PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1829985

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1829985

Battery Technology Market by Type (Lithium-ion Battery, Lead Acid, NiMh, NiCd, Sodium-ion, Solid-state Battery, Redox Flow Battery, Lithium Silicon, Lithium Sulfur Battery), Li-ion Battery Type (LFP, NMC, LCO, LTO, LMO, NCA) - Global Forecast to 2030

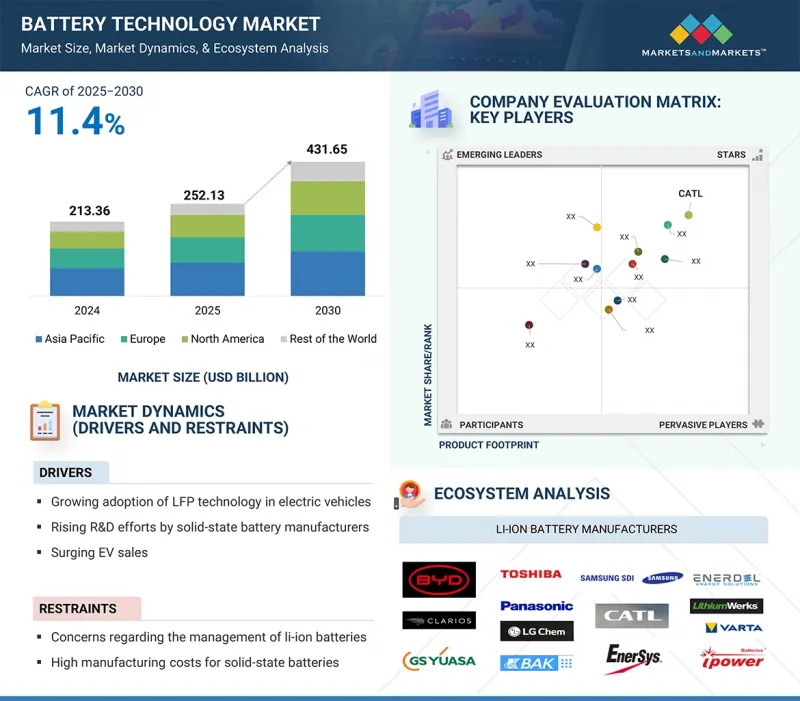

With a CAGR of 11.4%, the global battery technology market is projected to increase from USD 252.13 billion in 2025 to USD 431.65 billion by 2030. Growth is fueled by batteries' critical role in enabling electrification across mobility, energy, and industrial sectors. In transportation, rising electric vehicle adoption and the rollout of charging infrastructure are creating large-scale demand for advanced storage solutions. In the energy sector, utilities and renewable developers invest in large battery systems to stabilize grids, manage peak loads, and support solar and wind integration. Consumer electronics and industrial applications strengthen demand, where portable power and backup systems are essential for performance and reliability.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Battery Type and Region |

| Regions covered | North America, Europe, APAC, RoW |

The market includes various technologies such as lithium-ion, lead acid, nickel-based, flow, solid-state, and sodium-ion, each suited to specific operating conditions and cost requirements. Continuous improvements in energy density, cycle life, and safety, alongside investments in recycling and second-life use, are accelerating adoption. As global industries shift toward low-carbon and digitalized operations, batteries emerge as indispensable assets for powering sustainable growth and resilient energy infrastructure.

" Flow Battery Segment to Grow with a Significant CAGR in the Battery Technology Market."

The flow battery segment in the battery technology market is expected to grow with a significant CAGR during the forecast period, driven by its ability to provide scalable and long-duration energy storage for grid and industrial applications. Unlike conventional batteries, flow batteries store energy in liquid electrolytes, enabling flexible capacity expansion, deep discharge capability, and extended operational life. These features make them particularly suitable for renewable energy integration, microgrids, and utility-scale storage projects where stability, load shifting, and backup power are critical. Increasing deployment of solar and wind power plants and rising investments in smart grids and decentralized energy systems are fueling adoption. Continuous advancements in vanadium redox and zinc-bromine flow battery technologies improve efficiency, reduce costs, and enhance durability, positioning flow batteries as a viable alternative to lithium-ion in specific applications. As demand for sustainable and long-cycle energy storage solutions accelerates, the flow battery segment is emerging as a key growth area within the battery technology market ecosystem.

" Government Policies and Gigafactory Investments to Drive Strong Growth of the Battery Technology Market in Europe"

During the forecast period, Europe is expected to grow with a significant CAGR in the battery technology market, supported by strong regulatory frameworks, electrification targets, and rising investments in clean energy infrastructure. The European Union's Green Deal and strict emission reduction policies are accelerating the adoption of electric vehicles and stationary energy storage systems, creating consistent demand for advanced battery solutions. Countries including Germany, France, and the United Kingdom are leading gigafactory developments, backed by public-private partnerships and funding programs aimed at strengthening local supply chains. The region is also at the forefront of research in solid-state and other next-generation chemistries, driven by collaborations between academic institutions and industry players. With a growing focus on sustainability, recycling, and circular economy practices, Europe is positioning itself as a key market for battery technologies, contributing to both innovation and resilience in the global energy transition.

Breakdown of primaries

A variety of executives from key organizations operating in the battery technology market were interviewed in-depth, including CEOs, marketing directors, and innovation and technology directors.

- By Company Type: Tier 1 -45%, Tier 2 - 35%, and Tier 3 - 20%

- By Designation: Directors - 45%, C-level - 30%, and Others - 25%

- By Region: Asia Pacific - 45%, North America - 25%, Europe - 20%, and RoW - 10%

Note: Other designations include sales and product managers. The three tiers of the companies are defined based on their total revenue in 2024: Tier 1 - revenue greater than or equal to USD 5 billion; Tier 2 - revenue between USD 500 million and USD 5 billion; and Tier 3 revenue less than or equal to USD 500 million.

Major players profiled in this report are as follows: LG Energy Solution (South Korea), SAMSUNG SDI (South Korea), Panasonic Holdings Corporation (Japan), BYD Company Ltd. (China), Contemporary Amperex Technology Co., Limited (China), BAK Power (China), CALB (China), CLARIOS (US), EnerSys (US), EVE Energy Co., Ltd. (China), Gotion (China), GS Yuasa Corporation (Japan), Mitsubishi Electric Corporation (Japan), SK Innovation Co., Ltd. (South Korea), Tesla (US), Toshiba Corporation (Japan), Sunwoda Electronic Co., Ltd. (China), Blue Solutions (France), Solid Power, Inc. (US), ProLogium Technology Co, Ltd. (Taiwan), Ilika plc (UK), Factorial Energy (US), EXIDE INDUSTRIES LIMITED (India), QuantumScape Battery, Inc. (US), Sakuu Corporation(US), Kanadevia Corporation (Japan), Sumitomo Electric Industries, Ltd. (Japan), HiNa Battery Technology Co., Ltd. (China), Invinity Energy Systems (UK), VARTA AG (Germany), DURACELL (US) and Enerox GmbH (Austria). These leading companies possess a wide portfolio of products, establishing a prominent presence in established as well as emerging markets.

The study provides a detailed competitive analysis of these key players in the battery technology market, presenting their company profiles, most recent developments, and key market strategies.

Research Coverage

In this report, the battery technology market has been segmented based on battery type and region. The battery type segment includes lithium-ion, lead acid, nickel-based, flow, solid state, and sodium-ion. The regional analysis covers North America, Europe, Asia Pacific, and RoW.

Reasons to buy the report

The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market and the sub-segments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the battery technology market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

Key Benefits of Buying the Report

- Analysis of key drivers (Rising EV sales boost battery demand, Growing adoption of LFP technology in electric vehicles, Widespread adoption of battery-operated material handling equipment is accelerating Li-ion battery demand, Rising research and development efforts by solid-state battery manufacturers), restraints (Concerns in managing spent li-ion batteries, High manufacturing costs for solid-state batteries, Standardization challenges associated with flow battery), opportunities (BESS expansion and renewable integration accelerate Lithium-Ion battery market growth, Innovation and technological advances in sodium-ion batteries, Significant decline in costs of Lithium-Ion Battery, Progress in medical devices powered by solid-state batteries, Rising interest in residential energy storage solutions using flow batteries), and challenges (Intricate production processes of solid-state batteries, Increased tariffs on Chinese EVs in Europe and North America, Managing financial risks and market disruptions in the global battery industry, Limited usage capacity of lead acid batteries) influencing the growth of the battery technology market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the battery technology market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the battery technology market across varied regions.

- Market Diversification: Exhaustive information about new products/services, untapped geographies, recent developments, and investments in the battery technology market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Contemporary Amperex Technology Co., Limited. (China), LG Energy Solution (South Korea), Panasonic Holdings Corporation (Japan), BYD Company Ltd. (China), SAMSUNG SDI (South Korea), and others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of major secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Primary interviews with experts

- 2.1.3.2 Key primary interview participants

- 2.1.3.3 Key data from primary sources

- 2.1.3.4 Key industry insights

- 2.1.3.5 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.1.1 Estimation of market size using top-down approach

- 2.2.2 BOTTOM-UP APPROACH

- 2.2.2.1 Estimation of market size using bottom-up approach

- 2.2.1 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN BATTERY TECHNOLOGY MARKET

- 4.2 BATTERY TECHNOLOGY MARKET, BY TYPE

- 4.3 LITHIUM-ION BATTERY MARKET, BY INSTALLED CAPACITY

- 4.4 BATTERY TECHNOLOGY MARKET IN ASIA PACIFIC, BY TYPE AND COUNTRY

- 4.5 BATTERY TECHNOLOGY MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing EV sales

- 5.2.1.2 Increasing adoption of LFP chemistry in electric vehicles

- 5.2.1.3 Expanding use of battery-powered material handling equipment boosts Li-ion uptake

- 5.2.1.4 Rising R&D investments accelerate solid-state battery advancements

- 5.2.1.5 Rising demand for sustainable energy storage solutions

- 5.2.1.6 Growing adoption of flow batteries for utility and smart grid applications

- 5.2.2 RESTRAINTS

- 5.2.2.1 Challenges in recycling and managing end-of-life Li-ion batteries

- 5.2.2.2 Solid-state batteries face high production costs

- 5.2.2.3 Flow batteries encounter standardization and commercialization hurdles

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion of energy storage systems and renewable integration driving Li-ion growth

- 5.2.3.2 Advancements in sodium-ion technologies

- 5.2.3.3 Falling Li-ion production costs

- 5.2.3.4 Solid-state powering innovation in medical devices

- 5.2.3.5 Increasing residential energy storage demand benefiting flow batteries

- 5.2.4 CHALLENGES

- 5.2.4.1 Trade tariffs on Chinese EVs in Europe and North America

- 5.2.4.2 Financial risks and market volatility

- 5.2.4.3 Complex and costly manufacturing processes for solid-state batteries

- 5.2.4.4 Limited application scope restricting lead acid battery growth

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND OF LITHIUM-ION BATTERIES, 2021-2033

- 5.5.2 PRICING RANGE OF LITHIUM-ION BATTERY PACKS, BY KEY PLAYER, 2024

- 5.5.3 AVERAGE SELLING PRICE TREND OF LFP AND NMC BATTERIES, 2021-2024

- 5.5.4 AVERAGE SELLING PRICE TREND OF LITHIUM-ION BATTERIES, BY REGION, 2021-2024

- 5.5.5 PRICING RANGE OF SOLID-STATE BATTERIES, 2024

- 5.5.6 PRICING RANGE OF SOLID-STATE BATTERIES, BY REGION, 2024

- 5.5.7 INDICATIVE PRICING OF FLOW BATTERIES OFFERED BY KEY PLAYERS, 2024

- 5.6 KEY INSIGHTS RELATED TO LITHIUM-ION BATTERY INDUSTRY

- 5.6.1 TOP LITHIUM-PRODUCING COUNTRIES

- 5.6.2 LITHIUM-ION BATTERY MANUFACTURING CAPACITY, BY COUNTRY, 2022 VS. 2025 VS. 2030

- 5.6.3 LIST OF CURRENTLY OPERATIONAL AND UPCOMING GIGAFACTORIES

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Lithium-silicon batteries

- 5.9.1.2 Lithium-sulfur batteries

- 5.9.1.3 Secondary zinc-air batteries

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Liquid-metal batteries

- 5.9.2.2 Flywheel batteries

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Fuel cells

- 5.9.3.2 Supercapacitors

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 BARGAINING POWER OF SUPPLIERS

- 5.10.2 BARGAINING POWER OF BUYERS

- 5.10.3 THREAT OF NEW ENTRANTS

- 5.10.4 THREAT OF SUBSTITUTES

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 TOYOTA MATERIAL HANDLING HELPS REDUCE EQUIPMENT DOWNTIME BY REPLACING LEAD-ACID BATTERIES WITH LITHIUM-ION TECHNOLOGY

- 5.12.2 GEORGIA TECH RESEARCHERS DEVELOP LOW-MELTING CERAMIC ELECTROLYTES TO REDUCE SOLID-STATE BATTERY MANUFACTURING COSTS

- 5.12.3 SAMSUNG ELECTRONICS TESTS SILVER-CARBON COMPOSITE TO SUPPRESS DENDRITIC AND IMPROVE SOLID-STATE BATTERY LIFE AND SAFETY

- 5.12.4 REDFLOW PROVIDES OPTUS TELECOMMUNICATIONS WITH FLOW BATTERIES TO REDUCE CO2 EMISSIONS

- 5.13 TRADE ANALYSIS

- 5.13.1 IMPORT SCENARIO (HS CODE 850650)

- 5.13.2 EXPORT SCENARIO (HS CODE 850650)

- 5.14 PATENT ANALYSIS

- 5.15 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.16 REGULATORY LANDSCAPE

- 5.16.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.16.2 STANDARDS

- 5.17 IMPACT OF AI/GEN AI

- 5.17.1 INTRODUCTION

- 5.17.2 IMPACT OF AI ON BATTERY TECHNOLOGY MARKET

- 5.17.3 TOP USE CASES AND MARKET POTENTIAL

- 5.18 IMPACT OF 2025 US TARIFF

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON COUNTRY/REGION

- 5.18.4.1 US

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON APPLICATIONS

6 BATTERY TECHNOLOGY MARKET, BY BATTERY TYPE

- 6.1 INTRODUCTION

- 6.2 LITHIUM-ION BATTERY

- 6.2.1 EXPANDING ELECTRIC MOBILITY AND ENERGY STORAGE INTEGRATION TO DRIVE MARKET GROWTH

- 6.2.2 LITHIUM-ION BATTERY, BY TYPE

- 6.2.2.1 NMC

- 6.2.2.1.1 Enhanced thermal stability driving widespread NMC battery deployment

- 6.2.2.2 LFP

- 6.2.2.2.1 Extended lifespan and affordability driving LFP battery market expansion

- 6.2.2.3 LCO

- 6.2.2.3.1 High energy density in portable electronics sustaining lco battery demand

- 6.2.2.4 LTO

- 6.2.2.4.1 High security and stability of LTO batteries to drive strong adoption across advanced energy applications

- 6.2.2.5 LMO

- 6.2.2.5.1 High thermal stability and safety driving LMO battery adoption across industrial and EV applications

- 6.2.2.6 NCA

- 6.2.2.6.1 High energy density and durability driving NCA battery adoption in EVs and power sector

- 6.2.2.1 NMC

- 6.2.3 LITHIUM-ION BATTERY, BY APPLICATION

- 6.2.3.1 EVs

- 6.2.3.1.1 Rising electric vehicle penetration fueling market growth

- 6.2.3.1.2 By battery capacity

- 6.2.3.1.2.1 Below 50 kWh

- 6.2.3.1.2.2 50-100 kWh

- 6.2.3.1.2.3 Above 100 kWh

- 6.2.3.1.3 By battery type

- 6.2.3.1.4 By battery form

- 6.2.3.1.4.1 Prismatic

- 6.2.3.1.4.2 Pouch

- 6.2.3.1.4.3 Cylindrical

- 6.2.3.2 Energy storage

- 6.2.3.2.1 Rising deployment of Li-ion batteries in residential and grid-scale storage driving market growth

