PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1915209

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1915209

AI in Mining Market by Offering (Software, Services), Mining Type (Surface, Underground), Deployment Mode (On-Premises, Cloud, Hybrid), Technology (Generative AI, Machine Learning, NLP), Application, Vertical, and Region - Global Forecast to 2032

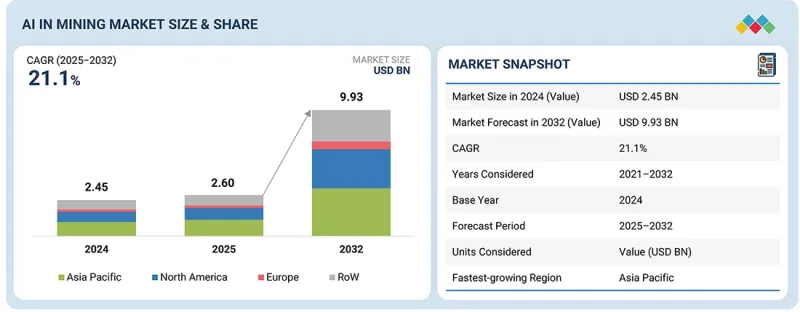

The AI in mining market is anticipated to grow from USD 2.60 billion in 2025 to USD 9.93 billion by 2032, at a CAGR of 21.1% between 2025 and 2032. The AI in mining market is driven by rapid digital transformation and the increasing deployment of IoT, cloud computing, and 5G connectivity across mining sites.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Billion) |

| Segments | By Offering, Deployment, Technology, Application, Minig Type, Vertical and Region |

| Regions covered | North America, Europe, Asia Pacific , Latin America, Middle East & Africa |

The expanding adoption of autonomous haulage systems, smart drilling, and fleet management platforms accelerates automation and enables remote operations, particularly in complex and inaccessible mining locations.

"Generative AI technology segment is estimated to hold the largest market share in 2030."

The generative AI technology segment is expected to account for the largest share of the AI in mining market in 2030 due to its ability to enhance operational efficiency, decision-making, and predictive capabilities across mining processes. Generative AI can analyze massive volumes of geological, operational, and sensor data to generate actionable insights, simulations, and predictive models, enabling mining companies to optimize exploration, drilling, and extraction strategies. By producing accurate 3D models of ore bodies, predicting equipment failures, and simulating mining scenarios, generative AI reduces operational risks, downtime, and costs. Additionally, it accelerates design and planning workflows, allowing engineers to test multiple approaches virtually before implementation. The technology also supports environmental compliance and safety management by generating predictive alerts for hazardous conditions and tailings management. Its integration with other AI tools, such as computer vision and IoT analytics, further amplifies value across end-to-end mining operations. Given the growing demand for advanced analytics, automation, and smarter resource utilization, generative AI provides a scalable and intelligent solution that addresses both operational and strategic challenges, securing its position as the leading technology segment in the AI in mining market.

"Services segment is estimated to record the highest CAGR during the forecast period."

The services segment is expected to grow at the highest CAGR in the AI in mining market during the forecast period due to the increasing reliance of mining companies on consulting, system integration, training, and managed services to successfully deploy and scale advanced AI solutions. As mining operations become more complex and digitally connected, companies require specialized expertise to integrate AI platforms with existing equipment, IoT devices, enterprise systems, and remote operational centers. Services are crucial in customizing AI use cases, such as predictive maintenance, fleet optimization, geological modeling, and safety monitoring, to meet site-specific challenges and regulatory requirements. Additionally, the shortage of skilled AI and data science professionals within the mining sector pushes operators to depend heavily on third-party service providers for ongoing support, real-time performance monitoring, and continuous model improvements. Managed services and subscription-based deployment models further drive the demand by reducing upfront investment costs and ensuring long-term ROI through outcome-based performance contracts. As AI transitions from pilot projects to full-scale implementation, service providers become essential partners, fueling the segmental growth.

"Asia Pacific is projected to hold the largest share of the AI in mining market in 2030."

Asia Pacific is estimated to hold the largest market share in 2030 due to the massive mining infrastructure expansion, the growing industrial output, and the rising demand for metals, minerals, and coal required for energy production and manufacturing. China, Australia, India, and Indonesia are among the world's largest producers of essential raw materials, including iron ore, copper, gold, lithium, and coal, leading to substantial investment in mining modernization. The increasing need for operational efficiency, cost optimization, and high productivity has accelerated the adoption of advanced AI technologies, such as predictive analytics, autonomous haulage systems, AI-powered drilling optimization, and real-time equipment monitoring. Government initiatives supporting digital transformation and Industry 4.0 integration in mining, along with large-scale public and private funding for automation, further strengthen AI deployment. Additionally, the high availability of skilled engineering talent and rapidly evolving digital infrastructure-5G connectivity and cloud computing platforms-enable seamless integration of AI solutions across remote mining sites. As the region continues to scale mineral extraction to support electronics, EV batteries, and renewable energy industries, it is positioned to lead the AI in mining market by 2030.

Extensive primary interviews were conducted with key industry experts in the AI in mining to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is provided below:

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1-40%, Tier 2-35%, and Tier 3-25%

- By Designation: C-level Executives-45%, Directors-40%, and Others-15%

- By Region: North America-30%, Europe-20%, Asia Pacific-35%, and RoW-15%

The report profiles key players in the AI in mining market with their respective market ranking analysis. Prominent players profiled in this report are Caterpillar (US), Komatsu Ltd. (Japan), Sandvik AB (Sweden), Epiroc AB (Sweden), Hitachi Construction Machinery Co., Ltd. (Japan), Hexagon AB (Sweden), Rockwell Automation (US), Siemens (Germany), Trimble Inc. (US), ABB (Switzerland), Microsoft (US), and SAP SE (Germany), among others.

Apart from this, IBM (US), RPMGLOBAL HOLDINGS LIMITED (Australia), Liebheer (Switzerland), GroundHog (US), Haultrax (Australia), Micromine (Australia), SYMX.AI (Canada), The Tomorrow Companies Inc. (US), VRIFY (US), IntelliSense.io (UK), Orica Limited. (Australia), MineSense Technologies Ltd. (Canada), Exyn Technologies (US), among others, are among the few other companies in the AI in mining market.

