PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1893724

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1893724

Railway Management System Market By Offering (Solution, Service), Railway Type - Global Forecast to 2030

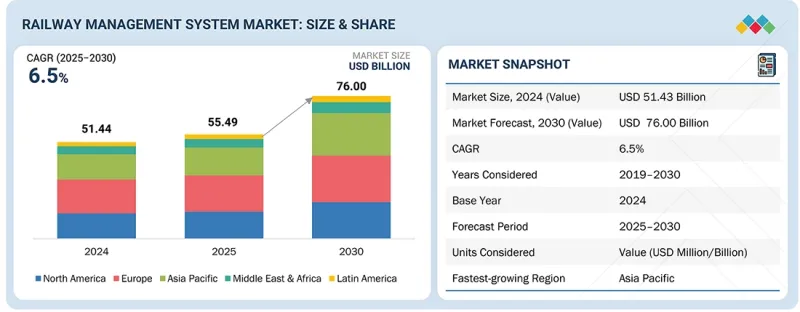

MarketsandMarkets forecasts that the railway management system market size is projected to grow from USD 55.49 billion in 2025 to USD 76.00 billion by 2030, at a CAGR of 6.5% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Segments | By Offering, By Railway Type |

| Regions covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

As passenger expectations evolve, railway operators are under pressure to provide a seamless and enjoyable travel experience. Integrated ticketing systems, real-time passenger information, Wi-Fi connectivity, and entertainment services are becoming standard features of modern railway management systems.

"Among offerings, railway management services are projected to grow at the highest CAGR during the forecast period."

The services segment in the railway management system market is projected to register the highest CAGR during the forecast period due to the expanding complexity of railway operations and the growing demand for end-to-end expertise. Consulting services guide operators through digital transformation and regulatory compliance, creating upfront demand. System integration and deployment tie together legacy signaling, rolling stock telemetry, and new cloud-based traffic management platforms, requiring specialist integrators. Support and maintenance provide recurring revenue as rail operators prioritize uptime, safety, cybersecurity and predictive maintenance, driving long-term service contracts. Additionally, rising public and private investment in electrification, high-speed corridors, and urban mobility projects fuels large deployment programs that rely on external services. Vendors offering comprehensive service bundles and performance-based SLAs are better positioned to capture value, accelerating services growth faster than standalone hardware or software.

"Support & maintenance services are poised to hold the largest share of the railway management services during the forecast period."

The support & maintenance segment is estimated to account for the largest market share because railway management systems require continuous overseeing, upgrades, and technical intervention to ensure safe, efficient, and uninterrupted operations. As rail networks adopt advanced signaling, real-time monitoring, predictive maintenance, and integrated traffic management platforms, the complexity of these systems increases, creating long-term reliance on specialized support services. Operators depend on vendors for software updates, system health monitoring, remote diagnostics, spare parts management, and corrective maintenance to maintain performance and regulatory compliance. Aging infrastructure further amplifies the need for sustained maintenance to extend asset life and avoid costly downtime. Vendors are strengthening this segment by offering multi-year maintenance contracts, remote operations support, and condition-based maintenance solutions integrated with IoT and AI. Since operational reliability and uptime are mission-critical for both passenger and freight services, ongoing support and maintenance become essential recurring expenditures, positioning this segment to dominate market share across the forecast period.

"Asia Pacific is projected to grow with the highest CAGR during the forecast period."

Asia Pacific is poised for the highest CAGR as concentrated public investment, rapid urbanization, and major capacity projects drive strong demand for signaling, traffic management, and digital operations platforms. India's national master plan and corridor programs are accelerating signaling upgrades and multimodal connectivity investments. Large deployments and control-center modernization, such as Alstom's ICONIS rollout for KiwiRail, demonstrate regional appetite for traffic management systems that improve scheduling and network visibility. Australia's multi-line metro expansion and new airport links are lifting demand for integrated control and automation platforms. Singapore's continued MRT reliability and upgrade programs underscore urban transit modernization needs across dense city networks. China's sustained rail modernization and network expansion further widen the addressable market for digital signaling, predictive maintenance, and lifecycle services. Collectively, policy support, funding availability, and high-volume greenfield and brownfield projects make Asia Pacific the fastest-growing region for railway management systems.

Breakdown of primaries

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The break-up of the primaries is as follows:

- By Company: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: Managers - 40%, C-level Executives - 35%, and Director Level - 25%

- By Region: North America - 22%, Europe - 22%, Asia Pacific - 45%, RoW - 11%

The major players in the railway management system market are Alstom SA (France), Huawei Technologies Co., Ltd. (China), Siemens AG (Germany), Hitachi, Ltd. (Japan), Wabtec Corporation (US), Cisco Systems, Inc. (US), ABB (Switzerland), Indra Sistemas, S.A. (Spain), IBM (US), Honeywell International Inc. (US), CAF, Construcciones y Auxiliar de Ferrocarriles, S.A. (Spain), WSP (Canada), Kyosan Electric Mfg. Co., (Japan), Advantech Co., Ltd. (Taiwan), Thales (France), Amadeus IT Group SA (Spain), AtkinsRealis (UK), DXC Technology Company (US), Fujitsu Limited (Japan), Railroad Software (US), Railcube (Netherlands), Praedico (Netherlands), NWAY Technologies Private Limited (India), Eurotech S.p.A. (Italy), Frequentis (Austria), Railinc Corporation (US), Arcadis Gen Holdings Limited (UK), Telegraph (US), Tracis (UK), and Rail-Flow (Germany). These players have adopted various growth strategies, such as partnerships, agreements, and collaborations, new product launches, product enhancements, and acquisitions, to expand their footprint in the railway management system market.