- 6.2.3.2.2 By battery capacity

- 6.2.3.2.2.1 Below 30 kWh

- 6.2.3.2.2.2 30 kWh-10 MWh

- 6.2.3.2.2.3 Above 10 MWh

- 6.2.3.2.3 By battery type

- 6.2.3.2.4 By connection type

- 6.2.3.3 Industrial

- 6.2.3.3.1 Rising adoption of electrified systems for automated operations driving market growth

- 6.2.3.3.2 By type

- 6.2.3.3.2.1 Material handling equipment

- 6.2.3.3.2.2 Mining equipment

- 6.2.3.3.2.3 Low-speed electric vehicles

- 6.2.3.3.2.4 Industrial tools

- 6.2.3.3.3 By battery capacity

- 6.2.3.3.3.1 Below 50 kWh

- 6.2.3.3.3.2 50-100 kWh

- 6.2.3.3.3.3 Above 100 kWh

- 6.2.3.3.4 Battery type

- 6.2.3.4 Consumer electronics

- 6.2.3.4.1 Long lifespan, high energy density, low self-discharge rate to increase integration into electronic devices

- 6.2.3.4.2 By product type

- 6.2.3.4.2.1 Smartphones

- 6.2.3.4.2.2 Laptops & tablets

- 6.2.3.4.2.3 Wearables

- 6.2.3.4.3 By battery capacity

- 6.2.3.4.3.1 Below 10 Wh

- 6.2.3.4.3.2 10-30 Wh

- 6.2.3.4.3.3 Above 30 Wh

- 6.2.3.4.4 By battery type

- 6.2.3.5 Medical

- 6.2.3.5.1 Growing demand for reliable power in life-saving devices driving adoption

- 6.2.3.5.2 By device type

- 6.2.3.5.2.1 Portable & diagnostic devices

- 6.2.3.5.2.2 Wearable & implantable devices

- 6.2.3.5.3 By battery capacity

- 6.2.3.5.3.1 Below 10 Wh

- 6.2.3.5.3.2 10-50 Wh

- 6.2.3.5.3.3 Above 50 Wh

- 6.2.3.5.4 By battery type

- 6.2.3.6 Other applications

- 6.2.3.6.1 Telecommunications

- 6.2.3.6.1.1 Enhanced performance and low maintenance features accelerating adoption

- 6.2.3.6.2 Marine

- 6.2.3.6.2.1 Resilience against high discharge currents and mechanical stress driving demand

- 6.2.3.6.3 Aerospace

- 6.2.3.6.3.1 Increasing priority on lightweight design and high power in aerospace to boost adoption

- 6.2.3.6.4 By battery type

- 6.2.3.6.1 Telecommunications

- 6.2.3.1 EVs

- 6.3 LEAD ACID

- 6.3.1 SUSTAINED DEMAND IN AUTOMOTIVE AND BACKUP POWER APPLICATIONS TO SUPPORT MARKET EXPANSION

- 6.3.2 LEAD ACID, BY APPLICATION

- 6.3.2.1 Power & utility

- 6.3.2.1.1 Rising grid modernization initiatives to drive lead acid battery deployment in power & utility

- 6.3.2.2 Transportation

- 6.3.2.2.1 Continued dominance of SLI batteries to sustain transportation demand

- 6.3.2.3 Industrial

- 6.3.2.3.1 Growing industrial automation accelerates adoption of lead acid batteries

- 6.3.2.4 Commercial & residential

- 6.3.2.4.1 Commercial expansion and backup needs strengthen lead acid battery utilization

- 6.3.2.1 Power & utility

- 6.4 NICKEL-BASED BATTERIES

- 6.4.1 RISING INDUSTRIAL AND AEROSPACE APPLICATIONS TO STRENGTHEN MARKET ADOPTION

- 6.4.2 NICKEL-BASED BATTERY, BY BATTERY TYPE

- 6.4.2.1 NiMh

- 6.4.2.1.1 Growing hybrid vehicle adoption sustains demand for NiMH batteries

- 6.4.2.2 NiCd

- 6.4.2.2.1 Reliability in extreme environments drives NiCd battery utilization

- 6.4.2.1 NiMh

- 6.4.3 NICKEL-BASED BATTERY, BY APPLICATION

- 6.4.3.1 Aerospace

- 6.4.3.1.1 Nickel-based batteries ensure mission-critical power reliability

- 6.4.3.2 Automotive & transportation

- 6.4.3.2.1 Rising hybrid vehicle adoption drives demand

- 6.4.3.3 Consumer electronics

- 6.4.3.3.1 Continued demand for cost-efficient power sustains nickel-based batteries

- 6.4.3.4 Healthcare

- 6.4.3.4.1 Increasing demand for reliable backup power strengthens nickel-based battery adoption

- 6.4.3.5 Industrial

- 6.4.3.5.1 Rising automation and backup needs fuel nickel-based battery demand

- 6.4.3.6 Marine

- 6.4.3.6.1 Safety and durability in harsh environments sustain NiCd demand

- 6.4.3.7 Commercial

- 6.4.3.7.1 Expanding infrastructure needs to strengthen nickel-based battery utilization

- 6.4.3.8 Residential

- 6.4.3.8.1 Cost-efficiency and availability to drive demand for nickel-based batteries

- 6.4.3.9 Other Nickel-based battery applications

- 6.4.3.9.1 Nickel-based batteries enable reliable power for telecom and infrastructure networks

- 6.4.3.1 Aerospace

- 6.5 SOLID-STATE BATTERY

- 6.5.1 ENHANCED SAFETY AND HIGH ENERGY DENSITY REQUIREMENTS TO PROPEL MARKET DEVELOPMENT

- 6.5.2 SOLID-STATE BATTERY, BY BATTERY TYPE

- 6.5.2.1 Primary

- 6.5.2.1.1 Market growth encouraged by environmental and health safety considerations

- 6.5.2.2 Secondary

- 6.5.2.2.1 Rising use in electric vehicles and consumer electronics drives market growth

- 6.5.2.1 Primary

- 6.5.3 SOLID-STATE BATTERY, BY CAPACITY

- 6.5.3.1 Below 20 mAh

- 6.5.3.1.1 Expanding use in packaging, smart cards, and cosmetic patches to drive demand

- 6.5.3.2 20-500 mAh

- 6.5.3.2.1 Rising global demand for IoT and wearable devices to fuel market growth

- 6.5.3.3 Above 500 mAh

- 6.5.3.3.1 Combined advancements, partnerships, and pilot-scale investments to offer lucrative growth opportunities

- 6.5.3.1 Below 20 mAh

- 6.5.4 SOLID-STATE BATTERY, BY APPLICATION

- 6.5.4.1 Consumer electronics

- 6.5.4.1.1 Increasing focus on slim and lightweight products to propel market growth

- 6.5.4.1.2 Smartphones

- 6.5.4.1.3 Wearables

- 6.5.4.1.4 Other consumer electronics

- 6.5.4.2 Electric vehicles

- 6.5.4.2.1 Rising focus on solid-state battery development and research supports market expansion

- 6.5.4.3 Medical devices

- 6.5.4.3.1 Capability to prolong battery life in compact medical devices to drive market growth

- 6.5.4.4 Energy harvesting

- 6.5.4.4.1 Adoption of solid-state batteries in environmental energy storage to drive market growth

- 6.5.4.5 Wireless sensors

- 6.5.4.5.1 Rising demand for compact and high-energy-density batteries to fuel market growth

- 6.5.4.6 Packaging

- 6.5.4.6.1 Growing demand for long-life of tags and labels to fuel drive market

- 6.5.4.7 Other applications

- 6.5.4.1 Consumer electronics

- 6.6 FLOW BATTERY

- 6.6.1 INCREASING RENEWABLE ENERGY DEPLOYMENT AND LONG-DURATION STORAGE NEEDS TO ACCELERATE GROWTH

- 6.6.2 FLOW BATTERY, BY BATTERY TYPE

- 6.6.2.1 Redox

- 6.6.2.1.1 Cost-effectiveness and convenience in large-scale energy storage applications to spike demand

- 6.6.2.2 Hybrid

- 6.6.2.2.1 Extended operational lifespan and convenient maintenance features to boost demand

- 6.6.2.1 Redox

- 6.6.3 FLOW BATTERY, BY MATERIAL

- 6.6.3.1 Vanadium

- 6.6.3.1.1 Growing demand for low-carbon energy storage solutions to drive adoption

- 6.6.3.2 Zinc-bromine

- 6.6.3.2.1 Easy availability and flexible design to foster segmental growth

- 6.6.3.3 Other materials

- 6.6.3.1 Vanadium

- 6.6.4 FLOW BATTERY, BY APPLICATION

- 6.6.4.1 Utilities

- 6.6.4.1.1 Peak capacity management

- 6.6.4.1.1.1 Pressing need to harness off-peak power for peak demand to drive market

- 6.6.4.1.2 Energy shifting

- 6.6.4.1.2.1 Increasing focus on optimizing grid operations to boost demand

- 6.6.4.1.3 Transmission

- 6.6.4.1.3.1 Escalating demand for highly efficient and reliable power grid to fuel market growth

- 6.6.4.1.4 Distribution

- 6.6.4.1.4.1 Urgent requirement to address voltage fluctuations and power outage issues to accelerate demand

- 6.6.4.1.5 Frequency regulation

- 6.6.4.1.5.1 Heightened need for consistent and reliable power to facilitate adoption

- 6.6.4.1.1 Peak capacity management

- 6.6.4.2 Commercial & industrial

- 6.6.4.2.1 Need for emergency backup power to prevent production loss during power outages to accelerate deployment

- 6.6.4.3 EV charging stations

- 6.6.4.3.1 Government-led funding to expand electric vehicle charging infrastructure to create growth opportunities

- 6.6.4.4 Other applications

- 6.6.4.1 Utilities

- 6.7 SODIUM-ION

- 6.7.1 ADVANCEMENTS IN COST-EFFECTIVE ALTERNATIVES AND MATERIAL AVAILABILITY TO BOOST MARKET POTENTIAL

- 6.7.2 SODIUM-ION BATTERY, BY APPLICATION

- 6.7.2.1 Energy storage

- 6.7.2.1.1 Accelerated deployment of sodium-ion batteries for renewable energy storage

- 6.7.2.2 Automotive

- 6.7.2.2.1 Rising adoption of sodium-ion batteries in hybrid and electric vehicles

- 6.7.2.3 Industrial

- 6.7.2.3.1 Growing industrial reliance on sodium-ion batteries for reliable energy management

- 6.7.2.4 Others

- 6.7.2.4.1 Expansion of sodium-ion battery applications in consumer and remote energy solutions

- 6.7.2.1 Energy storage

- 6.8 EMERGING BATTERY TYPES

- 6.8.1 LITHIUM-SILICON BATTERIES

- 6.8.2 LITHIUM-SULFUR BATTERIES

7 BATTERY TECHNOLOGY MARKET, BY REGION

- 7.1 INTRODUCTION

- 7.2 NORTH AMERICA

- 7.2.1 US

- 7.2.1.1 Strategic investments and innovation drive US battery technology growth

- 7.2.2 CANADA

- 7.2.2.1 Technological innovation and clean energy policies drive growth

- 7.2.3 MEXICO

- 7.2.3.1 Rising capital inflows boost Mexico's lithium-ion battery production

- 7.2.1 US

- 7.3 EUROPE

- 7.3.1 GERMANY

- 7.3.1.1 Clean energy targets drive battery demand growth

- 7.3.2 UK

- 7.3.2.1 Increasing emphasis on renewable electricity to drive market growth

- 7.3.3 FRANCE

- 7.3.3.1 Government initiatives and EV demand drive France's battery ecosystem expansion

- 7.3.4 ITALY

- 7.3.4.1 EV adoption and energy storage expansion drive growth in Italy's battery market

- 7.3.5 REST OF EUROPE

- 7.3.1 GERMANY

- 7.4 ASIA PACIFIC

- 7.4.1 CHINA

- 7.4.1.1 Strategic integration of storage, manufacturing, and EV adoption propels China's battery market

- 7.4.2 JAPAN

- 7.4.2.1 Significant presence of prominent lithium-ion manufacturers expected to support market growth

- 7.4.3 INDIA

- 7.4.3.1 Growing lithium reserves, EV uptake, and grid modernization fuel India's battery market expansion

- 7.4.3.2 Recent strategic developments accelerating India's battery technology market growth

- 7.4.4 SOUTH KOREA

- 7.4.4.1 Strategic investments in advanced battery technologies to drive market growth

- 7.4.5 REST OF ASIA PACIFIC

- 7.4.1 CHINA

- 7.5 ROW

- 7.5.1 MIDDLE EAST

- 7.5.1.1 Renewable energy expansion and smart technology adoption fueling battery demand

- 7.5.1.2 GCC countries

- 7.5.1.3 Rest of Middle East

- 7.5.2 AFRICA

- 7.5.2.1 Rising mining activities and flow battery projects strengthening Africa's role in battery technology market

- 7.5.3 SOUTH AMERICA

- 7.5.3.1 Favorable manufacturing hub for lithium-ion battery producers driving market growth

- 7.5.1 MIDDLE EAST

8 COMPETITIVE LANDSCAPE

- 8.1 INTRODUCTION

- 8.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 8.3 REVENUE ANALYSIS, 2021-2024

- 8.4 MARKET SHARE ANALYSIS, 2024

- 8.4.1 LITHIUM-ION BATTERY MARKET: MARKET SHARE ANALYSIS

- 8.4.2 SOLID-STATE BATTERY MARKET: MARKET SHARE ANALYSIS

- 8.5 COMPANY VALUATION AND FINANCIAL METRICS

- 8.6 BRAND COMPARISON

- 8.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 8.7.1 STARS

- 8.7.2 EMERGING LEADERS

- 8.7.3 PERVASIVE PLAYERS

- 8.7.4 PARTICIPANTS

- 8.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 8.7.5.1 Company footprint

- 8.7.5.2 Region footprint

- 8.7.5.3 Battery type footprint

- 8.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 8.8.1 PROGRESSIVE COMPANIES

- 8.8.2 RESPONSIVE COMPANIES

- 8.8.3 DYNAMIC COMPANIES

- 8.8.4 STARTING BLOCKS

- 8.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 8.8.5.1 Detailed list of key startups/SMEs

- 8.8.5.2 Competitive benchmarking of key startups/SMEs

- 8.8.6 STARTUP LANDSCAPE ACROSS KEY SEGMENTS OF LITHIUM BATTERY VALUE CHAIN

- 8.9 COMPETITIVE SCENARIO

- 8.9.1 PRODUCT LAUNCHES

- 8.9.2 DEALS

- 8.9.3 EXPANSIONS

- 8.9.4 OTHER DEVELOPMENTS

9 COMPANY PROFILES

- 9.1 KEY PLAYERS

- 9.1.1 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED

- 9.1.1.1 Business overview

- 9.1.1.2 Products/Solutions/Services offered

- 9.1.1.3 Recent developments

- 9.1.1.3.1 Product launches

- 9.1.1.3.2 Deals

- 9.1.1.4 MnM view

- 9.1.1.4.1 Key strengths

- 9.1.1.4.2 Strategic choices

- 9.1.1.4.3 Weaknesses and competitive threats

- 9.1.2 BYD COMPANY LTD.

