PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1923690

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1923690

RFID Market by Offering, Form Factor, Application, End Use - Global Forecast to 2034

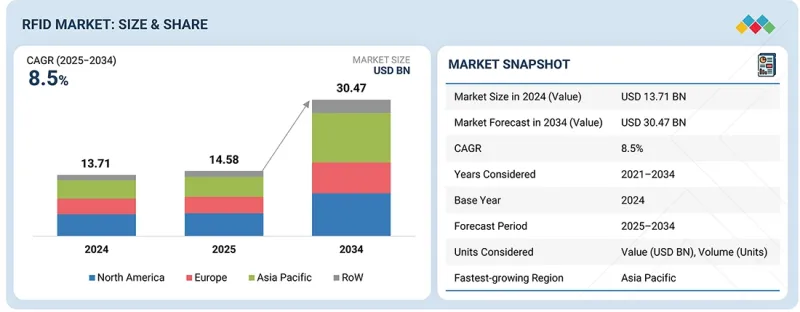

The RFID market is projected to reach USD 14.58 billion in 2025 and USD 30.47 billion by 2034, registering a CAGR of 8.5% between 2025 and 2034. The market is projected to witness steady growth during the forecast period, driven by increasing demand for real-time tracking, operational visibility, and data accuracy across multiple industries. Enterprises are adopting RFID to improve inventory accuracy, asset utilization, and supply chain transparency.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2034 |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Units Considered | Value (USD Billion) |

| Segments | By Offering, Frequency Range, Application and Region |

| Regions covered | North America, Europe, APAC, RoW |

Growing deployment of UHF RFID tags, fixed and handheld readers, antennas, and RFID software platforms supports automation across retail, logistics, manufacturing, and healthcare environments. Item-level tagging and warehouse automation are reducing manual processes and cycle times. Integration of RFID with IoT platforms, cloud analytics, and enterprise systems enables data-driven decision-making and predictive insights. Expansion of omnichannel retail, cold-chain logistics, and industrial automation further strengthens adoption. Government initiatives related to traceability, food safety, and healthcare compliance also support market growth. However, challenges such as upfront implementation costs, system integration complexity, and data management requirements may limit adoption in cost-sensitive environments. Continued innovation in tag design, reader performance, and software interoperability, along with scalable deployment models, will be critical to sustaining long-term RFID market expansion.

"By application, the contactless payments segment is expected to register the highest CAGR between 2025 and 2034."

The contactless payments segment is projected to record the highest CAGR in the RFID market during the forecast period, driven by rising demand for fast, secure, and convenient transaction methods. Increasing adoption of NFC- and HF-based RFID technologies supports widespread deployment across retail, public transport, hospitality, and banking applications. Consumers prefer contactless payments for reduced transaction time, improved hygiene, and enhanced user experience. Governments and financial institutions continue to promote cashless payment ecosystems, accelerating infrastructure upgrades and terminal installations. Growth of urban transit systems and smart mobility initiatives further boosts adoption of RFID-enabled fare collection. Advancements in secure elements, encryption, and tokenization strengthen transaction security and regulatory compliance. Integration of contactless payment systems with mobile wallets, wearables, and smart cards expands addressable use. Emerging markets are witnessing rapid growth as digital payment penetration increases. While initial infrastructure costs and interoperability challenges remain, ongoing standardization and technology improvements position contactless payments as the fastest-growing application segment in the RFID market.

"Based on form factor, the labels segment is projected to account for the largest market share in 2034."

The RFID labels segment is projected to hold the largest market share due to widespread adoption across high-volume, cost-sensitive applications. RFID labels combine RFID inlays with printed labels, enabling efficient identification and tracking of products, packages, and assets. Retail remains the primary driver, with large-scale deployment of item-level labeling to improve inventory accuracy, reduce shrinkage, and support omnichannel fulfillment. Logistics & warehousing operations use RFID labels for shipment tracking, pallet management, and process automation. The segment benefits from low unit costs, ease of integration, and compatibility with existing labeling workflows. Advances in antenna design, chip sensitivity, and printing technologies improve read performance and durability. RFID labels are also gaining adoption in healthcare, medical & pharmaceuticals, and food supply chains to support traceability and regulatory compliance. Standardization of UHF protocols and global sourcing capabilities further support scalability. As enterprises expand RFID deployments beyond pilot projects, RFID labels continue to dominate by volume and application breadth within the overall RFID market.

"The Asia Pacific region is projected to exhibit the highest CAGR from 2025 to 2034."

Asia Pacific represents the largest RFID market due to its strong manufacturing base, large retail footprint, and expanding logistics and supply chain networks. Countries such as China, Japan, South Korea, and India are witnessing rising adoption of RFID across retail, electronics manufacturing, automotive, healthcare, and transportation sectors. High-volume production of consumer goods and electronics supports large-scale deployment of RFID tags, inlays, and readers. The region benefits from the presence of major RFID component manufacturers, tag converters, and system integrators, enabling cost-effective and scalable deployments. Retailers in the Asia Pacific increasingly adopt item-level tagging to improve inventory accuracy and support omnichannel fulfillment. Logistics providers use RFID for warehouse automation, shipment tracking, and asset visibility. Government initiatives promoting digitalization, smart manufacturing, and supply chain transparency further support adoption. Growing use of RFID in healthcare, food safety, and public transportation also contributes to market expansion. Combined with declining tag costs and improving infrastructure, these factors position Asia Pacific as the leading regional contributor to the global RFID market.

The break-up of the profile of primary participants in the RFID market-

- By Company Type: Tier 1 - 25%, Tier 2 - 35%, Tier 3 - 40%

- By Designation: C-level Executives - 40%, Directors - 30%, Others - 30%

- By Region: North America - 35%, Europe - 25%, Asia Pacific - 25%, RoW - 15%

Note: Other designations include sales, marketing, and product managers.

The three tiers of the companies are based on their total revenues as of 2024: Tier 1: >USD 1 billion, Tier 2: USD 500 million-1 billion, and Tier 3: USD 500 million.

The major players in the RFID market with a significant global presence include Zebra Technologies Corp. (US), Honeywell International Inc. (US), Avery Dennison Corporation (US), HID Global Corporation (US), and Datalogic S.p.A. (Italy).

Research Coverage

The report segments the RFID market and forecasts its size by offering, form factor, frequency range, vertical, application, material, and region. It also comprehensively reviews the drivers, restraints, opportunities, and challenges that influence market growth. The report encompasses both qualitative and quantitative aspects of the market.

Reasons to Buy the Report:

The report will help the market leaders/new entrants with information on the closest approximate revenues for the overall RFID market and related segments. This report will help stakeholders understand the competitive landscape and gain valuable insights to strengthen their market position and develop effective go-to-market strategies. The report also helps stakeholders understand the pulse of the market, providing them with information on key market drivers, restraints, opportunities, and challenges.

The report provides insights into the following pointers:

- Analysis of key drivers (supply chain digitalization and real-time visibility demand, automation growth in logistics and warehousing, integration of RFID with IoT and analytics platforms, demand for contactless and touchless identification solutions), restraints (high total cost of ownership for large-scale deployments, integration complexity with legacy IT and WMS/ERP systems, price sensitivity of tags in low-margin industries, infrastructure upgrade requirements at the site level), opportunities (industry 4.0 and smart manufacturing adoption, RFID-enabled traceability in healthcare and pharmaceuticals, advances in low-cost, sensor-enabled, and printable RFID tags, adoption in emerging markets with modernizing supply chains), and challenges (RF signal interference and read accuracy constraints in metal- and liquid-intensive RFID deployments, )

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and strategies such as new product launches, expansions, partnerships, and acquisitions in the RFID market

- Market Development: Comprehensive information about lucrative markets-the report analyses the RFID market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the RFID market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players, including Zebra Technologies Corp. (US), Honeywell International Inc. (US), Avery Dennison Corporation (US), HID Global Corporation (US), Datalogic S.p.A. (Italy), Impinj, Inc. (US), Alien Technology, LLC (US), CAEN RFID S.r.l. (Italy), GAO RFID Inc. (Canada), and Xemelgo, Inc. (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS IN RFID MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN RFID MARKET

- 3.2 RFID MARKET, BY OFFERING

- 3.3 RFID MARKET, BY FORM FACTOR

- 3.4 RFID MARKET, BY MATERIAL

- 3.5 RFID MARKET, BY FREQUENCY RANGE

- 3.6 RFID MARKET, BY END USE

- 3.7 RFID MARKET, BY APPLICATION

- 3.8 RFID MARKET, BY REGION

- 3.9 RFID MARKET, BY GEOGRAPHY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Evolution of digital supply chains

- 4.2.1.2 Automation in logistics and warehousing due to rapid expansion of e-commerce sector

- 4.2.1.3 Integration of RFID into IoT, analytics, and edge computing platforms

- 4.2.1.4 Rising demand for contactless and touchless identification solutions

- 4.2.2 RESTRAINTS

- 4.2.2.1 High cost of ownership for large-scale multi-site deployments

- 4.2.2.2 Complexities associated with RFID integration in legacy IT and WMS/ERP systems

- 4.2.2.3 Price sensitivity of RFID tags in low-margin industries

- 4.2.2.4 Site-level infrastructure upgrade requirements

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Elevating adoption of Industry 4.0 and smart manufacturing solutions

- 4.2.3.2 Increasing use of RFID-enabled traceability solutions in healthcare and pharmaceutical supply chains

- 4.2.3.3 Advances in low-cost, sensor-enabled, and printable RFID tags

- 4.2.3.4 Transition of emerging markets toward digital supply chains

- 4.2.4 CHALLENGES

- 4.2.4.1 RF signal interference and read accuracy constraints in metal- and liquid-intensive RFID deployments

- 4.2.4.2 Interoperability issues in heterogeneous RFID ecosystems

- 4.2.4.3 Limited RFID expertise and workforce skills among SMEs

- 4.2.4.4 Difficulty in scaling pilot projects into enterprise-wide deployments

- 4.2.1 DRIVERS

- 4.3 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.3.1 INTERCONNECTED MARKETS

- 4.3.2 CROSS-SECTOR OPPORTUNITIES

- 4.4 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 PORTER'S FIVE FORCES ANALYSIS

- 5.2.1 THREAT OF NEW ENTRANTS

- 5.2.2 THREAT OF SUBSTITUTES

- 5.2.3 BARGAINING POWER OF SUPPLIERS

- 5.2.4 BARGAINING POWER OF BUYERS

- 5.2.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.3 MACROECONOMIC OUTLOOK

- 5.3.1 INTRODUCTION

- 5.3.2 GDP TRENDS AND FORECAST

- 5.3.3 TRENDS IN GLOBAL RFID INDUSTRY

- 5.3.4 TRENDS IN GLOBAL IOT INDUSTRY

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE TREND OF RFID OFFERINGS, BY KEY PLAYER, 2021-2024

- 5.6.1.1 Average selling price trend of RFID tags, by key player, 2021-2024

- 5.6.1.2 Average selling price trend of RFID readers, by key player, 2021-2024

- 5.6.2 AVERAGE SELLING PRICE TREND OF RFID OFFERINGS, BY REGION, 2021-2024

- 5.6.2.1 Average selling price trend of RFID tags, by region, 2021-2024

- 5.6.2.2 Average selling price trend of RFID readers, by region, 2021-2024

- 5.6.1 AVERAGE SELLING PRICE TREND OF RFID OFFERINGS, BY KEY PLAYER, 2021-2024

- 5.7 TRADE ANALYSIS

- 5.7.1 IMPORT SCENARIO (HS CODE 8523)

- 5.7.2 EXPORT SCENARIO (HS CODE 8523)

- 5.8 KEY CONFERENCES AND EVENTS, 2026-2027

- 5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

- 5.10 INVESTMENT AND FUNDING SCENARIO, 2021-2025

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 WALMART IMPROVES ITEM-LEVEL INVENTORY ACCURACY USING RFID TAGS OFFERED BY AVERY DENNISON

- 5.11.2 DECATHLON ENHANCES SUPPLY CHAIN VISIBILITY BY DEPLOYING RFID SOLUTION PROVIDED BY ZEBRA TECHNOLOGIES

- 5.11.3 HID GLOBAL HELPS HOSPITAL HEALTHCARE NETWORK TO OPTIMIZE STAFF PRODUCTIVITY BY DEPLOYING RFID TAGS

- 5.12 IMPACT OF 2025 US TARIFF - RFID MARKET

- 5.12.1 KEY TARIFF RATES

- 5.12.2 PRICE IMPACT ANALYSIS

- 5.12.3 IMPACT ON COUNTRIES/REGIONS

- 5.12.3.1 US

- 5.12.3.2 Europe

- 5.12.3.3 Asia Pacific

- 5.12.4 IMPACT ON END USES

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, AND INNOVATIONS

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 COMPUTER VISION

- 6.1.2 REAL-TIME LOCATION SYSTEMS

- 6.1.3 RFID-ENABLED SENSORS AND ROBOTICS

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 CLOUD-BASED RFID

- 6.2.2 RFID IN IOT

- 6.2.3 INTEGRATION OF RFID WITH BLOCKCHAIN

- 6.3 ADJACENT TECHNOLOGIES

- 6.3.1 NEAR-FIELD COMMUNICATION AND RFID HYBRID SOLUTIONS

- 6.3.2 FLEXIBLE RFID TAGS

- 6.4 TECHNOLOGY ROADMAP

- 6.4.1 SHORT-TERM (2025-2027): INFRASTRUCTURE MODERNIZATION & INTELLIGENT TRACKING

- 6.4.2 MID-TERM (2027-2030): INTELLIGENT AUTOMATION & ECOSYSTEM INTEGRATION

- 6.4.3 LONG-TERM (2030-2035+): AUTONOMOUS, TRUSTED, & DATA-DRIVEN RFID ECOSYSTEMS

- 6.5 PATENT ANALYSIS

- 6.6 IMPACT OF AI ON RFID MARKET

- 6.6.1 TOP USE CASES AND MARKET POTENTIAL

- 6.6.2 BEST PRACTICES FOLLOWED BY COMPANIES IN RFID MARKET

- 6.6.3 CASE STUDIES RELATED TO AI IMPLEMENTATION IN RFID MARKET

- 6.6.4 INTERCONNECTED/ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.6.5 CLIENTS' READINESS TO ADOPT AI IN RFID MARKET

7 REGULATORY LANDSCAPE AND SUSTAINABILITY INITIATIVES

- 7.1 INTRODUCTION

- 7.2 REGIONAL REGULATIONS AND COMPLIANCE

- 7.2.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.2.2 INDUSTRY STANDARDS

- 7.2.2.1 ISO/IEC RFID air interface standards (ISO/IEC 18000 series)

- 7.2.2.2 EPCglobal standards (GS1 EPC framework)

- 7.2.2.3 RFID security and data protection standards (ISO/IEC 29167 series)

- 7.2.2.4 Regional spectrum and compliance standards (ETSI, FCC, and others)