Research Coverage

The report segments the global railway management system market based on offering has been classified into solutions (rail operations management, rail traffic management [signaling solutions, real-time train planning and route scheduling/optimizing, centralized traffic control, positive train control, rail communications-based train control {CBTC}, other traffic management solutions], asset management, intelligent in-train solutions, other solutions [passenger information systems, network management, security, surveillance, and access control]) and services (consulting services, system integration and deployment services, support and maintenance services), by railway type (passenger, freight). By region, the market has been segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

Key benefits of the report

The report would help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall railway management system market and the subsegments. This report would help stakeholders understand the competitive landscape and gain insights to better position their businesses and plan suitable go-to-market strategies. The report would help stakeholders understand the pulse of the market and provide them with information on the key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

Analysis of key drivers (favorable government initiatives and public-private partnerships, rising global urbanization and passenger demand, predictive maintenance and real-time asset management), restraints (high upfront hardware and integration costs, fragmented legacy infrastructure), opportunities (integration of intelligent solutions in transportation infrastructure, real-time data analytics and business intelligence services), and challenges (data security and privacy issues, stringent safety and regulatory standards).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the railway management system market.

- Market Development: Comprehensive information about lucrative markets-the report analyses the railway management system market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the railway management system market.

Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Alstom SA (France), Huawei Technologies Co., Ltd. (China), Siemens AG (Germany), Hitachi, Ltd. (Japan), Wabtec Corporation (US), Cisco Systems, Inc. (US), ABB (Switzerland), Indra Sistemas, S.A. (Spain), IBM (US), Honeywell International Inc. (US), CAF (Construcciones y Auxiliar de Ferrocarriles, S.A.) (Spain), WSP (Canada), Kyosan Electric Mfg. Co., (Japan), Advantech Co., Ltd. (Taiwan), Thales (France), Amadeus IT Group SA (Spain), AtkinsRealis (UK), DXC Technology Company (US), Fujitsu Limited (Japan), Railroad Software (US), Railcube (Netherlands), Praedico (Netherlands), NWAY Technologies Private Limited (India), Eurotech S.p.A. (Italy), Frequentis (Austria), Railinc Corporation (US), Arcadis Gen Holdings Limited (UK), Telegraph (US), Tracis (UK), and Rail-Flow (Germany).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS IN RAILWAY MANAGEMENT SYSTEM MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN RAILWAY MANAGEMENT SYSTEM MARKET

- 3.2 RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING AND REGION

- 3.3 RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING

- 3.4 RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION

- 3.5 RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Favorable government initiatives and public-private partnerships

- 4.2.1.2 Rising global urbanization and passenger demand

- 4.2.1.3 Predictive maintenance and real-time asset management

- 4.2.2 RESTRAINTS

- 4.2.2.1 High upfront hardware and integration costs

- 4.2.2.2 Fragmented legacy infrastructure

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Integration of intelligent solutions in transportation infrastructure

- 4.2.3.2 Real-time data analytics and business intelligence services

- 4.2.3.3 Renewable energy integration and decarbonization

- 4.2.4 CHALLENGES

- 4.2.4.1 Data security and privacy issues

- 4.2.4.2 Stringent safety and regulatory standards

- 4.2.1 DRIVERS

- 4.3 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.3.1 INTERCONNECTED MARKETS

- 4.3.2 CROSS-SECTOR OPPORTUNITIES

- 4.4 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 THREAT OF NEW ENTRANTS

- 5.1.2 THREAT OF SUBSTITUTES

- 5.1.3 BARGAINING POWER OF SUPPLIERS

- 5.1.4 BARGAINING POWER OF BUYERS

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMIC OUTLOOK

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 TRENDS IN GLOBAL RAILWAY MANAGEMENT INDUSTRY

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.3.1 OEMS (ORIGINAL EQUIPMENT MANUFACTURERS)

- 5.3.2 CONNECTIVITY SERVICE PROVIDERS

- 5.3.3 SOLUTION AND SERVICE PROVIDERS

- 5.3.4 SYSTEM INTEGRATORS

- 5.3.5 RAILWAY OPERATING BODIES

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND, BY REGION, 2023-2026

- 5.5.2 INDICATIVE PRICING ANALYSIS, BY SYSTEM, 2024

- 5.6 TRADE ANALYSIS

- 5.6.1 EXPORT SCENARIO FOR HS CODE: 853010

- 5.6.2 IMPORT SCENARIO FOR HS CODE: 853010

- 5.7 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 NORTHERN TRAINS AND FUJITSU DEPLOYED INTEGRATED MOBILE TICKETING PLATFORM TO ENHANCE REVENUE PROTECTION

- 5.10.2 HITACHI RAIL AND RFI DELIVERED ADVANCED SIGNALING INTEGRATION FOR ITALY'S HIGH-SPEED RAIL NETWORK MODERNIZATION

- 5.10.3 PRASA AND HUAWEI IMPLEMENTED SMART PERIMETER SECURITY TO REDUCE THEFT AND IMPROVE RAILWAY SAFETY OPERATIONS

- 5.10.4 QUEENSLAND RAIL AND DXC DIGITALIZED MAINTENANCE OPERATIONS WITH MOBILE SAP WORK MANAGEMENT SOLUTION

- 5.10.5 THALES ENABLED UNIFIED DIGITAL IDENTITY PLATFORM FOR LEADING GLOBAL RAIL OPERATOR TO TRANSFORM PASSENGER EXPERIENCE