- 9.1.2.1 Business overview

- 9.1.2.2 Products/Solutions/Services offered

- 9.1.2.3 Recent developments

- 9.1.2.3.1 Deals

- 9.1.2.4 MnM view

- 9.1.2.4.1 Key strengths

- 9.1.2.4.2 Strategic choices

- 9.1.2.4.3 Weaknesses and competitive threats

- 9.1.3 LG ENERGY SOLUTION

- 9.1.3.1 Business overview

- 9.1.3.2 Products/Solutions/Services offered

- 9.1.3.3 Recent developments

- 9.1.3.3.1 Product launches

- 9.1.3.3.2 Deals

- 9.1.3.3.3 Expansions

- 9.1.3.4 MnM view

- 9.1.3.4.1 Key strengths

- 9.1.3.4.2 Strategic choices

- 9.1.3.4.3 Weaknesses and competitive threats

- 9.1.4 SAMSUNG SDI

- 9.1.4.1 Business overview

- 9.1.4.2 Products/Solutions/Services offered

- 9.1.4.3 Recent developments

- 9.1.4.3.1 Deals

- 9.1.4.3.2 Expansions

- 9.1.4.3.3 Other developments

- 9.1.4.4 MnM view

- 9.1.4.4.1 Key strengths

- 9.1.4.4.2 Strategic choices

- 9.1.4.4.3 Weaknesses and competitive threats

- 9.1.5 PANASONIC HOLDINGS CORPORATION

- 9.1.5.1 Business overview

- 9.1.5.2 Products/Solutions/Services offered

- 9.1.5.3 Recent developments

- 9.1.5.3.1 Deals

- 9.1.5.3.2 Expansions

- 9.1.5.3.3 Other developments

- 9.1.5.4 MnM view

- 9.1.5.4.1 Key strengths

- 9.1.5.4.2 Strategic choices

- 9.1.5.4.3 Weaknesses and competitive threats

- 9.1.6 EVE ENERGY CO., LTD.

- 9.1.6.1 Business overview

- 9.1.6.2 Products/Solutions/Services offered

- 9.1.6.3 Recent developments

- 9.1.6.3.1 Product launches

- 9.1.6.3.2 Deals

- 9.1.7 TESLA

- 9.1.7.1 Business overview

- 9.1.7.2 Products/Solutions/Services offered

- 9.1.7.3 Recent developments

- 9.1.7.3.1 Developments

- 9.1.8 GS YUASA CORPORATION

- 9.1.8.1 Business overview

- 9.1.8.2 Products/Solutions/Services offered

- 9.1.8.3 Recent developments

- 9.1.8.3.1 Deals

- 9.1.8.3.2 Other developments

- 9.1.9 SK INNOVATION CO., LTD.

- 9.1.9.1 Business overview

- 9.1.9.2 Products/Solutions/Services offered

- 9.1.9.3 Recent developments

- 9.1.9.3.1 Deals

- 9.1.10 TOSHIBA CORPORATION

- 9.1.10.1 Business overview

- 9.1.10.2 Products/Solutions/Services offered

- 9.1.10.3 Recent developments

- 9.1.10.3.1 Product launches

- 9.1.10.3.2 Deals

- 9.1.11 SUNWODA ELECTRONIC CO., LTD.

- 9.1.11.1 Business overview

- 9.1.11.2 Products/Solutions/Services offered

- 9.1.11.3 Recent developments

- 9.1.11.3.1 Deals

- 9.1.12 MITSUBISHI ELECTRIC CORPORATION

- 9.1.12.1 Business overview

- 9.1.12.2 Products/Solutions/Services offered

- 9.1.13 GOTION

- 9.1.13.1 Business overview

- 9.1.13.2 Products/Solutions/Services offered

- 9.1.13.3 Recent developments

- 9.1.13.3.1 Deals

- 9.1.14 ENERSYS

- 9.1.14.1 Business overview

- 9.1.14.2 Products/Solutions/Services offered

- 9.1.14.3 Recent developments

- 9.1.14.3.1 Deals

- 9.1.14.3.2 Expansions

- 9.1.15 VARTA AG

- 9.1.15.1 Business overview

- 9.1.15.2 Products/Solutions/Services offered

- 9.1.16 CALB

- 9.1.16.1 Business overview

- 9.1.16.2 Products/Solutions/Services offered

- 9.1.16.3 Recent developments

- 9.1.16.3.1 Product launches

- 9.1.1 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED

- 9.2 OTHER KEY PLAYERS

- 9.2.1 EXIDE INDUSTRIES LTD.

- 9.2.2 INVINITY ENERGY SYSTEMS

- 9.2.3 SUMITOMO ELECTRIC INDUSTRIES, LTD.

- 9.2.4 ILIKA

- 9.2.5 SOLID POWER, INC.

- 9.2.6 KANADEVIA CORPORATION

- 9.2.7 FACTORIAL INC.

- 9.2.8 DURACELL INC.

- 9.3 OTHER PLAYERS

- 9.3.1 AMPEREX TECHNOLOGY LIMITED

- 9.3.2 CLARIOS

- 9.3.3 BAK POWER

- 9.3.4 BLUE SOLUTIONS

- 9.3.5 PROLOGIUM TECHNOLOGY CO., LTD.

- 9.3.6 FACTORIAL INC

- 9.3.7 SAKUU CORPORATION

- 9.3.8 HINA BATTERY TECHNOLOGY CO., LTD.

- 9.3.9 ENEROX GMBH

- 9.3.10 FARASIS ENERGY(GANZHOU)CO., LTD.

- 9.3.11 ZONERGY CORPORATION

10 APPENDIX

- 10.1 DISCUSSION GUIDE

- 10.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 10.3 CUSTOMIZATION OPTIONS

- 10.4 RELATED REPORTS

- 10.5 AUTHOR DETAILS

List of Tables

- TABLE 1 BATTERY TECHNOLOGY MARKET: RISK ANALYSIS

- TABLE 2 LIST OF UPCOMING GLOBAL BESS PROJECTS

- TABLE 3 LIST OF COMPANIES WITNESSED BANKRUPTCY IN BATTERY TECHNOLOGY MARKET

- TABLE 4 BATTERY TECHNOLOGY ECOSYSTEM ANALYSIS

- TABLE 5 PRICING RANGE OF LITHIUM-ION BATTERY PACKS OFFERED BY KEY PLAYERS, 2024

- TABLE 6 AVERAGE SELLING PRICE TREND OF LFP AND NMC BATTERIES, 2021-2024 (USD/KWH)

- TABLE 7 AVERAGE SELLING PRICE TREND OF LITHIUM-ION BATTERIES, BY REGION, 2021-2024 (USD/KWH)

- TABLE 8 PRICING RANGE OF SOLID-STATE BATTERIES, 2024 (USD/KWH)

- TABLE 9 PRICING RANGE OF SOLID-STATE BATTERIES, BY REGION, 2024 (USD/KWH)

- TABLE 10 INDICATIVE PRICING OF FLOW BATTERIES OFFERED BY KEY PLAYERS, 2024

- TABLE 11 LITHIUM PRODUCTION, BY COUNTRY, 2023

- TABLE 12 LARGEST OPERATIONAL GIGAFACTORIES WORLDWIDE

- TABLE 13 UPCOMING GIGAFACTORIES WORLDWIDE

- TABLE 14 LARGEST PE/VC-BACKED INVESTMENTS IN BATTERY ENERGY STORAGE SYSTEMS ANNOUNCED IN 2024

- TABLE 15 BATTERY TECHNOLOGY MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- TABLE 17 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 18 IMPORT DATA FOR HS CODE 850650-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 19 EXPORT DATA FOR HS CODE 850650-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 20 BATTERY TECHNOLOGY MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2021-2025

- TABLE 21 BATTERY TECHNOLOGY MARKET: LIST OF KEY CONFERENCES AND EVENTS

- TABLE 22 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 25 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 26 STANDARDS

- TABLE 27 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 28 BATTERY TECHNOLOGY MARKET, BY BATTERY TYPE, 2021-2024 (USD MILLION)

- TABLE 29 BATTERY TECHNOLOGY MARKET, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 30 LITHIUM-ION BATTERY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 31 LITHIUM-ION BATTERY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 NORTH AMERICA: LITHIUM-ION BATTERY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 33 NORTH AMERICA: LITHIUM-ION BATTERY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 34 EUROPE: LITHIUM-ION BATTERY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 35 EUROPE: LITHIUM-ION BATTERY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 36 ASIA PACIFIC: LITHIUM-ION BATTERY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 37 ASIA PACIFIC: LITHIUM-ION BATTERY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 38 ROW: LITHIUM-ION BATTERY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 39 ROW: LITHIUM-ION BATTERY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 MIDDLE EAST: LITHIUM-ION BATTERY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 41 MIDDLE EAST: LITHIUM-ION BATTERY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 42 COMPARISON OF LITHIUM-ION BATTERY TYPES BASED ON DIFFERENT PARAMETERS

- TABLE 43 LITHIUM-ION BATTERY MARKET, BY BATTERY TYPE, 2021-2024 (USD MILLION)

- TABLE 44 LITHIUM-ION BATTERY MARKET, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 45 LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 46 LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 47 EVS: LITHIUM-ION BATTERY MARKET, BY BATTERY CAPACITY, 2021-2024 (USD MILLION)

- TABLE 48 EVS: LITHIUM-ION BATTERY MARKET, BY BATTERY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 49 EVS: LITHIUM-ION BATTERY MARKET, BY BATTERY TYPE, 2021-2024 (USD MILLION)

- TABLE 50 EVS: LITHIUM-ION BATTERY MARKET, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 51 BATTERY TYPE/FORM USED BY OEMS, BY EV MODEL, 2025-2026

- TABLE 52 BATTERY FORMS: ADVANTAGES AND DISADVANTAGES

- TABLE 53 EVS: LITHIUM-ION BATTERY MARKET, BY BATTERY FORM, 2021-2024 (USD MILLION)

- TABLE 54 EVS: LITHIUM-ION BATTERY MARKET, BY BATTERY FORM, 2025-2030 (USD MILLION)

- TABLE 55 ENERGY STORAGE: LITHIUM-ION BATTERY MARKET, 2021-2024 (MWH)

- TABLE 56 ENERGY STORAGE: LITHIUM-ION BATTERY MARKET, 2025-2030 (MWH)

- TABLE 57 ENERGY STORAGE: LITHIUM-ION BATTERY MARKET, BY BATTERY CAPACITY, 2021-2024 (USD MILLION)

- TABLE 58 ENERGY STORAGE: LITHIUM-ION BATTERY MARKET, BY BATTERY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 59 ENERGY STORAGE: LITHIUM-ION BATTERY MARKET, BY BATTERY TYPE, 2021-2024 (USD MILLION)

- TABLE 60 ENERGY STORAGE: LITHIUM-ION BATTERY MARKET, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 61 ENERGY STORAGE: LITHIUM-ION BATTERY MARKET, BY CONNECTION TYPE, 2021-2024 (USD MILLION)

- TABLE 62 ENERGY STORAGE: LITHIUM-ION BATTERY MARKET, BY CONNECTION TYPE, 2025-2030 (USD MILLION)

- TABLE 63 INDUSTRIAL: LITHIUM-ION BATTERY MARKET, BY BATTERY CAPACITY, 2021-2024 (USD MILLION)

- TABLE 64 INDUSTRIAL: LITHIUM-ION BATTERY MARKET, BY BATTERY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 65 INDUSTRIAL: LITHIUM-ION BATTERY MARKET, BY BATTERY TYPE, 2021-2024 (USD MILLION)

- TABLE 66 INDUSTRIAL: LITHIUM-ION BATTERY MARKET, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 67 CONSUMER ELECTRONICS: LITHIUM-ION BATTERY MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 68 CONSUMER ELECTRONICS: LITHIUM-ION BATTERY MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 69 CONSUMER ELECTRONICS: LITHIUM-ION BATTERY MARKET, BY BATTERY CAPACITY, 2021-2024 (USD MILLION)

- TABLE 70 CONSUMER ELECTRONICS: LITHIUM-ION BATTERY MARKET, BY BATTERY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 71 CONSUMER ELECTRONICS: LITHIUM-ION BATTERY MARKET, BY BATTERY TYPE, 2021-2024 (USD MILLION)

- TABLE 72 CONSUMER ELECTRONICS: LITHIUM-ION BATTERY MARKET, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 73 MEDICAL: LITHIUM-ION BATTERY MARKET, BY BATTERY CAPACITY, 2021-2024 (USD MILLION)

- TABLE 74 MEDICAL: LITHIUM-ION BATTERY MARKET, BY BATTERY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 75 MEDICAL: LITHIUM-ION BATTERY MARKET, BY BATTERY TYPE, 2021-2024 (USD MILLION)

- TABLE 76 MEDICAL: LITHIUM-ION BATTERY MARKET, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 77 OTHER APPLICATIONS: LITHIUM-ION BATTERY MARKET, BY BATTERY TYPE, 2021-2024 (USD MILLION)

- TABLE 78 OTHER APPLICATIONS: LITHIUM-ION BATTERY MARKET, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 79 LEAD ACID BATTERY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 80 LEAD ACID BATTERY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 NORTH AMERICA: LEAD ACID BATTERY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 82 NORTH AMERICA: LEAD ACID BATTERY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 83 EUROPE: LEAD ACID BATTERY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 84 EUROPE: LEAD ACID BATTERY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 85 ASIA PACIFIC: LEAD ACID BATTERY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 86 ASIA PACIFIC: LEAD ACID BATTERY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 87 ROW: LEAD ACID BATTERY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 88 ROW: LEAD ACID BATTERY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 MIDDLE EAST: LEAD ACID BATTERY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 90 MIDDLE EAST: LEAD ACID BATTERY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 91 LEAD ACID BATTERY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 92 LEAD ACID BATTERY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 93 NICKEL-BASED BATTERY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 94 NICKEL-BASED BATTERY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 95 NICKEL-BASED BATTERY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 96 NICKEL-BASED BATTERY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 97 NORTH AMERICA: NICKEL-BASED BATTERY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 98 NORTH AMERICA: NICKEL-BASED BATTERY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 99 EUROPE: NICKEL-BASED BATTERY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 100 EUROPE: NICKEL-BASED BATTERY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 101 ASIA PACIFIC: NICKEL-BASED BATTERY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 102 ASIA PACIFIC: NICKEL-BASED BATTERY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 103 ROW: NICKEL-BASED BATTERY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 104 ROW: NICKEL-BASED BATTERY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 105 MIDDLE EAST: NICKEL-BASED BATTERY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 106 MIDDLE EAST: NICKEL-BASED BATTERY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 107 NIMH BATTERIES: NICKEL-BASED BATTERY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 108 NIMH BATTERIES: NICKEL-BASED BATTERY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 109 NIMH BATTERIES: NICKEL-BASED BATTERY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 110 NIMH BATTERIES: NICKEL-BASED BATTERY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 111 NICD BATTERIES: NICKEL-BASED BATTERY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 112 NICD BATTERIES: NICKEL-BASED BATTERY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 113 NICD BATTERIES: NICKEL-BASED BATTERY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 114 NICD BATTERIES: NICKEL-BASED BATTERY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 115 NICKEL-BASED BATTERY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 116 NICKEL-BASED BATTERY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 117 SOLID-STATE BATTERY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 118 SOLID-STATE BATTERY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 119 NORTH AMERICA: SOLID-STATE BATTERY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 120 NORTH AMERICA: SOLID-STATE BATTERY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 121 EUROPE: SOLID-STATE BATTERY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 122 EUROPE: SOLID-STATE BATTERY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 123 ASIA PACIFIC: SOLID-STATE BATTERY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 124 ASIA PACIFIC: SOLID-STATE BATTERY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 125 ROW: SOLID-STATE BATTERY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 126 MIDDLE EAST: SOLID-STATE BATTERY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 127 SOLID-STATE BATTERY MARKET, BY BATTERY TYPE, 2021-2024 (USD MILLION)

- TABLE 128 SOLID-STATE BATTERY MARKET, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 129 SOLID-STATE BATTERY MARKET, BY CAPACITY, 2021-2024 (USD MILLION)

