA PACIFIC: LIQUID BIOPSY MARKET FOR CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 352 REST OF ASIA PACIFIC: LIQUID BIOPSY MARKET FOR NON-CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 353 REST OF ASIA PACIFIC: LIQUID BIOPSY MARKET, BY CLINICAL APPLICATION, 2023-2030 (USD MILLION)

- TABLE 354 REST OF ASIA PACIFIC: LIQUID BIOPSY MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 355 REST OF ASIA PACIFIC: LIQUID BIOPSY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 356 LATIN AMERICA: MACROECONOMIC INDICATORS

- TABLE 357 LATIN AMERICA: LIQUID BIOPSY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 358 LATIN AMERICA: LIQUID BIOPSY MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 359 LATIN AMERICA: LIQUID BIOPSY MARKET, BY CIRCULATING BIOMARKER TYPE, 2023-2030 (USD MILLION)

- TABLE 360 LATIN AMERICA: LIQUID BIOPSY MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 361 LATIN AMERICA: LIQUID BIOPSY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 362 LATIN AMERICA: LIQUID BIOPSY MARKET FOR CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 363 LATIN AMERICA: LIQUID BIOPSY MARKET FOR NON-CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 364 LATIN AMERICA: LIQUID BIOPSY MARKET, BY CLINICAL APPLICATION, 2023-2030 (USD MILLION)

- TABLE 365 LATIN AMERICA: LIQUID BIOPSY MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 366 LATIN AMERICA: LIQUID BIOPSY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 367 BRAZIL: LIQUID BIOPSY MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 368 BRAZIL: LIQUID BIOPSY MARKET, BY CIRCULATING BIOMARKER TYPE, 2023-2030 (USD MILLION)

- TABLE 369 BRAZIL: LIQUID BIOPSY MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 370 BRAZIL: LIQUID BIOPSY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 371 BRAZIL: LIQUID BIOPSY MARKET FOR CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 372 BRAZIL: LIQUID BIOPSY MARKET FOR NON-CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 373 BRAZIL: LIQUID BIOPSY MARKET, BY CLINICAL APPLICATION, 2023-2030 (USD MILLION)

- TABLE 374 BRAZIL: LIQUID BIOPSY MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 375 BRAZIL: LIQUID BIOPSY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 376 MEXICO: LIQUID BIOPSY MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 377 MEXICO: LIQUID BIOPSY MARKET, BY CIRCULATING BIOMARKER TYPE, 2023-2030 (USD MILLION)

- TABLE 378 MEXICO: LIQUID BIOPSY MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 379 MEXICO: LIQUID BIOPSY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 380 MEXICO: LIQUID BIOPSY MARKET FOR CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 381 MEXICO: LIQUID BIOPSY MARKET FOR NON-CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 382 MEXICO: LIQUID BIOPSY MARKET, BY CLINICAL APPLICATION, 2023-2030 (USD MILLION)

- TABLE 383 MEXICO: LIQUID BIOPSY MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 384 MEXICO: LIQUID BIOPSY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 385 REST OF LATIN AMERICA: LIQUID BIOPSY MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 386 REST OF LATIN AMERICA: LIQUID BIOPSY MARKET, BY CIRCULATING BIOMARKER TYPE, 2023-2030 (USD MILLION)

- TABLE 387 REST OF LATIN AMERICA: LIQUID BIOPSY MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 388 REST OF LATIN AMERICA: LIQUID BIOPSY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 389 REST OF LATIN AMERICA: LIQUID BIOPSY MARKET FOR CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 390 REST OF LATIN AMERICA: LIQUID BIOPSY MARKET FOR NON-CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 391 REST OF LATIN AMERICA: LIQUID BIOPSY MARKET, BY CLINICAL APPLICATION, 2023-2030 (USD MILLION)

- TABLE 392 REST OF LATIN AMERICA: LIQUID BIOPSY MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 393 REST OF LATIN AMERICA: LIQUID BIOPSY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 394 MIDDLE EAST & AFRICA: MACROECONOMIC INDICATORS

- TABLE 395 MIDDLE EAST & AFRICA: LIQUID BIOPSY MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 396 MIDDLE EAST & AFRICA: LIQUID BIOPSY MARKET, BY CIRCULATING BIOMARKER TYPE, 2023-2030 (USD MILLION)