Research Coverage:

This research report categorizes the AI in mining market based on offering, mining type, deployment mode, technology, application, vertical, and region. The report describes the major drivers, restraints, challenges, and opportunities pertaining to the AI in mining market and forecasts the same till 2032. Apart from these, the report also consists of leadership mapping and analysis of all the companies included in the AI in mining market ecosystem.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants in this market with information on the closest approximations of the numbers for the overall AI in mining market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (strong focus on AI-enabled safety, efficiency, and productivity improvements), restraints (high deployment costs and complex integration with legacy systems), opportunities (inclination of mine operators toward digital technologies), and challenges (interoperability issues between AI platforms, sensors, and mining equipment) of the AI in mining market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the AI in mining market

- Market Development: Comprehensive information about lucrative markets-the report analyzes the AI in mining market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the AI in mining market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as Caterpillar (US), Komatsu Ltd. (Japan), Sandvik AB (Sweden), Hitachi Construction Machinery Co., Ltd. (Japan), and Hexagon AB (Sweden) in the AI in mining market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

2 EXECUTIVE SUMMARY

- 2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIONS SHAPING AI IN MINING MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AI IN MINING MARKET

- 3.2 AI IN MINING MARKET, BY OFFERING

- 3.3 AI IN MINING MARKET, BY DEPLOYMENT MODE

- 3.4 AI IN MINING MARKET, BY TECHNOLOGY

- 3.5 AI IN MINING MARKET, BY MINING TECHNIQUE

- 3.6 AI IN MINING MARKET, BY MINING TYPE

- 3.7 AI IN MINING MARKET IN ASIA PACIFIC, BY OFFERING AND COUNTRY

- 3.8 AI IN MINING MARKET, BY GEOGRAPHY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Growing focus on AI-driven safety, efficiency, and productivity

- 4.2.1.2 Rising adoption of predictive maintenance and real-time monitoring solutions

- 4.2.1.3 High emphasis on data-driven sustainable mining operations

- 4.2.2 RESTRAINTS

- 4.2.2.1 High deployment costs and integration complexities

- 4.2.2.2 Poor data quality and limited digital infrastructure in remote mine sites

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Inclination toward digital technologies to optimize mining operations

- 4.2.3.2 Rising adoption of smart, connected mining practices

- 4.2.3.3 Reliance on AI for advanced geological modeling and exploration

- 4.2.4 CHALLENGES

- 4.2.4.1 Interoperability issues between AI platforms, sensors, and mining equipment

- 4.2.4.2 Rising sustainability concerns hindering tech-led mining

- 4.2.1 DRIVERS

- 4.3 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 THREAT OF NEW ENTRANTS

- 5.1.2 THREAT OF SUBSTITUTES

- 5.1.3 BARGAINING POWER OF SUPPLIERS

- 5.1.4 BARGAINING POWER OF BUYERS

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMIC OUTLOOK

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 TRENDS IN GLOBAL MINING INDUSTRY

- 5.2.4 TRENDS IN GLOBAL AI INDUSTRY

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 PRICING RANGE OF AI-POWERED MINING SOFTWARE, BY OFFERING, 2024

- 5.5.2 PRICING RANGE OF AI-POWERED MINING SOFTWARE, BY KEY PLAYER, 2024

- 5.5.3 AVERAGE SELLING PRICE TREND OF AI-POWERED MINING SOFTWARE, BY REGION, 2021-2024

- 5.6 TRADE ANALYSIS

- 5.6.1 IMPORT SCENARIO (HS CODE 8429)

- 5.6.2 EXPORT SCENARIO (HS CODE 8429)

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 KEY CONFERENCES AND EVENTS, 2026

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 ROCKWELL AUTOMATION OFFERS CONTROL SYSTEMS AND VISUALIZATION SOLUTIONS TO MINIMIZE DOWNTIME AND OPERATIONAL COST IN MINING PLANT

- 5.10.2 KOMATSU PROVIDES AUTONOMOUS HAULAGE SYSTEM TO ENHANCE PRODUCTIVITY AND SAFETY IN AITIK COPPER MINE

- 5.10.3 ROCKWELL AUTOMATION DEPLOYS FACTORYTALK SUITE AT AMRUN BAUXITE MINE TO IMPROVE OPERATIONAL VISIBILITY

- 5.10.4 HEXAGON OFFERS OPERATIONS MANAGEMENT SOLUTIONS TO STREAMLINE OPERATIONS AT VALTERRA PLATINUM LIMITED'S MINING SITES

- 5.11 IMPACT OF 2025 US TARIFF - AI IN MINING MARKET

- 5.11.1 INTRODUCTION

- 5.11.2 KEY TARIFF RATES

- 5.11.3 PRICE IMPACT ANALYSIS

- 5.11.4 IMPACT ON COUNTRIES/REGIONS

- 5.11.4.1 US

- 5.11.4.2 Europe

- 5.11.4.3 Asia Pacific

- 5.11.5 IMPACT ON MINING TYPES

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACTS, PATENTS, AND INNOVATIONS

- 6.1 KEY TECHNOLOGIES

- 6.1.1 MACHINE LEARNING AND PREDICTIVE ANALYTICS

- 6.1.2 COMPUTER VISION AND AUTONOMOUS SYSTEMS

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 IOT AND EDGE COMPUTING

- 6.2.2 HIGH-PRECISION MAPPING AND GEOSPATIAL ANALYTICS

- 6.3 PATENT ANALYSIS

7 REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 STANDARDS

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 8.1 INTRODUCTION

- 8.2 DECISION-MAKING PROCESS

- 8.3 KEY STAKEHOLDERS AND BUYING CRITERIA

- 8.3.1 KEY STAKEHOLDERS INVOLVED IN BUYING PROCESS AND THEIR EVALUATION CRITERIA

- 8.3.2 BUYING CRITERIA

- 8.4 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.5 UNMET NEEDS OF VARIOUS MINING TYPES

9 AI IN MINING MARKET, BY OFFERING

- 9.1 INTRODUCTION

- 9.2 SOFTWARE

- 9.2.1 HIGH EMPHASIS ON DIGITAL TRANSFORMATION, DATA-DRIVEN DECISION-MAKING, AND OPERATIONAL EFFICIENCY TO SPUR DEMAND

- 9.3 SERVICES

- 9.3.1 INCREASING USE OF ADVANCED ANALYTICS, MACHINE LEARNING, AND COMPUTER VISION IN MINING OPERATIONS TO DRIVE MARKET

10 AI IN MINING MARKET, BY DEPLOYMENT MODE

- 10.1 INTRODUCTION

- 10.2 ON-PREMISES

- 10.2.1 RELIABILITY, OPERATIONAL INDEPENDENCE, AND SUITABILITY FOR MISSION-CRITICAL MINING ACTIVITIES TO BOOST SEGMENTAL GROWTH

