PUBLISHER: SNE Research | PRODUCT CODE: 1784309

PUBLISHER: SNE Research | PRODUCT CODE: 1784309

<2025> 4680 Battery Technology Development Trend and Outlook

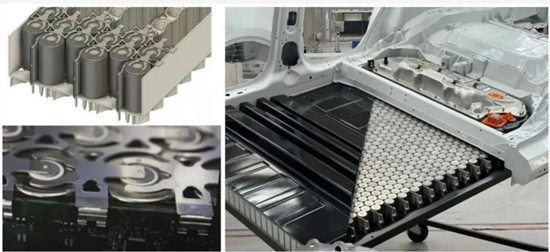

The 4680 battery is a large cylindrical lithium-ion cell with a diameter of 46 mm and a length of 80 mm. Since Tesla first unveiled it at its 2020 Battery Day, it has emerged as a symbolic cell form factor leading technological innovation across the global battery and electric vehicle industries. Compared to the existing 2170 and 1865 formats, the 4680 highlights multidimensional advantages such as higher energy density, reduced cell assembly count, improved thermal management efficiency, and lower costs.

Accordingly, not only Tesla but also major cell manufacturers including Panasonic, LG Energy Solution, Samsung SDI, CATL, and EVE Energy are racing to secure 4680 production capacity.

The 4680 battery particularly enables enhanced structural efficiency of EV platforms through Cell-to-Chassis (CtC) design and incorporates innovations such as the tabless electrode structure, which makes it possible to achieve high charge/discharge performance. These advances position the 4680 as a key technology that can drastically improve EV efficiency and cost competitiveness.

The most distinctive feature of the 4680, the tabless electrode structure, distributes the current-collecting tabs across the entire electrode instead of placing them at the cell's edges. This leads to more uniform current flow, reducing resistance distribution, suppressing heat generation, and improving thermal diffusion efficiency, thereby preventing localized overheating under high-power conditions. Additionally, the simplified manufacturing process eliminates the need for electrode-tab connection steps, boosting yield. While this architecture is difficult to implement in pouch or prismatic cells, in cylindrical cells-especially large ones-its advantages are maximized. Tesla's in-house cells actively leverage this structure along with dry electrode coating.

Meanwhile, Tesla sought to apply the dry electrode coating technology introduced via its acquisition of Maxwell Technologies to the 4680. This method, which attaches solid electrode materials to the current collector by high-speed pressing without using solvents, is an environmentally friendly (NMP-free) process. It shortens production time by eliminating drying, allows thicker and denser electrodes, and thereby improves energy density. However, challenges remain in mass production, such as ensuring coating thickness uniformity and interfacial adhesion stability. Some companies are therefore developing alternative high-speed coating solutions based on wet processes.

To maximize energy density, high-energy active materials are being applied: cathodes employ high-nickel (Ni > 88%) NCM/NCA to enhance both density and lifespan; anodes use silicon-composite graphite (Si-C) or fully silicon-based designs to boost fast-charging capability; electrolytes incorporate high-voltage stabilizing additives or gel electrolytes to improve durability and stability. In particular, silicon anodes face expansion control and conductivity challenges, tackled by nanocomposite technologies, carbon-matrix architectures, and interfacial stabilization additives.

As capacity increases, so does the need for thermal runaway and safety countermeasures. Due to the large-cell nature of the 4680, a single-cell failure can quickly cascade across the module. Accordingly, safety technologies such as thermal barriers, built-in PTC/thermal fuses, flame-retardant cell casings, and dispersed cooling pathways are being developed. Since structural analysis becomes more complex than in pouch or prismatic cells, simulation-based integrated structural-thermal-electrical design is expanding.

Although Tesla pioneered the concept, development of 46-Phi large-format cells is now actively underway in Korea, Japan, and China. Tesla is mass-producing 4680 cells at its Texas Gigafactory and Berlin plant, surpassing 100 million units in 2024. The company has applied the second-generation "Cybercell" to the Cybertruck to improve charging speed and performance, and by 2026 plans to develop at least four new variants-including the NC05-based on dry coating. Panasonic is conducting pilot production and supply from its Wakayama (Japan) and Nevada (U.S.) facilities, and has completed renovations for a large 4680 plant in Kansas. It is also undergoing sampling and approval processes with OEMs beyond Tesla.

Among Korean "K-3" companies: LG Energy Solution began pilot production at Ochang in August 2024 and is preparing for mass production at its new Arizona plant by the first half of 2026. Samsung SDI, starting in Q1 2025, will apply 46-Phi cells in micromobility packs and expand adoption with European OEMs such as BMW. Meanwhile, Chinese companies including CATL and EVE are testing 46-series cells for structural compatibility, while BYD is developing similar large cells based on LFP chemistry.

Ultimately, while the 4680 holds strong potential in terms of high capacity, high density, and cost reduction, the keys remain mass-production stabilization and technological maturity. The period between 2025 and 2026 is expected to be a watershed, as Tesla and Panasonic accumulate production experience while Korean firms build out full-scale supply systems.

Competition, however, is diversifying. Rivalry with other battery technologies such as LFP, the completion of dry processes, yield improvements, and levels of localization will shape the industry landscape. For the 4680 to truly establish itself as a game-changer in the EV market, the trifecta of technical completeness, cost competitiveness, and supply chain stability must be achieved.

This report by SNE systematically compiles scattered data from corporate announcements, teardown studies, and performance tests related to the 4680. It also reviews key academic papers to assess the actual effectiveness and performance improvements of the 4680, summarizes the status and main products of manufacturers, and presents correlations between Gigafactory scale, Cybertruck production volumes, and cell output-providing valuable insights on manufacturability for researchers and stakeholders.

The strong points of this report are as follows:

- 1. Comprehensive consolidation of development trends and information on the 4680, enabling easy overall understanding

- 2. Detailed analysis of 4680 cell and pack teardown reports, enhancing comprehension

- 3. Market and production outlook analysis for the 4680, clarifying market size and growth rates

- 4. In-depth review of materials and technologies applied in the 4680, based on academic papers

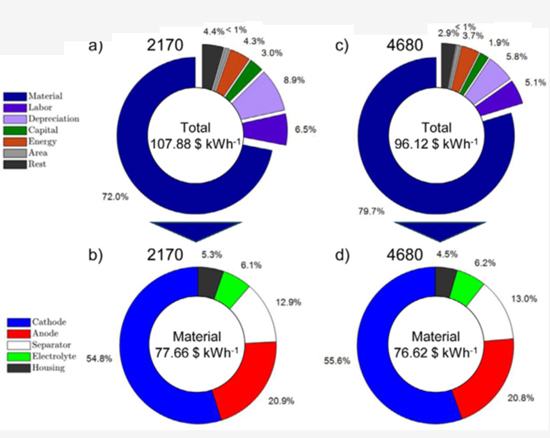

(a)(c) The total cost is classified into material costs, labor costs, depreciation, capital costs, energy costs, plant area costs, and other expenses, with their respective proportions shown. Material cost accounts for the largest share (72.0%).

(b)(d) Detailed material cost analysis of 2170 cells vs. 4680 cells. This donut chart breaks down material costs into anode, cathode, separator, electrolyte, and housing. It clearly shows that cathode and anode materials are the main cost drivers.

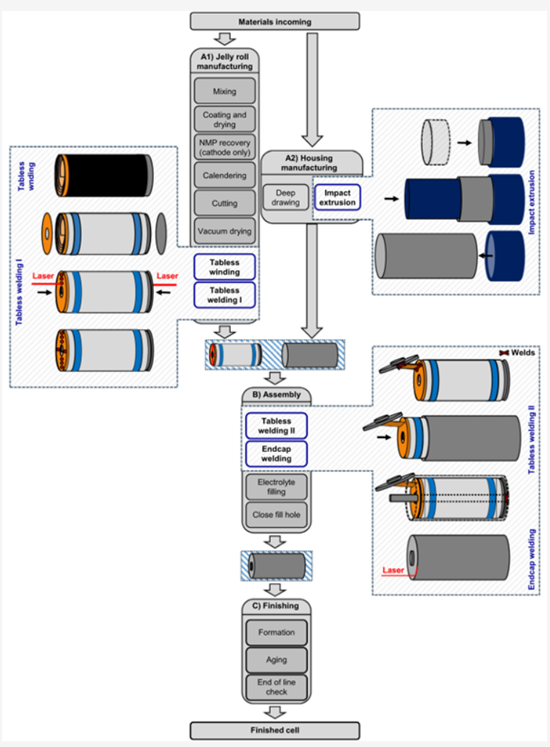

Manufacturing process of large tabless cylindrical lithium-ion cells (including can and end cap).

This figure visually illustrates the key steps of cell manufacturing:

- Top left: Tabless jelly-roll fabrication (A1) - shows how the jelly roll is formed together with the current collector plate. Laser welding is indicated.

- Top right: Can deep drawing (steel) or impact extrusion (aluminum) (A2) - illustrates the process of forming the housing.

- Center: Cell assembly (B) - the jelly roll is inserted into the housing and assembled through various welding processes. Laser and ultrasonic welding are indicated.

- Bottom: Finishing (C) - the fully assembled cell undergoes final inspection and treatment.

Table of Contents

1. Overview of 4680 Cylindrical Battery

- 1.1. Summary and Key Findings of Tesla Battery Day (Sep 22, 2020)

- 1.2. Battery Cell Design

- 1.3. Battery Cell Manufacturing Process

- 1.3.1. Coating Process

- 1.3.2. Winding Process

- 1.3.3. Assembly Process

- 1.3.4. Formation Process

- 1.4. Silicon Anode Material

- 1.5. High-Nickel Cathode Material

- 1.6. Cell-to-Vehicle Integration

- 1.7. Battery Cost Reduction

- 1.8. 4680 Battery Development

- 1.8.1. Specifications of 4680 Battery

- 1.8.2. Tesla Battery Suppliers

- 1.8.3. Global Development and Production Status of 4680 Batteries

- 1.9. Global 46xx Battery Production Capacity

- 1.9.1. Advantages and Disadvantages of New 46xx Cell Design

2. Development of 4680 Battery Cells

- 2.1. Cost Reduction and Efficiency Enhancement Strategy

- 2.2. Increasing Safety Requirements (Thermal Management Upgrade)

- 2.3. Fast Charging as a Future Trend: Advantages of 4680's High Charging Speed

- 2.4. Market Entry Competition Among Leading Companies

- 2.5. Detailed Specifications of 46xx Batteries by Company

3. Detailed Technology of 4680 Battery

- 3.1. Cathode Materials

- 3.1.1. Ultra High-Nickel Application

- 3.1.2. Production Capacity Expansion

- 3.1.3. Manufacturing Technology Upgrade

- 3.2. Anode Materials

- 3.2.1. Silicon-Based Development

- 3.2.2. Silicon Development Timeline

- 3.2.3. Silicon Anode Modifications: Nanostructuring, Carbon Composites, Pre-lithiation

- 3.2.4. Commercialization Acceleration of Silicon Anode

- 3.3. Other Battery Materials

- 3.3.1. SWCNT Conductive Additives

- 3.3.2. Steel Battery Can

- 3.3.3. Aluminum Battery Can

- 3.3.3.1. Al Housing Cell Design Concept

- 3.3.3.2. 46xx Large Cylindrical Cell

- 3.3.3.3. 46xx Jelly Roll Concept

- 3.3.3.4. Jelly Roll Thermal Transfer and Distribution

- 3.3.3.5. Thermal Simulation of Jelly Roll Concept

- 3.3.3.6. Cooling Performance Enhancement for 46xx Cells

- 3.4. Improvements in 4680 Manufacturing Process

- 3.4.1. Process Technologies for 4680

- 3.4.2. Differentiation in Production Process

- 3.4.2.1. Dry Electrode Coating

- 3.4.2.2. Example Dry Process (Huaqi New Energy)

- 3.4.2.3. Integrated Electrode and Tab Cutting

- 3.4.2.4. Increased Laser Welding Difficulty

- 3.4.2.5. Integrated Die Casting and CTC

4. 4680 Battery Teardown and Analysis

- 4.1. Overview

- 4.2. Teardown and Analytical Process

- 4.3. Detailed Engineering Analysis of Tesla 4680 Cells and Packs

- 4.3.1. Tesla 4680 Cell Design Data (w/o Tab)

- 4.3.2. Pack Structure (Cell Orientation)

- 4.3.3. Proposed Assembly Methods for 4680 Pack

- 4.3.4. Analysis of 4680 Pack for Model 3: Expected Charge Time, Power, and Dimensions