- TABLE 397 MIDDLE EAST & AFRICA: LIQUID BIOPSY MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 398 MIDDLE EAST & AFRICA: LIQUID BIOPSY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 399 MIDDLE EAST & AFRICA: LIQUID BIOPSY MARKET FOR CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 400 MIDDLE EAST & AFRICA: LIQUID BIOPSY MARKET FOR NON-CANCER APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 401 MIDDLE EAST & AFRICA: LIQUID BIOPSY MARKET, BY CLINICAL APPLICATION, 2023-2030 (USD MILLION)

- TABLE 402 MIDDLE EAST & AFRICA: LIQUID BIOPSY MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 403 MIDDLE EAST & AFRICA: LIQUID BIOPSY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 404 OVERVIEW OF STRATEGIES DEPLOYED BY KEY COMPANIES IN LIQUID BIOPSY MARKET, JANUARY 2021-JUNE 2025

- TABLE 405 LIQUID BIOPSY MARKET: DEGREE OF COMPETITION

- TABLE 406 LIQUID BIOPSY MARKET: REGION FOOTPRINT

- TABLE 407 LIQUID BIOPSY MARKET: PRODUCT & SERVICE FOOTPRINT

- TABLE 408 LIQUID BIOPSY MARKET: APPLICATION FOOTPRINT

- TABLE 409 LIQUID BIOPSY MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 410 LIQUID BIOPSY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY PRODUCT & SERVICE

- TABLE 411 LIQUID BIOPSY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY REGION

- TABLE 412 LIQUID BIOPSY MARKET: PRODUCT/SERVICE LAUNCHES & APPROVALS, JANUARY 2021-JUNE 2025

- TABLE 413 LIQUID BIOPSY MARKET: DEALS, JANUARY 2021-JUNE 2025

- TABLE 414 LIQUID BIOPSY MARKET: EXPANSIONS, JANUARY 2021-JUNE 2025

- TABLE 415 NATERA, INC.: COMPANY OVERVIEW

- TABLE 416 NATERA, INC.: PRODUCTS/SERVICES OFFERED

- TABLE 417 NATERA, INC.: PRODUCT/SERVICE LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 418 NATERA, INC.: DEALS, JANUARY 2021-JUNE 2025

- TABLE 419 NATERA, INC.: OTHER DEVELOPMENTS, JANUARY 2021- JUNE 2025

- TABLE 420 GUARDANT HEALTH: COMPANY OVERVIEW

- TABLE 421 GUARDANT HEALTH: PRODUCTS/SERVICES OFFERED

- TABLE 422 GUARDANT HEALTH: PRODUCT/SERVICE LAUNCHES & APPROVALS, JANUARY 2021-JUNE 2025

- TABLE 423 GUARDANT HEALTH: DEALS, JANUARY 2021-JUNE 2025

- TABLE 424 MYRIAD GENETICS, INC.: COMPANY OVERVIEW

- TABLE 425 MYRIAD GENETICS, INC.: PRODUCTS/SERVICES OFFERED

- TABLE 426 MYRIAD GENETICS, INC.: PRODUCT/SERVICE LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 427 MYRIAD GENETICS, INC.: DEALS, JANUARY 2021-JUNE 2025

- TABLE 428 ILLUMINA, INC.: COMPANY OVERVIEW

- TABLE 429 ILLUMINA, INC.: PRODUCTS/SERVICES OFFERED

- TABLE 430 ILLUMINA, INC.:PRODUCT/SERVICE LAUNCHES & APPROVALS, JANUARY 2021-JUNE 2025

- TABLE 431 ILLUMINA, INC.: DEALS, JANUARY 2021-JUNE 2025

- TABLE 432 ILLUMINA, INC.: EXPANSIONS, JANUARY 2021-JUNE 2025

- TABLE 433 ILLUMINA, INC.: OTHER DEVELOPMENTS, JANUARY 2021-JUNE 2025

- TABLE 434 F. HOFFMANN-LA ROCHE LTD.: COMPANY OVERVIEW

- TABLE 435 F. HOFFMANN-LA ROCHE LTD.: PRODUCTS/SERVICES OFFERED

- TABLE 436 F. HOFFMANN-LA ROCHE LTD.: PRODUCT/SERVICE LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 437 F. HOFFMANN-LA ROCHE LTD.: EXPANSIONS, JANUARY 2021-JUNE 2025

- TABLE 438 QIAGEN N.V.: COMPANY OVERVIEW

- TABLE 439 QIAGEN N.V.: PRODUCTS/SERVICES OFFERED

- TABLE 440 QIAGEN N.V.: PRODUCT/SERVICE LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 441 QIAGEN N.V.: DEALS, JANUARY 2021-JUNE 2025