- 7.2.2.5 RAIN RFID interoperability specifications

- 7.3 SUSTAINABILITY INITIATIVES

- 7.3.1 USE OF RFID TO REDUCE ENVIRONMENTAL IMPACT

- 7.3.1.1 Deployment of RFID technology to reduce carbon impact

- 7.3.1.2 Implementation of RFID products to promote circular economy

- 7.3.2 UTILIZATION OF SUSTAINABLE RFID PRODUCT DESIGNS AND MATERIALS

- 7.3.2.1 Material innovation and end-of-life considerations

- 7.3.3 DEPLOYMENT OF ENERGY-EFFICIENT AND LOW-POWER RFID SYSTEMS

- 7.3.3.1 Passive RFID and infrastructure-level energy optimization

- 7.3.4 ADOPTION OF RFID-ENABLED CIRCULAR ECONOMY AND REUSABLE MODELS

- 7.3.4.1 Lifecycle visibility and asset circulation

- 7.3.5 IMPLEMENTATION OF RFID TO MEET ENVIRONMENTAL AND TRACEABILITY REGULATIONS

- 7.3.5.1 Traceability of environmental and ESG regulations

- 7.3.6 ACCEPTANCE OF SUSTAINABLE MANUFACTURING AND SUPPLY CHAIN TRANSPARENCY

- 7.3.6.1 Process visibility and resource optimization

- 7.3.7 ADOPTION OF RFID TO REDUCE PACKAGING AND DOCUMENTATION WASTE

- 7.3.7.1 Digital identification and paperless operations

- 7.3.1 USE OF RFID TO REDUCE ENVIRONMENTAL IMPACT

- 7.4 IMPACT OF REGULATORY POLICIES ON SUSTAINABILITY INITIATIVES

- 7.4.1 IMPACT OF ENVIRONMENTAL REGULATIONS ON RFID PRODUCT DESIGN

- 7.4.2 IMPACT OF WASTE MANAGEMENT POLICIES ON RFID VENDORS AND END USERS

- 7.4.3 IMPACT OF TRADE REGULATIONS ACROSS DOMESTIC AND CROSS-BORDER SUPPLY CHAINS

- 7.4.4 IMPACT OF ESG DISCLOSURE REGULATIONS ON DATA COLLECTION AND MANAGEMENT

- 7.4.5 IMPACT OF VARYING REGULATIONS ACROSS REGIONS

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 8.1 INTRODUCTION

- 8.2 DECISION-MAKING PROCESS

- 8.3 KEY STAKEHOLDERS INVOLVED IN BUYING PROCESS AND THEIR EVALUATION CRITERIA

- 8.3.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.3.2 BUYING CRITERIA

- 8.4 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.5 UNMET NEEDS OF VARIOUS END USE SEGMENTS

9 WAFER DIMENSIONS USED IN RFID CHIP MANUFACTURING

- 9.1 INTRODUCTION

- 9.2 8-INCH

- 9.3 12-INCH

- 9.4 OTHERS

10 RFID MARKET, BY OFFERING

- 10.1 INTRODUCTION

- 10.2 TAGS

- 10.2.1 RISING DEMAND FOR REAL-TIME INVENTORY VISIBILITY AND SUPPLY CHAIN AUTOMATION TO DRIVE MARKET

- 10.2.2 PASSIVE

- 10.2.2.1 Low unit cost and suitability for high-volume tagging to accelerate demand

- 10.2.3 ACTIVE

- 10.2.3.1 Demand for long-range, real-time asset visibility to fuel segmental growth

- 10.3 READERS

- 10.3.1 GROWING FOCUS ON REAL-TIME VISIBILITY AND FASTER OPERATIONAL DECISION-MAKING TO SPUR DEMAND

- 10.3.2 FIXED

- 10.3.3 HANDHELD

- 10.3.4 WEARABLE

- 10.4 SOFTWARE & SERVICES

- 10.4.1 INCREASING COMPLEXITY OF MULTI-SITE OPERATIONS TO ESCALATE DEMAND

11 RFID MARKET, BY MATERIAL

- 11.1 INTRODUCTION

- 11.2 PLASTIC

- 11.2.1 COST EFFICIENCY, DURABILITY, AND HIGH-VOLUME DEPLOYMENTS TO FACILITATE SEGMENTAL GROWTH

- 11.3 GLASS

- 11.3.1 STABLE READ PERFORMANCE AND RESISTANCE TO HARSH CONDITIONS TO SUPPORT SEGMENTAL GROWTH

- 11.4 PAPER

- 11.4.1 INCREASING USE OF RECYCLABLE PACKAGING MATERIALS TO CONTRIBUTE TO SEGMENTAL GROWTH

- 11.5 OTHER MATERIALS

12 RFID MARKET, BY FREQUENCY RANGE

- 12.1 INTRODUCTION

- 12.2 LOW

- 12.2.1 STRINGENT REGULATIONS ACROSS AGRICULTURE AND FOOD SUPPLY CHAINS TO FOSTER SEGMENTAL GROWTH

- 12.3 HIGH

- 12.3.1 RISING USE IN FINANCIAL TRANSACTIONS AND COMPLIANCE-SENSITIVE APPLICATIONS TO DRIVE SEGMENTAL GROWTH

- 12.4 ULTRA-HIGH

- 12.4.1 LONG-RANGE READABILITY AND HIGH-SPEED MULTI-TAG IDENTIFICATION FEATURES TO BOOST DEMAND

13 RFID MARKET, BY FORM FACTOR

- 13.1 INTRODUCTION

- 13.2 CARDS

- 13.2.1 INCREASING USE IN ACCESS CONTROL AND SECURITY APPLICATIONS TO DRIVE MARKET

- 13.3 LABELS

- 13.3.1 NEED FOR REAL-TIME VISIBILITY INTO PRODUCT AVAILABILITY TO SPUR DEMAND

- 13.4 KEY FOBS & TOKENS

- 13.4.1 INCREASING USE OF CONTACTLESS ACCESS CONTROL SOLUTIONS AT OFFICES AND TRANSPORTATION HUBS TO DRIVE MARKET

- 13.5 BANDS

- 13.5.1 SURGING USE OF WEARABLE TECHNOLOGY TO CREATE GROWTH OPPORTUNITIES

- 13.6 PAPERS & INLAYS

- 13.6.1 RISING ADOPTION IN PHARMACEUTICAL PACKAGING TO ENSURE REGULATORY COMPLIANCE TO DRIVE MARKET

- 13.7 IMPLANTS

- 13.7.1 HEALTHCARE DIGITIZATION AND REGULATED IDENTIFICATION REQUIREMENTS TO BOOST DEMAND

- 13.8 SENSOR-BASED TAGS

- 13.8.1 COLD CHAIN INTEGRITY, CONDITION MONITORING, AND DATA-DRIVEN TRACEABILITY TO STIMULATE DEMAND

- 13.9 OTHER FORM FACTORS

14 RFID MARKET, BY APPLICATION

- 14.1 INTRODUCTION

- 14.2 INVENTORY & ASSET MANAGEMENT

- 14.2.1 E-COMMERCE EXPANSION, WAREHOUSE AUTOMATION, AND REAL-TIME VISIBILITY TO HIGH-VOLUME INVENTORY TO FACILITATE ADOPTION

- 14.3 SECURITY & ACCESS CONTROL

- 14.3.1 IDENTITY ASSURANCE, COMPLIANCE ENFORCEMENT, AND SMART FACILITY GOVERNANCE REQUIREMENTS TO ELEVATE ADOPTION

- 14.4 TICKETING

- 14.4.1 NEED FOR CROWD FLOW OPTIMIZATION IN HIGH-DENSITY ENVIRONMENTS TO FUEL DEMAND

- 14.5 CONTACTLESS PAYMENTS

- 14.5.1 PREFERENCE FOR FAST, RELIABLE, AND CONTACTLESS PAYMENTS TO FOSTER MARKET GROWTH

15 RFID MARKET, BY END USE

- 15.1 INTRODUCTION

- 15.2 AUTOMOTIVE

- 15.2.1 NEED FOR SUPPLY CHAIN OPTIMIZATION AND REAL-TIME INVENTORY MANAGEMENT TO DRIVE MARKET

- 15.3 MEDICAL, HEALTHCARE & PHARMACEUTICAL

- 15.3.1 DEMAND FOR REAL-TIME VISIBILITY OF PATIENTS, ASSETS, AND PHARMACEUTICALS TO DRIVE ADOPTION

- 15.4 AGRICULTURE

- 15.4.1 GROWING ADOPTION OF AUTOMATION AND TRACEABILITY IN CROP AND PRODUCE MANAGEMENT TO FUEL MARKET GROWTH

- 15.5 RETAIL

- 15.5.1 DEMAND FOR INVENTORY ACCURACY AND OMNICHANNEL FULFILLMENT TO FOSTER DEPLOYMENT

- 15.6 TRANSPORTATION, LOGISTICS & WAREHOUSING

- 15.6.1 FOCUS ON AUTOMATION, REAL-TIME VISIBILITY, AND INFRASTRUCTURE DIGITALIZATION TO SPUR DEMAND

- 15.7 ANIMAL TRACKING

- 15.7.1 REGULATORY MANDATES FOR ANIMAL IDENTIFICATION TO PROMOTE RFID ADOPTION

- 15.8 AEROSPACE & DEFENSE

- 15.8.1 EMPHASIS ON ENHANCING ASSET CONTROL AND IMPROVING MAINTENANCE EFFICIENCY TO BOOST DEMAND

- 15.9 SPORTS, EVENTS, & PEOPLE TRACKING

- 15.9.1 REQUIREMENT FOR SECURITY MEASURES FOR CROWD MANAGEMENT TO ELEVATE DEMAND

- 15.10 DATA CENTER

- 15.10.1 NEED TO MINIMIZE ASSET LOSS AND MANUAL AUDIT EFFORT TO INCREASE DEMAND

- 15.11 INDUSTRIAL & MANUFACTURING

- 15.11.1 AUTOMATION, TRACEABILITY, AND ASSET VISIBILITY REQUIREMENTS TO BOOST ADOPTION

- 15.11.2 PAPER & PULP

- 15.11.3 METAL & MINING

- 15.11.4 CEMENT

- 15.11.5 FOOD PROCESSING

- 15.11.6 OTHERS

16 RFID MARKET, BY REGION

- 16.1 INTRODUCTION

- 16.2 NORTH AMERICA

- 16.2.1 US

- 16.2.1.1 Rising focus of industry players on enhancing supply chain transparency to accelerate demand

- 16.2.2 CANADA

- 16.2.2.1 Growing adoption of RFID in logistics and transportation applications to drive market

- 16.2.3 MEXICO

- 16.2.3.1 Thriving e-commerce sector to create growth opportunities

- 16.2.1 US

- 16.3 EUROPE

- 16.3.1 UK

- 16.3.1.1 Booming retail and logistics sectors to propel market

- 16.3.2 GERMANY

- 16.3.2.1 Smart city initiatives to fuel market growth

- 16.3.3 FRANCE

- 16.3.3.1 Significant investment in digital transformation and smart city projects to spike demand

- 16.3.4 ITALY

- 16.3.4.1 Retail, fashion, and agriculture industries to contribute to market growth

- 16.3.5 SPAIN

- 16.3.5.1 Digital transformation of retail sector to fuel demand

- 16.3.6 RUSSIA

- 16.3.6.1 Government-backed infrastructure modernization projects to create opportunities

- 16.3.7 POLAND

- 16.3.7.1 Thriving e-commerce and logistics & warehousing sectors to propel market

- 16.3.8 REST OF EUROPE

- 16.3.1 UK

- 16.4 ASIA PACIFIC

- 16.4.1 CHINA

- 16.4.1.1 Retail, healthcare, and logistics & warehousing industries to be key contributors to market growth

- 16.4.2 JAPAN

- 16.4.2.1 Growing deployment of smart ticketing solutions in public transportation to augment market growth

- 16.4.3 SOUTH KOREA

- 16.4.3.1 Rising adoption of smart manufacturing to drive market

- 16.4.4 INDIA

- 16.4.4.1 Increasing use of automated toll collection systems to support market growth

- 16.4.5 AUSTRALIA & NEW ZEALAND

- 16.4.5.1 Elevating use of digital technology in agriculture, retail, and healthcare sectors to foster market growth

- 16.4.6 ASEAN

- 16.4.6.1 Growing adoption in logistics & warehousing, retail, animal tracking, and agriculture sectors to foster market growth

- 16.4.7 REST OF ASIA PACIFIC

- 16.4.1 CHINA

- 16.5 ROW

- 16.5.1 MIDDLE EAST

- 16.5.1.1 Bahrain

- 16.5.1.1.1 Government initiatives promoting smart infrastructure and operational transparency to drive market

- 16.5.1.2 Kuwait

- 16.5.1.2.1 Continued investments in energy infrastructure to propel market

- 16.5.1.3 Oman

- 16.5.1.3.1 Sustained capital allocation to modernize infrastructure and deploy automation to drive market

- 16.5.1.4 Qatar

- 16.5.1.4.1 Smart infrastructure development and logistics automation to boost adoption

- 16.5.1.5 Saudi Arabia

- 16.5.1.5.1 Large-scale industrial digitization to accelerate RFID adoption

- 16.5.1.6 UAE

- 16.5.1.6.1 Smart city initiatives to drive market

- 16.5.1.7 Rest of Middle East

- 16.5.1.1 Bahrain

- 16.5.2 AFRICA

- 16.5.2.1 South Africa

- 16.5.2.1.1 High demand from mining, retail, and healthcare sectors to contribute to market growth

- 16.5.2.2 Rest of Africa

- 16.5.2.1 South Africa

- 16.5.3 SOUTH AMERICA

- 16.5.3.1 Brazil

- 16.5.3.1.1 Large-scale retail operations and export-oriented agriculture to boost demand

- 16.5.3.2 Rest of South America

- 16.5.3.1 Brazil

- 16.5.1 MIDDLE EAST

17 COMPETITIVE LANDSCAPE

- 17.1 OVERVIEW

- 17.2 KEY PLAYER COMPETITIVE STRATEGIES/RIGHT TO WIN, 2021-2025

- 17.3 REVENUE ANALYSIS, 2020-2024

- 17.4 MARKET SHARE ANALYSIS, 2024

- 17.5 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 17.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 17.6.1 STARS

- 17.6.2 EMERGING LEADERS

- 17.6.3 PERVASIVE PLAYERS

- 17.6.4 PARTICIPANTS

- 17.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 17.6.5.1 Company footprint

- 17.6.5.2 Region footprint

- 17.6.5.3 Offering footprint

- 17.6.5.4 Frequency range footprint

- 17.6.5.5 Application footprint

- 17.6.5.6 End use footprint

- 17.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 17.7.1 PROGRESSIVE COMPANIES

- 17.7.2 RESPONSIVE COMPANIES

- 17.7.3 DYNAMIC COMPANIES

- 17.7.4 STARTING BLOCKS

- 17.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 17.7.5.1 Detailed list of startups/SMEs

- 17.7.5.2 Competitive benchmarking of key startups/SMEs

- 17.8 BRAND/PRODUCT COMPARISON

- 17.9 COMPETITIVE SCENARIO

- 17.9.1 PRODUCT LAUNCHES/ENHANCEMENTS

- 17.9.2 DEALS

- 17.9.3 EXPANSIONS

18 COMPANY PROFILES

- 18.1 INTRODUCTION

- 18.2 KEY PLAYERS

- 18.2.1 ZEBRA TECHNOLOGIES CORP.

- 18.2.1.1 Business overview

- 18.2.1.2 Products/Solutions/Services offered

- 18.2.1.3 Recent developments

- 18.2.1.3.1 Product launches/Enhancements

- 18.2.1.3.2 Deals

- 18.2.1.4 MnM view

- 18.2.1.4.1 Key strengths/Right to win

- 18.2.1.4.2 Strategic choices

- 18.2.1.4.3 Weaknesses/Competitive threats

- 18.2.2 HONEYWELL INTERNATIONAL INC.

- 18.2.2.1 Business overview

- 18.2.2.2 Products/Solutions/Services offered

- 18.2.2.3 Recent developments

- 18.2.2.3.1 Product launches/Enhancements

- 18.2.2.3.2 Deals

- 18.2.2.4 MnM view

- 18.2.2.4.1 Key strengths/Right to win

- 18.2.2.4.2 Strategic choices

- 18.2.2.4.3 Weaknesses/Competitive threats

- 18.2.3 AVERY DENNISON CORPORATION

- 18.2.3.1 Business overview

- 18.2.3.2 Products/Solutions/Services offered

- 18.2.3.3 Recent developments

- 18.2.3.3.1 Product launches/Enhancements

- 18.2.3.3.2 Deals

- 18.2.3.3.3 Expansions

- 18.2.3.4 MnM view

- 18.2.3.4.1 Key strengths/Right to win

- 18.2.3.4.2 Strategic choices

- 18.2.3.4.3 Weaknesses/Competitive threats

- 18.2.4 HID GLOBAL CORPORATION

- 18.2.4.1 Business overview

- 18.2.4.2 Products/Solutions/Services offered

- 18.2.4.3 Recent developments

- 18.2.4.3.1 Product launches/Enhancements

- 18.2.4.3.2 Deals

- 18.2.4.4 MnM view

- 18.2.4.4.1 Key strengths/Right to win

- 18.2.4.4.2 Strategic choices

- 18.2.4.4.3 Weaknesses/Competitive threats

- 18.2.5 DATALOGIC S.P.A.

- 18.2.5.1 Business overview

- 18.2.5.2 Products/Solutions/Services offered

- 18.2.5.3 MnM view

- 18.2.5.3.1 Key strengths/Right to win

- 18.2.5.3.2 Strategic choices

- 18.2.5.3.3 Weaknesses/Competitive threats

- 18.2.6 IMPINJ, INC.

