PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906178

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906178

Rail Road Wheels - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

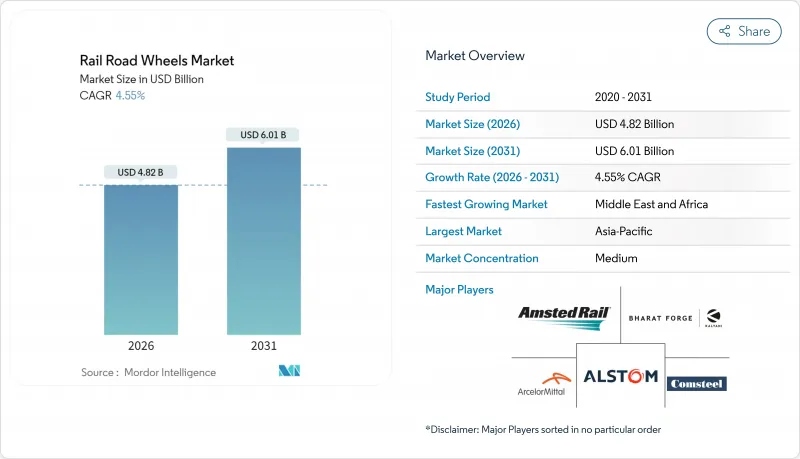

The Rail Road Wheels Market was valued at USD 4.61 billion in 2025 and estimated to grow from USD 4.82 billion in 2026 to reach USD 6.01 billion by 2031, at a CAGR of 4.55% during the forecast period (2026-2031).

This healthy trajectory reflects consistent investments in high-speed rail, dedicated freight corridors and digital maintenance platforms that improve life-cycle economics. Freight operators are refreshing wheel inventories to meet heavier axle-load mandates, while urban rail agencies are specifying lighter, quieter wheels for metro extensions that address congestion and emission goals. Materials research is shifting toward composite and hybrid formats, yet rolled carbon-steel remains entrenched due to cost efficiency and global supply familiarity. OEMs continue to capture the bulk of demand, but service-oriented leasing and predictive maintenance contracts are expanding more rapidly as operators prioritize availability and total cost of ownership. Supply-chain realignment, triggered by trade actions and raw-material volatility, is motivating regional forging investments and technology partnerships to secure resilient wheel pipelines.

Global Rail Road Wheels Market Trends and Insights

Surging Demand For High-Speed & Very-High-Speed Rail Wheels

High-speed rail programs are pushing wheel designers toward lighter, cleaner microstructures that resist thermal stress cracking over sustained 300 km/h operation. China's 400 km/h bogie initiative cut wheel mass by one-fifth and trimmed energy use around less than one-fifth while lowering wheel-rail wear 30%, highlighting tangible efficiency gains. Europe's goal of tripling high-speed modal share to more than one-tenth by 2050 similarly relies on wheels engineered with corrugated treads and premium steels that dissipate braking heat more uniformly. Japanese research into noise-damped wheels for curved track shows urban acceptance improves when decibel levels fall below 75 dB, steering transit agencies to premium products. As operators standardize on 25-ton axle loads for 350 km/h services, forged wheels with micro-alloy enhancements are becoming preferred. Continuous ultrasonic testing on production lines ensures defect-free rims, reinforcing safety confidence among regulators.

Dedicated Freight-Corridor Build-Outs In Asia & Europe

Freight diversification away from congested maritime chokepoints is boosting inland rail. The 19,392 China-Europe block trains that ran in 2024 underscore demand for heavy-duty wheels rated above 25-ton axle load. World Bank projections for the Middle Corridor indicate freight could triple by 2030, requiring wheels that maintain dimensional stability over million of kilometers before reprofiling. CRRC's 80-ton wagons, which use hollow-forged wheels to lighten tare yet withstand high dynamic loading, represent the engineering response. Kazakhstan's rail program earmarks for axle-load upgrades that mesh with these wheels, securing regional fleets against rising bulk exports. Europe's Rail Freight Corridor Rhine-Alpine similarly targets 740-meter trains, prompting Western manufacturers to co-develop tougher flange materials with domestic steel mills.

Metallurgical Coke & Alloy Scrap Price Volatility

Spot metallurgical coke rose in 2024 as supply disruptions in Australia coincided with energy price spikes. Steelmakers responded by rationing foundry coke, delaying wheel orders for smaller forges and stretching delivery times to 16 weeks. The U.S. probe of ferrosilicon imports, citing significant dumping margins, shook alloy supply confidence and forced buyers to hedge through multi-quarter contracts. Nippon Steel's 2025 loss, tied partly to alloy cost escalations during its U.S. Steel acquisition, shows how thin margins can erode capital spending on new wheel lines. Smaller foundries in Southeast Asia that lack captive coke ovens are now quoting wheels at premiums to cover price swings, dampening short-term replacement cycles for budget-constrained operators.

Other drivers and restraints analyzed in the detailed report include:

- Wheel-As-A-Service Leasing & Pay-Per-Kilometre Models

- OEM Integration Of Real-Time Wheel-Health Sensors

- Anti-Dumping Duties On Imported Wheels

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Freight operations accounted for 42.75% of Rail Road Wheels market share in 2025, reflecting the requirement for robust wheels that endure 25-ton axle loads during cross-continental hauls. The Rail Road Wheels market size for freight wheels is projected to expand steadily aligned with mineral and grain export growth. Technology upgrades such as CRRC's 80-ton wagons underscore a pivot toward hollow-forged wheels that trim tare weight while sustaining fatigue life. Metro & monorail wheels, although smaller in diameter, are designed for tighter curve negotiation and noise attenuation, and they are advancing at a 4.63% CAGR owing to extensive urban transit pipelines in India, Indonesia and Egypt. Passenger intercity wheels benefit from high-speed programs in France and Spain, which specify micro-alloy rims that reduce thermal cracking during emergency braking. Suburban rail occupies a niche with moderate growth as commuter fleets electrify and automate, prompting upgrades to resilient wheels compatible with regenerative braking.

Freight operators are lengthening wheel inspection intervals through trackside acoustic bearing detectors, cutting shop visits and freeing capacity for metro wheel refurbishment. Metro agencies demand composite damping layers bonded to steel cores, which lower interior cabin noise by 3 dB without compromising structural integrity. New procurement contracts frequently bundle wheel sets with onboard monitoring, reflecting a service-based culture shift. Long-distance passenger operators still favor conventional steel constructions due to extensive certification data, though incremental adoption of molybdenum-alloyed steels shows promise for extending reprofiling cycles. Combined, these dynamics keep train-type demand diversified, cushioning the Rail Road Wheels market against single-segment downturns.

Rolled carbon-steel retained 55.72% share of Rail Road Wheels market size in 2025, trusted for proven reliability and lower upfront cost. Rail Road Wheels market share is unlikely to shift dramatically in the near term because large freight fleets remain standardized on carbon-steel specifications that ensure interchangeability. Nevertheless, composite and hybrid solutions are posting a 4.7% CAGR as weight-reduction mandates grow more pressing for metro and high-speed lines. Manufacturers are experimenting with carbon fiber-reinforced rings bonded to steel hubs, achieving 8% mass savings and 20 °C lower rim temperature after full-service braking. Alloy-steel wheels hold a premium niche for mining service requiring elevated hardness to combat quartzitic ballast abrasion.

Certification agencies demand rigorous destructive testing for new materials, slowing their commercial rollout. End-of-life recyclability also tilts choices toward steel, whose closed-loop supply chain recovers 95% of wheel mass. Steelmakers such as ArcelorMittal are responding with bainitic grades that deliver enhanced toughness without significantly raising weight. As regulatory bodies clarify performance benchmarks for composites, procurement frameworks may broaden to include hybrid wheels where lifecycle cost justifies initial expense. For now, carbon-steel enjoys economies of scale and a global forge network, keeping it at the heart of wheel supply through 2031.

The Rail Road Wheels Market Report is Segmented by Train Type (Metro & Monorail, Suburban, Long-Distance Passenger, and Freight), Wheel Material (Rolled Carbon-Steel, Alloy-Steel, and Composite/Hybrid), Manufacturing Process (Rolled, Forged, and Cast), End-Use (OEM and Aftermarket), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific dominated with 36.30% Rail Road Wheels market share in 2025, anchored by China's 155,000-kilometer network and India's locomotive upgrade program. CRRC's global leadership in wheel supply is reinforced by its 2023 ESG pledge to hit carbon neutrality by 2035, aligning environmental goals with export competitiveness. India's forged-wheel plant aims for self-reliance, lowering import exposure and offering export potential to ASEAN neighbors. Japan continues to innovate premium steel grades, while South Korea's Korail integrates indigenous monitoring systems that provide real-time wear data to control centers. Together, these initiatives underpin sustained regional demand.