- TABLE 442 QIAGEN: EXPANSIONS, JANUARY 2021-JUNE 2025

- TABLE 443 EXACT SCIENCES CORPORATION: COMPANY OVERVIEW

- TABLE 444 EXACT SCIENCES CORPORATION: PRODUCTS/SERVICES OFFERED

- TABLE 445 EXACT SCIENCES CORPORATION: PRODUCT/SERVICE LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 446 EXACT SCIENCES CORPORATION: DEALS, JANUARY 2021-JUNE 2025

- TABLE 447 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- TABLE 448 THERMO FISHER SCIENTIFIC INC.: PRODUCTS/SERVICES OFFERED

- TABLE 449 THERMO FISHER SCIENTIFIC INC.: PRODUCT/SERVICE LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 450 THERMO FISHER SCIENTIFIC INC.: DEALS, JANUARY 2021-JUNE 2025

- TABLE 451 THERMO FISHER SCIENTIFIC INC.: EXPANSIONS, JANUARY 2021-JUNE 2025

- TABLE 452 GRAIL, INC.: COMPANY OVERVIEW

- TABLE 453 GRAIL, INC.: PRODUCTS/SERVICES OFFERED

- TABLE 454 GRAIL, INC.: PRODUCT/SERVICE APPROVALS, JANUARY 2021-JUNE 2025

- TABLE 455 GRAIL, INC.: DEALS, JANUARY 2021-JUNE 2025

- TABLE 456 BIO-RAD LABORATORIES, INC.: COMPANY OVERVIEW

- TABLE 457 BIO-RAD LABORATORIES, INC.: PRODUCTS/SERVICES OFFERED

- TABLE 458 BIO-RAD LABORATORIES, INC.: PRODUCT/SERVICE LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 459 BIO-RAD LABORATORIES, INC.: DEALS, JANUARY 2021-JUNE 2025

- TABLE 460 SYSMEX CORPORATION: COMPANY OVERVIEW

- TABLE 461 SYSMEX CORPORATION: PRODUCTS/SERVICES OFFERED

- TABLE 462 SYSMEX CORPORATION: DEALS, JANUARY 2021-JUNE 2025

- TABLE 463 SYSMEX CORPORATION: EXPANSIONS, JANUARY 2021-JUNE 2025

- TABLE 464 MDXHEALTH: COMPANY OVERVIEW

- TABLE 465 MDXHEALTH: PRODUCTS/SERVICES OFFERED

- TABLE 466 MDXHEALTH: DEALS, JANUARY 2021-JUNE 2025

- TABLE 467 PERSONALIS, INC.: COMPANY OVERVIEW

- TABLE 468 PERSONALIS, INC.: PRODUCTS/SERVICES OFFERED

- TABLE 469 PERSONALIS, INC.: PRODUCT/SERVICE LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 470 PERSONALIS, INC.: DEALS, JANUARY 2021-JUNE 2025

- TABLE 471 THE MENARINI GROUP: COMPANY OVERVIEW

- TABLE 472 THE MENARINI GROUP: PRODUCTS/SERVICES OFFERED

- TABLE 473 THE MENARINI GROUP: PRODUCT/SERVICE LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 474 THE MENARINI GROUP: DEALS, JANUARY 2021-JUNE 2025

