PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911438

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911438

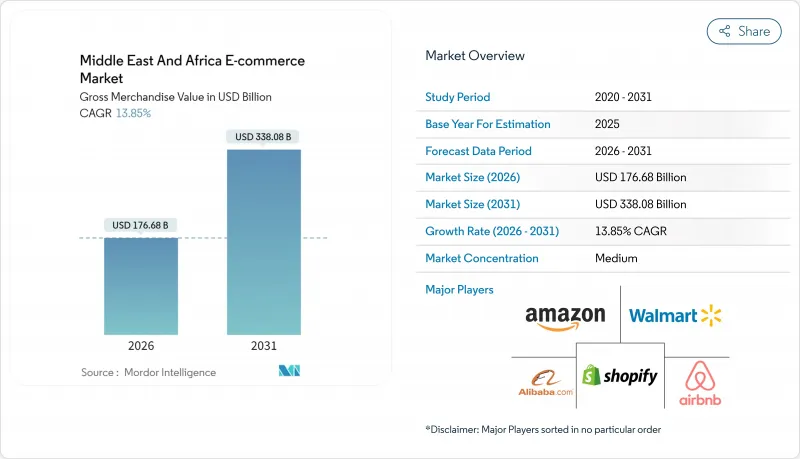

Middle East And Africa E-commerce - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Middle East and Africa e-commerce market was valued at USD 155.16 billion in 2025 and estimated to grow from USD 176.68 billion in 2026 to reach USD 338.08 billion by 2031, at a CAGR of 13.85% during the forecast period (2026-2031).

Healthy disposable-income growth in the Gulf, accelerating smartphone upgrades, and logistics investments are jointly expanding the addressable base of online shoppers. Marketplaces are courting consumers with ultra-fast delivery promises, while merchants adopt embedded-finance tools that smooth checkout friction. Cross-border corridors, especially China-to-GCC and intra-Africa routes, now carry a rising share of parcels, signaling greater integration between regional sellers and global supply chains. As regulatory sandboxes scale, fintech and e-commerce firms are co-developing credit-at-checkout products that spur basket-size growth, reinforcing a virtuous cycle of digital adoption.

Middle East And Africa E-commerce Market Trends and Insights

Rising Smartphone Penetration and Affordable Data Plans

Smartphones already drive 72.41% of regional B2C transactions, and the metric keeps rising as 4G and 5G coverage expands in GCC cities. Annual data-price declines make video-rich listings and augmented-reality try-ons accessible to middle-income shoppers, boosting conversion on fashion and furniture SKUs. Retailers layer super-app features, ride-hailing, food delivery, peer-to-peer payments, so users stay in-app from discovery to post-purchase engagement. In markets such as Saudi Arabia, mobile-initiated orders grew 9% year over year in 2024, underscoring the structural tilt toward handheld commerce. Robust handset upgrade cycles will keep mobile bandwidth demand high, sustaining incremental gains in session time and order frequency across the Middle East and Africa e-commerce market.

Government-Led Digital Transformation and Cashless Initiatives

Saudi Arabia's Vision 2030 and the UAE's national digital-economy agenda oblige ministries to migrate services online, normalizing e-payments across daily life. Revised e-invoicing mandates, real-time gross-settlement rails, and open-banking frameworks shrink cash usage, and cash-on-delivery preferences have already fallen 51% across MENA. Fintech sandboxes run by SAMA and CBUAE allow wallets, BNPL, and tokenized-payment pilots to operate under clear guardrails, lifting merchant confidence. Procurement portals such as Tradeling plug directly into public-sector purchasing systems, accelerating B2B order flows. These reforms lock in long-term gains for the Middle East and Africa e-commerce market by institutionalizing digital trust and expanding access to working-capital tools for SMEs.

Persistent Security and Fraud Concerns

Fraudulent chargebacks and account takeovers cost African merchants tens of millions USD in 2024, prompting heavier KYC investments and PSD2-style strong authentication rollouts. A high-profile breach that exposed 39 million customer records drew USD 1.9 million in penalties, accelerating GDPR-equivalent lawmaking in non-EU markets. Platforms now deploy machine-learning risk engines that score transactions in milliseconds, balancing false positives against shopper friction. Social-commerce channels introduce counterfeit-listing risks, forcing tighter seller-verification protocols. Despite these mitigations, lingering fear of data theft can delay first-time purchases, dampening growth potential in the Middle East and Africa e-commerce market until education campaigns and insurance products mature.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Logistics and Fulfillment Infrastructure

- Surge in Digital Wallet Adoption and Interoperability

- Low Rural Broadband Connectivity in Sub-Saharan Africa

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

B2C accounted for 87.02% of GMV in 2025, confirming its entrenched role in the Middle East and Africa e-commerce market size; yet B2B volumes are climbing at a 15.97% CAGR, signaling a structural pivot among wholesalers seeking transparent procurement. Tradeling extended USD 15 million in supplier credit to more than 65 SMEs, compressing order cycles from weeks to days. Egyptian wholesalers on Cartona report 30% inventory-turn acceleration after onboarding the platform. Because bulk orders travel via palletized freight, carriers monetize higher-margin capacity, encouraging logistics players to deploy dedicated B2B lanes. As blockchain-verified smart contracts automate dispute resolution, invoice-financing risk premia fall, stimulating additional supplier participation and reinforcing the B2B flywheel in the Middle East and Africa e-commerce market.

While consumer marketplaces chase loyalty via same-day grocery, B2B operators prioritize payment-term flexibility, localized after-sales support, and embedded-insurance modules. Regulatory clarity around electronic invoices and digital signatures boosts adoption among public-sector buyers, who increasingly procure office supplies and IT peripherals through vetted portals. Traditional B2C leaders such as Carrefour are piloting wholesale storefronts aimed at small restaurants, evidencing convergence between business models. This interplay sustains overall GMV momentum, ensuring B2B retains double-digit share in the broader Middle East and Africa e-commerce industry.

Smartphones delivered 71.78% of 2025 B2C GMV and will keep compounding at 15.36% CAGR, reinforcing mobile primacy within the Middle East and Africa e-commerce market share. Voice search, social-video shopping, and augmented-reality try-ons make small-screen buying more immersive, driving higher conversion on discretionary categories. Desktop retains niche relevance for big-ticket electronics and B2B catalog browsing, where screen real estate and complex configuration tools matter. Smart TVs and in-car infotainment systems form an emerging channel as affluent GCC households upgrade home and auto tech.

5G bandwidth removes latency barriers for livestream flash sales, while progressive-web-app caching secures seamless checkout in low-signal zones. Tap-on-phone enablers slash hardware costs for micro-merchants, onboarding kiosk operators and food-truck vendors who historically shunned digital payments. The virtuous cycle of mobile adoption heightens data-analytics fidelity, enabling retailers to refine personalization engines that anchor customer-lifetime value in the Middle East and Africa e-commerce market.

The Middle East and Africa E-Commerce Market Report is Segmented by Business Model (B2B, and B2C), Device Type for B2C E-Commerce (Smartphone/Mobile, Desktop, and More), Payment Method for B2C E-Commerce (Cards, Digital Wallets, BNPL, and More), Product Category for B2C E-Commerce (Beauty, Electronics, Fashion, Food, Furniture, and More), and Geography. Market Forecasts are in Value (USD).

List of Companies Covered in this Report:

- Amazon.com Inc.

- Noon AD Holdings SPC

- Jumia Technologies AG

- Alibaba Group Holding Limited (AliExpress)

- Namshi General Trading LLC

- Souq.com FZ-LLC (Amazon Services)

- SHEIN Group Ltd.

- Temu (PDD Holdings Inc.)

- Takealot Online (Pty) Ltd.

- Konga Online Shopping Ltd.

- Costco Wholesale Corporation

- Shopify Inc.

- Carrefour Online (Majid Al Futtaim Retail)

- Flipkart Internet Pvt. Ltd.

- Best Buy Co. Inc.

- Zando Online South Africa (Pty) Ltd.

- Jiji.ng (Genesis Technology Partners)

- Wadi.com FZ-LLC

- Mumzworld FZ-LLC

- Bash.com (Basharsoft)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising smartphone penetration and affordable data plans

- 4.2.2 Government-led digital transformation and cashless initiatives

- 4.2.3 Expansion of logistics and fulfilment infrastructure

- 4.2.4 Surge in digital wallet adoption and interoperability

- 4.2.5 Cross-border marketplace enablement for MEA SMEs

- 4.2.6 AI-driven Arabic-dialect personalisation

- 4.3 Market Restraints

- 4.3.1 Persistent security and fraud concerns

- 4.3.2 Low rural broadband connectivity in Sub-Saharan Africa

- 4.3.3 Fragmented customs thresholds in intra-Africa trade

- 4.3.4 Escalating last-mile costs from informal addressing

- 4.4 Industry Value Chain Analysis

- 4.5 Impact of Macroeconomic Factors

- 4.6 Regulatory Landscape

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers/Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Key Market Trends and Share of E-commerce of Total Retail Sector

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Business Model

- 5.1.1 B2B

- 5.1.2 B2C

- 5.2 By Device Type for B2C E-commerce

- 5.2.1 Smartphone / Mobile

- 5.2.2 Desktop and Laptop

- 5.2.3 Other Device Types

- 5.3 By Payment Method for B2C E-commerce

- 5.3.1 Credit / Debit Cards

- 5.3.2 Digital Wallets

- 5.3.3 BNPL

- 5.3.4 Other Payment Method

- 5.4 By Product Category for B2C E-commerce

- 5.4.1 Beauty and Personal Care

- 5.4.1.1 Hair Care

- 5.4.1.2 Skin Care

- 5.4.1.3 Cosmetics and Beauty

- 5.4.1.4 Other Types

- 5.4.2 Consumer Electronics

- 5.4.2.1 Mobile

- 5.4.2.2 PC and Laptops

- 5.4.2.3 Audio Devices

- 5.4.2.4 Gaming Devices

- 5.4.2.5 Other Types

- 5.4.3 Fashion and Apparel

- 5.4.3.1 Clothing

- 5.4.3.2 Footwear

- 5.4.3.3 Fashion Accessories

- 5.4.3.4 Other Types

- 5.4.4 Food and Beverages

- 5.4.4.1 Packaged Food

- 5.4.4.2 Bakery and Confectionery

- 5.4.4.3 Meat, Poultry, and Seafood

- 5.4.4.4 Other Types

- 5.4.5 Furniture and Home

- 5.4.5.1 Home Furniture

- 5.4.5.2 Office Furniture

- 5.4.5.3 Outdoor Furniture

- 5.4.5.4 Other Types

- 5.4.6 Other Product Categories

- 5.4.1 Beauty and Personal Care

- 5.5 Geography

- 5.5.1 United Arab Emirates

- 5.5.2 Saudi Arabia

- 5.5.3 South Africa

- 5.5.4 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amazon.com Inc.

- 6.4.2 Noon AD Holdings SPC

- 6.4.3 Jumia Technologies AG

- 6.4.4 Alibaba Group Holding Limited (AliExpress)

- 6.4.5 Namshi General Trading LLC

- 6.4.6 Souq.com FZ-LLC (Amazon Services)

- 6.4.7 SHEIN Group Ltd.

- 6.4.8 Temu (PDD Holdings Inc.)

- 6.4.9 Takealot Online (Pty) Ltd.

- 6.4.10 Konga Online Shopping Ltd.

- 6.4.11 Costco Wholesale Corporation

- 6.4.12 Shopify Inc.

- 6.4.13 Carrefour Online (Majid Al Futtaim Retail)

- 6.4.14 Flipkart Internet Pvt. Ltd.

- 6.4.15 Best Buy Co. Inc.

- 6.4.16 Zando Online South Africa (Pty) Ltd.

- 6.4.17 Jiji.ng (Genesis Technology Partners)

- 6.4.18 Wadi.com FZ-LLC

- 6.4.19 Mumzworld FZ-LLC

- 6.4.20 Bash.com (Basharsoft)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment