PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1856926

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1856926

Rolling Stock Market by Component, Product Type (Locomotive, Rapid Transit, Coach), Locomotive Technology (Conventional, Turbocharged, Maglev), Application (Passenger Transportation, Freight Transportation) and Region - Global Forecast to 2032

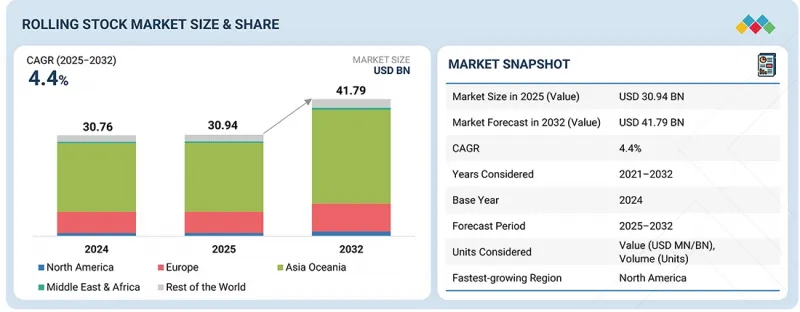

The rolling stock market is projected to grow from USD 30.94 billion in 2025 to USD 41.79 billion by 2032, at a CAGR of 4.4%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million/Billion), and Volume (Units) |

| Segments | By product type, locomotive technology, component, application, and region |

| Regions covered | Asia Oceania, Europe, North America, the Middle East & Africa, and the Rest of the World |

The demand for rolling stock is largely driven by new railway projects, rail line expansions, and the need to replace aging trains. Governments and companies aim to make trains more autonomous while reducing human involvement and travel time. Increased investment in electrifying, expanding, and modernizing rail networks is boosting the need for new rolling stock. Additionally, the development of autonomous, battery-powered, and hydrogen fuel cell locomotives is creating new opportunities for industry players.

Metro/Subways are expected to hold a significant market share of the rapid transit rolling stock market during the forecast period.

China, with the largest metro network in the world, is the biggest market for metro systems in terms of track length, supported by a substantial number of trains operating across its extensive rail network. Rapid urbanization and rising traffic congestion are driving the demand for efficient, high-capacity transit solutions such as metros and subways. Governments and private stakeholders are investing in expanding existing networks, developing new lines, and upgrading infrastructure to enhance passenger capacity and service reliability. These systems are increasingly recognized for their role in reducing urban traffic, lowering carbon emissions, and supporting economic growth, which sustains ongoing funding and development in the metro sector. Similarly, in India, expanding urban transit networks are driving metro growth. For instance, in June 2025, Alstom was awarded a USD 158 million (EUR 135 million) contract by Chennai Metro Rail Limited (CMRL) to design, manufacture, supply, test, and commission 96 Metropolis metro cars for Chennai Metro Phase II.

Coaches are expected to lead the passenger transportation rolling stock market during the forecast period.

Coaches are expected to lead the passenger transportation rolling stock market due to their versatility in meeting diverse travel needs, from short-distance commutes to long-distance journeys. The global focus on sustainable and cost-effective transportation further drives coach demand, as they are more energy-efficient than many alternative modes of travel. For instance, Indian Railways produced 4,601 coaches in 2024-2025. Advances in coach design now include enhanced safety features such as anti-collision technology, reinforced structures, fire detection and suppression systems, and improved emergency exits, while passenger comfort is elevated with ergonomically designed seating, climate control, noise reduction, Wi-Fi connectivity, and modern infotainment systems, ensuring a safer and more pleasant travel experience. The scalability of coach operations allows rail operators to adjust capacity according to demand, optimizing efficiency. Furthermore, the ongoing modernization of rail networks worldwide supports the expansion and upgrading of coach fleets to meet contemporary standards and passenger expectations. Aligned with this growth, in August 2024, the Massachusetts Bay Transportation Authority (MBTA) signed an option with Hyundai Rotem for an additional 41 double-deck commuter rail coaches.

"Europe is expected to hold a significant share of the rolling stock market during the forecast period."

Europe is expected to hold a significant share of the rolling stock market due to its extensive, modernized, and highly electrified rail infrastructure. The European Union's focus on sustainability and decarbonization has driven substantial investments in green rail technologies, including battery-electric and hydrogen-powered trains, supporting the EU's goals to reduce carbon emissions and promote clean transportation. Countries such as Germany, France, and the UK are leading in the adoption of high-speed and regional trains, driven by passenger demand and environmental policies. Initiatives such as the European Green Deal and the Digital Rail Agenda have accelerated the modernization of rolling stock, emphasizing automation, digitalization, and cross-border interoperability. Europe's strong manufacturing base, with key players such as Siemens Mobility, Alstom, and Stadler Rail, supports both domestic and export markets, reinforcing the region's leadership in rolling stock production. The ongoing trends of urbanization and sustainable mobility further boost demand for efficient, eco-friendly rail transport. Reflecting this momentum, in June 2024, Alstom signed a USD 377.5 million (€323 million) contract with Polo Logistica FS to supply 70 Traxx Universal locomotives with maintenance services. The locomotives will be manufactured in Italy at Alstom's Vado Ligure site, and maintenance services will be provided across the country. Similarly, in June 2025, Siemens Mobility received a major order from France's Akiem for 50 Vectron Dual Mode locomotives, with the first units scheduled for delivery in the fourth quarter of 2026.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: OEMs - 40%, Tier I - 41%, and Tier II - 19%

- By Designation: CXOs - 23%, Directors - 42%, and Others - 35%

- By Region: North America - 20%, Europe - 24%, Asia Oceania - 36%, MEA - 15%, and RoW - 5%

The rolling stock market is dominated by major players, including CRRC Corporation Limited (China), Siemens AG (Germany), Alstom SA (France), Stadler Rail AG (Switzerland), and Wabtec Corporation (US). These companies offer a wide range of products, including locomotives, passenger coaches, metro and light rail vehicles, freight wagons, and high-speed trains. They also provide comprehensive services such as maintenance, signaling and control systems, digital solutions, spare parts supply, and long-term service contracts, enabling operators to optimize fleet performance and operational efficiency.

Research Coverage:

The report covers the rolling stock market in terms of components, product type (locomotive, rapid transit, coach), locomotive technology (conventional, turbocharged, maglev), application (passenger transportation, freight transportation), and region. It also covers the competitive landscape and company profiles of the major players in the rolling stock market ecosystem.

The study also includes an in-depth competitive analysis of the key market players, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report:

- The report will help market leaders/new entrants with information on the closest approximations of revenue numbers for the overall rolling stock market and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights, enabling them to better position their businesses and plan suitable go-to-market strategies.

- The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (energy-efficient and sustainable transportation shift, traffic decongestion and network optimization, expansion of freight transport capacity, and expansion of railroad network and freight corridors) restraints (optimization of the existing fleet through refurbishment, and high capital intensity and investment barriers), opportunities (adoption of hydrogen fuel cell locomotives, rising rail demand from industrial and mining expansion, growing market for battery-operated trains, and leveraging big data and smart analytics in rail infrastructure), and challenges (rising overhaul and maintenance cost burden, and intensive R&D investment requirements).