- 18.2.6.1 Business overview

- 18.2.6.2 Products/Solutions/Services offered

- 18.2.6.3 Recent developments

- 18.2.6.3.1 Product launches/Enhancements

- 18.2.7 ALIEN TECHNOLOGY, LLC

- 18.2.7.1 Business overview

- 18.2.7.2 Products/Solutions/Services offered

- 18.2.8 CAEN RFID S.R.L.

- 18.2.8.1 Business overview

- 18.2.8.2 Products/Solutions/Services offered

- 18.2.8.3 Recent developments

- 18.2.8.3.1 Product launches/Enhancements

- 18.2.8.3.2 Deals

- 18.2.8.3.3 Expansions

- 18.2.9 GAO RFID INC.

- 18.2.9.1 Business overview

- 18.2.9.2 Products/Solutions/Services offered

- 18.2.9.3 Recent developments

- 18.2.9.3.1 Expansions

- 18.2.10 XEMELGO, INC.

- 18.2.10.1 Business overview

- 18.2.10.2 Products/solutions/services offered

- 18.2.10.3 Recent developments

- 18.2.10.3.1 Product launches/Enhancements

- 18.2.10.3.2 Deals

- 18.2.10.3.3 Other developments

- 18.2.1 ZEBRA TECHNOLOGIES CORP.

- 18.3 OTHER PLAYERS

- 18.3.1 INVENGO INFORMATION TECHNOLOGY CO., LTD.

- 18.3.2 MOJIX

- 18.3.3 SAG SECURITAG ASSEMBLY GROUP CO., LTD.

- 18.3.4 LINXENS

- 18.3.5 CHECKPOINT SYSTEMS, INC.

- 18.3.6 IDENTIV, INC.

- 18.3.7 NEDAP N.V.

- 18.3.8 JADAK

- 18.3.9 UNITECH ELECTRONICS CO., LTD.

- 18.3.10 INFOTEK SOFTWARE & SYSTEMS (P) LTD.

- 18.3.11 BARTRONICS INDIA LIMITED

- 18.3.12 BARTECH DATA SYSTEMS PVT. LTD.

- 18.3.13 GLOBERANGER

- 18.3.14 ORBCOMM INC.

- 18.3.15 BEONTAG

- 18.3.16 CORERFID

- 18.3.17 TAGMASTER NORTH AMERICA

- 18.3.18 RFID, INC.

- 18.3.19 OMNITAAS

- 18.3.20 CONTROLTEK

19 RESEARCH METHODOLOGY

- 19.1 RESEARCH DATA

- 19.1.1 SECONDARY AND PRIMARY RESEARCH

- 19.1.2 SECONDARY DATA

- 19.1.2.1 List of key secondary sources

- 19.1.2.2 Key data from secondary sources

- 19.1.3 PRIMARY DATA

- 19.1.3.1 List of primary interview participants

- 19.1.3.2 Breakdown of primaries

- 19.1.3.3 Key data from primary sources

- 19.1.3.4 Key industry insights

- 19.2 MARKET SIZE ESTIMATION

- 19.2.1 BOTTOM-UP APPROACH

- 19.2.1.1 Approach to estimate market size using bottom-up analysis (demand side)

- 19.2.2 TOP-DOWN APPROACH

- 19.2.2.1 Approach to estimate market size using top-down analysis (supply side)

- 19.2.1 BOTTOM-UP APPROACH

- 19.3 DATA TRIANGULATION

- 19.4 RESEARCH ASSUMPTIONS

- 19.5 RESEARCH LIMITATIONS

- 19.6 RISK ASSESSMENT

20 APPENDIX

- 20.1 INSIGHTS FROM INDUSTRY EXPERTS

- 20.2 DISCUSSION GUIDE

- 20.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 20.4 CUSTOMIZATION OPTIONS

- 20.5 RELATED REPORTS

- 20.6 AUTHOR DETAILS

List of Tables

- TABLE 1 RFID MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 STRATEGIC MOVE AND FOCUS OF COMPANIES IN RFID MARKET

- TABLE 3 RFID MARKET: IMPACT OF PORTER'S FIVE FORCES

- TABLE 4 GDP PERCENTAGE CHANGE, BY KEY COUNTRY, 2021-2029

- TABLE 5 ROLE OF PLAYERS IN RFID ECOSYSTEM

- TABLE 6 AVERAGE SELLING PRICE TREND OF RFID TAGS PROVIDED BY KEY PLAYERS, 2021-2024 (USD)

- TABLE 7 AVERAGE SELLING PRICE TREND OF RFID READERS PROVIDED BY KEY PLAYERS, 2021-2024 (USD)

- TABLE 8 AVERAGE SELLING PRICE TREND OF RFID TAGS, BY REGION, 2021-2024 (USD)

- TABLE 9 AVERAGE SELLING PRICE TREND OF RFID READERS, BY REGION, 2021-2024 (USD)

- TABLE 10 IMPORT DATA FOR HS CODE 8523-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 11 EXPORT DATA FOR HS CODE 8523-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 12 RFID MARKET: KEY CONFERENCES AND EVENTS, 2026-2027

- TABLE 13 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 14 RFID MARKET: LIST OF GRANTED PATENTS, JANUARY 2021-NOVEMBER 2025

- TABLE 15 TOP USE CASES AND MARKET POTENTIAL

- TABLE 16 BEST PRACTICES ADOPTED BY COMPANIES IN RFID MARKET

- TABLE 17 RFID MARKET: CASE STUDIES RELATED TO AI IMPLEMENTATION

- TABLE 18 INTERCONNECTED/ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- TABLE 19 CLIENTS' READINESS TO ADOPT AI-INTEGRATED RFID SOLUTIONS

- TABLE 20 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

- TABLE 25 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 26 UNMET NEEDS IN RFID MARKET, BY END USE

- TABLE 27 RFID MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 28 RFID MARKET, BY OFFERING, 2025-2034 (USD MILLION)

- TABLE 29 TAGS: RFID MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 30 TAGS: RFID MARKET, BY TYPE, 2025-2034 (USD MILLION)

- TABLE 31 TAGS: RFID MARKET, BY FREQUENCY RANGE, 2021-2024 (USD MILLION)

- TABLE 32 TAGS: RFID MARKET, BY FREQUENCY RANGE, 2025-2034 (USD MILLION)

- TABLE 33 TAGS: RFID MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 34 TAGS: RFID MARKET, BY END USE, 2025-2034 (USD MILLION)

- TABLE 35 TAGS: RFID MARKET FOR RETAIL, BY FORM FACTOR, 2021-2024 (USD MILLION)

- TABLE 36 TAGS: RFID MARKET FOR RETAIL, BY FORM FACTOR, 2025-2034 (USD MILLION)

- TABLE 37 TAGS: RFID MARKET FOR TRANSPORTATION, LOGISTICS & WAREHOUSING, BY FORM FACTOR, 2021-2024 (USD MILLION)

- TABLE 38 TAGS: RFID MARKET FOR TRANSPORTATION, LOGISTICS & WAREHOUSING, BY FORM FACTOR, 2025-2034 (USD MILLION)

- TABLE 39 TAGS: RFID MARKET FOR INDUSTRIAL & MANUFACTURING, BY FORM FACTOR, 2021-2024 (USD MILLION)

- TABLE 40 TAGS: RFID MARKET FOR INDUSTRIAL & MANUFACTURING, BY FORM FACTOR, 2025-2034 (USD MILLION)

- TABLE 41 TAGS: RFID MARKET FOR MEDICAL, HEALTHCARE & PHARMACEUTICAL, BY FORM FACTOR, 2021-2024 (USD MILLION)

- TABLE 42 TAGS: RFID MARKET FOR MEDICAL, HEALTHCARE & PHARMACEUTICAL, BY FORM FACTOR, 2025-2034 (USD MILLION)

- TABLE 43 TAGS: RFID MARKET FOR ANIMAL TRACKING, BY FORM FACTOR, 2021-2024 (USD MILLION)

- TABLE 44 TAGS: RFID MARKET FOR ANIMAL TRACKING, BY FORM FACTOR, 2025-2034 (USD MILLION)

- TABLE 45 TAGS: RFID MARKET FOR AUTOMOTIVE, BY FORM FACTOR, 2021-2024 (USD MILLION)

- TABLE 46 TAGS: RFID MARKET FOR AUTOMOTIVE, BY FORM FACTOR, 2025-2034 (USD MILLION)

- TABLE 47 TAGS: RFID MARKET FOR AGRICULTURE, BY FORM FACTOR, 2021-2024 (USD MILLION)

- TABLE 48 TAGS: RFID MARKET FOR AGRICULTURE, BY FORM FACTOR, 2025-2034 (USD MILLION)

- TABLE 49 TAGS: RFID MARKET FOR SPORTS, EVENTS, & PEOPLE TRACKING, BY FORM FACTOR, 2021-2024 (USD MILLION)

- TABLE 50 TAGS: RFID MARKET FOR SPORTS, EVENTS, & PEOPLE TRACKING, BY FORM FACTOR, 2025-2034 (USD MILLION)

- TABLE 51 TAGS: RFID MARKET FOR AEROSPACE & DEFENSE, BY FORM FACTOR, 2021-2024 (USD MILLION)

- TABLE 52 TAGS: RFID MARKET FOR AEROSPACE & DEFENSE, BY FORM FACTOR, 2025-2034 (USD MILLION)

- TABLE 53 TAGS: RFID MARKET FOR DATA CENTER, BY FORM FACTOR, 2021-2024 (USD MILLION)

- TABLE 54 TAGS: RFID MARKET FOR DATA CENTER, BY FORM FACTOR, 2025-2034 (USD MILLION)

- TABLE 55 TAGS: RFID MARKET, BY TYPE, 2021-2024 (MILLION UNITS)

- TABLE 56 TAGS: RFID MARKET, BY TYPE, 2025-2034 (MILLION UNITS)

- TABLE 57 PASSIVE: RFID MARKET, BY FREQUENCY RANGE, 2021-2024 (USD MILLION)

- TABLE 58 PASSIVE: RFID MARKET, BY FREQUENCY RANGE, 2025-2034 (USD MILLION)

- TABLE 59 ACTIVE: RFID MARKET, BY FREQUENCY RANGE, 2021-2024 (USD MILLION)

- TABLE 60 ACTIVE: RFID MARKET, BY FREQUENCY RANGE, 2025-2034 (USD MILLION)

- TABLE 61 READERS: RFID MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 62 READERS: RFID MARKET, BY END USE, 2025-2034 (USD MILLION)

- TABLE 63 SOFTWARE & SERVICES: RFID MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 64 SOFTWARE & SERVICES: RFID MARKET, BY END USE, 2025-2034 (USD MILLION)

- TABLE 65 RFID MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 66 RFID MARKET, BY MATERIAL, 2025-2034 (USD MILLION)

- TABLE 67 RFID MARKET, BY FREQUENCY RANGE, 2021-2024 (USD MILLION)

- TABLE 68 RFID MARKET, BY FREQUENCY RANGE, 2025-2034 (USD MILLION)

- TABLE 69 LOW: RFID MARKET FOR TAGS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 70 LOW: RFID MARKET FOR TAGS, BY TYPE, 2025-2034 (USD MILLION)

- TABLE 71 LOW: RFID MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 72 LOW: RFID MARKET, BY END USE, 2025-2034 (USD MILLION)

- TABLE 73 HIGH: RFID MARKET FOR TAGS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 74 HIGH: RFID MARKET FOR TAGS, BY TYPE, 2025-2034 (USD MILLION)

- TABLE 75 HIGH: RFID MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 76 HIGH: RFID MARKET, BY END USE, 2025-2034 (USD MILLION)

- TABLE 77 ULTRA-HIGH: RFID MARKET FOR TAGS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 78 ULTRA-HIGH: RFID MARKET FOR TAGS, BY TYPE, 2025-2034 (USD MILLION)

- TABLE 79 ULTRA-HIGH: RFID MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 80 ULTRA-HIGH: RFID MARKET, BY END USE, 2025-2034 (USD MILLION)

- TABLE 81 RFID MARKET, BY FORM FACTOR, 2021-2024 (USD MILLION)

- TABLE 82 RFID MARKET, BY FORM FACTOR, 2025-2034 (USD MILLION)

- TABLE 83 RFID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 84 RFID MARKET, BY APPLICATION, 2025-2034 (USD MILLION)

- TABLE 85 INVENTORY & ASSET MANAGEMENT: RFID MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 86 INVENTORY & ASSET MANAGEMENT: RFID MARKET, BY END USE, 2025-2034 (USD MILLION)

- TABLE 87 SECURITY & ACCESS CONTROL: RFID MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 88 SECURITY & ACCESS CONTROL: RFID MARKET, BY END USE, 2025-2034 (USD MILLION)

- TABLE 89 TICKETING: RFID MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 90 TICKETING: RFID MARKET, BY END USE, 2025-2034 (USD MILLION)

- TABLE 91 CONTACTLESS PAYMENTS: RFID MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 92 CONTACTLESS PAYMENTS: RFID MARKET, BY END USE, 2025-2034 (USD MILLION)

- TABLE 93 RFID MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 94 RFID MARKET, BY END USE, 2025-2034 (USD MILLION)

- TABLE 95 AUTOMOTIVE: RFID MARKET, BY FREQUENCY RANGE, 2021-2024 (USD MILLION)

- TABLE 96 AUTOMOTIVE: RFID MARKET, BY FREQUENCY RANGE, 2025-2034 (USD MILLION)

- TABLE 97 AUTOMOTIVE: RFID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 98 AUTOMOTIVE: RFID MARKET, BY REGION, 2025-2034 (USD MILLION)

- TABLE 99 AUTOMOTIVE: RFID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 100 AUTOMOTIVE: RFID MARKET, BY APPLICATION, 2025-2034 (USD MILLION)

- TABLE 101 AUTOMOTIVE: RFID MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 102 AUTOMOTIVE: RFID MARKET, BY OFFERING, 2025-2034 (USD MILLION)

- TABLE 103 MEDICAL, HEALTHCARE & PHARMACEUTICAL: RFID MARKET, BY FREQUENCY RANGE, 2021-2024 (USD MILLION)

- TABLE 104 MEDICAL, HEALTHCARE & PHARMACEUTICAL: RFID MARKET, BY FREQUENCY RANGE, 2025-2034 (USD MILLION)

- TABLE 105 MEDICAL, HEALTHCARE & PHARMACEUTICAL: RFID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 106 MEDICAL, HEALTHCARE & PHARMACEUTICAL: RFID MARKET, BY REGION, 2025-2034 (USD MILLION)

- TABLE 107 MEDICAL, HEALTHCARE & PHARMACEUTICAL: RFID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 108 MEDICAL, HEALTHCARE & PHARMACEUTICAL: RFID MARKET, BY APPLICATION, 2025-2034 (USD MILLION)

- TABLE 109 MEDICAL, HEALTHCARE & PHARMACEUTICAL: RFID MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 110 MEDICAL, HEALTHCARE & PHARMACEUTICAL: RFID MARKET, BY OFFERING, 2025-2034 (USD MILLION)

- TABLE 111 AGRICULTURE: RFID MARKET, BY FREQUENCY RANGE, 2021-2024 (USD MILLION)

- TABLE 112 AGRICULTURE: RFID MARKET, BY FREQUENCY RANGE, 2025-2034 (USD MILLION)

- TABLE 113 AGRICULTURE: RFID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 114 AGRICULTURE: RFID MARKET, BY REGION, 2025-2034 (USD MILLION)

- TABLE 115 AGRICULTURE: RFID MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 116 AGRICULTURE: RFID MARKET, BY OFFERING, 2025-2034 (USD MILLION)

- TABLE 117 RETAIL: RFID MARKET, BY FREQUENCY RANGE, 2021-2024 (USD MILLION)

- TABLE 118 RETAIL: RFID MARKET, BY FREQUENCY RANGE, 2025-2034 (USD MILLION)

- TABLE 119 RETAIL: RFID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 120 RETAIL: RFID MARKET, BY REGION, 2025-2034 (USD MILLION)

- TABLE 121 RETAIL: RFID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 122 RETAIL: RFID MARKET, BY APPLICATION, 2025-2034 (USD MILLION)

- TABLE 123 RETAIL: RFID MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 124 RETAIL: RFID MARKET, BY OFFERING, 2025-2034 (USD MILLION)