- 5.11 IMPACT OF 2025 US TARIFF - RAILWAY MANAGEMENT SYSTEM MARKET

- 5.11.1 INTRODUCTION

- 5.11.2 KEY TARIFF RATES

- 5.11.3 PRICE IMPACT ANALYSIS

- 5.11.3.1 Strategic Shifts and Emerging Trends

- 5.11.4 IMPACT ON COUNTRY/REGION

- 5.11.4.1 US

- 5.11.4.2 China

- 5.11.4.3 Europe

- 5.11.4.4 Asia Pacific (excluding China)

- 5.11.5 IMPACT ON END-USER INDUSTRY

- 5.11.5.1 Freight and intermodal logistics

- 5.11.5.2 Passenger transit and commuter rail

- 5.11.5.3 Urban metro systems and light rail

6 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTION

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 FUTURE RAILWAY MOBILE COMMUNICATION SYSTEM (FRMCS)

- 6.1.2 DIGITAL TWIN TECHNOLOGY

- 6.1.3 EUROPEAN TRAIN CONTROL SYSTEM (ETCS) LEVEL 3

- 6.1.4 DIGITAL AUTOMATIC COUPLING (DAC)

- 6.1.5 HYDROGEN FUEL CELL AND BATTERY-ELECTRIC PROPULSION SYSTEMS

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 GEOSPATIAL INFORMATION SYSTEMS (GIS) AND LIDAR TECHNOLOGY

- 6.2.2 CLOUD COMPUTING AND OPERATIONAL TECHNOLOGY (OT) CLOUD INFRASTRUCTURE

- 6.2.3 EDGE COMPUTING AND REAL-TIME DATA PROCESSING

- 6.2.4 COMPUTER VISION AND MACHINE VISION INSPECTION SYSTEMS

- 6.3 TECHNOLOGY ROADMAP

- 6.3.1 SHORT-TERM (2025-2026) | FOUNDATION & EARLY COMMERCIALIZATION

- 6.3.2 MID-TERM (2027-2028) | EXPANSION & STANDARDIZATION

- 6.3.3 LONG-TERM (2029-2030+) | MASS COMMERCIALIZATION & DISRUPTION

- 6.4 PATENT ANALYSIS

- 6.4.1 INTRODUCTION

- 6.4.2 METHODOLOGY

- 6.4.3 DOCUMENT TYPE

- 6.4.4 INSIGHTS

- 6.4.5 JURISDICTION ANALYSIS

- 6.4.6 TOP APPLICANTS

- 6.5 IMPACT OF AI/GEN AI ON RAILWAY MANAGEMENT SYSTEM MARKET

- 6.5.1 TOP USE CASES AND MARKET POTENTIAL

- 6.5.2 CASE STUDIES OF AI IMPLEMENTATION IN RAILWAY MANAGEMENT SYSTEM MARKET

- 6.5.3 INTERCONNECTED ADJACENT ECOSYSTEMS AND IMPACT ON MARKET PLAYERS

- 6.5.4 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN RAILWAY MANAGEMENT SYSTEM MARKET

- 6.6 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 6.6.1 ALSTOM: DRIVING PREDICTIVE MAINTENANCE TRANSFORMATION IN RAILWAY SYSTEMS WITH HEALTHHUB

- 6.6.2 SIEMENS MOBILITY: ADVANCING RAIL INFRASTRUCTURE MODERNIZATION THROUGH AI-POWERED DIGITAL TWINS

- 6.6.3 HITACHI RAIL: TRANSFORMING RAILWAY OPERATIONS WITH AI-ENABLED HMAX DIGITAL ASSET MANAGEMENT

7 REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 INDUSTRY STANDARDS

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

9 RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING

- 9.1 INTRODUCTION

- 9.1.1 MARKET DRIVERS

- 9.2 SOLUTIONS

- 9.2.1 RAIL OPERATIONS MANAGEMENT

- 9.2.1.1 Need for smooth, uninterrupted routine operations to drive market

- 9.2.2 RAIL TRAFFIC MANAGEMENT

- 9.2.2.1 Signaling solutions

- 9.2.2.1.1 Increasing focus on disaster management and loss minimization to drive market

- 9.2.2.2 Real-time train planning and route scheduling/optimizing

- 9.2.2.2.1 Rising need for improved workflow management and timetable planning to drive market

- 9.2.2.3 Centralized traffic control

- 9.2.2.3.1 Growing emphasis on collecting crucial real-time information about traffic density to drive market

- 9.2.2.4 Positive train control

- 9.2.2.4.1 Surge in use of GPS-based safety technology to drive market

- 9.2.2.5 Rail communications-based train control

- 9.2.2.5.1 Increasing demand for mass transit transport to drive market

- 9.2.2.6 Other traffic management solutions

- 9.2.2.1 Signaling solutions

- 9.2.3 ASSET MANAGEMENT

- 9.2.3.1 Enterprise asset management

- 9.2.3.1.1 Rising inclination toward centralized asset inventory management to drive the market

- 9.2.3.2 Field service management

- 9.2.3.2.1 Increasing need for optimized workforce allocation to drive market

- 9.2.3.3 Asset performance management

- 9.2.3.3.1 Growing focus on monitoring equipment health to drive market

- 9.2.3.4 Other asset management solutions

- 9.2.3.1 Enterprise asset management

- 9.2.4 INTELLIGENT IN-TRAIN SOLUTIONS

- 9.2.4.1 Increasing demand for enhanced passenger experience to drive market

- 9.2.5 OTHER SOLUTIONS

- 9.2.1 RAIL OPERATIONS MANAGEMENT

- 9.3 SERVICES

- 9.3.1 CONSULTING

- 9.3.1.1 Growing shift toward smart railway infrastructure to drive market

- 9.3.2 SYSTEM INTEGRATION AND DEPLOYMENT

- 9.3.2.1 Rising demand for cost-effective systems with minimal deployment-related disruptions to drive market