- 10.3 CLOUD-BASED

- 10.3.1 ABILITY TO PROVIDE SCALABLE COMPUTING AND CENTRALIZED DATA ACCESSIBILITY TO AUGMENT SEGMENTAL GROWTH

- 10.4 HYBRID

- 10.4.1 SUPPORT FOR REAL-TIME EDGE-BASED DECISION-MAKING TO CONTRIBUTE TO SEGMENTAL GROWTH

11 AI IN MINING MARKET, BY TECHNOLOGY

- 11.1 INTRODUCTION

- 11.2 GENERATIVE AI

- 11.2.1 MOUNTING ADOPTION IN EXPLORATION, MINE PLANNING, AND OPERATIONAL SIMULATION TO FOSTER SEGMENTAL GROWTH

- 11.2.2 RULE-BASED MODELS

- 11.2.3 STATISTICAL MODELS

- 11.2.4 DEEP LEARNING

- 11.2.5 GENERATIVE ADVERSARIAL NETWORKS (GANS)

- 11.2.6 AUTOENCODERS

- 11.2.7 CONVOLUTIONAL NEURAL NETWORKS (CNNS)

- 11.2.8 TRANSFORMER MODELS

- 11.3 MACHINE LEARNING

- 11.3.1 RISING NEED FOR PREDICTIVE AND PRESCRIPTIVE ANALYTICS TO ACCELERATE SEGMENTAL GROWTH

- 11.4 NATURAL LANGUAGE PROCESSING

- 11.4.1 STRONG FOCUS ON ANALYZING UNSTRUCTURED DATA TO DERIVE REAL-TIME ACTIONABLE INTELLIGENCE TO BOLSTER SEGMENTAL GROWTH

- 11.5 COMPUTER VISION

- 11.5.1 HIGH SUPPORT FOR REAL-TIME IMAGE AND VIDEO ANALYTICS TO EXPEDITE SEGMENTAL GROWTH

12 AI IN MINING MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- 12.2 PREDICTIVE MAINTENANCE & ASSET MANAGEMENT

- 12.2.1 RISING EQUIPMENT MAINTENANCE COSTS AND ASSET COMPLEXITY TO AUGMENT SEGMENTAL GROWTH

- 12.3 OPERATIONS & PROCESS OPTIMIZATION

- 12.3.1 STRONG FOCUS ON MAXIMIZING RECOVERY RATES AND OPTIMIZING OPERATING MARGINS TO FUEL SEGMENTAL GROWTH

- 12.4 EXPLORATION & GEOSCIENCES

- 12.4.1 URGENT NEED TO SECURE CRITICAL MINERALS FOR RENEWABLE ENERGY AND ELECTRIC VEHICLE SUPPLY CHAINS TO DRIVE MARKET

- 12.5 SAFETY, SECURITY & ENVIRONMENT

- 12.5.1 TIGHTENING ENVIRONMENTAL AND WORKER-SAFETY REGULATIONS TO CONTRIBUTE TO SEGMENTAL GROWTH

13 AI IN MINING MARKET, BY MINING TECHNIQUE

- 13.1 INTRODUCTION

- 13.2 SURFACE MINING

- 13.2.1 LOW OPERATIONAL COMPLEXITY, REDUCED SAFETY HAZARDS, AND COST ADVANTAGES TO BOOST SEGMENTAL GROWTH

- 13.3 UNDERGROUND MINING

- 13.3.1 STRONG FOCUS ON WORKER SAFETY, SUSTAINABILITY, AND PRODUCTIVITY TO FACILITATE SEGMENTAL GROWTH

14 AI IN MINING MARKET, BY MINING TYPE

- 14.1 INTRODUCTION

- 14.2 MINERAL MINING

- 14.2.1 EMPHASIS ON RESOURCE OPTIMIZATION AND COST-EFFICIENT PRODUCTION TO ACCELERATE SEGMENTAL GROWTH

- 14.3 METAL MINING

- 14.3.1 RISING DEMAND FOR CRITICAL MINERALS FOR ELECTRIC VEHICLES AND NEXT-GENERATION MANUFACTURING TO DRIVE MARKET

- 14.4 COAL MINING

- 14.4.1 FOCUS ON SAFETY, COST OPTIMIZATION, AND AUTOMATION TO BOOST SEGMENTAL GROWTH

15 AI IN MINING MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 NORTH AMERICA

- 15.2.1 US

- 15.2.1.1 Rapid digitalization of surface and underground mining operations to bolster market growth

- 15.2.2 CANADA

- 15.2.2.1 Strong presence of mineral and metal reserves to fuel market growth

- 15.2.3 MEXICO

- 15.2.3.1 High emphasis on predictive maintenance and advanced geological modeling to augment market growth

- 15.2.1 US

- 15.3 EUROPE

- 15.3.1 RUSSIA

- 15.3.1.1 Rapid innovation in AI-powered survey and exploration tools to bolster market growth

- 15.3.2 GERMANY

- 15.3.2.1 Industrial modernization and energy transition to contribute to market growth

- 15.3.3 FRANCE

- 15.3.3.1 Emphasis on enhancing operational efficiency, safety, and sustainability to accelerate market growth

- 15.3.4 KAZAKHSTAN

- 15.3.4.1 Digital transformation and Industry 4.0 adoption to foster market growth

- 15.3.5 REST OF EUROPE

- 15.3.1 RUSSIA

- 15.4 ASIA PACIFIC

- 15.4.1 CHINA

- 15.4.1.1 Energy security priorities and massive coal production scale to expedite market growth

- 15.4.2 INDIA

- 15.4.2.1 Need to enhance mineral discovery, improve operational efficiency, and strengthen regulatory compliance to drive market

- 15.4.3 AUSTRALIA

- 15.4.3.1 Vast mineral reserves and technology-driven mining ecosystem to facilitate market growth

- 15.4.4 INDONESIA

- 15.4.4.1 Mounting production of minerals for EV batteries and clean energy technologies to contribute to market growth

- 15.4.5 REST OF ASIA PACIFIC

- 15.4.1 CHINA

- 15.5 ROW

- 15.5.1 MIDDLE EAST & AFRICA

- 15.5.1.1 Abundant mineral and energy resources to boost market growth

- 15.5.1.2 GCC countries

- 15.5.1.3 Africa & Rest of Middle East

- 15.5.2 SOUTH AMERICA

- 15.5.2.1 Global energy transition and thriving electric vehicle industry to expedite market growth

- 15.5.1 MIDDLE EAST & AFRICA

16 COMPETITIVE LANDSCAPE

- 16.1 OVERVIEW

- 16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 16.3 MARKET SHARE ANALYSIS, 2024

- 16.4 REVENUE ANALYSIS, 2020-2024

- 16.5 COMPANY VALUATION AND FINANCIAL METRICS

- 16.6 BRAND/PRODUCT COMPARISON

- 16.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 16.7.1 STARS

- 16.7.2 EMERGING LEADERS

- 16.7.3 PERVASIVE PLAYERS

- 16.7.4 PARTICIPANTS

- 16.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 16.7.5.1 Company footprint

