Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644592

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644592

Malaysia E-commerce - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

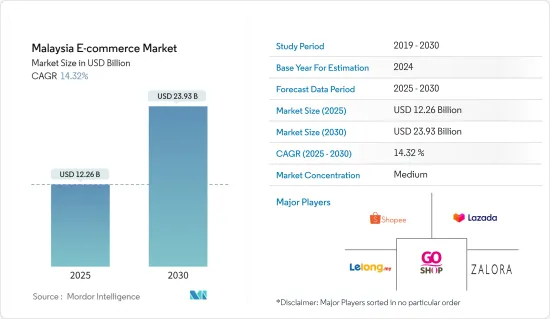

The Malaysia E-commerce Market size is estimated at USD 12.26 billion in 2025, and is expected to reach USD 23.93 billion by 2030, at a CAGR of 14.32% during the forecast period (2025-2030).

Key Highlights

- The e-commerce market is experiencing growth due to increasing internet penetration, access in developing economies, smartphone usage, technological advancements, and rapid urbanization.

- The primary factors fueling the market's expansion are consumer electronics, fashion and apparel, and personal care industries. Significant investments in consumer electronics, personal care, and fashion and clothing sectors are opening up possibilities for growth.

- According to Statistics Malaysia, in 2023, almost all individuals in the country accessed the internet through their mobile phones. Additionally, about 38% of users reported using the internet from their laptops, while 13% reported utilizing alternative mobile gadgets.

- The Malaysian government's proactive stance in fostering a digital economy has played a crucial role. Initiatives like the Digital Free Trade Zone (DFTZ) and the National E-commerce Strategic Roadmap have been instrumental in encouraging both local and international players to participate in the Malaysian e-commerce market. These policies not only streamlined regulatory processes but also provided incentives for e-commerce businesses, thereby catalyzing growth and innovation in the market.

- The government is implementing supportive measures for e-commerce. For example, in October 2023, PIKOM and e-Commerce Malaysia endorsed a careful and positive strategy for TikTok Shop, emphasizing the importance of proactive discussions with industry associations and e-commerce enablers. The focus was on local policies and developing the skills of local creators and e-commerce facilitators rather than foreign ones by providing workshops, training, and platform tools that help local players succeed in the digital market ethically.

- E-commerce companies recognize the importance and requirement of mobile commerce (m-commerce) in developing their existing and upcoming omnichannel strategies through effective, easy-to-use applications. During the forecast period, the rollout of 5G is expected to be a key driver of increased mobile traffic from consumer-facing websites across the country.

- According to Malaysia's Commercial Crime Investigation Department (CCID), by September 2023, Malaysia had recorded over 8,800 e-commerce scams. The tenacity of fraud hindered the market's expansion, which eroded purchasers' faith.

Malaysia E-commerce Market Trends

Government Initiatives Are Boosting the Adoption of Digital Solutions

- The Malaysian government also recognizes the rise in e-commerce. In the first quarter of 2023, the net income of e-commerce in Malaysia surpassed MYR 291 billion (USD 62.18 billion), increasing from around MYR 287 billion (USD 61.20 billion) in the previous quarter. The quarterly net income of e-commerce in the country has been steadily increasing over the past few years.

- The previously mentioned factor is seen as a means of promoting inclusivity by the government, which has pledged assistance to boost local micro, small, and medium enterprises (MSMEs). Additionally, Digital Free Trade Zones have been established to ease cross-border e-commerce and expand the market for MSMEs.

- The digital sector contributed USD 1.162 trillion to Malaysia's GDP, as reported by the Malaysian Finance Ministry. It is expected that over 500,000 new jobs will be created by 2025. The government actively collaborates with the private sector to encourage consumers to adopt digital services and to assist small businesses through incentives and support.

- The government unveiled an action plan with eight points. Some options include restructuring existing economic incentives and reducing non-tariff barriers such as consumer protection, cross-border, and e-fulfillment. Other strategies involve providing targeted funding for selected e-commerce firms and showcasing local brands to boost global e-commerce.

- The Digital Economy Blueprint outlines plans for Malaysia's digital transformation in sectors such as e-commerce, which will be executed by 2030. It lays out plans and actions to encourage digital usage, boost skill growth, improve digital resources, and establish a favorable regulatory setting. The plan intends to drive Malaysia's digital economy and establish the country as a key hub for e-commerce and digital innovation.

Consumer Electronics is Expected to Witness Growth

- According to the Malaysian Department of Statistics, the sales value of manufactured consumer electronics in Malaysia was approximately MYR 42.21 billion (USD 8.99 billion). The sales value of consumer electronics produced has fluctuated over the years. Nevertheless, e-commerce has been crucial as more ordinary individuals buy items online.

- Technology can improve individuals' lives by utilizing consumer electronics. The emergence of Industry 4.0 has accelerated the development of innovative consumer products, increasing the demand for smart consumer goods incorporating state-of-the-art technologies such as IoT, AR, VR, and AI.

- Some factors propelling the consumer electronics market include technological advancements, changing customer preferences, and the increasing need for affordable, user-friendly, and effective goods. Consumer electronics include smartphones, household appliances, computers, laptops, televisions, game consoles, and wearables. As product launches increase in the consumer electronics sector, e-commerce is becoming more popular for purchasing those items.

- The rising emphasis on luxury items in the consumer goods sector by domestic consumers is expected to boost the need for quality headphones and big-screen smart TVs. This trend is expected to push the market's current value growth above the growth in retail foot traffic.

Malaysia E-commerce Industry Overview

Due to a few big competitors, the level of competition in the Malaysian e-commerce market is medium. The market is semi-consolidated. The number of local and global brands is increasing, which increases market competition.

- January 2024: ZALORA, an e-commerce platform for fashion and lifestyle, introduced an AI-driven chatbot for customer service in Singapore, Malaysia, the Philippines, Indonesia, Hong Kong, and Taiwan to improve customer support. The chatbot, developed in collaboration with Forethought, utilizes generative AI to manage customer queries. It is able to transition between languages smoothly, delivering precise answers using natural language processing.

- October 2023: Lazada backed MSMEs in Indonesia by running the Sustainable Seller Acceleration Camp 2023. This program provided comprehensive training to help businesses incorporate sustainable practices and gain access to financial opportunities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 90765

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness-Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Key market trends and share of E-commerce of total Retail sector

- 4.4 Impact of COVID-19 on the e-commerce sales

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Government Initiatives Supporting the Increased Adoption of Digital Solutions

- 5.1.2 Promotion of e-commerce by the Government Sectors

- 5.2 Market Challenges

- 5.2.1 Online Frauds and Cybersecurity Issues

- 5.3 Analysis of key demographic trends and patterns related to ecommerce industry in Malasiya (Coverage to include Population, Internet Penetration, ecommerce Penetration, Age & Income etc.)

- 5.4 Analysis of the key modes of transaction in the ecommerce industry in Malasiya (coverage to include prevalent modes of payment such as cash, card, bank transfer, wallets, etc.)

- 5.5 Analysis of cross-border ecommerce industry in Malasiya (Current market value of cross-border & key trends)

- 5.6 Current positioning of Malasiya in the ecommerce industry in South East Asia

6 MARKET SEGMENTATION

- 6.1 By B2C ecommerce

- 6.1.1 Market Segmentation - by Application

- 6.1.1.1 Beauty and Personal Care

- 6.1.1.2 Consumer Electronics

- 6.1.1.3 Fashion and Apparel

- 6.1.1.4 Food and Beverage

- 6.1.1.5 Furniture and Home

- 6.1.1.6 Others (Toys, DIY, Media, etc.)

- 6.1.1 Market Segmentation - by Application

- 6.2 By B2B ecommerce

- 6.2.1 Market size for the period of 2017-2027

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Shopee

- 7.1.2 Lazada Group

- 7.1.3 Lelong.my

- 7.1.4 Zalora

- 7.1.5 Astro GS Shop Sdn Bhd

- 7.1.6 eBay Inc.

- 7.1.7 Presto Mall Sdn Bhd

- 7.1.8 ezbuy (EZbuy Holdings Limited)

- 7.1.9 Hermo Creative (M) Sdn Bhd

- 7.1.10 Sephora Digital SEA Pte Ltd

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.