- 9.3.3 SUPPORT & MAINTENANCE

- 9.3.3.1 Need for troubleshooting assistance and repairing components to drive market

- 9.3.1 CONSULTING

10 RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE

- 10.1 INTRODUCTION

- 10.1.1 MARKET DRIVERS

- 10.2 PASSENGER

- 10.3 FREIGHT

11 RAILWAY MANAGEMENT SYSTEM MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Favorable government initiatives to drive market

- 11.2.2 CANADA

- 11.2.2.1 Growing capital investments to drive market

- 11.2.1 US

- 11.3 EUROPE

- 11.3.1 UK

- 11.3.1.1 Increasing emphasis on improving infrastructure to drive market

- 11.3.2 GERMANY

- 11.3.2.1 Rising number of electrified tracks and rail modernization efforts to drive market

- 11.3.3 FRANCE

- 11.3.3.1 Surge in liberalization efforts to drive market

- 11.3.4 ITALY

- 11.3.4.1 Increasing emphasis on carbon neutrality efforts to drive market

- 11.3.5 REST OF EUROPE

- 11.3.1 UK

- 11.4 ASIA PACIFIC

- 11.4.1 CHINA

- 11.4.1.1 Booming Belt and Road Initiative to drive market

- 11.4.2 JAPAN

- 11.4.2.1 Rising focus on diversified revenue streams to drive market

- 11.4.3 INDIA

- 11.4.3.1 Increasing development of high-speed rail network to drive market

- 11.4.4 AUSTRALIA & NEW ZEALAND

- 11.4.4.1 Growing focus on Cross River Rail and Inland Rail projects to drive market

- 11.4.5 REST OF ASIA PACIFIC

- 11.4.1 CHINA

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 KSA

- 11.5.1.1 Growing focus on Cross River Rail and Inland Rail projects to drive market

- 11.5.2 UAE

- 11.5.2.1 Increasing number of logistics and fleet transport companies to drive market

- 11.5.3 SOUTH AFRICA

- 11.5.3.1 Growing adoption of IoT and cloud technologies to drive market

- 11.5.4 REST OF MIDDLE EAST & AFRICA

- 11.5.1 KSA

- 11.6 LATIN AMERICA

- 11.6.1 BRAZIL

- 11.6.1.1 Surge in information technology infrastructure development and upgrades to drive market

- 11.6.2 ARGENTINA

- 11.6.2.1 Accelerating railway modernization and private concessions to transform Argentina's rail network

- 11.6.3 REST OF LATIN AMERICA

- 11.6.1 BRAZIL

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS

- 12.5 BRAND/PRODUCT COMPARISON

- 12.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- 12.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.6.5.1 Company footprint: Key players, 2024

- 12.6.5.2 Offering footprint: Key players, 2024

- 12.6.5.3 Solution footprint: Key players, 2024

- 12.6.5.4 Railway type footprint: Key players, 2024

- 12.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- 12.7.5 COMPETITIVE BENCHMARKING

- 12.8 COMPANY VALUATION AND FINANCIAL METRICS

- 12.9 COMPETITIVE SCENARIOS AND TRENDS

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 MAJOR PLAYERS

- 13.1.1 ALSTOM SA

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches and enhancements

- 13.1.1.3.2 Deals

- 13.1.1.3.3 Expansions

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 HUAWEI TECHNOLOGIES CO., LTD.

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product Launches and Enhancements

- 13.1.2.3.2 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 SIEMENS

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product Launches and Enhancements

- 13.1.3.3.2 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 HITACHI, LTD.

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product Launches and Enhancements

- 13.1.4.3.2 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 WABTEC CORPORATION

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product Launches and Enhancements

- 13.1.5.3.2 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 CISCO SYSTEMS, INC.

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product Launches and Enhancements

- 13.1.7 ABB

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.8 INDRA SISTEMAS, S.A.

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product Launches

- 13.1.8.3.2 Deals

- 13.1.9 IBM CORPORATION

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.10 HONEYWELL INTERNATIONAL INC.

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.1 ALSTOM SA

- 13.2 OTHER PLAYERS

- 13.2.1 CAF

- 13.2.2 WSP

- 13.2.3 KYOSAN ELECTRIC MFG. CO., LTD.

- 13.2.4 ADVANTECH CO., LTD.

- 13.2.5 THALES

- 13.2.6 AMADEUS IT GROUP SA

- 13.2.7 ATKINSREALIS

- 13.2.8 DXC TECHNOLOGY COMPANY

- 13.2.9 FUJITSU

- 13.3 SMES/STARTUPS

- 13.3.1 RAILROAD SOFTWARE

- 13.3.2 RAILCUBE

- 13.3.3 PRAEDICO

- 13.3.4 NWAY TECHNOLOGIES

- 13.3.5 EUROTECH S.P.A.

- 13.3.6 FREQUENTIS

- 13.3.7 RAILINC CORPORATION

- 13.3.8 ARCADIS GEN HOLDINGS LIMITED

- 13.3.9 TELEGRAPH

- 13.3.10 TRACSIS PLC

- 13.3.11 RAIL-FLOW

14 RESEARCH METHODOLOGY

- 14.1 RESEARCH DATA

- 14.1.1 SECONDARY DATA

- 14.1.1.1 Key data from secondary sources

- 14.1.2 PRIMARY DATA

- 14.1.2.1 Breakup of primary interviews

- 14.1.2.2 Key primary interview participants

- 14.1.2.3 Key data from primary sources

- 14.1.2.4 Key industry insights

- 14.1.1 SECONDARY DATA

- 14.2 DATA TRIANGULATION

- 14.3 MARKET SIZE ESTIMATION METHODOLOGY

- 14.3.1 TOP-DOWN APPROACH

- 14.3.1.1 Demand-side analysis

- 14.3.2 BOTTOM-UP APPROACH

- 14.3.1 TOP-DOWN APPROACH

- 14.4 RESEARCH ASSUMPTIONS

- 14.5 RISK ASSESSMENT

- 14.6 RESEARCH LIMITATIONS

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

List of Tables

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES, 2022-2024

- TABLE 3 INTERCONNECTED MARKETS

- TABLE 4 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- TABLE 5 RAILWAY MANAGEMENT SYSTEM MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 GDP PERCENTAGE CHANGE, BY KEY COUNTRY, 2021-2029

- TABLE 7 ROLES OF COMPANIES IN RAILWAY MANAGEMENT SYSTEM ECOSYSTEM

- TABLE 8 INDICATIVE PRICING TREND OF RAILWAY MANAGEMENT SYSTEMS, BY SYSTEM, 2024

- TABLE 9 RAILWAY MANAGEMENT SYSTEM MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2026

- TABLE 10 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 11 RAILWAY MANAGEMENT SYSTEM MARKET: TOTAL NUMBER OF PATENTS, JANUARY 2016-NOVEMBER 2025

- TABLE 12 TOP USE CASES AND MARKET POTENTIAL

- TABLE 13 RAILWAY MANAGEMENT SYSTEM MARKET: CASE STUDIES RELATED TO GEN AI IMPLEMENTATION

- TABLE 14 INTERCONNECTED ADJACENT ECOSYSTEMS AND THEIR IMPACT ON MARKET PLAYERS

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 GLOBAL INDUSTRY STANDARDS IN RAILWAY MANAGEMENT SYSTEM MARKET

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS: TOP THREE SOLUTIONS (%)

- TABLE 21 KEY BUYING CRITERIA

- TABLE 22 UNMET NEEDS IN RAILWAY MANAGEMENT SYSTEM MARKET, BY END-USE INDUSTRY

- TABLE 23 RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 24 RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 25 RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 26 RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 27 SOLUTIONS: RAILWAY MANAGEMENT SYSTEM MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 28 SOLUTIONS: RAILWAY MANAGEMENT SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 RAIL OPERATIONS MANAGEMENT: RAIL MANAGEMENT SYSTEM MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 30 RAIL OPERATIONS MANAGEMENT: RAIL MANAGEMENT SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 RAIL TRAFFIC MANAGEMENT: RAILWAY MANAGEMENT SYSTEM MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 32 RAIL TRAFFIC MANAGEMENT: RAILWAY MANAGEMENT SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 ASSET MANAGEMENT: RAILWAY MANAGEMENT SYSTEM MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 34 ASSET MANAGEMENT: RAILWAY MANAGEMENT SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 INTELLIGENT IN-TRAIN SOLUTIONS: RAILWAY MANAGEMENT SYSTEM MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 36 INTELLIGENT IN-TRAIN SOLUTIONS: RAILWAY MANAGEMENT SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 OTHER SOLUTIONS: RAILWAY MANAGEMENT SYSTEM MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 38 OTHER SOLUTIONS: RAILWAY MANAGEMENT SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 40 RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 41 SERVICES: RAILWAY MANAGEMENT SYSTEM MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 42 SERVICES: RAILWAY MANAGEMENT SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 CONSULTING: RAILWAY MANAGEMENT SYSTEM MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 44 CONSULTING: RAILWAY MANAGEMENT SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 SYSTEM INTEGRATION AND DEPLOYMENT: RAILWAY MANAGEMENT SYSTEM MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 46 SYSTEM INTEGRATION AND DEPLOYMENT: RAILWAY MANAGEMENT SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 SUPPORT & MAINTENANCE: RAILWAY MANAGEMENT SYSTEM MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 48 SUPPORT & MAINTENANCE: RAILWAY MANAGEMENT SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2019-2024 (USD MILLION)

- TABLE 50 RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2025-2030 (USD MILLION)

- TABLE 51 PASSENGER: RAILWAY MANAGEMENT SYSTEM MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 52 PASSENGER: RAILWAY MANAGEMENT SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 FREIGHT: RAILWAY MANAGEMENT SYSTEM MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 54 FREIGHT: RAILWAY MANAGEMENT SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 RAILWAY MANAGEMENT SYSTEM MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 56 RAILWAY MANAGEMENT SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 NORTH AMERICA: RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 58 NORTH AMERICA: RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 59 NORTH AMERICA: RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 60 NORTH AMERICA: RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 61 NORTH AMERICA: RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 62 NORTH AMERICA: RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 63 NORTH AMERICA: RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2019-2024 (USD MILLION)

- TABLE 64 NORTH AMERICA: RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2025-2030 (USD MILLION)

- TABLE 65 NORTH AMERICA: RAILWAY MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 66 NORTH AMERICA: RAILWAY MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 67 US: RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 68 US: RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 69 US: RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 70 US: RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 71 US: RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 72 US: RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 73 US: RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2019-2024 (USD MILLION)