- Product Development/Innovation: Detailed insights on upcoming technologies and research & development activities in the rolling stock market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the rolling stock market across varied regions.

- Market Diversification: Exhaustive information about untapped geographies, recent developments, and investments in the rolling stock market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players, such as CRRC Corporation Limited (China), Siemens AG (Germany), Alstom SA (France), Stadler Rail AG (Switzerland), and Wabtec Corporation (US), in the rolling stock market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews: demand and supply sides

- 2.1.2.2 Primary participants

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ROLLING STOCK MARKET

- 4.2 ROLLING STOCK MARKET, BY PRODUCT TYPE

- 4.3 ROLLING STOCK MARKET, BY APPLICATION

- 4.4 ROLLING STOCK MARKET, BY LOCOMOTIVE TECHNOLOGY

- 4.5 ROLLING STOCK MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Traffic decongestion and network optimization

- 5.2.1.2 Shift toward energy-efficient and sustainable transportation

- 5.2.1.3 Development of advanced rolling stock technologies to enhance passenger comfort

- 5.2.1.4 Advancements in rail network electrification

- 5.2.1.5 Expansion of freight transport capacity

- 5.2.2 RESTRAINTS

- 5.2.2.1 Optimization of existing fleet through refurbishment

- 5.2.2.2 High capital intensity and investment barriers

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Leveraging big data and smart analytics in rail infrastructure

- 5.2.3.2 Rising rail demand from industrial and mining sectors

- 5.2.3.3 Adoption of hydrogen fuel cell locomotives

- 5.2.3.4 Growing market for battery-operated trains

- 5.2.4 CHALLENGES

- 5.2.4.1 Rising overhaul and maintenance cost burden

- 5.2.4.2 Intensive R&D investment requirements

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.2 PRICING ANALYSIS

- 6.2.1 INDICATIVE PRICING OF ROLLING STOCK OFFERED BY KEY PLAYERS

- 6.2.2 AVERAGE SELLING PRICE TREND, BY PRODUCT TYPE

- 6.2.3 AVERAGE SELLING PRICE TREND, BY REGION

- 6.3 ECOSYSTEM ANALYSIS

- 6.4 SUPPLY CHAIN ANALYSIS

- 6.4.1 RAW MATERIAL PROVIDERS AND COMPONENT SUPPLIERS

- 6.4.2 OEMS

- 6.4.3 OPERATORS AND END USERS

- 6.5 CASE STUDY ANALYSIS

- 6.5.1 MODERNIZATION OF ROLLING STOCK WITH STADLER RAIL'S FLIRT EMUS

- 6.5.2 CRRC SETS BENCHMARK FOR EXCAVATION OF BIG ANALOG DATA VALUE

- 6.5.3 GOLINC-M MODULES ENABLE RETROFITTING OF REMOTE CONDITION MONITORING

- 6.5.4 MONORAIL SYSTEMS REDUCE TRAFFIC CONGESTION IN KOREAN METROPOLIS

- 6.5.5 HYDROGEN TRAIN PROJECT HELPS SCOTTISH GOVERNMENT ACHIEVE NET ZERO TARGETS

- 6.5.6 FREIGHTLINER SHIFTS TOWARD NET ZERO WITH LOW-CARBON FUEL

- 6.6 PATENT ANALYSIS

- 6.7 TECHNOLOGY ANALYSIS

- 6.7.1 KEY TECHNOLOGIES

- 6.7.1.1 Regenerative braking

- 6.7.1.2 Autonomous trains

- 6.7.1.3 Tri-mode trains

- 6.7.1.4 Tilting trains

- 6.7.1.5 Digitalization

- 6.7.1.6 Internet of Trains

- 6.7.2 COMPLEMENTARY TECHNOLOGIES

- 6.7.2.1 Train control and management systems

- 6.7.2.2 Collision avoidance systems

- 6.7.2.3 Intelligent rail transit

- 6.7.3 ADJACENT TECHNOLOGIES

- 6.7.3.1 Big data analytics

- 6.7.3.2 Rail traffic management systems

- 6.7.3.3 Renewable energy systems

- 6.7.1 KEY TECHNOLOGIES

- 6.8 INVESTMENT AND FUNDING SCENARIO

- 6.9 FUNDING, BY APPLICATION

- 6.10 IMPACT OF AI/GEN AI

- 6.11 TRADE ANALYSIS

- 6.12 TARIFF AND REGULATORY LANDSCAPE

- 6.12.1 TARIFF ANALYSIS

- 6.12.1.1 US

- 6.12.1.2 Europe

- 6.12.1.3 India

- 6.12.1.4 South Korea

- 6.12.1.5 China

- 6.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.12.1 TARIFF ANALYSIS

- 6.13 KEY CONFERENCES AND EVENTS

- 6.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.14.2 BUYING CRITERIA

- 6.15 STRATEGIC PATHWAYS FOR ALTERNATIVE PROPULSION SYSTEMS

- 6.15.1 TECHNOLOGY READINESS

- 6.15.1.1 Hydrogen fuel cells

- 6.15.1.2 Battery-electric

- 6.15.1.3 Hybrid/Alternative engines

- 6.15.1.4 Emerging options

- 6.15.2 POLICY AND INCENTIVE ALIGNMENT

- 6.15.2.1 Government strategies and targets

- 6.15.2.2 Funding and grants

- 6.15.2.3 Regulations and mandates

- 6.15.2.4 Regional Initiatives

- 6.15.3 SUPPLY CHAIN AND INFRASTRUCTURE

- 6.15.3.1 Manufacturing ecosystems

- 6.15.3.2 Fueling and charging infrastructure

- 6.15.3.3 Supplier networks

- 6.15.1 TECHNOLOGY READINESS

- 6.16 RAILWAY INFRASTRUCTURE MODERNIZATION STRATEGY

- 6.16.1 DIGITALIZATION AND IOT INTEGRATION

- 6.16.1.1 DB/Digital train control

- 6.16.1.2 Onboard diagnostics and telematics

- 6.16.2 ENERGY EFFICIENCY UPGRADES

- 6.16.3 CYBERSECURITY AND DATA STRATEGIES

- 6.16.4 EU CYBERSECURITY REGULATIONS

- 6.16.5 US CYBERSECURITY DIRECTIVES

- 6.16.6 DATA-CENTRIC INITIATIVES

- 6.16.1 DIGITALIZATION AND IOT INTEGRATION

- 6.17 IMPLEMENTATION FRAMEWORK FOR AUTONOMOUS TRAIN TECHNOLOGY

- 6.17.1 SAFETY AND REGULATORY COMPLIANCE

- 6.17.2 OPERATIONAL TRANSFORMATION STRATEGY

7 ROLLING STOCK MARKET, BY PRODUCT TYPE

- 7.1 INTRODUCTION

- 7.2 LOCOMOTIVES

- 7.2.1 DIESEL LOCOMOTIVES

- 7.2.1.1 Electrification of railway networks in Europe and Asia to impede market

- 7.2.2 ELECTRIC LOCOMOTIVES

- 7.2.2.1 Rapid electrification of rail networks to drive market

- 7.2.3 ELECTRO-DIESEL LOCOMOTIVES

- 7.2.3.1 Public and private sectors' emphasis on sustainable practices to drive market

- 7.2.1 DIESEL LOCOMOTIVES

- 7.3 RAPID TRANSIT

- 7.3.1 DIESEL MULTIPLE UNITS

- 7.3.1.1 Electrification constraints in select regions to drive market

- 7.3.2 ELECTRIC MULTIPLE UNITS

- 7.3.2.1 Performance and efficiency advantages over diesel fueling to drive market

- 7.3.3 LIGHT RAILS/TRAMS

- 7.3.3.1 Push for alternatives to traditional buses and cars to drive market

- 7.3.4 SUBWAYS/METROS

- 7.3.4.1 Investments in urban transportation networks to drive market

- 7.3.5 MONORAILS

- 7.3.1 DIESEL MULTIPLE UNITS

- 7.4 COACHES

- 7.4.1 DEMAND FOR ENHANCED RAIL TRAVEL EXPERIENCES TO DRIVE MARKET

- 7.5 WAGONS

- 7.5.1 NEED FOR HIGH-CAPACITY FREIGHT IN LOGISTICS AND MANUFACTURING TO DRIVE MARKET

- 7.6 OTHER PRODUCT TYPES

- 7.7 PRIMARY INSIGHTS

8 ROLLING STOCK MARKET, BY LOCOMOTIVE TECHNOLOGY

- 8.1 INTRODUCTION

- 8.2 CONVENTIONAL LOCOMOTIVES

- 8.2.1 IMPROVED PERFORMANCE WITH TECHNOLOGICAL INNOVATIONS TO DRIVE MARKET

- 8.3 TURBOCHARGED LOCOMOTIVES

- 8.3.1 COMPLIANCE WITH STRICT EMISSION REGULATIONS TO DRIVE MARKET

- 8.4 MAGLEV

- 8.4.1 ELECTROMAGNETIC SUSPENSION

- 8.4.2 ELECTRODYNAMIC SUSPENSION

- 8.4.3 INDUCTRACK

- 8.5 PRIMARY INSIGHTS

9 ROLLING STOCK MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 PASSENGER TRANSPORTATION

- 9.2.1 LOCOMOTIVES

- 9.2.1.1 Rising adoption of electric rail systems to drive market

- 9.2.2 COACHES

- 9.2.2.1 Integration of enhanced safety systems to drive market

- 9.2.1 LOCOMOTIVES

- 9.3 FREIGHT TRANSPORTATION

- 9.3.1 LOCOMOTIVES

- 9.3.1.1 Efforts to lower operational expenses to drive market

- 9.3.2 WAGONS

- 9.3.2.1 Growing application in freight and logistics to drive market

- 9.3.1 LOCOMOTIVES

- 9.4 PRIMARY INSIGHTS

10 ROLLING STOCK MARKET, BY COMPONENT

- 10.1 INTRODUCTION

- 10.2 TRAIN CONTROL SYSTEMS

- 10.3 PANTOGRAPHS

- 10.4 AXLES

- 10.5 WHEELSETS

- 10.6 TRACTION MOTORS

- 10.7 PASSENGER INFORMATION SYSTEMS

- 10.8 BRAKES

- 10.9 AIR CONDITIONING SYSTEMS

- 10.10 AUXILIARY POWER SYSTEMS

- 10.11 GEARBOXES

- 10.12 BAFFLE GEARS

- 10.13 COUPLERS

11 ROLLING STOCK MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 ASIA OCEANIA

- 11.2.1 MACROECONOMIC OUTLOOK

- 11.2.2 RAPID TRANSIT PROJECTS

- 11.2.3 LIGHT RAIL PROJECTS

- 11.2.4 HIGH-SPEED RAIL/BULLET TRAIN PROJECTS

- 11.2.5 CHINA

- 11.2.5.1 Expansion of high-speed rail infrastructure to drive market

- 11.2.6 INDIA

- 11.2.6.1 Growth of electrified rail infrastructure to drive market

- 11.2.7 JAPAN

- 11.2.7.1 Strong presence of rail service providers to drive market

- 11.2.8 SOUTH KOREA

- 11.2.8.1 Government initiatives supporting public transportation to drive market

- 11.2.9 AUSTRALIA

- 11.2.10 MALAYSIA

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK

- 11.3.2 METRO/HIGH-SPEED RAILWAY PROJECTS

- 11.3.3 RAPID TRANSIT PROJECTS

- 11.3.4 GERMANY

- 11.3.4.1 Rising investments in railway infrastructure modernization to drive market

- 11.3.5 FRANCE

- 11.3.5.1 Government subsidies and incentives for sustainable transportation to drive market

- 11.3.6 UK

- 11.3.6.1 Ongoing upgrades of domestic rail networks to drive market

- 11.3.7 ITALY

- 11.3.7.1 Expanding railway networks to drive market

- 11.3.8 SPAIN

- 11.3.8.1 Modernization of mass rapid transit to drive market

- 11.3.9 SWITZERLAND

- 11.3.10 AUSTRIA

- 11.3.11 SWEDEN

- 11.4 NORTH AMERICA

- 11.4.1 MACROECONOMIC OUTLOOK

- 11.4.2 HIGH-SPEED RAIL/BULLET TRAIN PROJECTS

- 11.4.3 RAPID TRANSIT PROJECTS

- 11.4.4 US

- 11.4.4.1 Modernization of existing transportation modalities to drive market

- 11.4.5 MEXICO

- 11.4.5.1 Rail network expansion and modernization to drive market

- 11.4.6 CANADA

- 11.4.6.1 Elevated demand for passenger and freight transportation to drive market

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MACROECONOMIC OUTLOOK

- 11.5.2 METRO/MONORAIL PROJECTS

- 11.5.3 RAPID TRANSIT PROJECTS

- 11.5.4 SOUTH AFRICA

- 11.5.4.1 Government investments in railway sector to drive market

- 11.5.5 UAE

- 11.5.5.1 Advances in rail infrastructure to drive market

- 11.5.6 EGYPT

- 11.5.6.1 Booming tourism industry to drive market

- 11.5.7 IRAN

- 11.6 REST OF THE WORLD

- 11.6.1 MACROECONOMIC OUTLOOK

- 11.6.2 METRO/MONORAIL PROJECTS

- 11.6.3 BRAZIL

- 11.6.3.1 Growing rail investments and modernization to drive market

- 11.6.4 RUSSIA

- 11.6.4.1 Expansion of metro and subway networks to drive market

- 11.6.5 ARGENTINA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 12.3 MARKET SHARE ANALYSIS, 2024

- 12.4 REVENUE ANALYSIS, 2020-2024

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Application footprint

- 12.7.5.4 Product type footprint

- 12.7.5.5 Locomotive technology footprint

- 12.8 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING

- 12.8.5.1 List of start-ups/SMEs

- 12.8.5.2 Competitive benchmarking of start-ups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

- 12.9.4 CONTRACTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 CRRC CORPORATION LIMITED

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches/developments

- 13.1.1.3.2 Deals

- 13.1.1.3.3 Contracts

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 SIEMENS AG

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches/developments

- 13.1.2.3.2 Deals

- 13.1.2.3.3 Expansions

- 13.1.2.3.4 Contracts

- 13.1.2.3.5 Other developments

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 ALSTOM SA

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches/developments

- 13.1.3.3.2 Deals

- 13.1.3.3.3 Expansions

- 13.1.3.3.4 Contracts

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 STADLER RAIL AG

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches/developments

- 13.1.4.3.2 Deals

- 13.1.4.3.3 Expansions

- 13.1.4.3.4 Contracts

- 13.1.4.3.5 Other developments

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 WABTEC CORPORATION

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches/developments

- 13.1.5.3.2 Deals

- 13.1.5.3.3 Expansions

- 13.1.5.3.4 Contracts

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 KAWASAKI HEAVY INDUSTRIES, LTD.

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches/developments

- 13.1.6.3.2 Contracts

- 13.1.7 CAF GROUP

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.7.3.2 Expansions

- 13.1.7.3.3 Contracts

- 13.1.8 HYUNDAI ROTEM COMPANY

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches/developments

- 13.1.8.3.2 Deals

- 13.1.8.3.3 Contracts

- 13.1.8.3.4 Other developments

- 13.1.9 MITSUBISHI HEAVY INDUSTRIES, LTD.

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.9.3.2 Expansions

- 13.1.9.3.3 Contracts

- 13.1.10 TALGO

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Product launches/developments

- 13.1.10.3.2 Deals

- 13.1.10.3.3 Contracts

- 13.1.11 TRANSMASHHOLDING

- 13.1.11.1 Business overview

- 13.1.11.2 Products offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Product launches/developments

- 13.1.11.3.2 Deals

- 13.1.11.3.3 Expansions

- 13.1.11.3.4 Contracts

- 13.1.12 TITAGARH RAIL SYSTEMS LIMITED

- 13.1.12.1 Business overview

- 13.1.12.2 Products offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Product launches/developments

- 13.1.12.3.2 Deals

- 13.1.12.3.3 Contracts

- 13.1.1 CRRC CORPORATION LIMITED

- 13.2 OTHER PLAYERS

- 13.2.1 TOSHIBA CORPORATION

- 13.2.2 HITACHI RAIL LIMITED

- 13.2.3 STRUKTON

- 13.2.4 DEUTSCHE BAHN AG

- 13.2.5 BEML LIMITED

- 13.2.6 RAIL VIKAS NIGAM LIMITED

- 13.2.7 BRAITHWAITE & CO. (INDIA) LTD.

- 13.2.8 CHITTARANJAN LOCOMOTIVE WORKS

- 13.2.9 WJIS

- 13.2.10 RHOMBERG SERSA RAIL HOLDING GMBH

- 13.2.11 SINARA TRANSPORT MACHINES

- 13.2.12 TRINITY INDUSTRIES, INC.

- 13.2.13 THE GREENBRIER COMPANIES

- 13.2.14 DAWONSYS CO., LTD.

14 RECOMMENDATIONS BY MARKETSANDMARKETS

- 14.1 ASIA OCEANIA TO BE LEADING MARKET FOR ROLLING STOCK

- 14.2 ELEVATED DEMAND FOR WAGONS DUE TO RISE IN FREIGHT TRANSPORTATION

- 14.3 NEED FOR FAST URBAN TRANSPORTATION TO BOOST MARKET FOR SUBWAYS/METROS

- 14.4 CONCLUSION

15 APPENDIX

- 15.1 KEY INDUSTRY INSIGHTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.4.1 ADDITIONAL COMPANY PROFILES (UP TO FIVE)

- 15.4.2 ROLLING STOCK MARKET, BY TECHNOLOGY, AT COUNTRY LEVEL (FOR COUNTRIES COVERED IN REPORT)

- 15.4.3 ROLLING STOCK MARKET, BY PRODUCT TYPE, AT COUNTRY LEVEL (FOR COUNTRIES COVERED IN REPORT)

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS

List of Tables

- TABLE 1 MARKET DEFINITION, BY PRODUCT TYPE

- TABLE 2 MARKET DEFINITION, BY LOCOMOTIVE TECHNOLOGY

- TABLE 3 MARKET DEFINITION, BY APPLICATION

- TABLE 4 CURRENCY EXCHANGE RATES

- TABLE 5 MOST CONGESTED CITIES, 2024

- TABLE 6 ROLLING STOCK MODERNIZATION INTERVALS, BY COMPONENT

- TABLE 7 MINING PRODUCTION, BY COUNTRY, 2024

- TABLE 8 IMPACT OF MARKET DYNAMICS

- TABLE 9 INDICATIVE PRICING OF ROLLING STOCK OFFERED BY KEY PLAYERS, 2024 (USD THOUSAND)

- TABLE 10 AVERAGE SELLING PRICE TREND, BY PRODUCT TYPE, 2022-2024 (USD THOUSAND)

- TABLE 11 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024 (USD THOUSAND)

- TABLE 12 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 13 PATENT ANALYSIS

- TABLE 14 AUTONOMOUS TRAIN TECHNOLOGIES AND ASSOCIATED BENEFITS

- TABLE 15 LEVEL OF AUTONOMY FOR ROLLING STOCK

- TABLE 16 LIST OF FUNDING, 2023-2024

- TABLE 17 FUNDING, BY APPLICATION

- TABLE 18 IMPORT DATA FOR HS CODE 8604-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 19 EXPORT DATA FOR HS CODE 8604-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 20 IMPORT DATA FOR HS CODE 8603-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 21 EXPORT DATA FOR HS CODE 8603-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 22 RAIL TRACTION ENGINE (STAGE III A) STANDARDS

- TABLE 23 RAIL TRACTION ENGINE (STAGE III B) STANDARDS

- TABLE 24 STANDARDS FOR DESIGN OF EQUIPMENT, SYSTEMS, AND SUBSYSTEMS

- TABLE 25 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 26 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 27 ASIA OCEANIA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 28 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 29 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE PRODUCT TYPES (%)

- TABLE 31 KEY BUYING CRITERIA FOR TOP THREE PRODUCT TYPES

- TABLE 32 GLOBAL DEMONSTRATION AND DEPLOYMENT OF CLEAN RAIL TECHNOLOGIES

- TABLE 33 IMPLEMENTATION OF AUTONOMOUS TRAIN PROJECTS BY AUTOMATION LEVEL (GOA)

- TABLE 34 ROLLING STOCK MARKET, BY PRODUCT TYPE, 2021-2024 (UNITS)

- TABLE 35 ROLLING STOCK MARKET, BY PRODUCT TYPE, 2025-2032 (UNITS)

- TABLE 36 ROLLING STOCK MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 37 ROLLING STOCK MARKET, BY PRODUCT TYPE, 2025-2032 (USD MILLION)

- TABLE 38 ROLLING STOCK MODELS, BY COMPANY

- TABLE 39 LOCOMOTIVES: ROLLING STOCK MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 40 LOCOMOTIVES: ROLLING STOCK MARKET, BY TYPE, 2025-2032 (UNITS)

- TABLE 41 LOCOMOTIVES: ROLLING STOCK MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 42 LOCOMOTIVES: ROLLING STOCK MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 43 DIESEL LOCOMOTIVES: ROLLING STOCK MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 44 DIESEL LOCOMOTIVES: ROLLING STOCK MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 45 DIESEL LOCOMOTIVES: ROLLING STOCK MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 46 DIESEL LOCOMOTIVES: ROLLING STOCK MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 47 ELECTRIC LOCOMOTIVES: ROLLING STOCK MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 48 ELECTRIC LOCOMOTIVES: ROLLING STOCK MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 49 ELECTRIC LOCOMOTIVES: ROLLING STOCK MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 50 ELECTRIC LOCOMOTIVES: ROLLING STOCK MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 51 ELECTRO-DIESEL LOCOMOTIVES: ROLLING STOCK MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 52 ELECTRO-DIESEL LOCOMOTIVES: ROLLING STOCK MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 53 ELECTRO-DIESEL LOCOMOTIVES: ROLLING STOCK MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 54 ELECTRO-DIESEL LOCOMOTIVES: ROLLING STOCK MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 55 RAPID TRANSIT: ROLLING STOCK MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 56 RAPID TRANSIT: ROLLING STOCK MARKET, BY TYPE, 2025-2032 (UNITS)

- TABLE 57 RAPID TRANSIT: ROLLING STOCK MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 58 RAPID TRANSIT: ROLLING STOCK MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 59 DIESEL MULTIPLE UNITS: ROLLING STOCK MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 60 DIESEL MULTIPLE UNITS: ROLLING STOCK MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 61 DIESEL MULTIPLE UNITS: ROLLING STOCK MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 62 DIESEL MULTIPLE UNITS: ROLLING STOCK MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 63 ELECTRIC MULTIPLE UNITS: ROLLING STOCK MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 64 ELECTRIC MULTIPLE UNITS: ROLLING STOCK MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 65 ELECTRIC MULTIPLE UNITS: ROLLING STOCK MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 66 ELECTRIC MULTIPLE UNITS: ROLLING STOCK MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 67 LIGHT RAILS/TRAMS: ROLLING STOCK MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 68 LIGHT RAILS/TRAMS: ROLLING STOCK MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 69 LIGHT RAILS/TRAMS: ROLLING STOCK MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 70 LIGHT RAILS/TRAMS: ROLLING STOCK MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 71 SUBWAYS/METROS: ROLLING STOCK MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 72 SUBWAYS/METROS: ROLLING STOCK MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 73 SUBWAYS/METROS: ROLLING STOCK MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 SUBWAYS/METROS: ROLLING STOCK MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 75 COACHES: ROLLING STOCK MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 76 COACHES: ROLLING STOCK MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 77 COACHES: ROLLING STOCK MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 78 COACHES: ROLLING STOCK MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 79 WAGONS: ROLLING STOCK MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 80 WAGONS: ROLLING STOCK MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 81 WAGONS: ROLLING STOCK MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 82 WAGONS: ROLLING STOCK MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 83 HIGH-SPEED ELECTRIC LOCOMOTIVE MODELS

- TABLE 84 ROLLING STOCK MARKET, BY LOCOMOTIVE TECHNOLOGY, 2021-2024 (UNITS)

- TABLE 85 ROLLING STOCK MARKET, BY LOCOMOTIVE TECHNOLOGY, 2025-2032 (UNITS)

- TABLE 86 ROLLING STOCK MARKET, BY LOCOMOTIVE TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 87 ROLLING STOCK MARKET, BY LOCOMOTIVE TECHNOLOGY, 2025-2032 (USD MILLION)

- TABLE 88 CONVENTIONAL LOCOMOTIVES: ROLLING STOCK MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 89 CONVENTIONAL LOCOMOTIVES: ROLLING STOCK MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 90 CONVENTIONAL LOCOMOTIVES: ROLLING STOCK MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 91 CONVENTIONAL LOCOMOTIVES: ROLLING STOCK MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 92 TURBOCHARGED LOCOMOTIVES: ROLLING STOCK MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 93 TURBOCHARGED LOCOMOTIVES: ROLLING STOCK MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 94 TURBOCHARGED LOCOMOTIVES: ROLLING STOCK MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 95 TURBOCHARGED LOCOMOTIVES: ROLLING STOCK MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 96 COMPARISON BETWEEN CONVENTIONAL HIGH-SPEED RAIL, MAGLEV, AND HYPERLOOP

- TABLE 97 EXISTING/UPCOMING HIGH-SPEED TRAIN MODELS

- TABLE 98 ROLLING STOCK MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 99 ROLLING STOCK MARKET, BY APPLICATION, 2025-2032 (UNITS)

- TABLE 100 ROLLING STOCK MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 101 ROLLING STOCK MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 102 PASSENGER TRANSPORTATION: ROLLING STOCK MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 103 PASSENGER TRANSPORTATION: ROLLING STOCK MARKET, BY TYPE, 2025-2032 (UNITS)

- TABLE 104 PASSENGER TRANSPORTATION: ROLLING STOCK MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 105 PASSENGER TRANSPORTATION: ROLLING STOCK MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 106 PASSENGER LOCOMOTIVE MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 107 PASSENGER LOCOMOTIVE MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 108 PASSENGER LOCOMOTIVE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 109 PASSENGER LOCOMOTIVE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 110 PASSENGER COACH MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 111 PASSENGER COACH MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 112 PASSENGER COACH MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 113 PASSENGER COACH MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 114 FREIGHT TRANSPORTATION: ROLLING STOCK MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 115 FREIGHT TRANSPORTATION: ROLLING STOCK MARKET, BY TYPE, 2025-2032 (UNITS)

- TABLE 116 FREIGHT TRANSPORTATION: ROLLING STOCK MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 117 FREIGHT TRANSPORTATION: ROLLING STOCK MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 118 FREIGHT LOCOMOTIVE MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 119 FREIGHT LOCOMOTIVE MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 120 FREIGHT LOCOMOTIVE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 121 FREIGHT LOCOMOTIVE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 122 FREIGHT WAGON MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 123 FREIGHT WAGON MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 124 FREIGHT WAGON MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 125 FREIGHT WAGON MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 126 ROLLING STOCK MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 127 ROLLING STOCK MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 128 ROLLING STOCK MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 129 ROLLING STOCK MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 130 ASIA OCEANIA: PROPOSED RAPID TRANSIT PROJECTS

- TABLE 131 ASIA OCEANIA: PROPOSED LIGHT RAIL PROJECTS

- TABLE 132 ASIA OCEANIA: PROPOSED HIGH-SPEED RAIL/BULLET TRAIN PROJECTS

- TABLE 133 ASIA OCEANIA: ROLLING STOCK MARKET, BY COUNTRY, 2021-2024 (UNITS)

- TABLE 134 ASIA OCEANIA: ROLLING STOCK MARKET, BY COUNTRY, 2025-2032 (UNITS)

- TABLE 135 ASIA OCEANIA: ROLLING STOCK MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 136 ASIA OCEANIA: ROLLING STOCK MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 137 RAILWAY PROJECTS UNDER CHINA BELT

- TABLE 138 CHINA: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2021-2024 (UNITS)

- TABLE 139 CHINA: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2025-2032 (UNITS)

- TABLE 140 CHINA: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 141 CHINA: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2025-2032 (USD MILLION)

- TABLE 142 INDIA: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2021-2024 (UNITS)

- TABLE 143 INDIA: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2025-2032 (UNITS)

- TABLE 144 INDIA: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 145 INDIA: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2025-2032 (USD MILLION)

- TABLE 146 JAPAN: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2021-2024 (UNITS)

- TABLE 147 JAPAN: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2025-2032 (UNITS)

- TABLE 148 JAPAN: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 149 JAPAN: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2025-2032 (USD MILLION)

- TABLE 150 SOUTH KOREA: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2021-2024 (UNITS)

- TABLE 151 SOUTH KOREA: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2025-2032 (UNITS)

- TABLE 152 SOUTH KOREA: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 153 SOUTH KOREA: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2025-2032 (USD MILLION)

- TABLE 154 EUROPE: PROPOSED METRO/HIGH-SPEED RAILWAY PROJECTS

- TABLE 155 EUROPE: PROPOSED RAPID TRANSIT PROJECTS

- TABLE 156 EUROPE: ROLLING STOCK MARKET, BY COUNTRY, 2021-2024 (UNITS)

- TABLE 157 EUROPE: ROLLING STOCK MARKET, BY COUNTRY, 2025-2032 (UNITS)

- TABLE 158 EUROPE: ROLLING STOCK MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 159 EUROPE: ROLLING STOCK MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 160 GERMANY: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2021-2024 (UNITS)

- TABLE 161 GERMANY: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2025-2032 (UNITS)

- TABLE 162 GERMANY: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 163 GERMANY: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2025-2032 (USD MILLION)

- TABLE 164 FRANCE: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2021-2024 (UNITS)

- TABLE 165 FRANCE: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2025-2032 (UNITS)

- TABLE 166 FRANCE: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 167 FRANCE: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2025-2032 (USD MILLION)

- TABLE 168 UK: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2021-2024 (UNITS)

- TABLE 169 UK: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2025-2032 (UNITS)

- TABLE 170 UK: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 171 UK: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2025-2032 (USD MILLION)

- TABLE 172 ITALY: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2021-2024 (UNITS)

- TABLE 173 ITALY: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2025-2032 (UNITS)

- TABLE 174 ITALY: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 175 ITALY: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2025-2032 (USD MILLION)

- TABLE 176 SPAIN: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2021-2024 (UNITS)

- TABLE 177 SPAIN: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2025-2032 (UNITS)

- TABLE 178 SPAIN: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 179 SPAIN: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2025-2032 (USD MILLION)

- TABLE 180 NORTH AMERICA: PROPOSED HIGH-SPEED RAIL/BULLET TRAIN PROJECTS

- TABLE 181 NORTH AMERICA: PROPOSED RAPID TRANSIT PROJECTS

- TABLE 182 NORTH AMERICA: ROLLING STOCK MARKET, BY COUNTRY, 2021-2024 (UNITS)

- TABLE 183 NORTH AMERICA: ROLLING STOCK MARKET, BY COUNTRY, 2025-2032 (UNITS)

- TABLE 184 NORTH AMERICA: ROLLING STOCK MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 185 NORTH AMERICA: ROLLING STOCK MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 186 US: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2021-2024 (UNITS)

- TABLE 187 US: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2025-2032 (UNITS)

- TABLE 188 US: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 189 US: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2025-2032 (USD MILLION)

- TABLE 190 MEXICO: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2021-2024 (UNITS)

- TABLE 191 MEXICO: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2025-2032 (UNITS)

- TABLE 192 MEXICO: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 193 MEXICO: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2025-2032 (USD MILLION)

- TABLE 194 CANADA: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2021-2024 (UNITS)

- TABLE 195 CANADA: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2025-2032 (UNITS)

- TABLE 196 CANADA: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 197 CANADA: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2025-2032 (USD MILLION)

- TABLE 198 MIDDLE EAST & AFRICA: PROPOSED METRO/MONORAIL PROJECTS

- TABLE 199 MIDDLE EAST & AFRICA: PROPOSED RAPID TRANSIT PROJECTS

- TABLE 200 MIDDLE EAST & AFRICA: ROLLING STOCK MARKET, BY COUNTRY, 2021-2024 (UNITS)

- TABLE 201 MIDDLE EAST & AFRICA: ROLLING STOCK MARKET, BY COUNTRY, 2025-2032 (UNITS)

- TABLE 202 MIDDLE EAST & AFRICA: ROLLING STOCK MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 203 MIDDLE EAST & AFRICA: ROLLING STOCK MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 204 SOUTH AFRICA: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2021-2024 (UNITS)

- TABLE 205 SOUTH AFRICA: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2025-2032 (UNITS)

- TABLE 206 SOUTH AFRICA: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 207 SOUTH AFRICA: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2025-2032 (USD MILLION)

- TABLE 208 UAE: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2021-2024 (UNITS)

- TABLE 209 UAE: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2025-2032 (UNITS)

- TABLE 210 UAE: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 211 UAE: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2025-2032 (USD MILLION)

- TABLE 212 EGYPT: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2021-2024 (UNITS)

- TABLE 213 EGYPT: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2025-2032 (UNITS)

- TABLE 214 EGYPT: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 215 EGYPT: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2025-2032 (USD MILLION)

- TABLE 216 REST OF THE WORLD: PROPOSED METRO/MONORAIL PROJECTS

- TABLE 217 REST OF THE WORLD: ROLLING STOCK MARKET, BY COUNTRY, 2021-2024 (UNITS)

- TABLE 218 REST OF THE WORLD: ROLLING STOCK MARKET, BY COUNTRY, 2025-2032 (UNITS)

- TABLE 219 REST OF THE WORLD: ROLLING STOCK MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 220 REST OF THE WORLD: ROLLING STOCK MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 221 BRAZIL: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2021-2024 (UNITS)

- TABLE 222 BRAZIL: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2025-2032 (UNITS)

- TABLE 223 BRAZIL: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 224 BRAZIL: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2025-2032 (USD MILLION)

- TABLE 225 RUSSIA: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2021-2024 (UNITS)

- TABLE 226 RUSSIA: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2025-2032 (UNITS)

- TABLE 227 RUSSIA: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 228 RUSSIA: ROLLING STOCK MARKET, BY PRODUCT TYPE, 2025-2032 (USD MILLION)

- TABLE 229 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- TABLE 230 ROLLING STOCK MARKET: DEGREE OF COMPETITION

- TABLE 231 REGION FOOTPRINT

- TABLE 232 APPLICATION FOOTPRINT

- TABLE 233 PRODUCT TYPE FOOTPRINT

- TABLE 234 LOCOMOTIVE TECHNOLOGY FOOTPRINT

- TABLE 235 LIST OF START-UPS/SMES

- TABLE 236 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 237 ROLLING STOCK MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, 2022-2025

- TABLE 238 ROLLING STOCK MARKET: DEALS, 2022-2025

- TABLE 239 ROLLING STOCK MARKET: EXPANSIONS, 2022-2025

- TABLE 240 ROLLING STOCK MARKET: CONTRACTS, 2022-2025

- TABLE 241 CRRC CORPORATION LIMITED: COMPANY OVERVIEW

- TABLE 242 CRRC CORPORATION LIMITED: PRODUCTS OFFERED

- TABLE 243 CRRC CORPORATION LIMITED: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 244 CRRC CORPORATION LIMITED: DEALS

- TABLE 245 CRRC CORPORATION LIMITED: CONTRACTS

- TABLE 246 SIEMENS AG: COMPANY OVERVIEW

- TABLE 247 SIEMENS AG: PRODUCTS OFFERED

- TABLE 248 SIEMENS AG: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 249 SIEMENS AG: DEALS

- TABLE 250 SIEMENS AG: EXPANSIONS

- TABLE 251 SIEMENS AG: CONTRACTS

- TABLE 252 SIEMENS AG: OTHER DEVELOPMENTS

- TABLE 253 ALSTOM SA: COMPANY OVERVIEW

- TABLE 254 ALSTOM SA: PRODUCTS OFFERED

- TABLE 255 ALSTOM SA: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 256 ALSTOM SA: DEALS

- TABLE 257 ALSTOM SA: EXPANSIONS

- TABLE 258 ALSTOM SA: CONTRACTS

- TABLE 259 STADLER RAIL AG: COMPANY OVERVIEW

- TABLE 260 STADLER RAIL AG: PRODUCTS OFFERED

- TABLE 261 STADLER RAIL AG: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 262 STADLER RAIL AG: DEALS

- TABLE 263 STADLER RAIL AG: EXPANSIONS

- TABLE 264 STADLER RAIL AG: CONTRACTS

- TABLE 265 STADLER RAIL AG: OTHER DEVELOPMENTS

- TABLE 266 WABTEC CORPORATION: COMPANY OVERVIEW

- TABLE 267 WABTEC CORPORATION: PRODUCTS OFFERED

- TABLE 268 WABTEC CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 269 WABTEC CORPORATION: DEALS

- TABLE 270 WABTEC CORPORATION: EXPANSIONS

- TABLE 271 WABTEC CORPORATION: CONTRACTS

- TABLE 272 KAWASAKI HEAVY INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 273 KAWASAKI HEAVY INDUSTRIES, LTD.: PRODUCTS OFFERED

- TABLE 274 KAWASAKI HEAVY INDUSTRIES, LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 275 KAWASAKI HEAVY INDUSTRIES, LTD.: CONTRACTS

- TABLE 276 CAF GROUP: COMPANY OVERVIEW

- TABLE 277 CAF GROUP: PRODUCTS OFFERED

- TABLE 278 CAF GROUP: DEALS

- TABLE 279 CAF GROUP: EXPANSIONS

- TABLE 280 CAF GROUP: CONTRACTS

- TABLE 281 HYUNDAI ROTEM COMPANY: COMPANY OVERVIEW

- TABLE 282 HYUNDAI ROTEM COMPANY: PRODUCTS OFFERED

- TABLE 283 HYUNDAI ROTEM COMPANY: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 284 HYUNDAI ROTEM COMPANY: DEALS

- TABLE 285 HYUNDAI ROTEM COMPANY: CONTRACTS

- TABLE 286 HYUNDAI ROTEM COMPANY: OTHER DEVELOPMENTS

- TABLE 287 MITSUBISHI HEAVY INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 288 MITSUBISHI HEAVY INDUSTRIES, LTD.: PRODUCTS OFFERED

- TABLE 289 MITSUBISHI HEAVY INDUSTRIES, LTD.: DEALS

- TABLE 290 MITSUBISHI HEAVY INDUSTRIES, LTD.: EXPANSIONS

- TABLE 291 MITSUBISHI HEAVY INDUSTRIES, LTD.: CONTRACTS

- TABLE 292 TALGO: COMPANY OVERVIEW

- TABLE 293 TALGO: PRODUCTS OFFERED

- TABLE 294 TALGO: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 295 TALGO: DEALS

- TABLE 296 TALGO: CONTRACTS

- TABLE 297 TRANSMASHHOLDING: COMPANY OVERVIEW

- TABLE 298 TRANSMASHHOLDING: PRODUCTS OFFERED

- TABLE 299 TRANSMASHHOLDING: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 300 TRANSMASHHOLDING: DEALS

- TABLE 301 TRANSMASHHOLDING: EXPANSIONS

- TABLE 302 TRANSMASHHOLDING: CONTRACTS

- TABLE 303 TITAGARH RAIL SYSTEMS LIMITED: COMPANY OVERVIEW

- TABLE 304 TITAGARH RAIL SYSTEMS LIMITED: PRODUCTS OFFERED

- TABLE 305 TITAGARH RAIL SYSTEMS LIMITED: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 306 TITAGARH RAIL SYSTEMS LIMITED: DEALS

- TABLE 307 TITAGARH RAIL SYSTEMS LIMITED: CONTRACTS

- TABLE 308 TOSHIBA CORPORATION: COMPANY OVERVIEW

- TABLE 309 HITACHI RAIL LIMITED: COMPANY OVERVIEW

- TABLE 310 STRUKTON: COMPANY OVERVIEW

- TABLE 311 DEUTSCHE BAHN AG: COMPANY OVERVIEW

- TABLE 312 BEML LIMITED: COMPANY OVERVIEW

- TABLE 313 RAIL VIKAS NIGAM LIMITED: COMPANY OVERVIEW

- TABLE 314 BRAITHWAITE & CO. (INDIA) LTD.: COMPANY OVERVIEW

- TABLE 315 CHITTARANJAN LOCOMOTIVE WORKS: COMPANY OVERVIEW

- TABLE 316 WJIS: COMPANY OVERVIEW

- TABLE 317 RHOMBERG SERSA RAIL HOLDING GMBH: COMPANY OVERVIEW

- TABLE 318 SINARA TRANSPORT MACHINES: COMPANY OVERVIEW

- TABLE 319 TRINITY INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 320 THE GREENBRIER COMPANIES: COMPANY OVERVIEW

- TABLE 321 DAWONSYS CO., LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 ROLLING STOCK MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH DESIGN MODEL

- FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION NOTES

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS

- FIGURE 10 DEMAND- AND SUPPLY-SIDE FACTOR ANALYSIS

- FIGURE 11 ROLLING STOCK MARKET OVERVIEW

- FIGURE 12 ROLLING STOCK MARKET, BY REGION, 2025-2032

- FIGURE 13 ROLLING STOCK MARKET, BY PRODUCT TYPE, 2025-2032

- FIGURE 14 RISING INVESTMENTS IN RAPID TRANSIT PROJECTS TO DRIVE MARKET

- FIGURE 15 RAPID TRANSIT TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 16 FREIGHT TRANSPORTATION TO HOLD HIGHER SHARE THAN PASSENGER TRANSPORTATION DURING FORECAST PERIOD

- FIGURE 17 CONVENTIONAL LOCOMOTIVES TO BE LARGER THAN TURBOCHARGED LOCOMOTIVES DURING FORECAST PERIOD

- FIGURE 18 ASIA OCEANIA TO BE LEADING REGIONAL MARKET DURING FORECAST PERIOD

- FIGURE 19 ROLLING STOCK MARKET DYNAMICS

- FIGURE 20 GLOBAL CO2 EMISSIONS FROM DIFFERENT TRANSPORT SEGMENTS, 2019-2030

- FIGURE 21 ENERGY DEMAND FROM RAILWAYS, BY COUNTRY, 2017-2050

- FIGURE 22 FREIGHT LOADING IN INDIA, 2020-2024

- FIGURE 23 PROTOTYPE OF HYDROGEN TRAIN

- FIGURE 24 BENEFITS OF USING BATTERIES IN RAIL FOR MAXIMUM OPERATIONAL FLEXIBILITY

- FIGURE 25 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 26 AVERAGE SELLING PRICE TREND, BY PRODUCT TYPE, 2022-2024 (USD THOUSAND)

- FIGURE 27 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024 (USD THOUSAND)

- FIGURE 28 ECOSYSTEM ANALYSIS

- FIGURE 29 SUPPLY CHAIN ANALYSIS

- FIGURE 30 PATENT ANALYSIS

- FIGURE 31 LEGAL STATUS OF PATENTS, 2015-2024

- FIGURE 32 REGENERATIVE BRAKING IN TRAINS

- FIGURE 33 SPECIFICATIONS OF TRI-MODE BATTERY TRAINS

- FIGURE 34 THALES RAILWAY DIGITALIZATION

- FIGURE 35 TRAIN CONTROL AND MANAGEMENT SYSTEM

- FIGURE 36 BIG DATA IN RAILWAY TRANSPORTATION

- FIGURE 37 INVESTMENT AND FUNDING SCENARIO, 2022-2025

- FIGURE 38 ADVANTAGES OF HARNESSING AI IN RAILWAY OPERATIONS

- FIGURE 39 IMPORT DATA FOR HS CODE 8604-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD MILLION)

- FIGURE 40 EXPORT DATA FOR HS CODE 8604-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD MILLION)

- FIGURE 41 IMPORT DATA FOR HS CODE 8603-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD MILLION)

- FIGURE 42 EXPORT DATA FOR HS CODE 8603-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD MILLION)

- FIGURE 43 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE PRODUCT TYPES

- FIGURE 44 KEY BUYING CRITERIA FOR TOP THREE PRODUCT TYPES

- FIGURE 45 ROLLING STOCK MARKET, BY PRODUCT TYPE, 2025-2032 (USD MILLION)

- FIGURE 46 ELECTRIC LOCOMOTIVES TO BE DOMINANT DURING FORECAST PERIOD

- FIGURE 47 ELECTRIC MULTIPLE UNITS TO BE DOMINANT DURING FORECAST PERIOD

- FIGURE 48 ROLLING STOCK MARKET, BY LOCOMOTIVE TECHNOLOGY, 2025-2032 (USD MILLION)

- FIGURE 49 ROLLING STOCK MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- FIGURE 50 COACHES TO BE DOMINANT IN PASSENGER TRANSPORTATION SEGMENT DURING FORECAST PERIOD

- FIGURE 51 WAGONS TO BE DOMINANT IN FREIGHT TRANSPORTATION SEGMENT DURING FORECAST PERIOD

- FIGURE 52 ROLLING STOCK MARKET, BY REGION, 2025-2032 (USD MILLION)

- FIGURE 53 ASIA OCEANIA: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 54 ASIA OCEANIA: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 55 ASIA OCEANIA: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 56 ASIA OCEANIA: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, BY COUNTRY, 2024

- FIGURE 57 ASIA OCEANIA: ROLLING STOCK MARKET SNAPSHOT

- FIGURE 58 EUROPE: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 59 EUROPE: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 60 EUROPE: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 61 EUROPE: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, BY COUNTRY, 2024

- FIGURE 62 EUROPE: ROLLING STOCK MARKET SNAPSHOT

- FIGURE 63 NORTH AMERICA: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 64 NORTH AMERICA: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 65 NORTH AMERICA: CPI INFLATION RATE, BY COUNTRY, 2024-2026

- FIGURE 66 NORTH AMERICA: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, BY COUNTRY, 2024

- FIGURE 67 NORTH AMERICA: ROLLING STOCK MARKET SNAPSHOT

- FIGURE 68 MIDDLE EAST & AFRICA: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 69 MIDDLE EAST & AFRICA: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 70 MIDDLE EAST & AFRICA: CPI INFLATION RATE, BY COUNTRY, 2024-2026

- FIGURE 71 MIDDLE EAST & AFRICA: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, BY COUNTRY, 2024

- FIGURE 72 MIDDLE EAST & AFRICA: ROLLING STOCK MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- FIGURE 73 REST OF THE WORLD: REAL GDP GROWTH RATE, 2024-2026

- FIGURE 74 REST OF THE WORLD: GDP PER CAPITA, 2024-2026

- FIGURE 75 REST OF THE WORLD: CPI INFLATION RATE, 2024-2026

- FIGURE 76 REST OF THE WORLD: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, BY COUNTRY, 2024

- FIGURE 77 REST OF THE WORLD: ROLLING STOCK MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- FIGURE 78 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 79 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2024

- FIGURE 80 COMPANY VALUATION (USD BILLION)

- FIGURE 81 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 82 BRAND/PRODUCT COMPARISON

- FIGURE 83 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 84 COMPANY FOOTPRINT

- FIGURE 85 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024

- FIGURE 86 CRRC CORPORATION LIMITED: COMPANY SNAPSHOT

- FIGURE 87 SIEMENS AG: COMPANY SNAPSHOT

- FIGURE 88 ALSTOM SA: COMPANY SNAPSHOT

- FIGURE 89 ALSTOM SA: NEW BUSINESS OPPORTUNITY SPACE

- FIGURE 90 STADLER RAIL AG: COMPANY SNAPSHOT

- FIGURE 91 STADLER RAIL AG: FUTURE STRATEGY OVERVIEW

- FIGURE 92 WABTEC CORPORATION: COMPANY SNAPSHOT

- FIGURE 93 WABTEC CORPORATION: NORTH AMERICAN LOCOMOTIVES MARKET SNAPSHOT

- FIGURE 94 KAWASAKI HEAVY INDUSTRIES, LTD.: COMPANY SNAPSHOT

- FIGURE 95 CAF GROUP: COMPANY SNAPSHOT

- FIGURE 96 HYUNDAI ROTEM COMPANY: COMPANY SNAPSHOT

- FIGURE 97 MITSUBISHI HEAVY INDUSTRIES, LTD.: COMPANY SNAPSHOT

- FIGURE 98 TALGO: COMPANY SNAPSHOT

- FIGURE 99 TITAGARH RAIL SYSTEMS LIMITED: COMPANY SNAPSHOT