- TABLE 125 TRANSPORTATION, LOGISTICS & WAREHOUSING: RFID MARKET, BY FREQUENCY RANGE, 2021-2024 (USD MILLION)

- TABLE 126 TRANSPORTATION, LOGISTICS & WAREHOUSING: RFID MARKET, BY FREQUENCY RANGE, 2025-2034 (USD MILLION)

- TABLE 127 TRANSPORTATION, LOGISTICS & WAREHOUSING: RFID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 128 TRANSPORTATION, LOGISTICS & WAREHOUSING: RFID MARKET, BY REGION, 2025-2034 (USD MILLION)

- TABLE 129 TRANSPORTATION, LOGISTICS & WAREHOUSING: RFID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 130 TRANSPORTATION, LOGISTICS & WAREHOUSING: RFID MARKET, BY APPLICATION, 2025-2034 (USD MILLION)

- TABLE 131 TRANSPORTATION, LOGISTICS & WAREHOUSING: RFID MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 132 TRANSPORTATION, LOGISTICS & WAREHOUSING: RFID MARKET, BY OFFERING, 2025-2034 (USD MILLION)

- TABLE 133 ANIMAL TRACKING: RFID MARKET, BY FREQUENCY RANGE, 2021-2024 (USD MILLION)

- TABLE 134 ANIMAL TRACKING: RFID MARKET, BY FREQUENCY RANGE, 2025-2034 (USD MILLION)

- TABLE 135 ANIMAL TRACKING: RFID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 136 ANIMAL TRACKING: RFID MARKET, BY REGION, 2025-2034 (USD MILLION)

- TABLE 137 ANIMAL TRACKING: RFID MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 138 ANIMAL TRACKING: RFID MARKET, BY OFFERING, 2025-2034 (USD MILLION)

- TABLE 139 AEROSPACE & DEFENSE: RFID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 140 AEROSPACE & DEFENSE: RFID MARKET, BY REGION, 2025-2034 (USD MILLION)

- TABLE 141 AEROSPACE & DEFENSE: RFID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 142 AEROSPACE & DEFENSE: RFID MARKET, BY APPLICATION, 2025-2034 (USD MILLION)

- TABLE 143 AEROSPACE & DEFENSE: RFID MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 144 AEROSPACE & DEFENSE: RFID MARKET, BY OFFERING, 2025-2034 (USD MILLION)

- TABLE 145 SPORTS, EVENTS, & PEOPLE TRACKING: RFID MARKET, BY FREQUENCY RANGE, 2021-2024 (USD MILLION)

- TABLE 146 SPORTS, EVENTS, & PEOPLE TRACKING: RFID MARKET, BY FREQUENCY RANGE, 2025-2034 (USD MILLION)

- TABLE 147 SPORTS, EVENTS, & PEOPLE TRACKING: RFID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 148 SPORTS, EVENTS, & PEOPLE TRACKING: RFID MARKET, BY REGION, 2025-2034 (USD MILLION)

- TABLE 149 SPORTS, EVENTS, & PEOPLE TRACKING: RFID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 150 SPORTS, EVENTS, & PEOPLE TRACKING: RFID MARKET, BY APPLICATION, 2025-2034 (USD MILLION)

- TABLE 151 SPORTS, EVENTS, & PEOPLE TRACKING: RFID MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 152 SPORTS, EVENTS, & PEOPLE TRACKING: RFID MARKET, BY OFFERING, 2025-2034 (USD MILLION)

- TABLE 153 DATA CENTER: RFID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 154 DATA CENTER: RFID MARKET, BY REGION, 2025-2034 (USD MILLION)

- TABLE 155 DATA CENTER: RFID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 156 DATA CENTER: RFID MARKET, BY APPLICATION, 2025-2034 (USD MILLION)

- TABLE 157 DATA CENTER: RFID MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 158 DATA CENTER: RFID MARKET, BY OFFERING, 2025-2034 (USD MILLION)

- TABLE 159 INDUSTRIAL & MANUFACTURING: RFID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 160 INDUSTRIAL & MANUFACTURING: RFID MARKET, BY REGION, 2025-2034 (USD MILLION)

- TABLE 161 INDUSTRIAL & MANUFACTURING: RFID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 162 INDUSTRIAL & MANUFACTURING: RFID MARKET, BY APPLICATION, 2025-2034 (USD MILLION)

- TABLE 163 INDUSTRIAL & MANUFACTURING: RFID MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 164 INDUSTRIAL & MANUFACTURING: RFID MARKET, BY OFFERING, 2025-2034 (USD MILLION)

- TABLE 165 INDUSTRIAL & MANUFACTURING: RFID MARKET, BY FREQUENCY RANGE, 2021-2024 (USD MILLION)

- TABLE 166 INDUSTRIAL & MANUFACTURING: RFID MARKET, BY FREQUENCY RANGE, 2025-2034 (USD MILLION)

- TABLE 167 RFID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 168 RFID MARKET, BY REGION, 2025-2034 (USD MILLION)

- TABLE 169 NORTH AMERICA: RFID MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 170 NORTH AMERICA: RFID MARKET, BY COUNTRY, 2025-2034 (USD MILLION)

- TABLE 171 NORTH AMERICA: RFID MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 172 NORTH AMERICA: RFID MARKET, BY END USE, 2025-2034 (USD MILLION)

- TABLE 173 EUROPE: RFID MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 174 EUROPE: RFID MARKET, BY COUNTRY, 2025-2034 (USD MILLION)

- TABLE 175 EUROPE: RFID MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 176 EUROPE: RFID MARKET, BY END USE, 2025-2034 (USD MILLION)

- TABLE 177 ASIA PACIFIC: RFID MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 178 ASIA PACIFIC: RFID MARKET, BY COUNTRY, 2025-2034 (USD MILLION)

- TABLE 179 ASIA PACIFIC: RFID MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 180 ASIA PACIFIC: RFID MARKET, BY END USE, 2025-2034 (USD MILLION)

- TABLE 181 ROW: RFID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 182 ROW: RFID MARKET, BY REGION, 2025-2034 (USD MILLION)

- TABLE 183 ROW: RFID MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 184 ROW: RFID MARKET, BY END USE, 2025-2034 (USD MILLION)

- TABLE 185 MIDDLE EAST: RFID MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 186 MIDDLE EAST: RFID MARKET, BY COUNTRY, 2025-2034 (USD MILLION)

- TABLE 187 AFRICA: RFID MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 188 AFRICA: RFID MARKET, BY COUNTRY, 2025-2034 (USD MILLION)

- TABLE 189 SOUTH AMERICA: RFID MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 190 SOUTH AMERICA: RFID MARKET, BY COUNTRY, 2025-2034 (USD MILLION)

- TABLE 191 RFID MARKET: KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- TABLE 192 RFID MARKET: MARKET SHARE ANALYSIS OF TOP 5 PLAYERS, 2024

- TABLE 193 RFID MARKET: REGION FOOTPRINT

- TABLE 194 RFID MARKET: OFFERING FOOTPRINT

- TABLE 195 RFID MARKET: FREQUENCY RANGE FOOTPRINT

- TABLE 196 RFID MARKET: APPLICATION FOOTPRINT

- TABLE 197 RFID MARKET: END USE FOOTPRINT

- TABLE 198 RFID MARKET: KEY STARTUPS/SMES

- TABLE 199 RFID MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 200 RFID MARKET: PRODUCT LAUNCHES/ENHANCEMENTS, JANUARY 2021-DECEMBER 2025

- TABLE 201 RFID MARKET: DEALS, JANUARY 2021-DECEMBER 2025

- TABLE 202 RFID MARKET: EXPANSIONS, JANUARY 2021-DECEMBER 2025

- TABLE 203 ZEBRA TECHNOLOGIES CORP.: COMPANY OVERVIEW

- TABLE 204 ZEBRA TECHNOLOGIES CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 ZEBRA TECHNOLOGIES CORP.: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 206 ZEBRA TECHNOLOGIES CORP.: DEALS

- TABLE 207 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 208 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 210 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 211 AVERY DENNISON CORPORATION: COMPANY OVERVIEW

- TABLE 212 AVERY DENNISON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 AVERY DENNISON CORPORATION: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 214 AVERY DENNISON CORPORATION: DEALS

- TABLE 215 AVERY DENNISON CORPORATION: EXPANSIONS

- TABLE 216 HID GLOBAL CORPORATION: COMPANY OVERVIEW

- TABLE 217 HID GLOBAL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 HID GLOBAL CORPORATION: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 219 HID GLOBAL CORPORATION: DEALS

- TABLE 220 DATALOGIC S.P.A.: COMPANY OVERVIEW

- TABLE 221 DATALOGIC S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 IMPINJ, INC.: COMPANY OVERVIEW

- TABLE 223 IMPINJ, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 IMPINJ, INC.: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 225 ALIEN TECHNOLOGY, LLC: COMPANY OVERVIEW

- TABLE 226 ALIEN TECHNOLOGY, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 CAEN RFID S.R.L.: COMPANY OVERVIEW

- TABLE 228 CAEN RFID S.R.L.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 CAEN RFID S.R.L.: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 230 CAEN RFID S.R.L.: DEALS

- TABLE 231 CAEN RFID S.R.L.: EXPANSIONS

- TABLE 232 GAO RFID INC.: COMPANY OVERVIEW

- TABLE 233 GAO RFID INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 GAO RFID INC.: EXPANSIONS

- TABLE 235 XEMELGO, INC.: COMPANY OVERVIEW

- TABLE 236 XEMELGO, INC.: PRODUCTS/SOLUTIONS/SERVICES

- TABLE 237 XEMELGO, INC.: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 238 XEMELGO, INC.: DEALS

- TABLE 239 XEMELGO, INC.: OTHER DEVELOPMENTS

- TABLE 240 INVENGO INFORMATION TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 241 MOJIX: COMPANY OVERVIEW

- TABLE 242 SAG SECURITAG ASSEMBLY GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 243 LINXENS: COMPANY OVERVIEW

- TABLE 244 CHECKPOINT SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 245 IDENTIV, INC.: COMPANY OVERVIEW

- TABLE 246 NEDAP N.V.: COMPANY OVERVIEW

- TABLE 247 JADAK: COMPANY OVERVIEW

- TABLE 248 UNITECH ELECTRONICS CO., LTD.: COMPANY OVERVIEW

- TABLE 249 INFOTEK SOFTWARE & SYSTEMS (P) LTD.: COMPANY OVERVIEW

- TABLE 250 BARTRONICS INDIA LIMITED: COMPANY OVERVIEW

- TABLE 251 BARTECH DATA SYSTEMS PVT. LTD.: COMPANY OVERVIEW

- TABLE 252 GLOBERANGER: COMPANY OVERVIEW

- TABLE 253 ORBCOMM INC.: COMPANY OVERVIEW

- TABLE 254 BEONTAG: COMPANY OVERVIEW

- TABLE 255 CORERFID: COMPANY OVERVIEW

- TABLE 256 TAGMASTER NORTH AMERICA: COMPANY OVERVIEW

- TABLE 257 RFID, INC.: COMPANY OVERVIEW

- TABLE 258 OMNITAAS: COMPANY OVERVIEW

- TABLE 259 CONTROLTELK: COMPANY OVERVIEW

- TABLE 260 RFID MARKET: RESEARCH ASSUMPTIONS

- TABLE 261 RFID MARKET: RISK ASSESSMENT

List of Figures

- FIGURE 1 RFID MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 RFID MARKET: YEARS CONSIDERED

- FIGURE 3 MARKET SCENARIO

- FIGURE 4 GLOBAL RFID MARKET, 2021-2034

- FIGURE 5 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN RFID MARKET, 2021-2025

- FIGURE 6 DISRUPTIONS INFLUENCING GROWTH OF RFID MARKET

- FIGURE 7 HIGH-GROWTH SEGMENTS IN RFID MARKET, 2025-2034

- FIGURE 8 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE IN 2034

- FIGURE 9 RETAIL EXPANSION, SUPPLY CHAIN DIGITALIZATION, AND SMART INFRASTRUCTURE INITIATIVES TO DRIVE ADOPTION

- FIGURE 10 TAGS SEGMENT TO COMMAND RFID MARKET IN 2034

- FIGURE 11 LABELS SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2034

- FIGURE 12 PLASTIC SEGMENT TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 HIGH FREQUENCY SEGMENT TO COMMAND RFID MARKET IN 2034

- FIGURE 14 RETAIL SEGMENT TO HOLD PROMINENT SHARE OF RFID MARKET IN 2034

- FIGURE 15 CONTACTLESS PAYMENTS TO BE FASTEST-GROWING APPLICATION FROM 2025 TO 2034

- FIGURE 16 ASIA PACIFIC TO ACCOUNT FOR MAJORITY OF MARKET SHARE IN 2034

- FIGURE 17 CHINA TO REGISTER HIGHEST CAGR IN GLOBAL RFID MARKET DURING FORECAST PERIOD

- FIGURE 18 RFID MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 IMPACT ANALYSIS: DRIVERS

- FIGURE 20 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 21 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 22 IMPACT ANALYSIS: CHALLENGES

- FIGURE 23 RFID MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 24 RFID MARKET: VALUE CHAIN ANALYSIS

- FIGURE 25 RFID ECOSYSTEM ANALYSIS

- FIGURE 26 AVERAGE SELLING PRICE TREND OF RFID TAGS OFFERED BY KEY PLAYERS, 2021-2024

- FIGURE 27 AVERAGE SELLING PRICE TREND OF RFID READERS OFFERED BY KEY PLAYERS, 2021-2024

- FIGURE 28 AVERAGE SELLING PRICE TREND OF RFID TAGS, BY REGION, 2021-2024

- FIGURE 29 AVERAGE SELLING PRICE TREND OF RFID READERS, BY REGION, 2021-2024

- FIGURE 30 IMPORT SCENARIO FOR HS CODE 8523-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020-2024

- FIGURE 31 EXPORT SCENARIO FOR HS CODE 8523-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020-2024

- FIGURE 32 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 33 INVESTMENT AND FUNDING SCENARIO, 2021-2025

- FIGURE 34 RFID MARKET: PATENT ANALYSIS, 2016-2025

- FIGURE 35 DECISION-MAKING FACTORS IN RFID MARKET

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- FIGURE 37 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- FIGURE 38 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- FIGURE 39 TAGS TO DOMINATE RFID MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 40 PAPER SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 41 HIGH-FREQUENCY RFID PRODUCTS TO CAPTURE MAJORITY OF MARKET SHARE IN 2034

- FIGURE 42 SENSOR-BASED TAGS TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 43 INVENTORY & ASSET MANAGEMENT SEGMENT TO SECURE LARGEST MARKET SHARE IN 2034

- FIGURE 44 RETAIL SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 45 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN RFID MARKET BETWEEN 2025 AND 2034

- FIGURE 46 NORTH AMERICA: RFID MARKET SNAPSHOT

- FIGURE 47 EUROPE: RFID MARKET SNAPSHOT

- FIGURE 48 ASIA PACIFIC: RFID MARKET SNAPSHOT

- FIGURE 49 ROW: RFID MARKET SNAPSHOT

- FIGURE 50 REVENUE ANALYSIS OF KEY PLAYERS IN RFID MARKET, 2020-2024

- FIGURE 51 RFID MARKET SHARE ANALYSIS, 2024

- FIGURE 52 COMPANY VALUATION, 2024

- FIGURE 53 FINANCIAL METRICS, 2024

- FIGURE 54 RFID MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 55 RFID MARKET: COMPANY FOOTPRINT

- FIGURE 56 RFID MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 57 RFID MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 58 ZEBRA TECHNOLOGIES CORP.: COMPANY SNAPSHOT

- FIGURE 59 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 60 AVERY DENNISON CORPORATION: COMPANY SNAPSHOT

- FIGURE 61 DATALOGIC S.P.A.: COMPANY SNAPSHOT

- FIGURE 62 IMPINJ, INC.: COMPANY SNAPSHOT

- FIGURE 63 RFID MARKET: RESEARCH DESIGN

- FIGURE 64 RFID MARKET: RESEARCH APPROACH

- FIGURE 65 RFID MARKET: BOTTOM-UP APPROACH

- FIGURE 66 RFID MARKET: TOP-DOWN APPROACH

- FIGURE 67 RFID MARKET: DATA TRIANGULATION