- TABLE 74 US: RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2025-2030 (USD MILLION)

- TABLE 75 CANADA: RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 76 CANADA: RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 77 CANADA: RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 78 CANADA: RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 79 CANADA: RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 80 CANADA: RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 81 CANADA: RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2019-2024 (USD MILLION)

- TABLE 82 CANADA: RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2025-2030 (USD MILLION)

- TABLE 83 EUROPE: RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 84 EUROPE: RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 85 EUROPE: RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 86 EUROPE: RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 87 EUROPE: RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 88 EUROPE: RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 89 EUROPE: RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2019-2024 (USD MILLION)

- TABLE 90 EUROPE: RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2025-2030 (USD MILLION)

- TABLE 91 EUROPE: RAILWAY MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 92 EUROPE: RAILWAY MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 93 UK: RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 94 UK: RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 95 UK: RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 96 UK: RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 97 UK: RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 98 UK: RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 99 UK: RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2019-2024 (USD MILLION)

- TABLE 100 UK: RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2025-2030 (USD MILLION)

- TABLE 101 GERMANY: RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 102 GERMANY: RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 103 GERMANY: RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 104 GERMANY: RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 105 GERMANY: RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 106 GERMANY: RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 107 GERMANY: RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2019-2024 (USD MILLION)

- TABLE 108 GERMANY: RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2025-2030 (USD MILLION)

- TABLE 109 FRANCE: RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 110 FRANCE: RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 111 FRANCE: RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 112 FRANCE: RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 113 FRANCE: RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 114 FRANCE: RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 115 FRANCE: RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2019-2024 (USD MILLION)

- TABLE 116 FRANCE: RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2025-2030 (USD MILLION)

- TABLE 117 ITALY: RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 118 ITALY: RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 119 ITALY: RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 120 ITALY: RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 121 ITALY: RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 122 ITALY: RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 123 ITALY: RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2019-2024 (USD MILLION)

- TABLE 124 ITALY: RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2025-2030 (USD MILLION)

- TABLE 125 ASIA PACIFIC: RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 126 ASIA PACIFIC: RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 127 ASIA PACIFIC: RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 128 ASIA PACIFIC: RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 129 ASIA PACIFIC: RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 130 ASIA PACIFIC: RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 131 ASIA PACIFIC: RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2019-2024 (USD MILLION)

- TABLE 132 ASIA PACIFIC: RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2025-2030 (USD MILLION)

- TABLE 133 ASIA PACIFIC: RAILWAY MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 134 ASIA PACIFIC: RAILWAY MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 135 CHINA: RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 136 CHINA: RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 137 CHINA: RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 138 CHINA: RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 139 CHINA: RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 140 CHINA: RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 141 CHINA: RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2019-2024 (USD MILLION)

- TABLE 142 CHINA: RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2025-2030 (USD MILLION)

- TABLE 143 JAPAN: RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 144 JAPAN: RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 145 JAPAN: RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 146 JAPAN: RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 147 JAPAN: RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 148 JAPAN: RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 149 JAPAN: RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2019-2024 (USD MILLION)

- TABLE 150 JAPAN: RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2025-2030 (USD MILLION)

- TABLE 151 INDIA: RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 152 INDIA: RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 153 INDIA: RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 154 INDIA: RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 155 INDIA: RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 156 INDIA: RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 157 INDIA: RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2019-2024 (USD MILLION)

- TABLE 158 INDIA: RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2025-2030 (USD MILLION)

- TABLE 159 AUSTRALIA & NEW ZEALAND: RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 160 AUSTRALIA & NEW ZEALAND: RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 161 AUSTRALIA & NEW ZEALAND: RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 162 AUSTRALIA & NEW ZEALAND: RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 163 AUSTRALIA & NEW ZEALAND: RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 164 AUSTRALIA & NEW ZEALAND: RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 165 AUSTRALIA & NEW ZEALAND: RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2019-2024 (USD MILLION)

- TABLE 166 AUSTRALIA & NEW ZEALAND: RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2025-2030 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2019-2024 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2025-2030 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: RAILWAY MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: RAILWAY MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 177 KSA: RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 178 KSA: RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 179 KSA: RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 180 KSA: RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 181 KSA: RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 182 KSA: RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 183 KSA: RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2019-2024 (USD MILLION)

- TABLE 184 KSA: RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2025-2030 (USD MILLION)

- TABLE 185 UAE: RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 186 UAE: RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 187 UAE: RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 188 UAE: RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 189 UAE: RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 190 UAE: RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 191 UAE: RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2019-2024 (USD MILLION)

- TABLE 192 UAE: RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2025-2030 (USD MILLION)

- TABLE 193 SOUTH AFRICA: RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 194 SOUTH AFRICA: RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 195 SOUTH AFRICA: RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 196 SOUTH AFRICA: RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 197 SOUTH AFRICA: RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 198 SOUTH AFRICA: RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 199 SOUTH AFRICA: RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2019-2024 (USD MILLION)

- TABLE 200 SOUTH AFRICA: RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2025-2030 (USD MILLION)

- TABLE 201 LATIN AMERICA: RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 202 LATIN AMERICA: RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 203 LATIN AMERICA: RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 204 LATIN AMERICA: RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 205 LATIN AMERICA: RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 206 LATIN AMERICA: RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 207 LATIN AMERICA: RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2019-2024 (USD MILLION)

- TABLE 208 LATIN AMERICA: RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2025-2030 (USD MILLION)