- TABLE 475 NEOGENOMICS LABORATORIES: COMPANY OVERVIEW

- TABLE 476 ANGLE PLC: COMPANY OVERVIEW

- TABLE 477 LABCORP HOLDINGS INC.: COMPANY OVERVIEW

- TABLE 478 BIO-TECHNE: COMPANY OVERVIEW

- TABLE 479 MESA LABS, INC.: COMPANY OVERVIEW

- TABLE 480 MEDGENOME: COMPANY OVERVIEW

- TABLE 481 LUNGLIFE AI, INC.: COMPANY OVERVIEW

- TABLE 482 STRAND: COMPANY OVERVIEW

- TABLE 483 VORTEX BIOTECH HOLDINGS: COMPANY OVERVIEW

- TABLE 484 FREENOME HOLDINGS, INC.: COMPANY OVERVIEW

- TABLE 485 LUCENCE HEALTH INC.: COMPANY OVERVIEW

- TABLE 486 NEW DAY DIAGNOSTICS, LLC: COMPANY OVERVIEW

List of Figures

- FIGURE 1 LIQUID BIOPSY MARKET SEGMENTATION & REGIONAL SCOPE

- FIGURE 2 LIQUID BIOPSY MARKET: RESEARCH DESIGN METHODOLOGY

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 BOTTOM-UP APPROACH: COMPANY REVENUE ESTIMATION APPROACH

- FIGURE 6 CAGR PROJECTIONS: SUPPLY SIDE ANALYSIS

- FIGURE 7 LIQUID BIOPSY MARKET: TOP-DOWN APPROACH

- FIGURE 8 DATA TRIANGULATION METHODOLOGY

- FIGURE 9 LIQUID BIOPSY MARKET: PARAMETRIC ASSUMPTIONS ANALYSIS

- FIGURE 10 LIQUID BIOPSY MARKET, BY PRODUCT & SERVICE, 2025 VS. 2030 (USD MILLION)

- FIGURE 11 LIQUID BIOPSY MARKET, BY CIRCULATING BIOMARKER TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 12 LIQUID BIOPSY MARKET, BY TECHNOLOGY, 2025 VS. 2030 (USD MILLION)

- FIGURE 13 LIQUID BIOPSY MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 LIQUID BIOPSY MARKET, BY CLINICAL APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 15 LIQUID BIOPSY MARKET, BY SAMPLE TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 16 LIQUID BIOPSY MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 17 LIQUID BIOPSY MARKET, BY REGION, 2025 VS. 2030 (USD MILLION)

- FIGURE 18 INCREASING INCIDENCE OF CANCER AND ADVANCES IN LIQUID BIOPSY TECHNOLOGIES TO PROPEL MARKET

- FIGURE 19 ASSAY KITS SEGMENT IS EXPECTED TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 20 CIRCULATING TUMOR DNA SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 21 MULTI-GENE PARALLEL ANALYSIS USING NGS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 22 CANCER APPLICATIONS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 23 THERAPY SELECTION SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 24 BLOOD SAMPLES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 25 REFERENCE LABORATORIES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 26 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 27 LIQUID BIOPSY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 28 PATENT ANALYSIS FOR LIQUID BIOPSY (JANUARY 2015-DECEMBER 2024)

- FIGURE 29 VALUE CHAIN ANALYSIS OF LIQUID BIOPSY MARKET: MAJOR VALUE-ADDED DURING MANUFACTURING & ASSEMBLY PHASES

- FIGURE 30 LIQUID BIOPSY MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 31 LIQUID BIOPSY MARKET: ECOSYSTEM ANALYSIS

- FIGURE 32 LIQUID BIOPSY MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 33 LIQUID BIOPSY MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR LIQUID BIOPSY PRODUCTS

- FIGURE 35 KEY BUYING CRITERIA FOR LIQUID BIOPSY PRODUCTS

- FIGURE 36 NUMBER OF DEALS & FUNDING ACTIVITIES IN LIQUID BIOPSY MARKET

- FIGURE 37 MARKET POTENTIAL OF AI IN LIQUID BIOPSY MARKET

- FIGURE 38 NORTH AMERICA: LIQUID BIOPSY MARKET SNAPSHOT

- FIGURE 39 ASIA PACIFIC: LIQUID BIOPSY MARKET SNAPSHOT

- FIGURE 40 REVENUE ANALYSIS OF LEADING FIVE PLAYERS, 2022-2024

- FIGURE 41 MARKET SHARE ANALYSIS OF KEY PLAYERS (2024)

- FIGURE 42 LIQUID BIOPSY MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 43 LIQUID BIOPSY MARKET: COMPANY FOOTPRINT

- FIGURE 44 LIQUID BIOPSY MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 45 EV/EBITDA OF KEY VENDORS

- FIGURE 46 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 47 BRAND COMPARISON: PCR-BASED LIQUID BIOPSY ASSAYS

- FIGURE 48 NATERA, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 49 GUARDANT HEALTH: COMPANY SNAPSHOT (2024)

- FIGURE 50 MYRIAD GENETICS, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 51 ILLUMINA, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 52 F. HOFFMANN-LA ROCHE LTD.: COMPANY SNAPSHOT (2024)

- FIGURE 53 QIAGEN N.V.: COMPANY SNAPSHOT (2024)

- FIGURE 54 EXACT SCIENCES CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 55 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2024)

- FIGURE 56 GRAIL, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 57 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 58 SYSMEX CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 59 MDXHEALTH: COMPANY SNAPSHOT (2024)

- FIGURE 60 PERSONALIS, INC.: COMPANY SNAPSHOT (2024)