- TABLE 130 SOLID-STATE BATTERY MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 131 SOLID-STATE BATTERY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 132 SOLID-STATE BATTERY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 133 FLOW BATTERY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 134 FLOW BATTERY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 135 NORTH AMERICA: FLOW BATTERY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 136 NORTH AMERICA: FLOW BATTERY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 137 EUROPE: FLOW BATTERY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 138 EUROPE: FLOW BATTERY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 139 ASIA PACIFIC: FLOW BATTERY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 140 ASIA PACIFIC: FLOW BATTERY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 141 ROW: FLOW BATTERY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 142 ROW: FLOW BATTERY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 143 MIDDLE EAST: FLOW BATTERY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 144 MIDDLE EAST: FLOW BATTERY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 145 FLOW BATTERY MARKET, BY BATTERY TYPE, 2021-2024 (USD MILLION)

- TABLE 146 FLOW BATTERY MARKET, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 147 FLOW BATTERY MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 148 FLOW BATTERY MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 149 FLOW BATTERY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 150 FLOW BATTERY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 151 SODIUM-ION BATTERY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 152 SODIUM-ION BATTERY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 153 NORTH AMERICA: SODIUM-ION BATTERY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 154 NORTH AMERICA: SODIUM-ION BATTERY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 155 EUROPE: SODIUM-ION BATTERY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 156 EUROPE: SODIUM-ION BATTERY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 157 ASIA PACIFIC: SODIUM-ION BATTERY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 158 ASIA PACIFIC: SODIUM-ION BATTERY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 159 SODIUM-ION BATTERY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 160 SODIUM-ION BATTERY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 161 BATTERY TECHNOLOGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 162 BATTERY TECHNOLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 163 NORTH AMERICA: BATTERY TECHNOLOGY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 164 NORTH AMERICA: BATTERY TECHNOLOGY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 165 EUROPE: BATTERY TECHNOLOGY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 166 EUROPE: BATTERY TECHNOLOGY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 167 ASIA PACIFIC: BATTERY TECHNOLOGY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 168 ASIA PACIFIC: BATTERY TECHNOLOGY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 169 ROW: BATTERY TECHNOLOGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 170 ROW: BATTERY TECHNOLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 171 MIDDLE EAST: BATTERY TECHNOLOGY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 172 MIDDLE EAST: BATTERY TECHNOLOGY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 173 BATTERY TECHNOLOGY MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2021-2024

- TABLE 174 LITHIUM-ION BATTERY MARKET: DEGREE OF COMPETITION, 2024

- TABLE 175 SOLID-STATE BATTERY MARKET: DEGREE OF COMPETITION, 2024

- TABLE 176 BATTERY TECHNOLOGY MARKET: REGION FOOTPRINT

- TABLE 177 BATTERY TECHNOLOGY MARKET: BATTERY TYPE FOOTPRINT

- TABLE 178 BATTERY TECHNOLOGY MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 179 BATTERY TECHNOLOGY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 180 BATTERY TECHNOLOGY MARKET: PRODUCT LAUNCHES, JANUARY 2021-MAY 2025

- TABLE 181 BATTERY TECHNOLOGY MARKET: DEALS, JANUARY 2021-MAY 2025

- TABLE 182 BATTERY TECHNOLOGY MARKET: EXPANSIONS, JANUARY 2021-MAY 2025

- TABLE 183 BATTERY TECHNOLOGY MARKET: OTHER DEVELOPMENTS, JANUARY 2021-MAY 2025

- TABLE 184 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED: COMPANY OVERVIEW

- TABLE 185 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED: PRODUCT LAUNCHES

- TABLE 187 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED: DEALS

- TABLE 188 BYD COMPANY LTD.: COMPANY OVERVIEW

- TABLE 189 BYD COMPANY LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 BYD COMPANY LTD.: DEALS

- TABLE 191 LG ENERGY SOLUTION: COMPANY OVERVIEW

- TABLE 192 LG ENERGY SOLUTION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 LG ENERGY SOLUTION: PRODUCT LAUNCHES

- TABLE 194 LG ENERGY SOLUTION: DEALS

- TABLE 195 LG ENERGY SOLUTION: EXPANSIONS

- TABLE 196 SAMSUNG SDI: COMPANY OVERVIEW

- TABLE 197 SAMSUNG SDI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 SAMSUNG SDI: DEALS

- TABLE 199 SAMSUNG SDI: EXPANSIONS

- TABLE 200 SAMSUNG SDI: OTHER DEVELOPMENTS

- TABLE 201 PANASONIC HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 202 PANASONIC HOLDINGS CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 203 PANASONIC HOLDINGS CORPORATION: DEALS

- TABLE 204 PANASONIC HOLDINGS CORPORATION: EXPANSIONS

- TABLE 205 PANASONIC HOLDINGS CORPORATION: OTHER DEVELOPMENTS

- TABLE 206 EVE ENERGY CO., LTD.: COMPANY OVERVIEW

- TABLE 207 EVE ENERGY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 EVE ENERGY CO., LTD.: PRODUCT LAUNCHES

- TABLE 209 EVE ENERGY CO., LTD.: DEALS

- TABLE 210 TESLA: COMPANY OVERVIEW

- TABLE 211 TESLA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 TESLA: DEVELOPMENTS

- TABLE 213 GS YUASA CORPORATION: COMPANY OVERVIEW

- TABLE 214 GS YUASA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 GS YUASA CORPORATION: DEALS

- TABLE 216 GS YUASA CORPORATION: OTHER DEVELOPMENTS

- TABLE 217 SK INNOVATION CO., LTD.: COMPANY OVERVIEW

- TABLE 218 SK INNOVATION CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 SK INNOVATION CO., LTD.: DEALS

- TABLE 220 TOSHIBA CORPORATION: COMPANY OVERVIEW

- TABLE 221 TOSHIBA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 TOSHIBA CORPORATION: PRODUCT LAUNCHES

- TABLE 223 TOSHIBA CORPORATION: DEALS

- TABLE 224 SUNWODA ELECTRONIC CO., LTD.: COMPANY OVERVIEW

- TABLE 225 SUNWODA ELECTRONIC CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 SUNWODA ELECTRONIC CO., LTD.: DEALS

- TABLE 227 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 228 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 229 GOTION: COMPANY OVERVIEW

- TABLE 230 GOTION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 GOTION: DEALS

- TABLE 232 ENERSYS: COMPANY OVERVIEW

- TABLE 233 ENERSYS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 ENERSYS: DEALS

- TABLE 235 ENERSYS: EXPANSIONS

- TABLE 236 VARTA AG: COMPANY OVERVIEW

- TABLE 237 VARTA AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 CALB: COMPANY OVERVIEW

- TABLE 239 CALB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 CALB: PRODUCT LAUNCHES

- TABLE 241 EXIDE INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 242 INVINITY ENERGY SYSTEMS: COMPANY OVERVIEW

- TABLE 243 SUMITOMO ELECTRIC INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 244 ILIKA: COMPANY OVERVIEW

- TABLE 245 SOLID POWER, INC.: COMPANY OVERVIEW

- TABLE 246 KANADEVIA CORPORATION: COMPANY OVERVIEW

- TABLE 247 FACTORIAL INC.: COMPANY OVERVIEW

- TABLE 248 DURACELL INC.: COMPANY OVERVIEW

- TABLE 249 AMPEREX TECHNOLOGY LIMITED: COMPANY OVERVIEW

- TABLE 250 CLARIOS: COMPANY OVERVIEW

- TABLE 251 BAK POWER: COMPANY OVERVIEW

- TABLE 252 BLUE SOLUTIONS: COMPANY OVERVIEW

- TABLE 253 PROLOGIUM TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 254 FACTORIAL INC: COMPANY OVERVIEW

- TABLE 255 SAKUU CORPORATION: COMPANY OVERVIEW

- TABLE 256 HINA BATTERY TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 257 ENEROX GMBH: COMPANY OVERVIEW

- TABLE 258 FARASIS ENERGY (GANZHOU) CO., LTD.: COMPANY OVERVIEW

- TABLE 259 ZONERGY CORPORATION.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 BATTERY TECHNOLOGY MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 BATTERY TECHNOLOGY MARKET: RESEARCH DESIGN

- FIGURE 3 BATTERY TECHNOLOGY MARKET: RESEARCH APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY FOR LITHIUM-ION BATTERY MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY FOR SOLID-STATE BATTERY MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 ASSUMPTIONS