- TABLE 209 LATIN AMERICA: RAILWAY MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 210 LATIN AMERICA: RAILWAY MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 211 BRAZIL: RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 212 BRAZIL: RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 213 BRAZIL: RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 214 BRAZIL: RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 215 BRAZIL: RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 216 BRAZIL: RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 217 BRAZIL: RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2019-2024 (USD MILLION)

- TABLE 218 BRAZIL: RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2025-2030 (USD MILLION)

- TABLE 219 ARGENTINA: RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 220 ARGENTINA: RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 221 ARGENTINA: RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 222 ARGENTINA: RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 223 ARGENTINA: RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 224 ARGENTINA: RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 225 ARGENTINA: RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2019-2024 (USD MILLION)

- TABLE 226 ARGENTINA: RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2025-2030 (USD MILLION)

- TABLE 227 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 228 RAILWAY MANAGEMENT SYSTEM MARKET: DEGREE OF COMPETITION, 2024

- TABLE 229 RAILWAY MANAGEMENT SYSTEM MARKET: OFFERING FOOTPRINT, 2024

- TABLE 230 RAILWAY MANAGEMENT SYSTEM MARKET: SOLUTION FOOTPRINT, 2024

- TABLE 231 RAILWAY MANAGEMENT SYSTEM MARKET: RAILWAY TYPE FOOTPRINT, 2024

- TABLE 232 RAILWAY MANAGEMENT SYSTEM MARKET: KEY STARTUPS/SMES

- TABLE 233 RAILWAY MANAGEMENT SYSTEM MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 234 RAILWAY MANAGEMENT SYSTEM MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, DECEMBER 2023-NOVEMBER 2025

- TABLE 235 RAILWAY MANAGEMENT SYSTEM MARKET: DEALS, MARCH 2022-NOVEMBER 2025

- TABLE 236 ALSTOM SA: COMPANY OVERVIEW

- TABLE 237 ALSTOM SA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 ALSTOM SA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 239 ALSTOM SA: DEALS

- TABLE 240 ALSTOM SA: EXPANSIONS

- TABLE 241 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY OVERVIEW

- TABLE 242 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 243 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 244 HUAWEI TECHNOLOGIES CO., LTD.: DEALS

- TABLE 245 SIEMENS: COMPANY OVERVIEW

- TABLE 246 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 247 SIEMENS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 248 SIEMENS: DEALS

- TABLE 249 SIEMENS: OTHER DEVELOPMENTS

- TABLE 250 HITACHI, LTD.: COMPANY OVERVIEW

- TABLE 251 HITACHI, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 HITACHI, LTD.: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 253 HITACHI, LTD.: DEALS

- TABLE 254 HITACHI, LTD.: OTHER DEVELOPMENTS

- TABLE 255 WABTEC CORPORATION: COMPANY OVERVIEW

- TABLE 256 WABTEC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 257 WABTEC CORPORATION: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 258 WABTEC CORPORATION: DEALS

- TABLE 259 CISCO SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 260 CISCO SYSTEMS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 CISCO SYSTEMS, INC.: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 262 ABB: COMPANY OVERVIEW

- TABLE 263 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 264 INDRA SISTEMAS, S.A.: COMPANY OVERVIEW

- TABLE 265 INDRA SISTEMAS, S.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 266 INDRA SISTEMAS, S.A.: PRODUCT LAUNCHES

- TABLE 267 INDRA SISTEMAS, S.A.: DEALS

- TABLE 268 IBM CORPORATION: COMPANY OVERVIEW

- TABLE 269 IBM CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 270 IBM CORPORATION: DEALS

- TABLE 271 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 272 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 273 CAF: COMPANY OVERVIEW

- TABLE 274 WSP: COMPANY OVERVIEW

- TABLE 275 KYOSAN ELECTRIC MFG. CO., LTD.: COMPANY OVERVIEW

- TABLE 276 ADVANTECH CO., LTD.: COMPANY OVERVIEW

- TABLE 277 THALES: COMPANY OVERVIEW

- TABLE 278 AMADEUS IT GROUP SA: COMPANY OVERVIEW

- TABLE 279 ATKINSREALIS: COMPANY OVERVIEW

- TABLE 280 DXC TECHNOLOGY COMPANY: COMPANY OVERVIEW

- TABLE 281 FUJITSU: COMPANY OVERVIEW

- TABLE 282 RAILROAD SOFTWARE: COMPANY OVERVIEW

- TABLE 283 RAILCUBE: COMPANY OVERVIEW

- TABLE 284 PRAEDICO: COMPANY OVERVIEW

- TABLE 285 NWAY TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 286 EUROTECH S.P.A.: COMPANY OVERVIEW

- TABLE 287 FREQUENTIS: COMPANY OVERVIEW

- TABLE 288 RAILINC CORPORATION: COMPANY OVERVIEW

- TABLE 289 ARCADIS GEN HOLDINGS LIMITED: COMPANY OVERVIEW

- TABLE 290 TELEGRAPH: COMPANY OVERVIEW

- TABLE 291 TRACSIS PLC: COMPANY OVERVIEW

- TABLE 292 RAIL-FLOW: COMPANY OVERVIEW

- TABLE 293 KEY PRIMARY INTERVIEW PARTICIPANTS

- TABLE 294 RESEARCH ASSUMPTIONS

- TABLE 295 RISK ASSESSMENT

List of Figures

- FIGURE 1 RAILWAY MANAGEMENT SYSTEM MARKET SEGMENTATION

- FIGURE 2 YEARS CONSIDERED

- FIGURE 3 MARKET SCENARIO

- FIGURE 4 GLOBAL RAILWAY MANAGEMENT SYSTEM MARKET, 2019-2030

- FIGURE 5 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN RAILWAY MANAGEMENT SYSTEM MARKET, 2020-2025

- FIGURE 6 DISRUPTIONS INFLUENCING GROWTH OF RAILWAY MANAGEMENT SYSTEM MARKET

- FIGURE 7 HIGH-GROWTH SEGMENTS IN RAILWAY MANAGEMENT SYSTEM MARKET, 2025-2030

- FIGURE 8 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN RAILWAY MANAGEMENT SYSTEM MARKET, IN TERMS OF VALUE, DURING FORECAST PERIOD