- 16.7.5.2 Region footprint

- 16.7.5.3 Offering footprint

- 16.7.5.4 Mining technique footprint

- 16.7.5.5 Application footprint

- 16.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 16.8.1 PROGRESSIVE COMPANIES

- 16.8.2 RESPONSIVE COMPANIES

- 16.8.3 DYNAMIC COMPANIES

- 16.8.4 STARTING BLOCKS

- 16.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 16.8.5.1 Detailed list of key startups/SMEs

- 16.8.5.2 Competitive benchmarking of key startups/SMEs

- 16.9 COMPETITIVE SCENARIO

- 16.9.1 PRODUCT LAUNCHES

- 16.9.2 DEALS

17 COMPANY PROFILES

- 17.1 KEY PLAYERS

- 17.1.1 CATERPILLAR

- 17.1.1.1 Business overview

- 17.1.1.2 Products/Solutions/Services offered

- 17.1.1.3 Recent developments

- 17.1.1.3.1 Product launches

- 17.1.1.3.2 Deals

- 17.1.1.4 MnM view

- 17.1.1.4.1 Key strengths/Right to win

- 17.1.1.4.2 Strategic choices

- 17.1.1.4.3 Weaknesses/Competitive threats

- 17.1.2 KOMATSU LTD.

- 17.1.2.1 Business overview

- 17.1.2.2 Products/Solutions/Services offered

- 17.1.2.3 Recent developments

- 17.1.2.3.1 Deals

- 17.1.2.4 MnM view

- 17.1.2.4.1 Key strengths/Right to win

- 17.1.2.4.2 Strategic choices

- 17.1.2.4.3 Weaknesses/Competitive threats

- 17.1.3 SANDVIK AB

- 17.1.3.1 Business overview

- 17.1.3.2 Products/Solutions/Services offered

- 17.1.3.3 Recent developments

- 17.1.3.3.1 Product launches

- 17.1.3.3.2 Deals

- 17.1.3.4 MnM view

- 17.1.3.4.1 Key strengths/Right to win

- 17.1.3.4.2 Strategic choices

- 17.1.3.4.3 Weaknesses/Competitive threats

- 17.1.4 HITACHI CONSTRUCTION MACHINERY CO., LTD.

- 17.1.4.1 Business overview

- 17.1.4.2 Products/Solutions/Services offered

- 17.1.4.3 Recent developments

- 17.1.4.3.1 Product launches

- 17.1.4.3.2 Deals

- 17.1.4.4 MnM view

- 17.1.4.4.1 Key strengths/Right to win

- 17.1.4.4.2 Strategic choices

- 17.1.4.4.3 Weaknesses/Competitive threats

- 17.1.5 HEXAGON AB

- 17.1.5.1 Business overview

- 17.1.5.2 Products/Solutions/Services offered

- 17.1.5.3 Recent developments

- 17.1.5.3.1 Product launches

- 17.1.5.3.2 Deals

- 17.1.5.3.3 Expansions

- 17.1.5.4 MnM view

- 17.1.5.4.1 Key strengths/Right to win

- 17.1.5.4.2 Strategic choices

- 17.1.5.4.3 Weaknesses/Competitive threats

- 17.1.6 EPIROC AB

- 17.1.6.1 Business overview

- 17.1.6.2 Products/Solutions/Services offered

- 17.1.6.3 Recent developments

- 17.1.6.3.1 Deals

- 17.1.6.3.2 Expansions

- 17.1.7 ROCKWELL AUTOMATION

- 17.1.7.1 Business overview

- 17.1.7.2 Products/Solutions/Services offered

- 17.1.8 SIEMENS

- 17.1.8.1 Business overview

- 17.1.8.2 Products/Solutions/Services offered

- 17.1.8.3 Recent developments

- 17.1.8.3.1 Deals

- 17.1.9 TRIMBLE INC.

- 17.1.9.1 Business overview

- 17.1.9.2 Products/Solutions/Services offered

- 17.1.9.3 Recent developments

- 17.1.9.3.1 Product launches

- 17.1.9.3.2 Deals

- 17.1.10 ABB

- 17.1.10.1 Business overview

- 17.1.10.2 Products/Solutions/Services offered

- 17.1.10.3 Recent developments

- 17.1.10.3.1 Product launches

- 17.1.11 MICROSOFT

- 17.1.11.1 Business overview

- 17.1.11.2 Products/Solutions/Services offered

- 17.1.11.3 Recent developments

- 17.1.11.3.1 Deals

- 17.1.12 SAP SE

- 17.1.12.1 Business overview

- 17.1.12.2 Products/Solutions/Services offered

- 17.1.12.3 Recent developments

- 17.1.12.3.1 Deals

- 17.1.1 CATERPILLAR

- 17.2 OTHER PLAYERS

- 17.2.1 IBM

- 17.2.2 RPMGLOBAL HOLDINGS LIMITED

- 17.2.3 LIEBHEER

- 17.2.4 GROUNDHOG

- 17.2.5 HAULTRAX

- 17.2.6 MICROMINE PTY LTD.

- 17.2.7 SYMX.AI

- 17.2.8 THE TOMORROW COMPANIES INC.

- 17.2.9 VRIFY

- 17.2.10 INTELLISENSE.IO

- 17.2.11 ORICA LIMITED

- 17.2.12 MINESENSE TECHNOLOGIES LTD.

- 17.2.13 EXYN TECHNOLOGIES

18 RESEARCH METHODOLOGY

- 18.1 RESEARCH DATA

- 18.2 SECONDARY AND PRIMARY RESEARCH

- 18.2.1 SECONDARY DATA

- 18.2.1.1 Key data from secondary sources

- 18.2.1.2 List of key secondary sources

- 18.2.2 PRIMARY DATA

- 18.2.2.1 Key data from primary sources

- 18.2.2.2 List of primary interview participants

- 18.2.2.3 Breakdown of primaries

- 18.2.2.4 Key industry insights

- 18.2.1 SECONDARY DATA

- 18.3 MARKET SIZE ESTIMATION

- 18.3.1 BOTTOM-UP APPROACH

- 18.3.2 TOP-DOWN APPROACH

- 18.3.3 MARKET SIZE CALCULATION FOR BASE YEAR

- 18.4 MARKET FORECAST APPROACH

- 18.4.1 SUPPLY SIDE

- 18.4.2 DEMAND SIDE

- 18.5 DATA TRIANGULATION

- 18.6 FACTOR ANALYSIS

- 18.7 RESEARCH ASSUMPTIONS

- 18.8 RESEARCH LIMITATIONS

- 18.9 RISK ANALYSIS

19 APPENDIX

- 19.1 DISCUSSION GUIDE

- 19.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 19.3 CUSTOMIZATION OPTIONS