The Middle East & Africa is the fastest-growing region at 4.72% CAGR. Saudi Arabia's USD 45 billion rail blueprint, featuring the 1,300-kilometer landbridge, requires wheels rated for 230 km/h desert operation and abrasion-resistant alloys that handle sand ingress. Egypt's modernization to handle 2 million daily passengers by 2030 relies on imported GE locomotives and locally assembled passenger cars, translating into high aftermarket volumes for forged wheels. With 85% of Africa's track South Africa is opening freight slots to private operators, prompting fresh procurement of wheels optimized for manganese ore weight profiles. The region's growth creates an attractive export outlet for Asian and European forging groups.

Europe maintains a mature but steadily expanding footprint. Alstom's outlay to enlarge French capacity and digitize wheel assembly lines demonstrates ongoing investment. The proposed Trans-Europe high-speed grid, will specify low-noise mats and composite dampers. Valdunes' rescue by Europlasma, backed by French state support, secures domestic wheel sovereignty, while Italian forges ramp supplies for the Turin-Lyon base tunnel. Block-train volume between China and Europe is stimulating demand for freight wheels certified under EN 13262, sustaining volume stability amid passenger-fleet renewal cycles.

- Amsted Rail

- ArcelorMittal

- Bharat Forge

- Alstom

- Bonatrans Group

- CAF USA

- Comsteel

- CRRC Sifang

- Kolowag

- Lucchini RS

- Maanshan Iron & Steel

- Nippon Steel & Sumitomo Metal

- EVRAZ NTMK

- Vyksa Steel Works

- Texmaco Rail

- Ramkrishna Forgings

- Wabtec Corp.

- GHH-Valdunes

- Sumitomo Metal Industries

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Demand For High-Speed & Very-High-Speed Rail Wheels

- 4.2.2 Dedicated Freight-Corridor Build-Outs In Asia & Europe

- 4.2.3 Wheel-As-A-Service Leasing & Pay-Per-Kilometre Models

- 4.2.4 Government Incentives For Domestic Forging & Heat-Treat Capacity

- 4.2.5 OEM Integration Of Real-Time Wheel-Health Sensors

- 4.2.6 Shift To Verified Low-Carbon, Recycled-Content Wheel Steels

- 4.3 Market Restraints

- 4.3.1 Metallurgical Coke & Alloy Scrap Price Volatility

- 4.3.2 Anti-Dumping Duties On Imported Wheels

- 4.3.3 Fragile Global Supply Chain For >= 1 000 Mm Forged Blanks

- 4.3.4 Certification Lags For Composite / Hybrid Wheel Designs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Train Type

- 5.1.1 Metro & Monorail

- 5.1.2 Suburban

- 5.1.3 Long-Distance Passenger

- 5.1.4 Freight

- 5.2 By Wheel Material

- 5.2.1 Rolled Carbon-Steel

- 5.2.2 Alloy-Steel

- 5.2.3 Composite / Hybrid

- 5.3 By Manufacturing Process

- 5.3.1 Rolled

- 5.3.2 Forged

- 5.3.3 Cast

- 5.4 By End-Use

- 5.4.1 OEM

- 5.4.2 Aftermarket

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Turkey

- 5.5.5.4 Egypt

- 5.5.5.5 South Africa

- 5.5.5.6 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Amsted Rail

- 6.4.2 ArcelorMittal

- 6.4.3 Bharat Forge

- 6.4.4 Alstom

- 6.4.5 Bonatrans Group

- 6.4.6 CAF USA

- 6.4.7 Comsteel

- 6.4.8 CRRC Sifang

- 6.4.9 Kolowag

- 6.4.10 Lucchini RS

- 6.4.11 Maanshan Iron & Steel

- 6.4.12 Nippon Steel & Sumitomo Metal

- 6.4.13 EVRAZ NTMK

- 6.4.14 Vyksa Steel Works

- 6.4.15 Texmaco Rail

- 6.4.16 Ramkrishna Forgings

- 6.4.17 Wabtec Corp.

- 6.4.18 GHH-Valdunes

- 6.4.19 Sumitomo Metal Industries

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment