PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1944731

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1944731

Modular Construction Market by Type (Permanent, Relocatable), Material (Wood, Steel, Concrete), Module, End-use Industry (Residential, Office, Educational, Hospitality, Healthcare, Retail & Commercial), and Region - Global Forecast to 2030

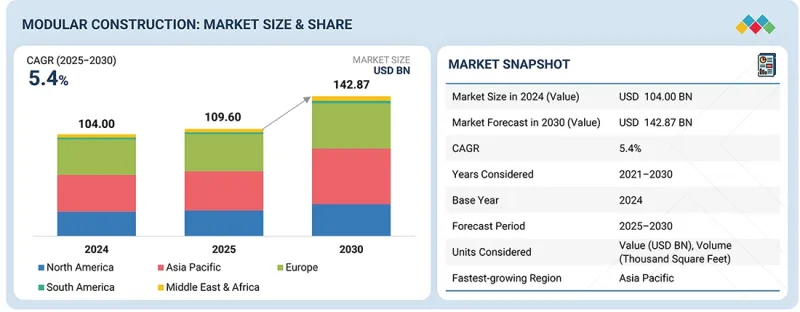

The modular construction market is expected to reach USD 142.87 billion by 2030 from USD 109.60 billion in 2025, at a CAGR of 5.4% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Thousand Square Feet) |

| Segments | Type, Material, Module, End-use Industry, and Region |

| Regions covered | North America, Asia Pacific, Europe, Middle East & Africa, and South America |

Modular construction is rapidly finding relevance in the residential, commercial, industrial, and institutional sectors due to the increasing need for fast- track construction, cost management, increased workforce efficiency, and adherence to the newer norms of building safety and sustainability regulations. The Modular Building Institute (MBI), International Code Council (ICC), and building regulations authorities are working toward ensuring the durability, safety, and energy efficiency of modular construction. Modular construction is designed with the use of advanced structural technology, mechanical, electrical, and plumbing assemblies, and building envelopes to meet or surpass the standards of conventional construction. Modular construction can be applied to multi-family residential, hotels, healthcare, data centers, and educational institutions, where there is a need for fast-track construction and repeatability. Moreover, research carried out by the U.S. Department of Housing and Urban Development (HUD) and the industry confirms the ability of modular construction to save up to 30-50% of the construction period and construction waste by as much as 20-25%, thereby making it sustainable and agile in the context of the built environment of the present and the future.

"Relocatable is projected to be the fastest-growing type in the modular construction market during the forecast period."

Relocatable modular construction is projected to be the fastest-growing type in the modular construction market during the forecast period. This is because relocatable modular constructions are very flexible and easy to set up. These types of constructions are reusable and can be disassembled for easy transfer from place to place. This feature makes them most appropriate for temporary use in educational institutions, health facilities, offices, employee settlements, and temporary aid facilities for disaster victims. Moreover, relocatable modular constructions have various advantages over conventional ones. These include minimizing construction waste, decreasing capital costs, and faster construction time. Government support for modular infrastructure development and the advantages of sustainability and rapid growth potential further contribute to the growth of the relocatable modular construction segment worldwide.

"Steel is projected to be the fastest-growing material in the modular construction market during the forecast period."

Steel is expected to be a fast-growing material in the modular construction market during the forecast period. This is because steel has unmatched strength, durability, and suitability for construction purposes in multi-story buildings. As steel can be fashioned off-site with great accuracy, this will facilitate faster assembly, better quality control, and faster construction. Additionally, steel has better resistance to fire, pests, and adverse climatic conditions, ensuring better safety. Moreover, with increased focus on greener materials in construction, modular construction involving steel is becoming common all over the globe.

"Hospitality is projected to be the fastest-growing end-use industry in the modular construction market during the forecast period."

The hospitality sector is expected to be the fastest-growing end-use sector of modular construction in the coming years. In fact, this push in the industry is because of the need for speed and scalability while trying to have tighter cost control. Hotels, resorts, serviced apartments, and budget stays are increasingly incorporating modular builds in their projects, thereby reducing project timelines by as much as 30-50% and speeding up time-to-market, critical in busy tourism and business hubs. On-site/off-site construction, managed during the prep work and facilitated through modular manufacturing, ensures a way around labor shortages, weather delays, and budget overruns. Similar room layouts repeated throughout a property, facilitated through quality inspections within the factory, allow the hospitality industry the way around maintaining consistency within a brand for multiple properties. It encourages greater use, particularly given the investment surge within the tourism infrastructure, leading the way for a middle- to low-end hotel market, pushing the hotel chains' expansion into new markets, in addition to the sustainable aspect, which resonates given the necessity for a greener approach for a new development within the industry.

"Asia Pacific is projected to be the fastest-growing region in the modular construction market during the forecast period."

The modular construction market in the Asia Pacific region is anticipated to be the fastest-growing market during the forecast period, largely reflecting the unfolding urbanization, steady population increase, and upgrading of infrastructure in the emerging economies such as China, India, and the countries of Southeast Asia. Developers, faced with the rising need for affordable housing, commercial spaces, and hotels, are turning to modular construction techniques to speed up the work and lower expenses. Further, the governmental schemes, which are aimed at smart cities, sustainable urban development, and energy-efficient building practices, also help in the widespread legacy of such a market proposal. Furthermore, the region's expanding industrial base, increased wages, and the increasing awareness of the environmental benefits of prefabricated construction have rendered modular technologies an attractive choice. These factors collectively position the Asia Pacific as a primary hub for growth, presenting significant opportunities for modular construction initiatives in both residential and commercial domains.

By Company Type: Tier 1: 40%, Tier 2: 30%, and Tier 3: 30%

By Designation: Directors: 30%, Managers: 20%, and Others: 50%

By Region: North America: 20%, Europe: 10%, Asia Pacific: 40%, South America: 10%, and Middle East & Africa 20%

Notes: Others include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million-1 Billion; and Tier 3: <USD 500 million

Companies Covered: Skanska (Sweden), Laing O'Rourke (UK), ATCO Ltd. (Canada), Modulaire Group (UK), Red Sea International (Saudi Arabia), VINCI (France), THE Bouygues group (France), Bechtel Corporation (US), Fluor Corporation (US), Lendlease Corporation (Australia), and KLEUSBERG Group (Germany) are covered in the report.

The study includes an in-depth competitive analysis of these key players in the modular construction market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the modular construction market based on type (Permanent and Relocatable), material (Wood, Steel, and Concrete), module (Four-sided Modules, Open-sided Modules, Partially Open-sided Modules, Mixed Modules and Floor Cassettes, Modules Supported by a Primary Structure, and Other Modules), and end-use industry (Residential, Retail & Commercial, Office, Education, Hospitality, Healthcare, and Other End-use Industries). The report's scope covers detailed information regarding the drivers, restraints, challenges, and opportunities influencing the growth of the modular construction market. A detailed analysis of the key industry players has been done to provide insights into their business overview, products offered, and key strategies, such as mergers, acquisitions, product launches, and expansions, associated with the modular construction market. This report covers a competitive analysis of upcoming startups in the modular construction market ecosystem.

Reasons to Buy the Report

The report will offer the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall modular construction market and the subsegments. This report will help stakeholders understand the competitive landscape, gain more insights into positioning their businesses better, and plan suitable go-to-market strategies. The report will help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (Rapid construction and cost savings driving modular adoption, Surging infrastructure investments, Enhanced worksite safety and sustainability driving growth, and Smart digital tools enabling faster, reliable, and high-quality modular builds), restraints (Transportation, logistics, and on-site assembly risks and Lack of awareness and perception barriers in developing economies ), opportunities (Rapid population growth and urbanization fuel demand, Rising high-rise and supertall developments creating strong demand and Rising housing shortages in developed economies driving modular construction adoption), and challenges (Supply chain volatility and raw material price fluctuations and Skilled workforce gap and hybrid talent shortage).

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the modular construction market.

- Market Development: Comprehensive information about profitable markets - the report analyzes the modular construction market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the modular construction market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Skanska (Sweden), Laing O'Rourke (UK), ATCO Ltd. (Canada), Modulaire Group (UK), Red Sea International (Saudi Arabia), VINCI (France), THE Bouygues group (France), Bechtel Corporation (US), Fluor Corporation (US), Lendlease Corporation (Australia), and KLEUSBERG Group (Germany), among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: INSIGHTS AND STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING THE MARKET

- 2.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS

- 2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MODULAR CONSTRUCTION MARKET

- 3.2 ASIA PACIFIC: MODULAR CONSTRUCTION MARKET, BY MATERIAL AND COUNTRY

- 3.3 MODULAR CONSTRUCTION MARKET, BY TYPE

- 3.4 MODULAR CONSTRUCTION MARKET, BY MATERIAL

- 3.5 MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY

- 3.6 MODULAR CONSTRUCTION MARKET, BY COUNTRY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Rapid construction and cost savings

- 4.2.1.2 Surging infrastructure investments

- 4.2.1.3 Enhanced worksite safety and sustainability

- 4.2.1.4 Smart digital tools enabling faster, reliable, and high-quality modular builds

- 4.2.2 RESTRAINTS

- 4.2.2.1 Transportation, logistics, and on-site assembly risks

- 4.2.2.2 Lack of awareness and perception barriers in developing economies

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Rapid population growth and urbanization

- 4.2.3.2 Rising high-rise and supertall developments

- 4.2.3.3 Rising housing shortages in developed economies

- 4.2.4 CHALLENGES

- 4.2.4.1 Supply chain volatility and raw material price fluctuations

- 4.2.4.2 Skilled workforce gap and hybrid talent shortage

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 UNMET NEEDS IN MODULAR CONSTRUCTION MARKET

- 4.3.2 WHITE SPACE OPPORTUNITIES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 INTERCONNECTED MARKETS

- 4.4.2 CROSS-SECTOR OPPORTUNITIES

- 4.4.2.1 Mining & oil/gas - renewable energy

- 4.4.2.2 Industrial & logistics - energy & utilities

- 4.4.2.3 Healthcare - data centers

- 4.4.2.4 Healthcare - emergency & temporary housing

- 4.4.2.5 Aerospace - modular construction

- 4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- 4.5.1 TIER 1 PLAYERS: GLOBAL LEADERS DRIVING CONSOLIDATION AND INNOVATION

- 4.5.1.1 ATCO Ltd. - Acquisition of NRB Ltd. to strengthen Canadian modular capabilities

- 4.5.1.2 Modulaire Group - Acquisition of mobile mini UK to strengthen UK modular leadership

- 4.5.2 TIER 2 PLAYERS: REGIONAL INNOVATORS AND NICHE LEADERS

- 4.5.2.1 Red Sea International - Agreement with Baker Hughes to supply modular accommodation facilities in Saudi Arabia

- 4.5.3 TIER 3 PLAYERS: STRENGTHENS ECO-EFFICIENCY WITH ZERO WASTE MILESTONE

- 4.5.3.1 Alho Group - Sustainable modular construction in Europe

- 4.5.1 TIER 1 PLAYERS: GLOBAL LEADERS DRIVING CONSOLIDATION AND INNOVATION

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 THREAT OF NEW ENTRANTS

- 5.1.2 THREAT OF SUBSTITUTES

- 5.1.3 BARGAINING POWER OF SUPPLIERS

- 5.1.4 BARGAINING POWER OF BUYERS

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMIC ANALYSIS

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECASTS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 INDICATIVE SELLING PRICE, BY MATERIAL

- 5.5.2 AVERAGE SELLING PRICE, BY REGION

- 5.6 TRADE ANALYSIS

- 5.6.1 EXPORT SCENARIO (HS CODE 9406)

- 5.6.2 IMPORT SCENARIO (HS CODE 9406)

- 5.7 KEY CONFERENCES AND EVENTS, 2026-2027

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 BENCH-SCALE-DRIVEN MODULAR CONSTRUCTION OF EMPLOYEE HOUSING IN KANANASKIS, AB

- 5.10.2 MODULAR AUDI SHOWROOM FOR LELLEK GROUP, KATOWICE

- 5.10.3 MODULAR CONSTRUCTION MANUFACTURER HELPED IN SPEEDY CONSTRUCTION OF SCHOOL

- 5.10.4 CUSTOM MODULAR CLASSROOM WING FOR GLASTONBURY PUBLIC SCHOOL, CONNECTICUT

- 5.11 IMPACT OF 2025 US TARIFF: MODULAR CONSTRUCTION MARKET

- 5.11.1 INTRODUCTION

- 5.11.2 KEY TARIFF RATES

- 5.11.3 PRICE IMPACT ANALYSIS

- 5.11.4 IMPACT ON COUNTRIES/REGIONS

- 5.11.4.1 US

- 5.11.4.2 Canada

- 5.11.4.3 China

- 5.11.5 IMPACT ON END-USE INDUSTRIES

6 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTIONS

- 6.1 KEY TECHNOLOGIES

- 6.1.1 BUILDING INFORMATION MODELING (BIM) & DIGITAL TWIN

- 6.1.1.1 3D printing

- 6.1.1.2 Automation and Artificial Intelligence (AI) in modular construction

- 6.1.1 BUILDING INFORMATION MODELING (BIM) & DIGITAL TWIN

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 SMART MATERIALS AND HIGH-PERFORMANCE PANELS

- 6.3 TECHNOLOGY/PRODUCT ROADMAP

- 6.3.1 SHORT-TERM (2025-2027) | PROCESS OPTIMIZATION AND EARLY DIGITAL INTEGRATION

- 6.3.2 MID-TERM (2027-2030) | DIGITALIZATION & AUTOMATION EXPANSION

- 6.3.3 LONG-TERM (2030-2035+) | SMART & SUSTAINABLE MODULAR ECOSYSTEM

- 6.4 PATENT ANALYSIS

- 6.4.1 INTRODUCTION

- 6.4.2 METHODOLOGY

- 6.5 FUTURE APPLICATIONS

- 6.5.1 MODULAR CONSTRUCTION FOR DATA CENTERS AND TECH INFRASTRUCTURE

- 6.5.2 MODULAR CONSTRUCTION FOR EMERGENCY AND DISASTER-RELIEF HOUSING

- 6.5.3 MODULAR CONSTRUCTION FOR REMOTE AND HARSH-ENVIRONMENT INFRASTRUCTURE

- 6.6 IMPACT OF AI/GEN AI ON MODULAR CONSTRUCTION MARKET

- 6.6.1 TOP USE CASES AND MARKET POTENTIAL

- 6.6.2 BEST PRACTICES IN MODULAR CONSTRUCTION PROCESSING

- 6.6.3 CASE STUDIES OF AI/GEN IMPLEMENTATION IN MODULAR CONSTRUCTION MARKET

- 6.6.3.1 Interconnected adjacent ecosystem and impact on market players

- 6.6.4 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN MODULAR CONSTRUCTION MARKET

- 6.7 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 6.7.1 ROC MODULAR DELIVERS AFFORDABLE SUPPORTIVE HOUSING ON STEVESTON HIGHWAY, RICHMOND, CANADA

- 6.7.2 CERNE ABBAS C OF E FIRST SCHOOL EXPANDS WITH MODULAR CONSTRUCTION, DORSET, UK

- 6.7.3 BAYFIELD EARLY EDUCATION PROGRAMS EXPANDS WITH MODULAR CONSTRUCTION, COLORADO, US

7 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.2 SUSTAINABILITY INITIATIVES

- 7.2.1 INTEGRATION OF ECO-FRIENDLY AND RECYCLED MATERIALS

- 7.2.2 PROMOTION OF CIRCULAR CONSTRUCTION PRACTICES

- 7.2.3 REDUCED CONSTRUCTION EMISSIONS AND RESOURCE INTENSITY

- 7.2.4 WASTE REDUCTION THROUGH OFF-SITE FABRICATION

- 7.2.5 ENERGY-EFFICIENT AND NET-ZERO MODULAR BUILDINGS

- 7.3 IMPACT OF REGULATORY POLICY ON SUSTAINABILITY INITIATIVES

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

- 8.5 MARKET PROFITABILITY

- 8.5.1 REVENUE POTENTIAL

- 8.5.2 COST DYNAMICS

- 8.5.3 MARGIN OPPORTUNITIES, BY APPLICATION

9 MODULAR CONSTRUCTION MARKET, BY TYPE

- 9.1 INTRODUCTION

- 9.2 PERMANENT

- 9.2.1 OFFERS FASTER, GREENER, AND MORE COST-EFFECTIVE BUILDING

- 9.3 RELOCATABLE 113 9.3.1 DEMAND FOR FLEXIBLE, FAST, AND REUSABLE SPACE SOLUTIONS TO DRIVE MARKET

10 MODULAR CONSTRUCTION MARKET, BY MATERIAL

- 10.1 INTRODUCTION

- 10.2 CONCRETE

- 10.2.1 DURABLE, SUSTAINABLE, AND IDEAL FOR HIGH-RISE APPLICATIONS

- 10.3 STEEL

- 10.3.1 LIGHTWEIGHT STRENGTH FOR FASTER, FLEXIBLE, AND HIGH-RISE BUILDS

- 10.4 WOOD

- 10.4.1 DEMAND FOR SUSTAINABLE AND COST-EFFECTIVE SOLUTIONS TO DRIVE MARKET GROWTH

11 MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY

- 11.1 INTRODUCTION

- 11.2 RESIDENTIAL

- 11.2.1 EFFICIENT, SUSTAINABLE, AND SCALABLE HOUSING DEVELOPMENT SUPPORTING MARKET GROWTH

- 11.3 RETAIL & COMMERCIAL

- 11.3.1 OFFERS SPEED, FLEXIBILITY, AND SCALABLE BUSINESS SPACES

- 11.4 HEALTHCARE

- 11.4.1 RISING DEMAND FOR RAPID, COST-EFFICIENT, AND COMPLIANT HEALTHCARE INFRASTRUCTURE TO DRIVE MARKET

- 11.5 EDUCATION

- 11.5.1 OFFERS COST-EFFICIENCY, FASTER BUILD TIMELINES, AND MINIMAL ACADEMIC DISRUPTION

- 11.6 HOSPITALITY

- 11.6.1 RAPID TOURISM RECOVERY AND NEED FOR FASTER, COST-EFFICIENT HOSPITALITY DEVELOPMENT SUPPORTING MARKET GROWTH

- 11.7 OFFICE

- 11.7.1 REDUCED CONSTRUCTION TIME AND MINIMAL WORKPLACE DISRUPTION SUPPORTING ADOPTION

- 11.8 OTHER END-USE INDUSTRIES

12 MODULAR CONSTRUCTION MARKET, BY MODULE

- 12.1 INTRODUCTION

- 12.2 FOUR-SIDED MODULES

- 12.2.1 USE OF CELLULAR BUILDING DESIGNS TO DRIVE MARKET GROWTH

- 12.3 OPEN-SIDED MODULES

- 12.3.1 RISING ADOPTION IN LOW-RISE AND RESIDENTIAL APPLICATIONS TO SUPPORT MARKET EXPANSION

- 12.4 PARTIALLY OPEN-SIDED MODULES

- 12.4.1 ACCELERATED CONSTRUCTION TIMELINES INDEPENDENT OF WEATHER CONDITIONS TO DRIVE MARKET GROWTH

- 12.5 MIXED MODULES AND FLOOR CASSETTES

- 12.5.1 STRUCTURAL LOAD LIMITATIONS TO CONSTRAIN MARKET EXPANSION

- 12.6 MODULES SUPPORTED BY PRIMARY STRUCTURES

- 12.6.1 USE IN MIXED RETAIL AND COMMERCIAL DEVELOPMENTS TO DRIVE MARKET GROWTH

- 12.7 OTHER MODULES

13 MODULAR CONSTRUCTION MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 ASIA PACIFIC

- 13.2.1 CHINA

- 13.2.1.1 Urbanization, policy mandates, and green infrastructure to drive market growth

- 13.2.2 INDIA

- 13.2.2.1 Rapid urbanization, massive housing shortages, and PMAY-driven affordable supply propelling demand

- 13.2.3 JAPAN

- 13.2.3.1 Advanced prefab heritage and urban housing demand sustain modular growth

- 13.2.4 SOUTH KOREA

- 13.2.4.1 Housing supply urgency and policy support for modular prefab drive adoption amid construction challenges

- 13.2.5 AUSTRALIA & NEW ZEALAND

- 13.2.5.1 Net-zero 2050 commitments and acute housing shortages accelerate modular adoption

- 13.2.6 REST OF ASIA PACIFIC

- 13.2.1 CHINA

- 13.3 EUROPE

- 13.3.1 GERMANY

- 13.3.1.1 Residential construction slump and skilled labor shortages highlighting modular as a cost-effective alternative

- 13.3.2 UK

- 13.3.2.1 Ambitious affordable housing targets and government push for offsite manufacturing driving modular revolution

- 13.3.3 FRANCE

- 13.3.3.1 Public works resilience and housing policy support shaping France's construction outlook

- 13.3.4 RUSSIA

- 13.3.4.1 Moderating growth and housing demand boost modular construction potential

- 13.3.5 SPAIN

- 13.3.5.1 Housing policies driving construction recovery in Spain

- 13.3.6 ITALY

- 13.3.6.1 Public infrastructure momentum and housing supply gaps accelerating modular construction adoption

- 13.3.7 AUSTRIA

- 13.3.7.1 Urban housing demand, cost pressures, and sustainability goals accelerate modular construction adoption

- 13.3.8 POLAND

- 13.3.8.1 Persistent housing shortage and rising construction costs propel modular solutions

- 13.3.9 REST OF EUROPE

- 13.3.1 GERMANY

- 13.4 NORTH AMERICA

- 13.4.1 US

- 13.4.1.1 Urban housing crises, sustainability goals, and policy support accelerate modular construction adoption

- 13.4.2 CANADA

- 13.4.2.1 Build Canada Homes agency and federal innovation driving modular housing to tackle supply gaps

- 13.4.3 MEXICO

- 13.4.3.1 Urban housing needs propelling modular construction adoption

- 13.4.1 US

- 13.5 MIDDLE EAST & AFRICA

- 13.5.1 GCC COUNTRIES

- 13.5.1.1 Saudi Arabia

- 13.5.1.1.1 Vision 2030 mega-projects and housing shortage driving demand

- 13.5.1.2 UAE

- 13.5.1.2.1 Government-backed affordable housing and mega projects fueling modular adoption

- 13.5.1.3 Rest of GCC Countries

- 13.5.1.1 Saudi Arabia

- 13.5.2 SOUTH AFRICA

- 13.5.2.1 Urban density pressures and housing deficits driving market growth

- 13.5.3 REST OF MIDDLE EAST & AFRICA

- 13.5.1 GCC COUNTRIES

- 13.6 SOUTH AMERICA

- 13.6.1 BRAZIL

- 13.6.1.1 Government programs and population growth driving modular construction adoption

- 13.6.2 ARGENTINA

- 13.6.2.1 Infrastructure recovery and energy investments supporting modular construction growth

- 13.6.3 REST OF SOUTH AMERICA

- 13.6.1 BRAZIL

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- 14.3 MARKET SHARE ANALYSIS

- 14.4 REVENUE ANALYSIS

- 14.5 COMPANY VALUATION AND FINANCIAL METRICS

- 14.6 BRAND COMPARISON

- 14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.7.1 STARS

- 14.7.2 EMERGING LEADERS

- 14.7.3 PERVASIVE PLAYERS

- 14.7.4 PARTICIPANTS

- 14.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.7.5.1 Company footprint

- 14.7.5.2 Regional footprint

- 14.7.5.3 Type footprint

- 14.7.5.4 Material footprint

- 14.7.5.5 End-use industry footprint

- 14.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.8.1 PROGRESSIVE COMPANIES

- 14.8.2 RESPONSIVE COMPANIES

- 14.8.3 DYNAMIC COMPANIES

- 14.8.4 STARTING BLOCKS

- 14.8.5 COMPETITIVE BENCHMARKING: KEY STARTUPS/SMES, 2024

- 14.8.5.1 Detailed list of key startups/SMEs

- 14.8.5.1.1 Competitive benchmarking of key startups/SMEs

- 14.8.5.1 Detailed list of key startups/SMEs

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 PRODUCT LAUNCHES

- 14.9.2 DEALS

- 14.9.3 EXPANSIONS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 SKANSKA

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions/Services offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Deals

- 15.1.1.3.2 Expansions

- 15.1.1.4 MnM view

- 15.1.1.4.1 Right to win

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses and competitive threats

- 15.1.2 LAING O'ROURKE

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions/Services offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Product launches

- 15.1.2.3.2 Deals

- 15.1.2.4 MNM view

- 15.1.2.4.1 Right to win

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses and competitive threats

- 15.1.3 ATCO LTD.

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions/Services offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Deals

- 15.1.3.4 MnM view

- 15.1.3.4.1 Right to win

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses and competitive threats

- 15.1.4 MODULAIRE GROUP

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions/Services offered

- 15.1.4.3 Recent developments

- 15.1.5 DEALS

- 15.1.5.1 MnM view

- 15.1.5.1.1 Right to win

- 15.1.5.1.2 Strategic choices

- 15.1.5.1.3 Weaknesses and competitive threats

- 15.1.5.1 MnM view

- 15.1.6 RED SEA INTERNATIONAL

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Deals

- 15.1.6.4 MnM view

- 15.1.6.4.1 Right to win

- 15.1.6.4.2 Strategic choices

- 15.1.6.4.3 Weaknesses and competitive threats

- 15.1.7 VINCI

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.7.2.1 Deals

- 15.1.7.3 MnM view

- 15.1.8 THE BOUYGUES GROUP

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Deals

- 15.1.8.3.2 Expansions

- 15.1.8.4 MnM view

- 15.1.9 BECHTEL CORPORATION

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Deals

- 15.1.9.4 MnM view

- 15.1.10 FLUOR CORPORATION

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Deals

- 15.1.10.4 MnM view

- 15.1.11 LENDLEASE CORPORATION

- 15.1.11.1 Business overview

- 15.1.11.2 Products/Solutions/Services offered

- 15.1.11.3 Recent developments

- 15.1.11.3.1 Product launches

- 15.1.11.3.2 Deals

- 15.1.11.4 MnM view

- 15.1.12 KLEUSBERG GROUP

- 15.1.12.1 Business overview

- 15.1.12.2 Products/Solutions/Services offered

- 15.1.12.3 Recent developments

- 15.1.12.3.1 Deals

- 15.1.12.4 MnM view

- 15.1.1 SKANSKA

- 15.2 OTHER PLAYERS

- 15.2.1 ALHO GROUP

- 15.2.2 BROAD GROUP

- 15.2.3 KWIKSPACE

- 15.2.4 WESTCHESTER MODULAR HOMES

- 15.2.5 WERNICK GROUP LIMITED

- 15.2.6 KOMA MODULAR

- 15.2.7 PREMIER MODULAR LIMITED

- 15.2.8 LUMUS INC.

- 15.2.9 HARBINGER PRODUCTION INC.

- 15.2.10 MODULOUS

- 15.2.11 NEXII, INC.

- 15.2.12 DUBOX

- 15.2.13 GUERDON, LLC.

- 15.2.14 FULLSTACK MODULAR

- 15.2.15 MODULUS HOUSING

16 RESEARCH METHODOLOGY

- 16.1 RESEARCH DATA

- 16.1.1 SECONDARY DATA

- 16.1.1.1 Key data from secondary sources

- 16.1.2 PRIMARY DATA

- 16.1.2.1 Key data from primary sources

- 16.1.2.2 Key industry insights

- 16.1.1 SECONDARY DATA

- 16.2 MARKET SIZE ESTIMATION

- 16.3 BASE NUMBER CALCULATION

- 16.3.1 DEMAND-SIDE APPROACH

- 16.3.2 SUPPLY-SIDE APPROACH

- 16.4 MARKET FORECAST APPROACH

- 16.4.1 SUPPLY SIDE

- 16.4.2 DEMAND SIDE

- 16.5 DATA TRIANGULATION

- 16.6 FACTOR ANALYSIS

- 16.7 RESEARCH ASSUMPTIONS

- 16.8 RESEARCH LIMITATIONS AND RISK ASSESSMENT

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS

List of Tables

- TABLE 1 ASIA PACIFIC URBANIZATION TREND, 1990-2050

- TABLE 2 MODULAR CONSTRUCTION MARKET: IMPACT OF PORTER'S FIVE FORCES

- TABLE 3 GLOBAL GDP GROWTH PROJECTION, BY REGION, 2021-2028 (USD TRILLION)

- TABLE 4 MODULAR CONSTRUCTION MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 5 INDICATIVE SELLING PRICE OF MATERIAL, BY KEY PLAYERS, 2024 (USD/SQUARE FEET)

- TABLE 6 AVERAGE SELLING PRICE OF KEY PLAYERS, BY REGION, 2021-2025 (USD/SQUARE FEET)

- TABLE 7 EXPORT DATA RELATED TO HS CODE 9406-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 8 IMPORT DATA FOR HS CODE 9406-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 9 MODULAR CONSTRUCTION MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 10 MODULAR CONSTRUCTION MARKET: LIST OF KEY PATENTS, 2023-2025

- TABLE 11 TOP USE CASES AND MARKET POTENTIAL

- TABLE 12 BEST PRACTICES: COMPANIES IMPLEMENTING USE CASES

- TABLE 13 MODULAR CONSTRUCTION MARKET: CASE STUDIES RELATED TO AI/GEN AI IMPLEMENTATION

- TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, INDUSTRY ASSOCIATIONS, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, INDUSTRY ASSOCIATIONS, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, INDUSTRY ASSOCIATIONS, AND OTHER ORGANIZATIONS

- TABLE 17 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, INDUSTRY ASSOCIATIONS, AND OTHER ORGANIZATIONS

- TABLE 18 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, INDUSTRY ASSOCIATIONS, AND OTHER ORGANIZATIONS

- TABLE 19 GLOBAL INDUSTRY STANDARDS IN MODULAR CONSTRUCTION MARKET

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY (%)

- TABLE 21 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- TABLE 22 UNMET NEEDS IN MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY

- TABLE 23 MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 24 MODULAR CONSTRUCTION MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 25 MODULAR CONSTRUCTION MARKET, BY TYPE, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 26 MODULAR CONSTRUCTION MARKET, BY TYPE, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 27 MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 28 MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 29 MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 30 MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 31 MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 32 MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 33 MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 34 MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 35 MODULAR CONSTRUCTION MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 36 MODULAR CONSTRUCTION MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 37 MODULAR CONSTRUCTION MARKET, BY REGION, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 38 MODULAR CONSTRUCTION MARKET, BY REGION, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 39 ASIA PACIFIC: MODULAR CONSTRUCTION MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 40 ASIA PACIFIC: MODULAR CONSTRUCTION MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 41 ASIA PACIFIC: MODULAR CONSTRUCTION MARKET, BY COUNTRY, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 42 ASIA PACIFIC: MODULAR CONSTRUCTION MARKET, BY COUNTRY, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 43 ASIA PACIFIC: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 44 ASIA PACIFIC: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 45 ASIA PACIFIC: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 46 ASIA PACIFIC: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 47 ASIA PACIFIC: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 48 ASIA PACIFIC: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 49 ASIA PACIFIC: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 50 ASIA PACIFIC: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 51 CHINA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 52 CHINA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 53 CHINA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 54 CHINA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 55 CHINA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 56 CHINA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 57 CHINA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 58 CHINA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 59 INDIA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 60 INDIA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 61 INDIA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 62 INDIA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 63 INDIA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 64 INDIA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 65 INDIA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 66 INDIA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 67 JAPAN: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 68 JAPAN: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 69 JAPAN: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 70 JAPAN: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 71 JAPAN: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 72 JAPAN: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 73 JAPAN: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 74 JAPAN: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 75 SOUTH KOREA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 76 SOUTH KOREA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 77 SOUTH KOREA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 78 SOUTH KOREA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 79 SOUTH KOREA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 80 SOUTH KOREA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 81 SOUTH KOREA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 82 SOUTH KOREA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 83 AUSTRALIA & NEW ZEALAND: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 84 AUSTRALIA & NEW ZEALAND: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 85 AUSTRALIA & NEW ZEALAND: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 86 AUSTRALIA & NEW ZEALAND: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 87 AUSTRALIA & NEW ZEALAND: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 88 AUSTRALIA & NEW ZEALAND: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 89 AUSTRALIA & NEW ZEALAND: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 90 AUSTRALIA & NEW ZEALAND: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 91 REST OF ASIA PACIFIC: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 92 REST OF ASIA PACIFIC: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 93 REST OF ASIA PACIFIC: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 94 REST OF ASIA PACIFIC: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 95 REST OF ASIA PACIFIC: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 96 REST OF ASIA PACIFIC: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 97 REST OF ASIA PACIFIC: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 98 REST OF ASIA PACIFIC: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 99 EUROPE: MODULAR CONSTRUCTION MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 100 EUROPE: MODULAR CONSTRUCTION MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 101 EUROPE: MODULAR CONSTRUCTION MARKET, BY COUNTRY, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 102 EUROPE: MODULAR CONSTRUCTION MARKET, BY COUNTRY, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 103 EUROPE: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 104 EUROPE: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 105 EUROPE: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 106 EUROPE: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 107 EUROPE: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 108 EUROPE: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 109 EUROPE: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 110 EUROPE: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 111 GERMANY: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 112 GERMANY: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 113 GERMANY: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 114 GERMANY: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 115 GERMANY: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 116 GERMANY: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 117 GERMANY: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 118 GERMANY: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 119 UK: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 120 UK: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 121 UK: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 122 UK: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 123 UK: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 124 UK: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 125 UK: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 126 UK: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 127 FRANCE: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 128 FRANCE: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 129 FRANCE: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 130 FRANCE: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 131 FRANCE: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 132 FRANCE: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 133 FRANCE: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 134 FRANCE: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 135 RUSSIA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 136 RUSSIA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 137 RUSSIA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 138 RUSSIA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 139 RUSSIA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 140 RUSSIA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 141 RUSSIA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 142 RUSSIA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 143 SPAIN: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 144 SPAIN: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 145 SPAIN: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 146 SPAIN: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 147 SPAIN: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 148 SPAIN: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 149 SPAIN: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 150 SPAIN: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 151 ITALY: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 152 ITALY: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 153 ITALY: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 154 ITALY: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 155 ITALY: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 156 ITALY: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 157 ITALY: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 158 ITALY: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 159 AUSTRIA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 160 AUSTRIA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 161 AUSTRIA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 162 AUSTRIA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 163 AUSTRIA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 164 AUSTRIA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 165 AUSTRIA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 166 AUSTRIA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 167 POLAND: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 168 POLAND: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 169 POLAND: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 170 POLAND: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 171 POLAND: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 172 POLAND: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 173 POLAND: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 174 POLAND: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 175 REST OF EUROPE: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 176 REST OF EUROPE: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 177 REST OF EUROPE: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 178 REST OF EUROPE: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 179 REST OF EUROPE: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 180 REST OF EUROPE: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 181 REST OF EUROPE: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 182 REST OF EUROPE: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 183 NORTH AMERICA: MODULAR CONSTRUCTION MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 184 NORTH AMERICA: MODULAR CONSTRUCTION MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 185 NORTH AMERICA: MODULAR CONSTRUCTION MARKET, BY COUNTRY, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 186 NORTH AMERICA: MODULAR CONSTRUCTION MARKET, BY COUNTRY, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 187 NORTH AMERICA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 188 NORTH AMERICA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 189 NORTH AMERICA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 190 NORTH AMERICA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 191 NORTH AMERICA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 192 NORTH AMERICA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 193 NORTH AMERICA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 194 NORTH AMERICA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 195 US: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 196 US: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 197 US: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 198 US: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 199 US: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 200 US: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 201 US: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 202 US: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 203 CANADA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 204 CANADA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 205 CANADA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 206 CANADA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 207 CANADA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 208 CANADA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 209 CANADA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 210 CANADA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 211 MEXICO: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 212 MEXICO: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 213 MEXICO: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 214 MEXICO: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 215 MEXICO: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 216 MEXICO: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 217 MEXICO: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 218 MEXICO: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 219 MIDDLE EAST & AFRICA: MODULAR CONSTRUCTION MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: MODULAR CONSTRUCTION MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: MODULAR CONSTRUCTION MARKET, BY COUNTRY, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 222 MIDDLE EAST & AFRICA: MODULAR CONSTRUCTION MARKET, BY COUNTRY, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 223 MIDDLE EAST & AFRICA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 224 MIDDLE EAST & AFRICA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 226 MIDDLE EAST & AFRICA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 227 MIDDLE EAST & AFRICA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 228 MIDDLE EAST & AFRICA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 229 MIDDLE EAST & AFRICA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 230 MIDDLE EAST & AFRICA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 231 SAUDI ARABIA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 232 SAUDI ARABIA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 233 SAUDI ARABIA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 234 SAUDI ARABIA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 235 SAUDI ARABIA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 236 SAUDI ARABIA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 237 SAUDI ARABIA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 238 SAUDI ARABIA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 239 UAE: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 240 UAE: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 241 UAE: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 242 UAE: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 243 UAE: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 244 UAE: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 245 UAE: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 246 UAE: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 247 REST OF GCC COUNTRIES: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 248 REST OF GCC COUNTRIES: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 249 REST OF GCC COUNTRIES: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 250 REST OF GCC COUNTRIES: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 251 REST OF GCC COUNTRIES: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 252 REST OF GCC COUNTRIES: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 253 REST OF GCC COUNTRIES: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 254 REST OF GCC COUNTRIES: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 255 SOUTH AFRICA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 256 SOUTH AFRICA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 257 SOUTH AFRICA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 258 SOUTH AFRICA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 259 SOUTH AFRICA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 260 SOUTH AFRICA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 261 SOUTH AFRICA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 262 SOUTH AFRICA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 263 REST OF MIDDLE EAST & AFRICA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 264 REST OF MIDDLE EAST & AFRICA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 265 REST OF MIDDLE EAST & AFRICA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 266 REST OF MIDDLE EAST & AFRICA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 267 REST OF MIDDLE EAST & AFRICA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 268 REST OF MIDDLE EAST & AFRICA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 269 REST OF MIDDLE EAST & AFRICA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 270 REST OF MIDDLE EAST & AFRICA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 271 SOUTH AMERICA: MODULAR CONSTRUCTION MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 272 SOUTH AMERICA: MODULAR CONSTRUCTION MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 273 SOUTH AMERICA: MODULAR CONSTRUCTION MARKET, BY COUNTRY, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 274 SOUTH AMERICA: MODULAR CONSTRUCTION MARKET, BY COUNTRY, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 275 SOUTH AMERICA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 276 SOUTH AMERICA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 277 SOUTH AMERICA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 278 SOUTH AMERICA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 279 SOUTH AMERICA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 280 SOUTH AMERICA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 281 SOUTH AMERICA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 282 SOUTH AMERICA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 283 BRAZIL: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 284 BRAZIL: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 285 BRAZIL: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 286 BRAZIL: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 287 BRAZIL: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 288 BRAZIL: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 289 BRAZIL: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 290 BRAZIL: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 291 ARGENTINA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 292 ARGENTINA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 293 ARGENTINA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 294 ARGENTINA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 295 ARGENTINA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 296 ARGENTINA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 297 ARGENTINA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 298 ARGENTINA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 299 REST OF SOUTH AMERICA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 300 REST OF SOUTH AMERICA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 301 REST OF SOUTH AMERICA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 302 REST OF SOUTH AMERICA: MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 303 REST OF SOUTH AMERICA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 304 REST OF SOUTH AMERICA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 305 REST OF SOUTH AMERICA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021-2023 (THOUSAND SQUARE FEET)

- TABLE 306 REST OF SOUTH AMERICA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND SQUARE FEET)

- TABLE 307 MODULAR CONSTRUCTION MARKET: OVERVIEW OF MAJOR STRATEGIES ADOPTED BY KEY PLAYERS, 2021-2025

- TABLE 308 MODULAR CONSTRUCTION MARKET: DEGREE OF COMPETITION, 2024

- TABLE 309 MODULAR CONSTRUCTION MARKET: REGIONAL FOOTPRINT, 2024

- TABLE 310 MODULAR CONSTRUCTION MARKET: TYPE FOOTPRINT, 2024

- TABLE 311 MODULAR CONSTRUCTION MARKET: MATERIAL FOOTPRINT, 2024

- TABLE 312 MODULAR CONSTRUCTION MARKET: END-USE INDUSTRY FOOTPRINT, 2024

- TABLE 313 MODULAR CONSTRUCTION MARKET: DETAILED LIST OF KEY STARTUPS/SMES, 2024

- TABLE 314 MODULAR CONSTRUCTION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024

- TABLE 315 MODULAR CONSTRUCTION MARKET: PRODUCT LAUNCHES, JANUARY 2021-DECEMBER 2025

- TABLE 316 MODULAR CONSTRUCTION MARKET: DEALS, JANUARY 2021-DECEMBER 2025

- TABLE 317 MODULAR CONSTRUCTION MARKET: EXPANSIONS, JANUARY 2021-DECEMBER 2025

- TABLE 318 SKANSKA: COMPANY OVERVIEW

- TABLE 319 SKANSKA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 320 SKANSKA: DEALS, JANUARY 2021-DECEMBER 2025

- TABLE 321 SKANSKA: EXPANSIONS, JANUARY 2021-DECEMBER 2025

- TABLE 322 LAING O'ROURKE: COMPANY OVERVIEW

- TABLE 323 LAING O'ROURKE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 324 LAING O'ROURKE: PRODUCT LAUNCHES, JANUARY 2021-DECEMBER 2025

- TABLE 325 LAING O'ROURKE: DEALS, JANUARY 2021-DECEMBER 2025

- TABLE 326 ATCO LTD.: COMPANY OVERVIEW

- TABLE 327 ATCO LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 328 ATCO LTD.: DEALS, JANUARY 2021-DECEMBER 2025

- TABLE 329 MODULAIRE GROUP: COMPANY OVERVIEW

- TABLE 330 MODULAIRE GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 331 MODULAIRE GROUP: DEALS, JANUARY 2021-DECEMBER 2025

- TABLE 332 RED SEA INTERNATIONAL: COMPANY OVERVIEW

- TABLE 333 RED SEA INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 334 RED SEA INTERNATIONAL: DEALS, JANUARY 2021-DECEMBER 2025

- TABLE 335 VINCI: COMPANY OVERVIEW

- TABLE 336 VINCI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 337 VINCI: DEALS, JANUARY 2021-DECEMBER 2025

- TABLE 338 THE BOUYGUES GROUP: COMPANY OVERVIEW

- TABLE 339 THE BOUYGUES GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 340 THE BOUYGUES GROUP: DEALS, JANUARY 2021-DECEMBER 2025

- TABLE 341 THE BOUYGUES GROUP: EXPANSIONS, JANUARY 2021-DECEMBER 2025

- TABLE 342 BECHTEL CORPORATION: COMPANY OVERVIEW

- TABLE 343 BECHTEL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 344 BECHTEL CORPORATION: DEALS, JANUARY 2021-DECEMBER 2025

- TABLE 345 FLUOR CORPORATION: COMPANY OVERVIEW

- TABLE 346 FLUOR CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 347 FLUOR CORPORATION: DEALS, JANUARY 2021-DECEMBER 2025

- TABLE 348 LENDLEASE CORPORATION: COMPANY OVERVIEW

- TABLE 349 LENDLEASE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 350 LENDLEASE CORPORATION: PRODUCT LAUNCHES, JANUARY 2021-DECEMBER 2025

- TABLE 351 LENDLEASE CORPORATION: DEALS, JANUARY 2021-DECEMBER 2025

- TABLE 352 KLEUSBERG GROUP: COMPANY OVERVIEW

- TABLE 353 KLEUSBERG GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 354 KLEUSBERG GROUP: DEALS, JANUARY 2021-DECEMBER 2025

- TABLE 355 ALHO GROUP: COMPANY OVERVIEW

- TABLE 356 BROAD GROUP: COMPANY OVERVIEW

- TABLE 357 KWIKSPACE: COMPANY OVERVIEW

- TABLE 358 WESTCHESTER MODULAR HOMES: COMPANY OVERVIEW

- TABLE 359 WERNICK GROUP LIMITED: COMPANY OVERVIEW

- TABLE 360 KOMA MODULAR: COMPANY OVERVIEW

- TABLE 361 PREMIER MODULAR LIMITED: COMPANY OVERVIEW

- TABLE 362 LUMUS INC: COMPANY OVERVIEW

- TABLE 363 HARBINGER PRODUCTION INC.: COMPANY OVERVIEW

- TABLE 364 MODULOUS: COMPANY OVERVIEW

- TABLE 365 NEXII, INC.: COMPANY OVERVIEW

- TABLE 366 DUBOX: COMPANY OVERVIEW

- TABLE 367 GUERDON, LLC.: COMPANY OVERVIEW

- TABLE 368 FULLSTACK MODULAR: COMPANY OVERVIEW

- TABLE 369 MODULUS HOUSING: COMPANY OVERVIEW

List of Figures

- FIGURE 1 MODULAR CONSTRUCTION MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 KEY INSIGHTS AND MARKET HIGHLIGHTS

- FIGURE 3 MODULAR CONSTRUCTION MARKET, 2021-2030

- FIGURE 4 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN MODULAR CONSTRUCTION MARKET (2020-2025)

- FIGURE 5 DISRUPTIVE TRENDS IMPACTING GROWTH OF MODULAR CONSTRUCTION MARKET DURING FORECAST PERIOD

- FIGURE 6 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS IN MODULAR CONSTRUCTION MARKET, 2025-2030

- FIGURE 7 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 8 HIGH DEMAND FOR MODULAR CONSTRUCTION IN RESIDENTIAL & NON-RESIDENTIAL TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 9 CHINA ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 10 PERMANENT SEGMENT DOMINATED MODULAR CONSTRUCTION MARKET IN 2024

- FIGURE 11 CONCRETE SEGMENT ACCOUNTED FOR LARGEST SHARE OF MODULAR CONSTRUCTION MARKET IN 2024

- FIGURE 12 RESIDENTIAL DOMINATED MODULAR CONSTRUCTION MARKET IN 2024

- FIGURE 13 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 MODULAR CONSTRUCTION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 15 GLOBAL BUILDING FLOOR AREA IN ADVANCED, EMERGING, AND DEVELOPING ECONOMIES (2010-2022) WITH 2030 PROJECTION (BILLION M2)

- FIGURE 16 GROWTH OF URBAN POPULATION, 2020-2024 (MILLION PERSONS)

- FIGURE 17 GLOBAL COMPLETIONS OF 200M+ AND 300M+ BUILDINGS, (2021-2025)

- FIGURE 18 MODULAR CONSTRUCTION MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 19 MODULAR CONSTRUCTION MARKET: VALUE CHAIN ANALYSIS

- FIGURE 20 MODULAR CONSTRUCTION MARKET: ECOSYSTEM ANALYSIS

- FIGURE 21 INDICATIVE SELLING PRICE OF MATERIAL, BY KEY PLAYERS, 2024 (USD/SQUARE FEET)

- FIGURE 22 MODULAR CONSTRUCTION MARKET: AVERAGE SELLING PRICE TREND, BY REGION (2021-2025)

- FIGURE 23 EXPORT DATA FOR HS CODE 9406-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 24 IMPORT DATA FOR HS CODE 9406-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 25 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 26 INVESTMENT AND FUNDING SCENARIO, 2018-2025

- FIGURE 27 LIST OF MAJOR PATENTS FOR MODULAR CONSTRUCTION, 2016-2025

- FIGURE 28 MAJOR PATENTS APPLIED AND GRANTED RELATED TO MODULAR CONSTRUCTION, BY COUNTRY/REGION, 2016-2025

- FIGURE 29 MODULAR CONSTRUCTION MARKET DECISION-MAKING FACTORS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY

- FIGURE 31 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- FIGURE 32 ADOPTION BARRIERS & INTERNAL CHALLENGES

- FIGURE 33 PERMANENT SEGMENT DOMINATED MODULAR CONSTRUCTION MARKET IN 2024

- FIGURE 34 CONCRETE DOMINATED MODULAR CONSTRUCTION MARKET IN 2024

- FIGURE 35 RESIDENTIAL DOMINATED MODULAR CONSTRUCTION MARKET IN 2024

- FIGURE 36 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 37 ASIA PACIFIC DOMINATES MODULAR CONSTRUCTION MARKET IN 2025

- FIGURE 38 ASIA PACIFIC: MODULAR CONSTRUCTION MARKET SNAPSHOT

- FIGURE 39 EUROPE: MODULAR CONSTRUCTION MARKET SNAPSHOT

- FIGURE 40 MODULAR CONSTRUCTION: MARKET SHARE ANALYSIS, 2024

- FIGURE 41 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024

- FIGURE 42 MODULAR CONSTRUCTION MARKET: COMPANY VALUATION, 2024

- FIGURE 43 MODULAR CONSTRUCTION MARKET: FINANCIAL MATRIX: EV/EBITDA RATIO, 2024

- FIGURE 44 MODULAR CONSTRUCTION MARKET: YEAR-TO-DATE PRICE AND FIVE-YEAR STOCK BETA, 2024

- FIGURE 45 MODULAR CONSTRUCTION MARKET: BRAND COMPARISON

- FIGURE 46 MODULAR CONSTRUCTION MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 47 MODULAR CONSTRUCTION MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 48 MODULAR CONSTRUCTION MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 49 SKANSA: COMPANY SNAPSHOT

- FIGURE 50 LAING O'ROURKE: COMPANY SNAPSHOT

- FIGURE 51 ATCO LTD.: COMPANY SNAPSHOT

- FIGURE 52 RED SEA INTERNATIONAL: COMPANY SNAPSHOT

- FIGURE 53 VINCI: COMPANY SNAPSHOT

- FIGURE 54 THE BOUYGUES GROUP: COMPANY SNAPSHOT

- FIGURE 55 BECHTEL CORPORATION: COMPANY SNAPSHOT

- FIGURE 56 FLUOR CORPORATION: COMPANY SNAPSHOT

- FIGURE 57 LENDLEASE CORPORATION: COMPANY SNAPSHOT

- FIGURE 58 MODULAR CONSTRUCTION MARKET: RESEARCH DESIGN

- FIGURE 59 BREAKDOWN OF INTERVIEWS WITH EXPERTS

- FIGURE 60 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 61 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 62 MODULAR CONSTRUCTION MARKET: APPROACH 1

- FIGURE 63 MODULAR CONSTRUCTION MARKET: APPROACH 2

- FIGURE 64 MODULAR CONSTRUCTION MARKET: DATA TRIANGULATION