- 19.4 RELATED REPORTS

- 19.5 AUTHOR DETAILS

List of Tables

- TABLE 1 AI IN MINING MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- TABLE 3 STRATEGIC MOVES ADOPTED BY TIER-1/2/3 PLAYERS

- TABLE 4 IMPACT OF PORTER'S FIVE FORCES

- TABLE 5 GDP PERCENTAGE CHANGE, BY KEY COUNTRY, 2021-2030

- TABLE 6 ROLE OF COMPANIES IN AI IN MINING ECOSYSTEM

- TABLE 7 PRICING RANGE OF AI-POWERED MINING SOFTWARE, 2024 (USD)

- TABLE 8 PRICING RANGE OF AI-POWERED MINING SOFTWARE OFFERED BY KEY PLAYERS, 2024 (USD/YEAR)

- TABLE 9 AVERAGE SELLING PRICE TREND OF AI-POWERED MINING SOFTWARE, BY REGION, 2021-2024 (USD THOUSAND)

- TABLE 10 IMPORT DATA FOR HS CODE 8429-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 11 EXPORT DATA FOR HS CODE 8429-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 12 LIST OF KEY CONFERENCES AND EVENTS, 2026

- TABLE 13 CONTROL SYSTEMS AND VISUALIZATION SOLUTIONS ENSURE INTEGRATED CONTROL AND SAFETY IN MINING PLANT

- TABLE 14 FRONTRUNNER AUTONOMOUS HAULAGE SYSTEM IMPROVES PRODUCTIVITY AND ASSET UTILIZATION IN AITIK OPEN-PIT COPPER MINE

- TABLE 15 FACTORYTALK SUITE AUTOMATION SOLUTIONS MAINTAIN CRITICAL OPERATIONS AT AMRUN BAUXITE MINE

- TABLE 16 J5 OPERATIONS MANAGEMENT SOLUTIONS STREAMLINES OPERATIONS AT MINING SITES OF VALTERRA PLATINUM LIMITED

- TABLE 17 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 18 LIST OF KEY PATENTS, 2023-2024

- TABLE 19 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 AI IN MINING STANDARDS

- TABLE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY MINING TYPE (%)

- TABLE 25 KEY BUYING CRITERIA FOR MINING TYPES

- TABLE 26 UNMET NEEDS IN AI IN MINING MARKET, BY MINING TYPE

- TABLE 27 AI IN MINING MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 28 AI IN MINING MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 29 SOFTWARE: AI IN MINING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 30 SOFTWARE: AI IN MINING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 31 SOFTWARE: AI IN MINING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 32 SOFTWARE: AI IN MINING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 33 SERVICES: AI IN MINING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 34 SERVICES: AI IN MINING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 35 SERVICES: AI IN MINING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 36 SERVICES: AI IN MINING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 37 AI IN MINING MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 38 AI IN MINING MARKET, BY DEPLOYMENT MODE, 2025-2032 (USD MILLION)

- TABLE 39 ON-PREMISES: AI IN MINING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 40 ON-PREMISES: AI IN MINING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 41 CLOUD-BASED: AI IN MINING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 CLOUD-BASED: AI IN MINING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 43 HYBRID: AI IN MINING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 44 HYBRID: AI IN MINING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 45 AI IN MINING MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 46 AI IN MINING MARKET, BY TECHNOLOGY, 2025-2032 (USD MILLION)

- TABLE 47 AI IN MINING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 48 AI IN MINING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 49 PREDICTIVE MAINTENANCE & ASSET MANAGEMENT: AI IN MINING MARKET, BY MINING TYPE, 2021-2024 (USD MILLION)

- TABLE 50 PREDICTIVE MAINTENANCE & ASSET MANAGEMENT: AI IN MINING MARKET, BY MINING TYPE, 2025-2032 (USD MILLION)

- TABLE 51 PREDICTIVE MAINTENANCE & ASSET MANAGEMENT: AI IN MINING MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 52 PREDICTIVE MAINTENANCE & ASSET MANAGEMENT: AI IN MINING MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 53 PREDICTIVE MAINTENANCE & ASSET MANAGEMENT: AI IN MINING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 54 PREDICTIVE MAINTENANCE & ASSET MANAGEMENT: AI IN MINING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 55 OPERATIONS & PROCESS OPTIMIZATION: AI IN MINING MARKET, BY MINING TYPE, 2021-2024 (USD MILLION)

- TABLE 56 OPERATIONS & PROCESS OPTIMIZATION: AI IN MINING MARKET, BY MINING TYPE, 2025-2032 (USD MILLION)

- TABLE 57 OPERATIONS & PROCESS OPTIMIZATION: AI IN MINING MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 58 OPERATIONS & PROCESS OPTIMIZATION: AI IN MINING MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 59 OPERATIONS & PROCESS OPTIMIZATION: AI IN MINING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 60 OPERATIONS & PROCESS OPTIMIZATION: AI IN MINING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 61 EXPLORATION & GEOSCIENCE: AI IN MINING MARKET, BY MINING TYPE, 2021-2024 (USD MILLION)

- TABLE 62 EXPLORATION & GEOSCIENCE: AI IN MINING MARKET, BY MINING TYPE, 2025-2032 (USD MILLION)

- TABLE 63 EXPLORATION & GEOSCIENCE: AI IN MINING MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 64 EXPLORATION & GEOSCIENCE: AI IN MINING MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 65 EXPLORATION & GEOSCIENCE: AI IN MINING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 66 EXPLORATION & GEOSCIENCE: AI IN MINING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 67 SAFETY, SECURITY & ENVIRONMENTAL: AI IN MINING MARKET, BY MINING TYPE, 2021-2024 (USD MILLION)

- TABLE 68 SAFETY, SECURITY & ENVIRONMENTAL: AI IN MINING MARKET, BY MINING TYPE, 2025-2032 (USD MILLION)

- TABLE 69 SAFETY, SECURITY & ENVIRONMENTAL: AI IN MINING MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 70 SAFETY, SECURITY & ENVIRONMENTAL: AI IN MINING MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 71 SAFETY, SECURITY & ENVIRONMENTAL: AI IN MINING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 72 SAFETY, SECURITY & ENVIRONMENTAL: AI IN MINING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 73 AI IN MINING MARKET, BY MINING TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 74 AI IN MINING MARKET, BY MINING TECHNIQUE, 2025-2032 (USD MILLION)

- TABLE 75 SURFACE MINING: AI IN MINING MARKET, BY MINING TYPE, 2021-2024 (USD MILLION)

- TABLE 76 SURFACE MINING: AI IN MINING MARKET, BY MINING TYPE, 2025-2032 (USD MILLION)

- TABLE 77 UNDERGROUND MINING: AI IN MINING MARKET, BY MINING TYPE, 2021-2024 (USD MILLION)

- TABLE 78 UNDERGROUND MINING: AI IN MINING MARKET, BY MINING TYPE, 2025-2032 (USD MILLION)

- TABLE 79 AI IN MINING MARKET, BY MINING TYPE, 2021-2024 (USD MILLION)

- TABLE 80 AI IN MINING MARKET, BY MINING TYPE, 2025-2032 (USD MILLION)

- TABLE 81 MINERAL MINING: AI IN MINING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 82 MINERAL MINING: AI IN MINING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 83 MINERAL MINING: AI IN MINING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 84 MINERAL MINING: AI IN MINING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 85 MINERAL MINING: AI IN MINING MARKET, BY MINING TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 86 MINERAL MINING: AI IN MINING MARKET, BY MINING TECHNIQUE, 2025-2032 (USD MILLION)

- TABLE 87 METAL MINING: AI IN MINING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 88 METAL MINING: AI IN MINING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 89 METAL MINING: AI IN MINING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 90 METAL MINING: AI IN MINING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 91 METAL MINING: AI IN MINING MARKET, BY MINING TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 92 METAL MINING: AI IN MINING MARKET, BY MINING TECHNIQUE, 2025-2032 (USD MILLION)

- TABLE 93 COAL MINING: AI IN MINING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 94 COAL MINING: AI IN MINING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 95 COAL MINING: AI IN MINING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 96 COAL MINING: AI IN MINING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 97 COAL MINING: AI IN MINING MARKET, BY MINING TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 98 COAL MINING: AI IN MINING MARKET, BY MINING TECHNIQUE, 2025-2032 (USD MILLION)

- TABLE 99 AI IN MINING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 100 AI IN MINING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 101 NORTH AMERICA: AI IN MINING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 102 NORTH AMERICA: AI IN MINING MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 103 NORTH AMERICA: AI IN MINING MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 104 NORTH AMERICA: AI IN MINING MARKET, BY DEPLOYMENT MODE, 2025-2032 (USD MILLION)

- TABLE 105 NORTH AMERICA: AI IN MINING MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 106 NORTH AMERICA: AI IN MINING MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 107 NORTH AMERICA: AI IN MINING MARKET, BY MINING TYPE, 2021-2024 (USD MILLION)

- TABLE 108 NORTH AMERICA: AI IN MINING MARKET, BY MINING TYPE, 2025-2032 (USD MILLION)

- TABLE 109 NORTH AMERICA: AI IN MINING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 110 NORTH AMERICA: AI IN MINING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 111 US: AI IN MINING MARKET, BY MINING TYPE, 2021-2024 (USD MILLION)

- TABLE 112 US: AI IN MINING MARKET, BY MINING TYPE, 2025-2032 (USD MILLION)

- TABLE 113 CANADA: AI IN MINING MARKET, BY MINING TYPE, 2021-2024 (USD MILLION)

- TABLE 114 CANADA: AI IN MINING MARKET, BY MINING TYPE, 2025-2032 (USD MILLION)

- TABLE 115 MEXICO: AI IN MINING MARKET, BY MINING TYPE, 2021-2024 (USD MILLION)

- TABLE 116 MEXICO: AI IN MINING MARKET, BY MINING TYPE, 2025-2032 (USD MILLION)

- TABLE 117 EUROPE: AI IN MINING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 118 EUROPE: AI IN MINING MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 119 EUROPE: AI IN MINING MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 120 EUROPE: AI IN MINING MARKET, BY DEPLOYMENT MODE, 2025-2032 (USD MILLION)

- TABLE 121 EUROPE: AI IN MINING MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 122 EUROPE: AI IN MINING MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 123 EUROPE: AI IN MINING MARKET, BY MINING TYPE, 2021-2024 (USD MILLION)

- TABLE 124 EUROPE: AI IN MINING MARKET, BY MINING TYPE, 2025-2032 (USD MILLION)

- TABLE 125 EUROPE: AI IN MINING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 126 EUROPE: AI IN MINING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 127 RUSSIA: AI IN MINING MARKET, BY MINING TYPE, 2021-2024 (USD MILLION)

- TABLE 128 RUSSIA: AI IN MINING MARKET, BY MINING TYPE, 2025-2032 (USD MILLION)

- TABLE 129 GERMANY: AI IN MINING MARKET, BY MINING TYPE, 2021-2024 (USD MILLION)

- TABLE 130 GERMANY: AI IN MINING MARKET, BY MINING TYPE, 2025-2032 (USD MILLION)

- TABLE 131 FRANCE: AI IN MINING MARKET, BY MINING TYPE, 2021-2024 (USD MILLION)

- TABLE 132 FRANCE: AI IN MINING MARKET, BY MINING TYPE, 2025-2032 (USD MILLION)

- TABLE 133 KAZAKHSTAN: AI IN MINING MARKET, BY MINING TYPE, 2021-2024 (USD MILLION)

- TABLE 134 KAZAKHSTAN: AI IN MINING MARKET, BY MINING TYPE, 2025-2032 (USD MILLION)

- TABLE 135 REST OF EUROPE: AI IN MINING MARKET, BY MINING TYPE, 2021-2024 (USD MILLION)

- TABLE 136 REST OF EUROPE: AI IN MINING MARKET, BY MINING TYPE, 2025-2032 (USD MILLION)

- TABLE 137 ASIA PACIFIC: AI IN MINING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 138 ASIA PACIFIC: AI IN MINING MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 139 ASIA PACIFIC: AI IN MINING MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 140 ASIA PACIFIC: AI IN MINING MARKET, BY DEPLOYMENT MODE, 2025-2032 (USD MILLION)

- TABLE 141 ASIA PACIFIC: AI IN MINING MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 142 ASIA PACIFIC: AI IN MINING MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 143 ASIA PACIFIC: AI IN MINING MARKET, BY MINING TYPE, 2021-2024 (USD MILLION)

- TABLE 144 ASIA PACIFIC: AI IN MINING MARKET, BY MINING TYPE, 2025-2032 (USD MILLION)

- TABLE 145 ASIA PACIFIC: AI IN MINING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 146 ASIA PACIFIC: AI IN MINING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 147 CHINA: AI IN MINING MARKET, BY MINING TYPE, 2021-2024 (USD MILLION)

- TABLE 148 CHINA: AI IN MINING MARKET, BY MINING TYPE, 2025-2032 (USD MILLION)

- TABLE 149 INDIA: AI IN MINING MARKET, BY MINING TYPE, 2021-2024 (USD MILLION)

- TABLE 150 INDIA: AI IN MINING MARKET, BY MINING TYPE, 2025-2032 (USD MILLION)

- TABLE 151 AUSTRALIA: AI IN MINING MARKET, BY MINING TYPE, 2021-2024 (USD MILLION)

- TABLE 152 AUSTRALIA: AI IN MINING MARKET, BY MINING TYPE, 2025-2032 (USD MILLION)

- TABLE 153 INDONESIA: AI IN MINING MARKET, BY MINING TYPE, 2021-2024 (USD MILLION)

- TABLE 154 INDONESIA: AI IN MINING MARKET, BY MINING TYPE, 2025-2032 (USD MILLION)

- TABLE 155 REST OF ASIA PACIFIC: AI IN MINING MARKET, BY MINING TYPE, 2021-2024 (USD MILLION)

- TABLE 156 REST OF ASIA PACIFIC: AI IN MINING MARKET, BY MINING TYPE, 2025-2032 (USD MILLION)

- TABLE 157 ROW: AI IN MINING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 158 ROW: AI IN MINING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 159 ROW: AI IN MINING MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 160 ROW: AI IN MINING MARKET, BY DEPLOYMENT MODE, 2025-2032 (USD MILLION)

- TABLE 161 ROW: AI IN MINING MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 162 ROW: AI IN MINING MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 163 ROW: AI IN MINING MARKET, BY MINING TYPE, 2021-2024 (USD MILLION)

- TABLE 164 ROW: AI IN MINING MARKET, BY MINING TYPE, 2025-2032 (USD MILLION)

- TABLE 165 ROW: AI IN MINING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 166 ROW: AI IN MINING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: AI IN MINING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: AI IN MINING MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: AI IN MINING MARKET, BY MINING TYPE, 2021-2024 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: AI IN MINING MARKET, BY MINING TYPE, 2025-2032 (USD MILLION)

- TABLE 171 GCC COUNTRIES: AI IN MINING MARKET, BY MINING TYPE, 2021-2024 (USD MILLION)

- TABLE 172 GCC COUNTRIES: AI IN MINING MARKET, BY MINING TYPE, 2025-2032 (USD MILLION)

- TABLE 173 AFRICA & REST OF MIDDLE: AI IN MINING MARKET, BY MINING TYPE, 2021-2024 (USD MILLION)

- TABLE 174 AFRICA & REST OF MIDDLE: AI IN MINING MARKET, BY MINING TYPE, 2025-2032 (USD MILLION)

- TABLE 175 SOUTH AMERICA: AI IN MINING MARKET, BY MINING TYPE, 2021-2024 (USD MILLION)

- TABLE 176 SOUTH AMERICA: AI IN MINING MARKET, BY MINING TYPE, 2025-2032 (USD MILLION)

- TABLE 177 AI IN MINING MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2021-NOVEMBER 2025

- TABLE 178 AI IN MINING MARKET: DEGREE OF COMPETITION, 2024

- TABLE 179 AI IN MINING MARKET: REGION FOOTPRINT

- TABLE 180 AI IN MINING MARKET: OFFERING FOOTPRINT

- TABLE 181 AI IN MINING MARKET: MINING TECHNIQUE FOOTPRINT

- TABLE 182 AI IN MINING MARKET: APPLICATION FOOTPRINT

- TABLE 183 AI IN MINING MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 184 AI IN MINING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 185 AI IN MINING MARKET: PRODUCT LAUNCHES, JANUARY 2021-NOVEMBER 2025

- TABLE 186 AI IN MINING MARKET: DEALS, JANUARY 2021-NOVEMBER 2025

- TABLE 187 CATERPILLAR: COMPANY OVERVIEW

- TABLE 188 CATERPILLAR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 CATERPILLAR: PRODUCT LAUNCHES

- TABLE 190 CATERPILLAR: DEALS

- TABLE 191 KOMATSU: COMPANY OVERVIEW

- TABLE 192 KOMATSU: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 KOMATSU: DEALS

- TABLE 194 SANDVIK AB: COMPANY OVERVIEW

- TABLE 195 SANDVIK AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 SANDVIK AB: PRODUCT LAUNCHES

- TABLE 197 SANDVIK AB: DEALS

- TABLE 198 HITACHI CONSTRUCTION MACHINERY CO., LTD.: COMPANY OVERVIEW

- TABLE 199 HITACHI CONSTRUCTION MACHINERY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 HITACHI CONSTRUCTION MACHINERY CO., LTD.: PRODUCT LAUNCHES

- TABLE 201 HITACHI CONSTRUCTION MACHINERY CO., LTD.: DEALS

- TABLE 202 HEXAGON AB: COMPANY OVERVIEW

- TABLE 203 HEXAGON AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 HEXAGON AB: PRODUCT LAUNCHES

- TABLE 205 HEXAGON AB: DEALS

- TABLE 206 HEXAGON AB: EXPANSIONS

- TABLE 207 EPIROC AB: COMPANY OVERVIEW

- TABLE 208 EPIROC AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 EPIROC AB: DEALS

- TABLE 210 EPIROC AB: EXPANSIONS

- TABLE 211 ROCKWELL AUTOMATION: COMPANY OVERVIEW

- TABLE 212 ROCKWELL AUTOMATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 SIEMENS: COMPANY OVERVIEW

- TABLE 214 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 SIEMENS: DEALS

- TABLE 216 TRIMBLE INC.: COMPANY OVERVIEW

- TABLE 217 TRIMBLE INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 TRIMBLE INC.: PRODUCT LAUNCHES

- TABLE 219 TRIMBLE INC.: DEALS

- TABLE 220 ABB: COMPANY OVERVIEW

- TABLE 221 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 ABB: PRODUCT LAUNCHES

- TABLE 223 MICROSOFT: COMPANY OVERVIEW

- TABLE 224 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 MICROSOFT: DEALS

- TABLE 226 SAP SE: COMPANY OVERVIEW

- TABLE 227 SAP SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 SAP SE: DEALS

- TABLE 229 IBM: COMPANY OVERVIEW

- TABLE 230 RPMGLOBAL HOLDINGS LIMITED: COMPANY OVERVIEW

- TABLE 231 LIEBHERR: COMPANY OVERVIEW

- TABLE 232 GROUNDHOG: COMPANY OVERVIEW

- TABLE 233 HAULTRAX: COMPANY OVERVIEW

- TABLE 234 MICROMINE PTY LTD.: COMPANY OVERVIEW

- TABLE 235 SYMX.AI: COMPANY OVERVIEW

- TABLE 236 THE TOMORROW COMPANIES INC.: COMPANY OVERVIEW

- TABLE 237 VRIFY: COMPANY OVERVIEW

- TABLE 238 INTELLISENSE.IO: COMPANY OVERVIEW

- TABLE 239 ORICA LIMITED: COMPANY OVERVIEW

- TABLE 240 MINESENSE TECHNOLOGIES LTD.: COMPANY OVERVIEW

- TABLE 241 EXYN TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 242 MAJOR SECONDARY SOURCES

- TABLE 243 PRIMARY INTERVIEW PARTICIPANTS

- TABLE 244 AI IN MINING MARKET: RESEARCH ASSUMPTIONS

- TABLE 245 AI IN MINING MARKET: RISK ANALYSIS

List of Figures

- FIGURE 1 AI IN MINING MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 AI IN MINING MARKET: DURATION COVERED

- FIGURE 3 AI IN MINING MARKET SCENARIO

- FIGURE 4 GLOBAL AI IN MINING MARKET SIZE, 2021-2032

- FIGURE 5 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN AI IN MINING MARKET, 2021-2025

- FIGURE 6 DISRUPTIONS INFLUENCING AI IN MINING MARKET GROWTH

- FIGURE 7 HIGH-GROWTH SEGMENTS IN AI IN MINING MARKET, 2025-2032

- FIGURE 8 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 9 ASIA PACIFIC LEADS GLOBAL GROWTH WITH EXPANDING ROBOTIC AUTOMATION ADOPTION

- FIGURE 10 SOFTWARE SEGMENT TO DOMINATE AI IN MINING MARKET DURING FORECAST PERIOD

- FIGURE 11 ON-PREMISES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2032

- FIGURE 12 MACHINE LEARNING SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2025

- FIGURE 13 SURFACE MINING SEGMENT TO CAPTURE LARGER MARKET SHARE IN 2032

- FIGURE 14 METAL MINING SEGMENT TO HOLD LARGEST SHARE OF AI IN MINING MARKET IN 2032

- FIGURE 15 SOFTWARE SEGMENT AND CHINA TO HOLD LARGEST SHARES OF ASIA PACIFIC AI IN MINING MARKET IN 2032

- FIGURE 16 INDIA TO RECORD HIGHEST CAGR IN GLOBAL AI IN MINING MARKET FROM 2025 TO 2032

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 IMPACT ANALYSIS: DRIVERS

- FIGURE 19 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 20 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 21 IMPACT ANALYSIS: CHALLENGES

- FIGURE 22 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 23 AI IN MINING VALUE CHAIN ANALYSIS

- FIGURE 24 AI IN MINING ECOSYSTEM

- FIGURE 25 AVERAGE SELLING PRICE TREND OF AI-POWERED MINING SOFTWARE IN VARIOUS REGIONS, 2021-2024

- FIGURE 26 IMPORT SCENARIO FOR HS CODE 8429-COMPLIANT PRODUCTS IN TOP FIVE COUNTRIES, 2020-2024

- FIGURE 27 EXPORT SCENARIO FOR HS CODE 8429-COMPLIANT PRODUCTS IN TOP FIVE COUNTRIES, 2020-2024

- FIGURE 28 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 29 INVESTMENT AND FUNDING SCENARIO, 2021-2021

- FIGURE 30 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 31 DECISION-MAKING FACTORS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY MINING TYPE

- FIGURE 33 KEY BUYING CRITERIA, BY MINING TYPE

- FIGURE 34 AI ADOPTION BARRIERS AND INTERNAL CHALLENGES IN MINING SECTOR

- FIGURE 35 SOFTWARE SEGMENT TO DOMINATE AI IN MINING MARKET FROM 2025 TO 2032

- FIGURE 36 ON-PREMISES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 37 GENERATIVE AI SEGMENT TO EXHIBIT HIGHEST CAGR FROM 2025 TO 2032

- FIGURE 38 OPERATIONS & PROCESS OPTIMIZATION SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 39 UNDERGROUND MINING SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 40 METAL MINING SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2032

- FIGURE 41 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR BETWEEN 2025 AND 2032

- FIGURE 42 NORTH AMERICA: AI IN MINING MARKET SNAPSHOT

- FIGURE 43 EUROPE: MINING AUTOMATION MARKET SNAPSHOT

- FIGURE 44 ASIA PACIFIC: MINING AUTOMATION MARKET SNAPSHOT

- FIGURE 45 ROW: MINING AUTOMATION MARKET SNAPSHOT

- FIGURE 46 MARKET SHARE ANALYSIS OF COMPANIES OFFERING AI MINING TECHNOLOGIES, 2024

- FIGURE 47 AI IN MINING MARKET: REVENUE ANALYSIS OF TOP FOUR PLAYERS, 2020-2024

- FIGURE 48 COMPANY VALUATION

- FIGURE 49 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 50 BRAND/PRODUCT COMPARISON

- FIGURE 51 AI IN MINING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 52 AI IN MINING MARKET: COMPANY FOOTPRINT

- FIGURE 53 AI IN MINING MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 54 CATERPILLAR: COMPANY SNAPSHOT

- FIGURE 55 KOMATSU: COMPANY SNAPSHOT

- FIGURE 56 SANDVIK AB: COMPANY SNAPSHOT

- FIGURE 57 HITACHI CONSTRUCTION MACHINERY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 58 HEXAGON AB: COMPANY SNAPSHOT

- FIGURE 59 EPIROC AB: COMPANY SNAPSHOT

- FIGURE 60 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

- FIGURE 61 SIEMENS: COMPANY SNAPSHOT

- FIGURE 62 TRIMBLE INC.: COMPANY SNAPSHOT

- FIGURE 63 ABB: COMPANY SNAPSHOT

- FIGURE 64 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 65 SAP SE: COMPANY SNAPSHOT

- FIGURE 66 AI IN MINING MARKET: RESEARCH DESIGN

- FIGURE 67 AI IN MINING MARKET: RESEARCH APPROACH

- FIGURE 68 DATA CAPTURED FROM SECONDARY SOURCES

- FIGURE 69 DATA CAPTURED FROM PRIMARY SOURCES

- FIGURE 70 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 71 CORE FINDINGS FROM INDUSTRY EXPERTS

- FIGURE 72 AI IN MINING MARKET: RESEARCH FLOW

- FIGURE 73 AI IN MINING MARKET: BOTTOM-UP APPROACH

- FIGURE 74 AI IN MINING MARKET: TOP-DOWN APPROACH

- FIGURE 75 AI IN MINING MARKET SIZE ESTIMATION (SUPPLY SIDE)

- FIGURE 76 AI IN MINING MARKET: DATA TRIANGULATION

- FIGURE 77 AI IN MINING MARKET: RESEARCH LIMITATIONS