- 4.3.4.1. Summary of Pack Analysis

- 4.3.4.2. Thermal Dissipation Discussion

- 4.3.5. Current Collector for Model 3 Battery

5. Teardown and Electrochemical Study of Tesla 4680 Cell

- 5.1. Summary

- 5.2. Study Overview

- 5.3. Previous Research

- 5.4. Detailed Analysis

- 5.5. Experiments

- 5.5.1. Overview of Test Cell

- 5.5.2. Cell Disassembly and Material Extraction

- 5.5.3. Structural and Elemental Analysis

- 5.5.4. Three-Electrode Analysis

- 5.5.5. Electrical Characteristics

- 5.5.6. Thermal Investigation

- 5.6. Results & Discussion

- 5.6.1. Cell and Jelly Roll Structure

- 5.6.2. Electrode Design

- 5.6.3. Material Properties

- 5.6.4. Three-Electrode Analysis

- 5.6.5. Capacity and Impedance Analysis

- 5.6.6. Quasi-OCV, DVA and ICA

- 5.6.7. HPPC (Hybrid Pulse Power Characterization)

- 5.6.8. Thermal Characterization at Cell Level

- 5.7. Conclusion

6. Technologies Required for 4680 Battery Success

- 6.1. Multi-Tab Technology

- 6.2. Tab Welding Technology

- 6.3. Cathode & Anode Materials

- 6.4. Cooling Technology

7. Comparison of 4680 with 18650 & 2170: Energy Density and Cost Reduction

- 7.1. Overview

- 7.2. 4680: Energy Density, Fast Charging, and Cost Reduction

- 7.2.1. Energy Density vs. Blade & Prismatic Hi-Ni Batteries

- 7.2.2. Improvement in Fast Charging Speed

- 7.2.3. Dry Electrode: Production Standardization and Cost Down

- 7.3. Use of High-Concentration Electrolyte

- 7.3.1. Electrolyte Reduction per GWh

- 7.3.2. High-Concentration Electrolyte with LiFSI Additive

- 7.3.3. Fluorinated Solvent (FEC): Performance Boost in NCM811/SiOx

- 7.4. Major Electrolyte Companies for 4680

8. Design of Battery Thermal Management System (BTMS) for Tesla 4680 Module

- 8.1. Introduction

- 8.2. Need for BTMS in EV Batteries

- 8.3. Cooling Methods

- 8.4. Literature Review

- 8.5. Liquid Cooling + Heat Pipe for 4680 Module: Method, Results, Conclusion

- 8.6. Thermal Analysis of Proposed Cooling System

- 8.7. Results & Discussion

- 8.8. Conclusion

9. Thermal Management of 4680 Cells: Design and Cooling

- 9.1. Overview

- 9.2. Introduction

- 9.2.1. Previous Research

- 9.2.2. Contributions of This Study

- 9.3. Experimental

- 9.3.1. Reference Cell

- 9.3.2. Thermal Battery Test Bench

- 9.3.3. Test Procedure

- 9.4. Simulation Model

- 9.4.1. Housing & Cooler

- 9.4.2. Jelly Roll

- 9.4.3. Cathode and Anode Tabs

- 9.4.4. Model Calibration and Validation

- 9.5. Simulation Results

- 9.5.1. Impact of Tab Design

- 9.5.2. Impact of Housing Materials

- 9.5.3. Interaction between Tab Design and Housing Material

- 9.6. Conclusion

10. Design, Properties, and Manufacturing of Cylindrical LIB Cells

- 10.1. Overview

- 10.2. Experimental Materials and Methods

- 10.2.1. Cell Design

- 10.2.2. Cell Properties

- 10.3. Experimental Results and Discussion

- 10.3.1. Design of Cylindrical LIB Cell

- 10.3.2. Jelly Roll Design

- 10.3.2.1. Geometry

- 10.3.3. Tab Design

- 10.3.4. Cell Characteristics

- 10.3.4.1. Energy Density

- 10.3.4.2. Cell Resistance

- 10.3.4.3. Thermal Behavior

- 10.3.5. Jelly Roll Manufacturing

- 10.4. Conclusion

11. Effects of Cell Size and Housing Materials in Tabless Cylindrical LIB Cells

- 11.1. Overview

- 11.2. Experiment

- 11.2.1. Reference Cell

- 11.2.2. Modeling

- 11.2.2.1. Geometrical Modeling

- 11.2.2.2. Jelly Roll Electrode Layers

- 11.2.2.3. Hollow Core

- 11.2.2.4. Tabless Design

- 11.2.3. Cell Housing

- 11.2.4. Thermo-Electrochemical Framework

- 11.2.4.1. Boundary Conditions and Discretization

- 11.3. Results and Discussion

- 11.3.1. Energy Density

- 11.3.1.1. Effect of Diameter

- 11.3.1.2. Effect of Height

- 11.3.1.3. Effect of Housing Material

- 11.3.2. Fast Charging Performance

- 11.3.2.1. Heat Transfer Algorithm

- 11.3.2.2. Effect of Axial Cooling (Height/Housing)

- 11.3.2.3. Effect of Axial Cooling (Diameter/Housing)

- 11.3.2.4. Tab Design & Series Resistance Scaling

- 11.3.2.5. Overall Effect on Fast Charging

- 11.3.1. Energy Density

- 11.4. Conclusion

12. Thermal Runaway & Propagation in Large Tabless Cylindrical LIB Cells

- 12.1. Study on TR & TP Characteristics

- 12.2. Introduction: Need for New Design

- 12.2.1. Test Cell & Innovations

- 12.2.2. Limitations of Al Housing

- 12.2.3. TR Test Methods

- 12.2.4. Potting Compounds

- 12.2.5. Future Research

- 12.3. Experiment

- 12.3.1. Tabless Cell Investigation

- 12.3.2. Trigger Methods in Al Housing

- 12.3.2.1. China Safety Standards

- 12.3.2.2. FTRC Comparison

- 12.3.2.3. Large Cell Triggering Limits

- 12.3.2.4. Rupture Mechanism & Short Circuit

- 12.3.2.5. Axial Nail Penetration

- 12.3.2.6. Trigger Parameters & Geometry

- 12.3.2.7. Accelerated Calorimetry (EV-ARC)

- 12.3.2.8. Pressure Chamber Bench

- 12.3.2.9. Small Module TP Test

- 12.3.2.10. Radial Nail & Plate Test

- 12.3.2.11. Mechanical Triggering

- 12.3.3. EV-ARC Evaluation

- 12.3.3.1. Decomposition & Detection Temp

- 12.3.3.2. Reaction Mechanism

- 12.3.3.3. Dispersion Analysis

- 12.3.3.4. Temperature Distribution

- 12.3.3.5. Enthalpy Estimation

- 12.3.3.6. Voltage & Venting

- 12.3.3.7. Post-TR Mass Mapping

- 12.3.3.8. TR Cell Characteristics

13. Comparative Analysis: Tesla 4680 vs. BYD Blade Cell

- 13.1. Introduction

- 13.2. Results & Discussion

- 13.2.1. Mechanical Design & Process

- 13.2.2. Cell Housing

- 13.2.3. Electrode Composition

- 13.2.4. Contact Technology

- 13.2.5. Electrode Structure & Measurement

- 13.2.6. Manufacturing Process Flow

- 13.2.7. Materials & Cost Analysis

- 13.2.8. Electrical Performance

- 13.2.9. Thermal Efficiency & Resistance

- 13.2.10. Thermal Analysis

14. Modeling Study: Cell Size & Housing Impact in Tabless Cylindrical LIB

- 14.1. Introduction

- 14.2. Process Analysis

- 14.2.1. Manufacturing Impact

- 14.2.2. Reference Cell

- 14.2.3. Manufacturing Classification

- 14.2.3.1. Tabless Jelly Roll

- 14.2.3.2. Housing

- 14.2.3.3. Assembly

- 14.3. Modeling

- 14.3.1. Process-Based Cost Model

- 14.3.2. Geometrical Model

- 14.3.3. Process Model

- 14.3.4. Operations Model

- 14.3.5. Financial Model

- 14.4. Results & Discussion

- 14.4.1. Validation

- 14.4.2. Cell Size Effects

- 14.4.2.1. Diameter

- 14.4.2.2. Height

- 14.4.2.3. Cell Count

- 14.4.3. Housing Material Effects

- 14.5. Conclusion

15. Cost Comparison: Tabless vs. Standard Electrode Cylindrical LIB

- 15.1. Summary: Tesla's Tabless Design

- 15.2. Introduction

- 15.2.1. Design Comparison & Process Considerations

- 15.3. Methodology

- 15.3.1. Cost Modeling

- 15.3.2. Included Elements

- 15.3.3. Parameterization

- 15.4. Results

- 15.4.1. Output Calculation

- 15.4.2. Baseline Cost Analysis

- 15.4.3. Sensitivity Analysis

- 15.5. Conclusion

16. Status of 4680 Cell Manufacturers

- 16.1. Tesla

- 16.2. Panasonic

- 16.3. LGES

- 16.4. Samsung SDI

- 16.5. SK On

- 16.6. EVE

- 16.7. BAK

- 16.8. CATL

- 16.9. Gotion Hi-TECH

- 16.10. SVOLT

- 16.11. CALB

- 16.12. Envision AESC

- 16.13. LISHEN

- 16.14. Easpring (Dangsheng Technology)

- 16.15. Kumyang

- 16.16. BMW

- 16.17. Dongwon Systems

- 16.18. Sungwoo

- 16.19. TCC Steel

- 16.20. Dongkuk Industries

- 16.21. Shinheung SEC

- 16.22. Sangsin EDP

- 16.23. LT Precision

- 16.24. NIO

17. Patent Analysis on 4680 Batteries

- 17.1. Battery with Tabless Electrode

- 17.2. Tesla: Tabless Energy Storage Devices and Manufacturing Methods

- 17.3. Tesla Dry Electrode Process Patent (1): Fine Particle Non-Fibrous Binder

- 17.4. Tesla Dry Electrode Process Patent (2): Adhesive Passivation Film Composition for Dry Electrodes

- 17.5. LG Energy Solution: Tabless-Related Patents (Electrode Assembly, Battery, Battery Pack, and Vehicle)

- 17.6. Murata: Tabless Battery

- 17.7. Jiangsu Zenergy Battery

- 17.8. EVE Energy (Tab Flattening Device)

- 17.9. Microvast Inc. (Tab Plate & Wound Battery)

18. Market Outlook for 4680 Batteries

- 18.1. Overall Market Outlook

- 18.2. Materials and Process Technology Forecast for 4680

- 18.3. Chemical Industry: Silicon-Carbon Anode, PTFE, LiFSI, and Other Materials

- 18.3.1. Silicon-Carbon Anode Materials

- 18.3.2. PTFE, LiFSI, and Other Additives

- 18.3.3. Non-Ferrous Metals: Lithium, Cobalt, Nickel Demand

- 18.3.4. Hi-Ni Cathode + Silicon-Based Anode

- 18.4. Policy, Demand, and CAPA Forecasts Surrounding 4680

- 18.4.1. 4680 Cylindrical Battery Industry Chain

- 18.4.2. Analysis of China's 4680 Battery Industry Status

- 18.4.3. Market Structure of 4680 Cylindrical Batteries

- 18.4.4. Declining Trend in Cylindrical Battery Adoption

- 18.4.5. New Form Factor Development by Battery Manufacturers

- 18.4.6. Development and Production Forecast for 4680 (46xxx) Batteries

- 18.4.7. Development Trend of China's 4680 Battery Industry

- 18.4.8. Demand Forecast for EV 46xx Batteries

19. Forecast of Tesla 4680 Cell Production

- 19.1. Estimated Production at GIGA TEXAS

- 19.2. Tesla 4680 Battery Production Timeline and Key Milestones

- 19.3. Summary of Latest Tesla 4680 Battery Program

- 19.4. Cost Structure of Tesla 4680 Battery Cells

- 19.5. Efficiency Improvements and Cost Reduction Factors

- 19.6. Current Status of Tesla 4680 Cell Development

- 19.7. Recent Developments in Tesla 4680 and Supercharger Network

- 19.8. Summary of Tesla's Battery Production and Lithium Refining Business

- 19.9. 4680 Cell Production Capacity vs. Cybertruck Output

- 19.10. Annual 4680 CAPA vs. Daily Production Output

- 19.11. 4680 CAPA vs. Production Time Trends

- 19.12. Major Assembly Processes at Tesla Giga Factory P/P Line