- FIGURE 10 BATTERY TECHNOLOGY MARKET, 2021-2030

- FIGURE 11 LITHIUM-ION BATTERY TYPE TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 12 ASIA PACIFIC TO LEAD GLOBAL BATTERY TECHNOLOGY MARKET DURING FORECAST PERIOD

- FIGURE 13 RISING SALES OF BATTERY-OPERATED ELECTRIC VEHICLES GLOBALLY TO DRIVE MARKET

- FIGURE 14 SOLID-STATE SEGMENT TO DOMINATE MARKET WITH HIGHEST CAGR, BY TYPE, IN 2030

- FIGURE 15 HISTORICAL AND PROJECTED DATA ON BATTERY CAPACITY INSTALLATIONS WORLDWIDE, 2021-2033

- FIGURE 16 LITHIUM-ION BATTERY SEGMENT AND CHINA TO HOLD LARGEST SHARE OF BATTERY TECHNOLOGY MARKET IN ASIA PACIFIC IN 2030

- FIGURE 17 INDIA TO RECORD HIGHEST CAGR IN GLOBAL BATTERY TECHNOLOGY MARKET BETWEEN 2025 AND 2030

- FIGURE 18 BATTERY TECHNOLOGY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 ELECTRIC CAR SALES, 2018-2024

- FIGURE 20 BATTERY TECHNOLOGY MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 21 BATTERY TECHNOLOGY MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 22 BATTERY TECHNOLOGY MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 23 BATTERY TECHNOLOGY MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 24 BATTERY TECHNOLOGY VALUE CHAIN ANALYSIS

- FIGURE 25 KEY PLAYERS IN BATTERY TECHNOLOGY ECOSYSTEM

- FIGURE 26 AVERAGE SELLING PRICE TREND OF LITHIUM-ION BATTERIES, 2021-2033

- FIGURE 27 AVERAGE SELLING PRICE TREND OF LFP AND NMC BATTERIES, 2021-2024

- FIGURE 28 AVERAGE SELLING PRICE TREND OF LITHIUM-ION BATTERIES, BY REGION, 2021-2024

- FIGURE 29 LITHIUM-ION BATTERY MANUFACTURING CAPACITY OF DIFFERENT COUNTRIES, 2022 VS. 2025 VS. 2030

- FIGURE 30 TRENDS/DISRUPTIONS INFLUENCING PLAYERS IN BATTERY TECHNOLOGY MARKET

- FIGURE 31 GLOBAL EV BATTERY INVESTMENT AND VC FUNDING SCENARIO, 2018-2024

- FIGURE 32 GLOBAL INVESTMENT AND PE/VC FUNDING SCENARIO FOR BATTERY ENERGY STORAGE SYSTEMS, 2020-2024

- FIGURE 33 BATTERY TECHNOLOGY MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- FIGURE 35 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- FIGURE 36 IMPORT SCENARIO FOR HS CODE 850650-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 37 EXPORT SCENARIO FOR HS CODE 850650-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 38 LITHIUM-ION BATTERY MARKET: PATENT ANALYSIS, 2015-2024

- FIGURE 39 KEY AI USE CASES IN BATTERY TECHNOLOGY MARKET

- FIGURE 40 BATTERY TECHNOLOGY MARKET, BY BATTERY TYPE

- FIGURE 41 SOLID-STATE BATTERIES TO LEAD MARKET WITH HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 42 LITHIUM-ION BATTERY MARKET, BY TYPE

- FIGURE 43 LFP SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 44 PERFORMANCE PARAMETERS OF NMC BATTERIES

- FIGURE 45 PERFORMANCE PARAMETERS OF LFP BATTERIES

- FIGURE 46 PERFORMANCE PARAMETERS OF LCO BATTERIES

- FIGURE 47 PERFORMANCE PARAMETERS OF LTO BATTERIES

- FIGURE 48 PERFORMANCE PARAMETERS OF LMO BATTERIES

- FIGURE 49 PERFORMANCE PARAMETERS OF NCA BATTERIES

- FIGURE 50 LITHIUM-ION BATTERY MARKET, BY APPLICATION

- FIGURE 51 SOLID-STATE BATTERY, BY BATTERY TYPE

- FIGURE 52 SOLID-STATE BATTERY MARKET, BY CAPACITY

- FIGURE 53 SOLID-STATE BATTERY MARKET, BY APPLICATION

- FIGURE 54 FLOW BATTERY MARKET, BY BATTERY TYPE

- FIGURE 55 FLOW BATTERY MARKET, BY MATERIAL

- FIGURE 56 FLOW BATTERY MARKET, BY APPLICATION

- FIGURE 57 BATTERY TECHNOLOGY MARKET, BY REGION

- FIGURE 58 INDIA TO REGISTER HIGHEST CAGR IN GLOBAL BATTERY TECHNOLOGY MARKET DURING FORECAST PERIOD

- FIGURE 59 ASIA PACIFIC TO RECORD HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 60 NORTH AMERICA: BATTERY TECHNOLOGY MARKET SNAPSHOT

- FIGURE 61 US HELD LARGEST SHARE OF NORTH AMERICAN MARKET IN 2024

- FIGURE 62 EUROPE: BATTERY TECHNOLOGY MARKET SNAPSHOT

- FIGURE 63 UK TO RECORD HIGHEST CAGR IN EUROPEAN BATTERY TECHNOLOGY MARKET DURING FORECAST PERIOD

- FIGURE 64 ASIA PACIFIC: BATTERY TECHNOLOGY MARKET SNAPSHOT

- FIGURE 65 CHINA TO CAPTURE LARGEST SHARE OF ASIA PACIFIC MARKET IN 2030

- FIGURE 66 EMERGING BATTERY POWERHOUSES: INDIA'S GIGAFACTORY MAP

- FIGURE 67 ROW: BATTERY TECHNOLOGY MARKET SNAPSHOT

- FIGURE 68 MIDDLE EAST TO EMERGE AS FASTEST-GROWING REGION IN BATTERY TECHNOLOGY MARKET IN ROW DURING FORECAST PERIOD

- FIGURE 69 BATTERY TECHNOLOGY MARKET: REVENUE ANALYSIS, 2021-2024

- FIGURE 70 LITHIUM-ION BATTERY MARKET SHARE ANALYSIS, 2024

- FIGURE 71 SOLID-STATE BATTERY MARKET SHARE ANALYSIS, 2024

- FIGURE 72 COMPANY VALUATION

- FIGURE 73 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 74 BRAND COMPARISON

- FIGURE 75 LITHIUM-ION BATTERY MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 76 SOLID-STATE BATTERY MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 77 BATTERY TECHNOLOGY MARKET: COMPANY FOOTPRINT

- FIGURE 78 LITHIUM-ION BATTERY MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 79 SOLID-STATE BATTERY MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 80 LITHIUM BATTERY STARTUP LANDSCAPE

- FIGURE 81 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED: COMPANY SNAPSHOT

- FIGURE 82 BYD COMPANY LTD.: COMPANY SNAPSHOT

- FIGURE 83 LG ENERGY SOLUTION: COMPANY SNAPSHOT

- FIGURE 84 SAMSUNG SDI: COMPANY SNAPSHOT

- FIGURE 85 PANASONIC HOLDINGS CORPORATION: COMPANY SNAPSHOT

- FIGURE 86 EVE ENERGY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 87 TESLA: COMPANY SNAPSHOT

- FIGURE 88 GS YUASA CORPORATION: COMPANY SNAPSHOT

- FIGURE 89 SK INNOVATION CO., LTD.: COMPANY SNAPSHOT

- FIGURE 90 TOSHIBA CORPORATION: COMPANY SNAPSHOT

- FIGURE 91 SUNWODA ELECTRONIC CO., LTD.: COMPANY SNAPSHOT

- FIGURE 92 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 93 GOTION: COMPANY SNAPSHOT

- FIGURE 94 ENERSYS: COMPANY SNAPSHOT

- FIGURE 95 VARTA AG: COMPANY SNAPSHOT

- FIGURE 96 CALB: COMPANY SNAPSHOT