PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1895144

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1895144

Railway Testing Market by End Use, Superstructure Testing Equipment, Electrification Testing Equipment, Use case, Application, and Region - Global Forecast to 2032

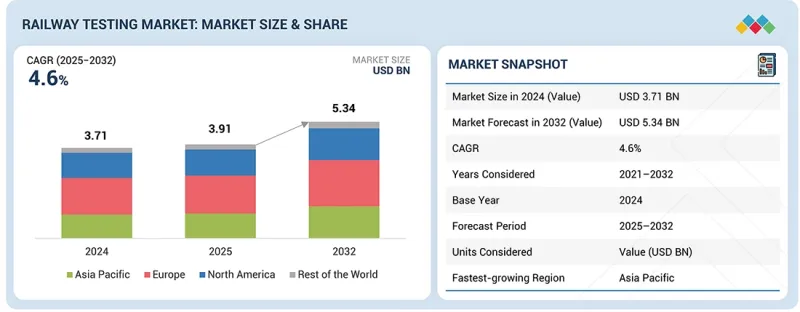

The railway testing market is projected to grow from USD 3.91 billion in 2025 to USD 5.34 billion by 2032, at a CAGR of 4.6%. Railway testing equipment is becoming increasingly central to operational efficiency, safety assurance, and infrastructure longevity in the rail sector. Growing complexity in rolling stock, signaling systems, and track networks is driving demand for advanced measurement and diagnostic solutions.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Billion) |

| Segments | End Use, Superstructure Testing Equipment, Electrification Testing Equipment, Use case, Application, and Region |

| Regions covered | Asia Pacific, North America, Europe, and Rest of the World |

Additionally, data acquisition (DAQ) systems, on-board sensors, and portable testing devices are enabling precise monitoring of parameters, such as axle loads, track geometry, brake performance, and propulsion efficiency.

Some of the other key drivers of this market include rising safety and reliability standards, the need for predictive maintenance, and pressure to minimize service disruptions. Integration of real-time analytics with testing platforms is allowing operators to identify deviations early, optimize maintenance schedules, and improve lifecycle management of assets.

The railway testing market is witnessing a shift toward automated, high-precision, and modular testing solutions that support post delivery inspection and ongoing operational monitoring, positioning railway testing equipment as a critical enabler of modern rail system performance.

"The railway power supply testing equipment is projected to be the fastest-growing market during the forecast period."

By electrification testing equipment, the railway power supply testing equipment is projected to be the fastest-growing segment during the forecast period, as railway operators are upgrading traction substations and overhead electrification systems to handle higher power demand from modern trains. These upgrades require tighter verification of power quality, load behaviour, and protection system responses. Networks that are adding high-speed, metro, and heavy haul freight capacity are facing greater pressure to maintain stable voltage and rapid fault isolation, which is driving the use of advanced testing tools that can assess harmonics, transient behaviour, and substation control logic with higher accuracy. This shift is strategic because power supply performance directly affects acceleration capability, punctuality, and system safety. Thus, operators seek equipment that reduces commissioning time and supports predictive maintenance planning.

Agencies in India and Japan are validating new traction substation configurations on upgraded corridors using high-precision power analysers and simulation-based load testing units, which confirm performance under peak operational demand and ensure that electrical systems can support the expected service intensity.

"The post-delivery & upkeep inspection segment is projected to be the fastest-growing segment during the forecast period."

By application, the post-delivery & upkeep inspection segment is projected to be the fastest-growing application segment during the forecast period, because operators are tightening their performance assurance processes as networks expand, train frequencies increase, and system upgrades become more complex. This shift in operating conditions is creating the need for continuous validation of new and in-service assets, since any deviation in track geometry, overhead line parameters, braking performance, or on-board control systems can disrupt service reliability and raise lifecycle costs. As a result, operators are adopting structured inspection cycles supported by automated measurement cars, portable diagnostics, and digital monitoring platforms that provide consistent and repeatable data throughout the asset lifecycle. This is strengthening the role of upkeep inspections as a strategic function rather than a routine compliance activity.

Leading metro systems in Asia are applying dedicated post-delivery acceptance tests for new trainsets and conducting high-frequency upkeep inspections on recently upgraded traction, signalling, and electrification assets, using precise measurement tools that verify operational readiness before deployment and maintain performance standards across intensive daily schedules.

"Asia Pacific is projected to be the fastest-growing market during the forecast period."

Asia Pacific is projected to be the fastest-growing market during the forecast period as national rail programs are expanding their capital expenditure on new corridors, suburban upgrades, and modern rolling stock, which is increasing the requirement for advanced measurement technologies that can manage high volumes of construction and maintenance activity. Additionally, governments are accelerating timelines for high-speed and freight projects, and operators are introducing tighter reliability targets, which is pushing the shift toward automated track geometry systems, overhead line inspection platforms, and on-board diagnostic solutions. The region is also adopting digital condition monitoring tools that reduce manual inspection time and improve asset availability, especially on networks that are adding capacity at a rapid pace.

The Indian Railways has rolled out automated track geometry systems, overhead line monitoring units, and real-time measurement platforms across dedicated freight corridors and semi-high-speed routes. This development is creating consistent demand for suppliers that can support broad network scale testing and monitoring requirements.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: Test Equipment Manufacturers - 40%, Railway Testing Service Providers - 40%, Track Measurement Equipment Providers & Others - 20%

- By Designation: Directors - 40%, CXOs - 25%, Others - 35%

- By Country: North America - 25%, Europe - 25%, Asia Pacific - 40%, and Rest of the World - 10%

The railway testing market is dominated by a few globally established players, such as Knorr-Bremse AG (Germany), ZF Friedrichshafen AG (Germany), Wabtec Corporation (US), HORIBA Group (Japan), and RENK Group AG (Germany). These companies manufacture and supply railway testing equipment to various countries globally. These companies have set up R&D infrastructure and offer best-in-class solutions to their customers.

Research Coverage:

The report covers the railway testing market, in terms of end use (Rolling stock test equipment, track/infrastructure test equipment, other test equipment), superstructure testing equipment (Rail mechanical testing equipment, electronics and DAQ testing equipment, switches/turnouts testing equipment, sleepers/crossties, fastenings testing equipment, track measurement equipment, other superstructure testing equipment), electrification testing equipment (On-board electronics test equipment, contact lines test equipment, traction power supply & substation testing equipment, railway power supply testing equipment), use case (control command, train control, operational telematics), application (Design & development, manufacturing & fabrication, pre-delivery testing, post-delivery & upkeep inspection), Region (Asia Pacific, Europe, North America, and Rest of the World). It covers the competitive landscape and company profiles of the major players in the railway testing market ecosystem.

The study includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report:

- This report will help market leaders/new entrants in this market with information on the closest approximations of revenue numbers for the overall railway testing ecosystem and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies.

- This report will also help stakeholders understand the market's pulse and provide information on key market drivers, restraints, challenges, and opportunities.

The report provides insight into the following pointers:

- Analysis of key drivers (Global focus on rail modernization, improved rail safety and reliability standards, expansion of high speed urban metro projects and growing demand from heavy-haul and freight corridor development), restraints (Fragmented rail infrastructure and lack of standardization and high cost of testing equipment), challenges (Complex stakeholder ecosystem leads to shifting requirements for testing equipment), and opportunities (Emerging markets rail infrastructure push and Integration of digital technologies to increase demand for testing equipment)

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product launches in the railway testing market

- Market Development: Comprehensive information about lucrative markets - the report analyses the railway testing market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the railway testing market.

- Competitive Assessment: In-depth assessment of market ranking, growth strategies, and service offerings of leading players like Knorr-Bremse AG (Germany), ZF Friedrichshafen AG (Germany), Wabtec Corporation (US), HORIBA Group (Japan), and RENK Group AG (Germany), among others, in the railway testing market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

2 EXECUTIVE SUMMARY

- 2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS IN RAILWAY TESTING MARKET

- 2.4 HIGH-GROWTH SEGMENTS IN RAILWAY TESTING MARKET

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN RAILWAY TESTING MARKET

- 3.2 RAILWAY TESTING MARKET, BY END USE

- 3.3 RAILWAY TESTING MARKET, BY SUPERSTRUCTURE TESTING EQUIPMENT

- 3.4 RAILWAY TESTING MARKET, BY ELECTRIFICATION TESTING EQUIPMENT

- 3.5 RAILWAY TESTING MARKET, BY USE CASE

- 3.6 RAILWAY TESTING MARKET, BY APPLICATION

- 3.7 RAILWAY TESTING MARKET, BY REGION

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Global focus on rail modernization

- 4.2.1.2 Need for improved rail safety and reliability standards

- 4.2.1.3 Expansion of high-speed urban metro projects

- 4.2.1.4 Growing demand from heavy-haul and freight corridor development

- 4.2.2 RESTRAINTS

- 4.2.2.1 Fragmented rail infrastructure and lack of standardization

- 4.2.2.2 High cost of railway testing equipment

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Emerging markets in railway infrastructure

- 4.2.3.2 Integration of digital technologies

- 4.2.4 CHALLENGES

- 4.2.4.1 Complex stakeholder ecosystem

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 LIMITED INTEGRATION ACROSS MULTI-MODAL AND CROSS-PLATFORM DATA SYSTEMS

- 4.3.2 INADEQUATE LOW-COST AND MODULAR TESTING SOLUTIONS FOR SECONDARY RAIL LINES

- 4.3.3 LIMITED TESTING INFRASTRUCTURE FOR NEW MATERIALS AND HYBRID TRACK SYSTEMS

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY KEY PLAYERS IN RAILWAY TESTING MARKET

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 INTRODUCTION

- 5.1.2 THREAT FROM NEW ENTRANTS

- 5.1.3 BARGAINING POWER OF SUPPLIERS

- 5.1.4 BARGAINING POWER OF BUYERS

- 5.1.5 THREAT FROM SUBSTITUTES

- 5.1.6 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 TRENDS IN GLOBAL ROLLING STOCK INDUSTRY

- 5.2.4 TRENDS IN GLOBAL AUTOMOTIVE & TRANSPORTATION INDUSTRY

- 5.3 ECOSYSTEM ANALYSIS

- 5.3.1 RAW MATERIAL & COMPONENT SUPPLIERS

- 5.3.2 RAILWAY EQUIPMENT MANUFACTURERS

- 5.3.3 TECHNOLOGY PROVIDERS

- 5.3.4 INFRASTRUCTURE PROVIDERS

- 5.3.5 MAINTENANCE & SERVICE PROVIDERS

- 5.3.6 REGULATORY & POLICY MAKERS

- 5.3.7 RAILWAY OPERATORS

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 VALUE CHAIN ANALYSIS

- 5.5.1 RAW MATERIAL PROVIDERS AND COMPONENT SUPPLIERS

- 5.5.2 ORIGINAL EQUIPMENT MANUFACTURERS

- 5.5.3 OPERATORS AND END USERS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE OF RAILWAY SYSTEMS, BY KEY PLAYER

- 5.6.2 AVERAGE SELLING PRICE TREND OF RAILWAY SYSTEMS, BY TYPE

- 5.6.3 AVERAGE SELLING PRICE TREND, BY REGION

- 5.7 TRENDS & DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 INVESTMENT & FUNDING SCENARIO

- 5.9 HS CODE

- 5.9.1 IMPORT SCENARIO

- 5.9.2 EXPORT SCENARIO

- 5.10 KEY CONFERENCES & EVENTS, 2025-2026

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 NETWORK RAIL DEPLOYED NEW MEASUREMENT TRAIN EQUIPPED WITH LASER GEOMETRY SYSTEMS, INERTIAL SENSORS, AND HIGH-SPEED IMAGING

- 5.11.2 SBB INTRODUCED ULTRASONIC TESTING VEHICLES THAT SCANNED RAILS FOR INTERNAL FATIGUE CRACKS

- 5.11.3 MTR DEPLOYED GROUND-PENETRATING RADAR ON INSPECTION VEHICLES TO MAP BALLAST AND SUBGRADE CONDITION

- 5.12 IMPACT OF 2025 US TARIFF

- 5.12.1 INTRODUCTION

- 5.12.2 KEY TARIFF RATES

- 5.12.3 PRICE IMPACT ANALYSIS

- 5.12.4 IMPACT ON COUNTRY/REGION

- 5.12.4.1 US

- 5.12.4.2 Europe

- 5.12.4.3 Asia Pacific

- 5.12.5 IMPACT ON END-USE INDUSTRIES

- 5.13 MNM INSIGHTS INTO RAILWAY TESTING SERVICE PROVIDERS

- 5.14 MNM INSIGHTS INTO PRIVATE-PUBLIC PARTNERSHIPS FOR RAILWAY TESTING MARKET

- 5.15 MNM INSIGHTS INTO TESTING EQUIPMENT FOR AUTONOMOUS RAILWAYS

6 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 6.1 DECISION-MAKING PROCESS

- 6.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 6.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.2.2 BUYING CRITERIA

7 REGULATORY LANDSCAPE

- 7.1 REGULATORY LANDSCAPE

- 7.1.1 REGULATORY ANALYSIS, BY KEY COUNTRY/REGION

- 7.1.1.1 US

- 7.1.1.2 Europe

- 7.1.1.3 India

- 7.1.1.4 South Korea

- 7.1.1.5 China

- 7.1.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.1 REGULATORY ANALYSIS, BY KEY COUNTRY/REGION

8 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTION

- 8.1 KEY EMERGING TECHNOLOGIES

- 8.1.1 INTRODUCTION

- 8.1.2 AI-BASED DIAGNOSTICS

- 8.1.3 FIBER OPTIC-BASED TRACK HEALTH MONITORING

- 8.1.4 DIGITAL TWIN-BASED SIMULATION FOR TRACK AND ROLLING STOCK

- 8.2 COMPLEMENTARY TECHNOLOGIES

- 8.2.1 REGENERATIVE BRAKING IN TRAINS

- 8.2.2 AUTONOMOUS TRAINS

- 8.2.3 TRI-MODE TRAINS

- 8.2.4 TILTING TRAINS

- 8.3 TECHNOLOGY/PRODUCT ROADMAP

- 8.4 PATENT ANALYSIS

- 8.4.1 INTRODUCTION

- 8.4.1.1 Methodology

- 8.4.1.2 Document type

- 8.4.1.3 Insights

- 8.4.1.4 Legal status of patents

- 8.4.1.5 Jurisdiction analysis

- 8.4.1.6 Top applicants

- 8.4.1 INTRODUCTION

- 8.5 FUTURE APPLICATIONS

- 8.5.1 ADVANCED AUTOMATED MEASUREMENT TO ENABLE PREDICTIVE AND HIGH AVAILABILITY RAILWAY OPERATIONS

- 8.6 IMPACT OF AI/GEN AI ON RAILWAY TESTING MARKET

- 8.6.1 ENHANCEMENT OF DEFECT DETECTION AND PREDICTIVE INSIGHTS

- 8.6.2 ACCELERATION OF FIELD MEASUREMENTS AND REPORTING

- 8.6.3 IMPROVED INTEGRATION WITH DIGITAL ASSET MANAGEMENT PLATFORMS

- 8.6.4 ENHANCEMENT OF AUTONOMOUS AND REMOTE INSPECTION CAPABILITIES

- 8.6.5 REDUCTION OF LIFECYCLE COSTS FOR EQUIPMENT USERS

- 8.6.6 STRENGTHENING OF COMPLIANCE AND QUALITY MANAGEMENT

- 8.6.7 EXPANSION OF REAL-TIME MONITORING AND ALERTS

- 8.7 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 8.7.1 NEW SOUTH WALES, AUSTRALIA: AUTOMATED TRACK GEOMETRY MONITORING FOR HIGH-DENSITY CORRIDORS

- 8.7.2 NORTH RHINE-WESTPHALIA, GERMANY: WAYSIDE CONDITION MONITORING FOR WHEEL AND BRAKE HEALTH

9 RAILWAY TESTING MARKET, BY SUPERSTRUCTURE TESTING EQUIPMENT

- 9.1 INTRODUCTION

- 9.2 RAIL MECHANICAL TESTING EQUIPMENT

- 9.2.1 NEED FOR DATA-DRIVEN RAIL TESTING SYSTEMS TO BOOST MARKET

- 9.2.2 RAIL PROFILE MEASUREMENT SYSTEMS

- 9.3 ELECTRONICS & DAQ TESTING EQUIPMENT

- 9.3.1 FOCUS ON CONTINUOUS COMMAND EXCHANGE AND PREDICTABLE EXECUTION OF DRIVING FUNCTIONS TO BOOST MARKET

- 9.3.2 ULTRASONIC FLAW DETECTORS

- 9.3.3 EDDY CURRENT TESTERS

- 9.4 SWITCHES/TURNOUTS TESTING EQUIPMENT MARKET

- 9.4.1 FOCUS ON EVALUATING PERFORMANCE OF TURNOUTS, FROGS, POINT BLADES, AND CROSSING COMPONENTS TO DRIVE GROWTH

- 9.4.2 GEOMETRY MEASUREMENT TOOLS

- 9.4.3 LASER ALIGNMENT TOOLS

- 9.4.4 SWITCH DIAGNOSTIC SYSTEMS

- 9.5 SLEEPERS/CROSSTIES, FASTENING TESTING EQUIPMENT

- 9.5.1 EMPHASIS ON STRUCTURAL INTEGRITY, LOAD-BEARING CAPACITY, AND FASTENING PERFORMANCE OF SLEEPERS AND THEIR ASSOCIATED RAIL CLIPS TO BOOST MARKET

- 9.5.2 VIBRATION SENSORS

- 9.5.3 TORQUE MEASUREMENT TOOLS

- 9.6 TRACK MEASUREMENT EQUIPMENT

- 9.6.1 NEED FOR ASSESSING GEOMETRY, STIFFNESS, LOAD DISTRIBUTION, AND LONG-TERM STRUCTURAL INTEGRITY OF SLAB TRACK SYSTEMS TO BOOST GROWTH

- 9.6.2 GROUND-PENETRATING RADARS

- 9.6.3 SLAB GEOMETRY MEASUREMENT DEVICES

- 9.7 OTHER SUPERSTRUCTURE TESTING EQUIPMENT

- 9.7.1 LOAD STRAIN GAUGES

- 9.7.2 WEAR MONITORING SYSTEMS

- 9.8 KEY PRIMARY INSIGHTS

10 RAILWAY TESTING MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 DESIGN & DEVELOPMENT

- 10.2.1 NEED FOR DEPENDABLE RAILWAY SYSTEM TO BOOST GROWTH

- 10.3 MANUFACTURING & FABRICATION

- 10.3.1 FOCUS ON IMPROVING QUALITY AND CONSISTENCY IN RAILWAY MANUFACTURING TO DRIVE MARKET

- 10.4 PRE-DELIVERY TESTING

- 10.4.1 FOCUS ON COMMISSIONING READINESS AND DELIVERY RELIABILITY IN RAILWAY TESTING TO BOOST GROWTH

- 10.5 POST-DELIVERY & UPKEEP INSPECTION

- 10.5.1 NEED FOR ROBUST MAINTENANCE DIAGNOSTICS TO REDUCE SERVICE DISRUPTIONS TO DRIVE MARKET

- 10.6 KEY PRIMARY INSIGHTS

11 RAILWAY TESTING MARKET, BY ELECTRIFICATION TESTING EQUIPMENT

- 11.1 INTRODUCTION

- 11.2 ON-BOARD ELECTRONICS TEST EQUIPMENT

- 11.2.1 NEED FOR ATP SYSTEM COMPLIANCE TO DRIVE GROWTH

- 11.3 CONTACT LINE TEST EQUIPMENT

- 11.3.1 DEMAND FOR HIGH-SPEED, NON-CONTACT LINES TO BOOST MARKET

- 11.3.2 CONTACT WIRE HEIGHT AND STAGGER MEASURING INSTRUMENTS

- 11.3.3 PANTOGRAPH MONITORING SYSTEMS

- 11.4 TRACTION POWER SUPPLY & SUBSTATION TESTING EQUIPMENT

- 11.4.1 EMPHASIS ON SUBSTATION MODERNIZATION TO PROPEL DEMAND

- 11.4.2 POWER ANALYZERS

- 11.4.3 INSULATION RESISTANCE TESTERS

- 11.4.4 SCADA DIAGNOSTICS

- 11.5 RAILWAY POWER SUPPLY TESTING EQUIPMENT

- 11.5.1 GROWING ELECTRIFICATION OF RAILWAY INFRASTRUCTURE TO BOOST DEMAND

- 11.5.2 VOLTAGE MEASUREMENT TOOLS

- 11.5.3 THERMAL CAMERAS

- 11.5.4 CIRCUIT TESTERS

- 11.6 KEY PRIMARY INSIGHTS

12 RAILWAY TESTING MARKET, BY END USE

- 12.1 INTRODUCTION

- 12.2 ROLLING STOCK TEST EQUIPMENT

- 12.2.1 DEMAND FOR ADVANCED DIAGNOSTICS TO DRIVE MARKET

- 12.3 TRACK/INFRASTRUCTURE TEST EQUIPMENT

- 12.3.1 NEED FOR ENABLING STABLE AND PREDICTABLE NETWORK PERFORMANCE TO DRIVE MARKET

- 12.4 OTHER TEST EQUIPMENT

- 12.5 KEY PRIMARY INSIGHTS

13 RAILWAY TESTING MARKET, BY USE CASE

- 13.1 INTRODUCTION

- 13.2 CONTROL COMMAND

- 13.2.1 NEED FOR STRONG COMMAND VALIDATION FOR SAFE AND PREDICTABLE TRAIN OPERATIONS TO DRIVE MARKET

- 13.3 TRAIN CONTROL

- 13.3.1 TRAIN CONTROL SERVES AS OPERATIONAL BACKBONE OF MODERN RAILWAY SYSTEMS

- 13.3.2 AUTOMATIC TRAIN PROTECTION

- 13.3.3 AUTOMATIC TRAIN CONTROL

- 13.3.4 AUTOMATIC TRAIN OPERATION

- 13.3.5 CENTRALIZED TRAFFIC CONTROL

- 13.4 OPERATIONAL TELEMATICS

- 13.4.1 FOCUS ON STRENGTHENING REAL-TIME DECISION SUPPORT IN RAIL OPERATIONS TO BOOST MARKET

- 13.4.2 COMMUNICATION-BASED TRAIN CONTROL

- 13.4.3 TRAIN CONTROL & MONITORING SYSTEM

- 13.5 KEY PRIMARY INSIGHTS

14 RAILWAY TESTING MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 ASIA PACIFIC

- 14.2.1 INDIA

- 14.2.1.1 Need for improving safety standards to drive market

- 14.2.2 JAPAN

- 14.2.2.1 Rising focus on high-speed rail reliability to drive growth

- 14.2.3 CHINA

- 14.2.3.1 Increasing passenger volume to boost market

- 14.2.4 SOUTH KOREA

- 14.2.4.1 Need for upgrading ageing rail infrastructure to drive market

- 14.2.1 INDIA

- 14.3 EUROPE

- 14.3.1 GERMANY

- 14.3.1.1 Focus on prioritizing digital rail operations across national and regional systems to drive market

- 14.3.2 UK

- 14.3.2.1 Emphasis on improving reliability, safety, and capacity across heavily utilized rail network to drive market

- 14.3.3 FRANCE

- 14.3.3.1 Large-scale public investments to boost growth of railways

- 14.3.4 ITALY

- 14.3.4.1 Need for modernization of railway lines to drive investments in railway testing market

- 14.3.5 SPAIN

- 14.3.5.1 Need for enhanced regional rail connectivity to boost growth

- 14.3.1 GERMANY

- 14.4 NORTH AMERICA

- 14.4.1 US

- 14.4.1.1 Rapid increase in railway enhancement projects to boost growth

- 14.4.2 CANADA

- 14.4.2.1 Federal programs to support sustained capital allocation for track renewal and signal upgrades

- 14.4.1 US

- 14.5 REST OF THE WORLD

- 14.5.1 SAUDI ARABIA

- 14.5.1.1 Demand for accelerated rail network expansion to boost market

- 14.5.2 UAE

- 14.5.2.1 Need for increasing scale and technical complexity of rail assets to drive market

- 14.5.3 SOUTH AFRICA

- 14.5.3.1 Focus on renewing metropolitan rail network to drive market

- 14.5.1 SAUDI ARABIA

15 COMPETITIVE LANDSCAPE

- 15.1 OVERVIEW

- 15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 15.3 MARKET SHARE ANALYSIS, 2025

- 15.4 REVENUE ANALYSIS OF TOP FIVE PLAYERS

- 15.5 COMPANY VALUATION AND FINANCIAL METRICS

- 15.5.1 COMPANY VALUATION

- 15.5.2 FINANCIAL METRICS

- 15.6 BRAND/PRODUCT COMPARISON

- 15.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2025

- 15.7.1 STARS

- 15.7.2 EMERGING LEADERS

- 15.7.3 PERVASIVE PLAYERS

- 15.7.4 PARTICIPANTS

- 15.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2025

- 15.7.5.1 Company footprint

- 15.7.5.2 Region footprint

- 15.7.5.3 End use footprint

- 15.7.5.4 Application footprint

- 15.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2025

- 15.8.1 PROGRESSIVE COMPANIES

- 15.8.2 RESPONSIVE COMPANIES

- 15.8.3 DYNAMIC COMPANIES

- 15.8.4 STARTING BLOCKS

- 15.8.5 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- 15.9 COMPETITIVE SCENARIO

- 15.9.1 PRODUCT LAUNCHES

- 15.9.2 DEALS

- 15.9.3 EXPANSIONS

- 15.9.4 OTHER DEVELOPMENTS

16 COMPANY PROFILES

- 16.1 INTRODUCTION

- 16.1.1 KNORR-BREMSE AG

- 16.1.1.1 Business overview

- 16.1.1.2 Products offered

- 16.1.1.3 Recent developments

- 16.1.1.3.1 Product launches

- 16.1.1.3.2 Deals

- 16.1.1.3.3 Other developments

- 16.1.1.4 MnM view

- 16.1.1.4.1 Key strengths

- 16.1.1.4.2 Strategic choices

- 16.1.1.4.3 Weaknesses and competitive threats

- 16.1.2 ZF FRIEDRICHSHAFEN AG

- 16.1.2.1 Business overview

- 16.1.2.2 Products offered

- 16.1.2.3 Recent developments

- 16.1.2.3.1 Product launches

- 16.1.2.3.2 Deals

- 16.1.2.4 MnM view

- 16.1.2.4.1 Key strengths

- 16.1.2.4.2 Strategic choices

- 16.1.2.4.3 Weaknesses and competitive threats

- 16.1.3 WABTEC CORPORATION

- 16.1.3.1 Business overview

- 16.1.3.2 Products offered

- 16.1.3.3 Recent developments

- 16.1.3.3.1 Deals

- 16.1.3.3.2 Expansions

- 16.1.3.4 MnM view

- 16.1.3.4.1 Key strengths

- 16.1.3.4.2 Strategic choices

- 16.1.3.4.3 Weaknesses and competitive threats

- 16.1.4 HORIBA GROUP

- 16.1.4.1 Business overview

- 16.1.4.2 Products offered

- 16.1.4.3 MnM view

- 16.1.4.3.1 Key strengths

- 16.1.4.3.2 Strategic choices

- 16.1.4.3.3 Weaknesses and competitive threats

- 16.1.5 RENK GROUP AG.

- 16.1.5.1 Business overview

- 16.1.5.2 Products offered

- 16.1.5.3 Recent developments

- 16.1.5.3.1 Deals

- 16.1.5.3.2 Expansions

- 16.1.5.4 MnM view

- 16.1.5.4.1 Key strengths

- 16.1.5.4.2 Strategic choices

- 16.1.5.4.3 Weaknesses and competitive threats

- 16.1.6 SPECTRIS

- 16.1.6.1 Business overview

- 16.1.6.2 Products offered

- 16.1.6.3 Recent developments

- 16.1.6.3.1 Deals

- 16.1.6.3.2 Other developments

- 16.1.7 WAGO

- 16.1.7.1 Business overview

- 16.1.7.2 Products offered

- 16.1.7.3 Recent developments

- 16.1.7.3.1 Product launches

- 16.1.8 ADOR TECH INC.

- 16.1.8.1 Business overview

- 16.1.8.2 Products offered

- 16.1.9 AMETEK INC.

- 16.1.9.1 Business overview

- 16.1.9.2 Products offered

- 16.1.9.3 Recent developments

- 16.1.9.3.1 Deals

- 16.1.10 KEYSIGHT TECHNOLOGIES

- 16.1.10.1 Business overview

- 16.1.10.2 Products offered

- 16.1.10.3 Recent developments

- 16.1.10.3.1 Product launches

- 16.1.10.3.2 Deals

- 16.1.11 NATIONAL INSTRUMENTS CORP.

- 16.1.11.1 Business overview

- 16.1.11.2 Products offered

- 16.1.11.3 Recent developments

- 16.1.11.3.1 Product launches

- 16.1.12 AKEBONO BRAKE INDUSTRY CO., LTD.

- 16.1.12.1 Business overview

- 16.1.12.2 Products offered

- 16.1.1 KNORR-BREMSE AG

- 16.2 OTHER PLAYERS

- 16.2.1 MTS SYSTEMS

- 16.2.2 HEXAGON AB

- 16.2.3 TRIMBLE INC.

- 16.2.4 INTERTEK PLC

- 16.2.5 TUV SUD

- 16.2.6 AVL

- 16.2.7 DSPACE

- 16.2.8 RICARDO

- 16.2.9 ROHDE & SCHWARZ

- 16.2.10 ILLINOIS TOOL WORKS INC.

- 16.2.11 ROBERT BOSCH GMBH

- 16.2.12 MB DYNAMICS, INC.

- 16.2.13 PANDROL

- 16.2.14 KINGSINE ELECTRIC AUTOMATION CO., LTD.

17 RESEARCH METHODOLOGY

- 17.1 RESEARCH DATA

- 17.1.1 SECONDARY DATA

- 17.1.1.1 List of secondary sources

- 17.1.1.2 Key data from secondary sources

- 17.1.2 PRIMARY DATA

- 17.1.2.1 Primary interviews: Demand and supply sides

- 17.1.2.2 Key industry insights and breakdown of primary interviews

- 17.1.2.3 List of primary participants

- 17.1.1 SECONDARY DATA

- 17.2 MARKET SIZE ESTIMATION

- 17.2.1 TOP-DOWN APPROACH

- 17.3 DATA TRIANGULATION

- 17.4 FACTOR ANALYSIS

- 17.5 RESEARCH ASSUMPTIONS

- 17.6 RESEARCH LIMITATIONS

- 17.7 RISK ASSESSMENT

18 APPENDIX

- 18.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 18.2 DISCUSSION GUIDE

- 18.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.4 CUSTOMIZATION OPTIONS

- 18.4.1 RAILWAY TESTING MARKET, BY TRACK GEOMETRY EQUIPMENT TYPE, AT REGIONAL LEVEL (FOR REGIONS COVERED IN REPORT)

- 18.4.2 RAILWAY TESTING MARKET, BY RAILWAY HARDWARE TEST EQUIPMENT, AT REGIONAL LEVEL (FOR REGIONS COVERED IN REPORT)

- 18.4.3 COMPANY INFORMATION

- 18.5 RELATED REPORTS

- 18.6 AUTHOR DETAILS

List of Tables

- TABLE 1 RAILWAY TESTING MARKET DEFINITION, BY END USE

- TABLE 2 RAILWAY TESTING MARKET DEFINITION, BY SUPERSTRUCTURE TEST EQUIPMENT

- TABLE 3 RAILWAY TESTING MARKET DEFINITION, BY ELECTRIFICATION TEST EQUIPMENT

- TABLE 4 RAILWAY TESTING MARKET DEFINITION, BY APPLICATION

- TABLE 5 RAILWAY TESTING MARKET DEFINITION, BY USE CASE

- TABLE 6 CURRENCY EXCHANGE RATES, 2020-2025

- TABLE 7 ANNOUNCEMENT OF INVESTMENTS IN RAILWAY MODERNIZATION PROJECTS, BY COUNTRY

- TABLE 8 STANDARDS FOLLOWED FOR RAILWAY AND TRACK TESTING

- TABLE 9 RAILWAY TESTING MARKET: IMPACT OF MARKET DYNAMICS

- TABLE 10 STRATEGIC MOVES BY KEY PLAYERS OPERATING IN RAILWAY TESTING MARKET ECOSYSTEM

- TABLE 11 GDP PERCENTAGE CHANGE, BY KEY COUNTRY, 2021-2030

- TABLE 12 ROLE OF COMPANIES IN MARKET ECOSYSTEM

- TABLE 13 AVERAGE SELLING PRICE OF RAILWAY SYSTEMS, BY KEY PLAYER, 2025 (USD MILLION)

- TABLE 14 AVERAGE SELLING PRICE TREND OF RAILWAY SYSTEMS, BY TYPE, 2023-2025 (USD MILLION)

- TABLE 15 AVERAGE SELLING PRICE, BY REGION, 2023-2025 (USD MILLION)

- TABLE 16 LIST OF FUNDING, 2021-2025

- TABLE 17 IMPORT DATA FOR HS CODE 8604-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 18 EXPORT DATA FOR HS CODE 8604-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 19 KEY CONFERENCES & EVENTS, 2025-2026

- TABLE 20 RECIPROCAL TARIFF RATES ADJUSTED BY US

- TABLE 21 COMPARISON BETWEEN RAILWAY TESTING SERVICE PROVIDERS ACROSS PARAMETERS

- TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USE

- TABLE 23 KEY BUYING CRITERIA FOR RAILWAY TESTING EQUIPMENT, BY END USE

- TABLE 24 RAIL TRACTION ENGINE (STAGE III A) STANDARDS

- TABLE 25 RAIL TRACTION ENGINE (STAGE III B) STANDARDS

- TABLE 26 STANDARDS FOR DESIGN OF EQUIPMENT, SYSTEMS, AND SUBSYSTEMS

- TABLE 27 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 28 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 29 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 30 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 31 AUTONOMOUS TRAIN TECHNOLOGIES AND ASSOCIATED BENEFITS

- TABLE 32 LEVELS OF AUTONOMY FOR ROLLING STOCK

- TABLE 33 NUMBER OF PATENTS, 2015-2025

- TABLE 34 LIST OF PATENTS IN RAILWAY TESTING MARKET

- TABLE 35 RAILWAY TESTING MARKET, BY SUPERSTRUCTURE TESTING EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 36 RAILWAY TESTING MARKET, BY SUPERSTRUCTURE TESTING EQUIPMENT, 2025-2032 (USD MILLION)

- TABLE 37 RAIL MECHANICAL TESTING EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 38 RAIL MECHANICAL TESTING EQUIPMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 39 ELECTRONICS & DAQ TESTING EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 40 ELECTRONICS & DAQ TESTING EQUIPMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 41 SWITCHES/TURNOUTS TESTING EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 SWITCHES/TURNOUTS TESTING EQUIPMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 43 SLEEPERS/CROSSTIES, FASTENING TESTING EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 44 SLEEPERS/CROSSTIES, FASTENING TESTING EQUIPMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 45 TRACK MEASUREMENT EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 46 TRACK MEASUREMENT EQUIPMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 47 OTHER TESTING EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 48 OTHER TESTING EQUIPMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 49 RAILWAY TESTING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 50 RAILWAY TESTING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 51 DESIGN & DEVELOPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 52 DESIGN & DEVELOPMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 53 MANUFACTURING & FABRICATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 54 MANUFACTURING & FABRICATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 55 PRE-DELIVERY TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 PRE-DELIVERY TESTING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 57 POST-DELIVERY & UPKEEP INSPECTION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 58 POST-DELIVERY & UPKEEP INSPECTION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 59 RAILWAY TESTING MARKET, BY ELECTRIFICATION TESTING EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 60 RAILWAY TESTING MARKET, BY ELECTRIFICATION TESTING EQUIPMENT, 2025-2032 (USD MILLION)

- TABLE 61 ON-BOARD ELECTRONICS TEST EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 62 ON-BOARD ELECTRONICS TEST EQUIPMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 63 CONTACT LINE TEST EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 64 CONTACT LINE TEST EQUIPMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 65 TRACTION POWER SUPPLY & SUBSTATION TESTING EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 66 TRACTION POWER SUPPLY & SUBSTATION TESTING EQUIPMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 67 RAILWAY POWER SUPPLY TESTING EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 68 RAILWAY POWER SUPPLY TESTING EQUIPMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 69 RAILWAY TESTING MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 70 RAILWAY TESTING MARKET, BY END USE, 2025-2032 (USD MILLION)

- TABLE 71 ROLLING STOCK TEST EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 72 ROLLING STOCK TEST EQUIPMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 73 TRACK/INFRASTRUCTURE TEST EQUIPMENT, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 TRACK/INFRASTRUCTURE TEST EQUIPMENT, BY REGION, 2025-2032 (USD MILLION)

- TABLE 75 OTHER TEST EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 76 OTHER TEST EQUIPMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 77 RAILWAY TESTING MARKET, BY USE CASE, 2021-2024 (USD MILLION)

- TABLE 78 RAILWAY TESTING MARKET, BY USE CASE, 2025-2032 (USD MILLION)

- TABLE 79 RAILWAY TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 80 RAILWAY TESTING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 81 ASIA PACIFIC: RAILWAY TESTING MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 82 ASIA PACIFIC: RAILWAY TESTING MARKET, BY END USE, 2025-2032 (USD MILLION)

- TABLE 83 EUROPE: RAILWAY TESTING MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 84 EUROPE: RAILWAY TESTING MARKET, BY END USE, 2025-2032 (USD MILLION)

- TABLE 85 NORTH AMERICA: RAILWAY TESTING MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 86 NORTH AMERICA: RAILWAY TESTING MARKET, BY END USE, 2025-2032 (USD MILLION)

- TABLE 87 REST OF THE WORLD: RAILWAY TESTING MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 88 REST OF THE WORLD: RAILWAY TESTING MARKET, BY END USE, 2025-2032 (USD MILLION)

- TABLE 89 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2023-2025

- TABLE 90 RAILWAY TESTING MARKET: REGION FOOTPRINT

- TABLE 91 RAILWAY TESTING MARKET: END USE FOOTPRINT

- TABLE 92 RAILWAY TESTING MARKET: APPLICATION FOOTPRINT

- TABLE 93 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 94 RAILWAY TESTING MARKET: PRODUCT LAUNCHES, JANUARY 2022-NOVEMBER 2025

- TABLE 95 RAILWAY TESTING MARKET: DEALS, JANUARY 2022-NOVEMBER 2025

- TABLE 96 RAILWAY TESTING MARKET: EXPANSIONS, JANUARY 2022-NOVEMBER 2025

- TABLE 97 RAILWAY TESTING MARKET: OTHER DEVELOPMENTS, JANUARY 2022-NOVEMBER 2025

- TABLE 98 KNORR-BREMSE AG: COMPANY OVERVIEW

- TABLE 99 KNORR-BREMSE AG: PRODUCTS OFFERED

- TABLE 100 KNORR-BREMSE AG: PRODUCT LAUNCHES

- TABLE 101 KNORR-BREMSE AG: DEALS

- TABLE 102 KNORR-BREMSE AG: OTHER DEVELOPMENTS

- TABLE 103 ZF FRIEDRICHSHAFEN AG: COMPANY OVERVIEW

- TABLE 104 ZF FRIEDRICHSHAFEN AG: PRODUCTS OFFERED

- TABLE 105 ZF FRIEDRICHSHAFEN AG: PRODUCT LAUNCHES

- TABLE 106 ZF FRIEDRICHSHAFEN AG: DEALS

- TABLE 107 WABTEC CORPORATION: COMPANY OVERVIEW

- TABLE 108 WABTEC CORPORATION: PRODUCTS OFFERED

- TABLE 109 WABTEC CORPORATION: DEALS

- TABLE 110 WABTEC CORPORATION: EXPANSIONS

- TABLE 111 HORIBA GROUP: COMPANY OVERVIEW

- TABLE 112 HORIBA GROUP: PRODUCTS OFFERED

- TABLE 113 RENK GROUP AG.: COMPANY OVERVIEW

- TABLE 114 RENK GROUP AG.: PRODUCTS OFFERED

- TABLE 115 RENK GROUP AG.: DEALS

- TABLE 116 RENK GROUP AG.: EXPANSIONS

- TABLE 117 SPECTRIS: COMPANY OVERVIEW

- TABLE 118 SPECTRIS: PRODUCTS OFFERED

- TABLE 119 SPECTRIS: DEALS

- TABLE 120 SPECTRIS: OTHER DEVELOPMENTS

- TABLE 121 WAGO: COMPANY OVERVIEW

- TABLE 122 WAGO: PRODUCTS OFFERED

- TABLE 123 WAGO: PRODUCT LAUNCHES

- TABLE 124 ADOR TECH INC.: COMPANY OVERVIEW

- TABLE 125 ADOR TECH INC.: PRODUCTS OFFERED

- TABLE 126 AMETEK INC.: COMPANY OVERVIEW

- TABLE 127 AMETEK INC.: PRODUCTS OFFERED

- TABLE 128 AMETEK INC.: DEALS

- TABLE 129 KEYSIGHT TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 130 KEYSIGHT TECHNOLOGIES: PRODUCTS OFFERED

- TABLE 131 KEYSIGHT TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 132 KEYSIGHT TECHNOLOGIES: DEALS

- TABLE 133 NATIONAL INSTRUMENTS CORP.: COMPANY OVERVIEW

- TABLE 134 NATIONAL INSTRUMENTS CORP.: PRODUCTS OFFERED

- TABLE 135 NATIONAL INSTRUMENTS CORP.: PRODUCT LAUNCHES

- TABLE 136 AKEBONO BRAKE INDUSTRY CO., LTD.: COMPANY OVERVIEW

- TABLE 137 AKEBONO BRAKE INDUSTRY CO., LTD.: PRODUCTS OFFERED

List of Figures

- FIGURE 1 RAILWAY TESTING MARKET SCENARIO

- FIGURE 2 RAILWAY TESTING MARKET, BY END USE, 2025-2032

- FIGURE 3 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN RAILWAY TESTING MARKET, 2020-2025