- FIGURE 9 ONGOING TECHNOLOGICAL ADVANCEMENTS AND GOVERNMENT-LED INITIATIVES TO DRIVE MARKET

- FIGURE 10 SOLUTIONS ACCOUNTED FOR LARGEST MARKET SHARE IN 2025

- FIGURE 11 SOLUTIONS SEGMENT SET TO DOMINATE RAILWAY MANAGEMENT SYSTEM MARKET IN 2025

- FIGURE 12 RAIL TRAFFIC MANAGEMENT SYSTEM TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 13 PASSENGER SEGMENT SET TO DOMINATE RAILWAY MANAGEMENT SYSTEM MARKET IN 2025

- FIGURE 14 RAILWAY MANAGEMENT SYSTEM MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 15 RAILWAY MANAGEMENT SYSTEM: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 16 RAILWAY MANAGEMENT SYSTEM MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 17 RAILWAY MANAGEMENT SYSTEM ECOSYSTEM

- FIGURE 18 AVERAGE SELLING PRICE TREND, BY REGION, 2023-2026

- FIGURE 19 EXPORT VALUE OF ELECTRICAL SIGNALING, SAFETY, OR TRAFFIC CONTROL EQUIPMENT, BY COUNTRY, 2015-2024 (USD MILLION)

- FIGURE 20 IMPORT VALUE OF ELECTRICAL SIGNALING, SAFETY, OR TRAFFIC CONTROL EQUIPMENT, BY COUNTRY, 2015-2024 (USD MILLION)

- FIGURE 21 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 22 RAILWAY MANAGEMENT SYSTEM MARKET: INVESTMENT AND FUNDING SCENARIO OF MAJOR PLAYERS, 2024 (USD MILLION)

- FIGURE 23 PATENT ANALYSIS, BY DOCUMENT TYPE, JANUARY 2016-NOVEMBER 2025

- FIGURE 24 PATENT PUBLICATION TRENDS, 2016-2025

- FIGURE 25 JURISDICTION OF US REGISTERED HIGHEST PERCENTAGE OF PATENTS, JANUARY 2016-NOVEMBER 2025

- FIGURE 26 TOP PATENT APPLICANTS, JANUARY 2016-NOVEMBER 2025

- FIGURE 27 RAILWAY MANAGEMENT SYSTEM MARKET: DECISION-MAKING FACTORS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS: TOP THREE SOLUTIONS

- FIGURE 29 KEY BUYING CRITERIA

- FIGURE 30 RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- FIGURE 31 RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- FIGURE 32 RAILWAY MANAGEMENT SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- FIGURE 33 RAILWAY MANAGEMENT SYSTEM MARKET, BY RAILWAY TYPE, 2025-2030 (USD MILLION)

- FIGURE 34 RAILWAY MANAGEMENT SYSTEM MARKET, BY REGION, 2025-2030

- FIGURE 35 EUROPE: RAILWAY MANAGEMENT SYSTEM MARKET SNAPSHOT

- FIGURE 36 ASIA PACIFIC: RAILWAY MANAGEMENT SYSTEM MARKET SNAPSHOT

- FIGURE 37 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024 (USD MILLION)

- FIGURE 38 MARKET SHARE ANALYSIS, 2024

- FIGURE 39 BRAND/PRODUCT COMPARISON

- FIGURE 40 RAILWAY MANAGEMENT SYSTEM MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 41 RAILWAY MANAGEMENT SYSTEM MARKET: COMPANY FOOTPRINT

- FIGURE 42 RAILWAY MANAGEMENT SYSTEM MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 43 COMPANY VALUATION AND FINANCIAL METRICS, 2025

- FIGURE 44 FINANCIAL METRICS OF KEY VENDORS, 2025

- FIGURE 45 ALSTOM SA: COMPANY SNAPSHOT

- FIGURE 46 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY SNAPSHOT

- FIGURE 47 SIEMENS: COMPANY SNAPSHOT

- FIGURE 48 HITACHI, LTD.: COMPANY SNAPSHOT

- FIGURE 49 WABTEC CORPORATION: COMPANY SNAPSHOT

- FIGURE 50 CISCO SYSTEMS, INC.: COMPANY SNAPSHOT

- FIGURE 51 ABB: COMPANY SNAPSHOT

- FIGURE 52 INDRA SISTEMAS, S.A.: COMPANY SNAPSHOT

- FIGURE 53 IBM CORPORATION: COMPANY SNAPSHOT

- FIGURE 54 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 55 RAILWAY MANAGEMENT SYSTEM MARKET: RESEARCH DESIGN

- FIGURE 56 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 57 TOP-DOWN APPROACH

- FIGURE 58 DEMAND-SIDE ANALYSIS

- FIGURE 59 BOTTOM-UP APPROACH

- FIGURE 60 BOTTOM-UP (SUPPLY SIDE) ANALYSIS: COLLECTIVE REVENUE FROM SOLUTIONS/SERVICES OF RAILWAY MANAGEMENT SYSTEM MARKET