- FIGURE 4 DISRUPTIONS INFLUENCING GROWTH OF RAILWAY TESTING MARKET

- FIGURE 5 HIGH-GROWTH SEGMENTS IN RAILWAY TESTING MARKET, 2025-2032

- FIGURE 6 ASIA PACIFIC TO REGISTER HIGHEST GROWTH IN RAILWAY TESTING MARKET, IN TERMS OF VALUE, DURING FORECAST PERIOD

- FIGURE 7 NEED FOR INFRASTRUCTURE EXPANSION AND SAFETY MANDATES TO DRIVE DEMAND FOR ADVANCED DIAGNOSTIC SYSTEMS IN RAILWAY TESTING

- FIGURE 8 TRACK/INFRASTRUCTURE TEST AND GEOMETRY MEASUREMENT EQUIPMENT SEGMENT TO ACHIEVE HIGHEST GROWTH BY 2032

- FIGURE 9 RAIL MECHANICAL TESTING EQUIPMENT SEGMENT TO LEAD MARKET BY 2032

- FIGURE 10 RAILWAY POWER SUPPLY TESTING EQUIPMENT SEGMENT TO ACHIEVE HIGHEST GROWTH BY 2032

- FIGURE 11 TRAIN CONTROL SEGMENT TO LEAD MARKET BY 2032

- FIGURE 12 POST-DELIVERY UPKEEP INSPECTION SEGMENT TO LEAD MARKET BY 2032

- FIGURE 13 EUROPE TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 14 RAILWAY TESTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 15 GLOBAL HIGH SPEED RAILWAY LAYOUT

- FIGURE 16 DIGITALIZATION OF RAILWAY SYSTEMS

- FIGURE 17 ECOSYSTEM ANALYSIS

- FIGURE 18 SUPPLY CHAIN ANALYSIS

- FIGURE 19 VALUE CHAIN ANALYSIS

- FIGURE 20 AVERAGE SELLING PRICE TREND OF RAILWAY SYSTEMS, BY TYPE, 2023-2025 (USD MILLION)

- FIGURE 21 AVERAGE SELLING PRICE TREND, BY REGION, 2023-2025 (USD MILLION)

- FIGURE 22 TRENDS & DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 23 INVESTMENT & FUNDING SCENARIO, 2022-2025 (USD MILLION)

- FIGURE 24 IMPORT DATA FOR HS CODE 8604-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 25 EXPORT DATA FOR HS CODE 8604-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USE

- FIGURE 27 KEY BUYING CRITERIA FOR RAILWAY TESTING EQUIPMENT, BY END USE

- FIGURE 28 PROGRESSIVE INTEGRATION OF AI: FUTURE OF RAILWAY MAINTENANCE

- FIGURE 29 FIBER OPTIC-BASED SENSOR NETWORK FOR STRUCTURAL INTEGRITY

- FIGURE 30 DIGITAL TWIN TECHNOLOGY FOR AUTOMOTIVE EMISSIONS VALIDATION

- FIGURE 31 REGENERATIVE BRAKING IN TRAINS

- FIGURE 32 SPECIFICATIONS OF TRI-MODE BATTERY TRAINS

- FIGURE 33 NUMBER OF PATENTS, BY DOCUMENT TYPE, 2015-2025

- FIGURE 34 PATENT PUBLICATION TRENDS IN RAILWAY TESTING MARKET, 2014-2024

- FIGURE 35 LEGAL STATUS OF PATENTS, 2014-2024

- FIGURE 36 PERCENTAGE OF PATENTS REGISTERED, BY REGION, 2015-2024

- FIGURE 37 TOP PATENT APPLICANTS, JANUARY 2015-DECEMBER 2024

- FIGURE 38 RAIL MECHANICAL TESTING EQUIPMENT SEGMENT TO ACCOUNT FOR LARGEST MARKET BY 2032

- FIGURE 39 POST-DELIVERY & UPKEEP INSPECTION SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 40 ON-BOARD ELECTRONICS TEST EQUIPMENT SEGMENT TO LEAD MARKET BY 2032

- FIGURE 41 ROLLING STOCK TEST EQUIPMENT SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 42 TRAIN CONTROL SEGMENT TO LEAD MARKET BY 2032

- FIGURE 43 RAILWAY TESTING MARKET, BY REGION, 2025 VS. 2032 (USD MILLION)

- FIGURE 44 ASIA PACIFIC: RAILWAY TESTING MARKET SNAPSHOT

- FIGURE 45 EUROPE: RAILWAY TESTING MARKET SNAPSHOT

- FIGURE 46 NORTH AMERICA: RAILWAY TESTING MARKET SNAPSHOT

- FIGURE 47 REST OF THE WORLD: RAILWAY TESTING MARKET SNAPSHOT

- FIGURE 48 MARKET SHARE ANALYSIS OF KEY RAILWAY TESTING EQUIPMENT MANUFACTURERS, 2025

- FIGURE 49 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2024 (USD BILLION)

- FIGURE 50 COMPANY VALUATION, 2025 (USD BILLION)

- FIGURE 51 FINANCIAL METRICS, 2025

- FIGURE 52 BRAND/PRODUCT COMPARISON

- FIGURE 53 RAILWAY TESTING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2025

- FIGURE 54 RAILWAY TESTING MARKET: COMPANY FOOTPRINT

- FIGURE 55 RAILWAY TESTING MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2025

- FIGURE 56 KNORR-BREMSE AG: COMPANY SNAPSHOT

- FIGURE 57 ZF FRIEDRICHSHAFEN AG: COMPANY SNAPSHOT

- FIGURE 58 WABTEC CORPORATION: COMPANY SNAPSHOT

- FIGURE 59 HORIBA GROUP: COMPANY SNAPSHOT

- FIGURE 60 RENK GROUP AG.: COMPANY SNAPSHOT

- FIGURE 61 SPECTRIS: COMPANY SNAPSHOT

- FIGURE 62 ADOR TECH INC.: COMPANY SNAPSHOT

- FIGURE 63 AMETEK INC.: COMPANY SNAPSHOT

- FIGURE 64 KEYSIGHT TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 65 AKEBONO BRAKE INDUSTRY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 66 RESEARCH DESIGN

- FIGURE 67 RESEARCH DESIGN MODEL

- FIGURE 68 KEY INDUSTRY INSIGHTS

- FIGURE 69 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 70 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 71 TOP-DOWN APPROACH

- FIGURE 72 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 73 MARKET GROWTH PROJECTIONS FROM SUPPLY-SIDE DRIVERS